04-30: Sorry, nose allergic attack. Last 2 days – 347.4M smartphones shipped worldwide in 1Q17; Windows Phone is missing from the list of investments Microsoft is making; etc.

Chipsets

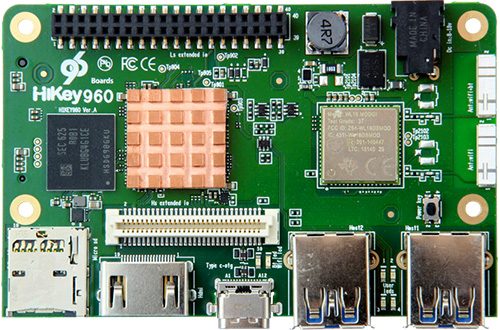

ARM hardware developer Linaro, in partnership with Huawei, is readying a new computer board product capable of running Android with current-gen CPU and GPU technologies. The HiKey 960 is intended to act as a tool for Android devs to test software and drivers, it could also be used in the production of robotics, drones, and digital home devices. (Android Authority, 96Boards, PC World, CSDN, Baijiahao)

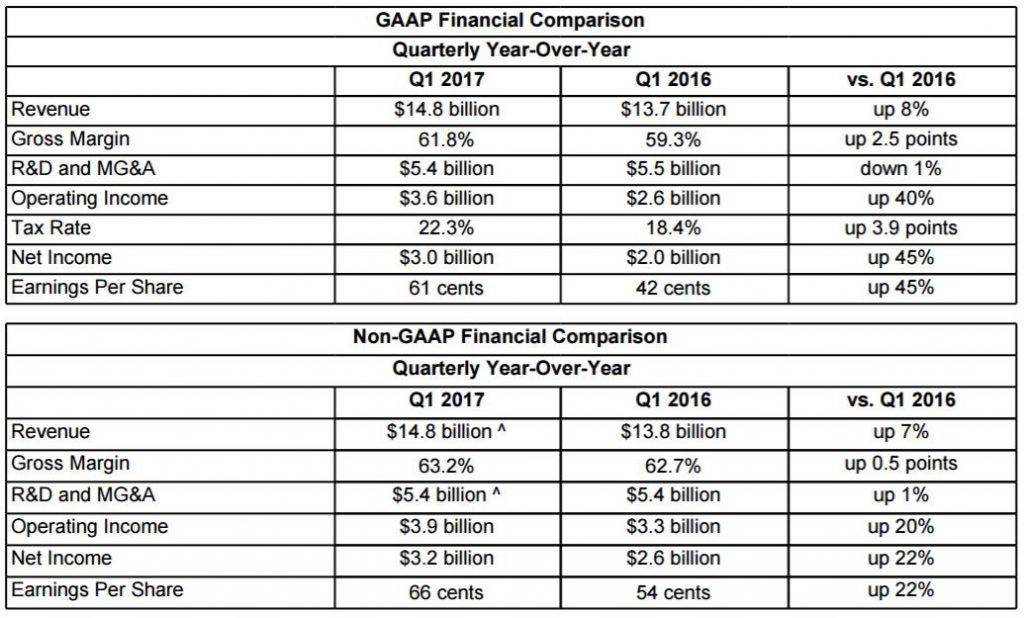

Intel reported earnings that beat analysts’ earnings for 1Q17. Revenues for the quarter were USD14.8B and non-GAAP earnings were USD3.2B. The company also generated approximately USD3.9B in cash from operations, paid dividends of USD1.2B. (VentureBeat, VentureBeat, Intel, CN Beta)

United Microelectronics Corp (UMC) 28nm process fell to 17% of overall sales in 1Q17 compared with 22% in 4Q16. JP Morgan analyst Gokul Hariharan indicates that it feels like there is some oversupply in 28nm. UMC said it aims to increase 28nm to 20% of its total sales by 4Q17. The process technology will probably contribute about 15% to company revenue during 2Q17, according to UMC CEO Yen. (EE Times, Design-Reuse, HC360)

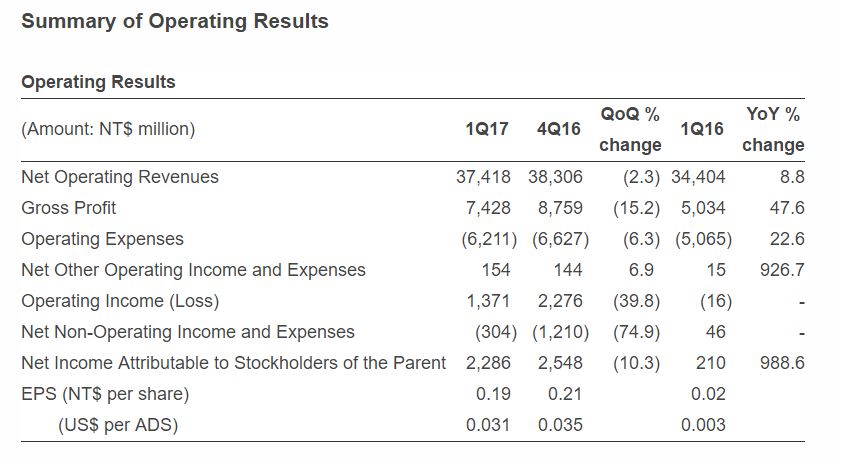

UMC’s 1Q17 consolidated revenue was NTD37.42B, down from NTD38.31B in 4Q16 and up 8.8% YoY from NTD34.40B in 1Q16. 1Q17 consolidated gross margin was 19.9%. Net income attributable to the stockholders of the parent was NTD2.29B. (Business Wire, HC360)

UMC has disclosed plans to roll out 22nm process technology as early as 2018. UMC has started IP development for its 22nm process, and expects to introduce the node technology in 2018 or 2019. UMC also disclosed it started shipping 14nm chips in 1Q17. The process manufacturing capacity is maintained at about 2,000 wafers per month. (Digitimes, press)

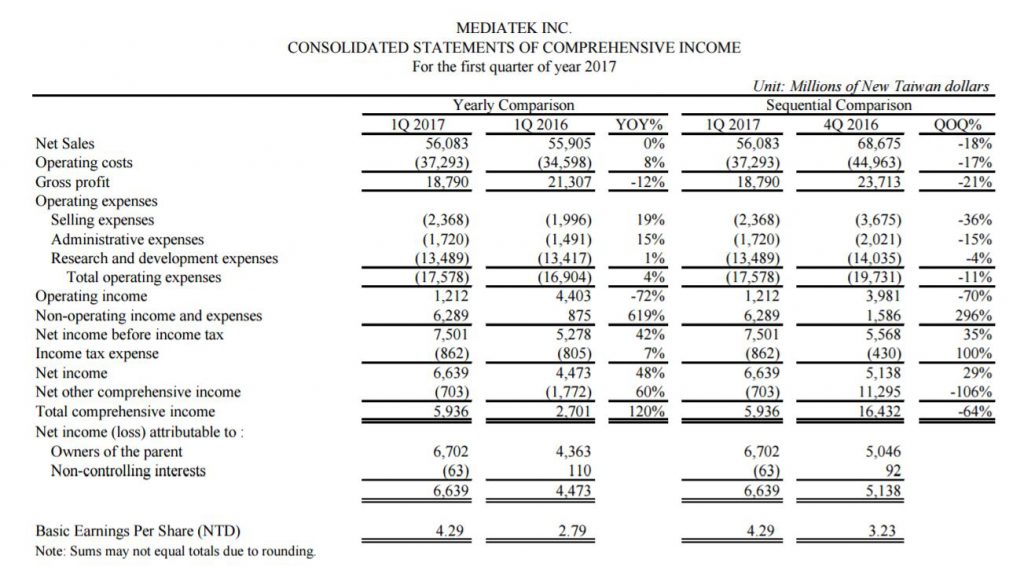

MediaTek saw its gross margin reach a record low of 33.5% in 1Q17. MediaTek’s gross margin for 1Q17 represented declines of 1% sequentially and 4.6% on year. The company posted consolidated revenues of NTD56.08B (USD1.86B) in 1Q17, down 18.3% on quarter and 0.3% compared to the same period in 2016. (Laoyaoba, China Times, Digitimes, press, MediaTek)

ARM has recently revealed that Qualcomm Snapdragon 835-based Windows 10 notebook will be launched in the market by the end of 2017 and some market watchers believe ARM and Microsoft’s partnership is expected to focus on conquering the weakness in software ecosystem and could bring pressure to Intel. (Digitimes, press, PC Online, 163)

Touch Display

LG Display (LGD) is expected to face further delay in its planned supply of OLED panels for Apple iPhone as it is still struggling to ramp up the yield rate that meets Apple’s strict criteria. LGD’s OLED shipment for iPhone could start from as early as 2019, about a year’s delay from previously planned. LGD plans to start producing OLED panels from 3Q17, possibly in Aug 2017, possibly for Xiaomi and LG. (TechNews, 4-Traders)

Camera

Truly Optoelectronics plans to ramp up capacity for its dual-lens modules to 4M units a month in Jul 2017, up from 3M units currently, in order to meet increasing demand. (Laoyaoba, EE World, Digitimes, press)

Memory

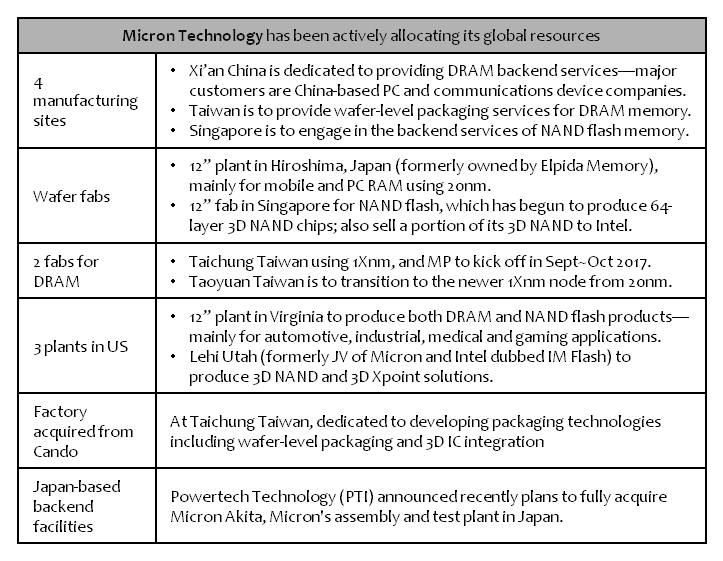

Micron has been actively allocating its global resources to enhance its DRAM and NAND flash product lines, according to VP Wayne Allan. (Digitimes, press)

Macronix International has posted net profits of NTD203M on revenues of NTD6.61B for 1Q17. Of Macronix’s 1Q17 revenues, NOR flash memory accounted for 58% followed by ROM products with 23%, NAND flash with 11% and the foundry business with 8%. (Digitimes, press, OfWeek, EE Focus)

Macronix has been engaged in the development of 3D NAND technology, and expects to enter volume production of chips built using the technology for SSDs in 2018, according to company chairman Miin Wu. 3D NAND chips will be the mainstream NAND flash market segment over the next 10 years, said Wu, adding that Macronix is gearing up to enter the 3D NAND flash market targeting initially SSD applications. (Digitimes, press, OfWeek)

Battery

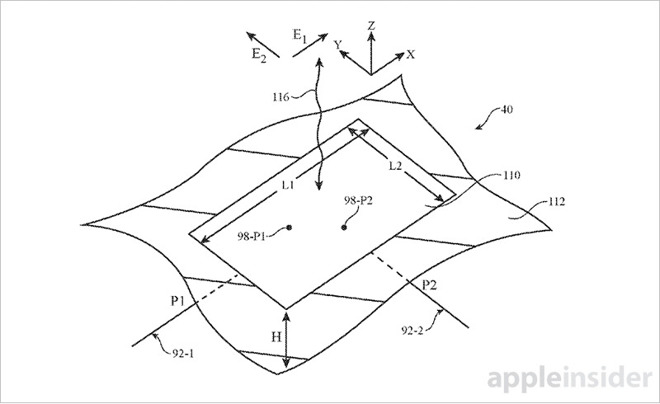

Apple’s patent application for “Wireless Charging and Communications Systems With Dual-Frequency Patch Antennas” is a method for transferring power to electronic devices over frequencies normally dedicated to data communications. (Laoyaoba, Apple Insider, USPTO)

Smartphones

According to IDC, phone companies shipped a total of 347.4M smartphones worldwide in 1Q17. In light of what might seem like a slowing market, consumers continue to show demand for smartphones and OEM flagship hype seems strong as ever. Worldwide smartphone shipments grew 4.3% in 1Q17. (IDC, press, Android Headlines)

Apple is said to be working on its own peer-to-peer money transfer service, potentially under the secure Apple Pay umbrella, allowing users to quickly and securely send money to one another, much like Venmo and Square Cash. (Apple Insider, Re/code, RFID World)

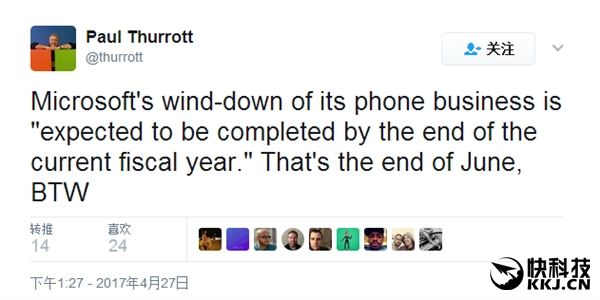

Microsoft watcher Paul Thurrott said that “Microsoft’s wind-down of its phone business is ‘expected to be completed by the end of the current fiscal year.’ That is the end of Jun 2017,” while Mary Jo Foley added that “MS’ GM Investor relations Chris Suh just said there is effectively no revenue in the phone segment, at this point.” (My Drivers, Softpedia)

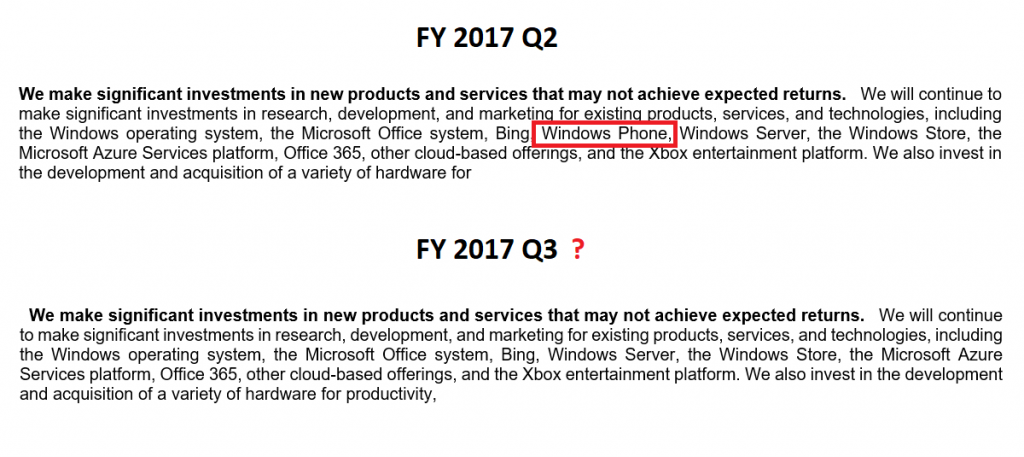

Microsoft’s official 10Q SEC filing has confirmed the lack of investment in the future of Microsoft’s smartphone OS. In the section speaking about risks, and specifically about the return on investment, it is notable that Windows Phone is missing from the list of investments Microsoft is making. (Microsoft, Phone Arena, MS Poweruser, Huanqiu)

LeEco has sold property, laid off employees, and announced halting acquisition of Vizio in US, and this has hurdled LeEco from expanding its smartphone market in US. LeEco reportedly will re-organize internally, and will focus on several regions and some offline channels. (Laoyaoba, Wall Street CN, press)

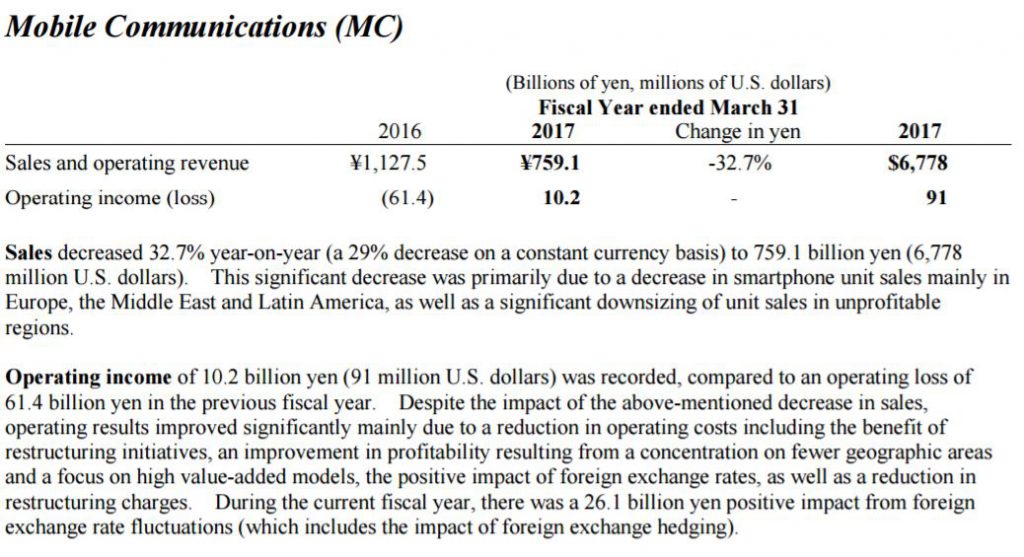

In its fiscal year financial results, Sony said its Mobile Communications division had generated an operating income of JPY10.2B (USD91M). This was compared to an operating loss of JPY61.4B (USD550M), in the previous fiscal year. Sony said that it sold about 14.6M phones in the just completed fiscal year, down from 24.9M units in the previous year. (Android Authority, Sony, Sina, Sohu)

Foxconn’s Integrated Digital Product Business Group (iDPBG) has signed a cooperation agreement with the Hengyang City Government to build a precision molding demonstration park as well as Amazon production center in the city. The investment project will require a capital input of CNY6B (USD870.53M). (Digitimes, press, CN Beta)

BLU R1 Plus is launched – 5.5” HD display, MediaTek MT6737 processor, 13MP + 8MP camereas, 2 / 3GB RAM, 16 / 32GB storage, 4000mAh battery, from USD159.99. (Android Authority, Amazon)

Internet of Things

Didi Chuxing has closed a USD5.5B financing round. The money will be used as part of efforts to “build an efficient and sustainable global mobility ecosystem,” according to a statement issued by the company. (VentureBeat, 163, Baijia)

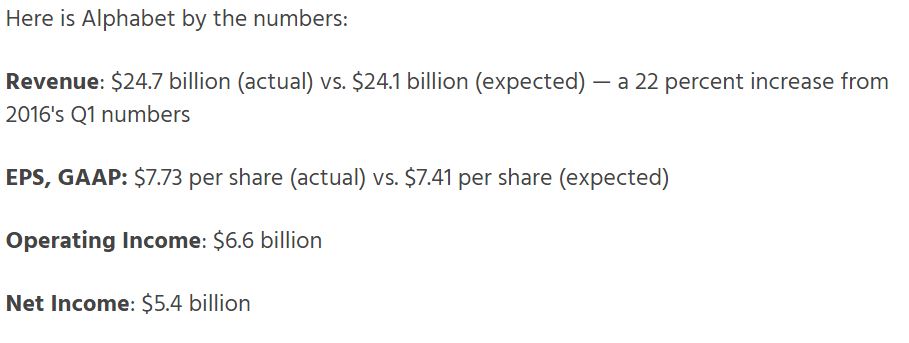

Alphabet Inc., the parent company of Google, posted a strong revenue performance for 1Q17. Alphabet showed a 22% revenue increase, amounting to USD24.75B, a bulk of which came from ads. (CN Beta, Tech Times, Alphabet)