12-02: A federal judge has set a trial date for Qualcomm’s lawsuit against Apple; There will be consolidation of reports once a month in the future (an effort); etc.

Chipsets

A federal judge has set a trial date for Qualcomm’s lawsuit against Apple: 15 Apr 2019. Apple’s lawyers have dismissed the possibility of a settlement between the two companies that would avert a trial. (CN Beta, San Diego Union-Tribune, The Verge)

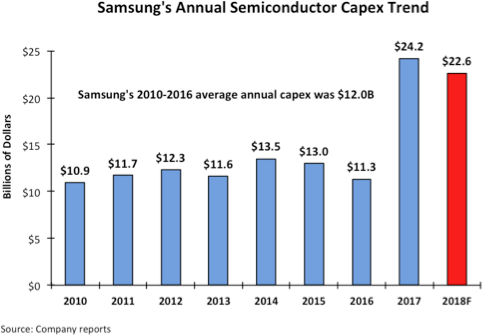

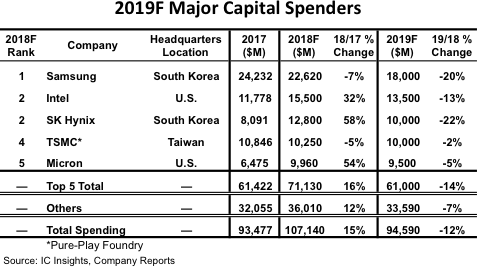

Samsung is expected to have the largest capex budget of any IC supplier again in 2018. After spending USD24.2B for semiconductor capex in 2017, IC Insights forecasts that Samsung’s spending will edge slightly downward, but remain at a very strong level of USD22.6B in 2018. If it comes in at this amount, Samsung’s two-year semiconductor capital spending will be an astounding USD46.8B. (Digitimes, press, IC Insights, press, Semi Insights)

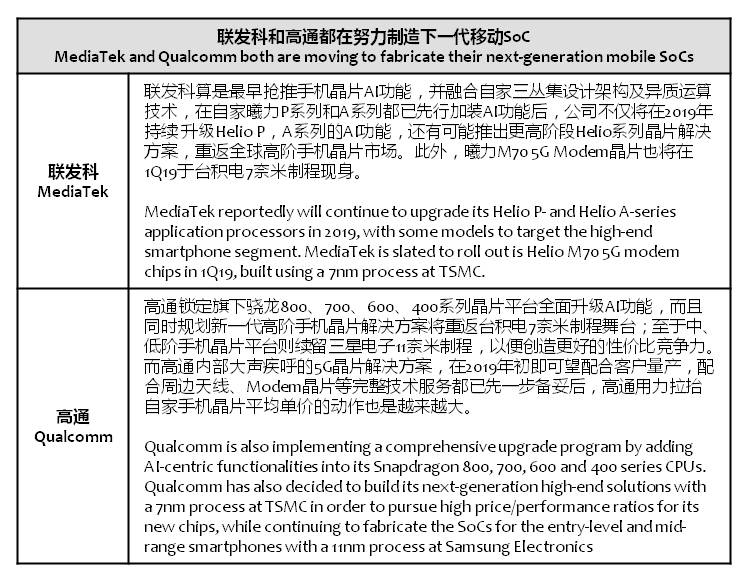

MediaTek and Qualcomm both are moving to fabricate their next-generation mobile SoCs with advanced process nodes in 2019 that will support more advanced technologies, as they aim to maintain their sales momentum and ASPs to tide over a period full of uncertainty over replacement demand in the smartphone market before the arrival of the 5G era, according to Digitimes. (Digitimes, press, Digitimes, Digitimes)

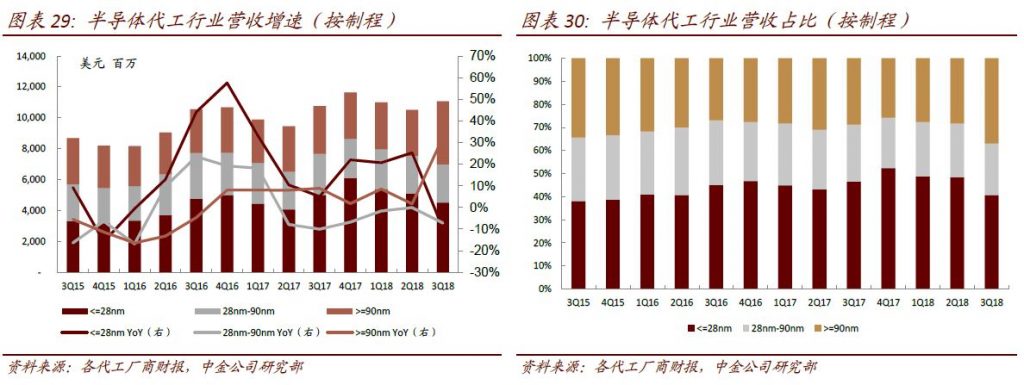

CICC believes that the price competition of 28nm will continue, but with customers’ orders shifted to 40nm and introduction of TSMC’s 22nm, the price pressure of 28nm wafer will be alleviated to some extent. Additionally, manufacturers are also adjusting their production capacity. For example, SMIC has clearly pointed out that it will slow down the 28nm expansion, and the new capacity of HKC+ platform will come from the reduction of HKC. The new 8” wafer factory in the Mainland China is about to be put into production. It will reduce the shortage of upstream silicon wafers in 2019. Thus, CICC expects that the shortage of 8” is going to last for another quarter, but the demand will be weaken entering 2019. (CICC report)

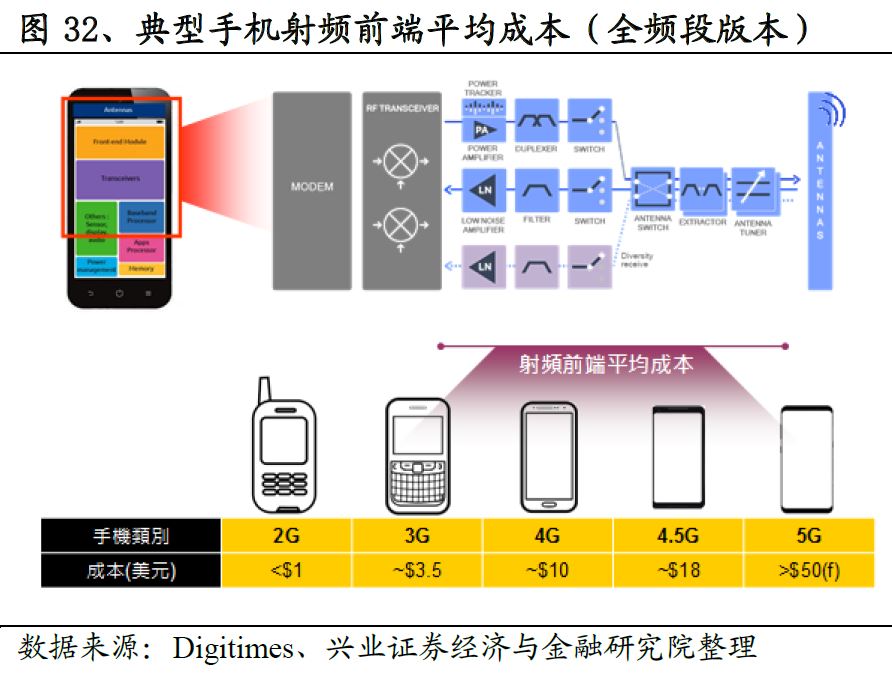

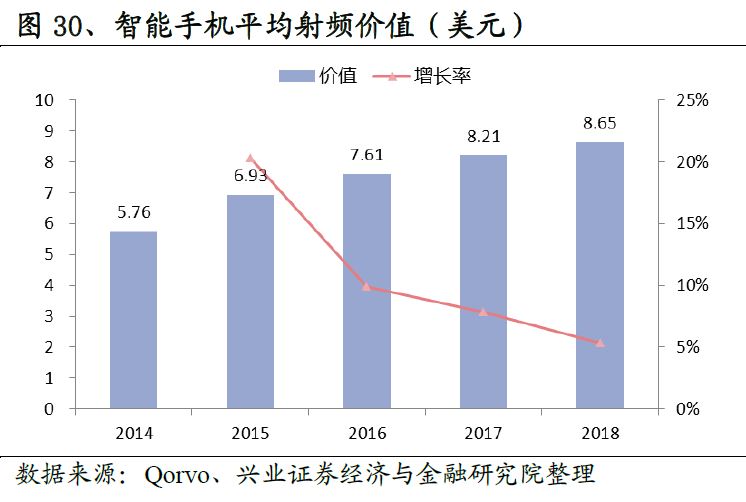

According to Industrial Securities, standard 2G mobile phones require USD0.8 RF cost, and high-end 4G mobile phones that meet global roaming requirements cost USD18. From traditional 2G to current high-end models, the single-chip RF value has increased 20 times. The RF value required for a single handset is from an average of USD5.76 in 2014 to an average of USD8.65 in 2018. Due to the increase in the number of RF front-ends and technical difficulties, the RF cost of 5G mobile phones is expected to exceed 3 times that of 4G mobile phones. (Industrial Securities report)

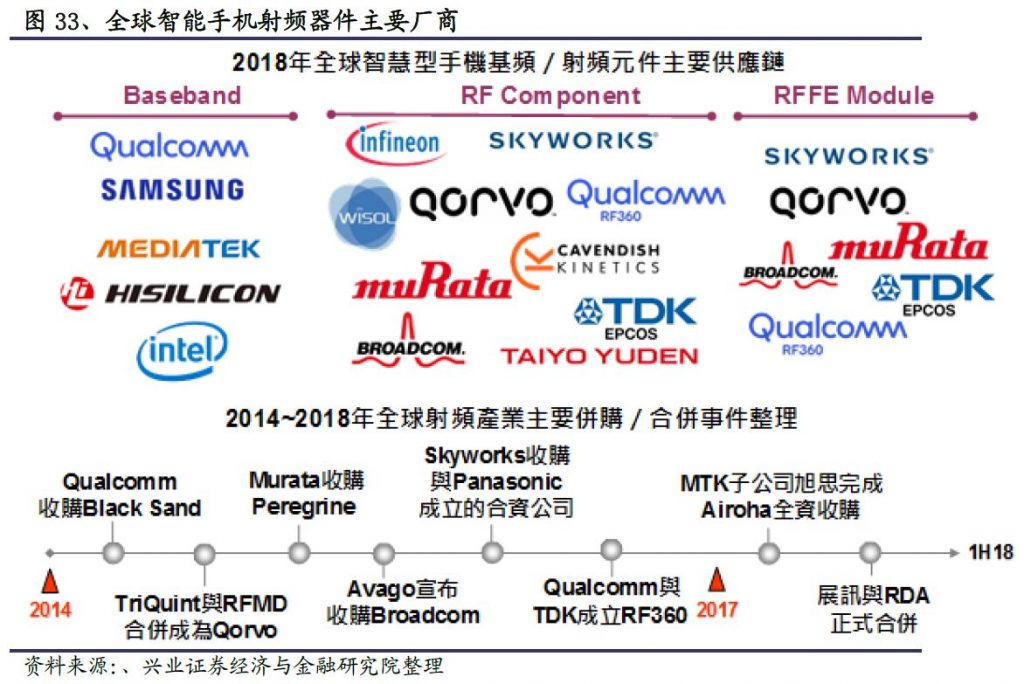

According to Industrial Securities, the power amplifier (PA) market is consolidated and stable due to the high threshold for PA technology in GaAs processes. The PA main design companies include Skyworks, Qorvo and Avago. The GaAs wafer foundries are mainly Taiwan’s Win Foundry, Advanced Wireless Semiconductor and the US’ TriQuint, with a market share of more than 85%. In addition to the main business of chip design, Avago and Skyworks also have some production capacity. When their own production capacity is insufficient, they will give orders to Taiwanese OEMs. (Industrial Securities report)

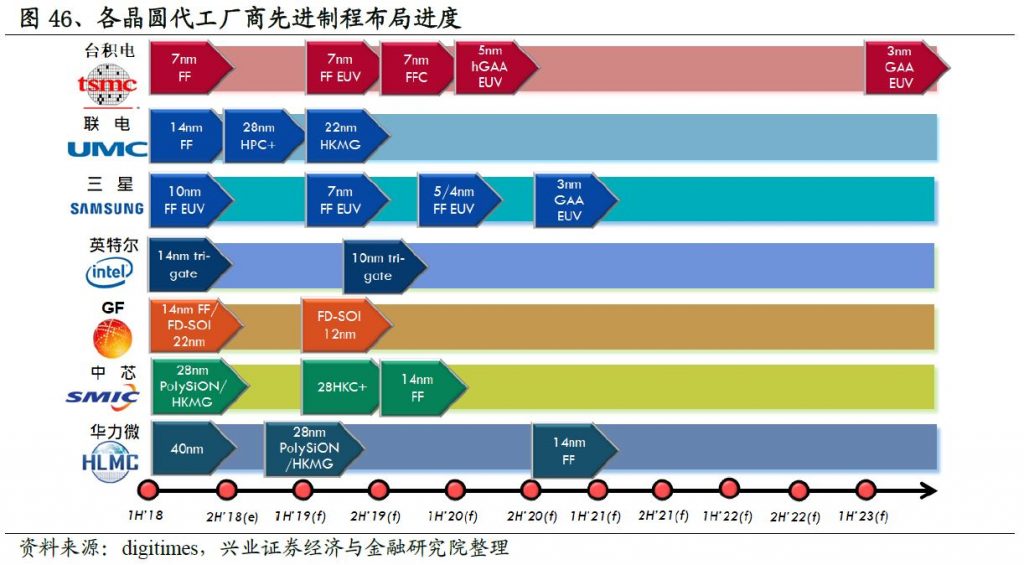

Industrial Securities indicate that SMIC 14nm will be put into production in 1H19, in 2H19 will contribute revenue, and TSMC 14nm will enter mass production in 2015; TSMC’s 28nm is 4 years later. SMIC’s 28nm HKC only enters mass production in 4Q17, a 4 years gap. SMIC’s is slowly catching up, and the market share is expected to increase. Although the gap with TSMC is still large, it will continue to seize the market share of UMC and GlobalFoundaries and is expected to surpass them and become the 2nd largest foundry vendor after TSMC. (Industrial Securities report)

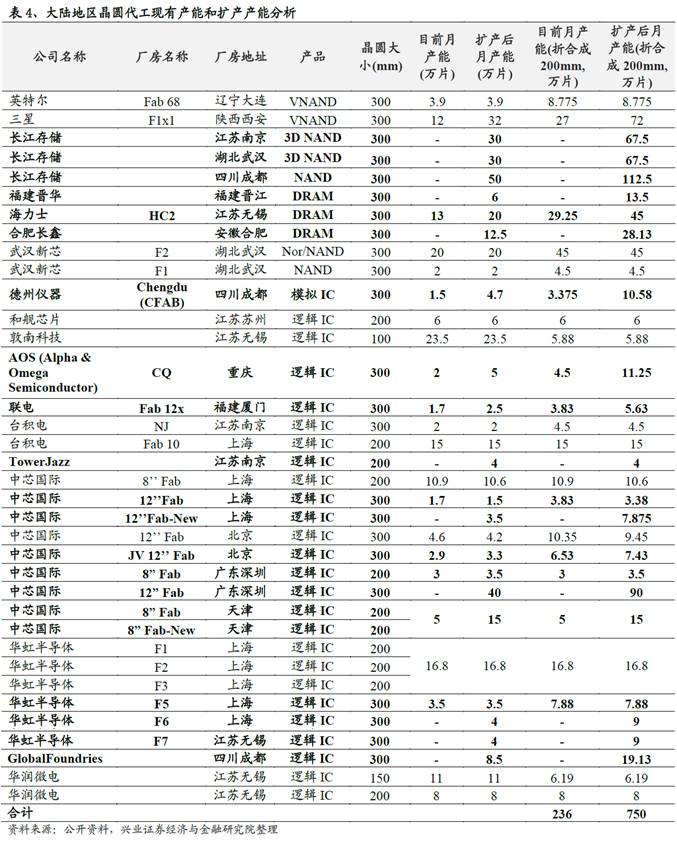

According to Industrial Securities’ study on wafer fabs in China, the monthly production capacity of 8” wafers in Mainland China is close to 2.4M units. After the completion of the existing expansion plan in next 3~5 years, The monthly capacity of 8” will be expected to reach 7.5M units, i.e., more than 2 times expansion. (Industrial Securities report)

Touch Display

The supply of polarizers has fallen short of demand recently and will stay tight throughout 2019, when several China-based panel makers are set to kick off commerical operation of their new production lines, bringing Taiwan polarizer makers significant revenue growth momentum, according to Digitimes. As one LCD panel must be paired with two polarizers, the growing production capacities at China plants and the peak season effect have made polarizer supply increasingly tight at Taiwan makers including BenQ Materials and Cheng Mei Materials Technology (CMMT) since the beginning of 3Q18. (Digitimes, press, Digitimes, press, China Times)

Japan Display Inc (JDI) has developed its own tethered VR headset, which features 3-degree-of-freedom (3DoF) positional tracking and is aimed primarily at businesses interested in providing VR entertainment. The VRM-100 device will initially be available to software developers. JDI’s VRM-100 relies on a 5.35” LCD display featuring a 2880×1600 resolution, 615PPI, and an 80 Hz refresh rate (with a 60 Hz auto cutover). (AnandTech, JDI, Yiyan, Sina)

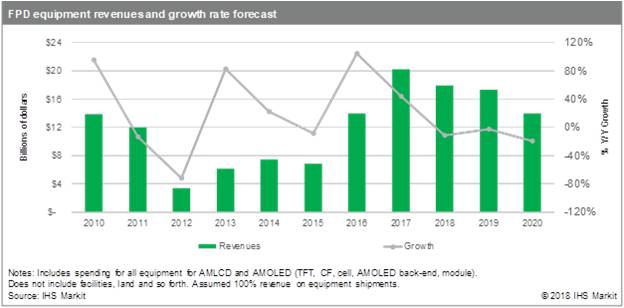

The flat panel display (FPD) equipment market is expected to start to decline after an unprecedented build-up in 2017 as panel makers take a more cautious approach as they wait for demand to catch up to rapidly ramping capacity. The FPD equipment market is forecast to fall from USD20.2B in 2017 to USD14.0B in 2020, declining at a compound annual rate of 11.6%, according to IHS Markit. (IHS Markit, press, HQEW)

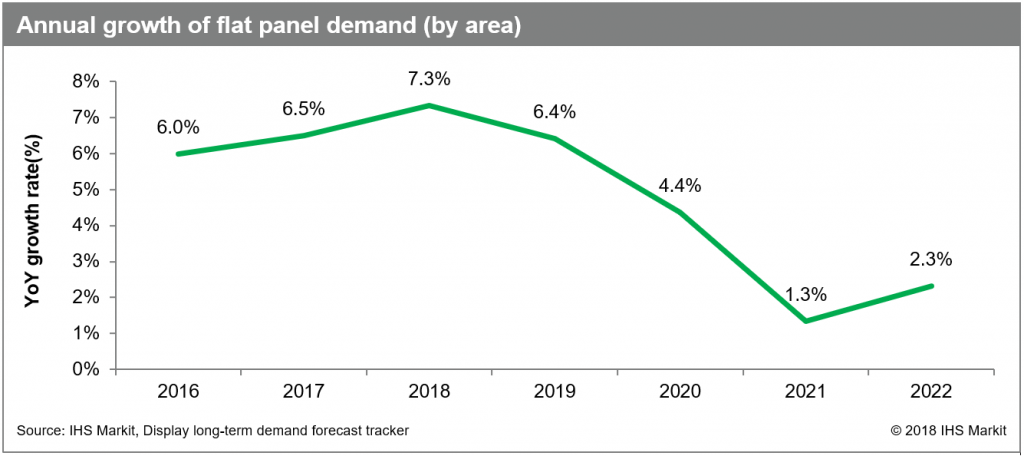

After hitting 7.3% growth in 2018, global demand for flat panel displays (FPDs) in terms of area is forecast to expand 6.4% to 228Mm2 in 2019. It is the first slowdown in year-on-year growth in four years, according to IHS Markit. Although the FPD demand will continue to grow, mainly driven by migration to larger displays for major applications, such as TVs, desktop monitors, mobile PCs and smartphones, the pace is expected to slow through 2021. (IHS Markit, press)

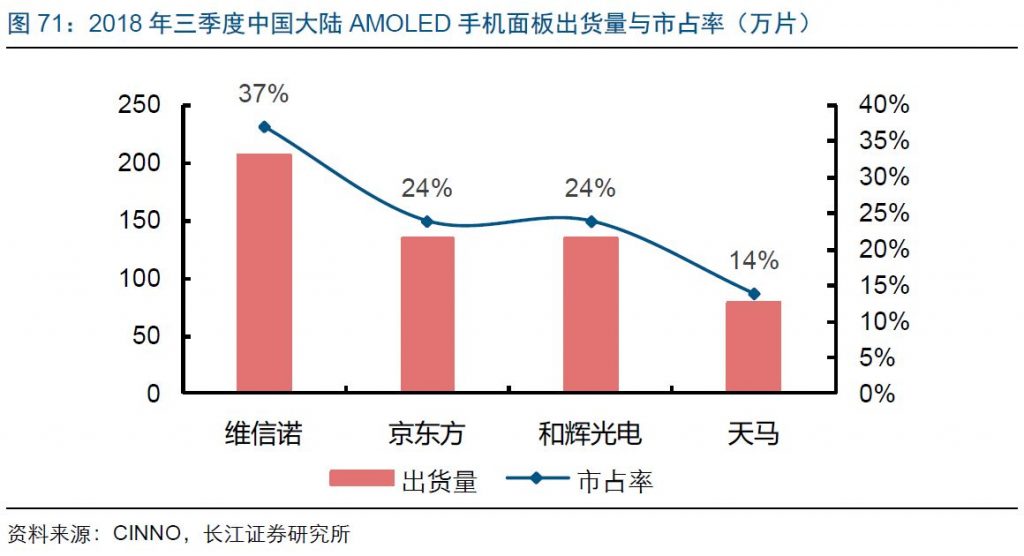

Based on CINNO Research, in 3Q18 Mainland China AMOLED smartphone panel shipment reaches 5.57M units, which is comparable with Samsung. Samsung is still top 1 in smartphone panel vendors, contributing most on OLED panel. According to IHS, Samsung smartphone panel shipment reaches 114M units in 3Q18. BOE (66.4M) and Tianma (53.3M) follows at top 2 and top 3, respectively. Century Display (30.4M) and JDI (28.8M) follows at top 4 and 5. (Changjiang Securities)

Memory

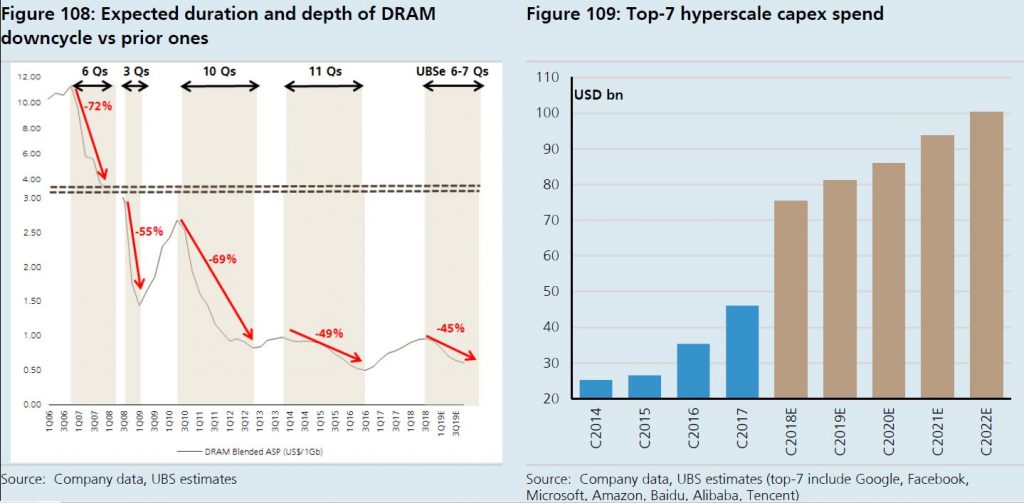

UBS expects DRAM contract prices to decline 7% QoQ in 4Q18, ending a 9-quarter-long up-cycle of unprecedented strength. During that period, UBS estimates that Samsung’s DRAM operating margins went from 35% in 2Q16 to 72% in 3Q18. Meanwhile, NAND flash contract prices started declining in 4Q17, and should be down 17% in 4Q18.UBS expects the NAND flash down-cycle to continue into early 2020, and the DRAM downcycle to last 6~7 quarters, with pricing down 45% from peak (3Q18) to trough (1Q20~2Q20). (UBS report)

Material

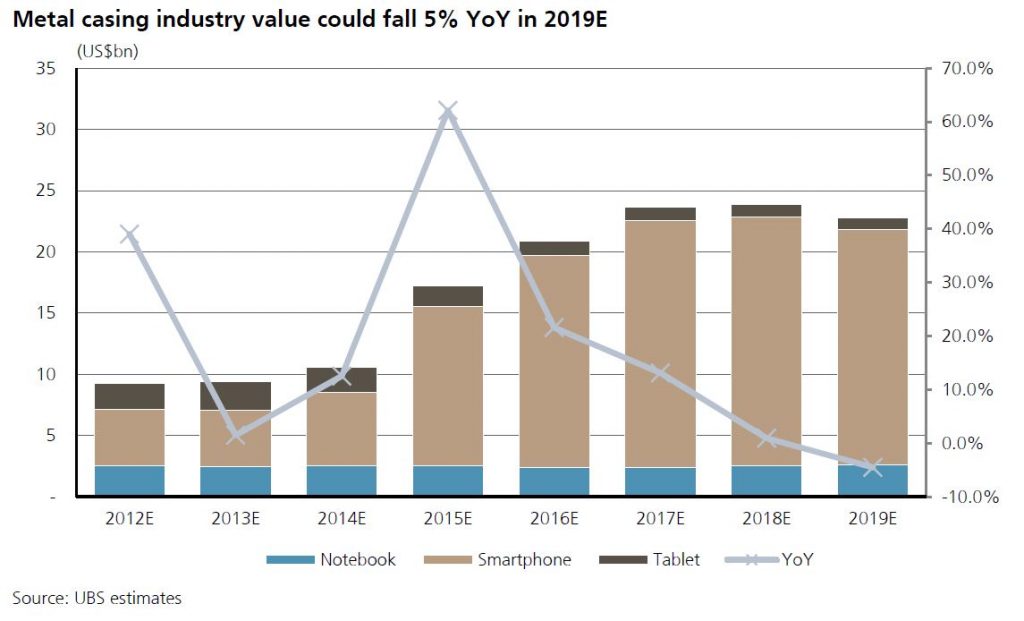

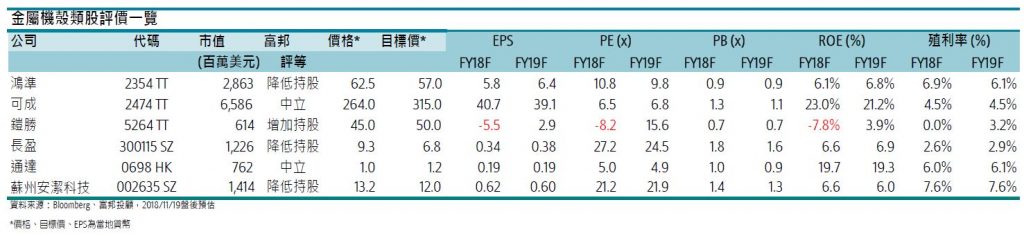

UBS estimates the ASP for Android metal parts in 2019 could be 25%~50% lower than previous designs due to lower entry barriers and shorter production time. UBS estimates a 14% YoY decline for Android in 2019 but 6% YoY growth for Apple iPhone. In 2018, China handset OEMs have opted to focus more on glass back-cover upgrade, either to 3D curved glass or with more surface treatment. Therefore, they can only use a simple metal frame given limited bill of materials (BOM) cost. (UBS report)

To support wireless charging technology and improve connectivity, Fubon Research believes glass back cover + metal frame design would continue to be mainstream for smartphone. However, as this kind of design is costly, Fubon believes that more mid-range smartphone would adopt plastic cover + metal frame design. Fubon also believes that mid-range metal cover market cost competition will become fierce, and expects to impact negatively on Tongda, Everwin Precision, and Suzhou Anjie Technology. (Fubon Securities report)

Phone

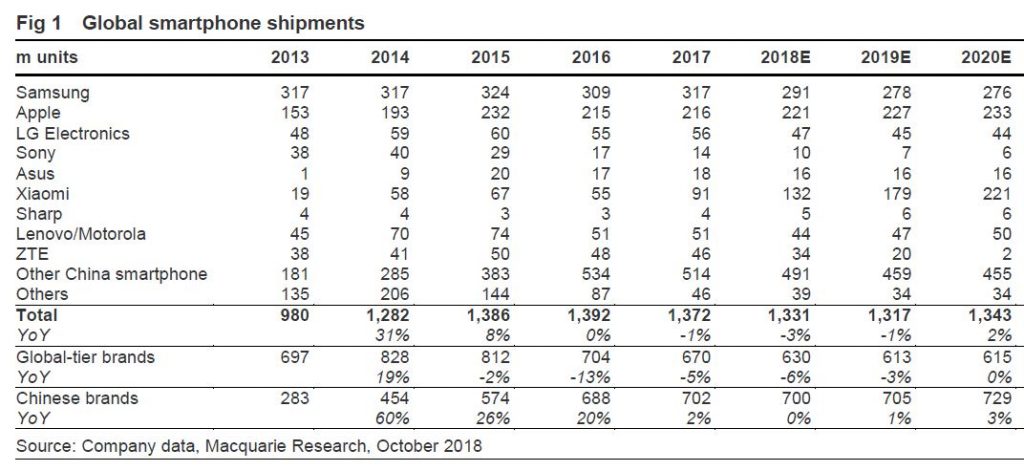

Macquarie Research expects global smartphone shipments to be down 1% YoY in 2019 with global-tier brands down 3% YoY and Chinese brands up 1% YoY, driven by industry consolidation in the China market (top 4 brands in China at 66% / 80% market share in 2017 / 2Q18) and overseas expansion. (Macquarie Research report)

According to Changjiang Securities, smartphone is still the core revenue for Xiaomi, which contributes 68.9%. In 3Q18 alone, Xiaomi smartphone shipment reaches 33.3M units, a 21.2% up on year. Up to 26 Oct 2018, Xiaomi smartphone shipment surpasses 100M units. In 2017, Xiaomi flagship and high end smartphone sales contribute 20.17%, but the new data shows that 69% is from below CNY2000 mid-to-low segment, 31% is from flagship and high-end segments. (Changjiang Securities report)

Augmented / Virtual Reality

Acer’s virtual reality (VR) HMD subsidiary StarVR, following its recent delisting from Taiwan’s emerging stock market, reportedly may disband or be sold. Acer has allegedly given StarVR 3 months to turn profitable or will terminate its operation, Acer is also looking to sell the company to China- or Japan-based enterprises. StarVR is a joint venture between Acer and Sweden-based game developer Starbreeze with Acer holding a 63.25% stake and Starbreeze 33.18%. (Digitimes, press, 36Kr, Yahoo)

Robotics

Cheetah Mobile and Dmall have jointly launched a robot for the supermarket. This robot looks like a car with a square display on top showing an animated smiley face. This robot does not require voice interaction. After recognizing a human face, it can actively wake up and provide services. (My Drivers, Inpai, Sina)