10-31: Apple is reportedly trying to find ways to design its iPhone and iPad that would drop Qualcomm; Meizu is partnering with MediaTek to create the “best facial recognition technology on smartphones”; etc.

Chipsets

Samsung Electronics has reportedly received a setback in its USD5B project to construct a next-generation fab in its chipmaking base in Hwaseong, Gyeonggi Province after the host city refused to license the plant, citing the need for the company to make a contribution to public traffic infrastructure. (TechNews, Pulse, Laoyaoba)

Apple is reportedly trying to find ways to design its iPhone and iPad that would drop Qualcomm’s components for 2018. Apple could source exclusively from Intel or maybe even go with another company such as MediaTek. (WSJ, Ubergizmo, TechCrunch, Reuters, Sohu, Wall Street CN)

Biometrics

KGI Securities analyst Ming-Chi Kuo believes that prognostications of a lower-spec TrueDepth system with hybrid glass and plastic lenses in a late Apple’s 2018 iPhone are inaccurate. The analyst believes that Apple will stick with the existing technology with no increase or decrease in sensitivity or accuracy. Glass suppliers for the system in 2017 are expected to be Largan, Genius, Hoya, and/or Asia Optical, suggesting that Apple has either already diversified its supply chain, or will have done so before any 2018 model year phone heads to mass production. (Phone Arena, Apple Insider, iFeng, XNN News)

According to Meizu’s head of global marketing Ard Boudeling, Meizu is partnering with MediaTek to create the “best facial recognition technology on smartphones”. (Android Authority, BGR)

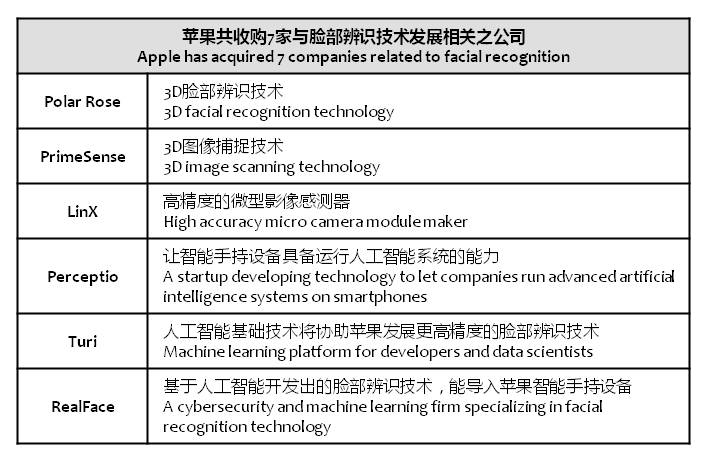

Apple has started R&D from 2009, and since 2010 it has begun acquiring companies related to facial recognition. Till 2017, Apple has acquired 7 companies that are related to facial recognition, showing its ambition. (Sohu, Laoyaoba, UDN)

Connectivity

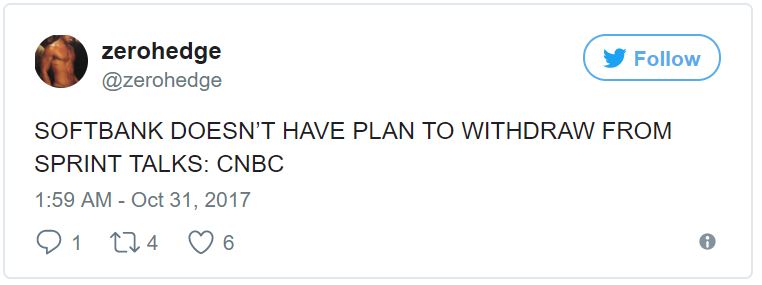

U.S. wireless carrier Sprint’s parent company, SoftBank Group, is reportedly proposing to halt the merger negotiations with T-Mobile after company executives raised concerns over losing control of the resulting entity. However, SoftBank denies such rumor. (Apple Insider, Asia Nikkei, Reuters, Wall Street CN, 163, WSJ, The Verge, Bloomberg)

Smartphones

Supply chain reports that as inventory of older models are high, new models sales are not on par of expectation, Chinese vendors including Huawei, OPPO and vivo have readjusted their 2017 shipment status, which impact the new products launched in 4Q17. This could cause some over-stocked components being released in the market. Chinese phone market always impacts Taiwan supply chain including MediaTek, Largan, FocalTech, AUO and Innolux. (Laoyaoba, UDN, CECB2B)

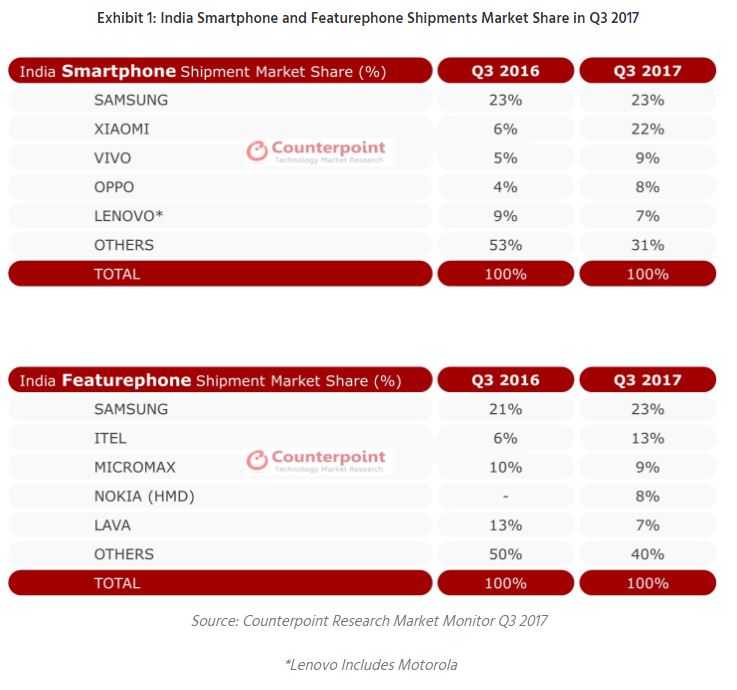

According to Counterpoint Research, India handset shipments reached an all-time high of over 84M for the first time ever driven by strong sell-in of both featurephones and smartphones in 3Q17. Samsung is still leading the market with 23% market share. Xiaomi is now just one point away with market share of 22%, a rise of 16% from the same period a year ago. (Android Central, Counterpoint Research, Sohu, Huanqiu)

Xiaomi CEO Lei Jun has revealed that the company has shipped over 10M smartphones in Oct 2017. (Gizmo China, Huanqiu, Sina)

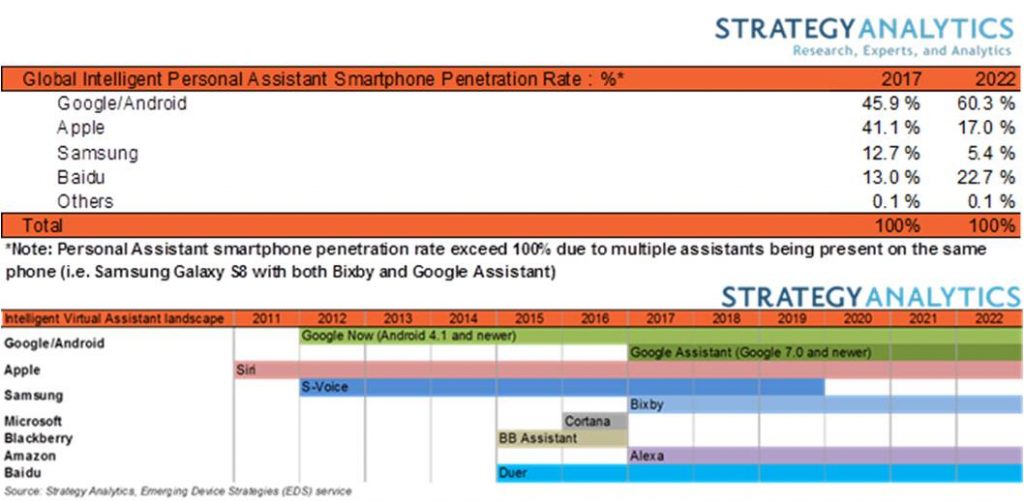

According to Strategy Analytics, 1 out of 3 smartphones sold worldwide in 2017 will use artificial intelligence (AI) to power virtual assistants. In 2017 already over 93% of premium tier smartphones (with a wholesale price above USD300) sold worldwide have a virtual assistant integrated out-of-the-box. In 2020 Strategy Analytics estimates that over 80% of the smartphones sold with a wholesale price of over USD100 will have a virtual assistant integrated natively. (Strategy Analytics, press, Laoyaoba)

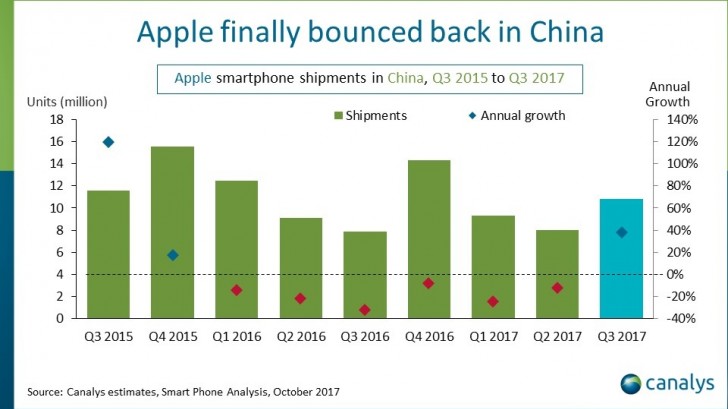

According to Canalys, Chinese smartphone shipments registered another quarter of decline as the market contracted 5% in 3Q17 to 119M units. The race to the top remains tight as Huawei, OPPO and vivo took 19%, 18% and 17% market share, respectively. Apple’s declining streak in China has come to an end, as shipments grew 40% from 8M in 3Q16 to about 11M in 3Q17. (GSM Arena, Canalys, press, 199IT)

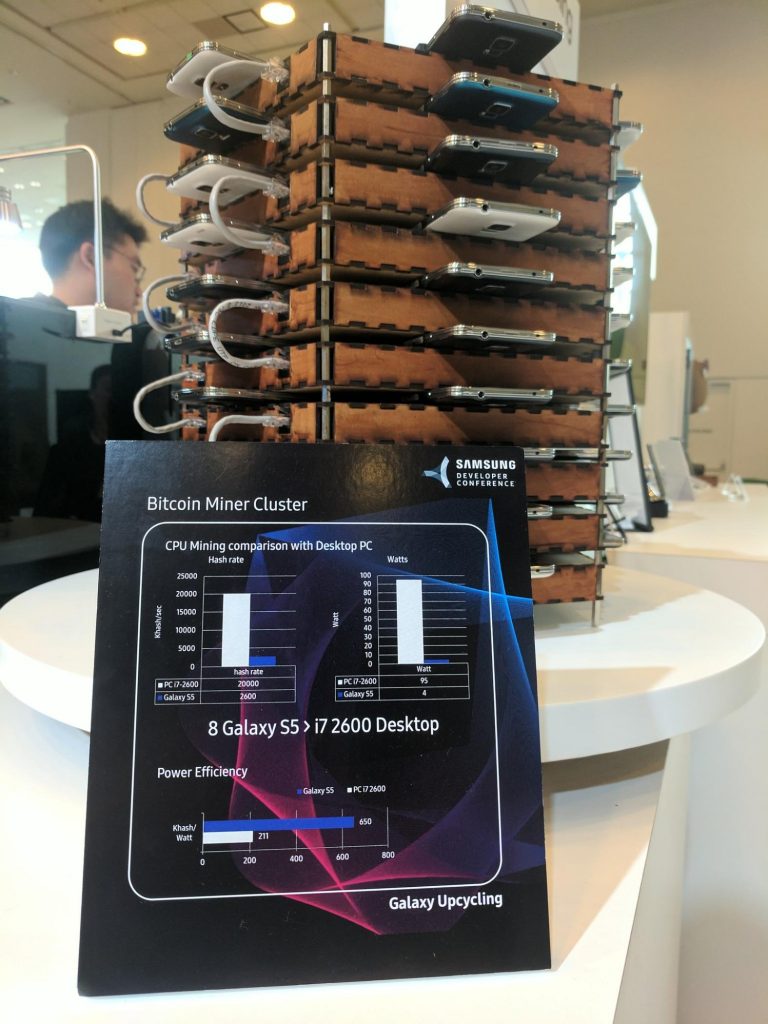

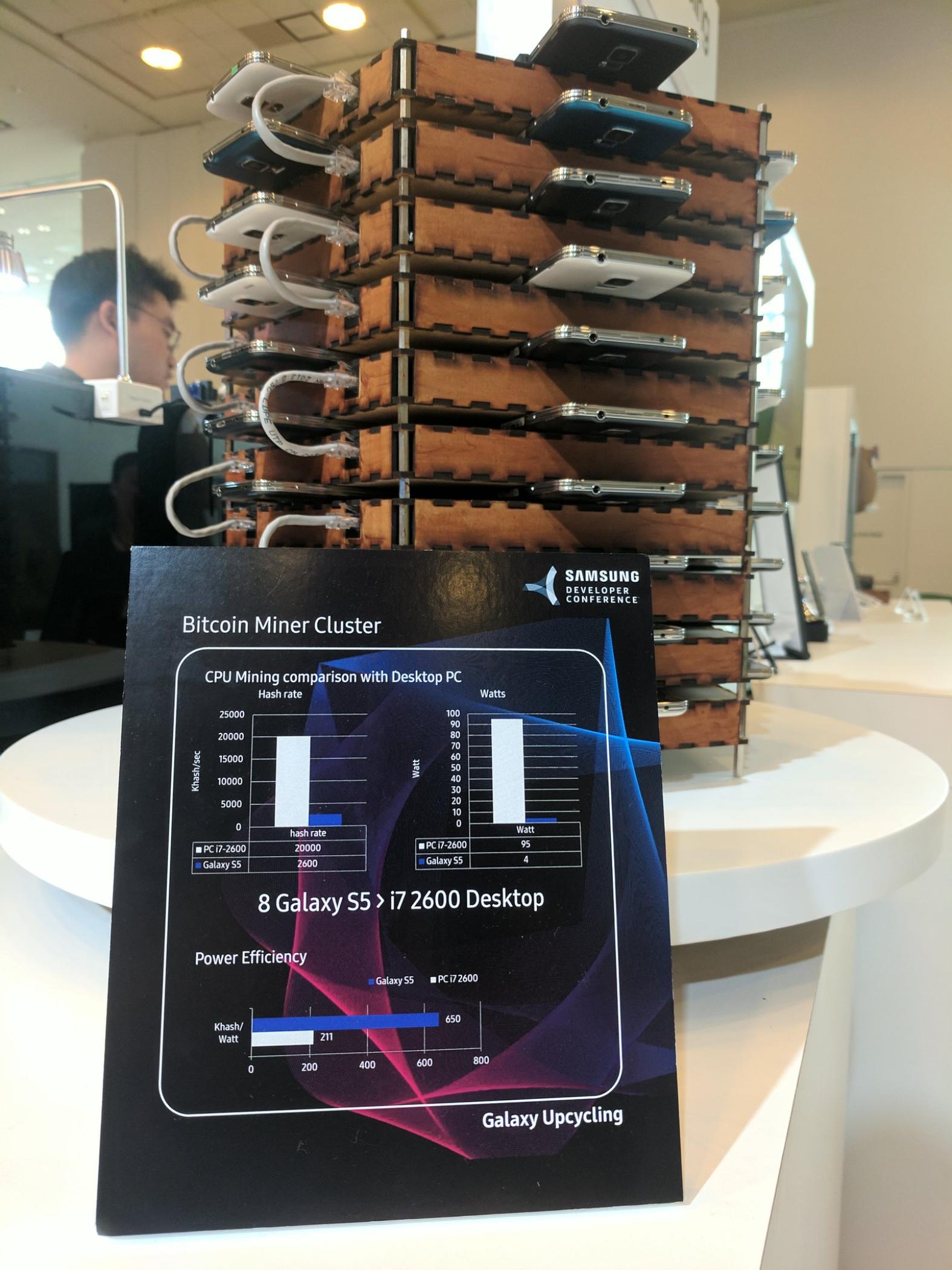

Samsung starts a new “Upcycling” initiative that is designed to turn old smartphones and turn them into something brand new. It has built a bitcoin mining rig, made out of 40 old Galaxy S5 devices, which runs on a new operating system it has developed for its upcycling initiative. (Phone Arena, Motherboard, Android Authority, Sina, iFanr, CN Beta)

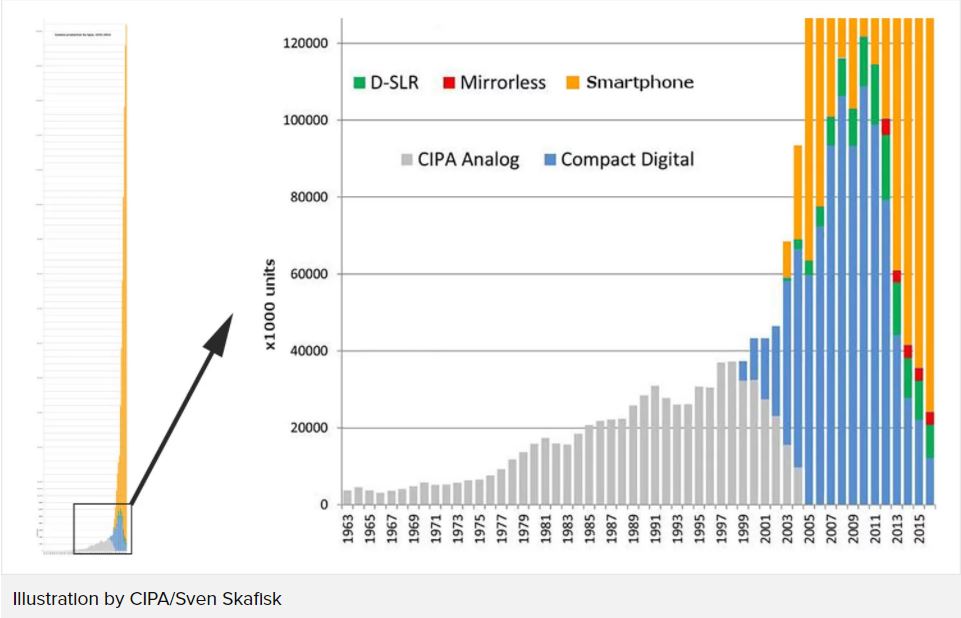

Nikon has announced today that it will be shutting down its digital camera factory Nikon Imaging (China), a subsidiary of Nikon that was formed in 2002 in Wuxi City, Jiangsu, China. Nikon blames the rise of smartphones for the demise of the compact digital camera market. (Ubergizmo, Nikon, Peta Pixel, Asia Nikkei, Xinhuanet, TechWeb)

ODM vendor WingTech reveals that new smartphones will all feature “18:9 full display”, and will be priced at CNY1000~2000. Xiaomi is preparing 3 highly value-for-money Redmi series featuring 18:9 display—Redmi 5, Redmi 5 Plus and Redmi Note 5, priced at CNY899, CNY1099 and CNY1299, respectively. Also, Huawei, Lenovo, Meizu, etc. are also preparing new phones with similar display. (My Drivers, CN Beta, Huanqiu)

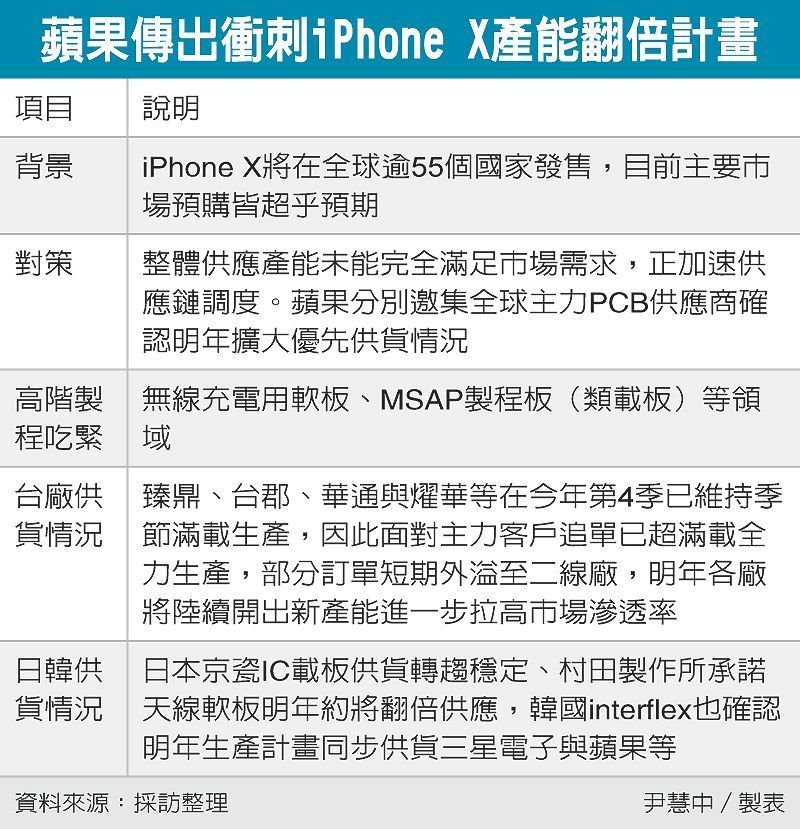

Apple reportedly has urged Taiwan supply chain to expand their supply for the components. A number of executives of those suppliers have travelled to US to meet up with Apple’s executives to discuss production expansion and supply increase for 2018. (Laoyaoba, UDN)

Yuanta Investment Consulting expects AR to start picking up from 2H17, thanks to the optimization on the hardware, and emerging of application use cases. They expects AR equipped smartphone shipment could reach 199M units by 2018, and will grow to 425M units by 2020, with about 27% penetration rate. The market size could reach USD50B. Apple will be leading the AR technology, including 3D sensors. The supply chain including Largan Precision, WIN Semiconductor, Chroma ATE, Elite Advanced Laser Corp, and TSMC, etc., will be beneficial from this. (UDN, UDN, Apple Daily)

HiSense Hali is lanuched – 5.99” 1440×720 HD+ screen-to-body ratio 78% 2.D curved display, Qualcomm Snapdragon 430 processor, rear 12MP + front 16MP PDAF cameras, 4GB RAM, 32GB storage, 3400mAh battery, CNY1399. (CN Beta, iMobile, Sina, Gizmo China)

ZTE Blade A3 is launched in China – 5.5” HD 2.5D curved TFT display, MediaTek MT6737T processor, rear 13MP + front dual 5MP-2MP cameras, 3GB RAM, 32GB storage, Android 7.0 (MiFavor 4.2), rear fingerprint scanner, Face Unlock, 4000mAh battery, CNY799. (CN Beta, Gizmo China, Android Headlines)

Wearables

Acer has revealed that it has added USD5M to a joint investment with Starbreeze on StarVR, making it the majority owner of the VR headset. The investment will bring Acer’s total interest to 66.7% and the company will relieve Starbreeze of its “remaining capital commitment” of USD7.5M. (Upload VR, TechNews, China Times)

Internet of Things

Baidu and Shouqi Limousine & Chauffeur, a car-hailing operator, are joining up to develop driverless vehicles. Baidu will provide Shouqi with its Baidu Map service, while Shouqi will help Baidu develop high-precision maps for self-driving cars. Baidu will also offer software and hardware to help the new vehicles navigate using artificial intelligence technology. (Ubergizmo, Engadget, Xinhuanet, Reuters, Caijing, Tencent)

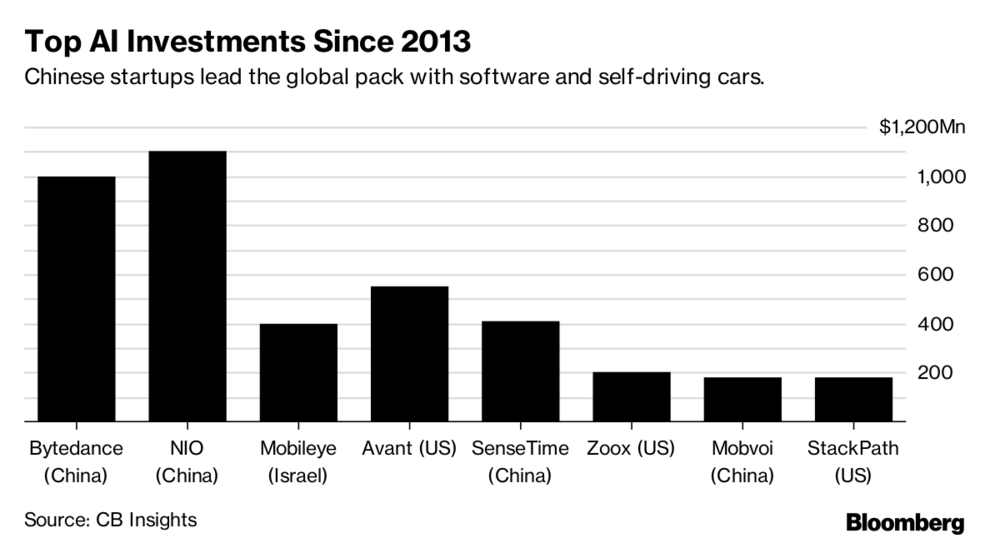

Google is reportedly actively promoting TensorFlow, software that makes it easier to build AI systems, as a way to forge business ties in the world’s largest online market. It’s a wide pitch targeting China’s academics and tech titans. At the same time, Google parent Alphabet Inc. is adding more personnel to scour Chinese companies for potential AI investments. (CN Beta, Bloomberg, article)