09-22: Google said it would pay USD1.1B in cash to acquire the division at HTC; Toshiba has agreed to sell its prized semiconductor business to a group led by U.S. private equity firm Bain Capital; etc.

Chipsets

TSMC’s 7nm will continue after 10nm, to have large amount of output in 2H18, grabbing the leadership in the market. TSMC’s partner IP vendor Synaptics has announced successfully finished 7nm FinFET process IP portfolio. (CTimes, China Times, Laoyaoba)

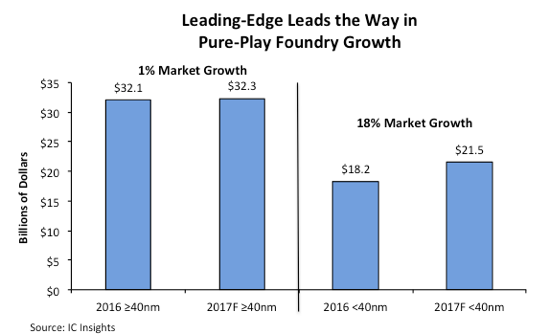

According to IC Insights, in 2017, the 7% increase in the total pure-play foundry market is forecast to be almost entirely due to an 18% jump in <40nm feature size device sales. Although expected to represent 60% of total pure-play foundry sales in 2017, the ≥40nm pure-play IC foundry market is forecast to be up only USD0.2B in 2017. In contrast, the 2017 leading-edge <40nm pure-play foundry market is expected to surge by a hefty USD3.3B. (IC Insights, press, Laoyaoba)

Ambiq Micro, the pioneer and leader in ultra-low power solutions, today announced that Huawei has selected the Apollo2 platform, built on TSMC’s 40nm Near-Vt technology platform, to power its new line of lightweight fitness wearables including the newly launched Huawei Band 2 Pro. (Apple Daily, EDE World, Digtimes, UDN)

Electric carmaker Tesla is working with Advanced Micro Devices (AMD) to develop its own artificial intelligence chip for self-driving cars. AMD spin-off GlobalFoundries CEO Sanjay Jha said his company is working directly with Tesla. (CN Beta, CNBC, Reuters)

Globalfoundries has unveiled a new 12nm manufacturing process that can yield a 10% performance gain over the previous generation. This kind of process will be the backbone of semiconductor factories that cost USD10B or more. (VentureBeat, NASDAQ, SEMI, CN Beta)

GlobalFoundries has asked European antitrust regulators to investigate market leader TSMC, accusing the Taiwanese firm TSMC of unfair competition. GlobalFoundries has told the European Commission that TSMC is unfairly using loyalty rebates, exclusivity clauses and bundled rebates and even penalties to discourage customers from switching to rivals. (CN Beta, Reuters)

Samsung Semiconductor Business Device Solutions Division president Kinam Kim indicates that with the current central processing unit (CPU) and graphic processing unit (GPU), it cannot achieve AI computing effectiveness. However, with neural network processing unit (NPU) can complement the deficiencies. In other words, Samsung intents to integrate smartphone AP with NPU. (Laoyaoba, EE World)

The PAC1934, a precision power and energy monitoring chip, is now available from Microchip Technology. The chip works in conjunction with a Microchip software driver that is fully compatible with the Energy Estimation Engine (E3) built into the Windows 10 operating system to provide 99% accuracy on all Windows 10 devices with batteries. (CN Beta, Microchip, Global Newswire)

Touch Display

LG Display (LGD) and Huawei are expected to sign a long-term supply contract for OLED. LGD is planning to supply panels manufactured at the E2 and E5 OLED plants, which are currently in operation, to Huawei as well as to additionally supply more products produced at the E5 and E6 plants in the future. The company will supply 2M~3M small and mid-size OLED panels worth KRW200B~300B (USD176.76M~265.13M) in 2018. (Android Headlines, Business Korea)

Visionox flexible AMOLED full display products are off the assembly line, officially launched at the downstream supply chain to supply flexible AMOLED full-display product design. This is to alleviate the shortage for high-end flexible AMOLED. (China FPD, SEMI, Xinmin, Laoyaoba)

Memory

Toshiba has agreed to sell its prized semiconductor business to a group led by U.S. private equity firm Bain Capital. Toshiba said the deal to sell the world No.2 producer of NAND memory chips was worth about JPY2T (USD18B). (Laoyaoba, Reuters, Bloomberg, CNBC)

Sensory

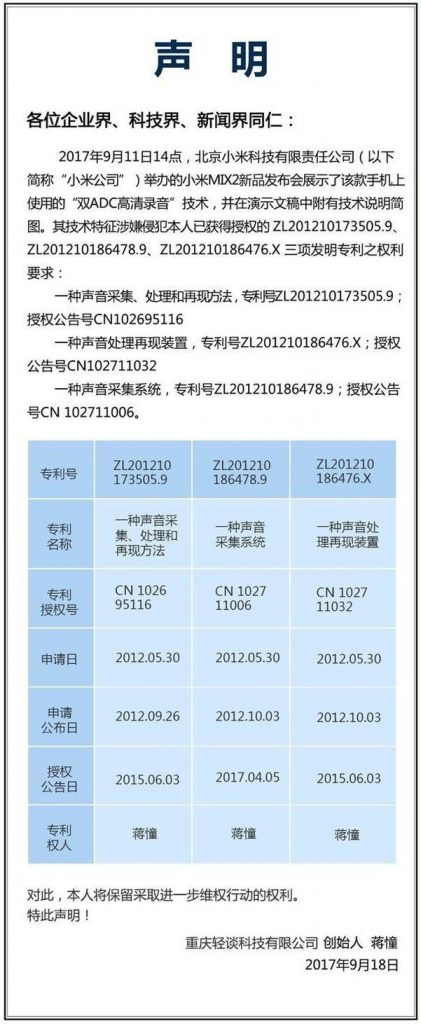

A company in Chongqing (Chongqing Qingtan) founder Jiang Dong claims that Xiaomi Mix 2 has infringed its “dual ADC high-def recording” technologies patents. (Laoyaoba, Qudong, Read01)

Battery

Xiaomi has joined the Wireless Power Consortium, known for its Qi standard. That is the same standard that is supported by Apple, LG, Samsung (which also supports PMA) and others. (GSM Arena, Wireless Power Consortium, Sina, CNFOL)

Smartphones

Apple has yet to begin final production of its new, upcoming iPhone X, according to Raymond James analyst Christopher Caso. Caso adds that final production could be suspended for about another month or even later, compared to previous expectations. (CN Beta, Barron’s, The Street)

In 2016, China Poly has acquired 30% stake of Yota Devices. In early Sept 2017, Congqing Tongnan district government and China Poly have signed collaboration deal, the production base for high-end YOTA phones will be located in Tongnan High-Tech zone, and expects in 2018 enters production. Tongnan disctrict deputy mayor Chen Jianhua indicates that plans to invest CNY1B. (CN Beta, P5W, Sina)

Wisconsin has approved a package of subsidies worth up to USD3B to Taiwanese manufacturing giant Foxconn in exchange for a new US factory. The annual payout to Foxconn will be between USD200M~250M, according to the Wisconsin Economic Development Corporation. That means the state will pay between USD15K~19K per job per year, assuming 13,000 positions are actually created. (Laoyaoba, Sina, iFeng, Techroomage, BBC, CNN, NY Times)

Alphabet Inc’s Google said it would pay USD1.1B in cash to acquire the division at HTC that develops the U.S. firm’s Pixel smartphones, its latest push into hardware manufacturing. HTC is a long-time partner of Google and some analysts estimate that Pixel smartphones account for 20% of HTC’s smartphone shipments. (Apple Insider, Google, Reuters, CNBC, Sina, WSJ, Financial Times)

Morgan Stanley analyst Katy Huberty indicates that Apple is an aspirational brand offering high quality, innovative products at a premium price. As a result, the company escapes the typical trend of declining prices that drive demand for other devices. In fact, demand for iPhone is directly correlated to the direction of ASPs – higher prices, higher demand and vice versa. Huberty has raised her 2018 revenue forecast to USD301B. (CN Beta, CNBC, Investopedia, Finance)

Google has announced a new “zero-touch” enrollment service. With zero-touch enrollment, companies can configure the devices they purchase and have them shipped with management and settings pre-configured, so employees can get up and running out of the box. (Android Authority, Phone Arena, NDTV, First Post)

vivo X20 and X20 Plus with face recognition are launched, powered by Qualcomm Snapdragon 660 MSM8956 processor, rear dual 2PD 12MP f/1.8 – 5MP + front 12MP f/2.0 cameras, 4GB RAM, 64 / 128GB storage: X20 – 6.01” FHD+ Super AMOLED display, 3250mAh battery, CNY2998 / 3398. X20 Plus – 6.43” FHD+ Super AMOLED display, 3900mAh battery, CNY3498. (CN Beta, GSM Arena, Gizmo China, vivo, vivo)

LG Q6 Plus is launched in India – 5.5” FHD+ FullVision display, Qualcomm Snapdragon 435 processor, 13MP + 5MP cameras, 4GB RAM, 64GB storage, 3000mAh battery, INR17,990. (Android Authority, Phone Arena, NDTV, First Post)

Internet of Things

Nest, Google’s smart-home cousin company under the Alphabet umbrella, just announced Nest Hello, a smart video doorbell, shipping in 1Q18. It has built-in camera. (CN Beta, The Verge, Business Insider, Daily Mail)

Robot vacuum company Neato Robotics has announced that it has now been acquired by one of its investors, namely by its long-time partner Vorwerk Group. Neato will operate within the Vorwerk as a “wholly owned independent business unit” with no leadership changes. (Android Headlines, CNET, VentureBeat, Sina)

Baidu has announced a CNY10B (USD1.52B) autonomous driving fund as part of a wider plan to speed up its technical development and compete with U.S. rivals. The “Apollo Fund” will invest in 100 autonomous driving projects over the next 3 years. (VentureBeat, Reuters, ZDNet, Globe Newswire, 163, Huanqiu)