06-28: Meitu has announced entering chipset industry; Apple and Samsung have agreed to a settlement in the case; etc.

Chipsets

Meitu has announced entering chipset industry, launching its own MT-AI image processing chipset. The chipset speeds up image “beautification” process, and increase the team’s efficiency. (CN Beta, My Drivers)

Huawei Kirin 1020 SoC reportedly is aiming for 5G network, and its performance is claimed to be double of Kirin 970, and will be embedded with neural processing unit (NPU). Kirin 1020 reportedly is going to power Mate 30 and Mate 30 Pro. (Ubergizmo, GSM Arena, Anzhuo, MoneyDJ, Sohu)

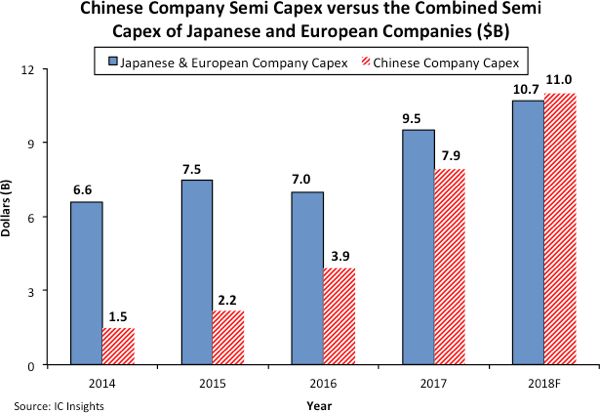

IC Insights forecasts that China-headquartered companies will spend USD11.0B in semiconductor industry capex in 2018, which would represent 10.6% of the expected worldwide outlays of USD103.5B. Not only would this amount be 5x what the Chinese companies spent only 3 years earlier in 2015, but it would also exceed the combined semiconductor industry capital spending of Japan- and Europe-headquartered companies in 2018. (TechNews, IC Insights, press)

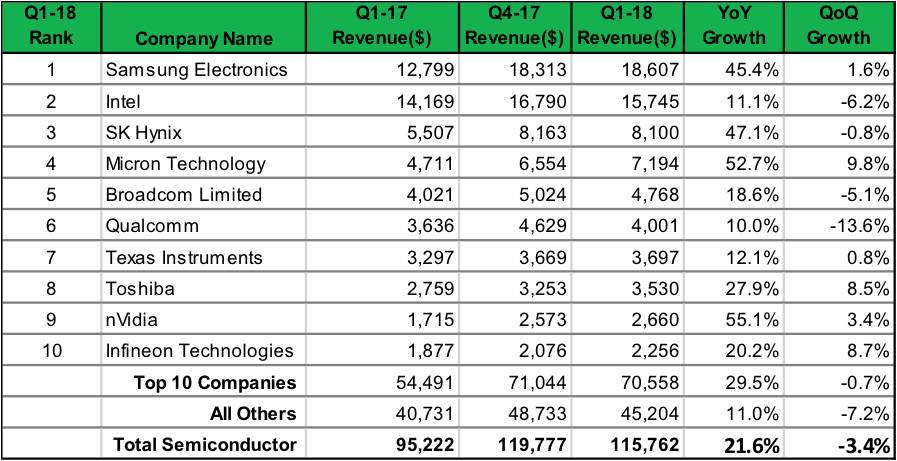

Global semiconductor industry revenue declined 3.4% in 1Q18 falling to USD115.8B. Semiconductor industry performance was negatively affected by the declining sales and first-quarter seasonality in the wireless communications market. Other sectors, such as automotive and consumer semiconductors, experienced nominal market growth, according to IHS Markit. (IHS Markit, press, Laoyaoba)

Northland analyst Gus Richard indicates that Apple may choose to use modems manufactured by MediaTek instead of modems from Intel in future iPhone. (CN Beta, Mac Rumors, Bloomberg Quint, Bloomberg)

Touch Display

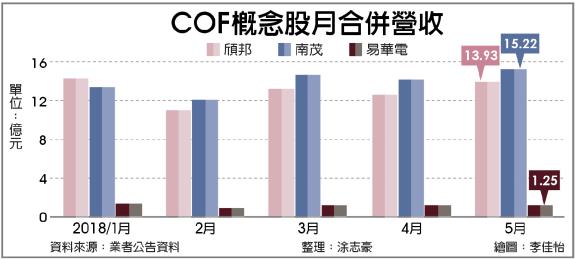

ChipMOS Technologies has seen its COF (chip-on-film) packaging production capacity run at full utilization, thanks to strong demand for TDDI (touch and display driver integration) chips for use in smartphone panels, according to company chairman SJ Cheng. In addition, ChipMOS will see its shipments for 3D sensing components expand in 2H18. (Digitimes, press, UDN)

JOLED has announced official plans for its first mass production printed OLED fab. JOLED will establish the production site in Nomi City, Ishikawa Prefecture. The capacity of the new fab will be 20,000 monthly 5.5-Gen (1300×1500 mm) substrates and the plan is to begin mass production in 2020. JOLED will produce 10- to 32” OLED displays for automotive displays, high-end monitors and more. (TechNews, Money DJ, OLED-Info)

Samsung is now working to establish a pilot Gen-8 line for QD-OLED production. Samsung is reportedly collaborating with both Canon Tokki and Kateeva to develop the production equipment – apparently the OLED layers will be evaporated using Canon’s machines while the QD filters will be deposited using ink-jet printing equipment made by Kateeva. Samsung aims to finalize the production line by 2H19. (OLED-Info, ET News, Laoyaoba)

Chip on film (COF) packaging substrate supplier JMC Electronics and COF back-end service firms Chipbond Technology and ChipMOS Technologies are set to enjoy brisk sales in 2H18 thanks to increasing adoption of COF packaging for LCD driver ICs for smartphone panels, according to Digitimes. As a result, JMC has plans to expand the production capacity of COF substrates to 10M units a month in 2H18 and to 20M units in 2019. (Digitimes, press, LTN, CTEE, Hangjia)

Connectivity

LITE-ON’s wireless communication modules WSG300S, WSG303S, WSG304S, and WSG306S have been officially accredited with “Sigfox-Verified” certification and are ready for the booming market for IoT. The newest LITE-ON modules integrate RF and microcontroller technology from STMicroelectronics. (Laoyaoba, Globe Newswire, NASDAQ, RTT News)

Phone

Apple and Samsung have agreed to a settlement in the case, according to filed court documents, but did not disclose the terms. The settlement closes a dispute that started in 2011 when Apple accused Samsung of “slavishly” copying the iPhone’s design and software features. (Android Headlines, CNBC, CNN, CN Beta)

Sony Mobile is allegedly planning to “shut down its operations and offices” in the Middle East, Turkey, and Africa later in 2018. The company will apparently make this decision in Oct 2018. (Ubergizmo)

KaiOS Technologies, developer of the emerging operating system for smart feature phones, KaiOS, today announced a USD22M Series A investment from Google to help bring the internet to the next generation of users. KaiOS works closely with manufacturers like TCL, HMD Global, and Micromax and has partnerships with carriers such as Reliance Jio, Sprint, AT&T, and T-Mobile. (TechCrunch, VentureBeat, 9to5Google, KaiOS, My Drivers, Sohu)

Meitu T9 is announced in China – 6.01” 1080×2160 FHD+ AMOLED, Qualcomm Snapdragon 660, rear dual 12MP-5MP + front dual 12MP-5MP, 4GB+64GB / 6GB+128GB, Android 8.1 (MEIOS4.3), 3100mAh, CNY3399 / CNY4199. (CN Beta, Gizmo China, Meitu)

Samsung Galaxy J8 is launched in India – 6” 1480×720 HD+ Super AMOLED, Qualcomm Snapdragon 450, rear dual 16MP-5MP + front 16MP, 4GB+64GB, Android 8.0, 3500mAh, INR18,990. (GSM Arena, Samsung)

Augmented / Virtual Reality

Facebook has won a ruling that halved a jury’s USD500M verdict against its Oculus unit for using computer code in its virtual reality headset that was taken from another company. U.S. District Judge Ed Kinkeade in Dallas has also rejected ZeniMax Media’s request that he ban sales of Oculus headsets. (CN Beta, Bloomberg)

Robotics

Honda Motor has ended the development of its humanoid robot, ASIMO. The Japanese automaker is shifting focus to more practical robots such as models that help in nursing care. (CN Beta, Asia Nikkei, NHK)

Automotive

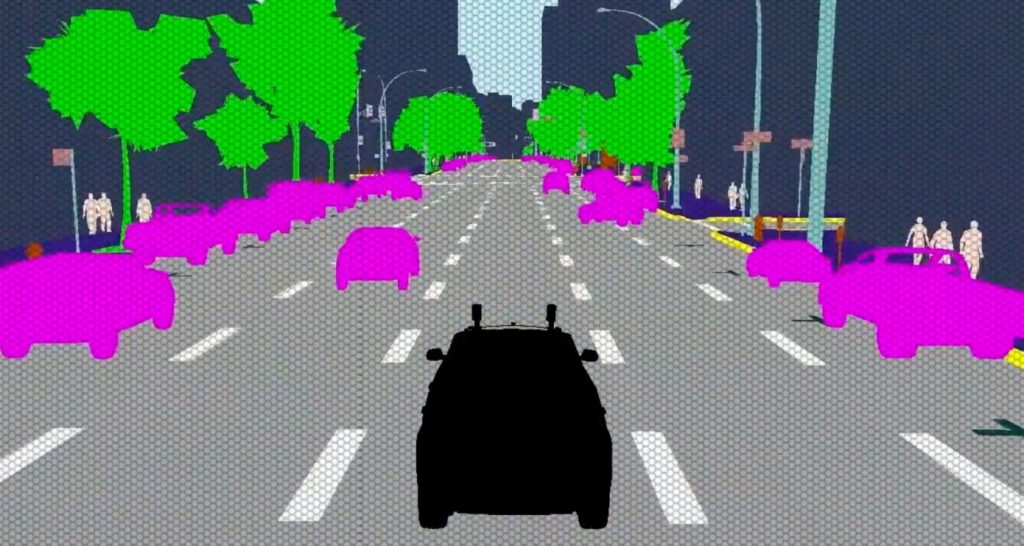

Cognata has announced that Autonomous Intelligent Driving GmbH (AID), a wholly-owned subsidiary of AUDI AG, has selected Cognata as its Autonomous Vehicle simulation partner. AID chose Cognata’s solution, which leverages artificial intelligence, deep learning and computer vision in a highly realistic simulation environment. (Android Headlines, Reuters, TechCrunch, PR Newswire)

Artificial Intelligence

iFlytek is now working with the country’s 3 telecommunication network operators – China Mobile, China Unicom and China Telecom – to develop voice-activated smart devices that are designed to control home entertainment systems. That strategic alliance would open up a large market of broadband users to iFlytek, giving it an edge over other AI-enabled smart device suppliers in the country. (Laoyaoba, SCMP)

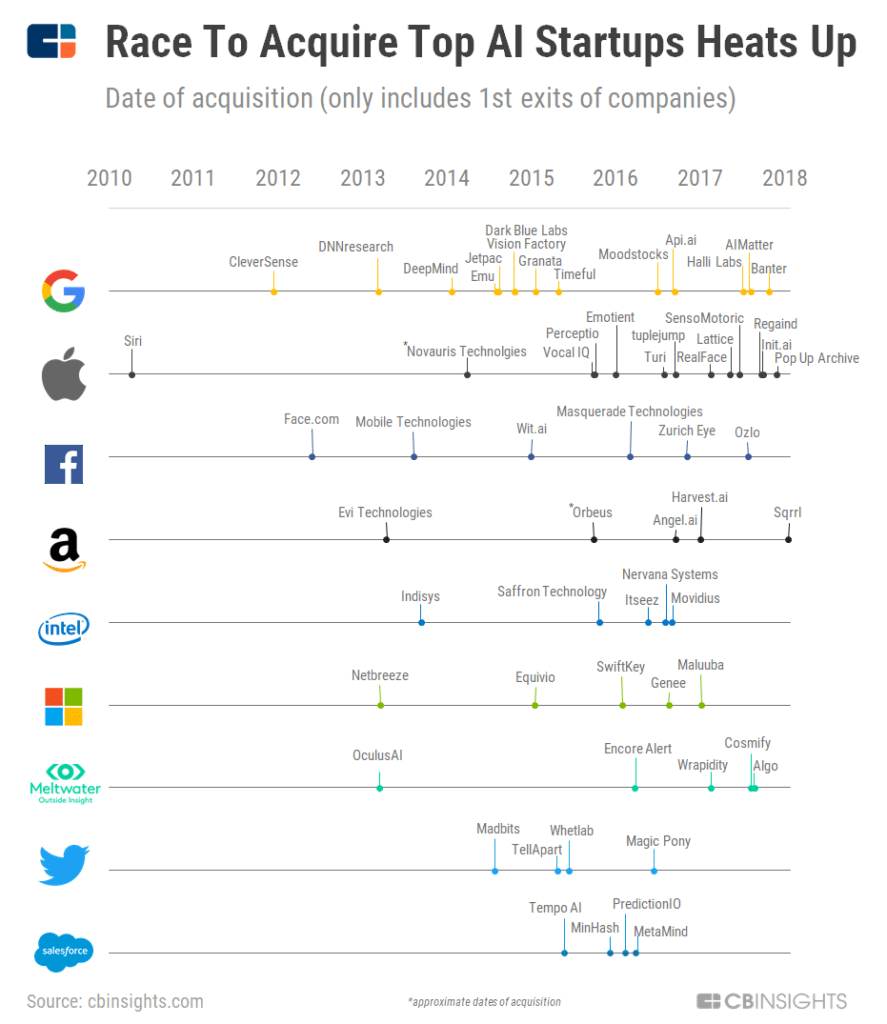

Tech giants like IBM and Google have invested billions internally in A.I. research, but the past few years have also seen a wave of acquisitions, as big companies buy up startups to obtain top talent and new data-crunching science. (CB Insights, press, Laoyaoba, Fortune, CN Beta)