11-10: Samsung has shown off its Infinity Flex foldable phone; Samsung’s new “infinity display” pushes 3 other fresh designs; etc.

Chipset

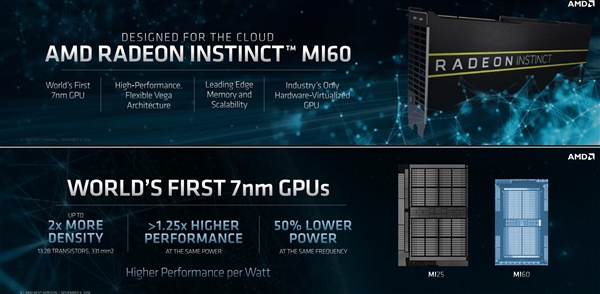

AMD has unveiled the world’s first and fastest 7nm data center GPUs. The Radeon Instinct MI60 and MI50 accelerators were built to tackle the most demanding workloads, such as deep learning, high-performance computing, cloud computing and other intensive rendering applications. (GizChina, Tom’s Hardware, Sohu, Baijiahao, Leiphone)

In an ongoing antitrust lawsuit against Qualcomm led by the Federal Trade Commission (FTC), the company is forced to license its patents to its rivals, according to a preliminary ruling by the US federal court judge. This would potentially eliminate the possibility of Qualcomm achieving monopoly in the chip maker market. (GSM Arena, Android Central, Business Insider, Reuters, Sina)

HiSilicon Kirin 990 will allegedly debut in 1Q19. It will be manufactured using the 2nd-gen 7nm process node technology of TSMC. HiSilicon, the semiconductor subsidiary of Huawei, is working with TSMC for the testing and development of the SoC. (Android Headlines, My Drivers, CNMO)

Touch Display

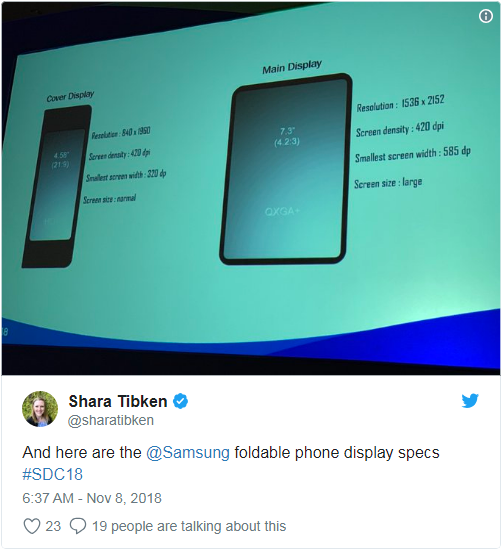

Samsung has shown off its Infinity Flex foldable phone. The phone part featuring a 21:9 4.58” screen with a resolution of 1960×840. In tablet mode, the screen extends to 7.3” with a ratio of 4.2:3 and a resolution of 2152×1356. The pixel density in both modes is 420ppi. (Android Authority, Android Central, GSM Arena, CN Beta, CN Beta, CN Beta)

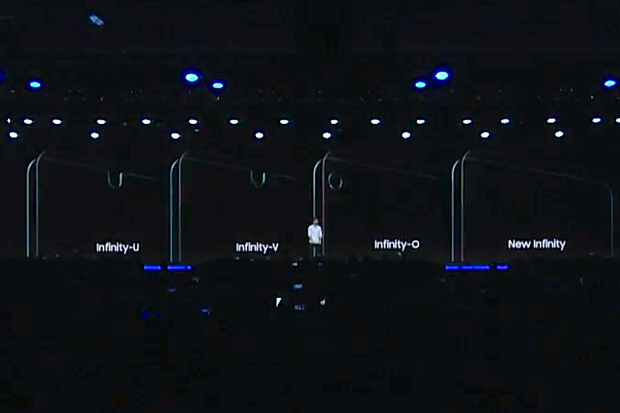

Samsung’s new “infinity display” pushes 3 other fresh designs: Infinity V with V-shaped notch, Infinity U with U-shaped notch, and Infinity O with drilling a hole on display. (Android Central, Android Authority, CN Beta, The Verge)

Samsung Infinity display will allegedly be first adopted by Galaxy A70 / A90, which will be launched in Feb 2019. (CN Beta, iGao7, Phone Arena)

LG Display (LGD) has reportedly started to mass produce OLED panels for Apple iPhone, with the first batch of 400K panels expected to be delivered in Dec 2018. The parts and materials have been received by LG’s E-6 facility in Paju, South Korea. At an estimated price of KRW100,000 (USD89.29) per OLED panel, the total order is expected to be worth around KRW40B (USD35.7M) to LGD. (Apple Insider, ET News, Sohu, iFeng, Tencent, OfWeek)

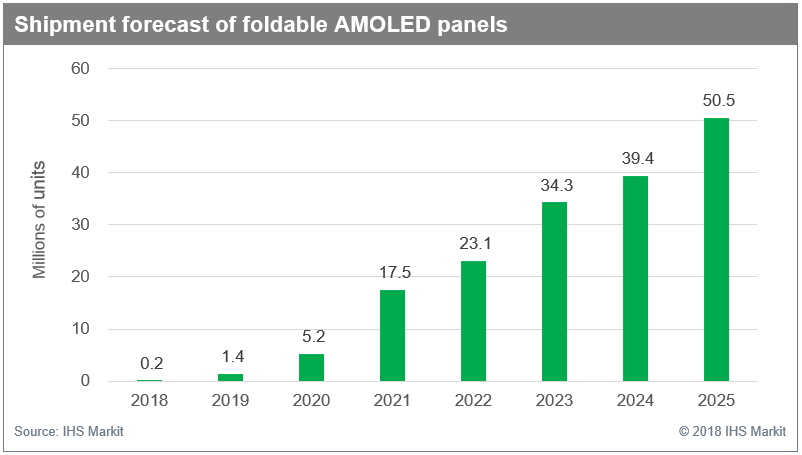

Spurred on by growing demand for innovative user experience in smartphones, shipments of foldable active-matrix organic light-emitting diode (AMOLED) panels are expected to reach 50M units by 2025 for the first time since their launch in 2018, according to IHS Markit. The foldable AMOLED panels are expected to account for 6% of total AMOLED panel shipments (825M), or 11% of total flexible AMOLED panel shipments (476M) by 2025. (IHS Markit, press, CN Beta)

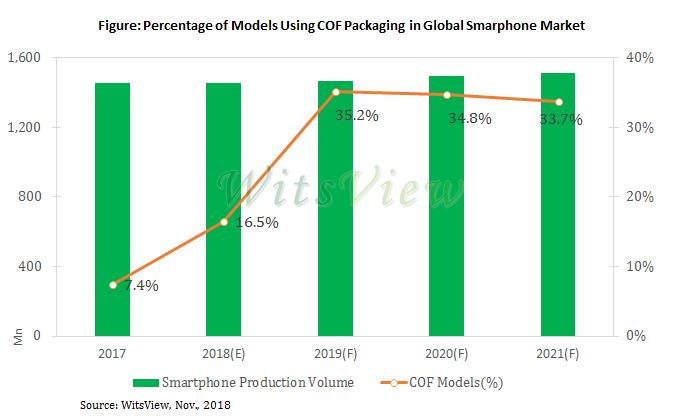

According to TrendForce, the market has witnessed stronger demand for full-screen smartphones while higher screen-to-body ratio has become a major trend of this year. In order to make bezels narrower, drive ICs for mid- and high-end phones have been switching from solutions based on Chip-on-Glass (COG) packaging to those on Chip-on-Film (COF) packaging. With major smartphone vendors actively adopting COF solutions, the percentage of models using COF packaging would account for 35% of the global smartphone market in 2019, a significant increase from 16.5% in 2018. (TrendForce[cn], TrendForce, press)

Camera

Huawei’s patent shows that Huawei hides the camera in the strip-shaped in-ear speaker hole. This strip hole will accommodate the front camera and associated required sensors. (GizChina, 163, Sina)

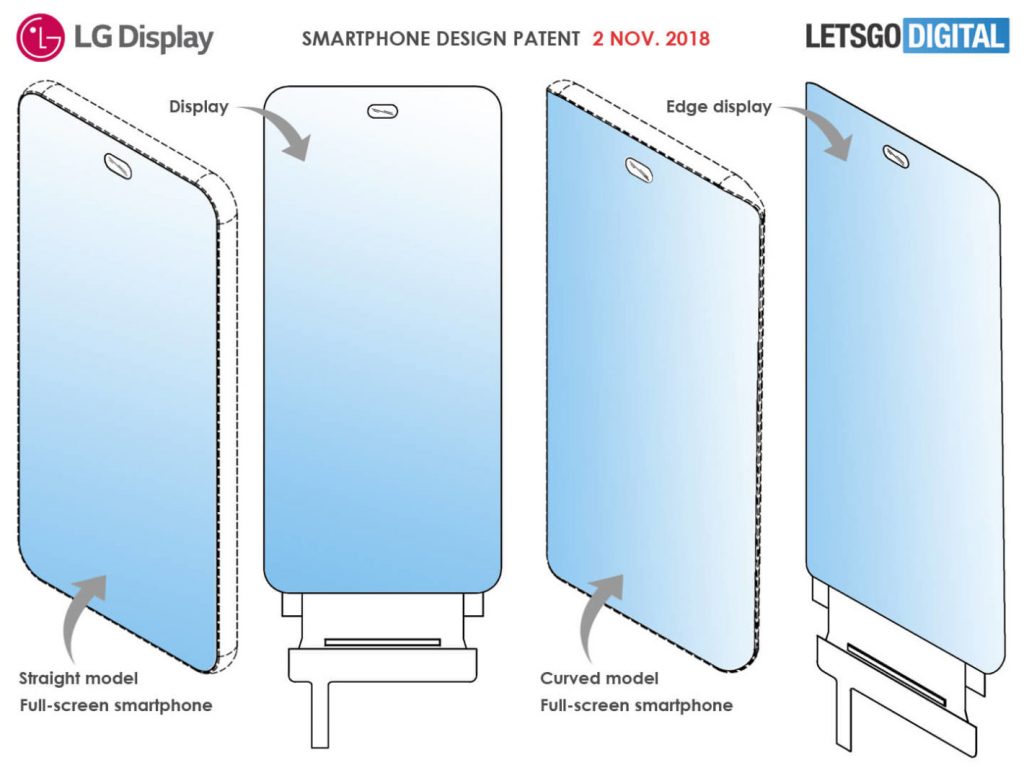

LG Display (LGD) has filed a patent that includes a phone with a camera under the display. The patent shows that the module can be placed in three locations — top-middle, upper-left corner, and upper-right corner on the front panel. (Gizmo China, LetsGoDigital, Android Headlines, Xuehua, Sohu)

Memory

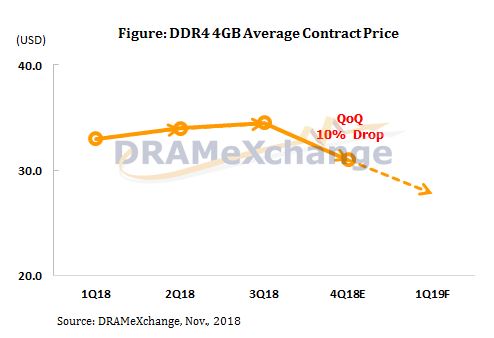

Contract prices of PC DRAM products have started to turn downward sharply Oct 2018 as major suppliers have completed most contract negotiations, reports TrendForce. The average price of 4GB PC DRAM modules for 4Q18 contracts has dropped by 10.14% QoQ from USD34.5 in 3Q18 to the current USD31. As for the average contract price of 8GB PC DRAM modules, it has dropped by 10.29% QoQ from USD68 in 3Q18 to the current USD61. (TrendForce, press, TrendForce[cn])

The market originally expected ZTE’s resumption of US business to boost demands from China’s netcom devices biddings in 3Q18, but the results turned out to be lower than expected, says DRAMeXchange analyst Ben Yeh, and the sufficient inventories of netcom ODMs would influence the stock-up demand in the coming quarters. As the result, the market has seen an oversupply for SLC NAND Flash in 4Q18, driving down contract prices by 10%~15%. (TrendForce, press, TrendForce[cn])

Sensory

Laser and optical components maker II-VI would acquire Apple’s supplier Finisar for about USD3.2B, to expand in consumer electronics and fast-growing sectors such as autonomous vehicles. (CN Beta, OfWeek, CNBC, II-VI)

Biometrics

Qualcomm and MediaTek’s China-based subsidiary Goodix Technology are expected to dominate the supply of fingerprint sensors for Android-based smartphones in 2019. The all-screen design of smartphones has fueled the adoption of fingerprint sensors for new-generation smartphones to be launched in 2019, driving IC design houses in greater China, including Taiwan’s Egis Technology, FocalTech, Elan Microelectronics and Novatek Microelectronics as well as China’s Goodix and Silead to develop such sensors to meet the increasing market demand. (Digitimes, press, Android Headlines)

Digitimes has revealed that Samsung could be planning to bring ultrasonic in-display finterprint sensors onto their mid-range handsets in 2019. Qualcomm has won orders for its next-generation ultrasonic fingerprint sensors from Samsung to support the latter’s new midrange and high-end Galaxy models for 2019, and shipments are expected to set off in late 2018 or early 2019. (Ubergizmo, Digitimes, press, OfWeek, 52RD)

Connectivity

IDC expects 5G infrastructure revenues to reach USD26B in 2022, compared to just USD528M in 2018. It said the compound annual growth rate (CAGR) of 118% will be spurred on in 4Q18 and 2019 as 5G handsets start to infiltrate the market and customers begin to experience the new capabilities themselves and demand the faster speeds ubiquitously. (CN Beta, IDC, Neowin)

Phone

Samsung is reportedly working on a new smartphone series dubbed as Galaxy R. A rumor reveals that this moniker will be used in a brand new smartphone set to launch with Qualcomm Snapdragon 450 chipset. (GizChina, Sina, CN Beta, Phone Arena, Twitter)

Apple has signaled disappointing demand for iPhone XR, telling its top smartphone assemblers Foxconn and Pegatron to halt plans for additional production lines dedicated to iPhone XR. For the Foxconn side, it first prepared nearly 60 assembly lines for iPhone XR model, but allegedly uses only around 45 production lines as its top customer said it does not need to manufacture that many by now. (Apple Insider, Nikkei Asian Review, Epoch Times)

Samsung has announced an all-new take on its Samsung Experience software. The new, revamped software design is called One UI, and it is focused on 3 major things: simplification, ease of use, and making everything more visually appealing. (Android Authority, Samsung, GSM Arena, Baijiahao)

Facebook has released an app called Lasso that lets users create fun, short videos designed to compete with TikTok, the viral 15s video app that recently merged with Musical.ly. (The Verge, CNET, Business Insider, East Money, US China Press, TechWeb)

Tencent founder and CEO Pony Ma has announced that WeChat now has over 1M such mini programs. That makes its ecosystem half the size of the Apple App Store, which recorded 2.1M apps in Apr 2018. Meanwhile, 200M users are active on WeChat mini programs every day as of Aug 2018. (TechCrunch, Tencent, Caijing, CCIDNet, DoNews, 36Kr)

Xiaomi’s expansion into Europe continues at speed after the Chinese smartphone maker announced plans to open its first retail store in London, United Kingdom. That outlet will become Xiaomi’s first authorized Mi Store. (TechCrunch, Mi.com, iFanr, CN Beta)

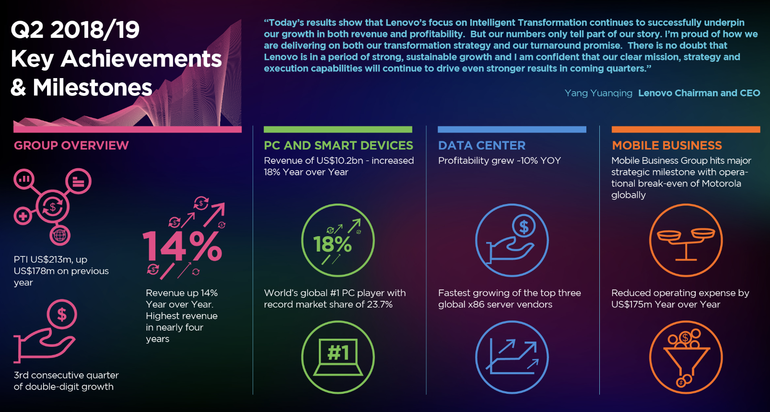

Lenovo has reported strong 2Q18 earnings on the back of PC, smartphone, and tablet sales. Group revenue reached USD13.4B, up 14% year-over-year (18% at constant currencies), which is the highest quarterly revenue report for close to 4 years. Lenovo’s PC and smart devices business, under IDG, reported revenue of USD10.2B, up 18% year-over-year. (CN Beta, ZDNet, Business Tech, Washington Post, Mobile World Live)

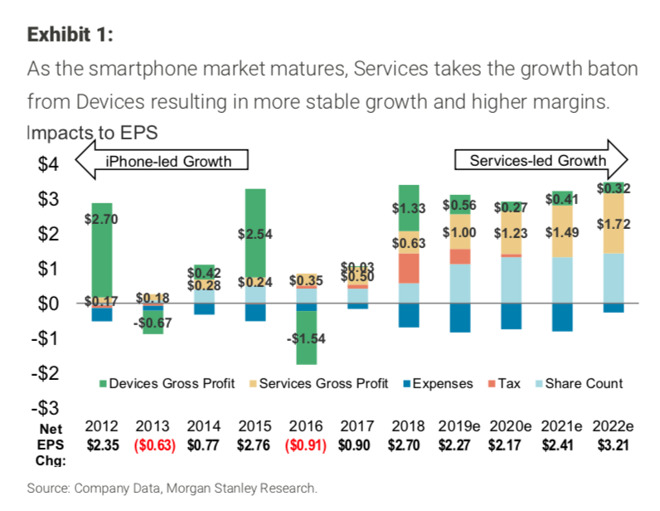

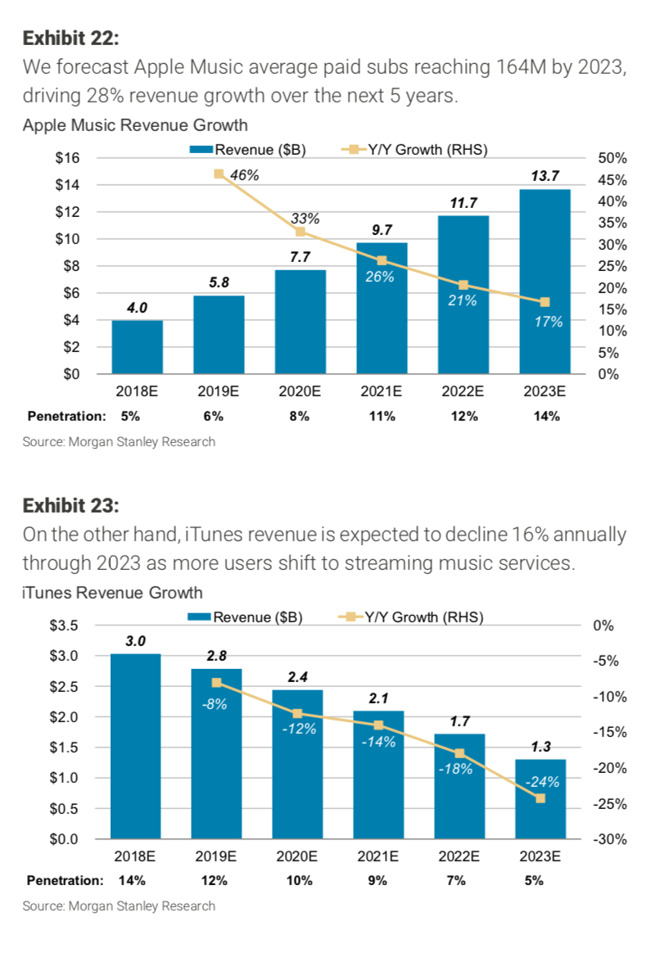

According to Katy Huberty from Morgan Stanley, Apple’s course to growth in a contracting hardware market overall world-wide is in services. Huberty is expecting USD101B in Services revenue alone in calendar year 2023 —a marked increase from the fiscal year 2018 revenue of USD37.2B. For comparison, in fiscal year 2018, Apple sold USD112B in iPhone hardware in the US alone. Morgan Stanley’s research suggests that 40% of Apple users pay for APPs today, with it conservatively estimated growing to 50% over the next 5 years. (CN Beta, Apple Insider, Investors, Barron’s)

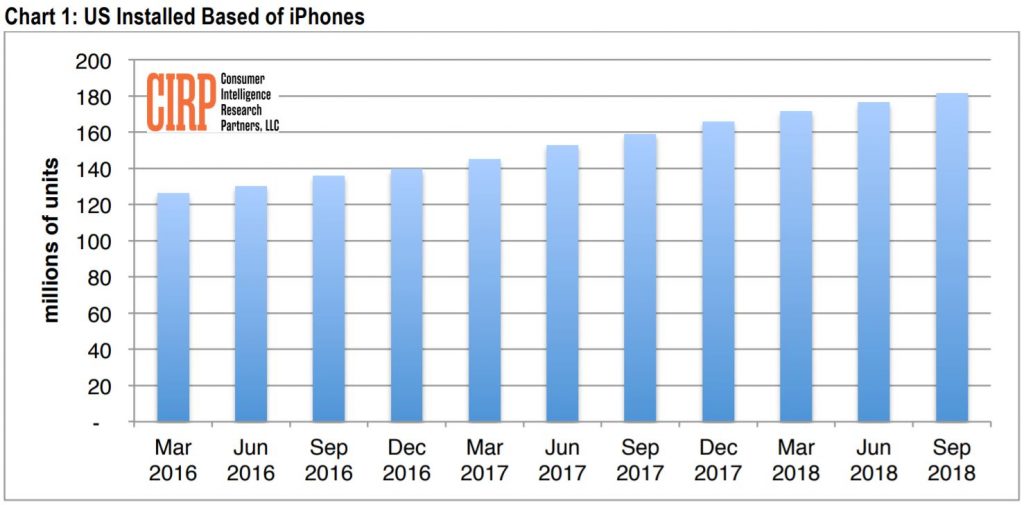

Based on Consumer Intelligence Research Partners, LLC (CIRP), at the end of the fiscal quarter that ended on 29 Sept 2018, the U.S. installed base for the Apple iPhone had reached 181M units. That is up 5M handsets from the previous quarter, or a 3% hike in the U.S. installed base sequentially. On a year-over-year basis, the increase works out to 11%. (CN Beta, Tele Competitor, 9to5Mac, CIRP)

Samsung’s Android Go phone J4 Core is announced – 6” 720×1480 HD+ IPS, Qualcomm Snapdragon 425, rear 8MP + front 5MP, 1+16GB, Android 8.1 (Go Edition), 3300mAh. (Android Central, The Verge, NDTV)

Samsung W2019 flip phone is announced – 4.2” FHD internal and external Super AMOLED, Qualcomm Snapdragon 845, rear dual 12MP variable aperture-12MP, 6+128/256GB, Android 8.1, side-mounted fingerprint scanner, Bixby 2.0, 3070mAh, ~CNY20,000. (GizChina, Sina, iFanr, India Today)

vivo X21s with in-display fingerprint scanner is launched – 6.41” 2340×1080 FHD+ Super AMOLED, Qualcomm Snapdragon 660, rear dual 12MP-5MP + front 24MP, 6+128GB, Android 8.1, under-display fingerprint scanner, 3400mAh, CNY2498. (GSM Arena, vivo, Sina)

Wearables

Xiaomi has announced AirDots, which have silicone tips that could allow for better sound isolation and a more secure fit, and also support Bluetooth 5.0. It is priced at CNY199. (My Drivers, Mi.com, Leikeji, The Verge, 9to5Mac)

Fossil Sport Smartwatch is launched – 41 and 43mm case size, Qualcomm Snapdragon Wear 3100, new Wear OS, a new battery saving mode, enhanced ambient mode, integrated heart rate, NFC, and GPS capabilities, 350mAh, USD255. (Ubergizmo, Business Wire, Engadget CN)

Augmented / Virtual Reality

The augmented reality (AR) mapping startup Fantasmo is focusing on the urgent use case of scooter accountability. Its camera attaches to personal electric vehicles, captures video and matches that against Fantasmo’s map to reliably identify if a scooter is being illegally ridden on the sidewalk or parked in the middle of the walkway. (CN Beta, Sohu, TechCrunch)

Toii is dedicated to creating brand-new gaming experience integrated with AR (augmented reality) and location-based service (LBS) and mobile gaming, according to company founder Allen Yu. Yu said that by leveraging the combination of gaming and LBS, his company has entered cooperation with Canal City Hakata in Japan. (Digitimes, press, Digitimes)

Home

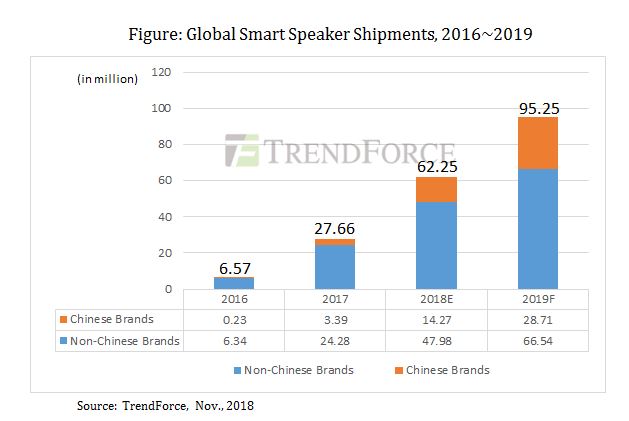

According to TrendForce, the global shipments of smart speakers are expected to reach 62.25M units in 2018. Driven by the expansion of Google Home into more regions and the growth of smart speaker market in China, the shipments would increase further by 53% YoY, reaching 95.25M units in 2019. (TrendForce[cn], TrendForce, press)

Automotive

Tesla expects to spend up to USD6B on factories and equipment over the next 2 years as it ramps up production and develops new vehicles, the company said in a regulatory filing. Tesla said it expects to spend just under USD2.5B in capital investments for 2018 and USD2.5B~3B annually over the next 2 years. Tesla is also planning to build a factory in China, which it is calling Gigafactory 3, where it hopes to eventually produce 3,000 of its popular Model 3 sedans a week. (CN Beta, CNBC, Xinhuanet)

Robotics

LG Electronics and E-Mart has recently signed a contract to develop robots for retail services. The first retail service robot to be introduced is a smart shopping cart. This robot avoids obstacles on its own using its object recognition functions and follows consumers using its self-driving functions. (CN Beta, Cool3C, Business Korea, Fresh Plaza)

Artificial Intelligence

Samsung has announced the launch of a toolkit for businesses and third-party developers to create voice apps compatible with intelligent assistant Bixby. The Bixby Developer Center will allow developers to create Bixby voice apps using AI-powered software to understand when to apply machine learning to automate tasks. (The Verge, CN Beta, VentureBeat)

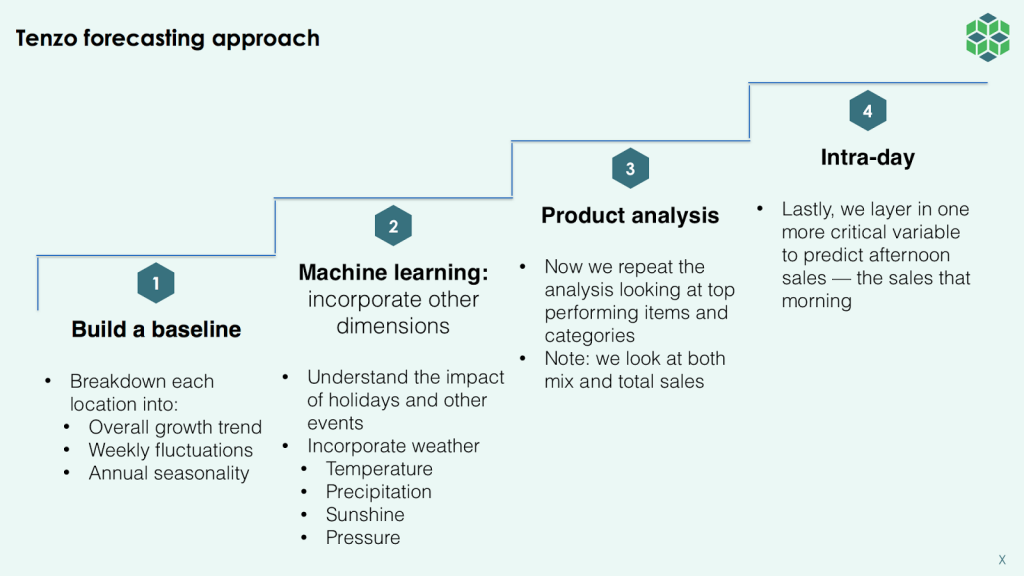

Tenzo has announced a USD1.8M funding round for their AI-powered restaurant analytics platform. Tenzo is an algorithm-based system that analyzes restaurant data in real time about sales, labor costs, customer feedback, and inventory. (VentureBeat, The Spoon, iFeng)

Aiden.ai, a London based AI analytics startup, has raised a USD1.6M seed round to develop its “AI-powered marketing analyst” which, they claim, is like having an extra person on the marketing team for mobile apps. (TechCrunch, CNMO)

Bonobo AI, an AI-based platform that helps companies get insights from customer support calls, texts and other interactions, announced today that it has raised USD4.5M in seed funding led by G20 Ventures and Capri Ventures. (TechCrunch, FINSMES, Baijiahao)

Fintech

Blockchain venture production studio and specializes in all things Ethereum, ConsenSys has acquired the pioneering space company Planetary Resources through an asset-purchase transaction. (TechCrunch, Planetary Resources, Morning Whistles)

Download link works perfect for me.