03-12: Qualcomm’s market share in smartphone AP is decreasing; Nanya is looking to beef up its investment in 20nm process capacity; Kingston indicates a DRAM shortage throughout 2017; etc.

Chipsets

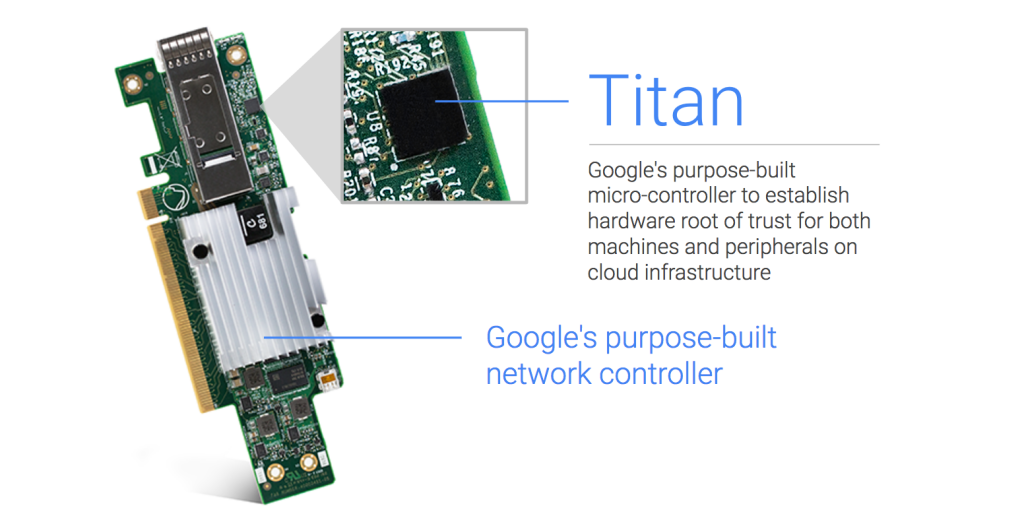

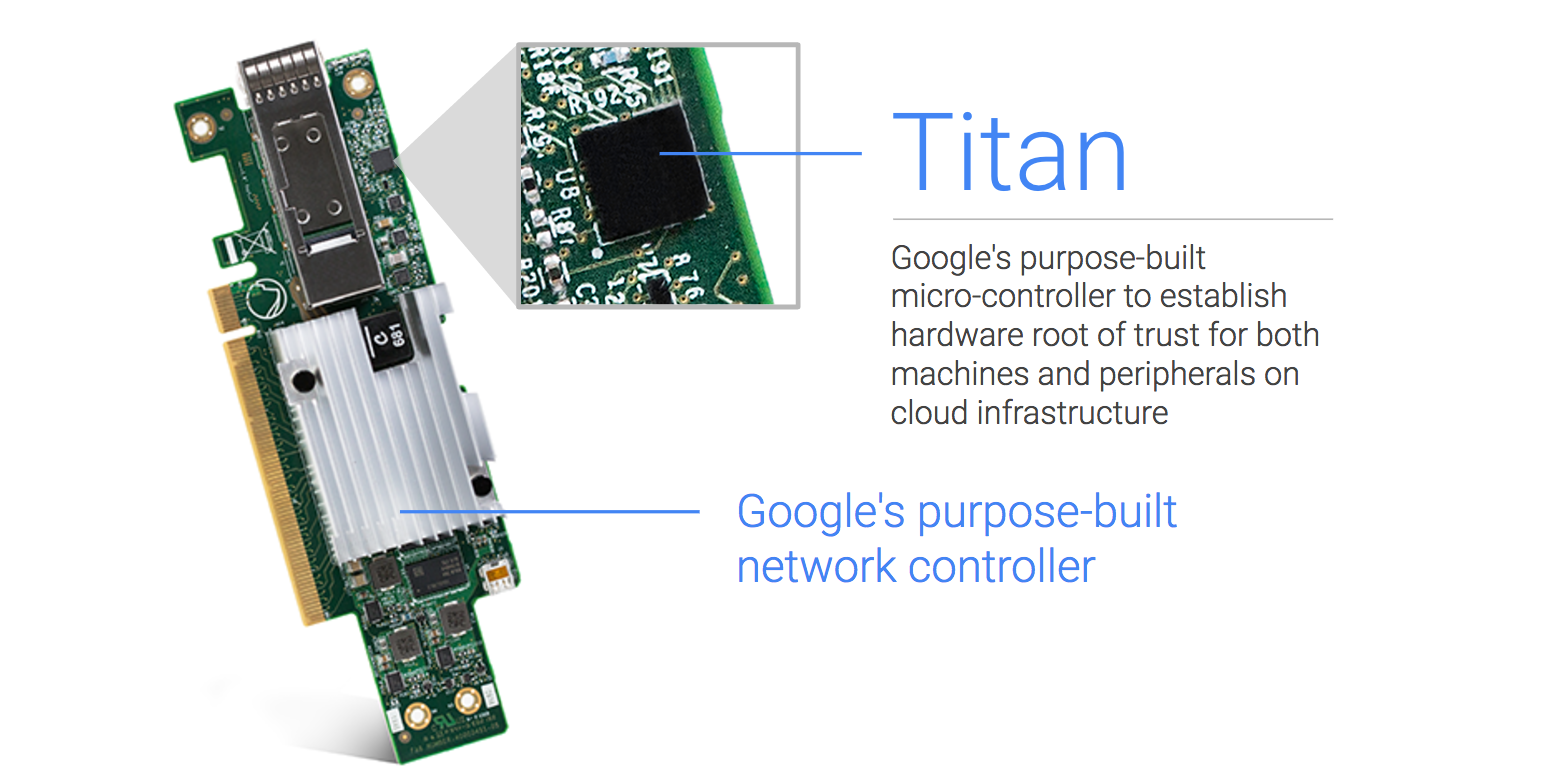

Google announces custom built security chip Titan. It is a low-power microcontroller designed specifically for hardware security. The chip gives a cryptographic identity to a machine. (TechNews, ZDNet)

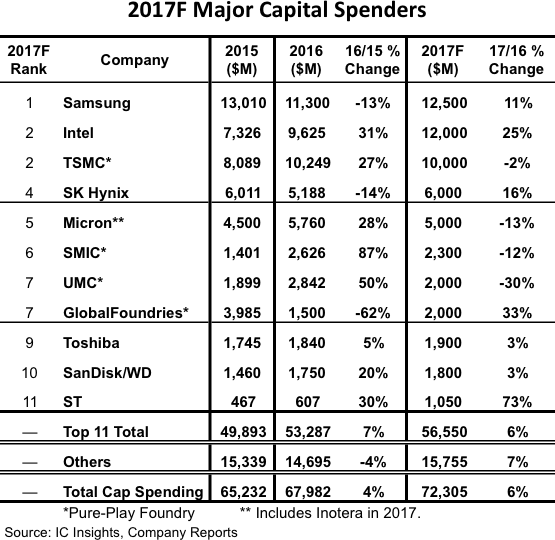

Samsung Electronics and SK Hynix scaled down facility investment due to the sluggish DRAM market in 2016. In 2017, however, they will invest aggressively. Samsung Electronics is projected to spend USD12.5B (about KRW14.5T) in CAPEX, the biggest amount in the world semiconductor industry. Samsung’s facility investment is expected to focus on Pyeongtaek in Gyeonggi-do, South Korea. It is building the world’s largest semiconductor complex there, and plans to roll out V-NAND flashes beginning in mid 2017. (IC Insights, press, Yonhap News, TechNews)

Samsung Electronics’ NAND flash fab in Xian, China generated CNY23.75B (USD3.44B) in output value in 2016 outpacing the total output value generated by SMIC’s fabs estimated at CNY20.22B, according to Digitimes. (EE Focus, Digitimes, press)

Strategy Analytics estimates that Qualcomm controlled 42% of the smartphone AP market in 2015, down from its 52% share in 2014. Qualcomm’s share in the smartphone AP market fell to 39% in 1H16. Qualcomm is rumored to be manufacturing Snapdragon 660 using the 14nm fabrication process rather than the 28nm process of its predecessors and rumors indicate that Xiaomi will be a customer. (Laoyaoba, EE World, Sohu, Motley Fool, press)

Touch Display

CSOT’s parent company TCL Group chairman Li Dongsheng indicates that the market demand is growing, and he estimates in next 5 years, the market still can fit in 4-5 10.5G or 11G production lines. He believes efficiency and technology innovation are the vital factors to success. Mainland China’s 2 biggest panel makers BOE and CSOT are building 10.5G and 11G production lines, in addition to Foxconn’s 10.5G line, the production will start in 2018 and 2019. This causes concern in the market that it will be over-supply. (Laoyaoba, 51Touch, ChinaFPD, OfWeek, ECNS)

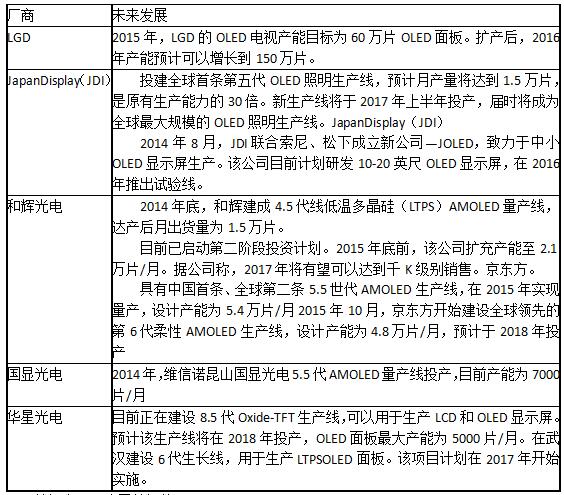

Currently OLED panel production vendors are focused in East Asia, including Korea, Japan and Taiwan. Samsung has occupied near 90% of AMOLED global supply. However, a number of vendors are aggressively entering the production, and this monopoly status will soon be broken. (OfWeek, Sohu, China FPD, CHYXX, article)

Tianma Microelectronics says it plans to buy stakes in 2 microelectronic firms valued at CNY10.7B (USD1.55B) via share issue and aims to raise up to CNY1.9B in private placement of shares to fund project. (Laoyaoba, eMoney, OfWeek, Yahoo)

Camera

With Apple iPhone 7 Plus, Huawei P9 and other flagships adopting dual-camera, Zhejiang Crystal-Optech and O-Film are benefiting from this market demand for dual-camera. CITIC Securities believes that camera is the obvious selling point to a smartphone, and expecting dual-camera equipped smartphone share will increase from 5% in 2016 to 60% in 2020. (CNYES, NBD, Laoyaoba)

Rex Wu of Jefferies believes that OPPO’s next flagship will adopt a 5x optical zoom solution, using a dual camera for 3x zooming and software to enhance 2x zooming. This will benefit Sunny Optical as a leading high-end dual camera technology supplier. Assuming 10M units shipment and ASP of CNY200 (25% higher), he estimates this will boost Sunny’s 2017 group revenue by 6% and lift dual camera ASP by around 4% if Sunny can get 60% order allocation. (Barron’s, blog, Barron’s, blog, Next Media, UDN, WSJ)

Memory

DRAM firm Nanya Technology has disclosed its capex for 2017 will reach NTD34.3B (USD1.1B), up over 50% from the about NTD22.3B allocated for 2016. Nanya indicated it is looking to beef up its investment in 20nm process capacity. Nanya expects to output 30,000 wafers per month using 20nm process technology by the end of 2017, with the output to reach 38,000 units in 1H18. (China Times, Digitimes, press)

According to Kingston chairman Chen Jian Hua’s analysis, currently DRAM vendors do not have any plan to increase production. In fact they are improving their process node to increase bit rate output, and also shifting production to 3D NAND flash. This is causing shortage of DRAM, and it will be throughout 2017. Additionally, as NAND Flash is entering 3D generation, yield rate still requires improvement, causing NAND flash shortage too. (Laoyaoba, EE World, UDN, Apple Daily)

Biometrics

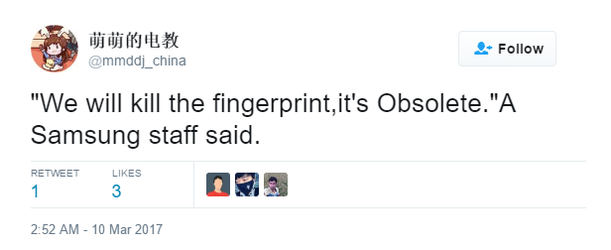

A staff member of Samsung has said that the company has made plans to ditch the fingerprint because it is “obsolete”. (Phone Arena, Droidholic, Feng)

Due to some limits of iris scanning such as speed and accuracy, Samsung has reportedly made a decision to add facial recognition to the Galaxy S8. On the Galaxy Note7, the addition of the iris scanner was definitely a fresh way to unlock the device, but it was slower than the fingerprint reader. (CN Beta, Laoyaoba, Phone Radar, Tech Know Bits, WCCFTech)

Smartphones

KGI Securities analyst Ming-Chi Kuo predicts Samsung Galaxy S8 to have 5.8” and 6.2” OLED screens with 2960×1440 WQHD+ resolution. Qualcomm 8998 SoC is expected for the US and Japan markets, with the remainder of the world getting the phone equipped with the Samsung Exynos 9985. He expects shipments 40M-45M units in fiscal year 2017, notably less than the 52M Galaxy S7 shipped in a comparable timeframe. (Laoyaoba, 9to5Google, Apple Insider)

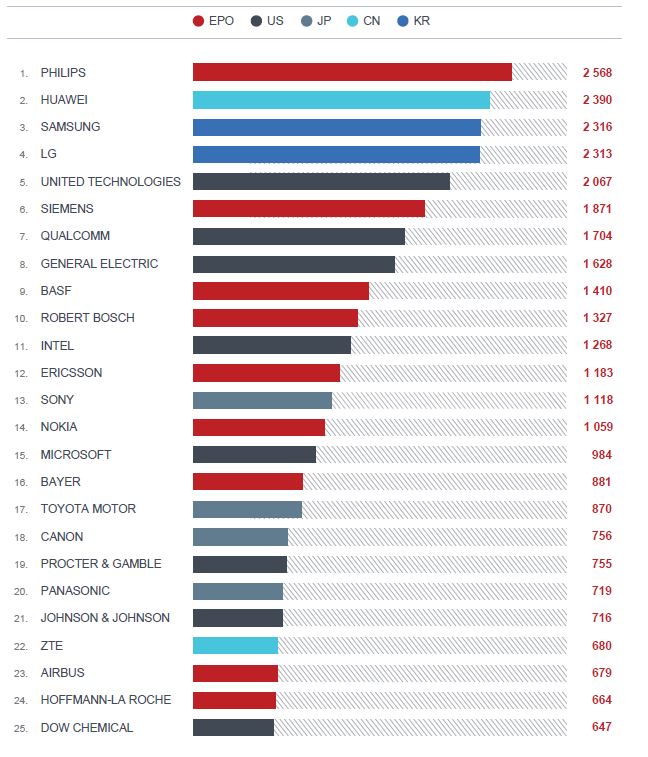

According to figures released by the European Patent Office, Chinese companies filed 7,150 patents with the EPO in 2016, a year-on-year increase of 24.8%. Huawei has filed a notable 2,390 patents, which was the 2nd-largest filing by a company globally, after Philips with 2,568 patents. (Laoyaoba, 4-Traders, China Daily, EPO, statistics)

Wearables

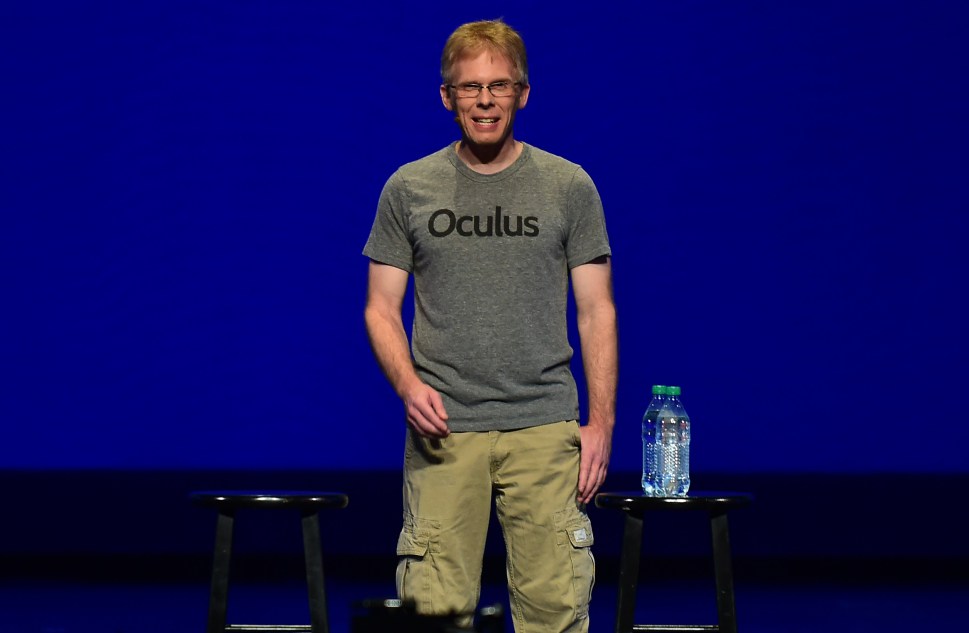

The CTO of Oculus, John Carmack is suing ZeniMax Media for UDS22.5M that he says has not been paid to him for the 2009 sale of his game studio, id Software, known for such pioneering video game classics as Doom and Quake. (TechCrunch, ChinaZ, Caijing)

CNN has announced a new unit dedicated to the medium, CNNVR, which includes correspondents in 12 cities around the world. As part of the move, the company will be adding more 360º video content to its iOS and Android apps. (The Verge, TechCrunch, Variety, Sootoo, HIAPK, Sohu)

HTC’s president of Vive in China Alvin Graylin pointed out that there could be “hundreds” of accessories for the HTC Vive in 2017 because of the Vive Tracker. (CN Beta, VentureBeat, UploadtoVR)

Internet of Things

RBC Capital Markets analysts Mark Mahaney and Jim Shaughnessy see a 3-fold tailwind for Amazon Alexa device sales, incremental voice-driven sales, and platform revenues–driving Amazon to the USD10B revenue mark. They also see an installed base of more than 100M in 3-5 years. (Yahoo, NASDAQ, Barron’s, blog, Laoyoaba)

Samsung Electronics announced it has completed the previously announced acquisition of Harman International Industries for a total of USD8B. (GSM Arena, Samsung, Phone Arena, Engadget)