03-23: Huawei is reportedly to launch TVs in Apr 2019; Xiaomi is reportedly working on Android One phones with under display fingerprint scanners; etc.

Chipsets

Intel has announced its Processor Graphics Gen11 Architecture. Intel’s architectural advances have been lamented of late with the last major processor update arriving with the introduction of Skylake, which came with Gen9 graphics. With the 10nm Ice Lake processors scheduled for release later in 2019 both processor IPC gains and a whole new approach to integrated graphics with Gen11 iGPUs. Gen11 bumps the number of enhanced execution units from 24 to 64, and pushes compute performance to over 1 TFLOPS. (CN Beta, Phoronix, WCCFTech, Tom’s Hardware, Hexus, Intel)

Intel has reportedly stopped the development of Compute Cards. Compute Cards were Intel’s vision of modular computing that would allow customers to continually update point of sale systems, all-in-one desktops, laptops and other devices. Pull out one card, replace it with another, and have a new CPU, plus RAM and storage. (CN Beta, Engadget, Tom’s Hardware)

TSMC’s new 8” wafer fab to be built in Tainan will have its capacity mostly fulfill robust orders for automotive chips from STMicroelectronics and other dedicated chipmakers, according to Digitimes. Vendors of fingerprint ID ICs, power management ICs , MOSFET chips and IGBT chips have shifted from 6” wafer fabs to 8” for foundry support, while automotive chips and IoT chips see significant lower production costs at 8” fabs than at 12” ones. (Digitimes, press, Digitimes)

Touch Display

Huawei is reportedly to launch TVs in Apr 2019. The 55” display supplier is from Beijing Oriental Enterprise (BOE), while the supplier of the 65” display comes from Shenzhen China Star Optoelectronics Technology (CSOT). Huawei’s goal for the TV industry is to sell 10M units a year, which is would make them first in the industry. (CN Beta, Pandaily)

Qualcomm Institute has 70 monitors with 4K resolution that researchers said create the world’s highest resolution virtual reality (VR) system. The virtual technology could be coming to consumers soon, which may replace TV in the future. (CN Beta, KPBS)

Japan Display Inc (JDI) made an agreement with Apple to build a new factory in Japan in 2015, dedicated to the production of LCD panels destined for use in Apple’s products. The facility would cost the company approximately USD1.5B to build. Apple has agreed it would pay the majority of the funds for the construction. In return, Japan Display would repay Apple by giving it a percentage of display sales over time. The Apple’s shift to OLED has led to the factory reportedly running at only half capacity, and with Apple still owed the majority of what it paid towards its construction. (Apple Insider, Reuters, Tencent, My Drivers)

Speculation has circulated recently in Taiwan’s industry about a new company that will be set up jointly by the local LCD panel and driver IC companies to specialize in the manufacture of chip-on-film (COF) substrates. Taiwan-based JMC Electronics, an affiliate of Chang Wah Electromaterials (CWE), is among the world’s few COF substrate suppliers. Demand for handset driver ICs is already able to digest more than 30% of the available COF substrate capacity worldwide, JMC indicated. There was once zero demand for handset-use COF substrates. (Digitimes, press, China Times, STCN)

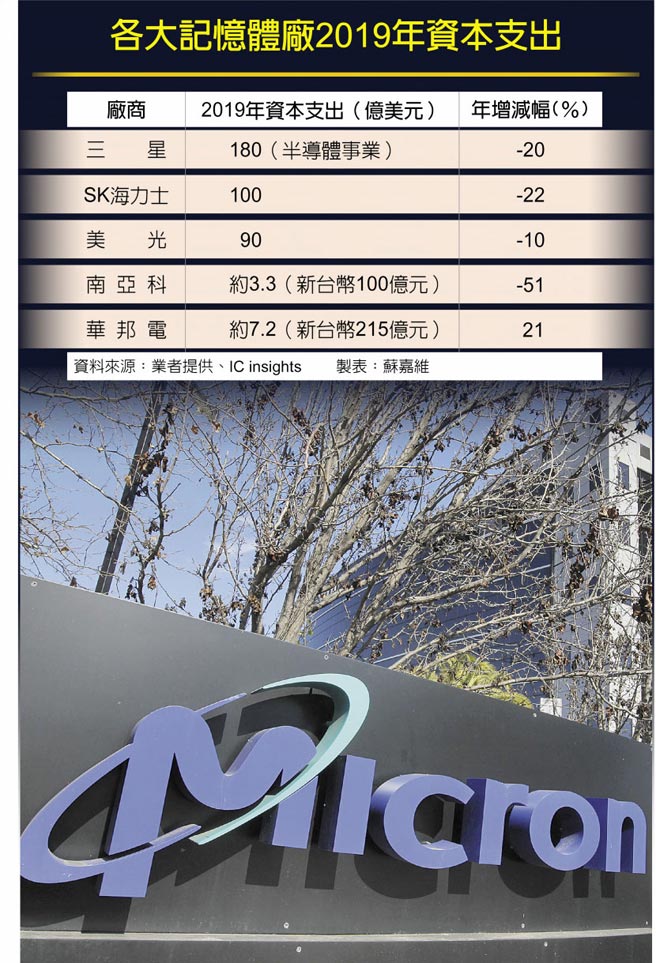

Memory

Micron Technology has unveiled plans to idle up to 5% of DRAM wafer starts and also reduce its total NAND flash wafer starts by 5% in 2019, while expressing caution about sales performance in its fiscal 3Q19. Oversupply in both DRAM and NAND flash sectors led to an over 20% fall in Micron’s product ASPs during the quarter ended 28 Feb 2019. (Digitimes, press, Digitimes, China Times, Unlisted)

Biometrics

Xiaomi is reportedly working on Android One phones with under display fingerprint scanners. The devices are likely to be marketed as the Xiaomi Mi A3 and Mi A3 Lite, codenamed “Bamboo” and “Cosmo”, respectively. These phones are being tested with “fod” (fingerprint on display). (GizChina, XDA-Developers, ePrice)

Phone

Apple has acquired Italian startup Stamplay, which offered an API-based back-end development platform. Apple is believed to have paid around EUR5M (USD5.6M) for the company. (Mac Rumors, Apple Insider, Il Sore 24 Ore, CN Beta)

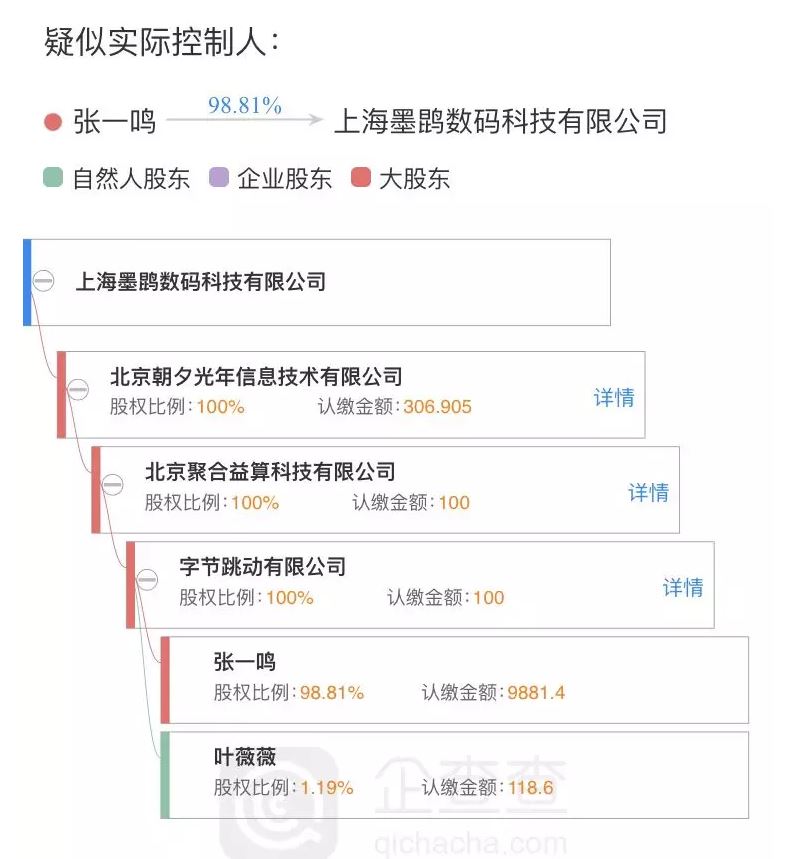

Bytedance, the world’s most valuable startup behind a collection of rising new media apps including TikTok and Jinri Toutiao, is making a further push into video games after it took control of a mobile game developer through a roundabout deal. Shanghai Mokun has become wholly owned by Beijing Zhaoxi Guangnian, a second-tier subsidiary of Bytedance. Mokun is a mobile game developer previously owned by 37 Interactive Entertainment, a publicly listed games publisher that earmarked USD791M in revenue in 2018. (TechCrunch, TechNode, VeryOL, 36Kr)

Razer has announced a collaboration with Tencent to bring the mobile gaming experience to the next level. The two companies will combine their strengths to serve the world’s 2.4B active mobile gamers1 by pushing the boundaries of mobile gaming hardware, software and services. (Phone Arena, Business Wire, IT Home, My Drivers)

Finland’s data protection watchdog is investigating Nokia parent HMD Global for reportedly transmitting sensitive information to China. After initial reports, HMD Global reportedly admitted to Norwegian public broadcaster NRK that it was sending data to China, but said that it was a software error and that the issue had been fixed in a January software update. (Digital Trends, Reuters, VOA)

vivo has announced a new brand-level strategy which is the opening of a new concept store dubbed Vivo Lab. The first of its kind will be opened in Shenzhen, the hub for innovative startups in China, on 22 Mar 2019. (Gizmo China, 36Kr, Caijing)

Samsung may have found some shady business practices within its own U.S. marketing team. The company has abruptly laid off many of its marketing employees and the head of marketing, Marc Mathieu, has abruptly resigned. Reportedly, Samsung has run the internal audit on its own team. (Android Authority, WSJ, CN Beta)

According to a report from China Electronic Equipment Technology Development and Utilization Association and environmental protection organization, the smartphone recycling rate is less than 2% in China. People are not recycling their electronic products, claims the ‘China Waste Electronics Products Circular Economy Report’. The report predicts that China can garner CNY130B if they improve the recycling rate to 85% by 2030. (Gizmo China, My Drivers, Green Peace, report)

Xiaomi plans to open about 100 stores in 2019 in Russia while Huawei plans to open 30 stores this 2019. Huawei plans to grow its stores from 150 to 200. The Chinese market leader is said to be scouting for partners and is already in talks with Inventive Retail Group. (Gizmo China, Hybrid Techcar, Kommer Sant, Sina)

Augmented / Virtual Reality

Oculus has unveiled a new-generation Rift headset called the Oculus Rift S. It has collaborated with Lenovo to refine the Rift S’ hardware using with feedback from the Lenovo Legion gaming community. The headset also comes with a single cable which makes it easier to manage and avoid cable clutter. (Gizmo China, Oculus, ZOL, My Drivers)

HTC has tied up with Photon Engine, a cross platform multiplayer game backend service company, to jointly promote its Viveport VR content services. Leveraging Photon’s SKD products, the collaborative efforts will roll out real-time multiplayer game solutions and services to enable users of Viveport, Steam and even Oculus to play digital games cross platform simultaneously. (Digitimes, press, iKanchai)

Automotive

Uber is expanding its business helping independent trucking companies with logistics. In Apr 2019, Uber Freight will start operations in the Netherlands, marking the unit’s first international expansion. (CN Beta, TechCrunch, Bloomberg, Uber)

Ford is investing approximately USD900M in its southeast Michigan manufacturing footprint and targeting 900 incremental direct new jobs through 2023. This includes the company’s plan to expand production capacity at Flat Rock (Mich.) Assembly Plant – including next-generation fully electric vehicles – targeting to invest more than USD850M through 2023 and adding a second shift. (Engadget, Ford, CN Beta)