1Q18 Smartphones Shipment Brief (Canalys)

This is a simple report summarizing the shipment of smartphones based on Canalys’s latest number (1Q18). The reasoning behind some of those numbers cannot be explained in detail here, but will be explored in another report.

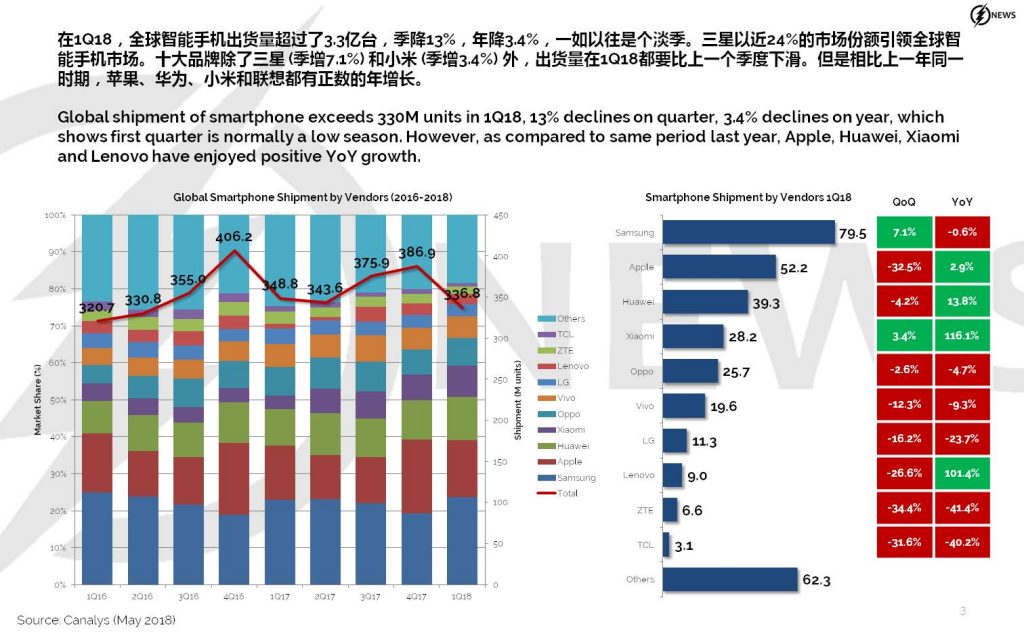

- Global shipment of smartphone exceeds 330M units in 1Q18, 13% declines on quarter, 3.4% declines on year, which shows first quarter is normally a low season. However, as compared to same period last year, Apple, Huawei, Xiaomi and Lenovo have enjoyed positive YoY growth.

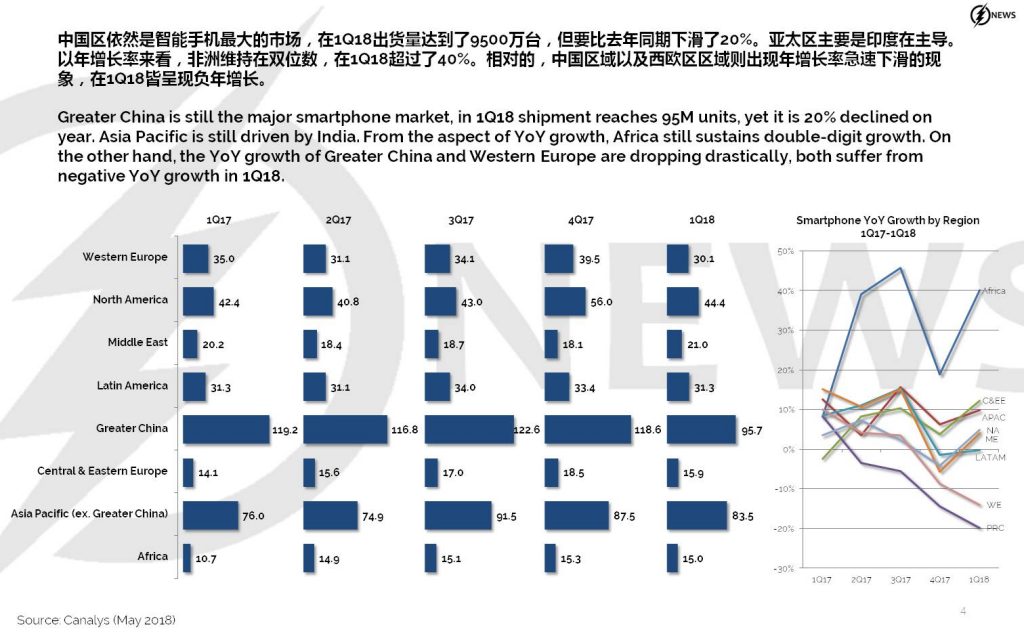

- Greater China is still the major smartphone market, in 1Q18 shipment reaches 95M units, yet it is 20% declined on year. Asia Pacific is still driven by India. From the aspect of YoY growth, Africa still sustains double-digit growth. On the other hand, the YoY growth of Greater China and Western Europe are dropping drastically, both suffer from negative YoY growth in 1Q18.

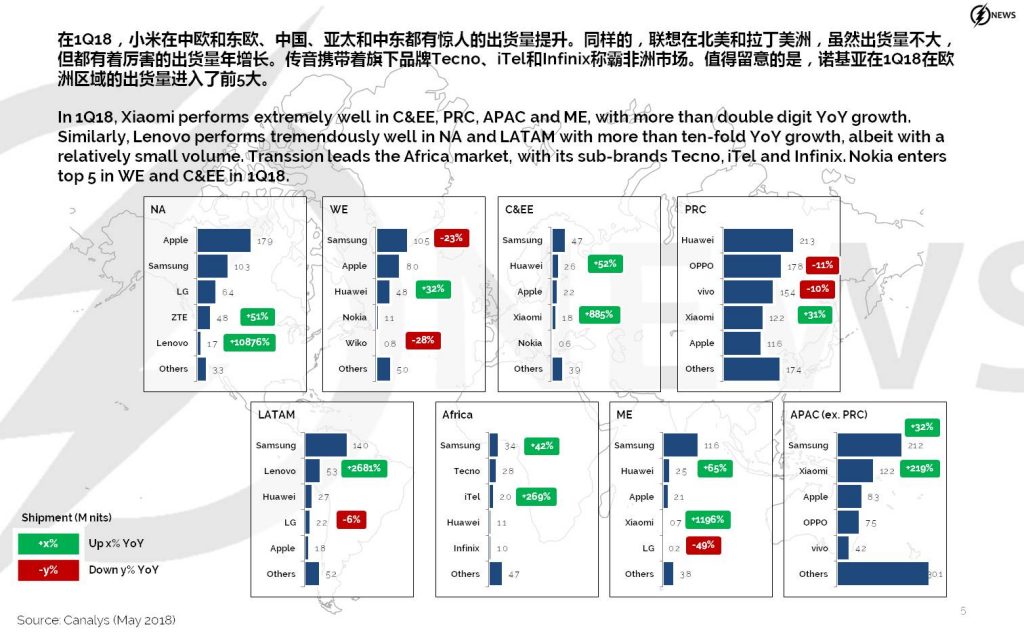

- In 1Q18, Xiaomi performs extremely well in C&EE, PRC, APAC and ME, with more than double digit YoY growth. Similarly, Lenovo performs tremendously well in NA and LATAM with more than ten-fold YoY growth, albeit with a relatively small volume. Transsion leads the Africa market, with its sub-brands Tecno, iTel and Infinix. Nokia enters top 5 in WE and C&EE in 1Q18.

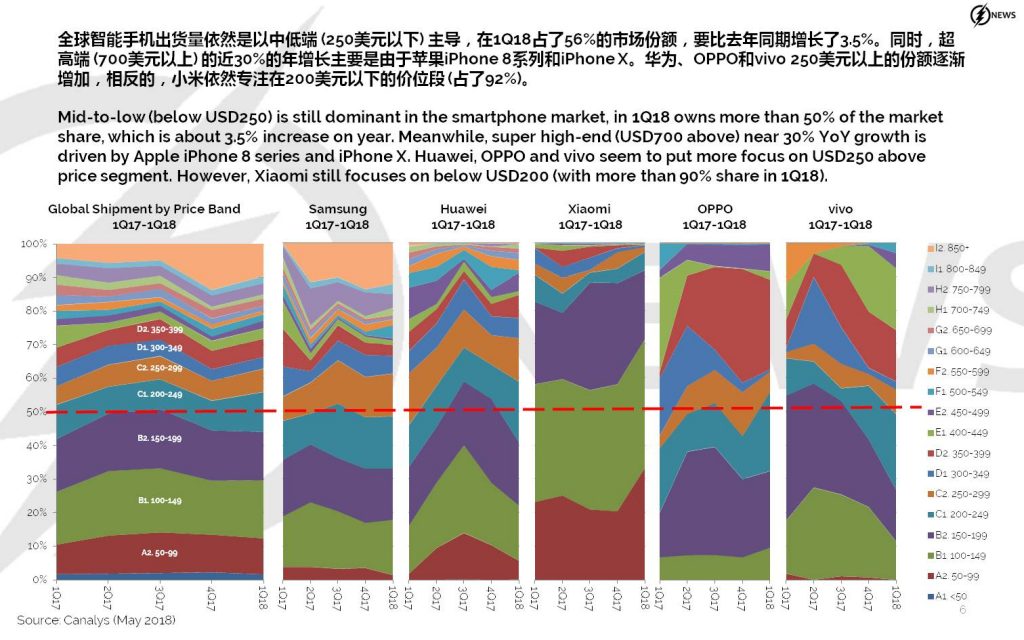

- Mid-to-low (below USD250) is still dominant in the smartphone market, in 1Q18 owns more than 50% of the market share, which is about 3.5% increase on year. Meanwhile, super high-end (USD700 above) near 30% YoY growth is driven by Apple iPhone 8 series and iPhone X. Huawei, OPPO and vivo seem to put more focus on USD250 above price segment. However, Xiaomi still focuses on below USD200 (with more than 90% share in 1Q18).