01-26: Huawei has proclaimed his company will be the biggest smartphone manufacturer as early as 2019; Nokia is expanding its presence in North America with its first carrier partnerships this side of the Atlantic; etc.

Chipsets

Annual semiconductor unit shipments, including integrated circuits and optoelectronics, sensors and discrete (O-S-D) devices, grew 10% in 2018 and surpassed the 1T unit mark for the first time, according to IC Insights. Semiconductor unit shipments climbed to 1,068.2B units in 2018, said IC Insights. Shipments are expected to climb further to 1,142.6B in 2019, which equates to 7% growth for the year. (Digitimes, press, IC Insights, press, TechNews, Yahoo)

Intel interim CEO Bob Swan has suggested that Intel is on track to resolve its “supply constraints” by the end of 2Q19. The shortages were and are the most pronounced in the value end of the PC market, as Intel’s strategy is to prioritize Xeon chips for servers—where there are “no shortages,” Swan said—and the so-called “big core” products at the high end of the PC market. “Big core” chips like the Core i9 will be prioritized over “small core,” mid-range processors, followed by the cheapest “value” chips. (Liliputing, PC World, Sina, Leiphone)

Touch Display

Apple’s patent, titled “Electronic devices with structural glass members”, highlights the use of a flexible display that could be mounted to a glass support member, ultimately creating a device that looks like it is built from one big curved piece of glass. (Digital Trends, USPTO, Teller China)

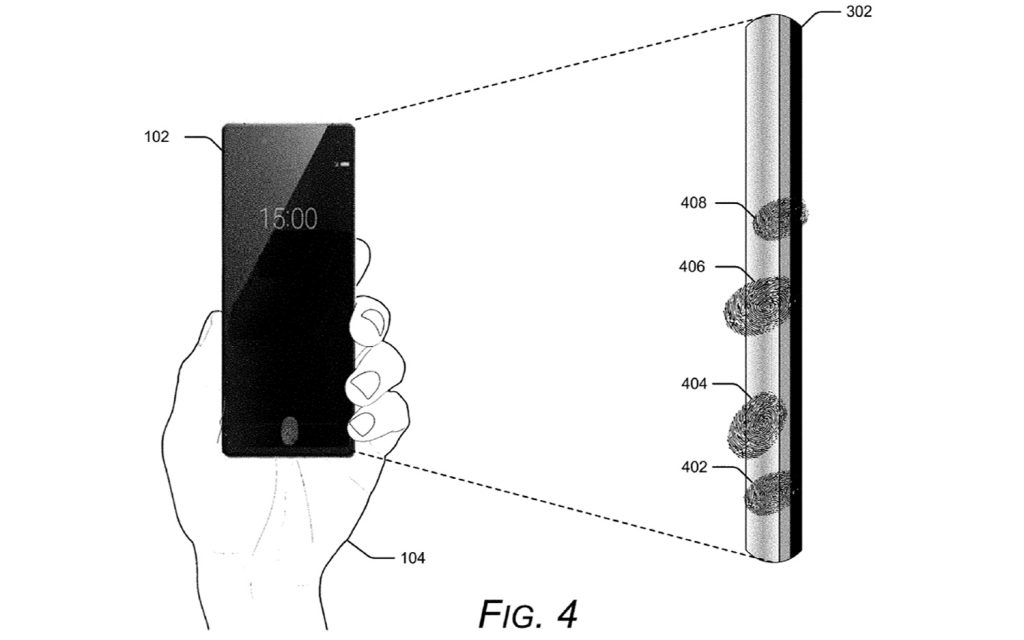

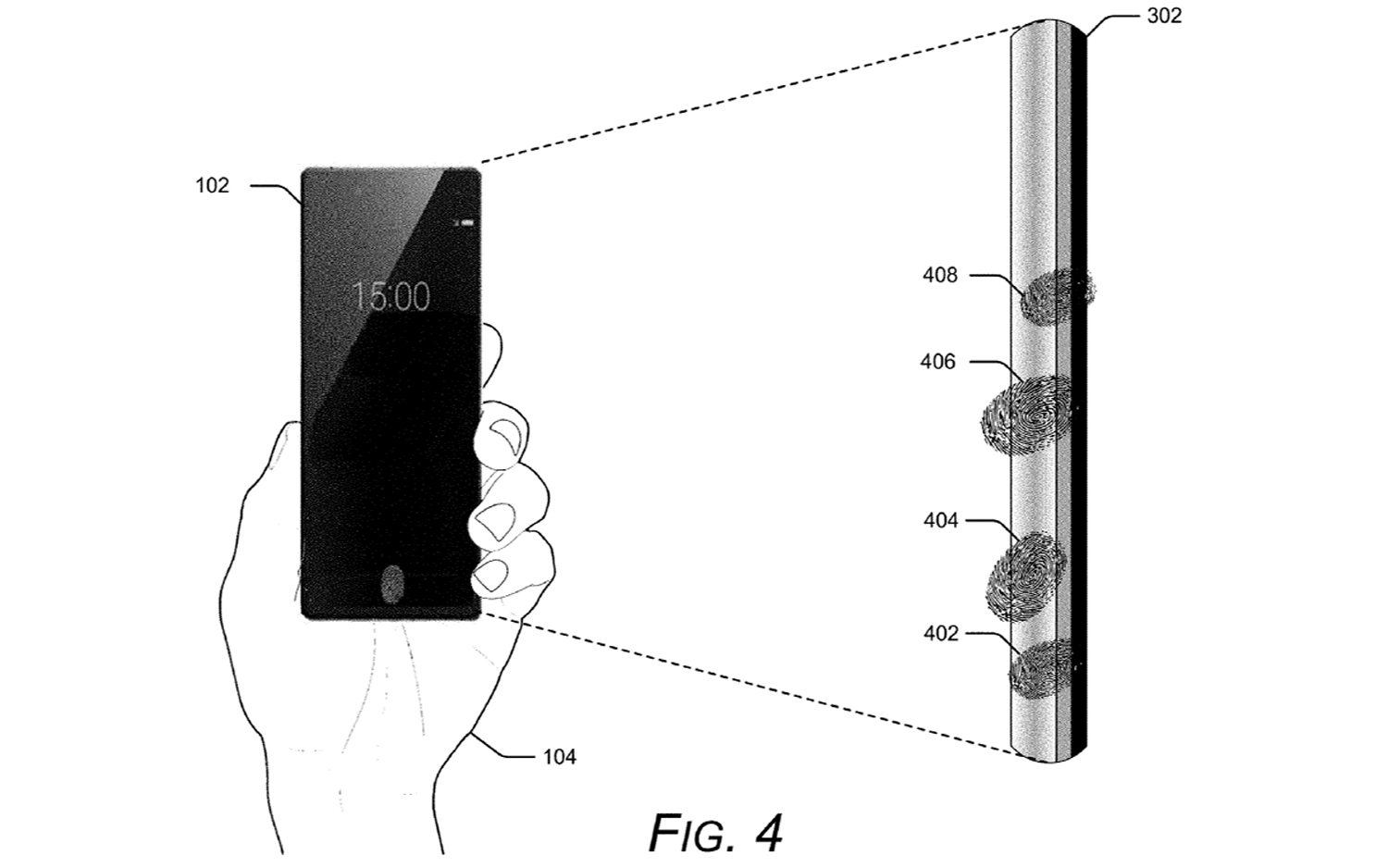

As revealed by a recently-published patent, Motorola is researching a new gripping system that individually fingerprints each user’s fingers. It would be able to detect the locations where a user’s hand was in contact with its frame, and then display relevant controls next to them. (Gizmo China, Phone Arena, Tom’s Guide, 91Mobiles)

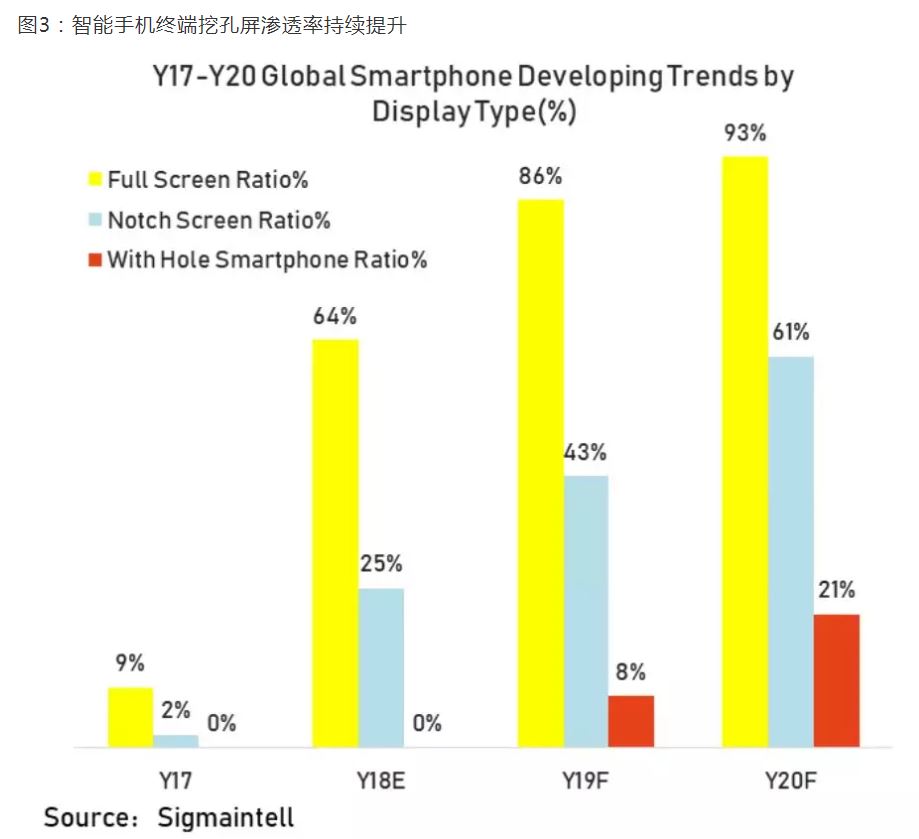

Sigmaintell Consulting has shown that of global handset sales of 1.82B units for 2018, smartphone models accounted for 1.37B units, down 4.3% on year. The company estimated global smartphone sales volume for 2019 to inch down 1.1% on year to 1.36B. Global sales of hole-punch smartphones are estimated to reach 110M units in 2019 for a penetration rate of 8%, with the rate expected to rise sharply to 20% in 2020, according to Sigmaintell. (Digitimes, press, CN Beta, Sigmaintell, press)

Memory

Macronix International has been engaged in 3D NAND technology R&D, and plans to offer 48- and 96-layer processes to deliver 128Gb and 256Gb products, according to company president CY Lu. Macronix expects to enter risk production of 96-layer 3D NAND chips at the end of 2020. Macronix will also be actively upgrading its 12” fabrication processes in 2019, Lu indicated. (Digitimes, press, China Times)

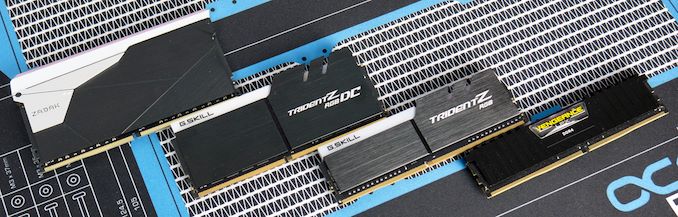

Two memory module companies, G.Skill and ZADAK, have developed a new memory format with double capacity DDR4 memory. These new modules put the equivalent of two standard modules onto one PCB, making one memory module act like two. Both companies have introduced 2×32GB kits. As a result, these memory modules are double the capacity over regular DDR4 memory, with the downside that they are also double the height. (AnandTech, Techspot, CN Beta)

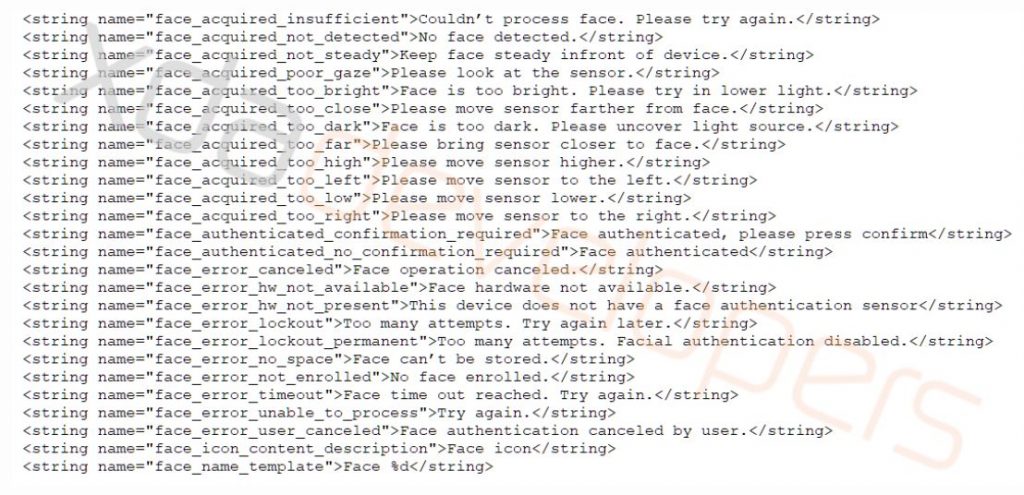

Biometrics

Google is reportedly to provide native support for secure facial recognition hardware in Android Q should make using these types of advanced systems much more common. (GizChina, XDA-Developers, My Drivers, CN Beta)

Phone

According to CIRP, Apple iPhone XR is the best-selling iPhone for the first fiscal 1Q19 (Oct 2018~Feb 2019). The iPhone XR accounted for 39% of iPhone sales amongst survey takers during this period. (Android Authority, CIRP, Apple Insider, CN Beta)

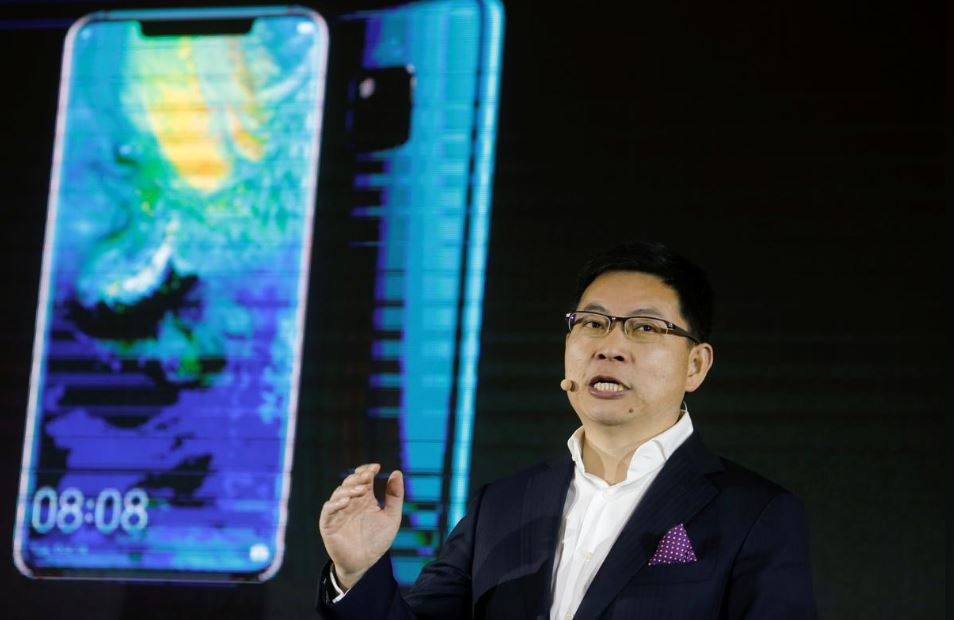

Huawei consumer business CEO Richard Yu has proclaimed his company will be the biggest smartphone manufacturer as early as 2019. The company saw smartphone shipments grow by 35% from 2017 to 2018. (CN Beta, Android Authority, Reuters)

Huawei consumer business CEO Richard Yu has hinted that Honor brand not only saw some upgrade but also managed to overcome expectations with huge growth. The company’s sub-brand has achieved a growth of 170% YoY in the international market. When it comes to the domestic market, the company has managed to be the 1st E-Brand for the 9th consecutive quarter. (Sohu, GizChina)

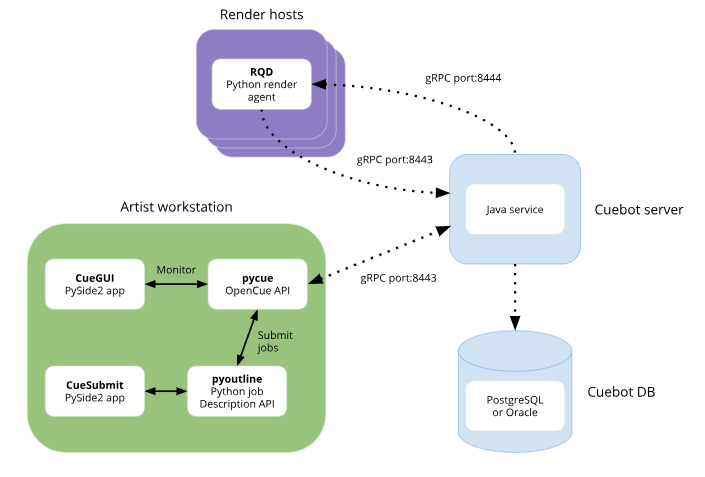

Google has announced that it has partnered with Sony Pictures Imageworks, Sony’s visual effects and animation studio, to launch OpenCue, an open-source render manager. OpenCue does not handle any of the actual rendering processes, but it provides all the tools to break down those different steps and then schedule and manage the different rendering jobs across large rendering farms, both local and in the cloud. (TechCrunch, 9to5Google, Digital Media Wire, PingWest)

HMD Global, the Finnish startup creating Nokia-branded phones, is expanding its presence in North America with its first carrier partnerships this side of the Atlantic. Three phones are respectively arriving at Rogers Wireless in Canada, as well as Verizon and Cricket Wireless in the U.S. (Android Central, Digital Trends, The Verge, Teller China)

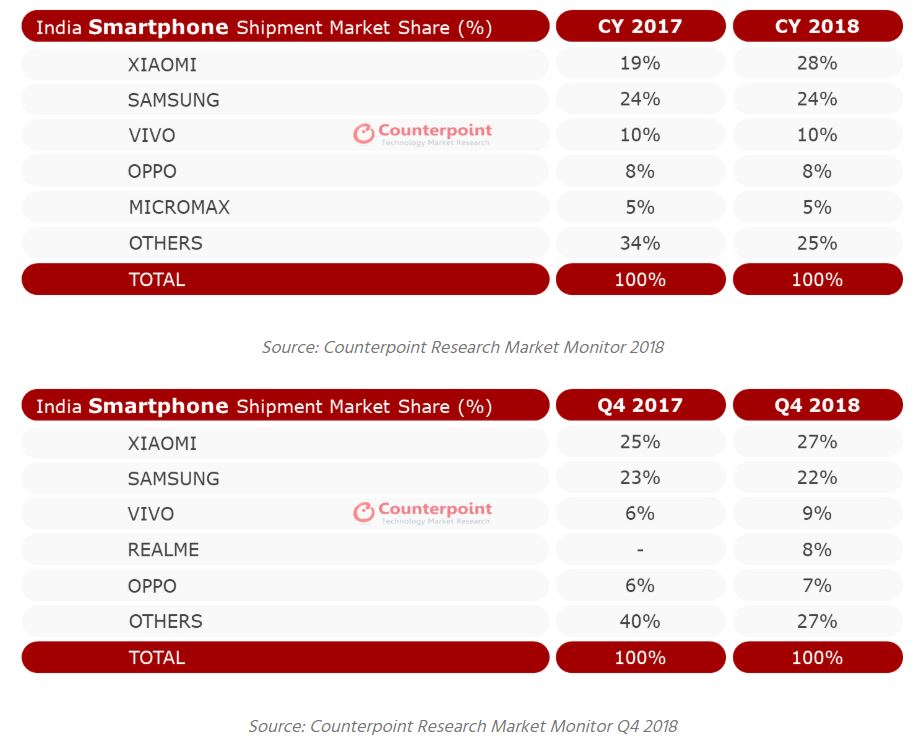

According to Counterpoint Research, India’s overall mobile phone shipments grew 11% and smartphone shipments grew 10% with feature phones growing faster than smartphones (11%). India was also the fastest-growing smartphone market in 2018 with an annual growth rate of 10%. In terms of revenue, the market grew even faster with a growth rate of 19% during the year with Samsung, Xiaomi, vivo, OPPO and Apple being the market leaders by revenue. (Counterpoints Research, press, VentureBeat)

Smartphone makers in India are calling for export credits on devices and tariff cuts on machinery imports as part of measures they say will make Asia’s third-biggest economy a global smartphone manufacturing hub. The India Cellular and Electronics Association (ICEA) has submitted the proposals to the government ahead of its annual budget announcement next week. ICEA has proposed the government raise the export credit received on the value of mobile phone shipments to 8% from 4%. It has also called for the introduction of a 5% export credit on services such as mobile apps. (CN Beta, Economic Times, First Post, Reuters)

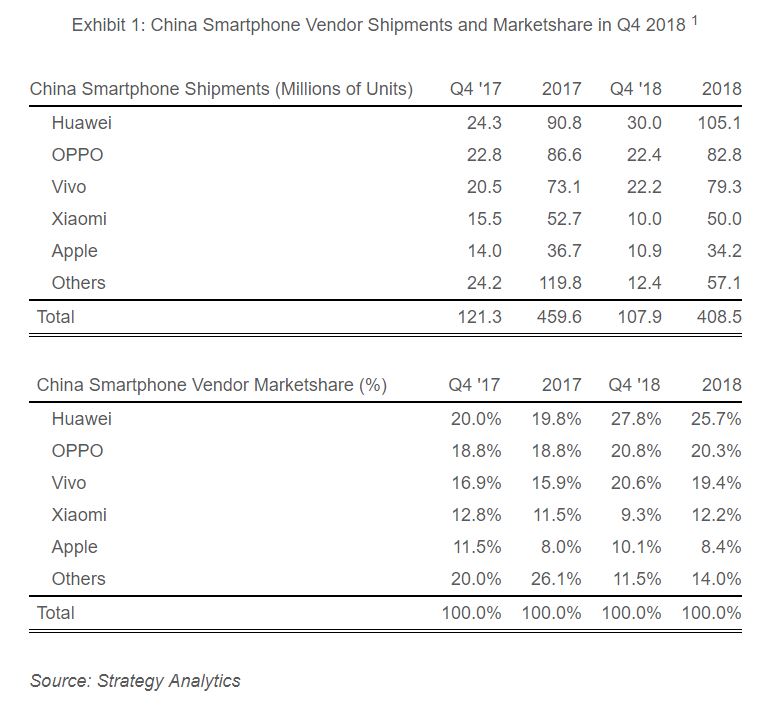

According to Strategy Analytics, China smartphone shipments tumbled 11% annually to reach 108M units in 4Q18. Huawei was the star performer and clear market leader, while Apple and Xiaomi lost ground. The Chinese smartphone market is in recession and has declined for 5 consecutive quarters. The smartphone market is suffering from longer replacement cycles and weak consumer spending. (Strategy Analytics, press, My Drivers, Apple Insider)

Wearables

Speaker maker Sonos is reportedly planning to expand beyond the home with high-end headphones. The wireless, over-the-ear headphones are still in the early development stages and could be launched by 2020. (Pocket-Lint, Bloomberg, Sina, Engadget)

Fitbit unveils Inspire and Inspire HR, only available exclusively through Fitbit corporate, wellness, health plan and health system partners. The Fitbit Inspire offers a range of health and fitness-related features like activity and sleep tracking, calories burned and reminders to move. The fitness tracker is swim-proof and offers up to 5 days of battery life. HR version comes with a heart-rate monitor. (GizChina, Wearable, Android Central, Fitbit)

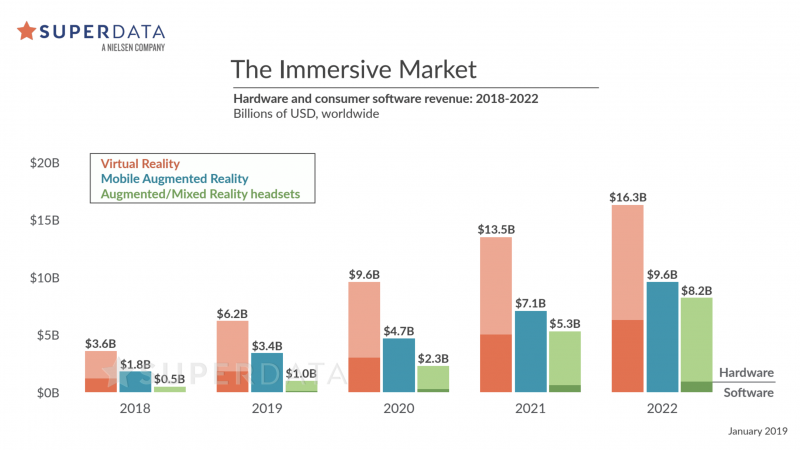

Augmented / Virtual Reality

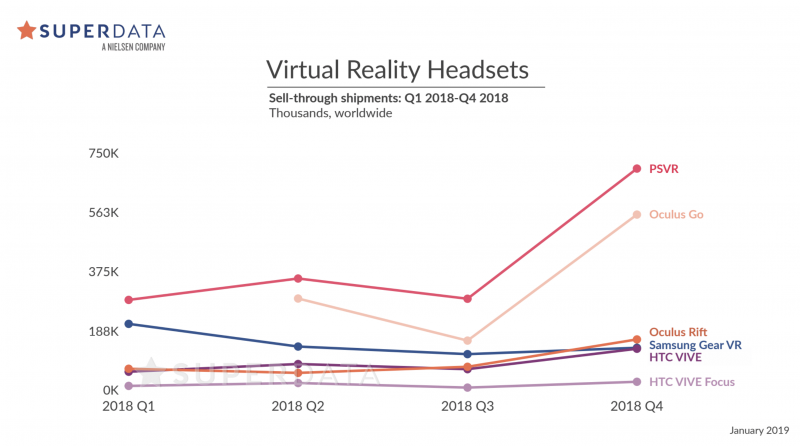

According to SuperData’s 4Q18 XR market report, Sony PlayStation VR became the market leader during the holiday quarter, selling 700K units — the largest number of headsets sold across any category. By contrast, the standalone Oculus Go sold 555K units, with the PC-tethered Oculus Rift and HTC Vive selling 160K and 130K headsets, respectively. (VentureBeat, SuperData Research, press, Qianzhan)

MelodyVR, a subsidiary of EVR Holdings, has announced a new version of their app made for an upcoming Oculus device. The company has signed major licensing deals with Warner/Chappell, Sony Music Entertainment, Universal Music Group, and Roc Nation. The firm has also announced a hefty USD19M in funding. Then, launching its official app, MelodyVR has confirmed an additional USD30M in funding through EVR Fundings, bringing the startup’s total funding to USD70M. (VentureBeat, Billboard, Digital Music News, Robot Sky)

Robotics

Sony has shown off the latest tricks of its signature robotic dog, Aibo, including a new security capability of patrolling inside a house. In the future, Aibo could act as a component in a security system, relaying information to Secom. Aibo can potentially distinguish all members of a family and become familiar with the areas of a home in which it is capable of moving within 90 days. (My Drivers, Sina, The Verge, Engadget, Sony, Japan Times)

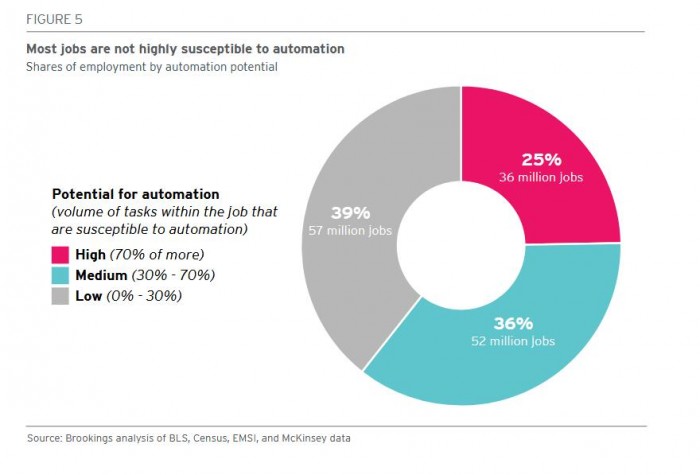

According to Brookings Institution, approximately 25% of U.S. employment (36M jobs in 2016) will face high exposure to automation in the coming decades (with greater than 70% of current task content at risk of substitution). At the same time, some 36% of U.S. employment (52M jobs in 2016) will experience medium exposure to automation by 2030, while another 39% (57M jobs) will experience low exposure. (CN Beta, Brookings report)

Automotive

Zoov, the Paris-based bike share service created by Withings cofounder Eric Carreel, has raised USD6.8M in venture capital for a system that it hopes will be more appealing to cities. The funding round includes money from Daphni, C4 Ventures, Road Ventures, BNP Paribas Développement, and the Banque des Territoires. (VentureBeat, Evening Standard)

California’s Division of Occupational Safety and Health inspected GA4, an assembly line Tesla constructed in an open-air structure outside its main vehicle factory, and issued penalties for six violations of California’s labor regulations. The citations resulted in fines that total USD29,365. (CN Beta, Inside EVs, Business Insider, The Verge)

Google Android Auto manager Patrick Brady has illustrated the current situation and the future of the platform that will change the way we relate to cars very soon. Google has developed, in collaboration with some car manufacturers, a version of the system that does not require the use of the smartphone and that guarantees a deep integration with all the car’s systems. (GizChina, The Verge, 9to5Google)