12-04: Huawei to launch 5G support smartphones in 2019; Qualcomm will launch the first 5G applications in 2019; etc.

Chipsets

Huawei rotation CEO Xu Zhijun indicates that Huawei will launch commercialized 5G total network solution in 2018, and in 2019 will launch 5G HiSilicon Kirin SoC, at the same time launching 5G support smartphones. (CN Beta, iFeng, China Daily)

Qualcomm SVP Serge Willenegger indicates that 5G could be deployed by 2019 and is likely to become widely available by 2020. Qualcomm said it was the first enterprise to achieve a 5G breakthrough in 2016, and the company’s cellular technology is still at the leading position in the world. Qualcomm will launch the first 5G applications in 2019. (CN Beta, People.com, Laoyaoba)

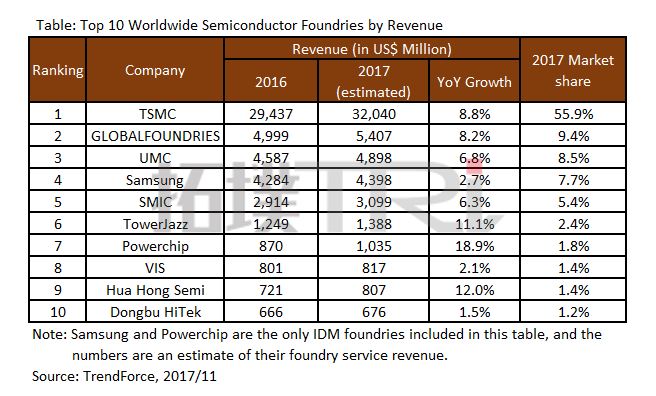

According to TrendForce, the global revenue for semiconductor foundry is expected to reach USD57.3B in 2017, an increase of 7.1% compared with 2016, marking the 5th consecutive year with a growth rate over 5%. The semiconductor industry sees increasing needs for high performance and efficiency from computing and mobile devices, which drive the development of advanced process technology. 10nm nodes began the mass production in 2017, with the revenue expected to reach about USD3.72B, accounting for more than 95% of the yearly foundry revenue growth. (TrendForce[cn], TrendForce, press)

Intel CEO Brian Krzanich has touted a system-on-a-chip for use in self-driving cars that delivers more than 2 times the performance of a platform that Nvidia expects to launch in 2018. He describes Intel’s EyeQ5 SOC leveraging the advanced driver-assistance expertise of its Mobileye acquisition, offers best-in-class deep-learning performance efficiency — and 2.4 times the performance-per-watt “compared with the competition”. (TechNews, Investors)

Touch Display

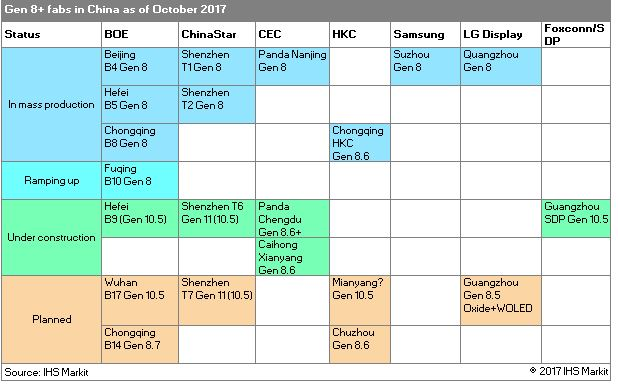

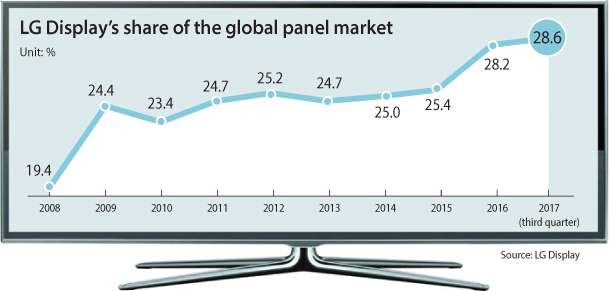

LG Display (LGD) president Lv Xiangde indicates that the OLED TV panel fab being constructing in Guangzhou, China will become LGD’s core of development in Guangzhou in the future. Early in Jul 2017 LGD revealed plan to build a 8.5G OLED production line for OLED TV panels. (Sina, XCN News, Laoyaoba)

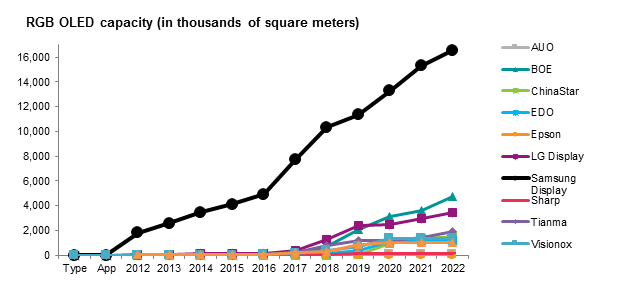

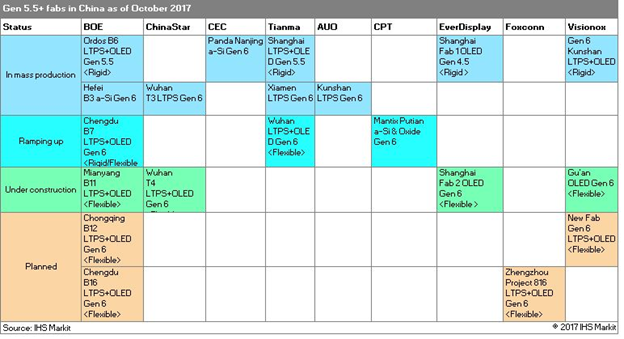

According to IHS Markit, global AMOLED capacity will rise from 11.9Mm2 in 2017 to 50.1Mm2 in 2022, equivalent to 322% growth. The numbers include capacity for RGB OLED—utilized mainly for smartphones, mobile devices, virtual reality, and automotive; as well as capacity for WOLED, also known as White OLED–used primarily for TVs. Of the two segments, RGB OLED has the larger share of market, with capacity growing from 8.9Mm2 in 2017 to 31.9Mm2 in 2022. (OLED-Info, IHS Markit, press, iFeng, Sohu)

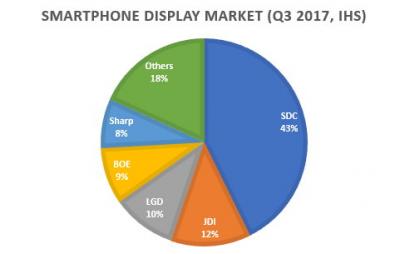

According to the IHS Market, the display panel market for smartphones hit a new record quarterly high of USD11.79B in 3Q17, replacing the previous record of USD11.02B in 4Q16. Samsung Display chalked up a market share of 42.7% with USD5.03B in sales. Second-ranked Japan Display posted USD1.47B in sales (12.5% market share), followed by LG Display with USD1.19B (10.1%). (OLED-Info, Business Korea)

A new television by Samsung, expected to hit local shelves as early as the beginning of 2018. The new model will be sold with Samsung’s logo but its liquid-crystal display (LCD) panel will come from LG Display. The quantity of supplied panels reportedly will not exceed 100,000. (Korea JoongGang Daily, Korea Herald, Sina, EE World, Laoyaoba)

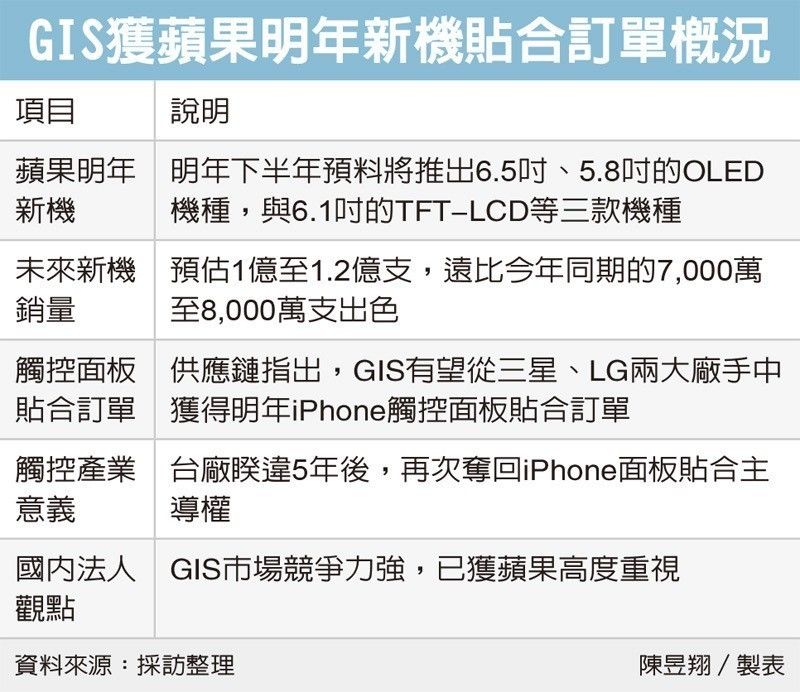

General Interface Solution (GIS) has won the orders of Apple iPhone X 3D sensing binding. It is a vital role to solve the early production low yield rate. In 2018, GIS is likely to continue the similar orders with the new iPhone. If it won touch panel binding orders, it would indicate the big orders of two new iPhone. (UDN, Laoyaoba)

Memory

Samsung Electronics has reportedly started making investments into 2nd floor of its semiconductor line 1 in Pyeongtaek. Size of investment for the 2nd floor will be bigger than the investment made for the 1st floor. (TechNews, ET News, Morgan Stanley report)

Sensory

The vice president for digital enterprise solutions at Walmart Chris Enslin wants a sub-USD1 sensor for the Internet of Things (IoT). For the right product, his company might be willing to purchase a few million of them a year. Walmart is working toward such sensors with grad students in a handful of universities. Meanwhile, it just completed in 2017 an initial rudimentary deployment of IoT in its estimated 5,000 stories in the U.S. (EE Times)

Connectivity

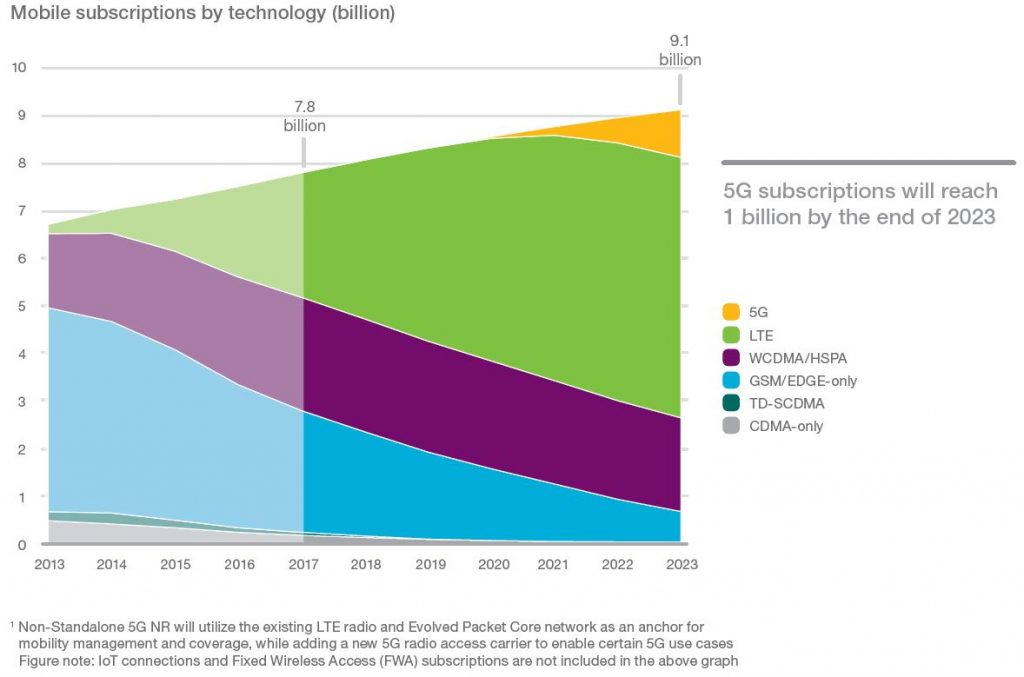

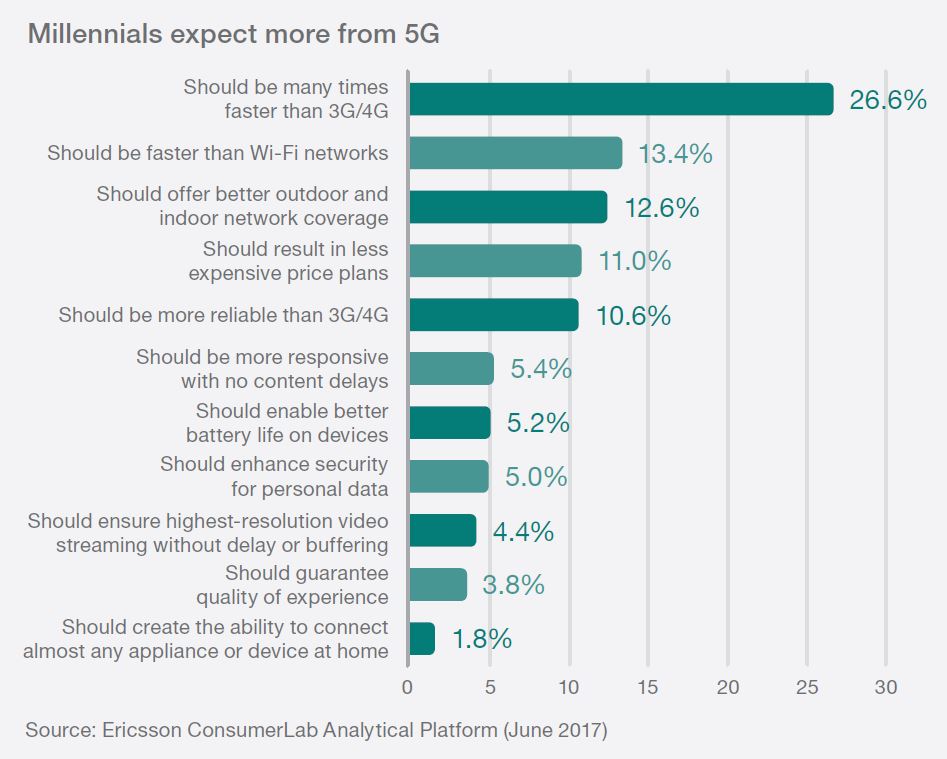

Mobile infrastructure experts Ericsson predicts that in 2023 20% of the global population will have access to a super-fast, next generation 5G phone connection. Ericsson says mobile video will be one of the primary uses for faster 5G connections, but interestingly adds that virtual reality and augmented reality technology will push networks and infrastructure firms like Ericsson and Nokia to get 5G connections up and running quickly. (Digital Trends, Ericsson, report, Ericsson, article, CC Time)

Smartphones

Xiaomi CEO Lei Jun indicates that in the coming decade, artificial intelligence (AI) will be the main core strategy for the company. Xiaomi’s next-generation flagship in 2018 will be equipped with AI, showing how much technology knowledge Xiaomi has gained over the years. (My Drivers, Sina)

Apple CEO Tim Cook shared that developers on the Apple platform have earned CNY112B (USD16.93B) in China. That figure is about 25% of the total earnings from the App Store (where the total revenue to date is about USD70B). (Digital Trends, Apple, Reuters, China News, Sohu)

Internet of Things

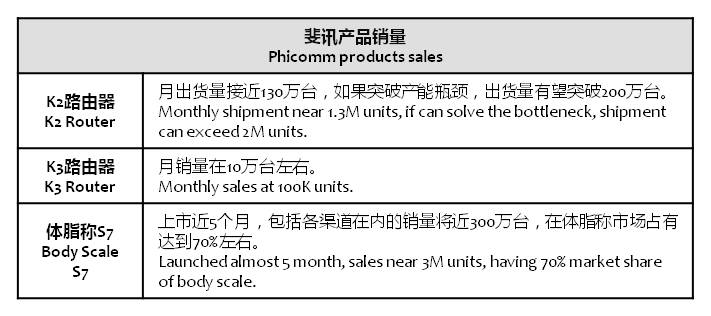

Phicomm founder and CEO Gu Guoping indicates that AI technology makes sense on products that provide service, such as dishwasher, robotic vacuum cleaner, etc. Gu Guoping is positive with smart speaker future, and Phicomm will launch related products in 2018. (CN Beta, XCN News, Sohu)

Baidu chairman Robin Li reveals that currently self-driving car development is very good, and mass production plan is faster than expected. The mass production collaborating with King Long will begin in Jul 2018. The cars working with King Long will not have steeling wheel. Baidu’s Apollo project has more than 70 partners. (My Drivers, CN Beta, JRJ, 36Kr)