06-16: BOE has revealed that the company’s Chengdu G6 flexible AMOLED production line has progressed smooth; Baidu and China Mobile have announced a comprehensive partnership to collaborate; etc.

Chipsets

Broadcom said it has laid off about 1,100 employees across its businesses to cut costs after its merger with Brocade Communications Systems. The chipmaker completed its USD5.5B acquisition of network gear maker Brocade in Nov 2017. (CN Beta, Reuters)

Chinese regulators have allegedly approved Qualcomm’s proposed USD44B acquisition of NXP Semiconductors. The decision by China’s Ministry of Commerce (Mofcom) clears a months-long antitrust roadblock caused by trade tensions between the US and China and will allow the takeover to proceed. (TechCrunch, SCMP, Reuters CN, ESM China)

Touch Display

China Star Optoelectronics (CSOT) High Generation Module Project has a total investment of CNY9.6B and covers an area of 519,000m2. After the project is put into production, it will enter the stage of ramp-up of production capacity and yield, and it is expected that by 2021, the project will complete all construction and achieve production, and will reach an annual output of 60M LCD panels of various sizes. (Laoyaoba, 52RD, CCID Net)

TCL’s subsidy CSOT’s module project is entering mass production. CSOT’s high-end module project is at Shenzhen CSOT G11 and G8.5 fab. It is also an important measure for TCL Group to actively optimize the industrial structure and realize the integrated development of the upstream and downstream industries of the LCD industry. (Laoyaoba, CCID Net, OfWeek, 51Touch)

TCL Group has indicated that the company will continue their LCD competitive leverage, at the same time planning large-size printing OLED technology research. Additionally, the company’s Wuhan t3 factory designed monthly substrate production is 30,000 units. Currently the production increase is stable, yield rate has increased. (Laoyaoba, JRJ, Semi Insights, FPDisplay)

BOE has revealed that the company’s Chengdu G6 flexible AMOLED production line has progressed smooth. Till Mar 2018, yield rate has achieved higher than 65%, which has capability to begin 2nd phase ramp up. (JRJ, East Money, Laoyaoba,

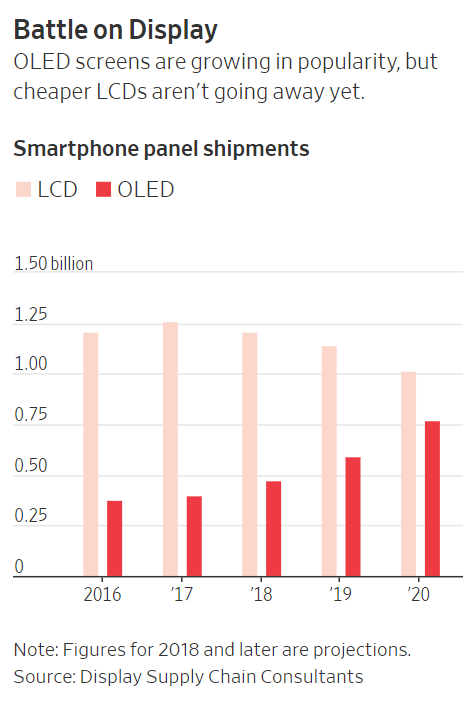

Apple allegedly will not ship 3 OLED display iPhone models in 2018. Apple plans to make more of the LCD model, anticipating that consumers would lean toward the cheaper model. Apple is not expected to shift to an full OLED lineup until 2020 at the earliest. (Phone Arena, WSJ, CNET, SlashGear, Mobile Syrup, My Drivers, Sina)

Storage

Samsung will reportedly begin mass production of LPDDR5 RAM and UFS 3.0 NAND in 2H18. These two components may first appear in the Galaxy S10. (Gizmo China, WCCFTech, Android Headlines, Sina)

Battery

Samsung has announced a big change in the way it powers all of its operations. By 2020, the company aims to use 100% renewable energy at factories, offices, and operational facilities throughout the United States, China, and Europe. (Android Central, Samsung, Engadget CN, Sina)

Jun Zhang of Rosenblatt Securities believes that Apple will upgrade from 5V 2A to 9V 2A and 5V 3A charging circuitry in its upcoming iPhone generation. Their interest in doing so is to “support more applications , provide a quicker recharge, and better compete with Android OEMs”. (Pocket-Lint, Apple Insider, Sina, Sohu)

Connectivity

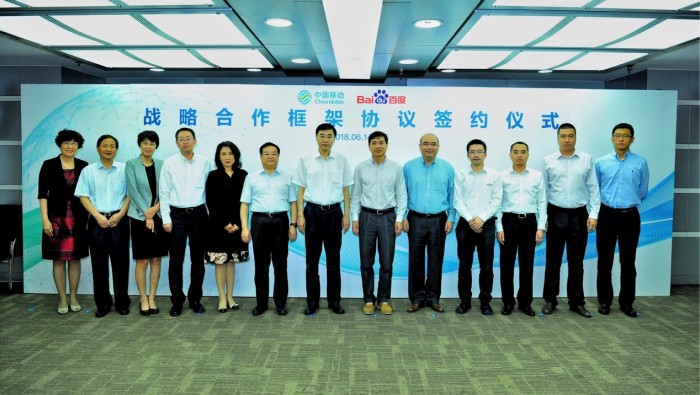

Baidu and China Mobile have announced a comprehensive partnership to collaborate on AI, 5G, and big data — “frontier areas” where each company’s strengths will be necessary to move forward. On the AI front, they will collaborate on image recognition, voice recognition, and natural language processing to leverage AI in telecommunications applications, using Baidu’s algorithms across China Mobile’s networks and services, as well as in future intelligent devices and connected homes. (VentureBeat, Globe Newswire, Sina, STCN, CN Beta)

Ericsson and Intel, together with China Mobile Research Institute and China Mobile Jiangsu Company, have successfully demonstrated the first 3GPP-compliant, multi-vendor Standalone (SA) 5G New Radio (NR) call – accelerating the commercial deployment of standard-based 5G networks. (Laoyaoba, Economic Times, Telecom Paper)

China is allegedly establishing an electronic identification system to track cars nationwide, adding to a growing array of surveillance tools the government uses to monitor its citizens. Under the plan being rolled out 1 Jul 2018, a radio-frequency identification (RFID) chip for vehicle tracking will be installed on cars when they are registered. (Laoyaoba, The Verge, WSJ, Engadget)

Phone

OnePlus has announced it has sold more than 1M units worldwide of its OnePlus 6 within 22 days making it the company’s fastest-selling device to date. (Android Headlines, The Verge, CNET, My Drivers)

According to Protolabs, consumers are willing to pay more money to customize their devices. Majority of survey respondents, 86% found greater customization to be appealing. However, consumers expect a short timeline for delivery of their custom small electronics. Over 60% of respondents said that the item would need to arrive in three days or less in order to be completely satisfied and one in five expect overnight or better delivery. (Gizmo China, Forbes, Protolabs, Sohu)

Xiaomi deserves to trade at a premium to global phone brands due to its market-share gains and faster growth trajectory, according to Morgan Stanley, one of banks leading its Hong Kong IPO. Xiaomi has a fair value of about USD65B~USD85B, translating into around 27~34 times forecasts for its 2019 adjusted earnings. (Investopedia, Bloomberg, CN Beta)

Meizu’s internal letter reveals that the company has expanded successfully in the past few years, but did not abide by the principle of streamlining the business. The company has confirmed that it will lay off about 610 staff members. (CN Beta, Sina, Sohu)

According to industry analyst Pan Jiutang, shortage of Xiaomi’s models often affects the sales performance. Despite that the Mi 8 is the top performer in sales among all Snapdragon 845 brands in China, the Xiaomi supply chain still falls behind those of Apple, Samsung and Huawei. The stock of the 2 global smartphone market leaders is usually in the region of 10M whenever a new model is released. (PC Pop, Tencent, Gizmo China)

Automotive

Startup RideOS has raised USD9M led by venture firm Sequoia Capital and reached a partnership with a division of Ford Motor. RideOS plans to sell software that gives routes and other dispatching instructions to fleets of autonomous cars. (Android Headlines, Bloomberg, NDTV, PR Newswire, Sohu)