02-10: Qualcomm has announced that it has received intense interest to test its X50 5G platform; ZTE has inaugurated a new 5G Innovation and Research Centre in the central Italian city of L’Aquila; etc.

Chipsets

Broadcom has recently came back to Qualcomm with a new offer of USD121B (USD16B more than the initial USD105B), but even so, Qualcomm has continued to refuse the deal. (Android Central, Qualcomm, WSJ)

Qualcomm has announced that it has received intense interest from worldwide telecom operators and equipment manufacturers, including LG and HTC, to test its burgeoning X50 5G platform, which is set to be released in 2019. (Android Central, Qualcomm, Qianlong, Sina, My Drivers)

Touch Display

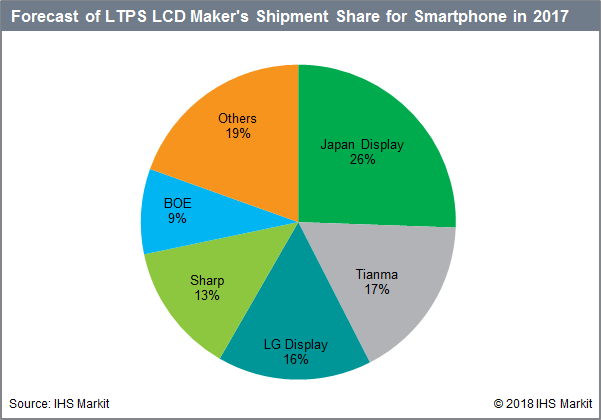

Total shipments of mobile phone displays, including thin-film transistor liquid crystal display (TFT LCD) and active matrix organic light-emitting diode (AMOLED) panels, reached 2.01B units in 2017, up 3% from 2016, according to IHS Markit. Shipments of low-temperature-poly-silicon (LTPS) TFT LCD panels, which realize high-resolution images, increased by 21% to 620M units in 2017 compared to the previous year. Shipments of amorphous silicon (a-Si) TFT LCD mobile phone panels declined 4% to 979M units during the same period. (IHS Markit, press, Laoyaoba)

Visionox has developed a new VR AMOLED display that achieves a very high pixel density of 814PPI. Black Cattle Food, which is a Chinese soy and grain beverage maker, has teamed up with Visionox and provided financial support for Visionox’s upcoming Gen-6 flexible AMOLED fab. (OLED-Info, Sina, GWM)

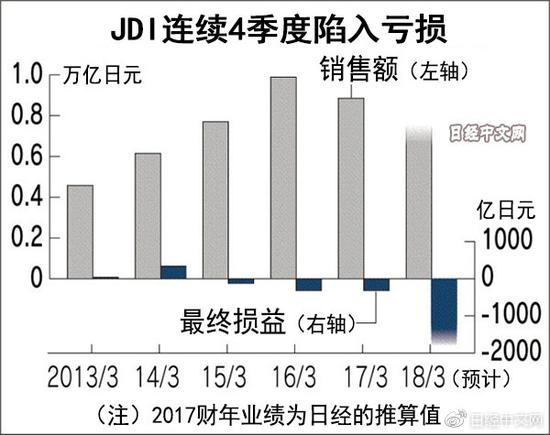

Japan Display Inc (JDI) has estimated that it will require more than JPY200B (USD1.77B) to start mass producing OLEDs in 2019, and the company started reaching out to display makers in China and Korea as finding a partner in Japan is difficult. JDI hoped to finalize its financing by March 2018, allegedly the investors in China, while initially eager to participate, are now hesitating. The company is in talks with BOE, CSOT, Visionox and Hon Hai Precision (Foxconn). (Asia Nikkei, OLED Info, OfWeek, Sina, OfWeek)

Storage

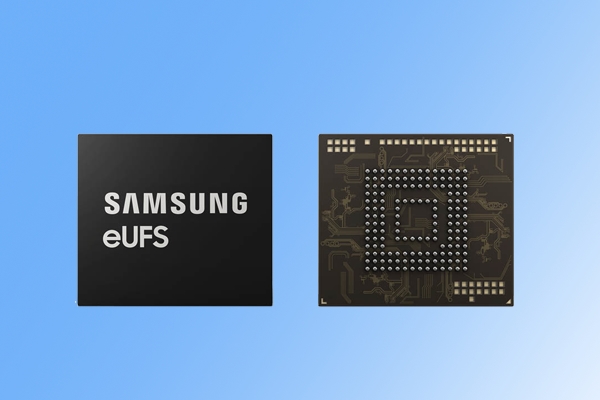

Samsung Electronics has begun production and supply of a 256GB eUFS for use in next-generation cars. The memory chip is designed for use in advanced driver assistance systems, infotainment, and dashboard systems in luxury sedans, sports cars, and other premium automobiles. (CN Beta, Samsung, ZDNet, Storage Review)

Biometrics

According to Counterpoint Research, more than 1B smartphones will ship with facial recognition in 2020. Apple and Samsung will likely lead the pack for this new technology adoption, followed by Chinese players like, OPPO, vivo, Xiaomi, OnePlus, Huawei etc. The diffusion of facial recognition technology into lower tier price bands will be faster than any other flagship feature due to 2D facial recognition being native on the Android platform. They estimate close to 60% of all smartphones with facial recognition, will use 3D technology in 2020. (TechNews, Counterpoint Research, press)

Apple is allegedly adding two Chinese suppliers in 2018 for a stable supply of 3-D sensing modules for its Face ID. LG Innotek will remain as the main vendor, while the secondary Chinese suppliers will produce the remainder. Sharp, which supplied parts for the iPhone X, reportedly has failed to renew the deal. (Apple Daily, China Times, CNYES, TechNews, Apple Insider, Korea Herald, ET News)

Connectivity

The Italian subsidiary of China’s ZTE has inaugurated a new 5G Innovation and Research Centre in the central Italian city of L’Aquila, part of a commitment to invest EUR500M (USD611M) in the country over the next 5 years. ZTE has also revealed plans to build its European 5G hub in Italy and is partnering with Wind Tre and Open Fiber to build a 5G pre-commercial network in the 3.6-3.8 GHz band in L’Aquila. (Android Headlines, RCR Wireless, Telecom Paper, Huanqiu)

Huawei has announced that that it will invest CNY5B in 5G technology research and development and release a full set of 5G commercial devices in 2018. Huawei’s 5G Kirin processors and smartphones are expected in 2019. Yang Chaobin, president of the 5G product line, has disclosed that Huawei has started 5G research as early as 2009, prototyped key technology verification in 2012 and invested USD600M for 5G tech in 2013. (CN Beta, GizChina, Fonow)

Wearables

Huami has just been listed on the New York Stock Exchange and will be now trading under the “HMI” symbol. According to Huami IPO’s reports, the company will offer USD10M ADSs at a price range of USD10~12 in order to achieve a growth of about USD110M. (GizChina, CN Beta)

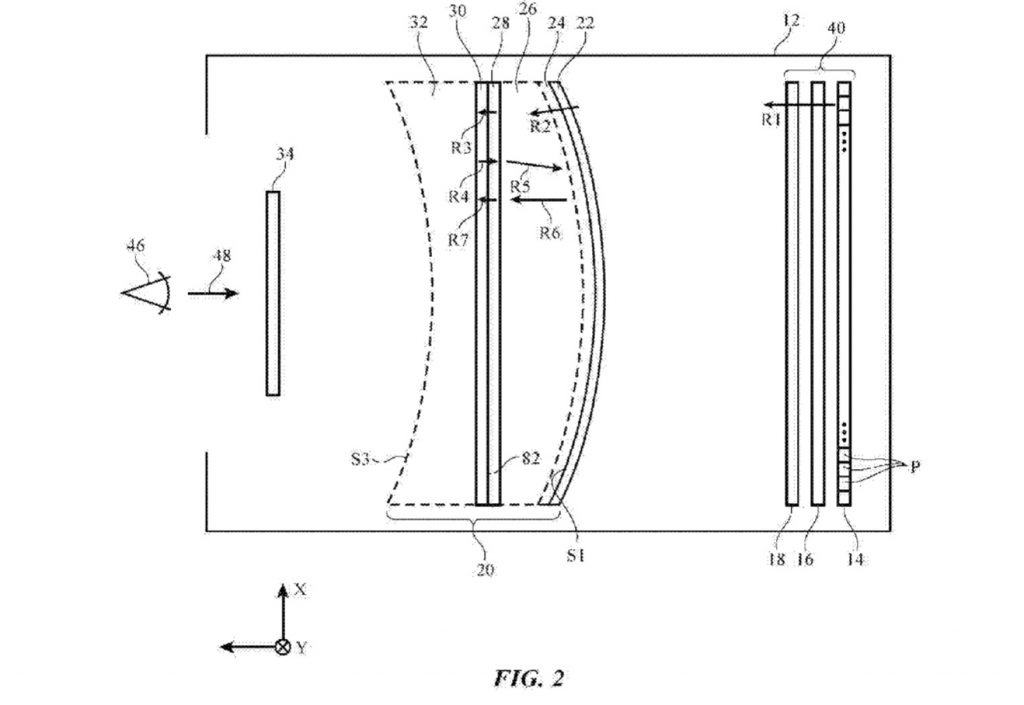

Apple’s patent dubbed “Optical System for Head-mounted Display” describes a multi-lens configuration that could be significantly lighter and less bulky than existing designs. The patent points out it might help reduce fatigue and allow for longer periods of use. (The Verge, Slash Gear, USPTO, iFeng, 163)

Internet of Things

Chinese ride hailing giant Didi Chuxing will set up a venture with SoftBank to provide ride-hailing and other services for the Japanese taxi industry. The two firms aim to establish the joint venture and begin trial services in Japan in 2018. (TechCrunch, Reuters, CNBC, WSJ, Leiphone)

Toyota will invest JPY7.5B (USD69M) into JapanTaxi, an Uber-like service that is owned by Ichiro Kawanabe, who runs Japan’s largest taxi operator Nihon Kotsu and heads up the country’s taxi federation. Toyota is also an Uber investor and it previously backed JapanTaxi via USD4.5M investment from its Mirai Creation Fund. (TechCrunch, Toyota, Bloomberg, Baijiahao, Sohu)

Rosenblatt Securities analyst Jun Zhang predicts that Apple will ship a “low-end” HomePod this fall costing USD150~200 instead of the current model’s USD349 and a new Apple Pencil. Apple is forecast to ship about 6M units of the full-size product. (Apple World, JSTV, Apple Insider)