11-27: BOE has announced the company has successfully developed China’s first 55” 4K ultra-high-definition OLED display using inkjet printing technology; Samsung Display is already producing the Infinity-O displays for Galaxy S10 launch in 2019; etc.

Chipsets

Graphcore, a UK-based AI hardware startup, is touting higher performance on various AI tasks with its stylishly designed microprocessors and server blades. Designed with the design firm Pentagram, the Graphcore microprocessors feature colorful plastic shells in pink, blue, and tan pastels, and they are algorithmically generated so that each unit features a unique design. (CN Beta, The Verge, Fast Company)

Touch Display

vivo’s successor of NEX is rumored to feature a secondary display on the back. It also features tri-cam on the back. By adding a second display, companies essentially remove the need of selfie shooters. (GSM Arena, Leikeji)

Samsung Display (SDC) is already producing the Infinity-O displays for Galaxy S10 launch in 2019. SDC apparently finished adapting its production lines for the new Infinity-O display designs, adding the laser equipment necessary to drill holes into OLED displays. (CN Beta, Android Pit, ET News, First Post, Android Authority)

BOE Technology has announced the company has successfully developed China’s first 55” 4K ultra-high-definition OLED display using inkjet printing technology. The inkjet printing technology can greatly improve the utilization rate of organic materials. (CN Beta, East Money, IT Home, Silicon Investor)

Memory

Cadence has announced that it has successfully taped out its GDDR6 IP on Samsung’s 7LPP fabrication process. The new building blocks should enable developers of various chips to be made using 7LPP and quickly and easily integrate support of GDDR6 memory into their SoCs. (My Drivers, Sohu, HQEW, AnandTech)

The supply of high-end NOR flash memory chips continues to be tight though the supply of low-end ones has risen substantially to affect the chip prices, according to Macronix International chairman Miin Wu. Prices for entry-level NOR flash memory chips are still under downward pressure, but prices for high-density products are expected to remain stable, Wu indicated. (Digitimes, press, China Times, Yahoo, EDA365)

Biometrics

Fingerprint sensor supplier Egis Technology (Egistec) has delivered samples of its optical fingerprint identification solutions to China and Korea smartphone vendors for validation, and is gearing up to enter volume shipments of the chips in 1H19. (Digitimes, press, Yahoo, China Times)

Battery

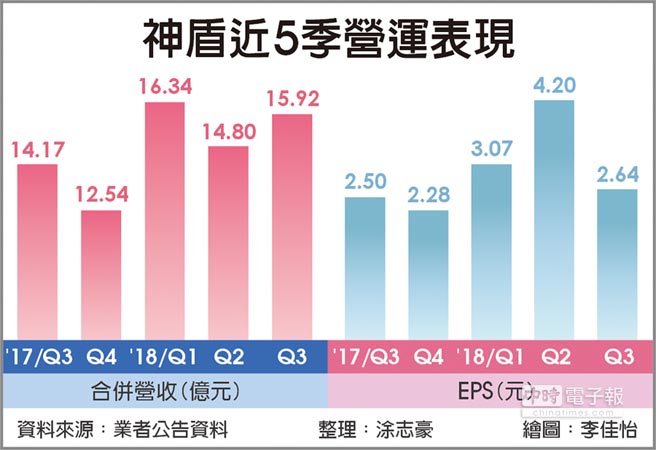

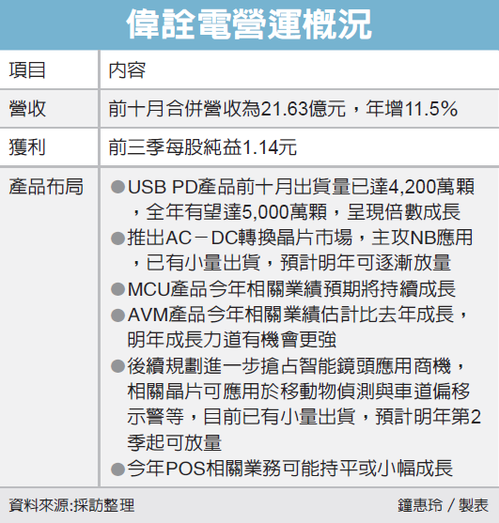

Taiwan-based Weltrend Semiconductor may see its annual shipments of USB power delivery (PD) controller chips for 2018 double from a year earlier to reach 50M units as the shipments for the first 10 months of the year already hit 42M units, and such chips are expected to become the largest driver for the firm’s continued revenue increases in 2019, according to Digitimes. (Digitimes, press, EE World, UDN)

Connectivity

5G smartphones are expected to emerge in 1H19, with Samsung, Huawei and Honor to launch their 5G phones in MWC 2019. 5G smartphones will boom rapidly in 1Q19 thanks to Verizon, Sprint and other operators pushing their 5G infrastructure and services. And from 2H19, there will be some 5G phones launched with some advanced technologies such as foldable, AI, blockchain, AR, and VR. (CN Beta, CCID Net)

PC / Tablet

Logitech has confirmed it was engaged in discussions with Plantronics regarding a potential transaction. However, those discussions were terminated. Logitech does not intend to comment further. (Apple Insider, Reuters, Business Wire, Sina, Kaixian)

Automotive

General Motors (GM) is undertaking a massive cost-cutting plan aimed at freeing up cash to fund the development of technologies like electric powertrains and autonomous driving systems. GM appears set to purge many of the cars from its lineup as it closes factories that build them, while keeping more profitable trucks and SUVs in production. GM hopes to free up USD6B in cash by 2020, with USD4.5B of that amount coming from cost reductions. (Digital Trends, TechCrunch, FT Chinese, VOA Chinese)

Geely Holding and China Telecom have inked a strategic cooperation framework agreement to jointly build a next-generation vehicle-to-home Internet business mode and a multifaceted smart mobility ecosystem. (CN Beta, Gasgoo)

Lime has launched in the United Kingdom, starting with a group of dockless electric-assist bikes in a Milton Keynes shopping center. The company says it plans to expand into more UK cities over the next few weeks. Bike rides cost GBP1 (about USD1.28) to unlock and an additional 15 pence per minute of riding time and will be available first at intu Milton Keynes Shopping Centre. (CN Beta, TechCrunch, Bloomberg)

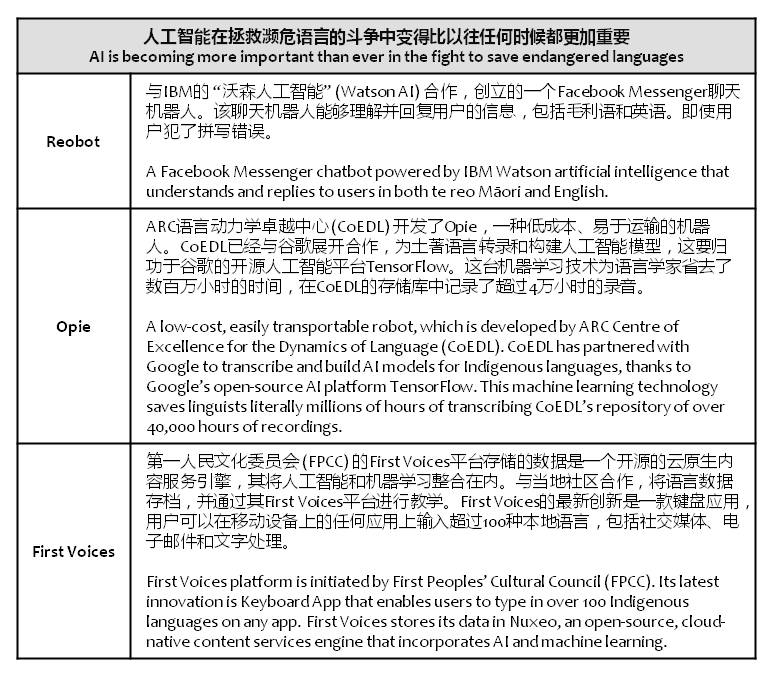

Artificial Intelligence

The United Nations has declared 2019 as the International Year of Indigenous Languages in an effort to promote awareness of the plight of languages that are in danger of disappearing. Thanks to the benefits of artificial intelligence (AI) for language documentation and learning, AI is becoming more important than ever in the fight to save endangered languages. (CN Beta, Huanqiu, Forbes, IYIL 2019, TechNews)

Payment

China UnionPay has announced that its mobile payment app Cloud Quick Pass (云闪付) just exceeded 100M users. (My Drivers, 95516, TechNode, iFeng)

Tencent’s WeChat is set to make its payments service more ubiquitous in Japan, a popular outbound destination for Chinese tourists. WeChat unveils a partnership with Japan’s Line chat app on mobile payments. The tie-up allows Japanese brick-and-mortar merchants with a Line Pay terminal to process WeChat Pay transactions directly. (My Drivers, TechCrunch, 36Kr, TechNode, Asia Nikkei)