12-16: BlackBerry announced the major global partner in its shift toward a solely software and service company is TCL; An early Lunar Near Year in 2017 is driving a strong 4Q16 for the supply chain, which translates to downside risk in 1Q17;

Chipset

According to Digitimes, with Microsoft’s recent announcement of adding support to Qualcomm‘s processor solutions in Windows 10, sources from the upstream supply chain have pointed out that many brand vendors have already started developing and testing notebooks and tablets using Qualcomm Aps and their final products are likely to arrive at the end market in 2H17. (Digitimes, press, CN Beta)

MediaTek collaborates with Taiwan National Cheng Kung University to use innovative technology to build a smart city to prevent disease or epidemic. MediaTek indicates the first phase is to launch “smart mosquito killer” combining IoT technology, Big Data and AI to tackle dengue fever. (TechNews, Tinsa, China Times, ET Today)

BlueFin Research Partners analysts Steve Mullane and Paul Peterson indicates that 4Q16 production of semiconductors improve slightly from -2.2% to -1.2% sequentially. The 1.2% projected decline in 4Q16 is significantly better than 5-year seasonality of -5.4%. They indicate that SMIC, TSMC, and UMC improved by 1%, while Vanguard improved by 2%. GlobalFoundries Singapore forecast remained unchanged. (TechNews, Barron’s, blog)

BlueFin Research Partners analysts Paul Peterson and Steve Mullane continue to see modest forecast upside from Qualcomm and HiSilicon. With 28nm capacity still constrained, they believe TSMC is prioritizing Qualcomm over MediaTek and HiSilicon, a decision likely due to contractual obligations and influenced by Qualcomm’s planned move back to TSMC at 7nm. (TechNews, Barron’s, blog)

Touch / Display

LG is reportedly making some major changes in its display businesses to prepare for the future, which it thinks will be all about OLED. LG has reportedly merged the existing 5 business divisions – TV, OLED, IT, mobile and AD – into 3– TV, IT and mobile. (Android Authority, Android Headlines, Business Korea)

There are four 10.5G, 11G TFT-LCD factories under construction, to be constructed in China, including BOE, CSOT, HKC and Foxconn / Sharp. (Digitimes, press, Laoyaoba, iFeng, 51Touch)

BMW is showcasing HoloActive Touch, a concept interior that uses a free-floating projection that interacts like a physical touchscreen. (Engadget, BMW, Autoblog, 163)

Samsung is allegedly to give its lower-cost Galaxy A5 phone for 2017 something that right now only its highest-end phones have: a curved screen. (CN Beta, CNET, The Android Soul)

Innolux was granted the Innovative Product Awards by Hsinchu Science Park for its automotive display technologies: S Shape Display (R curve rate = 170mm), 1-axis Curve Display (R curve rate = 500mm), Curve with Touch Display (R curve rate = 500mm). (Innolux, TechNews)

According to Digitimes, Innolux supplies automotive display panels for automakers on an OEM basis and for after-market sale, with OEM clients including Mercedes-Benz, BMW, Porsche and Tesla. Innolux expects to ship 8-9M automotive display panels in 2016, with OEM and after-market each accounting for 50%. (Digitimes, press, Sohu, China Times)

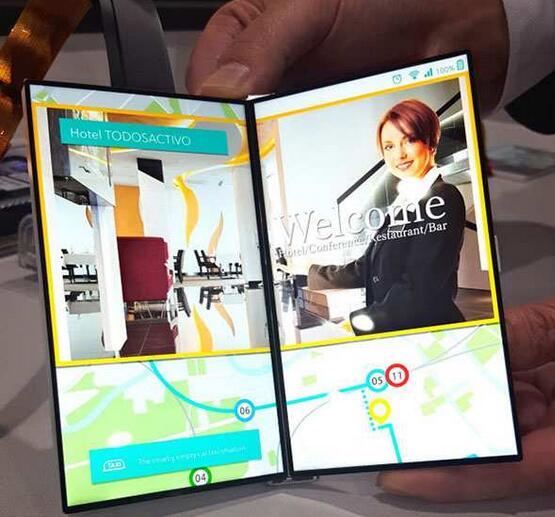

Japan Display Inc. (JDI) has offered TFT-LCD panels with bezel as narrow as less than 1mm, facilitating use of such panels in foldable-screen smartphones. JDI will further offer flexible TFT-LCD panels in 2017 and plans to kick off volume production in 2018-2019. (Digitimes, press, Pocket Now, CECB2B)

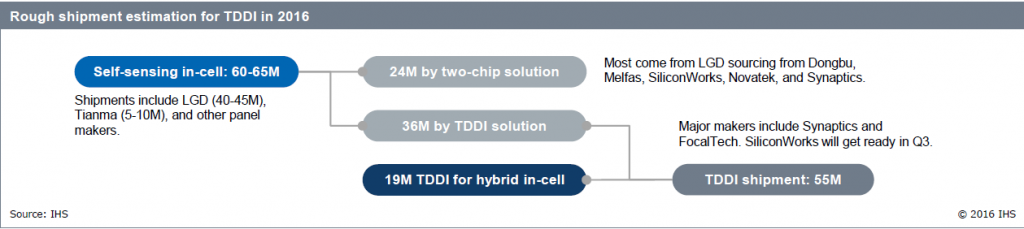

IHS Markit estimates that self-sensing in-cell shipments will reach 60M in 2016, but not all of them will adopt TDDI. Additionally, some TDDI demand is for hybrid in-cell touch. IHS Markit also forecasts that in 2016 global TDDI shipment would reach 50M in 2016, and in 2017 it will grow 200% to 100M units. Novatek, FocalTech and Himax are the TDDI vendors that benefit the most. (IHS report, Laoyaoba)

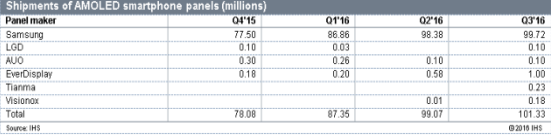

While Samsung Display has dominated the global supply of smartphone-use AMOLED panels, China-based EverDisplay Optronics (Shanghai), Tianma Micro-electronics and Kunshan Govisionox Optoelectronics have become alternative sources for first-tier China-based smartphone vendors. According to IHS Markit, the three China-based makers together shipped 1.41M units AMOLED panels, hiking 139% on quarter (Digitimes, press, FPDisplay)

LG Display has reportedly partnered up with Apple and Google and is developing ‘out-foldable’ displays for smartphones. It is going to start mass-producing them in 2018 and supply them to Apple, Google, and Microsoft. (ET News, TechNews)

J.P. Morgan’s JJ Park indicates that Samsung Display will be Apple’s sole OLED supplier until at least 2018. They expect one of three iPhone models in 2017 to use OLED and the total supply volume to be in the 70M range, followed by a sharp increase in 2018. They see Apple shipping 16.6M OLED phones in 3Q17 and another 38.4M in 4Q17. (Barron’s, blog)

Sensory

Smartsuit Pro from Danish startup Rokoko is a full-body motion capture (mocap) suit that allows users absolute freedom in their creative process, boasting 19 sensors dotted around the wearer’s body, with each one including a gyrometer, accelerometer, and magnometer. (Digital Trends, Rokoko, Wtoutiao)

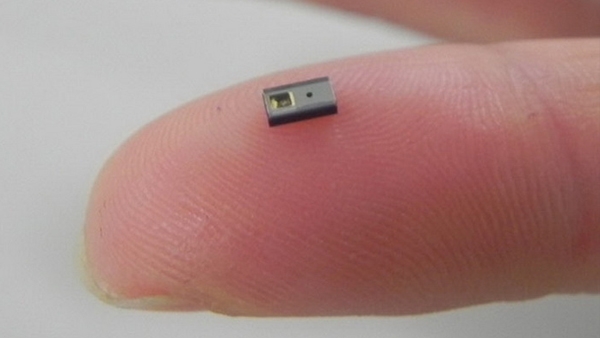

Kyocera announced that it has developed one of the smallest known optical blood-flow sensors, which measures the volume of blood flow in subcutaneous tissue. It measures 1×1.6×3.2mm. The company will offer sensor module samples starting April 2017, and aims to commercialize the technology as a device by March 2018. (EE Trend, EXP Review, AZO Sensors)

Max Ortiz Catalan of Chalmers University of Technology wants to use augmented reality (AR) technology to alleviate chronic pain that patients with missing limbs would suffer from. It uses myoelectric sensors, similar to the Myo armband gesture control system, that detect the electrical signals travelling through the muscle on the end of the patient’s amputated limb. (TechNews, CNET, The Lancet)

Battery

Germany’s Transport Minister, Alexander Dobrindt, is set to announce his government will introduce a series of subsidies and financial help to introduce hydrogen-powered vehicles. Dobrindt will announce measures that include a government pledge of more than EUR250M (USD260M) in 2019 alone. (CN Beta, Auto Car Pro, Reuters, Motoring)

Volkswagen has invested in Hubject, a group that aims to ease Europe into electrification. Hubject’s whole goal is to standardize certain parts of the electrification experience, namely mapping and payment. Hubject has a platform called eRoaming, which it will use to bring chargers together, even if they’re across country borders or built by different companies. (CN Beta, CNET)

Panasonic will supply solar panels to U.S.-based Tesla Motors, looking to offset dwindling business in Japan with sales abroad. Japanese demand for solar panels has waned owing to cuts to the feed-in tariff for solar power. Panasonic’s solar business has suffered as a result, prompting it to halt production at Kaizuka in February. The segment’s April-September sales apparently fell 40-50% on the year. (Asian Nikkei, TechNews)

Smartphone

BlackBerry announced the major global partner in its shift toward a solely software and service company is TCL. Under this deal, TCL will build and distribute BlackBerry-branded devices globally, while BlackBerry provides the security, apps and customer support. (CN Beta, TechCrunch, Market Wired)

Samsung will reportedly install its mobile payment solution Samsung Pay in nearly all its smartphone models in a bid to expand its footing in the sector in 2017. (Korea Herald, CN Beta)

Administration of Quality and Technology Supervision of Guangdong Province announced the results of quality check on 2016 mobile phones, and found out a total of 44 batches of mobile phones failed to meet the standard requirements. The main reasons include leak of personal information, safety issue for elderly, and the brands include Coolpad, Meizu, Haier, etc. (Laoyaoba, Dayoo, Sohu, OfWeek, GDQTS, failed list)

According to Huatai Research, an early Lunar Near Year in 2017 is driving a strong 4Q16 for the supply chain, which translates to downside risk in 1Q17, however, although forecasts for the quarter currently look seasonal with a 10-15% QoQ decline. (TechNews, Barron’s, blog)

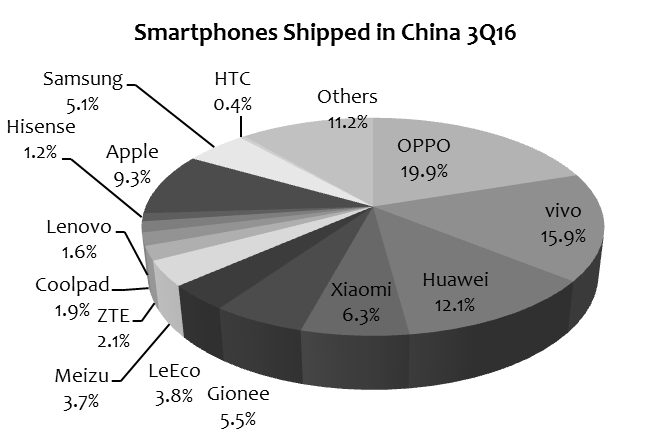

There were 112.3M smartphones shipped in the China market during 3Q16, increasing 5.2% on quarter and 5.8% on year and accounting for 30.9% of the global total. International vendors shipped 17.1M units, accounting for 15.2% of the shipments and decreasing 2.8% on quarter and 36.7% on year, according to Digitimes. In 4Q16, 118.4M smartphones will ship in the China market, including 22.5M units by non-China-based international vendors. (Digitimes, press)

Coolpad Cool Changer S1 is announced – 5.5” FHD display, Qualcomm Snapdragon 821 processor, 16MP PDAF + 8MP cameras, 4 / 6GB RAM, 64 / 128GB storage, Android 6.0 (EUI 5.8), 2 Harmon Kardon speakers, 4070mAh battery, from CNY2499. (TechNode, 163, Gizmo China)

Wearables

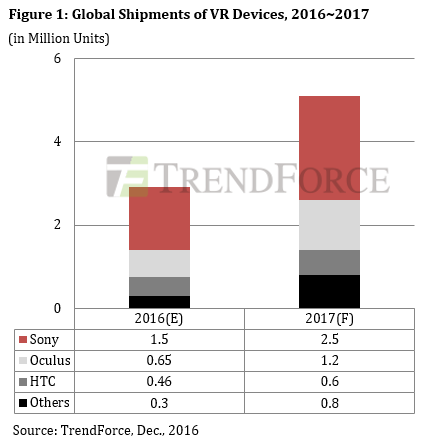

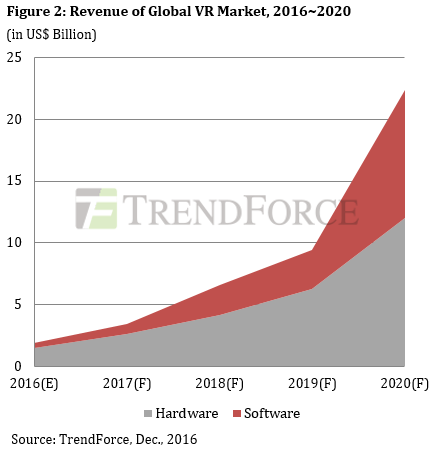

Based on TrendForce’s latest analysis, annual shipments of VR devices worldwide (excluding mobile VR device) are projected to reach 2.91M units for 2016 and grow massively by 75% to 5.1M units for 2017. TrendForce expects the VR market will begin to expand at a more rapid pace in 2018, when hardware shipments begin to stabilize. By 2020, global VR market will grow to USD22.4B. (Digitimes, TrendForce, press, TrendForce[cn], press)

Internet of Things

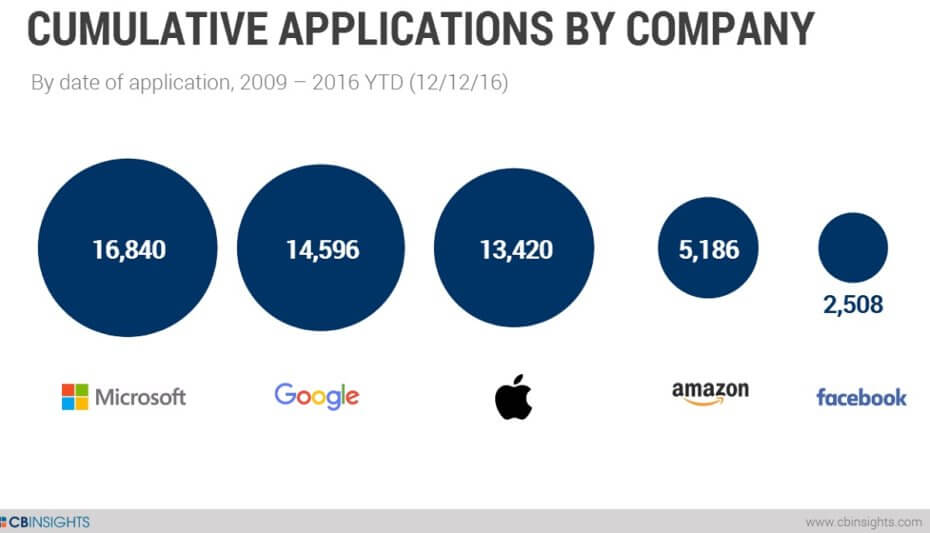

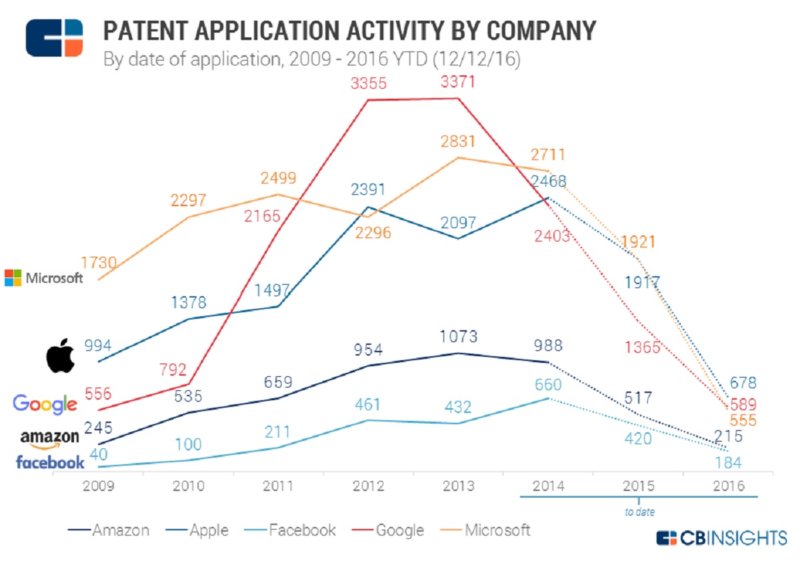

The 5 biggest tech companies have applied for more than 52,000 patents since 2009, according to CB Insights. Google, meanwhile, is No. 1 in vehicle patents, a sign of its interest in self-driving cars. Apple is No. 2 in that category, and Amazon is No. 3. (Android Headlines, CB Insights, VentureBeat)

LG launches its premium home appliance brand “LG SIGNATURE” in China, bringing 3 products including 65” OLED TV, double magic space refrigerator, twin-wash washing machine and air cleaner. (CN Beta, Korea IT Times, 163, Xinhuanet)

LeEco CEO Jia Yueting invested 3 electric vehicle companies will showcase their products in CES 2017, one of which is Lucid Motors’ Lucid Air – equips a 100kWh battery pack as standard, but a larger 130kWh option is coming with 1,000 horsepower and approximately 400 miles of range. (CN Beta, Yahoo, Fox News)

General Motor (GM) has announced their plans to start testing out their self-driving cars on the roads of Michigan. The testing has already begun and come early 2017, the company expects to begin the production of their next-generation of self-driving test vehicles as well. (CN Beta, Ubergizmo, GM, iFeng)

DeepMind, the London-based division of Alphabet that is responsible for numerous recent breakthroughs in artificial intelligence, is hiring its first researcher in the U.S. to boost collaboration across the Atlantic. (CN Beta, Yahoo, Bloomberg)

Futuris Automotive sues Faraday Future specifically for breach of contract—Faraday agreed that it would pay all of its bills within 30 days of the invoice, and many of those bills have run on past that period. A full USD7M of the USD1M total is over 30 days late, says Futuris. (CN Beta, Jalopink, Buzzfeed News)

Daimler and BMW are reportedly looking to share a vehicle platform to better compete with the likes of Uber. They are combining their car-sharing divisions, but will keep their individual brand names – BMW’s DriveNow and Daimler’s Car2Go. (CN Beta, Auto News, Hybrid Cars)

IBM announced partnering with German automaker BMW at their IoT HQ collaboratory in Munich, Germany. The pair will focus on the natural language capabilities of Watson, hoping to use cognitive computing to “personalise the driving experience” and improve driver support. (Digital Trends, Computer Weekly, Tech Republic, IBM, Tencent, 36Kr)