9-16: Samsung Electronics has sold all its shares in Sharp; Blackcow Food raises CNY18 billion that will be invested in OLED R&D and production; etc.

|

Chipset |

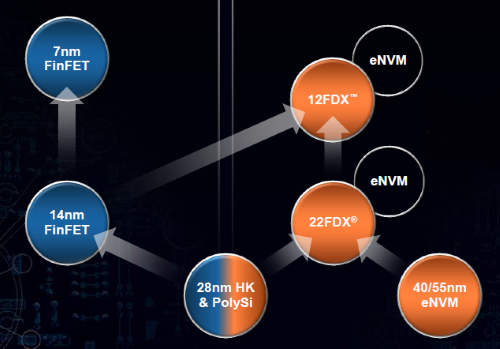

| Globalfoundries (GF) has announced plans for a 7nm FinFET process that can deliver chips with up to 30% more performance or 60% less power consumption than its current 14nm node. The process will be in production in late 2018. Separately, GF will support a new embedded MRAM in sub-Gbit densities starting in 2018 for chips made in its 22nm FD-SOI process. (EE Times, article) |

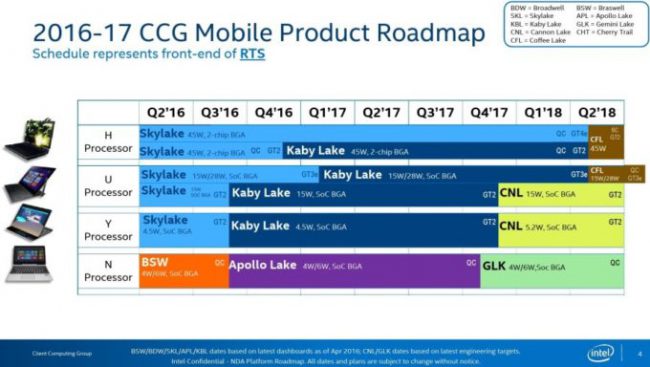

| Intel’s latest generation of processors is codenamed as “Kaby Lake”, and they are rolling out to the market now as the 7th-generation Core processor. According to a leak document, following Kaby Lake will be “Cannon Lake” along with “Coffee Lake”, the latter of which will offer a six-core chip along with two-core and four-core models. (Liliputing, Digital Trends, AnandTech, Chiphell) |

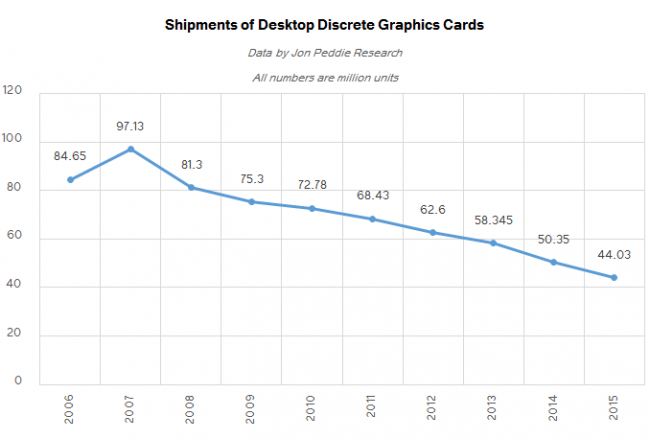

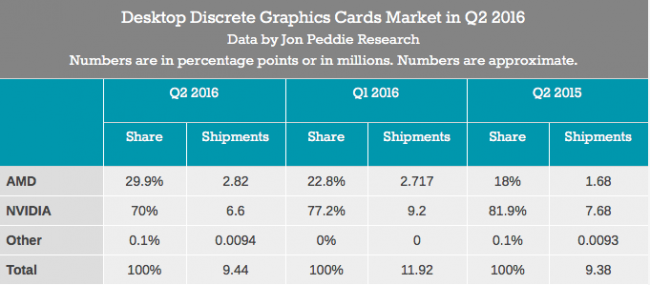

| Jon Peddie Research estimates that shipments of standalone GPUs in 2Q16 were down 14.19% from 1Q16, and decreased 1.03% from 2Q15. AMD market share increased 0.4% from last quarter and 2.8% from last year, Intel increase market share 2.4 % from last quarter, and NVIDIA overall share decreased 2.8%, from last quarter. (199IT, AnandTech, Jon Peddie Research, press) |

|

Touch Display |

| Samsung Electronics has sold all its shares valued about JPY4.6 billion or a 0.7% stake in Sharp following Foxconn’s investment in the company. (WSJ, CN Beta, Sam Mobile, 4-Traders, Android Authority, Asia Nikkei) |

| A soy and grain beverage maker based in Shenzhen, China, called Blackcow Food, announced that it aims to raise CNY18 billion (about USD2.7 billion) that will be invested in OLED R&D and production. (OLED-Info, 4-Traders, Sohu, CS) |

|

Battery |

| Apple is working on a viable wireless charging solution for iPhone in partnership with Energous, a sector specialist whose long-distance WattUp technology has been under development for years. (Venture Beat, Bloomberg, EE Times, Tencent, 163) |

|

Smartphones |

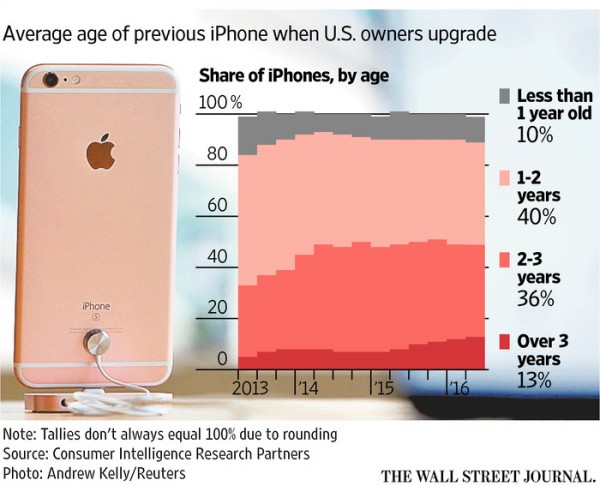

| Citigroup estimates the handset replacement cycle lengthened to 29.6 months in 2Q16. In 2011, that upgrade rate was below 24 months. UBS Group AG expects global iPhone unit sales to decline 9% in Apple’s current fiscal year and rise a modest 5% next year after the launch of the new device. (CN Beta, CNET, WSJ, article) |

| Japan’s tax authority ordered Apple to pay about JPY12 billion (roughly USD118 million) in taxes for improperly reporting earnings associated with its iTunes unit. (Apple Insider, Reuters, Sina, Tencent) |

|

Wearables |

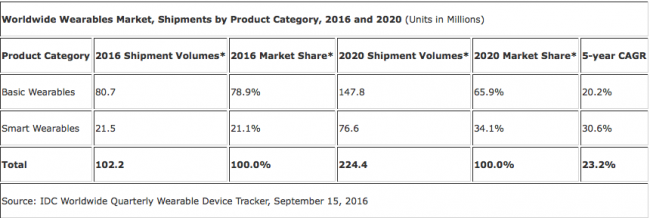

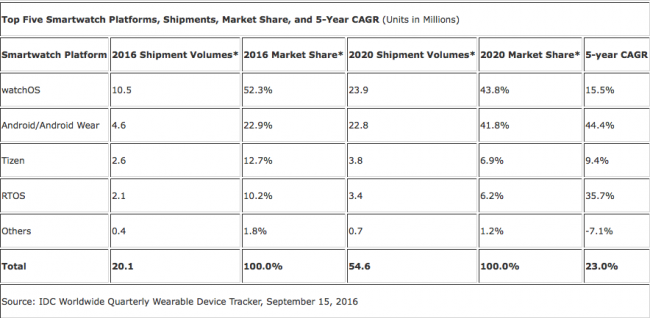

| According to IDC, total smartwatch shipments will reach 20.1 million units in 2016, an increase of 3.9% from the 19.4 million units shipped in 2015. IDC expects total smart wearable volumes to reach 21.5 million units shipped in 2016. By volume, smartwatches account for the largest part of the category, and are expected to reach a total value of USD17.8 billion dollars in 2020. (IDC, press, CN Beta 1, 2, CNET) |

| Apple continues to stockpile talent in augmented reality—Zeyu Li from Magic Leap and Yury Petrov from Oculus. (Apple Insider, CN Beta, Business Insider) |

| Sony aims to extend content for its dedicated VR headset into non-gaming areas such as TV and film, and has no plans to join the burgeoning market for smartphone-based headsets, says Andrew House, Sony Interactive Entertainment’s chief executive. (Android Headlines, Reuters, Fortune, ZOL) |

| castAR, the augmented reality company founded by two former Valve engineers, has set up a new studio in Salt Lake City with talent recruited from the former developers of Disney’s Infinity toy-game franchise. (Engadget, Venture Beat, 163, Baidu VR, Digital Trends) |