07-20: Europe has hit Qualcomm with a EUR242M (USD271M) fine; LG will likely support OLED display production for Apple’s 2019 iPhones; etc.

Chipsets

Europe has hit Qualcomm with a EUR242M (USD271M) fine, saying the US chipmaker used “predatory pricing” to drive a competitor out of the market for 3G phone hardware. Qualcomm has said it would appeal the decision, which it described as “meritless”. (CN Beta, Euractiv, CNN, TechCrunch, The Register)

Intel has announced a deep partnership with SAP around using advanced Intel technology to optimize SAP software tools. Specifically, the company plans to tune its Intel Xeon Scalable processors and Intel Optane DC persistent memory for SAP’s suite of applications. (TechCrunch, Intel, VentureBeat)

TSMC’s CFO Lora Ho has revealed that TSMC has seen a ramp-up in chip demand for 5G devices. Demand for 5G smartphones and base station equipment will become robust starting 2H19. The pure-play foundry’s capex 2019 will outpace the high end of its previously-estimated USD10B-11B. TSMC plans to spend more to expand further its 7nm process production capacity and build up capacity for its newer 5nm node. The foundry is on track to move the 5nm to volume production in 1H20. (Apple Insider, Digitimes, CN Beta)

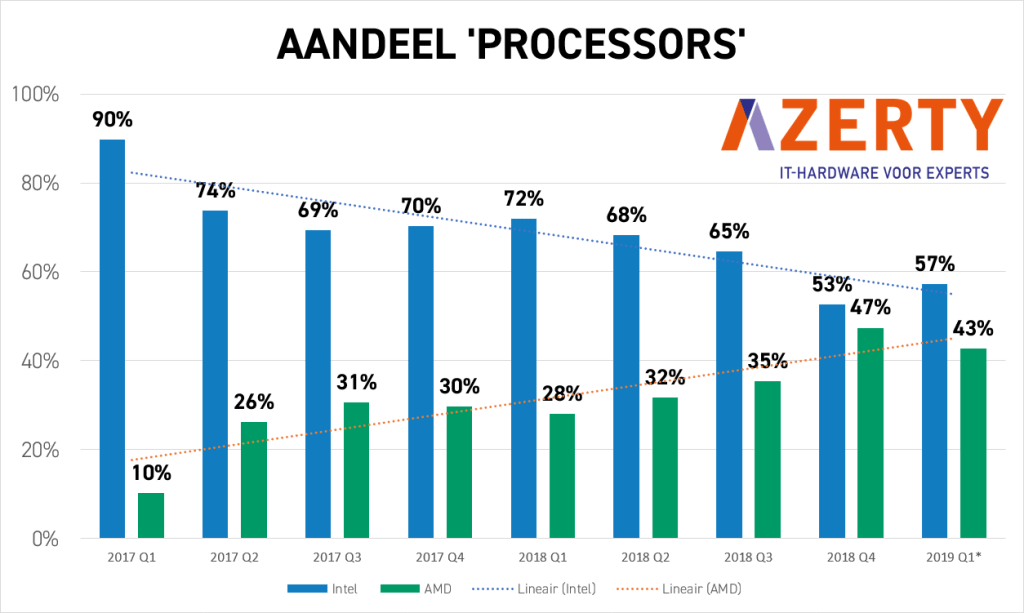

Intel has explained how it has struggled to bring 10nm processors to market, while also admitting that the market will not see its 7nm chips until 2021. Meanwhile, its competitor AMD has recently released 7nm chips (such as the AMD Ryzen 9 3900X). Germany, Netherlands, and Japan have already embraced team red, and now just within a week of the Ryzen 3000 launch, AMD has outpaced Intel in the South Korean market, holding a lead of 7% after many years. (Digital Trends, CN Beta, Tom.com, TechRadar, PC Gamer, Techquila)

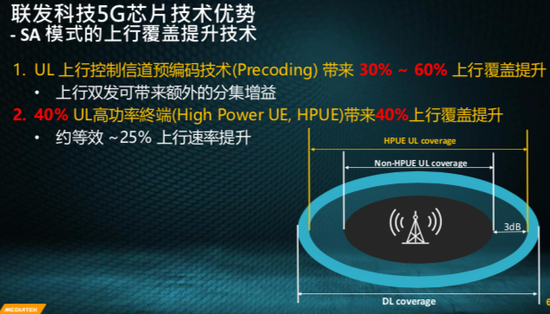

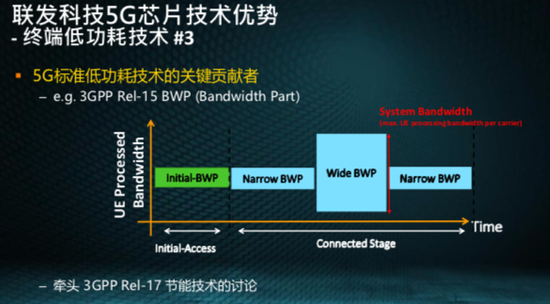

HiSilicon’s Balong 5000 has completed SA and NSA tests. Qualcomm X50 has completed the NSA test. Mediatek has completed the indoor tests of NSA and SA and the outdoor performance test is also in progress. UNISOC is conducting the NSA test and will start the SA test later. Dr. Fu Yikang, director of the design division of MediaTek’s communications system, involved in the development of 5G standards, said MediaTek is the leading group of 5G technologies. MediaTek’s 5G chip not only benefits in terminal technology, upgrading technology and top speed, but also the world’s first manufacturer to release 5G SoC chips. (GizChina, CN Beta, C114, Vaaju)

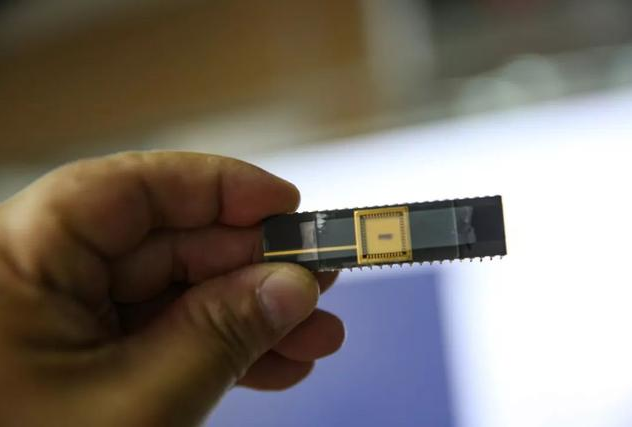

Zbit Semiconductor is a fabless memory design start-up based in Hefei and Shanghai. Zbit is cooperating with the University of Science and Technology of China to research and develop in-memory computing AI acceleration chips for IOT and wearable applications. They have successfully demo its AI chipset. The AI chip is equipped with edge calculation and reasoning. It can detect the face avatar taken by the camera in real time and give the calculation probability, which is accurate and stable. (CN Beta, EET China, Zbit Semiconductor, Moore)

AMD has joined other industry leaders in the Compute Express Link (CXL) Consortium. Compute Express Link (CXL) is an open industry standard interconnect offering high-bandwidth, low-latency connectivity between host processors, systems and devices such as accelerator cards, memory buffers, and smart I/O devices. (My Drivers, Tom’s Hardware, AnandTech, AMD)

Touch Display

Barclays has revealed that LG will likely support OLED display production for Apple’s 2019 iPhones, possibly followed by BOE as early as 2020. Apple is widely expected to launch 3 new iPhones in 2019, including 2 higher-end 5.8” and 6.5” OLED models and one lower-end 6.1” LCD model. (CN Beta, Mac Rumors)

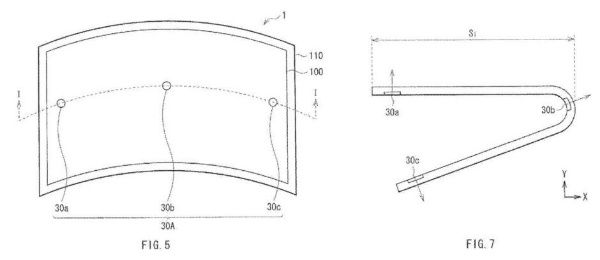

Sony’s new patent shows a flexible display with sensors in the screen. The flexible screen from Sony has at least 3 sensors—a pressure sensor, temperature sensor, and an acceleration sensor. Optionally, a photosensor and a resistance sensor can come in. These sensors can detect whether the user is holding the smartphone and how it is being held. (GizChina, Phone Arena, CN Beta)

According to CINNO Research, AMOLED panels in global smartphones industry accounts for 23.2% in 2018. This value will increase to 27.6% in 2019. However, in 1Q19, the global smartphone AMOLED panel shipments hit 86.7M, down 20% year-on-year. In terms of market share, Samsung is still the world’s largest supplier of AMOLED mobile phone panels. Samsung AMOLED panel has a market share of 85.7%. Nevertheless, this is the first time that Samsung’s AMOLED market share plunges below 90%. (GizChina, My Drivers, CN Beta)

Camera

Apple has reportedly asked its supply chain partner to supply vertical-cavity surface-emitting laser (VCSEL) components for use in rear ToF camera lens in its mobile devices to be released in 2020, according to Digitimes. This sensor will be able to measure distances up to 4.5m (15ft) away. (GSM Arena, GizChina, Digitimes, Digitimes, Bloomberg)

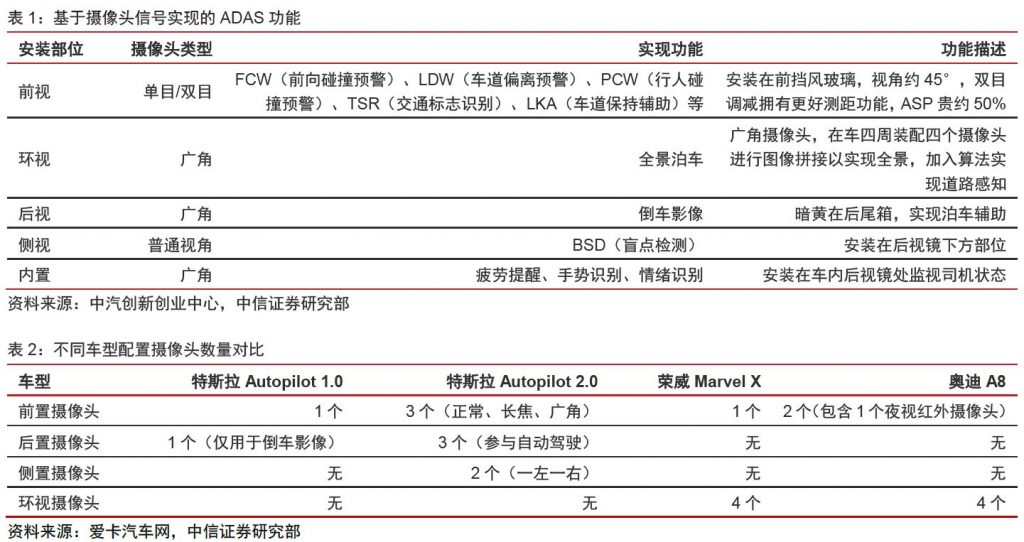

To achieve full self-driving, at least 5 types of cameras are needed, such as front view, surround view, rear view, side view, and built-in camera. In order to achieve more accurate recognition, 2-3 pieces of each camera type are needed. Tesla Autopilot 2.0 is equipped with 3 front cameras, 3 rear cameras and 2 side cameras for better image recognition performance, while the Autopilot 1.0 front/rear/side camera is 1/1/0 only. (CITIC Securities report)

According to IHS, the global automotive camera market in 2018 is USD9.7B. It is expected to reach USD13.3B in 2020 and with 2015-2020 CAGR of 16%. According to China Industrial Information Network, the top 3 global automotive camera market share is Panasonic, Valeo and Fujitsu, with market share of 20%, 11% and 10% respectively. The current industry CR3 is 41%, and the top ten companies in the world account for 96% of the market. (CITIC Securities report)

Memory

Toshiba Memory Holdings Corporation has announced that it will officially change its name to Kioxia Holdings Corporation on 1 Oct 2019. (CN Beta, My Drivers, AnandTech, Toshiba)

Battery

Contemporary Amperex Technology Limited (CATL) and Toyota Motor have announced that they have entered into a comprehensive partnership agreement for the stable supply and further development of New Energy Vehicle (NEV) batteries. The partnership covers a wide range of fields, including: supply of batteries, new technology development, product quality improvements, and the reuse and recycling of batteries. (My Drivers, CN Beta, 36Kr, Toyota, Electrek)

BYD Company and Toyota Motor have announced today that they have signed an agreement for the joint development of battery electric vehicles (BEVs). They will jointly develop sedans and low-floor SUVs as well as the onboard batteries for these vehicles and others with the aim to launch them in the Chinese market under the Toyota brand in the first half of the 2020s. (CN Beta, Bloomberg, Electrek, Toyota)

Connectivity

Vodafone Group has won conditional European Union approval for its EUR18.4B (USD20.7B) takeover of Liberty Global’s cable assets in Germany and eastern Europe. (CN Beta, Financial Times, Bloomberg, EU, Reuters, Telegraph)

Verizon has announced its latest 5G device Inseego 5G MiFi M1000, priced at USD650. 5G data is only offered with Verizon’s unlimited plan, which starts at USD90 per month (USD10 more per month than the LTE plan) and gets 50GB of 5G data per month before throttling (down to 3Mbps), and 15GB of LTE data (which gets throttled down to 600 Kbps once you use that up.) (The Verge, Verizon, Sina)

Phone

Apple is reportedly introducing SiriOS, which is a new operating system designed for HomePod but also IoT in general. Mangrove Capital Partners believes that the launch of SiriOS in 2020 will unleash huge innovation in the voice economy, which will be worth USD1T by 2025 (surpassing the growth of the mobile app economy). (GizChina, Pingwest, MacDaily News, WCCFTech, Mangrove, report)

Wearables

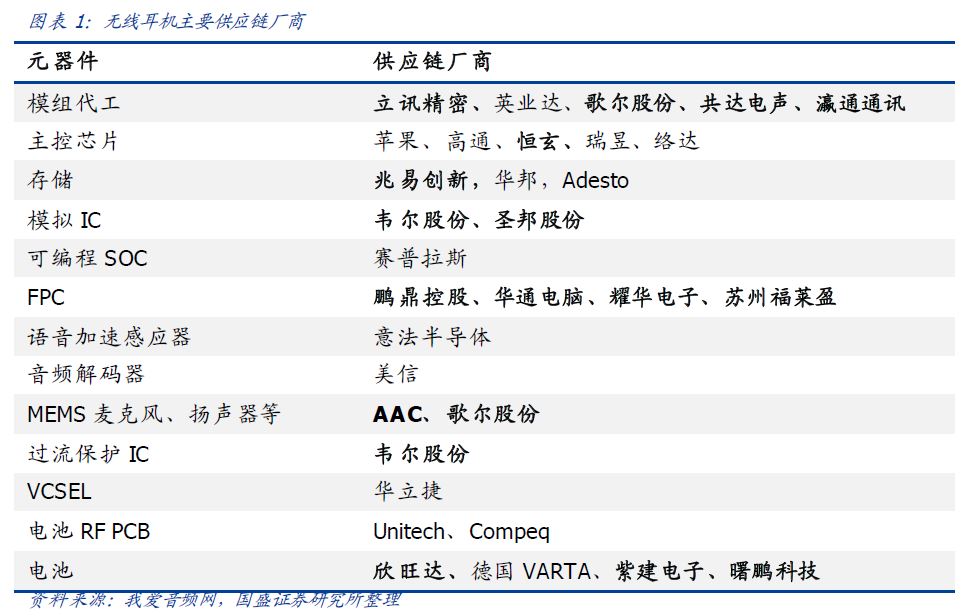

True wireless headsets have ushered in an explosive year in 2019, and sales continued to exceed expectations. Apple AirPods shipments continue to increase, Huawei Freebuds, Samsung Galaxy Buds, Xiaomi Air and other brands, white-brand wireless headsets have ushered in explosive growth, mainly for OEM / ODM manufacturers, master control, simulation, storage, etc. have brought considerable performance. (Guosheng Securities report)

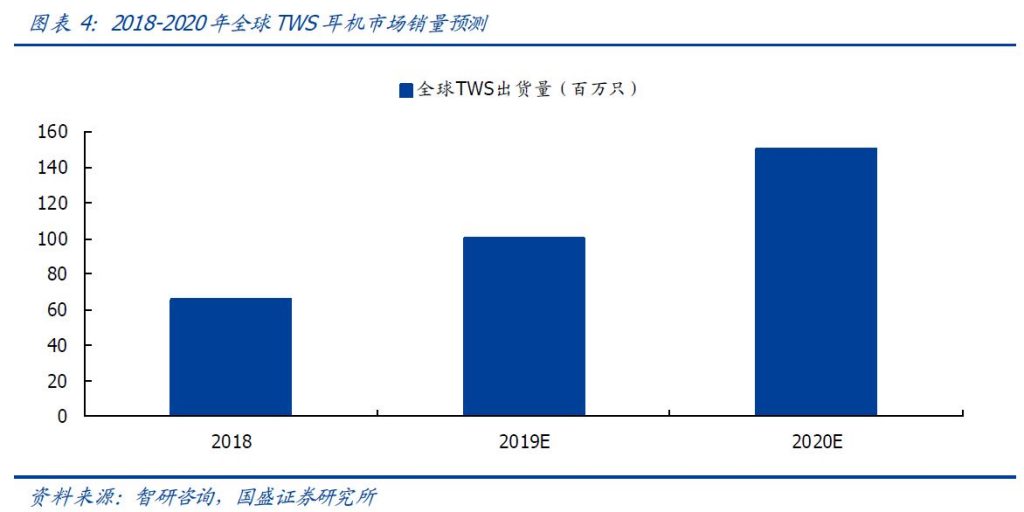

According to Counterpoint and KGI, in 2016 true wireless stereo (TWS) headset shipment is only 9.18M units. Sigmaintell expects the shipment will grow rapidly within 2018-2020, with shipment reaches 65M, 100M and 150M units, CAGR of 51.9%. (Guosheng Securities report)

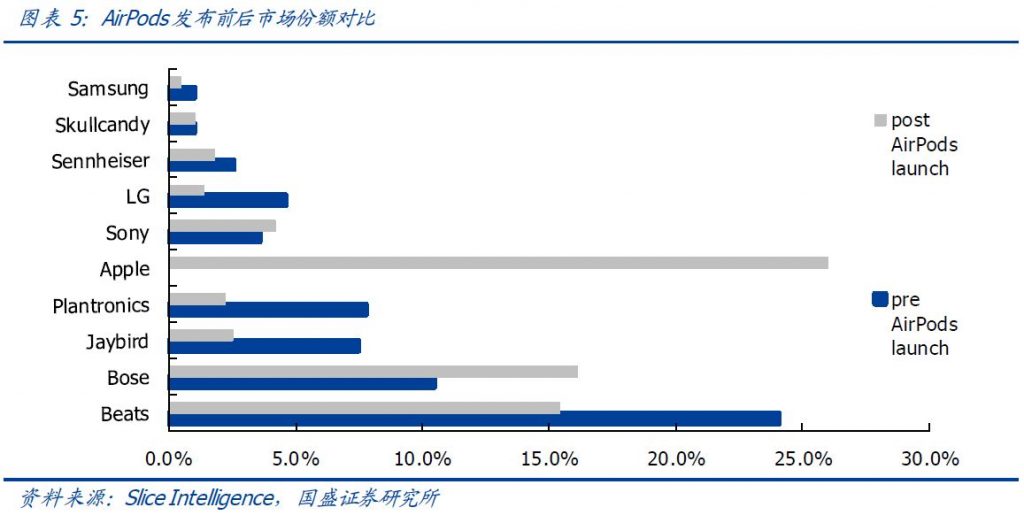

According to Slice Intelligence, 1 month after Apple AirPods is launched, it has gain 26% market share, exceeding Beats and Bose. According to Counterpoint, in 4Q18, AirPods shipment has gained 60% market share, reaching 12.5M units. (Guosheng Securities report)

Automotive

BMW and Tencent are teaming up to launch a computing center in China that will help develop self-driving cars in the world’s biggest auto market. The computing center, which will start operations by the end of the year, will provide cars with data-crunching capabilities to help them drive semi-autonomously and, eventually, autonomously. (Neowin, Reuters, Tencent)