03-28: YMTC is set to kick off volume production of 64-layer 3D NAND flash chips by the end of 2019; Sony will close its smartphone plant in Beijing; etc.

Chipsets

Mid-range Samsung Exynos 9710 is reportedly manufactured using 8nm process. The chipset includes 4 Cortex-A76 cores clocked at 2.1GHz and 4 Cortex-A55 cores at 1.7GHz. They will be mated to a 650MHz Mali-G76 MP8 GPU. (Sam Mobile, GizChina, Weibo, DZCS)

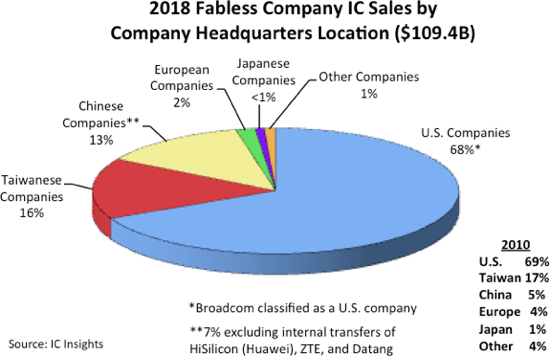

China-based fabless chipmakers saw their combined share of the global market reach 13% in 2018, up from only 5% in 2010, according to IC Insights. 4 of the top-5 fastest growing fabless IC companies (with greater than USD200M in sales) in 2018 were China-based companies – Bitmain, ISSI, Allwinner and HiSilicon, IC Insights said. However, when excluding the internal transfers of HiSilicon (over 90% of its sales go to its parent company Huawei), ZTE, and Datang, the Chinese share of the fabless company IC sales drops by about half to 7%, IC Insights indicated. (IC Insights, press, Business Times)

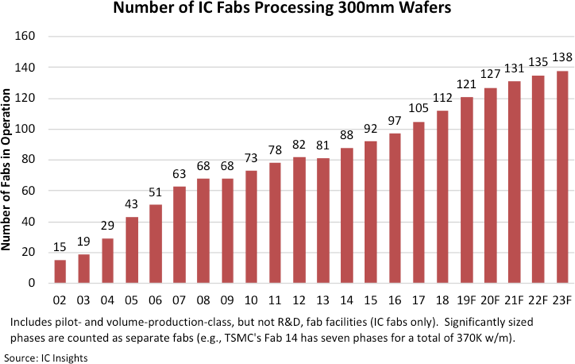

IC Insights shows that 300mm wafers took over as the industry’s primary wafer size in terms of total surface area used in 2008. Furthermore, the number of 300mm wafer fabrication facilities in operation continues to increase. With 9 new 300mm wafer fabs scheduled to open in 2019, the worldwide number of operational 300mm wafer fabs is expected to climb to 121 in 2019 and grow to a total of 138 fabs at the end of the forecast period. (IC Insights, press, CN Beta)

Touch Display

When BOE VP Yuan Wei is asked if BOE supplies the display panel for Huawei P30 Pro (6.47” 2340×1080 FHD+ dual curved OLED), he has confirmed that it is indeed BOE. (Gizmo China, OfWeek)

Global shipments of smartphone-use TDDI (touch and display driver integration) chips are expected to increase 20% in 2019 from about 414M units in 2018, according to Digitimes Research. (Digitimes, press)

Memory

China’s Yangtze Memory Technology (YMTC) is set to kick off volume production of 64-layer 3D NAND flash chips by the end of 2019 as scheduled, despite prices for such memory products continuing sliding down. (Digitimes, press, Sina, iFeng)

With memory demand for automotive set to grow robustly, Micron Technology is gearing up for the market boom by accelerating its deployments of related products and technologies, according to company executive VP and chief business officer Sumit Sadana. According to Semico Research, a fully autonomous vehicle (L5) is expected to require 74GB DRAM and 1TB NAND memory. (Digitimes, press)

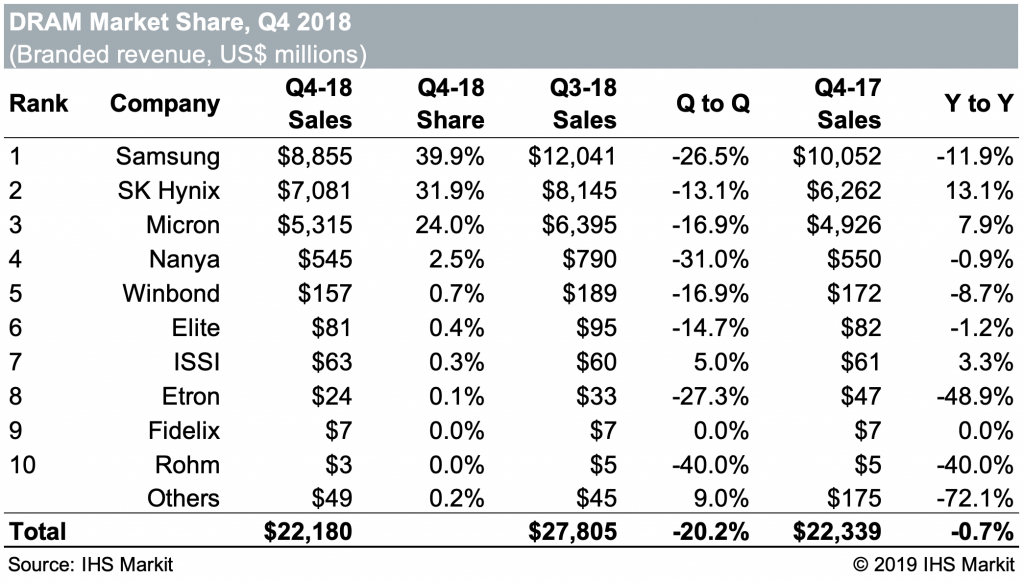

Recent concerns over market conditions, coupled with a sharp downturn in average selling prices, will lead the DRAM market to reach just USD77B in 2019 – a 22% year-over-year decline. Falling prices and weak demand will likely continue through 3Q19, according to IHS Markit. (IHS Markit, press, Digitimes, China Flash Market)

Material

According to Brian Shen, OPPO’s VP, the to-be-launched Reno would be powered by Qualcomm Snapdragon 855 and will have a copper tube and liquid cooling. (GSM Arena, Weibo, My Drivers)

Connectivity

LG has reportedly managed to save precious space inside phones by integrating the 5G antenna in the display itself—by slapping the thin antenna films on the back side of the screen. (Phone Arena, ET News)

Phone

Xiaomi’s Sun Changxu reckons that mobile phones compete not only hardware specs but also system. After using MIUI, the users could not stop using it. After 9 years of building the MIUI system, she thinks that in principle there are 3 types of systems: Apple’s iOS, Xiaomi’s MIUI and “others”. (CN Beta, iResearch)

Sony has announced that it will realign its Imaging Products & Solutions (IP&S) Business, Home Entertainment & Sound (HE&S) Business, and Mobile Communications (MC) Business as Electronics Products & Solutions (EP&S) Business effective 1 Apr 2019. (CN Beta, My Drivers, Sony)

Sony will close its smartphone plant in Beijing, as the company aims to cut costs in the loss-making business. Sony will shift production to its plant in Thailand in a bid to halve costs and turn the smartphone business profitable in the year from Apr 2020. (My Drivers, Reuters CN, Reuters)

Huawei consumer business group CEO Richard Yu has revealed the Mate 30 (or whatever name is eventually chosen) is likely to have 5G, and signaled that the latter part of 2019 is very much going to be 5G-driven for Huawei . (CN Beta, Digital Trends)

vivo S1 is announced – 6.53” 1080×2340 FHD+ IPS, MediaTek Helio P70, rear tri 12MP-8MP-5MP + front pop-up 24.8MP, 6+128GB, Android 9.0, rear fingerprint scanner, 3940mAh 18W fast charging, CNY2,298. (Gizmo China, My Drivers)

Huawei P30 Lite is launched in Canada – 6.15” 2312×1080 FHD+ IPS, HiSilicon Kirin 710, rear tri 24MP-2MP-8MP ultrawide + front 32MP, 6+128GB, Android 9.0, rear fingerprint scanner, 3340mAh 18W fast charging, CAD450 (USD335). (GizChina, TechRadar, GSM Arena, Gizmo China)

Wearables

He Gang, president of Huawei’s smartphone business, has revealed that Huawei Watch GT released at the end of 2018, 5 months after its launch, created Huawei’s fastest multi-million-dollar record for wearables priced over CNY1,000. (My Drivers, Leikeji, ZOL, GizChina)

Augmented / Virtual Reality

Huawei vice chairman Hu Houkun believes that, with the development of 5G network, VR and AR will be detonated in 2019. He has revealed that Huawei plans to launch a disruptive VR terminal in 2H19. (CN Beta, JQK News)

Google-backed Mobvoi is allegedly close to securing funding that will value the artificial intelligence (AI) startup at more than USD1B before an initial public offering (IPO) in China. The smartwatch and AI software developer is seeking to raise USD100M and plans to list on a proposed board for technology companies on the Shanghai bourse. (Android Authority, Bloomberg, Sohu, eBrun)

Home

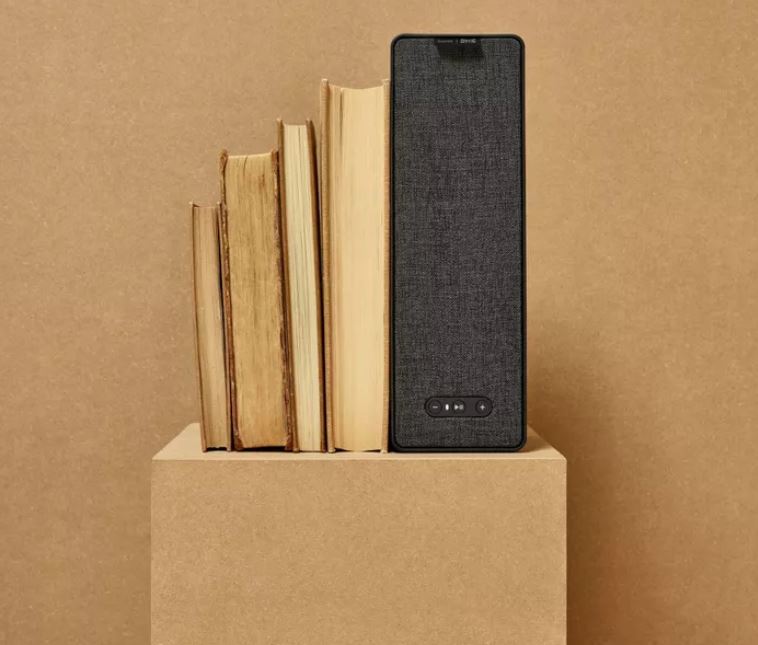

Ikea has revealed its newest collaboration with Sonos: the Wi-Fi bookshelf speaker, winner of the Red Dot Design award. The speaker is part of the Symfonisk product range is expected to be available in Aug 2019. (CN Beta, CNET)

Robotics

Google has quietly been retooling an ambitious but troubled robotics program. Google’s new effort is known as Robotics at Google. Google’s early robotics efforts began in 2013 with the purchasing of six robotics startups, in a project overseen by Andy Rubin — the Android creator who reportedly received a USD90M exit package from Google while he was a subject of sexual misconduct claims. (CN Beta, Business Insider, NY Times)

Coretronic Intelligent Robotics (CIR), a startup developing computer vision, AI, high-performance computing and precision control technologies, has disclosed an aim to ship 200 business-use drones in 2019. Before spun off from Coretronic in Jan 2018, CIR was a business unit of the backlight unit (BLU) maker Coretronic focusing on development of business-use drones based on AI and sensing fusion. (Digitimes, press, Apple Daily)

Automotive

Alibaba, Tencent, Suning, and car makers including Chongqing Changan Automobile have set up a USD1.5B Chinese ride-hailing venture, a move that could test the dominance of ride-sharing giant Didi Chuxing. T3, which is short for “top 3”, officially launched after a dozen entities, including 3 major automakers, agreed to lay out a total of CNY9.76B (USD1.45B) for the joint venture following an initial agreement in Jul 2019. (TechCrunch, Reuters, Changan, Sina, Wallstreet CN)

Sony and NTT DOCOMO have announced that they will jointly trial Sony’s conceptual driverless vehicle, the New Concept Cart SC-1, which leverages 5G mobile technologies for various remotely controlled functions. The test will be conducted using the trial network in DOCOMO 5G Open Lab TM GUAM. (CN Beta, Sony, Japan Times, Associated Press)

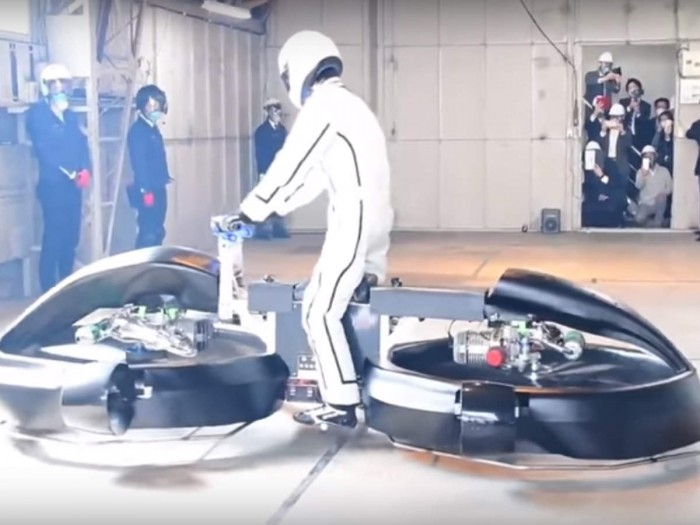

Tokyo-based venture company A.L.I. Technologies aims to release a mass-market flying motorcycle by 2022, CEO Shuhei Komatsu said. A.L.I. Technologies, which mainly develops small drones, hopes to sell the product, called a “hover bike,” in emerging economies in Africa, the Middle East and Asia with poor road infrastructure. (CN Beta, Japan Times)

Payment

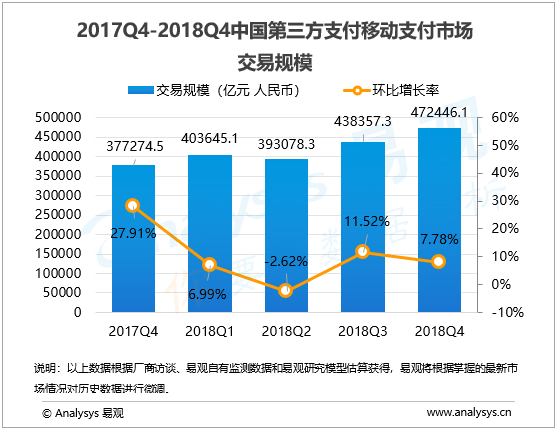

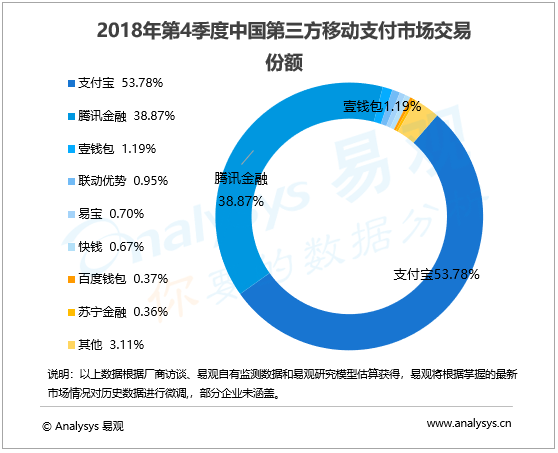

According to Analysys, in 4Q18 China’s third-party payment mobile payment market transaction volume reached CNY47,424.61B, an increase of 7.78%. Among them, Alipay occupied 53.78% market share, ranking first, Tencent Financial (including WeChat payment) ranked second, accounting for 38.87% of the market, which together accounted for 92.65% of the entire market, an increase of 12 ppt over the previous quarter. (Analysys, Sohu, CN Beta)