11-11: Qualcomm has signed three non-binding MOUs with Xiaomi, OPPO and vivo; Apple has purchased decade-old InVisage technology; etc.

Chipsets

Qualcomm has signed three non-binding memorandum of understanding (MOUs) at the capital’s Great Hall of the People to sell components over three years to phone makers Xiaomi, OPPO and vivo. The agreement was part of an over USD250B package of deals unveiled between U.S. and Chinese firms. (CN Beta, PR Newswire, Reuters)

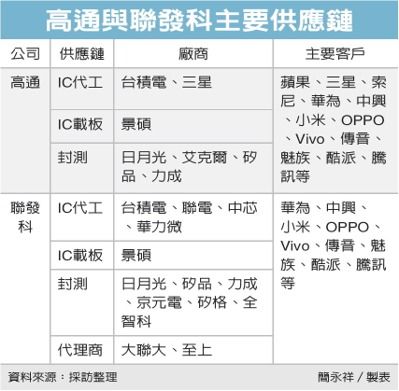

US president Donald Trump visiting Beijing, and Qualcomm has signed MOU with OPPO, Xiaomi and vivo for a value of USD12B. This has impact MediaTek considering those 3 vendors are MediaTek’s main customers. MediaTek allegedly has reduced the prices of its Helio series SoC. MediaTek indicates that the collaboration with its customers have no change, P23 and P30 shipment has not changed and no cost down. (Laoyaoba, UDN, China Times, UDN)

Qualcomm has demonstrated the speed and power of Gigabit Class LTE on T-Mobile’s network with smartphones powered by Snapdragon Gigabit LTE modems. The Un-carrier announced that LTE Advanced has expanded to more than 920 markets, eclipsing every other national wireless company, with a powerful combination of three speed-boosting technologies – carrier aggregation, 4X4 MIMO and 256 QAM – now live in 430 of those markets. (Android Authority, T-Mobile)

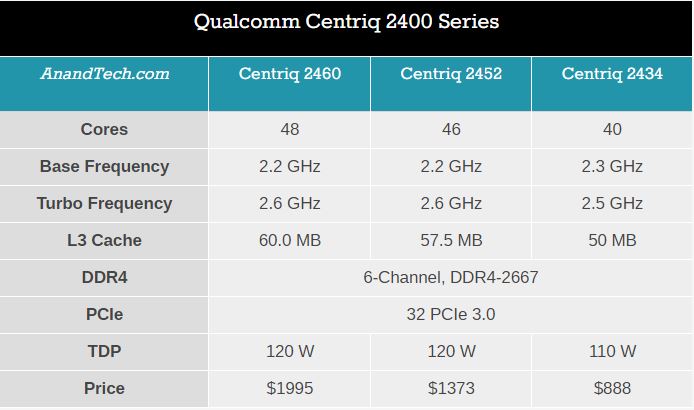

Qualcomm has announced the formal launch of its new Centriq 2400 family of ARM-based SoCs for cloud applications. As TSMC and ARM have been collaborating since 2016 on ARM-based server SoCs, and with Samsung’s 7nm is facing some obstacles, and if Qualcomm really likes to compete with Intel for server SoCs, next-generation 7nm server SoCs would go back to TSMC. (UDN, Laoyaoba, EE World, AnandTech)

Spreadtrum Communications has announced its solutions have been selected by Accent, an IT brand based in Morocco, for two smartphone models sold in the North Africa region. Spreadtrum’s SC9832 series LTE and SC7731C series WCDMA/HSPA+ chip platforms are being incorporated into Accent’s Cameleon C6 Plus and Cameleon C5 smartphone models which are already available in the markets across many countries in North Africa, Spreadtrum indicated. (Laoyaoba, PR Newswire, iFeng, Digitimes, press)

The Exynos 9 Series 9810 is Samsung’s latest flagship processor, with 3rd-generation custom CPU cores, upgraded GPU, and gigabit LTE modem with industry-first 6CA support. It is built on 2nd generation 10nm process technology. (Android Authority, GSM Arena, Samsung, CN Beta)

Touch Display

Japan Display Inc (JDI) is the world’s biggest automotive panel supplier. After Hon Hai Precision acquires Sharp, the former has gained its influence in the automotive panel market. Now BOE allegedly has intention to acquire JDI, making Taiwanese vendors Innolux, AUO, CPT and GiantPlus are paying attention on JDI. (Laoyaoba, UDN, 52RD)

TCL group subsidy CSOT production capacity has increased and already fully occupied with satisfying orders in 4Q17. Currently CSOT has 2 lines of G8.5 and G6, and constructing G11 and 2nd G6 lines. Two G8.5 lines and one G11 lines are located in Shenzhen mainly for producing TV panels. Two G6 lines in Wuhan are mainly for mobile phone or other small-sized panels. As for full-display panels, CSOT will enter mass production in 4Q17. (Laoyaoba, STCN, JRJ)

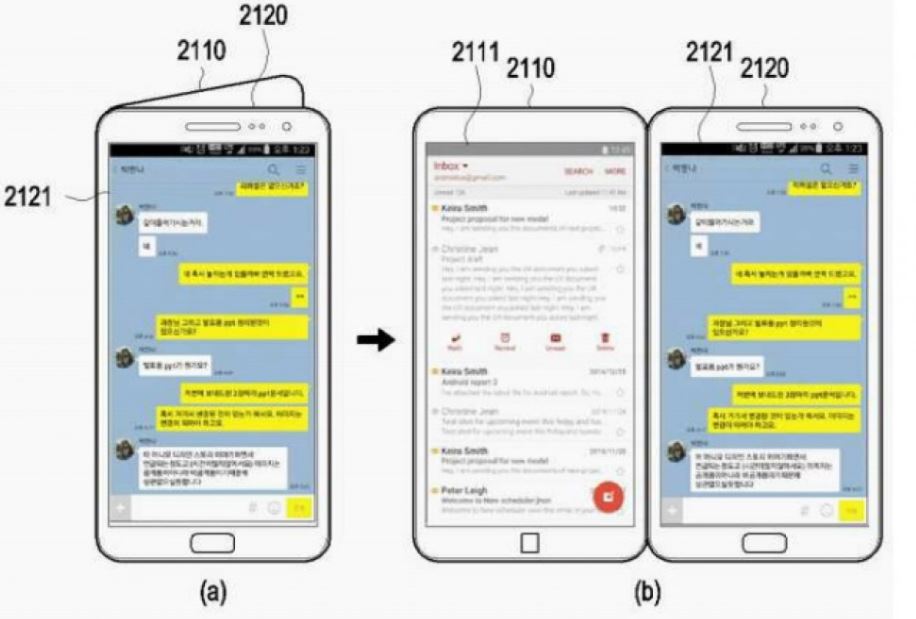

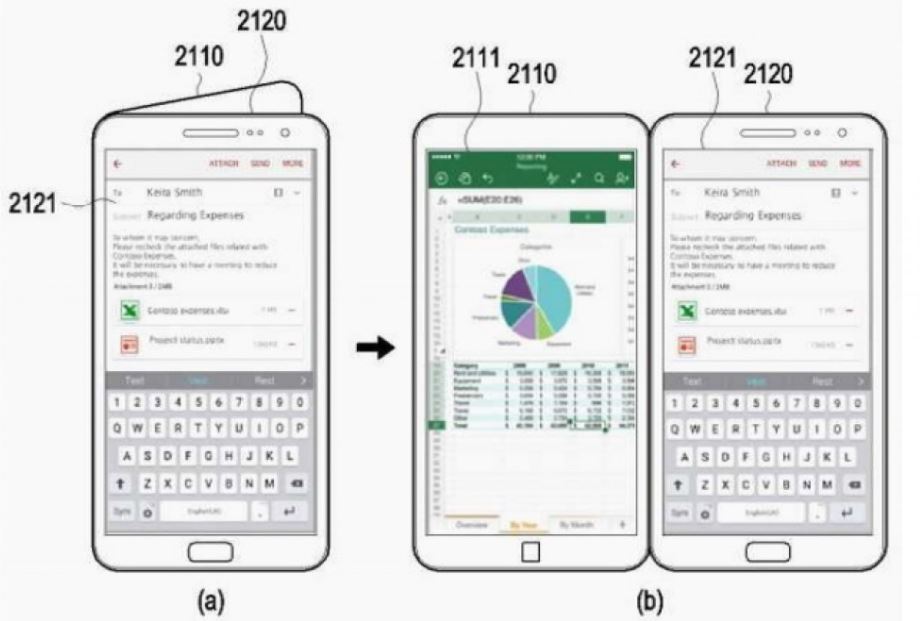

The patent application filed in 2016 shows a Samsung interface for a folding smartphone. The details also reveal that each display will have its own app switcher and will be able to work in both portrait and landscape mode. The application also shows an option to use the device as a traditional smartphone, or one with dual-display , or even one that can be used in tent mode similar to 2-in-1 convertible laptops. (Laoyaoba, TechRadar, GSM Arena, Galaxy Club)

Camera

Apple has purchased decade-old InVisage technology, a company behind the QuantumFilm technology that takes up less space than traditional camera sensors and with better performance characteristics. The company’s QuantumFilm technology uses quantum dots dispersed on a grid and coated on a substrate for an image sensor. (Apple Insider, Business Insider, Image Sensors World, Sina)

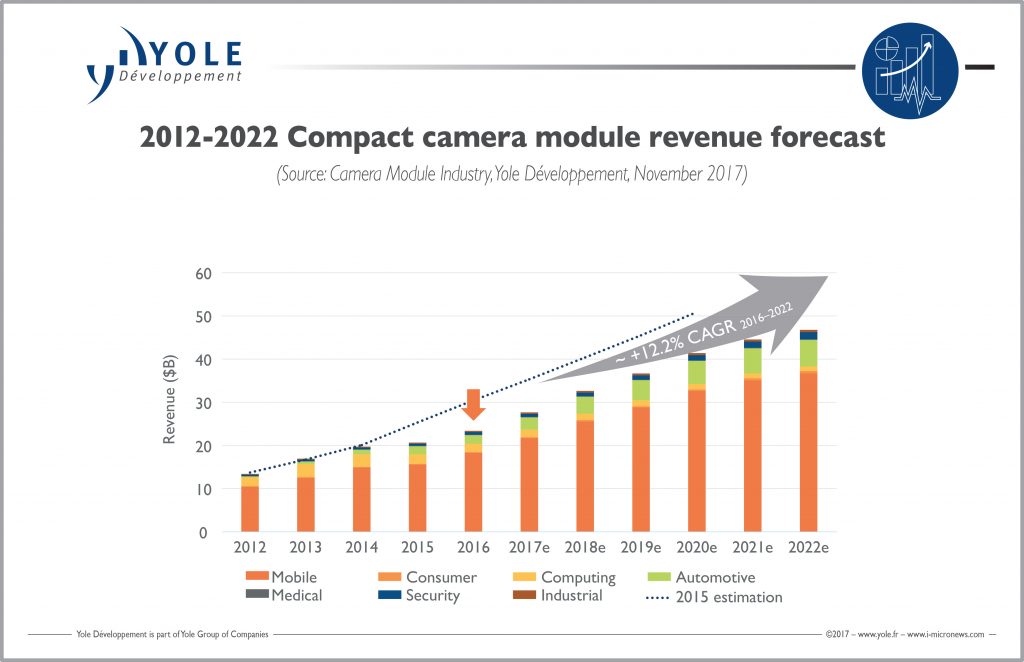

According to Yole Développement, at 12.2% CAGR for the next 5 years, the CCM industry is a growth powerhouse with numerous large companies thriving in a dynamic market. New technologies are serving demanding applications in a market hungry for technology performance. Automotive CCM are reaching USD2B in revenue and are now well beyond emergence. (Laoyaoba, Yole, press)

Sensory

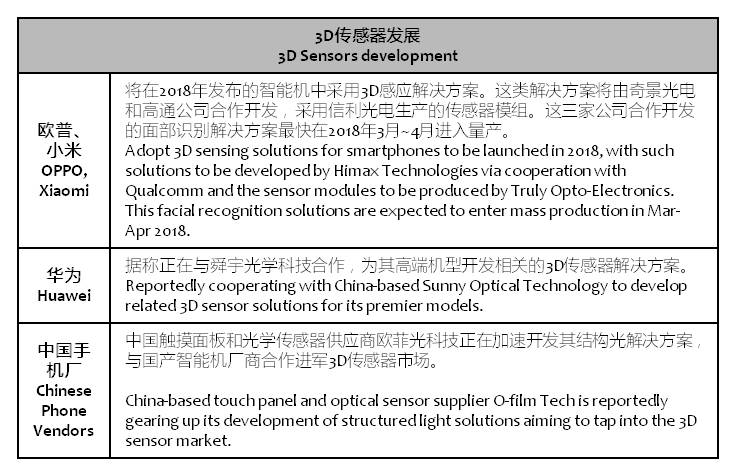

OPPO and Xiaomi will adopt 3D sensing solutions for smartphones to be launched in 2018, with such solutions to be developed by Himax Technologies via cooperation with Qualcomm and the sensor modules to be produced by Truly Opto-Electronics, according to Digitimes. (Android Headlines, Digitimes, press, iFeng)

Memory

Two Taiwanese memory module makers, ADATA and Transcend, agree that DRAM will continue to be in shortage. Trascend expects this shortage will continue through 2018. (Laoyaoba, UDN)

Battery

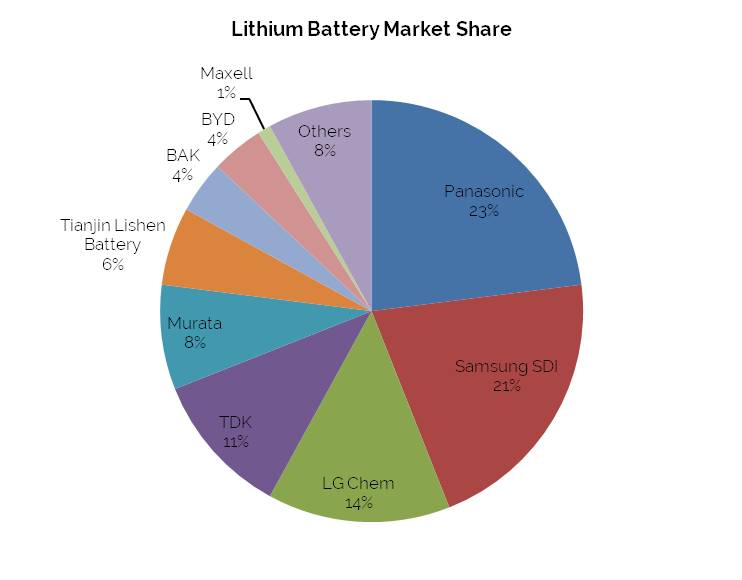

According to the information of Japanese research company Techno Systems Research, the current lithium-ion battery leading manufacturer in the world is Japan’s Panasonic, with market share 23%, followed by Korea’s Samsung SDI, with market share 21%. The rests are South Korea’s LG Chem (market share is 14%), TDK (11%), Murata (8%), China’s Tianjin Lishen Battery (6%), China’s BAK (4%), China’s BYD (4%) and Maxell (1%). (Energy Trend, ESCN)

Smartphones

Huawei has reportedly kicked off a “Made of Huawei” program for certified accessories and the first product in the lineup will be a USB-C to HDMI adapter made for the Mate 10 series. (Phone Arena, GizChina, JRJ)

Samsung India Director Commercialization Group (Product Planning) Sanjay Razdan announces that Samsung currently has over 2.5M people using Samsung Pay. In an effort to expand the business, he said the company had made investments of INR4,915 crore at the facility in Noida to double the capacity. (Android Headlines, NDTV, Business Standard, India Times, Baijing)

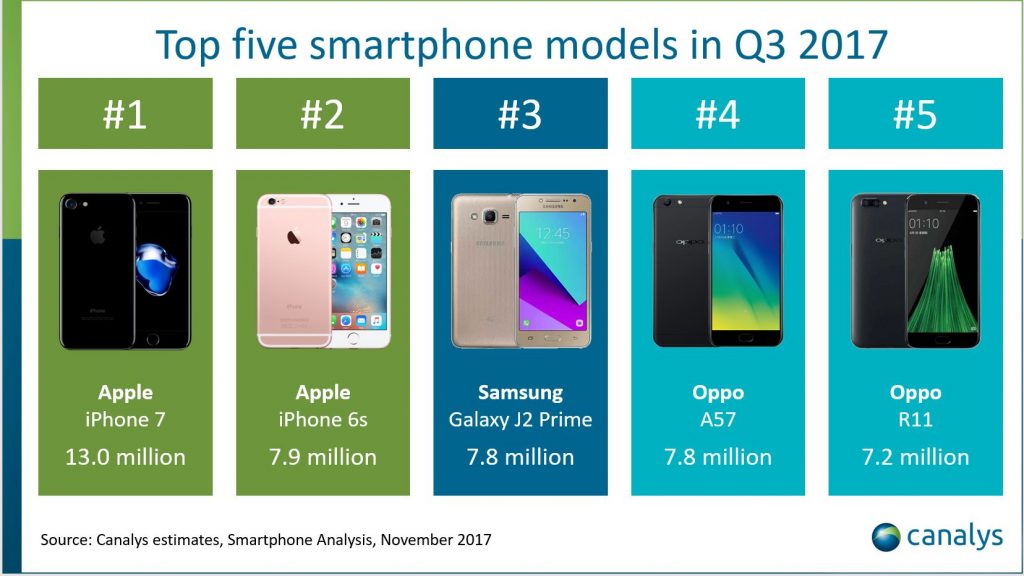

According to Canalys, Apple iPhone 7 was the world’s best-shipping smartphone in 3Q17, with 13.0M units shipped. The iPhone 6s was a distant second. Samsung Galaxy J2 Prime was third, with 7.8M shipped, while OPPO took fourth and fifth place, with its A57 and R11 shipping 7.8M and 7.2M units, respectively. (Canalys, press, Laoyaoba)

IHS Markit has completed their preliminary physical dissection of the new Apple iPhone X and found that the model A1865 version of the smartphone with 64GB of NAND memory carries a bill of materials (BOM) of USD370.25. (IHS Markit, press, Tencent)

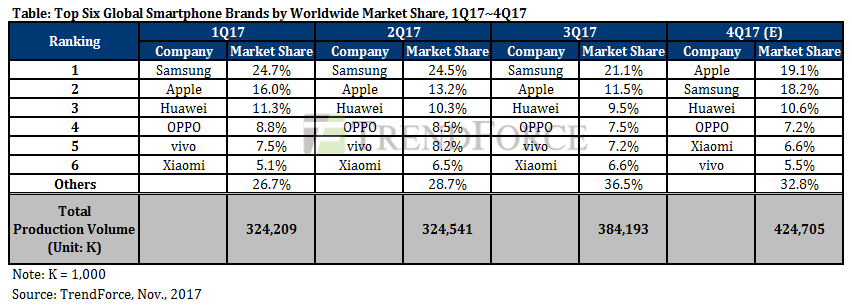

According to TrendForce, the global smartphone production volume for 3Q17 totaled 384M units, registering a year-on-year increase of 6%. Chinese brands together posted a much higher year-on-year growth of 20%. In terms of ranking by production volume, Samsung, Apple, Huawei, OPPO and vivo still held their respective positions in the top five for 3Q17, while Xiaomi followed at sixth place. (Laoyaoba, TrendForce[cn], TrendForce, press)

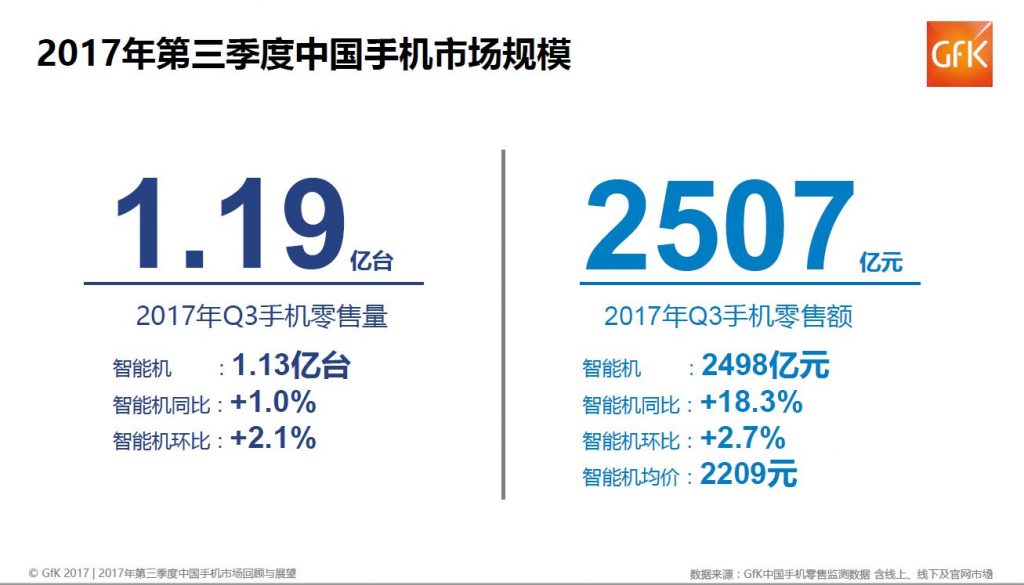

According to GfK, China smartphone market retail sales have reached 119M units in 3Q17, up 1% YoY; and retail market size has reached CNY250.7B, of which smartphone retail size has reached CNY249.8B, with 18.3% increase YoY. GfK forecasts that in 2017 China mobile phoe sales will reach 474M units, a 0.7% up YoY; market size reaches CNY1.03T, a 16.6% increase YoY. Smartphone ASP has reached CNY2250. (Laoyaoba, Sohu, GfK, report)

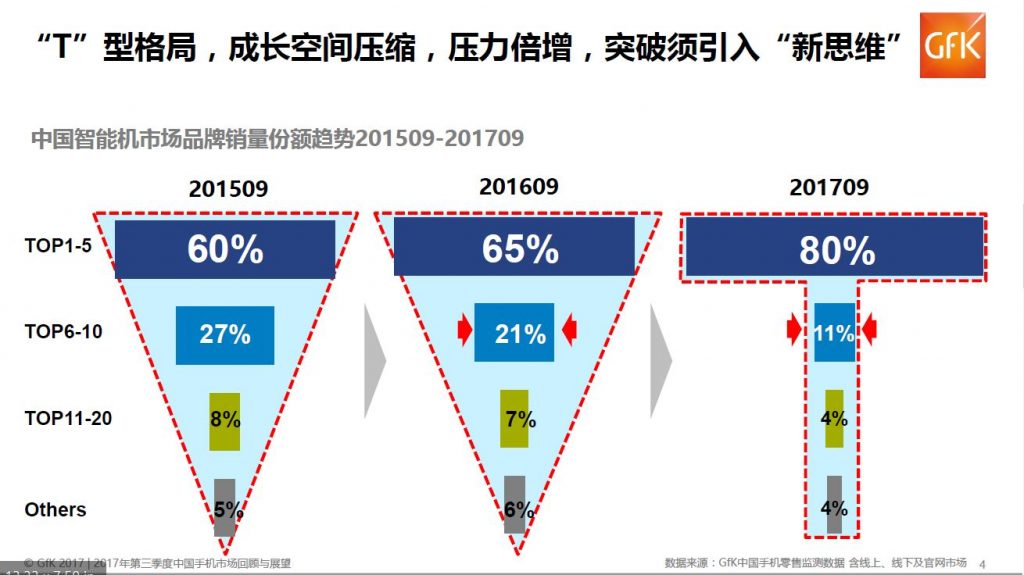

GfK indicates that entering 2H16, China mobile phone resource has quickly consolidated, from the original “reversed triangular” evolving into “T-shape structure”. The brand on the top are expanding, mid-to-top brands are shuffling with its brand space being squeezed and limited. Smaller brands are having a huge gap with the consumers, and having problems to penetrate the channels, thus their market size are drastically shrunk. (Laoyaoba, Sohu, GfK, report)

Huawei Honor 9i is launched in India – 5.9” 2160×1080 FHD+ display, HiSilicon Kirin 659 processor, rear dual 16MP-2MP + front dual 13MP-2MP cameras, 4GB RAM, 64GB storage, 3340mAh battery, INR17,999. (Android Headlines, First Post)

Flipkart launches Billion Capture+ in India – 5.5” FHD 2.5D Asahi Dragontail display, Qualcomm Snapdragon 625 processor, rear dual 13MP + front 8MP cameras, 3 / 4GB RAM, 32 / 64GB storage, USB Type-C, 3500mAh battery, from INR10,999. (Android Headlines, NDTV, First Post)

Wearables

Google expects that “hundreds of millions” of Android devices will be capable of augmented reality (AR) uses next year, bringing a slew of potential monetization opportunities. Amit Singh, vice president of business and operations for virtual reality (VR) at Google, spoke about the company’s investment in the technology and the release of ARCore. (Phone Arena, CNBC, Shafa, Sohu)

Apple is seeking a breakthrough product to succeed the iPhone, aims to have technology ready for an augmented reality (AR) headset in 2019 and could ship a product as early as 2020. The new operating system, internally dubbed “rOS” for “reality operating system,” is based on iOS. (CN Beta, Gizmo China, Bloomberg, Apple Insider)

Internet of Things

Tesla founder Elon Musk said that the company’s Autopilot system can achieve full self-driving autonomy, as it is at least as good as a human driver. (Ubergizmo, Inverse, Sohu)

Nvidia CEO Jensen Huang said that self-driving cars will be on the roads and highways within three years. In 2018, Nvidia will get revenues from the supercomputers for development systems. In 2019, the robot taxis will ramp, he said. Late 2020 to 2021, we will see the first fully automatic, level four, autonomous cars, Huang said. Level four cars have no driver participation. (VentureBeat, Xinhuanet, CN Beta)

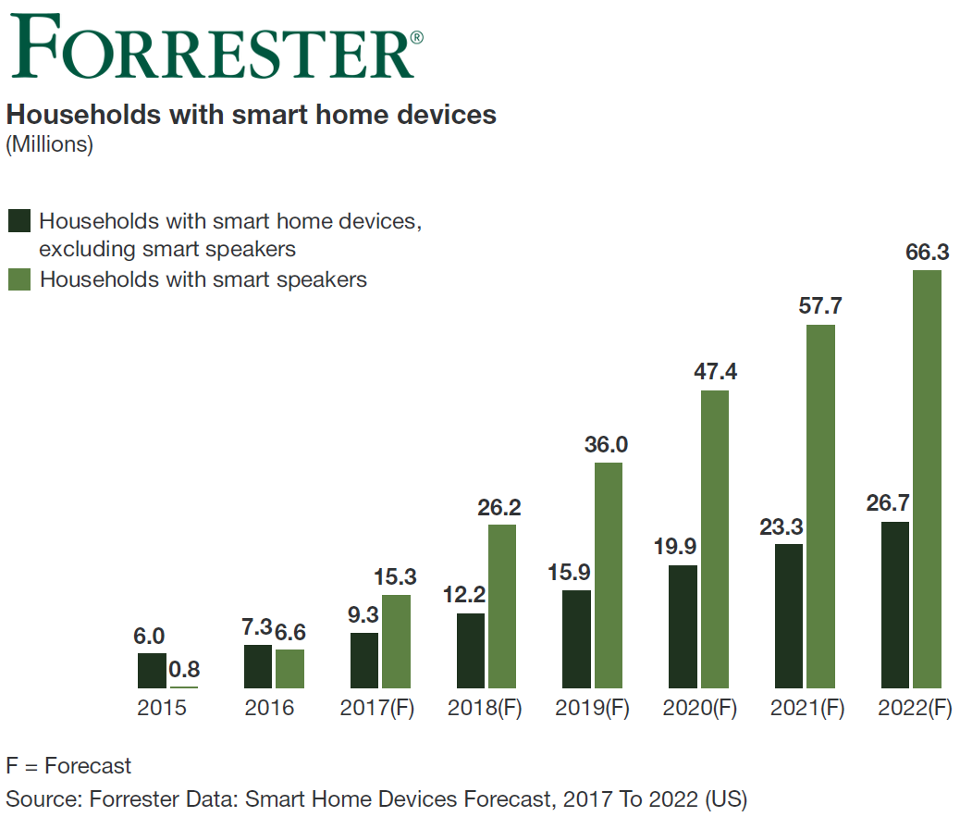

Driven by the rapidly growing adoption of smart speakers, the installed base of smart home devices in the U.S. will reach 244M in 2022, up from 24M in 2016, according to Forrester Research. Amazon sold over 11M Amazon Echo devices in 2016, and Forrester expects this number to double in 2017. Smart speakers, including Amazon Echo, will account for 50% of the total installed base of smart home devices in 2017 and will reach 68% by 2022. (Forbes, Forrester, Laoyaoba, Forrester)