3Q16 Mobile Device Shipment – Smartphones, Feature Phones and Tablets (IDC)

This is a simple report summarizing the shipment of mobile devices—smartphones, feature phones and tablets—based on IDC’s latest number (3Q16). The reasoning behind some of those numbers cannot be explained in detail here, but will be explored in another report.

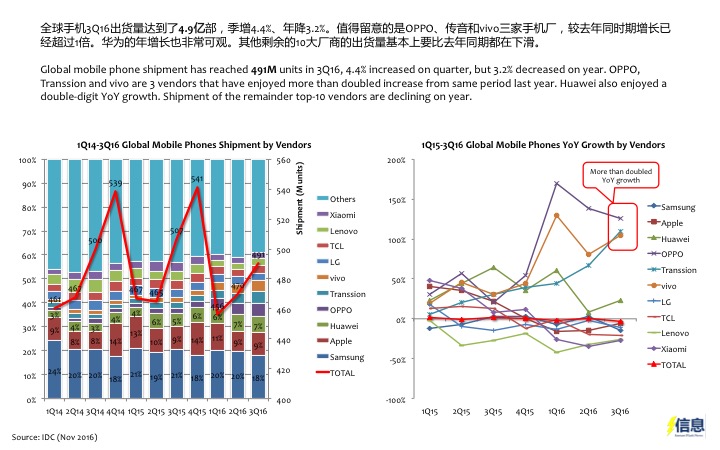

- Global mobile phone shipment has reached 491M units in 3Q16, 4.4% increased on quarter, but 3.2% decreased on year. OPPO, Transsion and vivo are 3 vendors that have enjoyed more than doubled increase from same period last year. Huawei also enjoyed a double-digit YoY growth. Shipment of the remainder top-10 vendors are declining on year.

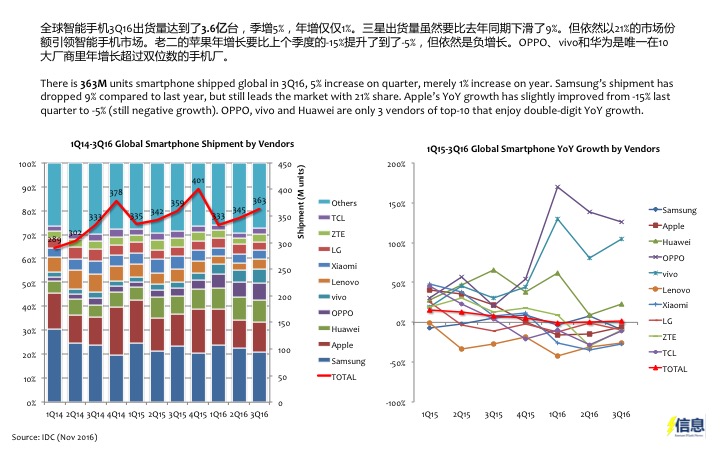

- There is 363M units smartphone shipped global in 3Q16, 5% increase on quarter, merely 1% increase on year. Samsung’s shipment has dropped 9% compared to last year, but still leads the market with 21% share. Apple’s YoY growth has slightly improved from -15% last quarter to -5% (still negative growth). OPPO, vivo and Huawei are only 3 vendors of top-10 that enjoy double-digit YoY growth.

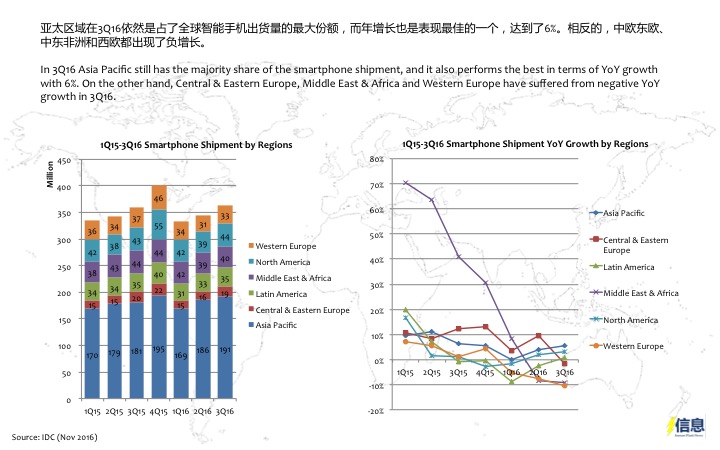

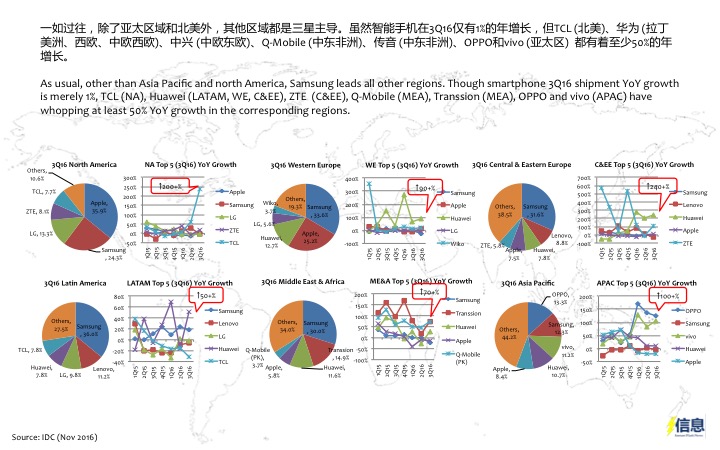

- In 3Q16 Asia Pacific still has the majority share of the smartphone shipment, and it also performs the best in terms of YoY growth with 6%. On the other hand, Central & Eastern Europe, Middle East & Africa and Western Europe have suffered from negative YoY growth in 3Q16.

- As usual, other than Asia Pacific and north America, Samsung leads all other regions. Though smartphone 3Q16 shipment YoY growth is merely 1%, TCL (NA), Huawei (LATAM, WE, C&EE), ZTE (C&EE), Q-Mobile (MEA), Transsion (MEA), OPPO and vivo (APAC) have whopping at least 50% YoY growth in the corresponding regions.

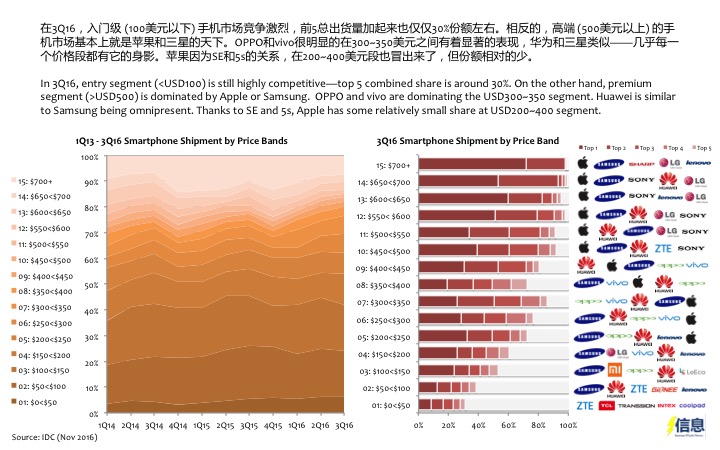

- In 3Q16, entry segment (<USD100) is still highly competitive—top 5 combined share is around 30%. On the other hand, premium segment (>USD500) is dominated by Apple or Samsung. OPPO and vivo are dominating the USD300~350 segment. Huawei is similar to Samsung being omnipresent. Thanks to SE and 5s, Apple has some relatively small share at USD200~400 segment.

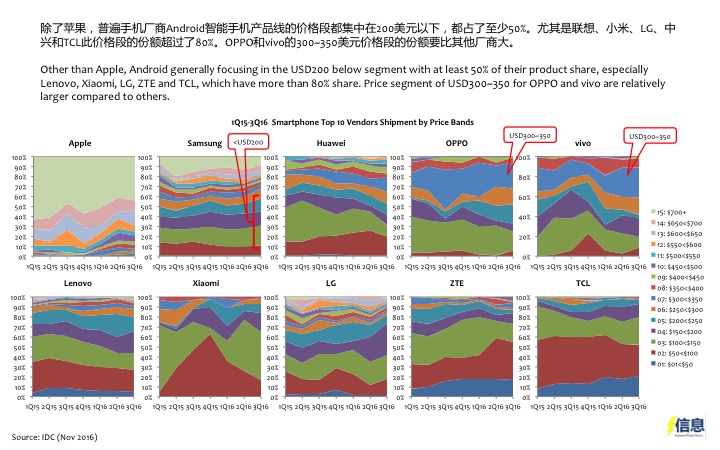

- Other than Apple, Android generally focusing in the USD200 below segment with at least 50% of their product share, especially Lenovo, Xiaomi, LG, ZTE and TCL, which have more than 80% share. Price segment of USD300~350 for OPPO and vivo are relatively larger compared to others.

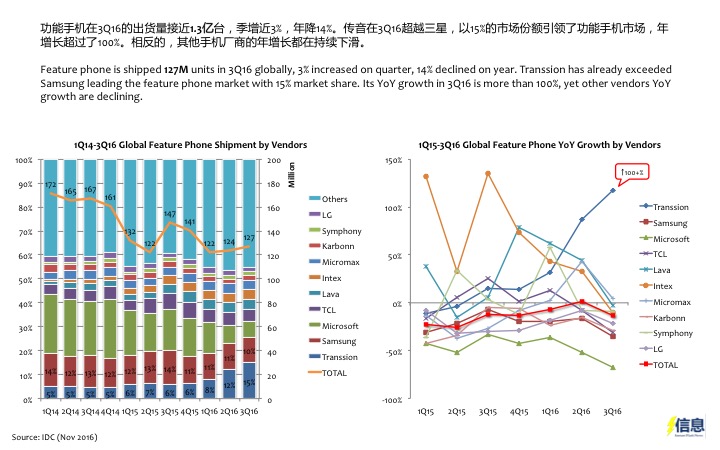

- Feature phone is shipped 127M units in 3Q16 globally, 3% increased on quarter, 14% declined on year. Transsion has already exceeded Samsung leading the feature phone market with 15% market share. Its YoY growth in 3Q16 is more than 100%, yet other vendors YoY growth are declining.

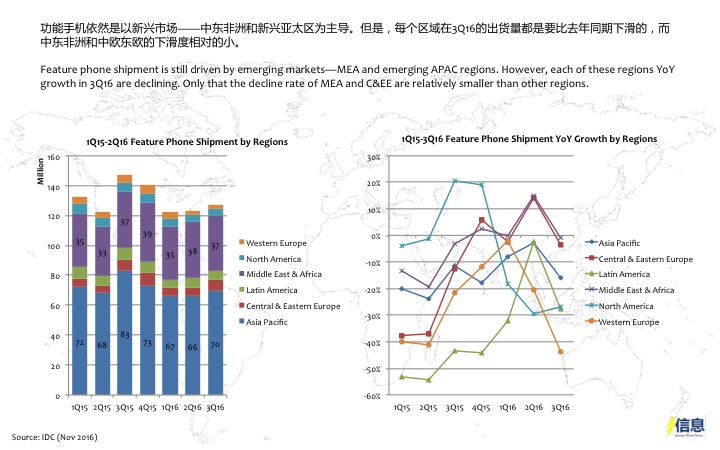

- Feature phone shipment is still driven by emerging markets—MEA and emerging APAC regions. However, each of these regions YoY growth in 3Q16 are declining. Only that the decline rate of MEA and C&EE are relatively smaller than other regions.

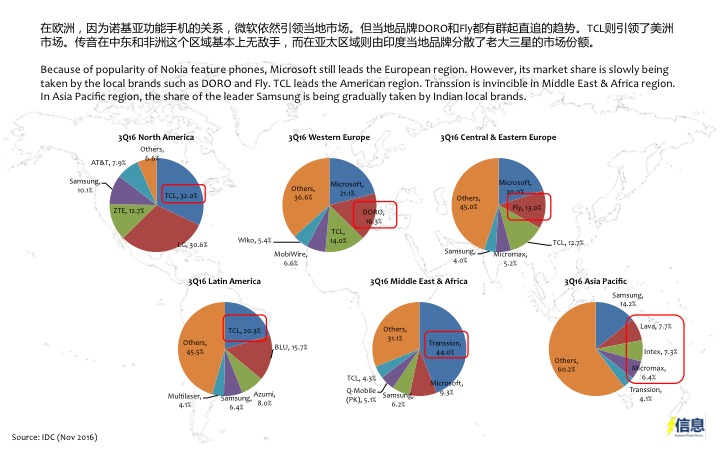

- Because of popularity of Nokia feature phones, Microsoft still leads the European region. However, its market share is slowly being taken by the local brands such as DORO and Fly. TCL leads the American region. Transsion is invincible in Middle East & Africa region. In Asia Pacific region, the share of the leader Samsung is being gradually taken by Indian local brands.

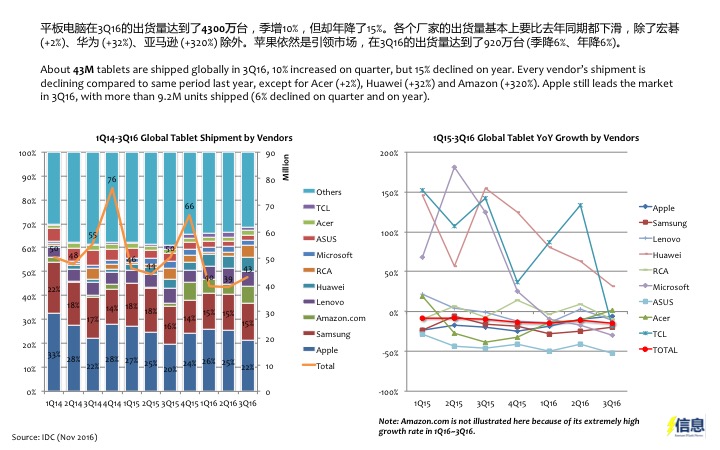

- About 43M tablets are shipped globally in 3Q16, 10% increased on quarter, but 15% declined on year. Every vendor’s shipment is declining compared to same period last year, except for Acer (+2%), Huawei (+32%) and Amazon (+320%). Apple still leads the market in 3Q16, with more than 9.2M units shipped (6% declined on quarter and on year).

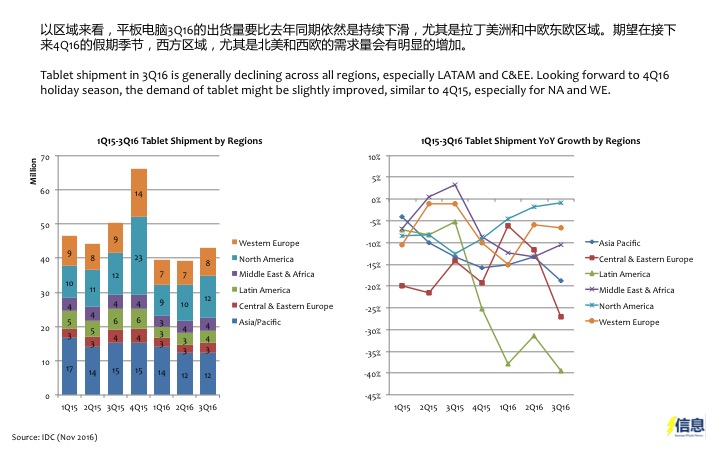

- Tablet shipment in 3Q16 is generally declining across all regions, especially LATAM and C&EE. Looking forward to 4Q16 holiday season, the demand of tablet might be slightly improved, similar to 4Q15, especially for NA and WE.