04-01: Happy April’s Fool – Huawei’s annual profit growth was nearly flat, its slowest pace in 5 years; Meizu reportedly intents to work with TI to develop processor for smartphones; etc.

Chipsets

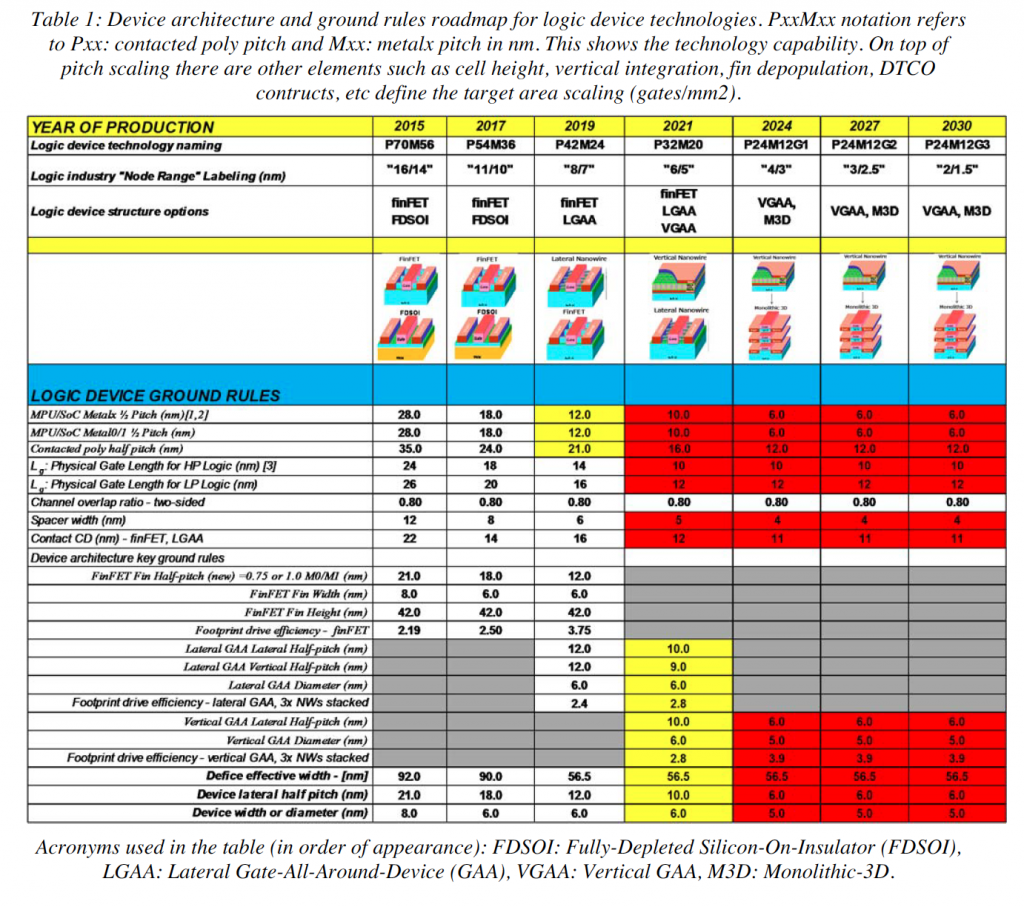

Traditional semiconductor scaling is expected to reach an end by about 2024, according to International Roadmap for Devices and Systems (IRDS). Die cost reduction has been enabled so far by concurrent scaling of poly pitch, metal pitch, and cell height scaling. This (will likely) continue until 2024. (EE Times, article, IRDS white paper, EET China)

Taiwan-based silicon wafer supplier Wafer Works is expected to start operating its new plant in Zhengzhou, China which will be dedicated to producing 8” wafers in 1Q18, with a production capacity of 200,000 wafers a month. (Laoyaoba, China Times, Digitimes, press)

In 1Q17, silicon wafer price is raised approximately 10%. In 2Q17, with the imbalance of supply demand, the price can continue to go up 15%-20%. Because of the wafer fabs have faced price down in previous years, there is no obvious plan for expanding production. Also, thanks to Mainland China-based SMIC and Huahong, and also Samsung coming to Taiwan for 12” wafer market share, it is expected the silicon wafer price will go up further in 3Q17. (China Times, Digitimes, press)

Meizu reportedly intents to work with Texas Instruments (TI) to develop processor for smartphones. However, TI has 2 major products—embedded processor, and analog / power management. The latter product accounts for about 70%-80% of TI’s overall revenue. As for highly competitive phone processor segment, TI has stopped invest in R&D for a number of years. (Laoyaoba, Elecfans, China Times)

Asustek has failed to be among the 1st wave of Qualcomm’s customers adopting the firm’s 10nm Snapdragon 835 processor and is also unwilling to use the older-generation Snapdragon 821, pushing back the launch of its 4th-generation ZenFone until Jun / Jul 2017, according to Digitimes. This might push Asustek to re-start its connection with MediaTek. (Digitimes, press, My Drivers)

Kaizad Mistry, a vice president and co-director of logic technology at Intel said that the company can now pack more than 100M transistors in each square millimeter of chip “for the first time in our industry’s history.” (Laoyaoba, IEEE)

Touch Display

Samsung foldable smartphone Galaxy X is rumored to be launched in 3Q17, before Galaxy Note 8 in 4Q17. (Ubergizmo, GSM Arena, Droidholic, ZOL)

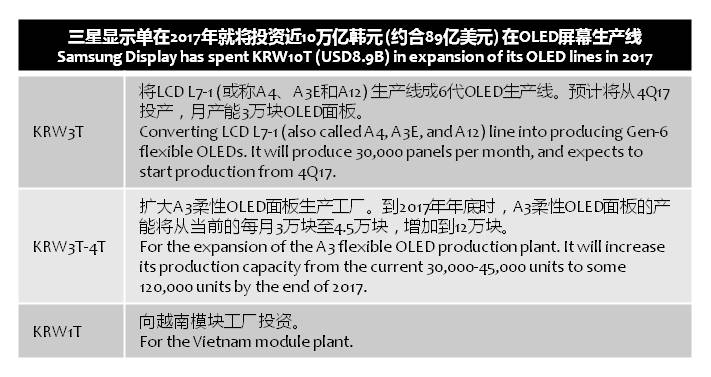

Samsung Display has started expansion of its organic light-emitting diode production lines under its plans to spend almost KRW10T (USD8.90B) in 2017 alone. (Phone Arena, The Investor, ET News, 91.com, CN Beta)

Google is encouraging Android developers to optimize their apps for the new 18:9 and 18.5:9 aspect ratios, featured on the LG G6 and the Galaxy S8 / S8+, respectively. (Phone Arena, Softpedia, Android Central, Gizbrain, TechWeb, Qudong)

TCL Corp. announced that its subsidy China Star Optoelectronics Technology (CSOT) is building a Gen-6 LTPS-AMOLED flexible display panel production line in Wuhan. It will be able to produce 45,000 flexible LTPS-AMOLED panel per month. It is using vapor deposition production process, focusing on 3”~12” high definition mid-t0-small size flexible AMOLED display. It will start production in 2020, total investment would be CNY35B. (CN Beta, CNFOL, 163)

BOE, OLED Microdisplay maker OLiGHTEK and Shenzhen Gao Ping Technology have announced a new joint-venture to produce OLED microdisplays for VR and AR. The new company will be established in Kunming, Yunnan, and will have an annual production capacity of 1M OLED microdisplays. Total investment in the new venture will total USD167M. (OLED-Info, BOE, Sina, LED100)

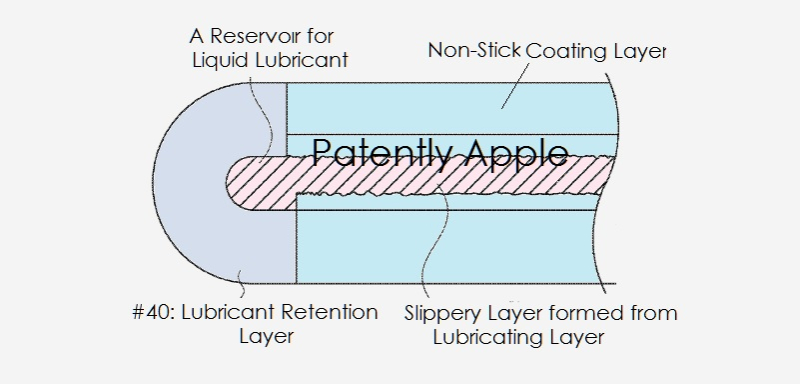

According to Apple’s patent filing, the iPhone’s housing for a foldable design may be formed of plastic, glass, ceramics, vfiber composites, metal, other suitable materials, or a combination of any 2 or more of these materials. The invention focuses on a unique lubrication system to support bendable displays so as to protect them from bending, twisting and folding over many years. (CN Beta, Patently Apple)

Barclay’s analysts analysts Andrew Gardiner, Hiral Patel, Joseph Wolf, Blayne Curtis, and Mark Moskowitz believe that all Apple’s next-gen iPhone in 2017 will reportedly feature True Tone technology, using a full spectral sensing ambient light sensor to change the color of the screen. Sensors will apparently be sourced from AMS of Austria, and will be embedded into the LCD displays of the “iPhone 7s” refresh, and the OLED screen of the “iPhone 8.” (Apple Insider, 9to5Mac, Mac Rumors, Laoyaoba)

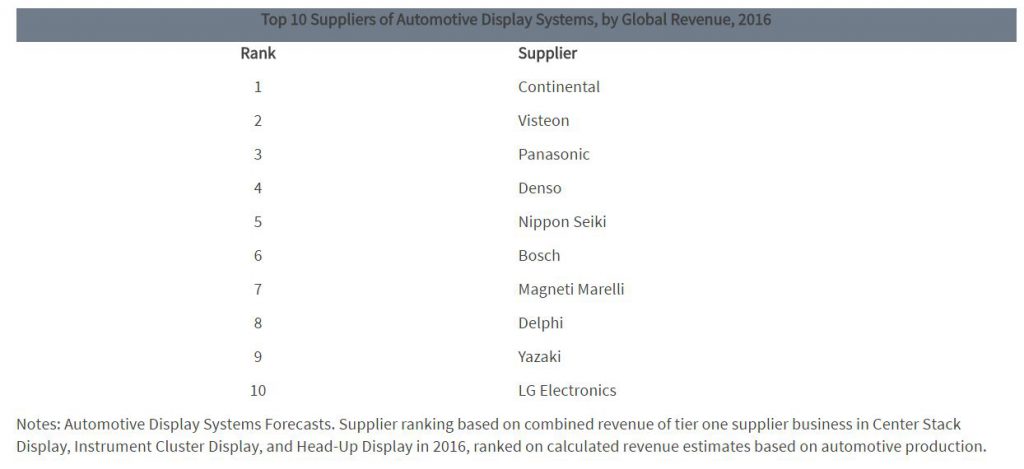

Continental tops the list of tier one suppliers of automotive display systems in 2016 based on global revenue forecasts, according to recent IHS Markit. This market represents nearly USD10B in tier one supplier revenue. IHS also forecasts the global automotive display systems market as a whole to grow to USD18.4B by 2021, nearly doubling in the next 6 years. (IHS Markit, press)

According to IDC, the total production capacity of LCD panels in 2020 will exceed 370km2, which is equivalent to 110 size of New York Central Park. IDC analyst Chen Jianzhu indicates that, the 2015-2020 CAGR of global LCD panel is about 7%, in other words, averagely every year the production grows 6.1 size of Central Park, in 3 years the production growth rate could reach Samsung Display’s total production in 2015. To consume all this newly added production, average size of large-size panel have to increase 12” by 2020. (IDC, press, Laoyaoba)

Camera

Samsung Galaxy S8 is reportedly facing manufacturing issues with its camera modules, as its supplier Patron is struggling to boost the yield rate, which is still below 70%. S8, Samsung has combined two camera modules — respectively for the front-facing camera and the iris scanner — into one. The S8 Plus uses separate camera modules produced by Power Logics. (The Investor, Ubergizmo)

Memory

The Joint Electron Device Engineering Council (JEDEC) says the DDR5 (Double Data Rate 5) standard should be finalized in 2018. DDR5 will succeed the current DDR4 memory, which is used in PCs and servers. DDR5 will be two times faster than DDR4 and also more power efficient. (Liliputing, JEDEC, Ars Technica, PC World, Tencent)

Sensory

Himax Technologies will be among the component suppliers of Apple for its OLED iPhone that will feature a built-in 3D-sensing module to enable AR / VR, according to Digitimes. Lumentum will provide 3D sensing modules for Apple’s next-gen OLED iPhone, which will adopt VCSEL (vertical-cavity surface-emitting laser)-based DOE (diffractive optical elements) in its front camera system, which will have both 3D sensing and 3D modeling capabilities. (Apple Insider, Digitimes, press, 163, ZOL)

Biometrics

Samsung totally knew it put the Galaxy S8’s fingerprint sensor in a terrible spot. After setting up the fingerprint sensor on the S8 and S8+, a special note will appear in the camera app to — get this — remind you to clean your camera lens. (Laoyaoba, ChinaZ, My Drivers, Mashable, Forbes, Android Authority)

Infineon Technologies and XMOS partner to deliver a new building block for voice recognition. It features a combination of radar and silicon microphone sensors from Infineon and audio processor from XMOS. The devices provide far field voice capture by audio beamforming combined with radar target presence detection. (EE News, Laoyaoba, Eletimes)

Battery

Toyota is using artificial intelligence for help in the hunt for new advanced battery materials and fuel cell catalysts. The Toyota Research Institute (TRI) is investing USD35M into the project and is teaming up with various institutions and companies, including MIT and Stanford University. (Engadget, Toyota, ZOL)

Foxconn Electronics (Hon Hai Precision Industry) will invest over CNY1B (USD145.24M) to acquire 7.66M shares or a 1.19% stake in China-based lithium battery maker Contemporary Amperex Technology (CATL). (Digitimes, press, Sohu)

Connectivity

Ericsson has publicly set a price tag on what it will cost to license the company’s technology for 5G high-speed mobile phone networks. Ericsson said it will cap royalties at UDS5 per phone for higher-end handsets, though it would go as low as USD2.50 for less expensive devices. (Laoyaoba, Bloomberg, Ericsson, Mobile World Live)

South Korea’s largest telecom provider SK Telecom is come under intense pressure to back away from an offer to use the network equipment of Huawei Technologies as critics say such technologies could be used to spy on the country. (CN Beta, Asia Nikkei)

Smartphones

LeEco managed to secure a USD2.2B injection from several new investors including Sunac China Holdings and Tianjin Jiarui Huixin Corporate Management Company that’s controlled by Sunac China. (Android Headlines, Variety, HKExnews, Qianzhan)

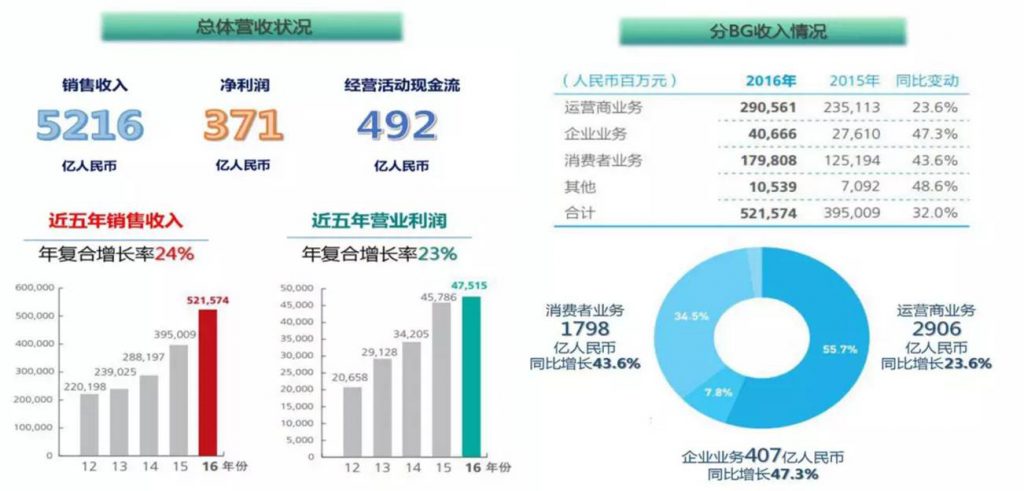

Huawei’s annual profit growth was nearly flat, its slowest pace in 5 years, as it ramped up spending to boost market share amid fierce competition. Its 2016 net profit edged up just 0.4% to CNY37.1B (USD5.3B). Profits took a hit after Huawei’s consumer business spent an additional CNY4.9B in part on branding. (Phone Arena, WSJ, Market Watch, Reuters, Sina, 163)

Based on 800M social media users, and 1B smart devices, Tencent issues a report. In 2016, the growth of Chinese brands in the smartphone market is tremendous, with top-4 brands market share grows from 46% in 2015 to 57% in 2016. In 2016 among the phone change users and brand switch, OPPO, vivo, and Huawei have the most share. (My Drivers, report, ChinaZ)

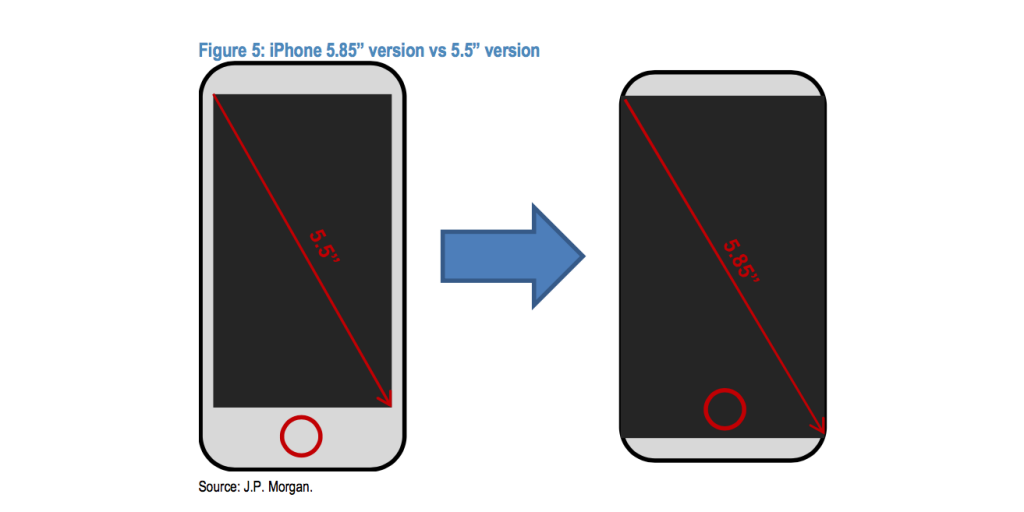

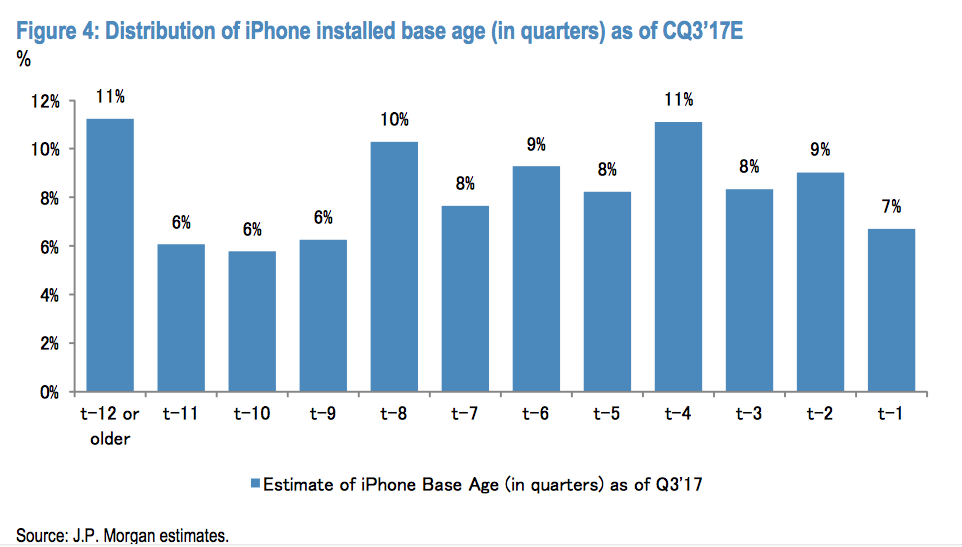

JP Morgan analyst Rod Hall indicates that Apple’s high-end iPhone Pro in 2017 will feature 5.85” edge-to-edge OLED screen in a compact form, front-facing 3D scanning capability, wireless charging, and it will will cost USD65 more to make than the iPhone 7, and that it will make up 41% of total iPhone shipments in 4Q17. Currently, the average iPhone in use is 6.4 quarters old, according to Hall’s model. (CN Beta, Business Insider, article)

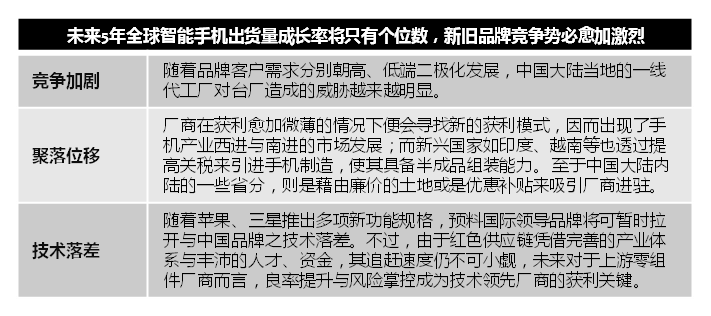

IDC analyst Sean Kao indicates that with the slow pace of upgrading infrastructure in the emerging markets, in coming 5 years the growth of smarpthone shipment will only be single digit. Under this circumstance, the competition between new and old brands will become increasingly fierce, and thus 3 market trends emerge: increased competition, market focus shifting, and technical gap. (EE World, EE Focus, Laoyaoba, IDC, press)

According to Strategy Analytics, global smartphone wholesale revenue will growth +8% YoY in 2017, from the dip of 2016. Strategy Analytics forecasts the 4 largest countries (China, US, Japan India) to account for 56% of all smartphone wholesale revenues worldwide in 2017. (Strategy Analytics, press)

Drexel Hamilton analyst Brian White indicates that Huawei is likely to unseat Samsung to become Apple’s biggest rival. Samsung and probably some smaller competitors underneath them. Over the next 3~5 years some smartphone handset makers will “go by the wayside,” he said. (Gizmo China, CNBC, 163)

According to Brand Finance, the total value of America’s top 500 brands now exceeds USD3T, having increased 11%, from USD2.82T in 2016 to USD3.14T in 2017. Google has overtaken Apple to become the “most valuable global brand” with USD109.4B. (CN Beta, Business Insider, The Drum, Brand Finance, report)

Wearables

Garmin Forerunner 935 is a GPS-enabled smartwatch with advanced tracking features for complex exercise routine – running, sprinting, swimming, biking, even triathlons, and it is priced at USD500. Onboard sensors include a heart rate monitor, a barometer/altimeter and a compass. (GSM Arena, Garmin, The Verge, Sina, 163)

Internet of Things

China has strong demand for robots, but locally produced robots took up only 26.7% of its demand in 2015. Too meet the demand, China firms have geared up development of robots with government incentives in recent years and the use of robots has extended from manufacturing to other sectors. But the development of China’s robot industry faces 2 risks: over investment in low-end robots with low added values, and consequently oversupply, according to Digitimes Research. (Digitimes, press)