IDC: 2Q16 Mobile Devices (smartphone, feature phone, tablet) Shipment

This is a simple report summarizing the shipment of mobile devices—smartphones, feature phones and tablets—based on IDC’s latest number (2Q16). The reasoning behind some of those numbers cannot be explained in detail here, but will be explored in another report.

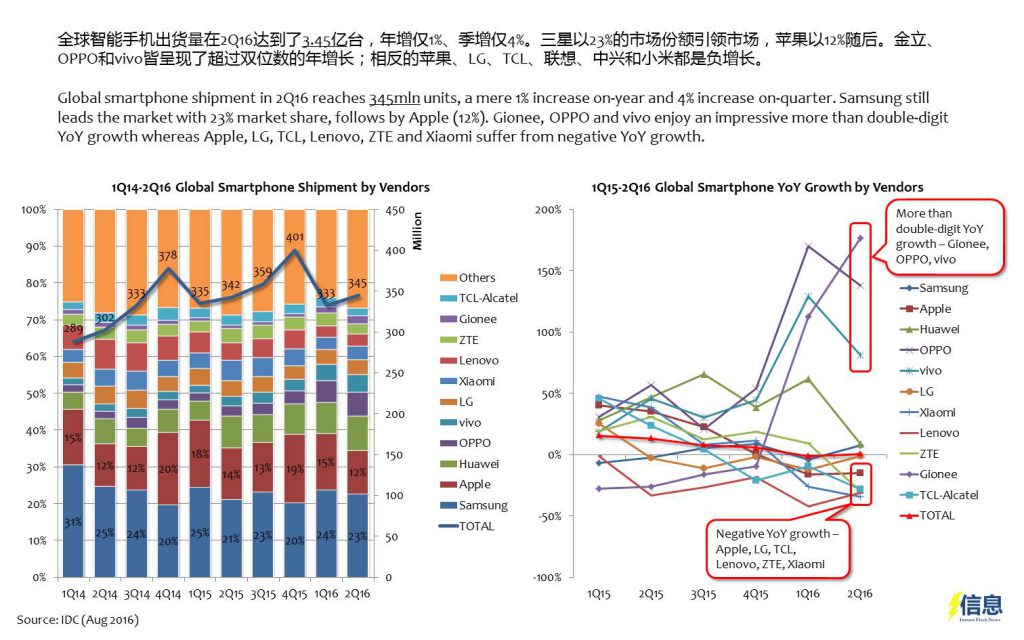

- Global smartphone shipment in 2Q16 reaches 345mln units, a mere 1% increase on-year and 4% increase on-quarter. Samsung still leads the market with 23% market share, follows by Apple (12%). Gionee, OPPO and vivo enjoy an impressive more than double-digit YoY growth whereas Apple, LG, TCL, Lenovo, ZTE and Xiaomi suffer from negative YoY growth.

- Smartphone shipment has reached 186 million units in APAC in 2Q16 (with China 111 million and India 27 million). Looking at year-on-year growth in 2Q16, LATAM, EE and ME&A have shown negative growth, especially M&EA—its growth has shown a steep decline from 1Q15.

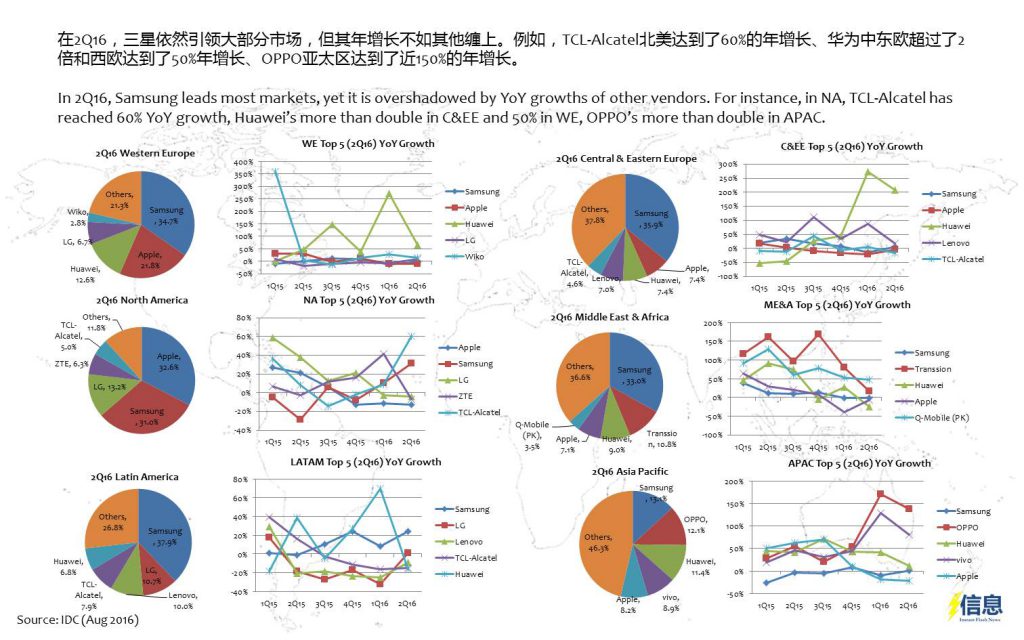

- In 2Q16, Samsung leads most markets, yet it is overshadowed by YoY growths of other vendors. For instance, in NA, TCL-Alcatel has reached 60% YoY growth, Huawei’s more than double in C&EE and 50% in WE, OPPO’s more than double in APAC.

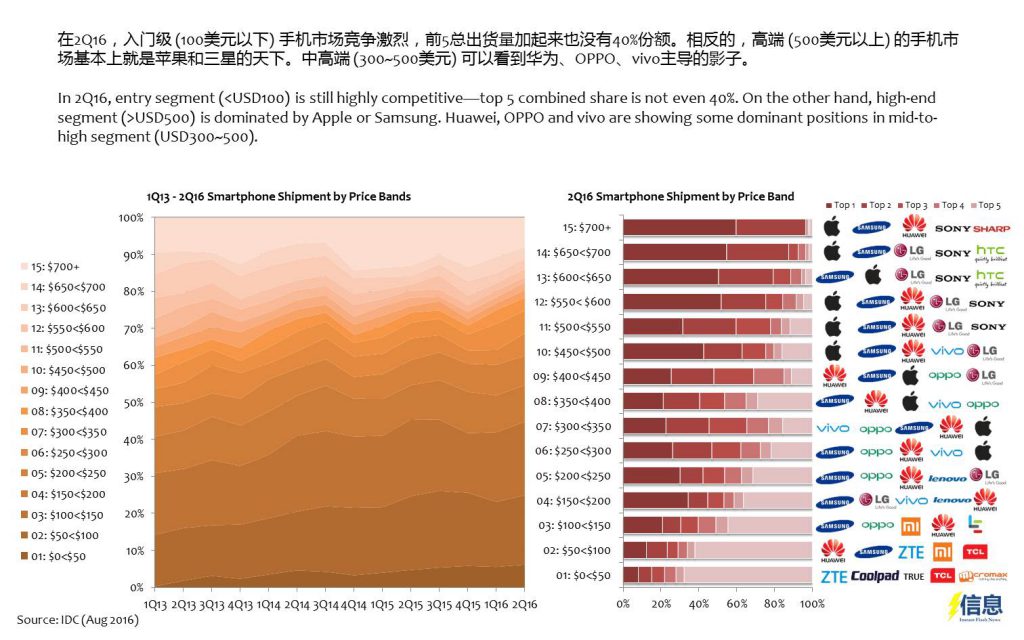

- In 2Q16, entry segment (<USD100) is still highly competitive—top 5 combined share is not even 40%. On the other hand, high-end segment (>USD500) is dominated by Apple or Samsung. Huawei, OPPO and vivo are showing some dominant positions in mid-to-high segment (USD300~500).

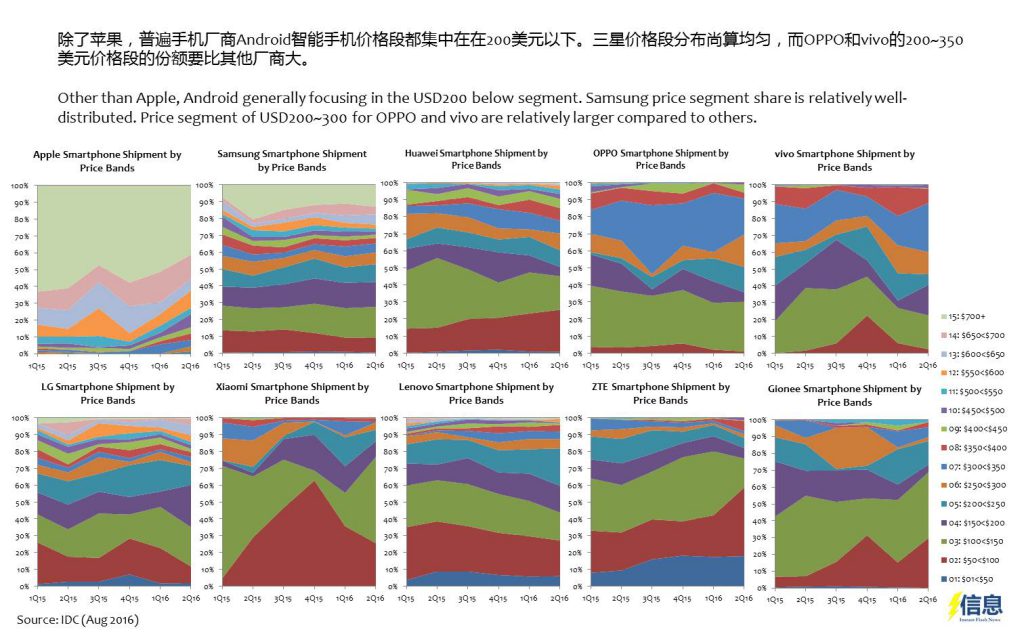

- Other than Apple, Android generally focusing in the USD200 below segment. Samsung price segment share is relatively well-distributed. Price segment of USD200~300 for OPPO and vivo are relatively larger compared to others.

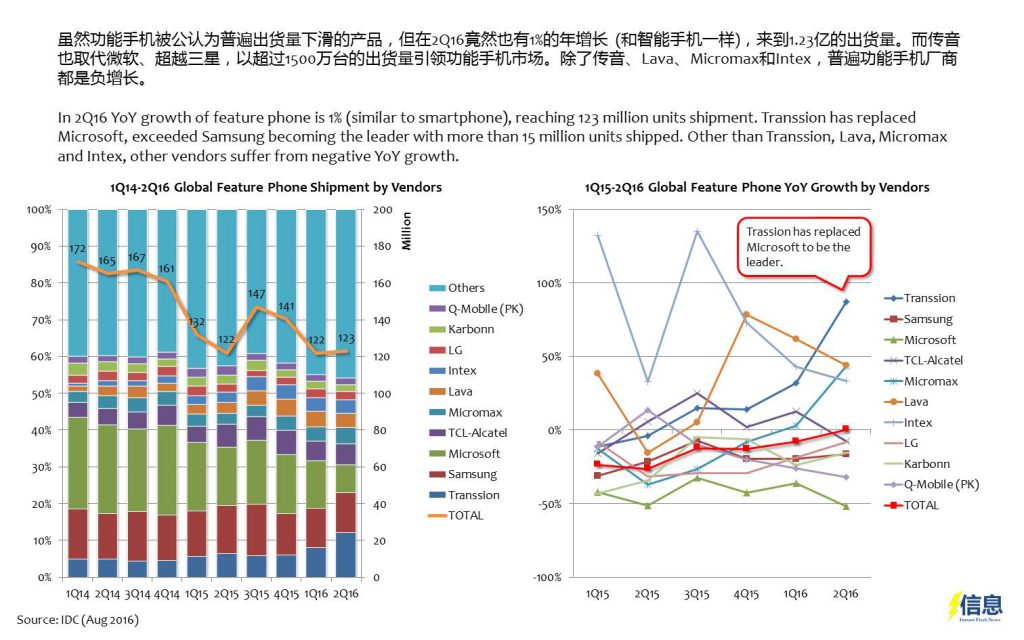

- In 2Q16 YoY growth of feature phone is 1% (similar to smartphone), reaching 123 million units shipment. Transsion has replaced Microsoft, exceeded Samsung becoming the leader with more than 15 million units shipped. Other than Transsion, Lava, Micromax and Intex, other vendors suffer from negative YoY growth.

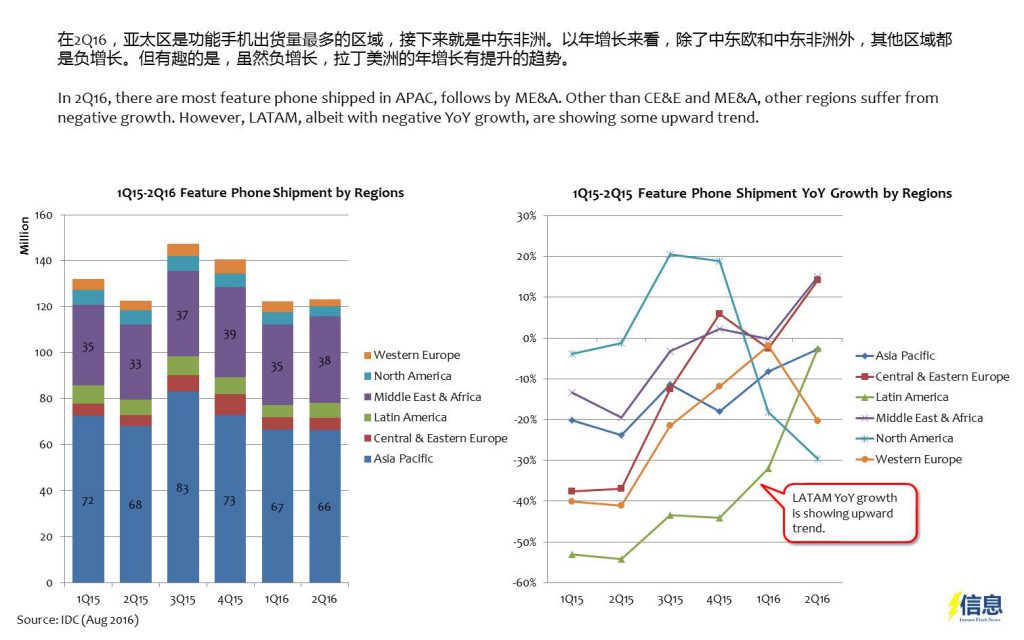

- In 2Q16, there are most feature phone shipped in APAC, follows by ME&A. Other than CE&E and ME&A, other regions suffer from negative growth. However, LATAM, albeit with negative YoY growth, are showing some upward trend.

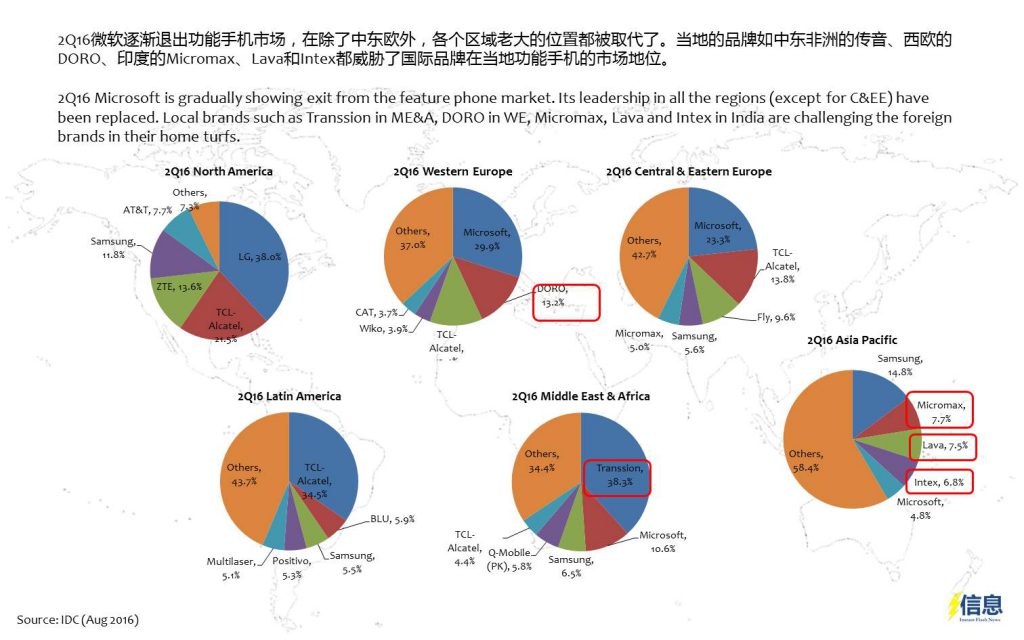

- 2Q16 Microsoft is gradually showing exit from the feature phone market. Its leadership in all the regions (except for C&EE) have been replaced. Local brands such as Transsion in ME&A, DORO in WE, Micromax, Lava and Intex in India are challenging the foreign brands in their home turfs.

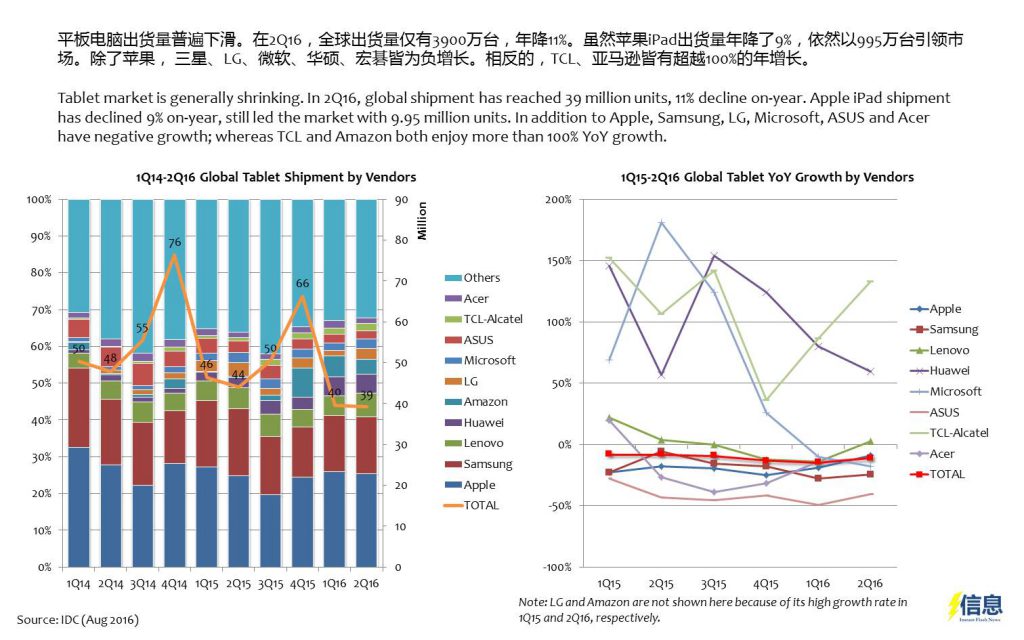

- Tablet market is generally shrinking. In 2Q16, global shipment has reached 39 million units, 11% decline on-year. Apple iPad shipment has declined 9% on-year, still led the market with 9.95 million units. In addition to Apple, Samsung, LG, Microsoft, ASUS and Acer have negative growth; whereas TCL and Amazon both enjoy more than 100% YoY growth.

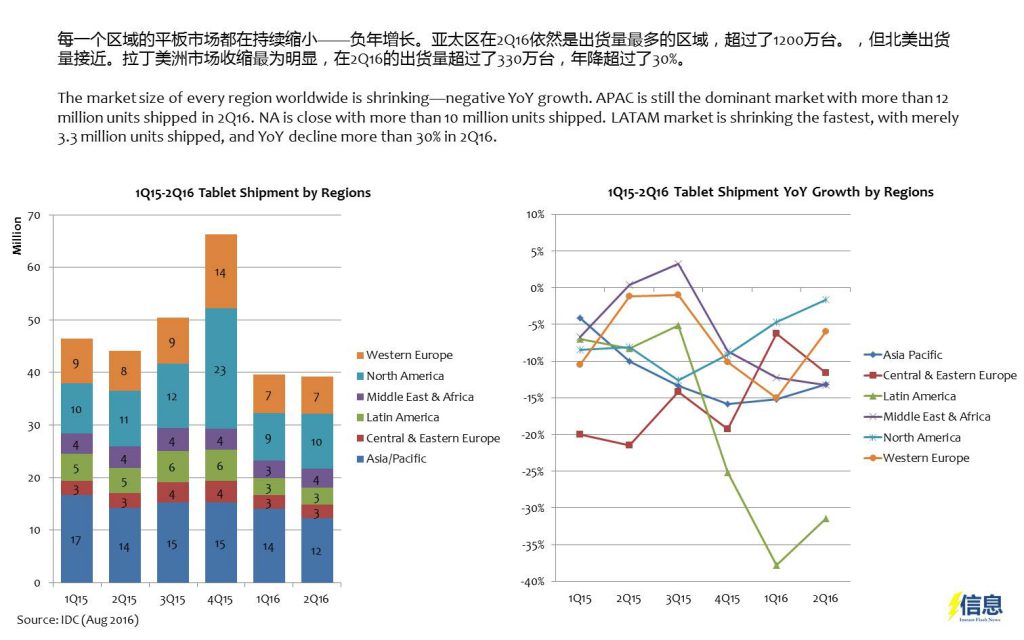

- The market size of every region worldwide is shrinking—negative YoY growth. APAC is still the dominant market with more than 12 million units shipped in 2Q16. NA is close with more than 10 million units shipped. LATAM market is shrinking the fastest, with merely 3.3 million units shipped, and YoY decline more than 30% in 2Q16.