12-14: MediaTek Helio P90 is announced; Intel’s series of announcements; JDI is reportedly holding talks with Chinese businesses and investment funds; etc.

Chipsets

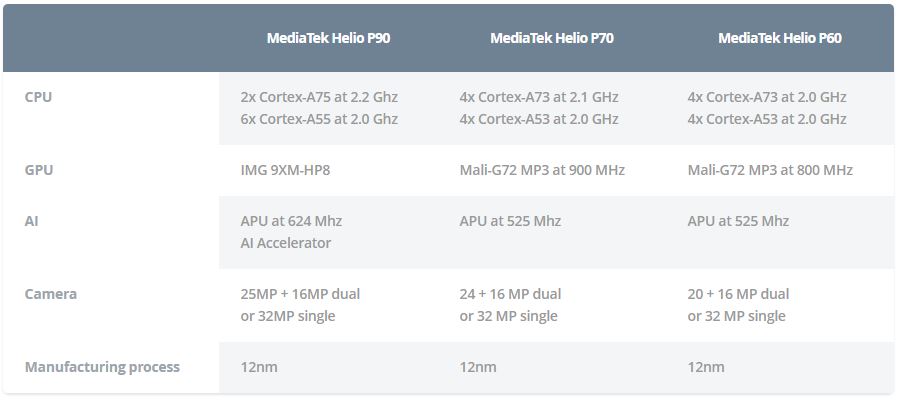

MediaTek officially announces Helio P90, featuring octa-core processor with 2 high-power ARM Cortex-A75 cores at 2.2GHz with 6 efficient Cortex-A55s at 2.0GHz, using a 12nm process, paired with a PowerVR GM 9446 GPU (a more than 50% performance improvement from the previous generation), and MediaTek’s own CorePilot load-balancing technology, which can help balance load across cores for more efficient power consumption and minimal heat. (Android Authority, Android Central, CN Beta)

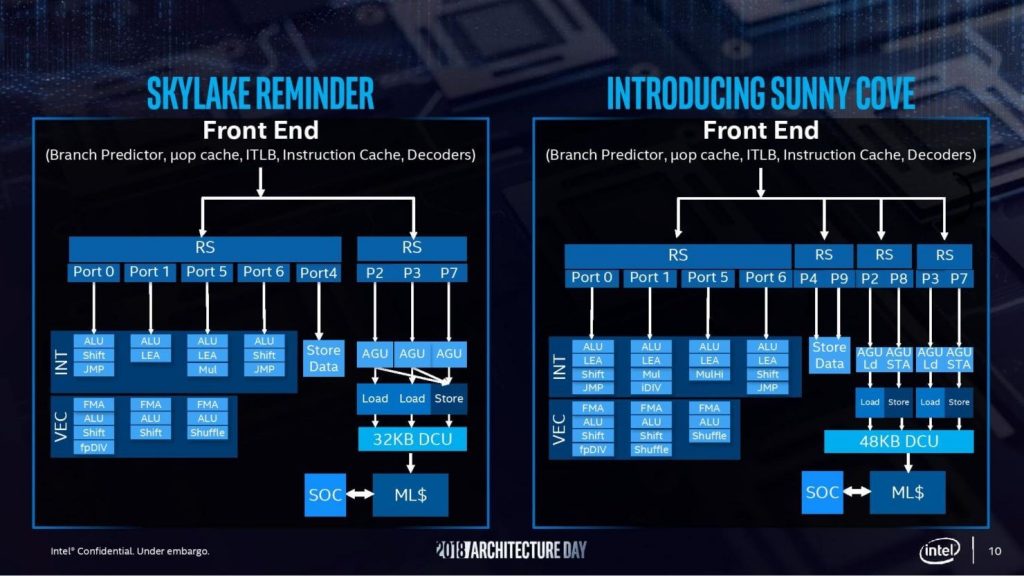

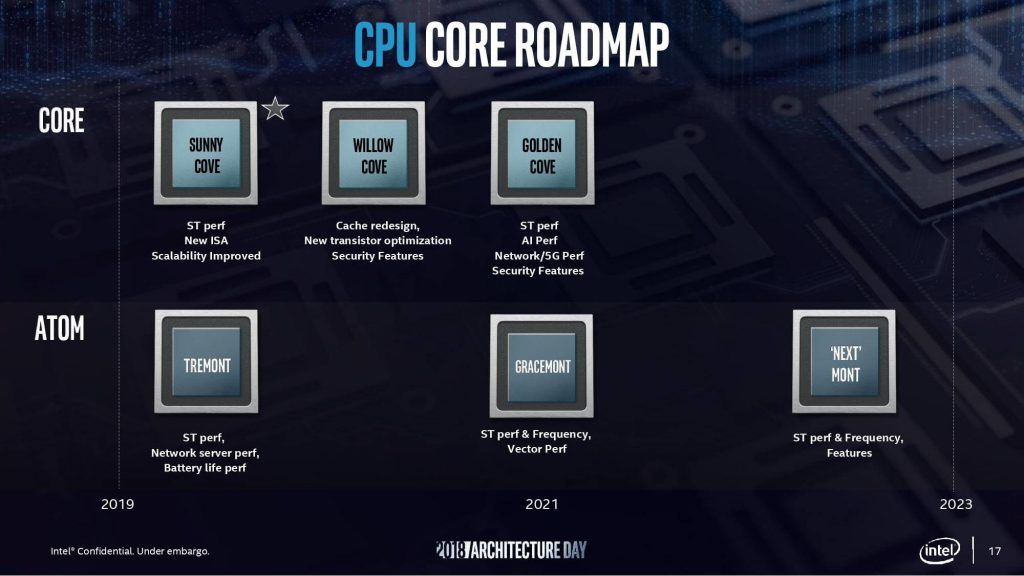

Intel is including a new CPU architecture called Sunny Cove, a next-generation integrated graphics solution. The new architecture is bound for both Xeon server and Core consumer processors. Intel reveals that it designs Sunny Cover to execute more operations in parallel, with new algorithms to reduce latency. (CN Beta, Leiphone, PC World, PC Gamer, Intel)

Intel is unveiling of the Gen 11 graphics and its high level tech specs. The Intel Gen 11 graphics will be Intel’s first TFLOP capable mobile GPU. This advancement would make the GT 1030 (which only scores 0.94 TFLOPs) defunct and is one of the first dGPU level integrated processors from Intel (not counting the Vega GPUs in the NUCs). Gen 11 graphics feature a 2x performance increase per clock as well as coarse pixel shading. (CN Beta, Intel, WCCFTech)

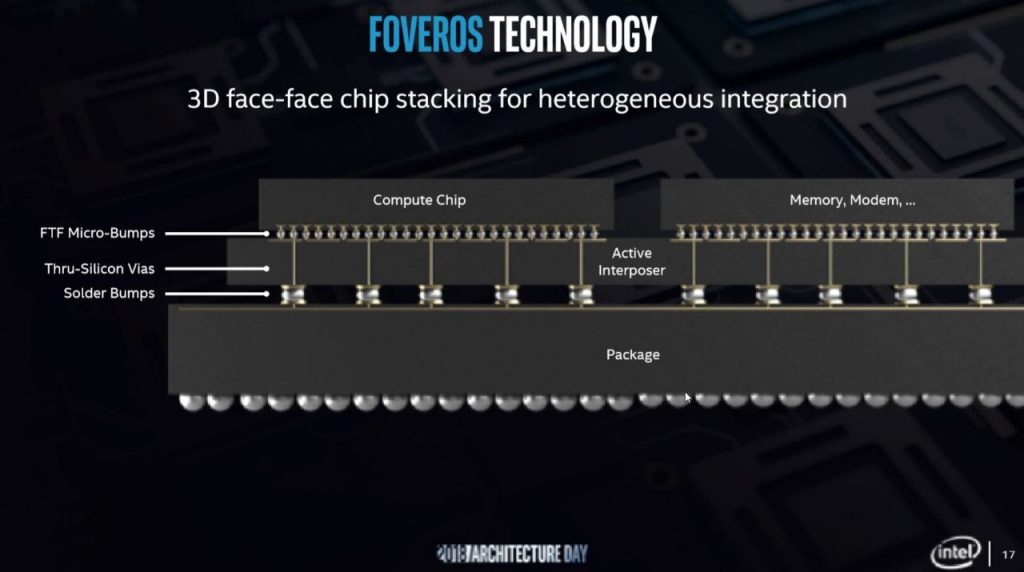

In 2019, Intel is going to ship chips using a new 3D stacking technology the company is calling Foveros. Foveros allows complex logic dies to be stacked upon one another, providing a much greater ability to mix and match processor components with optimal manufacturing processes. (The Verge, My Drivers, Ars Technica, Extreme Tech)

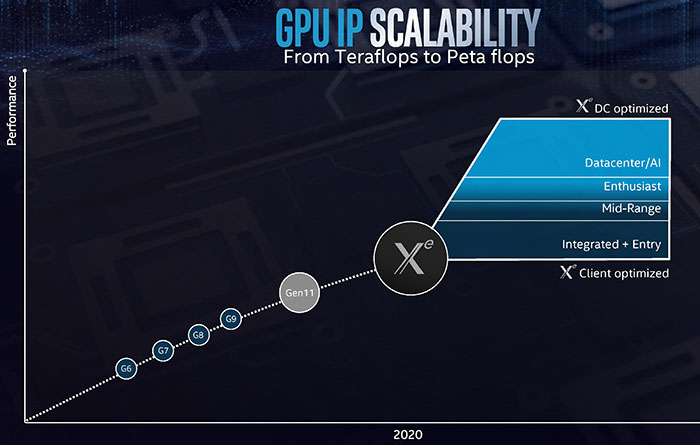

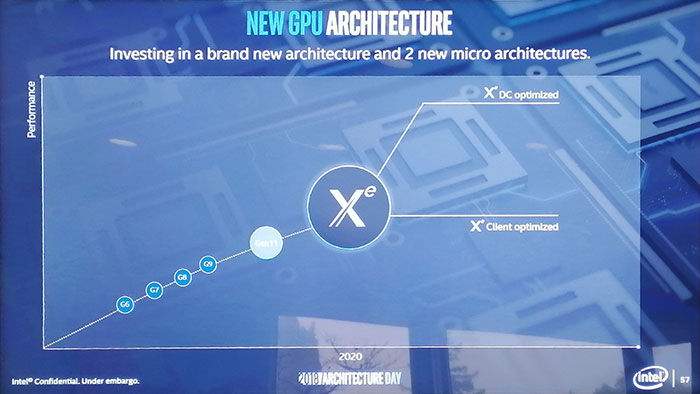

Intel is introducing its new Xe architecture that will come after the Gen11 graphics engine. By 2020, Xe graphics will arrive and be a performance step up from the iGPUs. (Digital Trends, CN Beta, Tom’s Hardware, Tweak Town)

Apple is seeking a cellular systems architect to work out of San Diego. Apple has plans to build a new cellular modem chip out of that location. Apple-designed chip is allegedly 3 years away from shipping. (Gizmo China, Apple Insider, The Information, Feng)

Touch Display

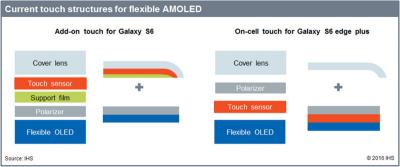

Apple will reportedly be using a new form of screen technology to make at least one of its 2019 iPhone models thinner and lighter. The technology, branded Y-Octa, will be made by Samsung. The technology should be ready for use in 2019, but says that initial supplies will be constrained. (CN Beta, OLED-Info, ET News, 9to5Mac)

Japan Display Inc (JDI) is reportedly holding talks with Chinese businesses and investment funds to get support for its turnaround efforts. Candidates include the state-owned Silk Road Fund, as well as electronic parts maker O-film Tech and auto parts maker Minth Group. (CN Beta, Sina, Asia Nikkei)

Camera

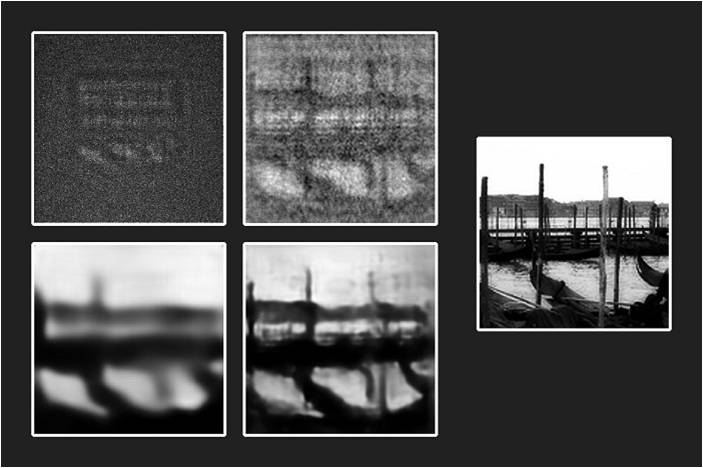

MIT has trained a deep neural network to reconstruct objects from images taken in near pitch-black conditions. The technique results in a reconstructed pattern that is “more defined than a physics-informed reconstruction of the same pattern, imaged in light that was more than 1,000 times brighter”. (CN Beta, TechSpot, MIT)

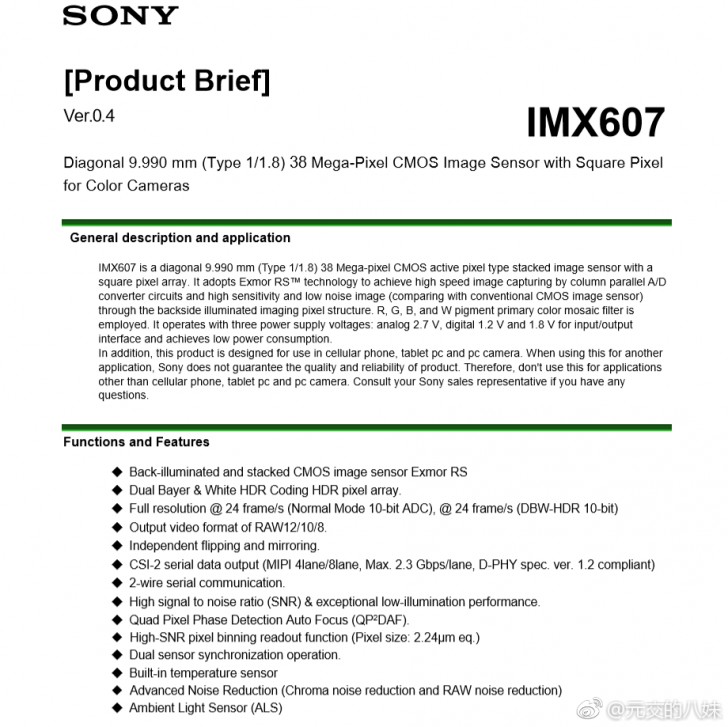

Sony’s 38MP image sensor IMX607 is leaked and reportedly to be the main sensor for Huawei P30 Pro. One of its main features is its “exceptional low-illumination performance” and it is 1/1.8” size. It also adds a White HDR Coding array. (GSM Arena, Gizmo China, IT Home, ePrice)

Sensory

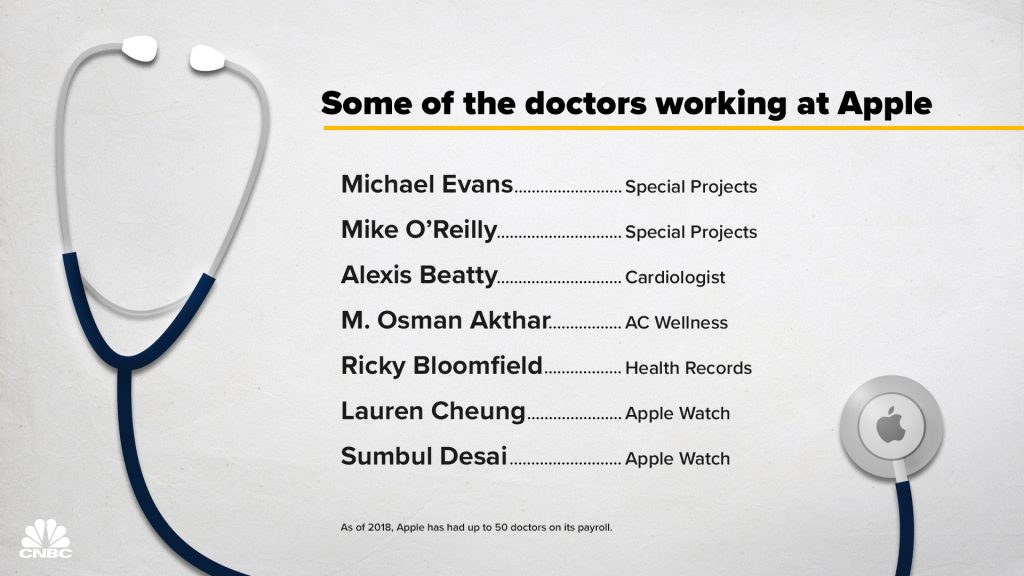

Apple may now have as many as 50 medical doctors spread through the company as it continues to build on the health technologies found in the iPhone, Apple Watch, and HealthKit. (CN Beta, Apple Insider, CNBC)

Battery

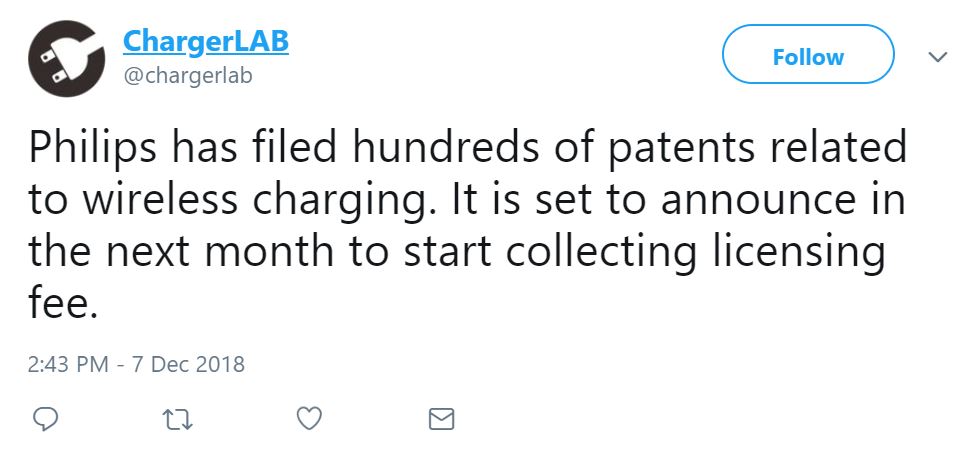

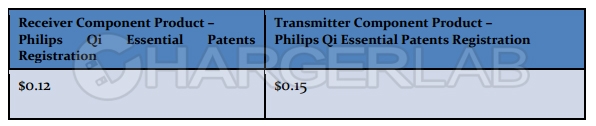

Philips has announced the rules for charging wireless charging royalty fees – Rx receivers charge USD0.12 per device, and Tx transmitters charge USD0.15 per device. After Philips purchased the Fulton’s patents, the company owns hundreds of wireless charging patents, and Philips and Fulton are both WPC long-time members. (CN Beta, IT Home, Twitter)

Phone

Sony Mobile will let go 200 staff from Swedish office as it tries to halve costs. Deputy Chairman of Sony’s Lund operations- Stefan Olsson said “It is evident that Lund is going to get affected by cost savings but it is very uncertain how the whole process is going to be affected”. (CN Beta, GizChina, GSM Arena, Xperia Blog)

According to IDC, smartphone shipments are expected to drop to 1.42B units in 2018, down from 1.47B in 2017. However, IDC expects year-over-year shipment growth of 2.6% in 2019. Over the long-term, smartphone shipments are forecast to reach 1.57B units in 2022. While the on-going U.S.-China trade war has the industry on edge, IDC still believes that continued developments from emerging markets, mixed with potential around 5G and new product form factors, will bring the smartphone market back to positive growth. (CN Beta, IDC, data)

Samsung Electronics will cease operations at one of its mobile phone manufacturing plants in China, as its sales in the world’s biggest smartphone market slumps amid rising competition from lower-cost local rivals. The factory, which currently employs about 2,600 people, is scheduled to be shut down by the end of 2018. (Android Authority, Reuters, My Drivers, CN Beta)

vivo has acquired additional 169-acre of land in the Yamuna Expressway region in Uttar Pradesh with an estimated investment of INR4000 crore (USD560M / EUR500M) for its second manufacturing facility. The deal on the expansion is approved by state chief minister Shri Yogi Adityanath. The current manufacturing plant is yielding 2M smartphones per month. (GSM Arena, Fone Arena, Sina, CN Beta)

Xiaomi has recently revealed that it has sold over 700,000 units of Poco F1 smartphone in India within 3 months of launch. Now, the company is focusing on mobile gaming and thus, it has launched a new initiative — Poco Game Development Academy. (Gizmo China, Deccan Chronicle)

After organizational restructure in Sept 2018, Xiaomi is conducting a second organizational restructure. Xiaomi says it is creating a China business region formed from what used to be originally known as Sales and Service Department China that will be headed by Wang Chuan. Mr. Chuan is a co-founder who is also a Senior Vice President and Chief of Staff of the Xiaomi Group. (CN Beta, Gizmo China)

TCL Group plans to restructure its business through the sale of 9 subsidiaries. It would focus on semiconductors and displays as its core business, with an emphasis on R&D of the next generation of display technology and materials. The company will sell 100% of its shares in 5 of the companies, including Huizhou-based TCL Household Appliances, while offloading 36%~75% of the remaining companies. After the transaction is finalized, TCL Group’s operating income will shrink to CNY50.1B from CNY111.7B in 2017. (TechNode, SZSE, CE, iFeng, UDN)

ASUS has announced that long-time CEO Jerry Shen is stepping down ahead of “a comprehensive corporate transformation” — part of which involving a new co-CEO structure, as well as a major shift in mobile strategy to focus on gamers and power users. Shen announced that he will be off to run a new AIoT startup, iFast, as chairman and CEO, with its business targeting B2B applications. (Engadget, Engadget CN, Business Next, GizChina, Sina)

Wearables

GoPro has announced that it plans to move “most of its US-bound camera production” out of China by summer 2019 as a result of the ongoing trade war between the two countries. The action camera company does not say specifically where it will move that slice of its overall manufacturing efforts. (The Verge, Forbes, China Trade News, GoPro)

Augmented / Virtual Reality

French startup Molotov is slowly becoming the leading platform to stream TV in France. It is said to stream a total of 1.1M hours of content. Molotov Together will be released in Feb 2019. A Molotov user will be able to access the service with a compatible VR headset. Molotov will let user invite people to user’s virtual living room and watch your TV. (TechCrunch, Maketecheasier, Silicon Canals)

Automotive

Defunct startup Sidecar, which pioneered on-demand ride-hailing, is suing Uber, alleging it engaged in predatory pricing and anti-competitive practices that ultimately put Sidecar out of business. Sidecar went out of business in Dec 2015 and sold its assets to General Motors in 2016. (CN Beta, TechCrunch, VentureBeat)

Shenzhen now has the world’s largest fully electric bus fleet. All 16,000 buses in this megacity are fully electric. According to Shenzhen Bus Group, the fully electric bus fleet has enabled them to conserve 160,000 tonnes of coal per year and cut down the annual CO2 emissions by 440,000 tonnes. (Ubergizmo, The Guardian, Xinhuanet)

E-commerce / Retail

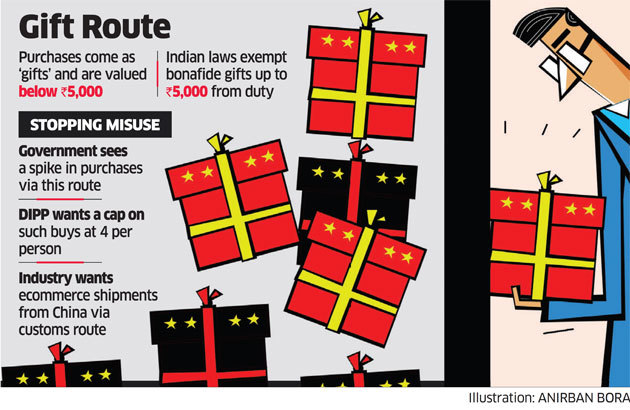

India is considering imposing restrictions on online purchases of goods from Chinese ecommerce platforms and applications in a move triggered by concerns over adverse impact on local manufacturing and violation of domestic laws. The department of industrial policy and promotion (DIPP) has suggested capping purchases of “gifts” from Chinese etailers and apps at 4 per buyer per year. (CN Beta, Entrackr, Economic Times, Huanqiu, Economic Times)