02-19 Happy Lantern Festival: OPPO will mass produce 10 times lossless camera zoom in 1H19; Xiaomi’s goal for 2019 is to bring the “Fingerprint on Display” (FoD) feature to more mid-range models; etc.

Chipsets

Taiwan Semiconductor Manufacturing Company (TSMC) has revised downward its first-quarter 2019 guidance following the completion of an assessment of all wafers recently affected by a batch of problematic photoresist material. The incident is expected to reduce TSMC’s 1Q19 revenues by about USD550M. (My Drivers, EXP Review, UDN, Sohu, Digitimes, press)

Intel has acquired Hyderabad-based startup Ineda Systems, a low-key fabless semiconductor product company. Ineda operates in the sphere of autonomous driving, artificial intelligence and IoT. In the past, it has raised over $60 Mn from big-ticket investors, including Samsung Catalyst Fund, Qualcomm Ventures, Walden-Riverwood Ventures, Imagination Technologies, among others. (CN Beta, Tom’s Hardware, India Times)

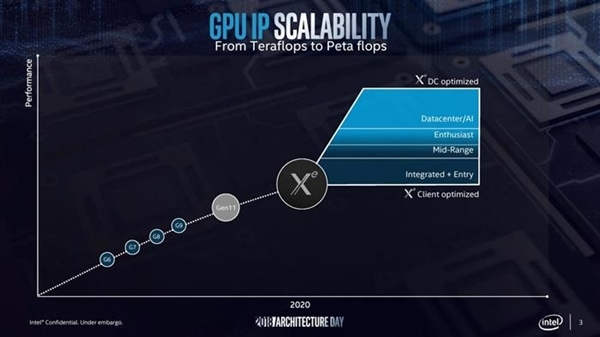

Intel has issued a mountain of patches for the Intel Linux graphics driver, precursor to discrete GPU support on the open source Linux kernel. The 42 patches and 4,000 lines of code implement local memory support, a crucial step towards offering full Linux driver support for Intel Xe arriving in 2020. (My Drivers, CN Beta, PC Games N)

Qualcomm is reportedly testing QM215 for Android Go phones. This chipset is related to the Snapdragon 410 and 425. The QM215 will stick to a quad-core CPU (most likely with Cortex-A53 cores) clocked at 1.3GHz and a GPU clocked at 650MHz. (GSM Arena, Winfuture, IT Home)

Touch Display

Kwon Bong-seok, LG’s president and head of the mobile communications (MC) division and home entertainment (HE) division, indicates that it would be premature to release a foldable phone now. The market demand for smartphones is expected to be at around 1M but LG’s main issue in smartphone business is to regain its market position. (CN Beta, GizChina, Korea Times)

According to TF Securities analyst Ming-Chi Kuo, Apple’s 2019 iPhone lineup will mirror that of the current lineup, including 6.5” and 5.8” OLED models as well as a 6.1” LCD model. The new 5.8” OLED may support DSDS, and the new 6.1” LCD may be upgraded to 4GB. All of part of the new models’ main upgrades include Ultra-Wide Band (UWB) for indoor positioning and navigation, frosted glass casing, bilateral wireless charging for charging other devices. (Mac Rumors, CN Beta, My Drivers)

The new OPPO foldable smartphone design revealed by the patent documentation is more refined. From the front one “half” of the device will be home to the selfie camera and other will house the ear piece. The corners are better defines and so are the bezels. (CN Beta, GizChina, 91Mobiles)

Camera

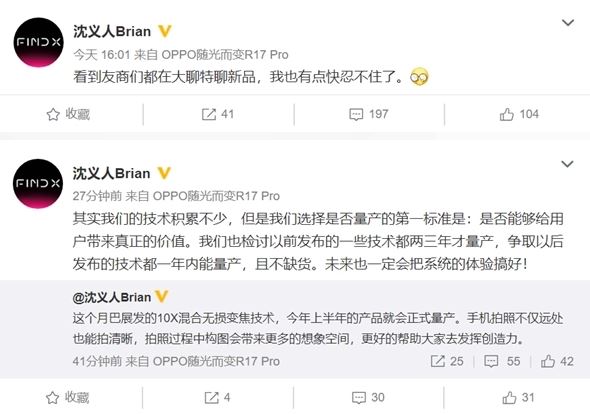

OPPO VP Brian Shen indicates that the company will mass produce 10 times lossless camera zoom in 1H19, which h simply means that images captured by OPPO cameras are just as good as photos captured on conventional cameras. (Anzhuo, CN Beta, ZOL, Vanguard, Gizmo China)

Memory

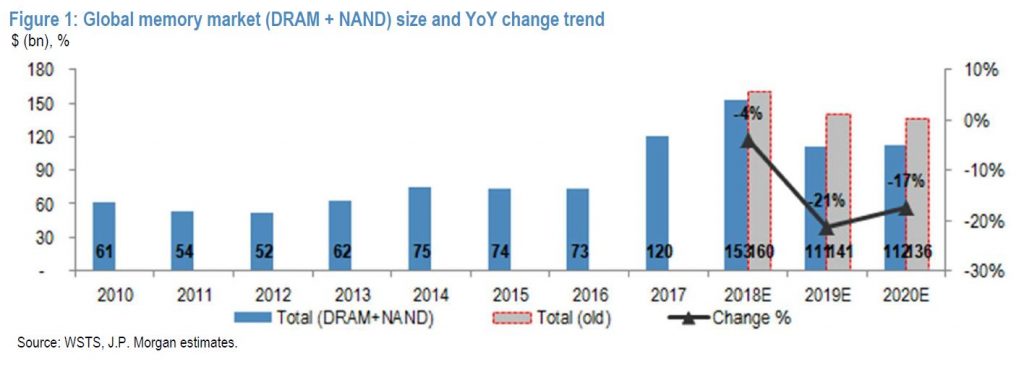

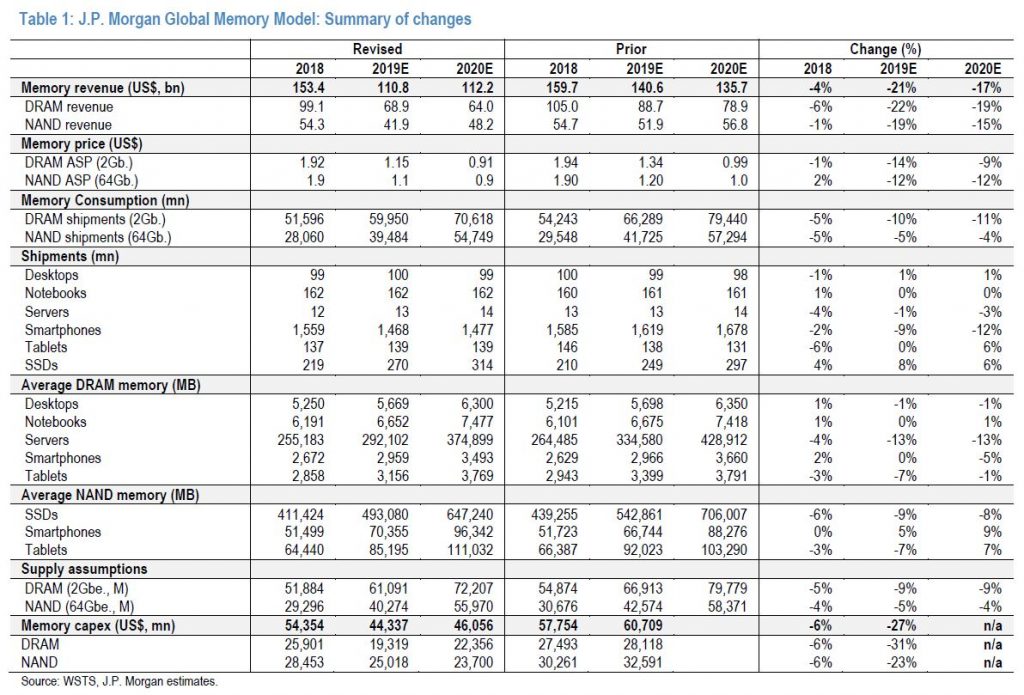

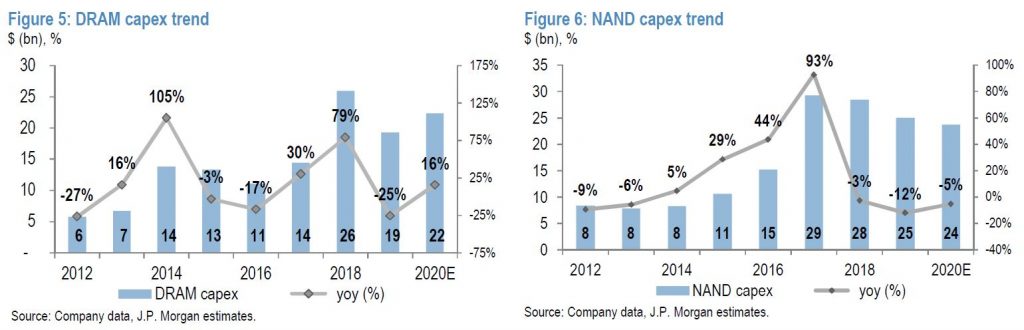

JP Morgan forecasts the DRAM market in 2019 to account for USD69B, which implies a stronger than expected shrink of 30% driven by price declines amidst much weaker than expected demand in both smartphone and especially server. JP Morgan thinks a supply glut will still result in steep NAND ASP decline (45%) causing a market shrink of 23%. For 2020, they expect NAND market to resume 15% YoY growth while DRAM market will decline by a further 7%. On a full year basis for 2019, they forecast DRAM and NAND prices to decline 40% YoY and 45% YoY followed by another decline of 21% YoY and 17% YoY for DRAM and NAND, respectively in 2020. (JP Morgan Report)

For DRAM, as inventory destocking happens throughout 2019 combined with weak incremental demand, JP Morgan has revised down ASP assumptions for 2019 / 2020 by 14% / 9% respectively. For NAND, given weak end-demand and inventory destocking cycle, JP Morgan has also made downward adjustments (2019 / 2020 ASP’s 12% down) to reflect oversupply situation. This implies a 45% / 17% price decline in 2019 / 2020 following a 11% correction in 2018. (JP Morgan Report)

According to JP Morgan, the annual capex should come around ~USD44B, which breaks down into ~USD19B capex for DRAM (down 25% YoY) and ~USD25B capex for NAND (down 12% YoY). Although DRAM is entering a downturn cycle, capex is a long-term commitment (at least 5~10 years) and all DRAM companies are generating extremely high margins (mid-50%+ operating margin). (JP Morgan Report)

Sensory

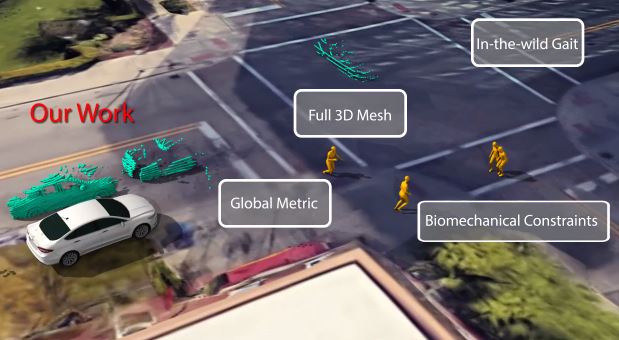

University of Michigan is developing a system that teaches self-driving cars to predict pedestrian movement. When pedestrians and vehicles attempt to occupy the same space, pedestrians lose. Since pedestrians are easily distracted and cannot be counted on to act in their own best self-interest, autonomous cars will need to practice both defensive and protective driving. (Digital Trends, IEEE, CN Beta)

Biometrics

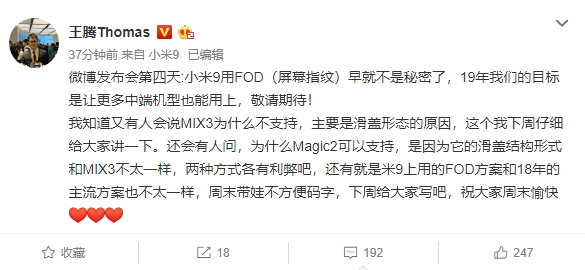

Xiaomi product director Thomas Wang indicates that their goal for 2019 is to bring the “Fingerprint on Display” (FoD) feature to more mid-range models. (My Drivers, IT Home, KK News, 91Mobiles, Gizmo China)

Connectivity

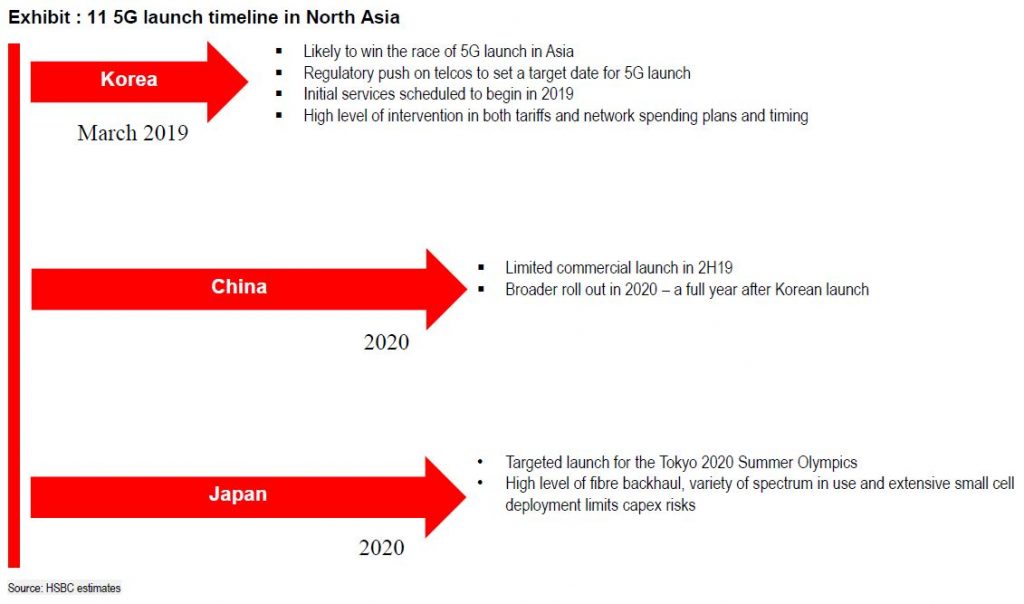

HSBC Global Research outlines the timeline for 5G launch. This is still consistent with the operators’ recent pronouncements. However, some broader considerations have changed, with the most potential impact in China. (HSBC report)

Phone

Huawei has reportedly set annual smartphone shipment goal for 2019 at 250M units and will challenge the 300M mark in 2020. In early Feb 2019, Huawei reportedly asked its supply chain chip vendors to provide extra capacity support. (CN Beta, Channel News, Digitimes, press)

According to Jefferies’ analyst Tim O’Shea, Apple’s video service expected to launch at USD15 per month. It is expected to be launched in Apr 2019. Even if Apple were to hit 250M subscribers in 2023, that would likely represent just 5% of the company’s expected revenue that year. (CN Beta, Apple Insider)

The amount of Samsung Electronics’ consolidated cash reserves came to KRW104.21T (USD92.26B) as of end of 2018. The figure showed a whopping 24.7% growth from KRW83.60T (USD74.02B) a year earlier, surpassing the KRW100T (USD88.53B) mark for the first time. Cash reserves include a company’s cash, cashable assets, short-term finance products and long-term time deposits. (CN Beta, The Investor, Business Korea)

Xiaomi has restructured its mobile phone business group. A new advisory team will be set up under the smartphone business group and led by Zhu Lei, formerly head of sales, combined with an operational team controlling product expenses within the company. Chinese media cited Xiaomi CEO Lei Jun as saying that the restructuring aims to enhance the company’s operation and strategy in its smartphone business. (CN Beta, TechNode, Tencent)

Wearables

According to TF Securities analyst Ming-Chi Kuo, Apple Watch will be equipped with ECG supports developed for additional countries, and new ceramic casing design is added. Apple has been working to expand access since its launch but regulations may hold up its acceptance in many countries. (GizChina, Mac Rumors, CN Beta)

Fintech

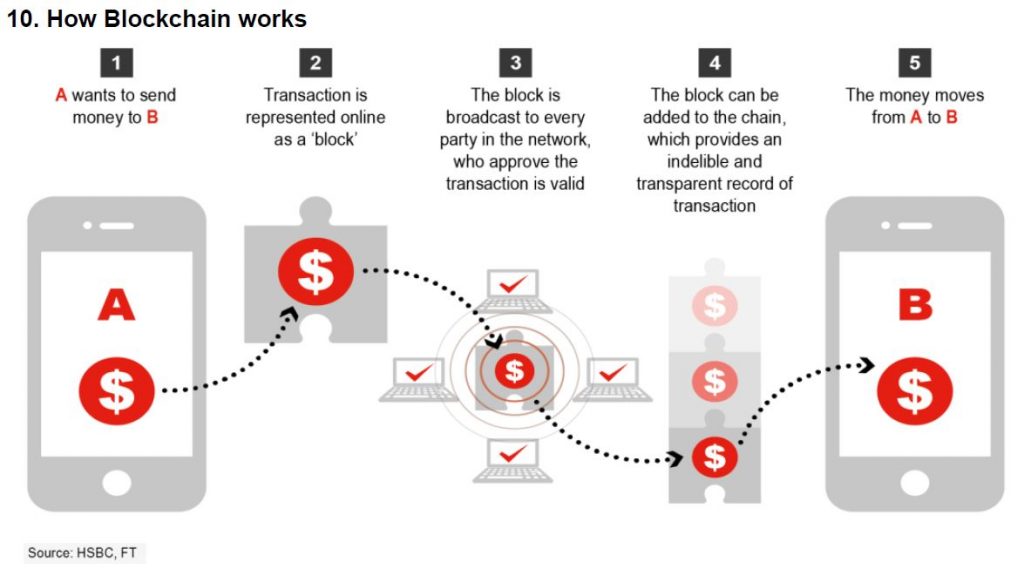

Blockchain is a decentralised and distributed ledger, maintained by a network of so-called “peers”. A peer is simply a computer which has a copy of blockchain and the ability to verify transactions. The “block” in the word blockchain refers to a transaction that has been executed and verified and whose details are then stored in “blocks”. Every complete block is added to the “chain” of all previous transactions. Each time a transaction is carried out in the system, the peers race to solve a mathematical puzzle and get a reward for the computational efforts they have made. The peers are said to have acted as “miners”. Because the existence of the transaction in the ledger needs to be cryptographically proved, there is no double spending − a key feature of blockchain. (HSBC report)

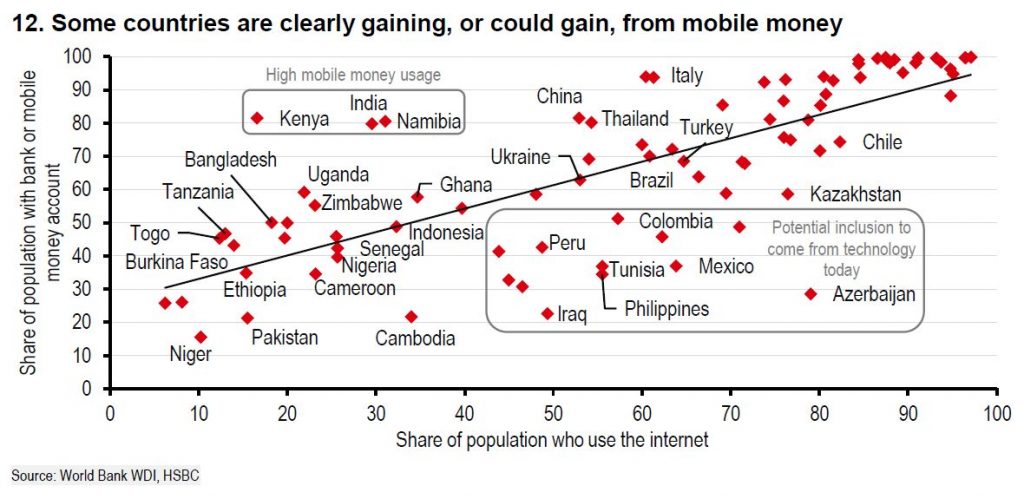

The rise of mobile payments and electronic money can have a far more transformative impact in the emerging world than the developed world. McKinsey estimates that the ability for roughly 1.6B people, who will gain access to banking via their mobile phone, to receive salaries, remittances and government pay-outs as well as paying bills and for their shopping, could provide an economic boost of USD3.7T by 2025 and generate 95M new jobs. The impact could be even more pronounced in those lower-income countries that today are severely under-banked. (HSBC report)