04-23: ZTE has released an official statement about the US’ ban; Huawei plans to make user interactions with the smartphone more emotionally interactive; etc.

Chipsets

TSMC’s 2H18 7nm is hoping to gain exclusivity of Apple A12 SoC orders for its new iPhone in 2018, and TSMC might use 7nm process for MacBook processors as well. TSMC has revealed that it has developed two separate 7nm FinFet tracks, one optimized for mobile applications, the other for “high performance computing applications”. (Laoyaoba, UDN, Ubergizmo, Notebook Check)

Intel acquired global 2nd largest FPGA vendor Altera in Jun 2015 for USD16.7B. Now, Dell will make programmable acceleration cards with Intel Arria 10 GX FPGAs generally available in the PowerEdge R640, R740 and R740XD servers, and Fujitsu will give priority customers early access to Primergy RX2540 M4servers with the cards installed. (TechNews, Leiphone, Next Platform, Network World)

Touch Display

Samsung’s foldable smartphone allegedly features 3 OLED panels. Samsung is said to have developed a prototype that has three OLED panels measuring 3.5” each. Two of those panels are combined to create a 7” display when the smartphone is unfolded while the third panel is then placed on the outside where it doubles as an information ticker. (Android Headlines, Ubergizmo, The Bell, Huanqiu, My Drivers)

As in 2018 Samsung Display and LG Display (LGD) will not invest in mid-to-small sized OLED equipment, Canon Tokki reportedly has sold its equipments to Mainland China market. Canon Tokki exclusively produce mid-to-small sized OLED equipment, and in 2018 the company plans to ship 11 units of equipments. (Laoyaoba, OfWeek)

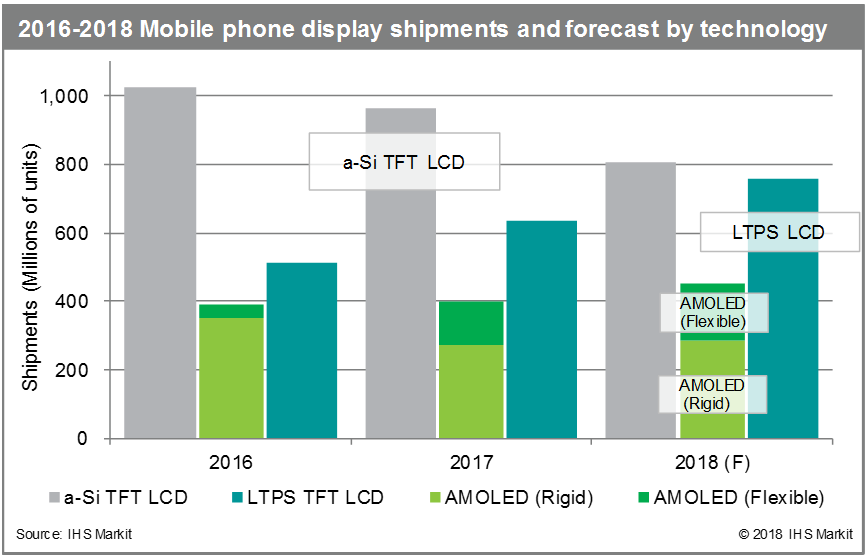

According to IHS Markit, with the adoption by Apple iPhone X, shipments of film-based, flexible AMOLED panels for smartphones more than tripled in 2017 to 125M units from 40M units in 2016, and it was expected to see continued strong growth in 2018. However, now flexible AMOLED panel shipments for smartphones are expected to reach 167M units in 2018, up 34% from 2017, much slower than the expected almost double growth. (IHS Markit, press, OLED-Info, China Stock)

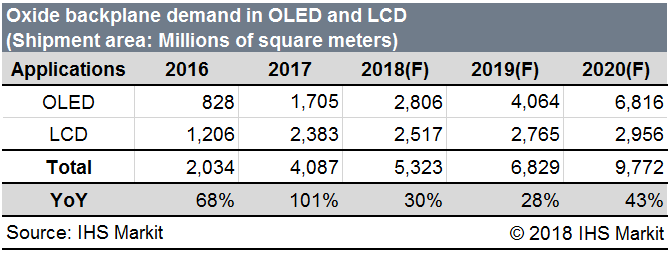

Demand for panels – both thin-film transistor liquid crystal display (TFT LCD) and active-matrix organic light-emitting diode (AMOLED) – using oxide backplane technology doubled in 2017, in terms of area, compared to a year ago, according to IHS Markit. The market is forecast to grow 30% in 2018 to 5.3Bm2 from 2017. (IHS Markit, press, OLED-Info, 51Touch)

Connectivity

Wen Ku, director of the telecom development department at the Ministry of Industry and Information Technology, hopes in 2H19 first 5G phone will be launched. He indicates that in 2017 China has 1.03B 4G users. Currently 5G has already entered international standard establishment vital stage, and global 5G frequencies consensus has been preliminarily established. In the future, 5G will become global only international standard, and China is the first global 5G country. (CN Beta, JRJ, Sohu, CRI)

A telecommunications standards organization GSMA is delaying implementation of a new cellphone technology due to a U.S. government probe of alleged coordination between the group, AT&T and Verizon Communications to hinder consumers from easily switching wireless carriers. (Ubergizmo, Reuters, 10JQKA)

Phones

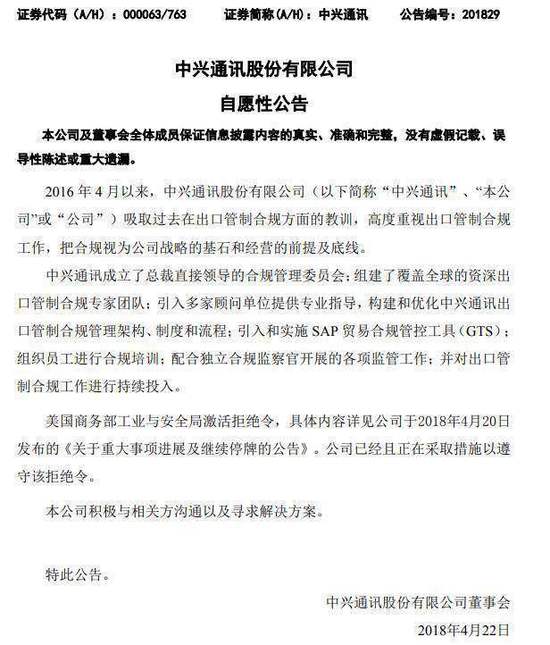

ZTE has released an official statement about the US’ ban from importing US tech (including Qualcomm processors) for 7 years. In summary, ZTE says it has been working hard to comply with the previous settlement, and at some point took measures “against the employees who might have been responsible for this incident.” (CN Beta, Brink Wire)

Huawei plans to make user interactions with the smartphone more emotionally interactive, according to Felix Zhang, VP software engineering at Huawei’s consumer business group. The idea that a program can detect a user’s mood and respond accordingly is defined as “emotion AI”. (Phone Arena, CNBC, CN Blogs, Tencent)

Atherton Research VP Jean Baptiste Su believes that the U.S. market is no longer part of Huawei’s global strategy. He expects that by the end of the year, Huawei will have permanently shut down its U.S. operations selling telecommunications equipment. (GizChina, My Drivers, Caijing, Sohu, Sina, Forbes)

Huawei may be exiting US market, and now focusing on Canadian market. Beginning 17 May 2018, the Huawei P20, P20 Lite, and P20 Pro will be available on Rogers, Bell, Telus, Fido, Virgin Mobile, Koodo, and Videotron. (The Verge, Android Central, My Drivers)

According to Sino MR, in terms of sales, in China market, the top 5 vendors are OPPO, vivo, Apple, Huawei and Honor. And in terms of sales value, the top 5 would be Apple, OPPO, Huawei, vivo and Honor. In Jan~Mar 2018, China market cumulative shipment is 81.87M units, a 27% drop on year. In particular, China vendors shipment amount to 75.864M units, a drop of 27.8% on year. (CN Beta, Laoyaoba)

InFocus Vision 3 Pro is launched in India via Amazon – 5.7” HD+ IPS, MediaTek MT6750, rear dual 13MP-8MP + front 13MP, 4GB+64GB, Android 7.0, rear fingerprint scanner, face unlock, 4000mAh, INR10,999. (Gizmo China, Economic Times, BGR)

Meizu 15 series is announced: 15 – 5.46” FHD, Qualcomm Snapdragon 660, rear dual 12MP-20MP + front 20MP, 4GB+64/128GB, Android 7.1.2, 3000mAh, CNY2499 / CNY2799. 15 Plus – 5.9” 1440×2560 QHD+ AMOLED, Samsung Exynos 8895 Octa, rear dual 12MP-20MP + front 20MP, 6GB+64/128GB, Android 7.1.2, rear fingerprint, 3500mAh, CNY2999 / CNY3299. 15 Lite – 5.46” FHD+ LTPS, Qualcomm Snapdragon 626, rear 12MP + front 20MP, 4GB+64GB, Android 7.1.2, 3000mAh. (GSM Arena, CN Beta, GizChina, CNET, BGR)

vivo Y53i is launched in India – 5” qHD, Qualcomm Snapdragon 425, rear 8MP+front 5MP, 2GB+16GB, Android 6.0, face unlock, 2500mAh, INR7990. (Gizmo China, First Post, News Station, Telecom Talk)

ASUS ZenFone Max Pro M1 is launched in India – 5.99” 2160×1080 FHD+ IPS, Qualcomm Snapdragon 636, rear dual 13MP-5MP + front 8MP, 3 / 4 / 6GB + 32 / 64 / 128GB, Android 8.1, rear fingerprint scanner, 5000mAh 10W fast charging, from INR10,999. (Android Central, Android Headlines)

AR/VR

TheWaveVR has raised USD6M in venture funding for its social VR platform and community for VR music and visual arts experiences. TheWaveVR turns concerts into social VR experiences where people can dance with each other in a VR disco. (VentureBeat, TechCrunch, Road to VR, Sina)

HTC president Cher Wang indicates that in addition to AR / VR, 5G communication, the company also pays interest in blockchain technology. However, from the long term perspective, the company still pays focus on AR / VR strategy. (My Drivers, iFeng, LTN, JRJ, Android Headlines, NBD)

Internet of Things

Faraday Future indicates that FF91 is expected to launch first batch by end of 2018. New batch of cars assembly will begin on 21 May 2018, expects by end of 2018 or early 2019 will be available in China. (CN Beta, Electrive, SCMP)

Alibaba Group is getting its digital assistant into Mercedes-Benzes, Audis and Volvos in China, enlisting a clutch of global automakers in an effort to popularize the year-old technology for everything from shopping to home security. Daimler AG, Volkswagen AG and Zhejiang Geely Holding Group Co.’s Volvo join some 100 brands Alibaba says it’s partnered with. (CN Beta, The National, Bloomberg)

Sinovation Ventures, a Chinese VC co-founded by the ex-head of Google China, Kai-Fu Lee, has raised a new fund of USD500M to invest in AI startups out of the region. Now, the first tranche of investment has been announced for it: USD50M from Spanish bank BBVA. The USD50M investment is the first money that has been announced, but it sounds like the larger USD500M total has already been committed. (Sina, Laoyaoba, Technode, TechWeb, TechCrunch)

Fintech

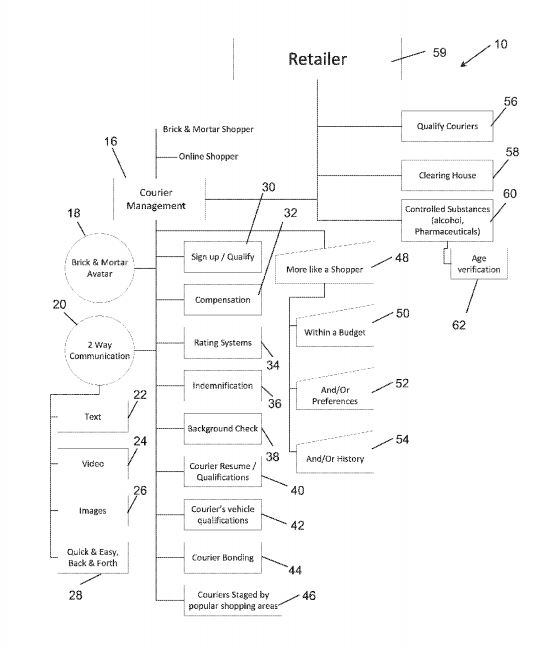

Walmart submitted two U.S. Patent Applications (Courier Shopping System and Vendor Payment Sharing System) on 19 Apr 2018 claiming the invention of computer systems utilizing blockchain technology for automatic integration of courier services into the online shopping experience. (CN Beta, BGR, BTC Manager, Coin Desk)

Economy

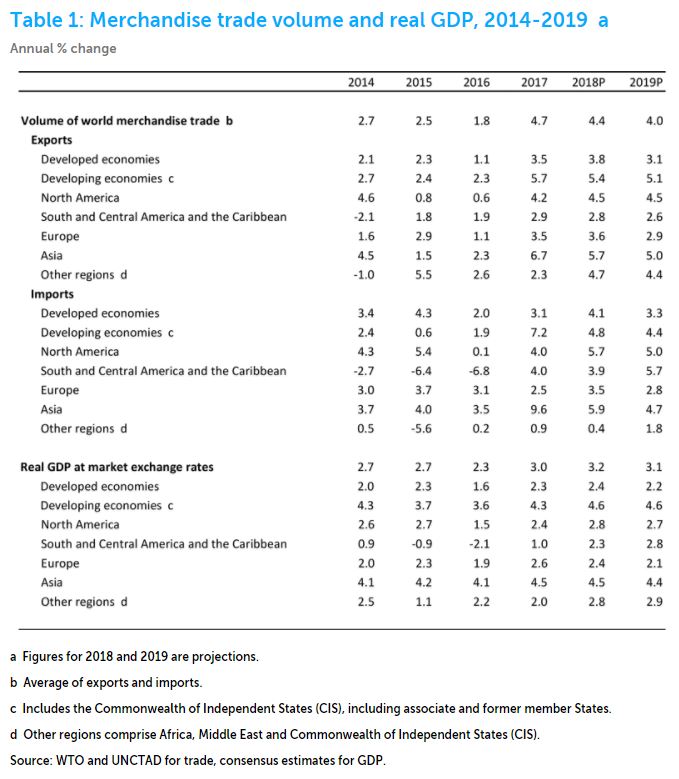

The WTO anticipates merchandise trade volume growth of 4.4% in 2018, as measured by the average of exports and imports, roughly matching the 4.7% increase recorded for 2017. Growth is expected to moderate to 4.0% in 2019, below the average rate of 4.8% since 1990 but still firmly above the post-crisis average of 3.0%. However, there are signs that escalating trade tensions may already be affecting business confidence and investment decisions, which could compromise the current outlook. (TechNews, WTO)