11-17: Intel introduces the Intel XMM 8000 series, its family of 5G NR multimode commercial modems; Qualcomm, China Mobile and ZTE combined their 5G expertise and demonstrated what’s being described as the world’s first end-to-end 5G New Radio (NR) Interoperability Data Testing (IoDT) system; etc.

Chipsets

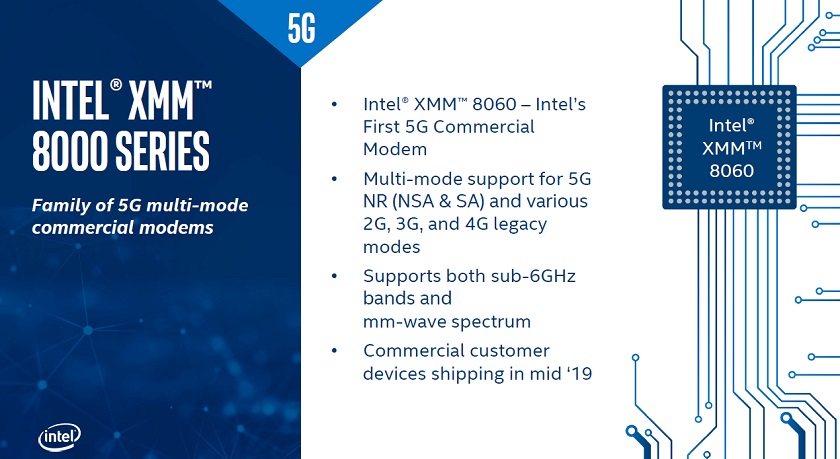

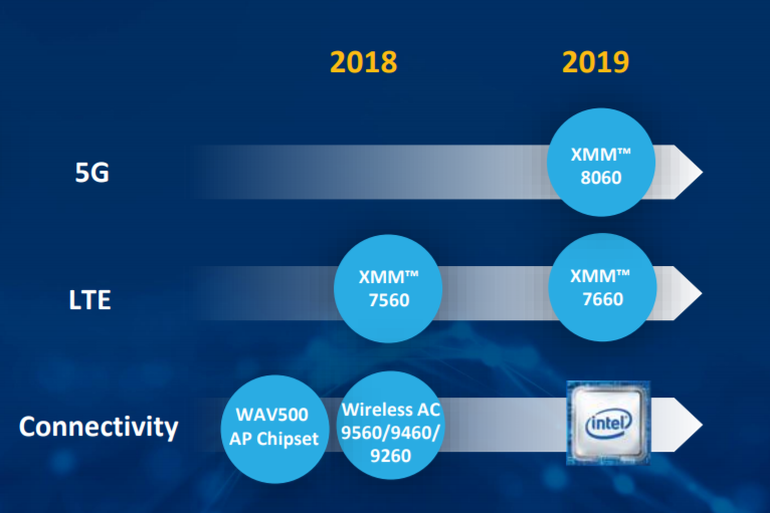

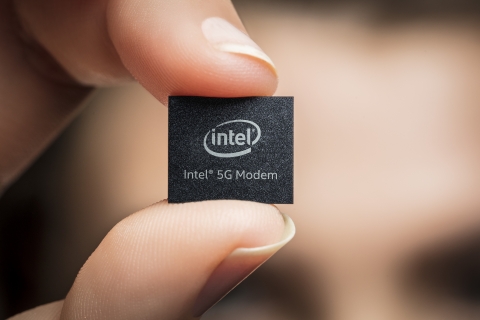

Intel introduces the Intel XMM 8000 series, its family of 5G New Radio (5G NR) multimode commercial modems and said it has successfully completed a full end-to-end 5G call based on its early 5G silicon, the Intel 5G Modem. It operates in both sub-6 GHz and millimeter wave global spectrum bands. (VentureBeat, Fierce Wireless, Business Wire, Intel)

Apple staff are allegedly “engaged with Intel counterparts” for work on a 5G modem for a future iPhone. If the report is accurate, Intel may completely unseat Qualcomm’s dominance in supplying Apple since 2011. (Apple Insider, Fast Company, 163, TechNode, Tencent)

Intel XMM 7660 is the new flagship for 4G, which is the first Cat. 19, 1.6Gbps LTE modem, and going to be launched in 2019. (CN Beta, PC Mag, Intel, Hot Hardware)

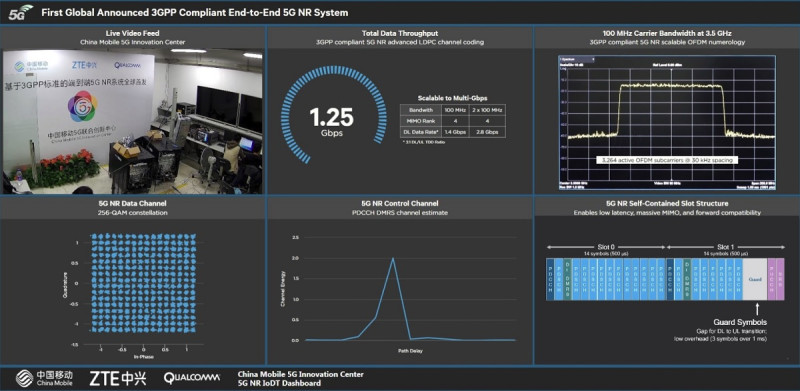

Qualcomm, China Mobile and ZTE combined their 5G expertise and demonstrated what’s being described as the world’s first end-to-end 5G New Radio (NR) Interoperability Data Testing (IoDT) system with a data connection based on 3GPP Release 15. (VentureBeat, Android Authority, Fierce Wireless, iMobile, YeSky)

MediaTek is aggressively persuading China smartphone vendors to adopt its Helio P processors to reduce risks of heavy reliance on Qualcomm, whose operations might be affected by Broadcom’s takeover bid, according to Digitimes. Brand vendors dedicated to smartphones models priced under USD600 could see dwindling technical support from Qualcomm for mobile chip solutions. (Laoyaoba, Digitimes, Digitimes, press, KK News, Jianshu)

MediaTek product planning and sales director Li Yanji indicates that in 2018 the company will slow down Helio X series flagship SoC market development, and accelerate the push of Helio P mid-to-high SoC. At the same time the company will also push mid-to-entry SoC, mainly focusing on MT6739 SoC. (Laoyaoba, XCN News)

Apple is expected to introduce its next mobile processor, the A11X, which will arrive with its 2018 series of iPad Pro at 1Q / 2Q18, according to Digitimes. The SoC chip will be the first product built using TSMC’s 7nm process technology along with the foundry’s backend integrated fan-out (InFO) WLP technology. (TechNews, Digitimes, press)

Richard Chang, founder and former CEO of China-based pure-play foundry Semiconductor Manufacturing International (SMIC), has orchestrated the establishment of a new foundry house in China that will run as a commune IDM (CIDM). Named Sien IC Manufacturing (SIMC), the first China-based CIDM will be located in Huangpu (Guangzhou). An estimated CNY6.8B (USD1B) will be poured into the establishment in the first phase. (TechNews, Digitimes, press, Digitimes)

Touch Display

LG Display (LGD) has shut down its Gumi P4 plant that produces liquid-crystal displays (LCDs). This came after LG Display Vice Chairman Han Sang-beom announced in Jul 2017 to close its P2, P3 and P4 lines in Gumi by the end of this year. LG Display reportedly bets on organic light-emitting diode (OLED) displays, is accelerating the phase-out of LCD. (Business Korea, My Drivers)

PMOLED panel maker WiseChip Semiconductor will showcase its1.36” and 1.8” flexible in-cell PMOLED touch panels. The flexible PMOLED panels come with a thickness of 0.3mm and a curvature radius of below 30mm and are ideal for production of mobile devices. (Digitimes, press, 51Touch)

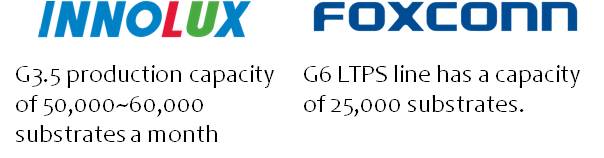

Innolux will take up Foxconn Electronics 6G LTPS LCD fab in Luzhu, southern Taiwan for NTD31.4B (USD1.041B), a move which will ramp up its global LTPS panel market share to 8% from the current 2%. While Innolux is ramping up the production of 18:9 all-screen displays and the supply of a-Si panels is becoming tight during the peak season, the company then decided to expand its capacity through the acquisition of the 6G LTPS plant, according to company president Robert Hsiao. (Digitimes, press, PJ Time)

Memory

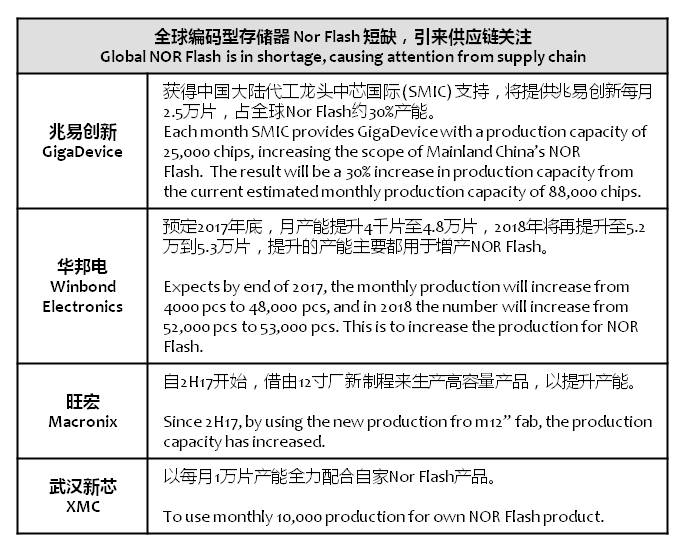

Each month SMIC provides GigaDevice with a production capacity of 25,000 chips, increasing the scope of Mainland China’s NOR Flash. The result will be a 30% increase in production capacity from the current estimated monthly production capacity of 88,000 chips. (TechNews, China Times, Laoyaoba, CTimes, ESM China)

Material

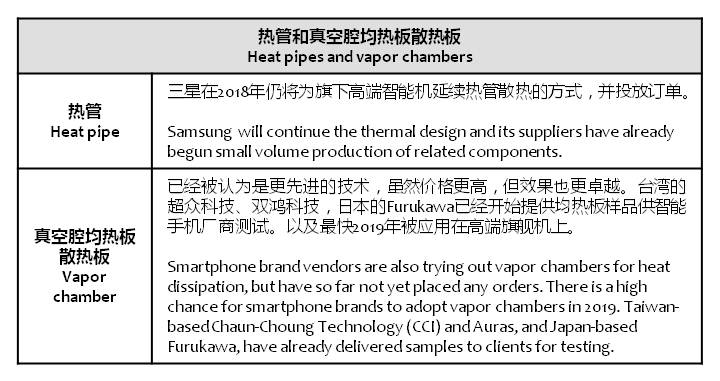

Despite the recent market rumors indicating that Samsung may stop using heat pipes for its new smartphones in 2018, sources from upstream supply chain players, cited by Digitimes, have pointed out that Samsung will continue the thermal design and its suppliers have already begun small volume production of related components. (Digitimes, press, My Zaker, My Drivers)

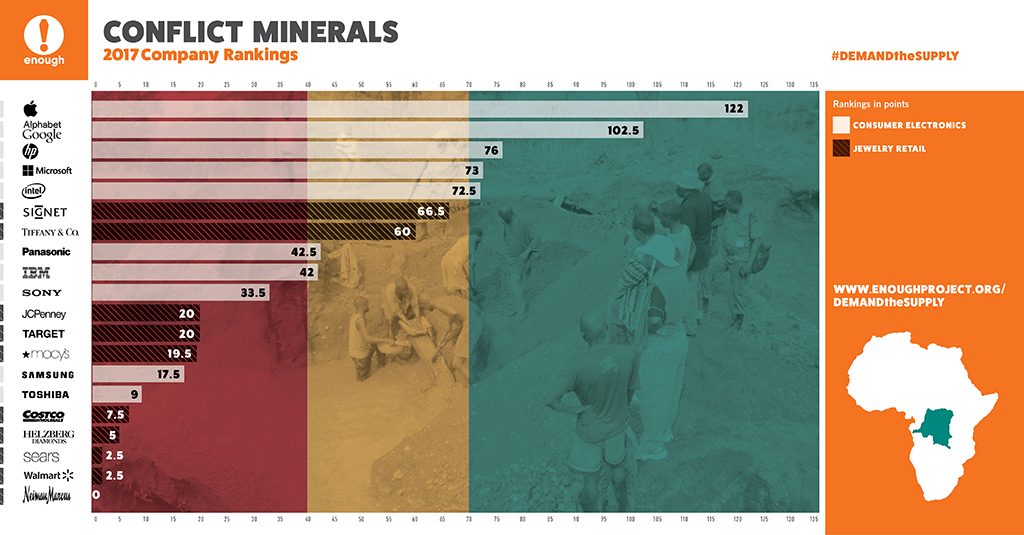

Enough Project has examined 20 of the world’s largest companies in terms of market capitalization. Mineral supply chains examined include tin, tungsten, tantalum, and gold. Apple emerged as the “clear leader” scoring 114 out of a possible 120 points. Following the top 5, including HP, Microsoft, Intel, and Google, the remaining electronic companies take a precipitous drop in rankings, with Panasonic scoring 42.5 —and the anchor of the charts being Toshiba at 9. (Apple Insider, Enough Project, report, CN Beta)

Smartphones

According to analyst, Pan Jiutang, in 2017, other than Huawei, OPPO, vivo and Xiaomi which have huge growth, another one is Foxconn produced Nokia-branded feature phone, which will have nearly 10M units per month shipment. (Gizmo China, My Drivers)

Just as Xiaomi has expanded availability of its smartphones to its Western EU market in Spain, as well as launching Redmi devices on Amazon’s site in Spain – the company has also opened a Xiaomi flagship store. One that would be open 24 hours a day. (GSM Arena, GizChina, Huanqiu)

Smartphone shipments in the China market reached 112.8M units in 3Q17, increasing 18.6% sequentially but decreasing 1.9% on year. China shipments accounted for 31.3% of the global smartphone shipments in the quarter, according to Digitimes Research. Inventory replenishments by Huawei, OPPO and vivo contributed to the sequential shipment growth in 3Q17. (Laoyaoba, Digitimes, press, XCN News)

OnePlus 5T is announced – 6.01” 1080×2160 FHD+ AMOLED display, Qualcomm Snapdragon 835 processor, rear dual 16MP- 20MP + front 16MP cameras, 6 / 8GB RAM, 64 / 128GB storage, rear fingerprint scanner, 3300mAh battery, USD499. (Android Authority, Android Central, TechCrunch)

Tablets

Lenovo is announcing entry-level tablets: Tab 7 – 7” 1280×720 display, MediaTek MT8161 processor, rear 5MP + front 2MP cameras, 1GB RAM, 16GB storage, 15 hours battery life, USD100. Tab 7 Essential – 7” 1024×600 display, MediaTek MT8176D processor, 1GB RAM, 16GB storage, front 2MP camera, 20 hours battery life, USD80. (Liliputing, Tablet Monkeys)

Wearables

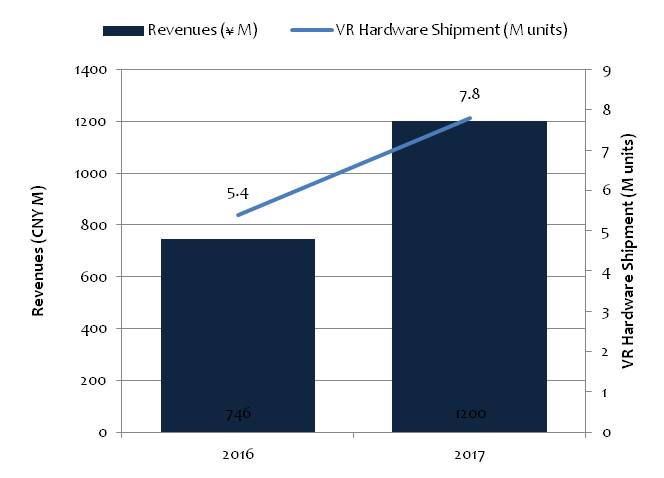

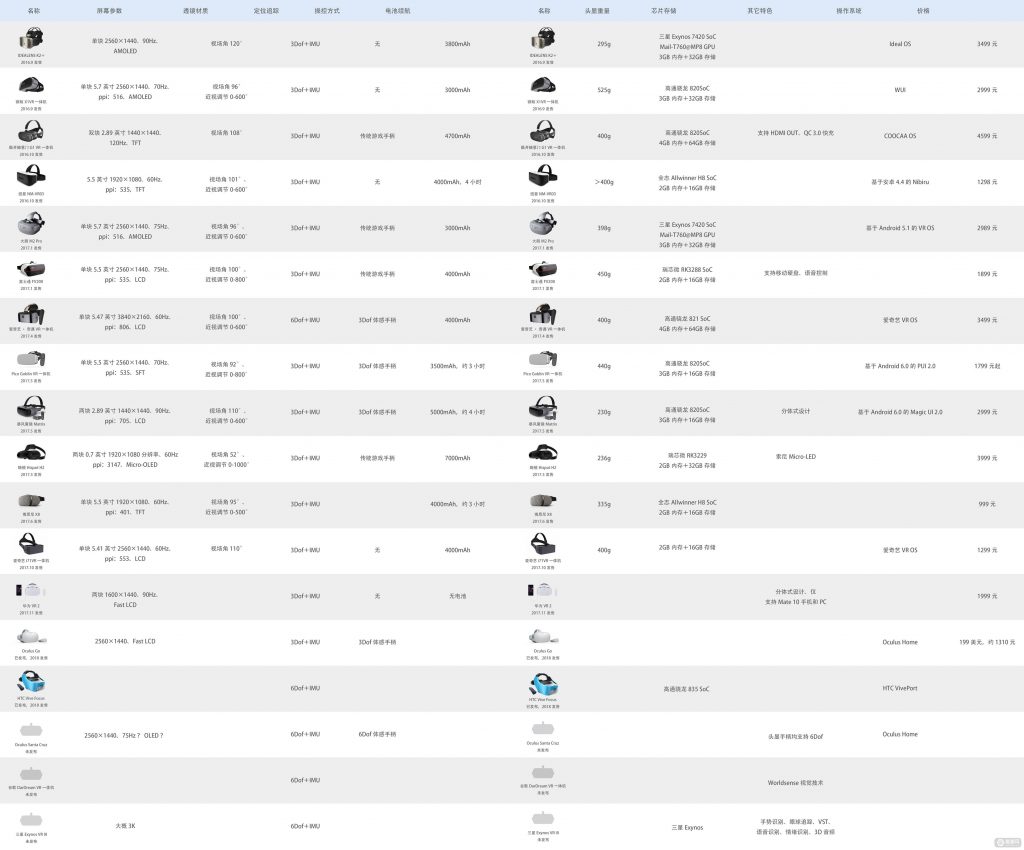

With the ecosystem of standalone virtual reality (VR) head-mounted displays (HMDs) and PC-bundled VR HMDs gradually becoming more complete, demand for the two types of devices are expected to grow in a pace much stronger than that of entry-level mobile VR products in China, according to Digitimes. For China, entry-level mobile VR devices currently still account for nearly 50% of overall VR product sales. In contrast, standalone VR HMDs are expected to enjoy over 30% annual shipment growth for the next 2 years. (Digitimes, press, Digitimes)

According to Digitimes, HTC is reportedly planning to release a new head-mounted display (HMD) supporting Ultra HD resolution in 2018 at the earliest. Most high-end VR HMDs are equipped with FHD-quality OLED displays—HTC Vive and Oculus Rift are both 456ppi, while Sony PSVR is 386ppi. Samsung Display is expected to begin small volume production for its 5.5” Ultra HD (3,840×2,160) OLED panels in 2018. (Digitimes, press, JRJ, 7Tin)

Fossil Q Control sports smartwatch is launched, featuring 45mm circular case, 20mm watchband, 50m water-resistance or “swim-proof”, powered by Android Wear, USD275. (Ubergizmo, TechRadar, Shafa, Yesky)

Internet of Things

Baidu CEO and co-founder Robin Li reveals that his company will begin mass producing driverless buses by the end of Jul 2018. Baidu is also expected to cooperate with Chinese car manufacturers JAC Motors and BAIC Motor in 2019, as well as Chery Automobile the following year, to launch driverless passenger cars. (CN Beta, 21CN, Geek Park, GB Times, Tencent)

Baidu announces Mobile Baidu 10.0, and a number of new smart products including raven H. Baidu has showcased a number of AI technologies including self-driving platform Apollo, Baidu Brain, DuerOS 2.0, etc. (Laoyaoba, NBD, Sina, Sohu, CNBC)

Tesla has has debuted its semi truck, Tesla Semi, that was previously expected with a 500 mile range between charges, and also unveiled a new roadster, Tesla Roaster, capable of going 620 miles —with the ability to go zero to 60 miles per hour in 1.9 seconds. (Apple Insider, The Verge, TechCrunch, Ars Technica, Sina)