08-11: Huawei plans to build an USD800M plant in Sao Paulo state over the next 3 years; OPPO has announced the completion of the first phase of its manufacturing facility in Greater Noida; etc.

Chipsets

GlobalFoundries (GF) has announced that it has used its 12nm FinFET process to tape-out a high-performance 3D ARM chip. GF believes that these high-density 3D chips will enable a “new-level of system performance and power efficiency for computing applications, such as AI/ML [artificial intelligence and machine learning] and high-end consumer mobile and wireless solutions”. (CN Beta, Sohu, Tom’s Hardware)

Touch Display

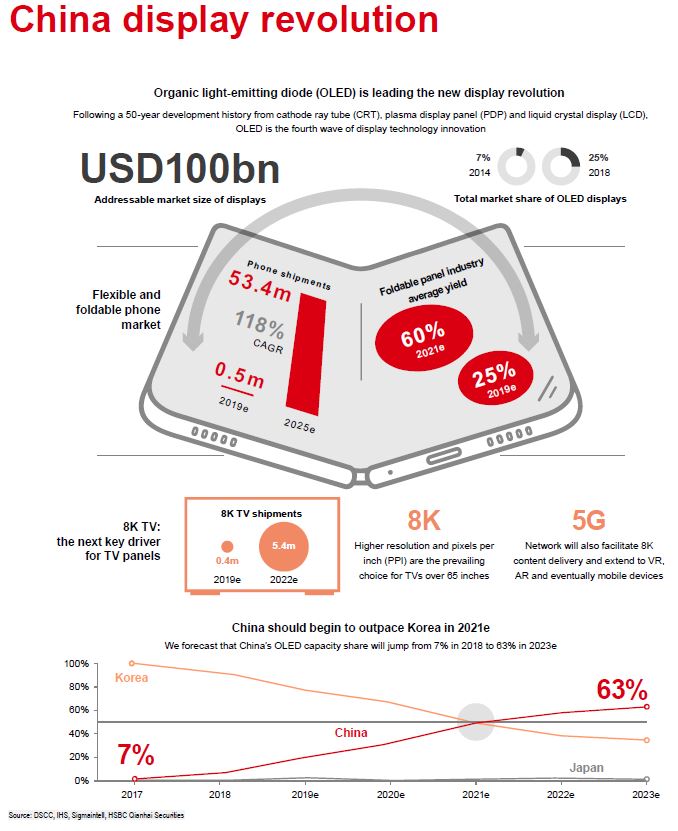

HSBC estimates the display industry’s addressable market size to be around USD100B in 2019 with OLED already taking considerable market share. HSBC sees that momentum continuing with OLED likely to capture 53% of market share in smartphone panel shipments in 2023 versus 26% in 2018, according to Sigmaintell. In the coming 3 years, HSBC believes flexible and foldable OLED, as well as 8K resolution display, will become the key growth areas for the display industry. They forecast foldable phone shipments increasing from 0.5M in 2019 to 53.4M in 2025, implying a 118% CAGR, with the penetration rate increasing. (HSBC report)

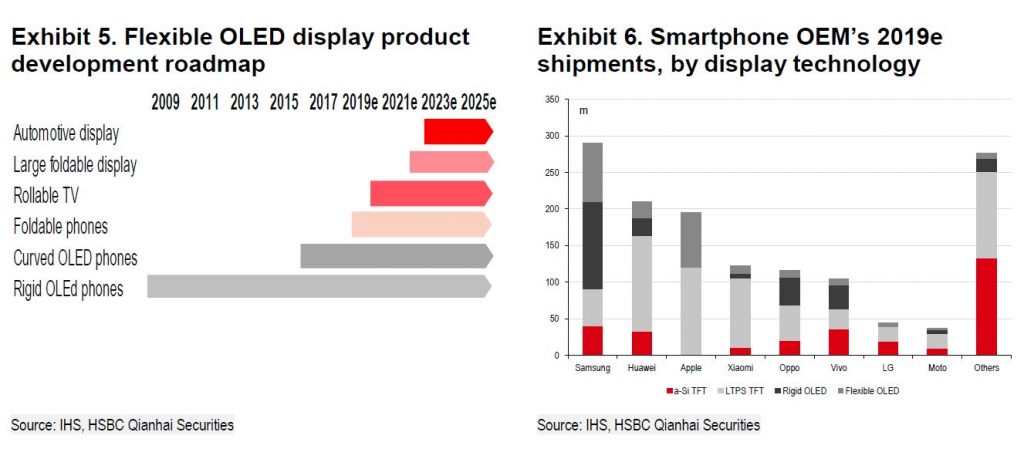

Major smartphone manufacturers have adopted OLED screens by varying amounts so far. Samsung is likely to lead the pack with a 70% adoption rate in 2019e, according to IHS Markit, while Apple, vivo and OPPO’s OLED adoption rate will reach 40% in 2019. Huawei and Xiaomi are catching up due to their wider product portfolio. However, excluding Samsung and Apple, flexible OLED’s adoption rate in other OEMs are generally less than 10%, suggesting substantial growth potential in the years ahead. (HSBC report)

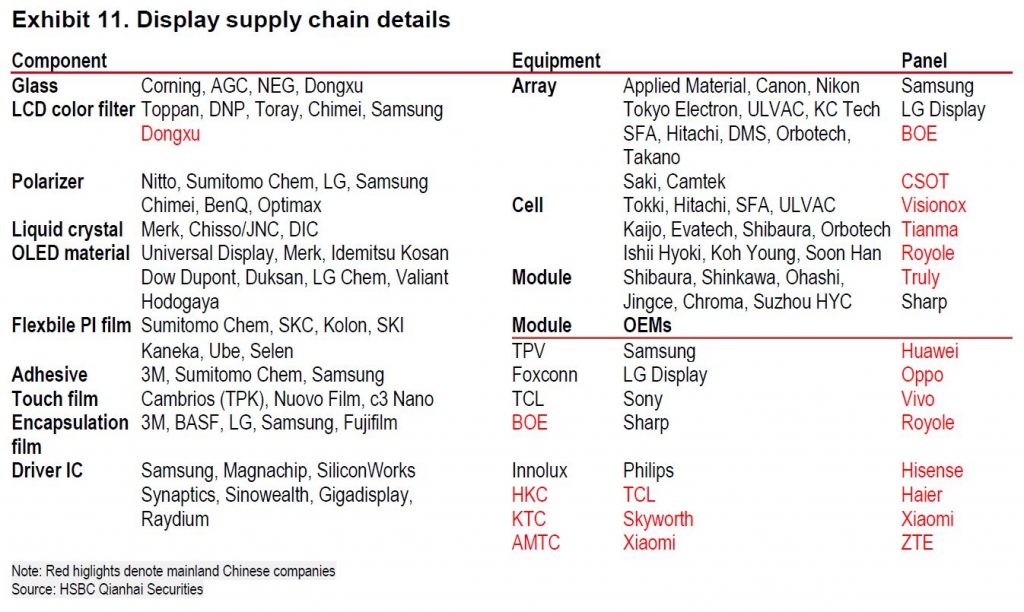

China relies heavily on imports for manufacturing materials and equipment needed to produce LCD and OLED, such as colour filters, polarisers and liquid crystal. In addition, Chinese equipment vendors are only strong in module testing and inspection area, with minimum exposure to array and cell level manufacturing. Therefore, HSBC sees a long path for China to migrate from a follower to a leader, and enhance its vertical integration level for the display supply chain. (HSBC report)

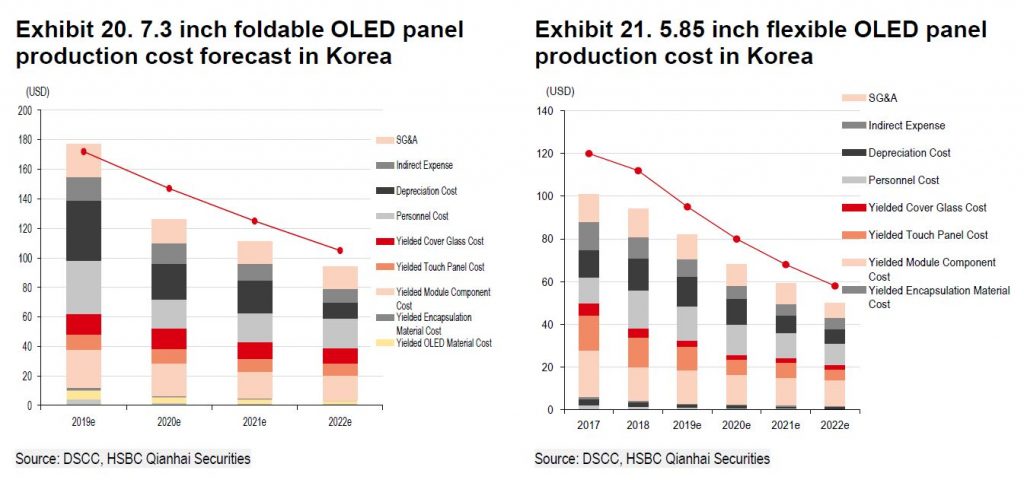

Over time, DSCC expects flexible and foldable OLED panel costs will decline to around USD50 and USD100 in 2022, respectively, implying an annual rate of decline of 15% and 19%, respectively. This is driven mainly by yield and utilization improvement, as well as decreasing amortization cost for fabs. The yield improvement is primarily driven by running some key evaporation equipment at a slower phase than normal, which can help to clean the process chambers and fine metal mask (FMM) equipment more frequently. The price decline should help drive wider adoption of foldable phones in the coming decade. (HSBC report)

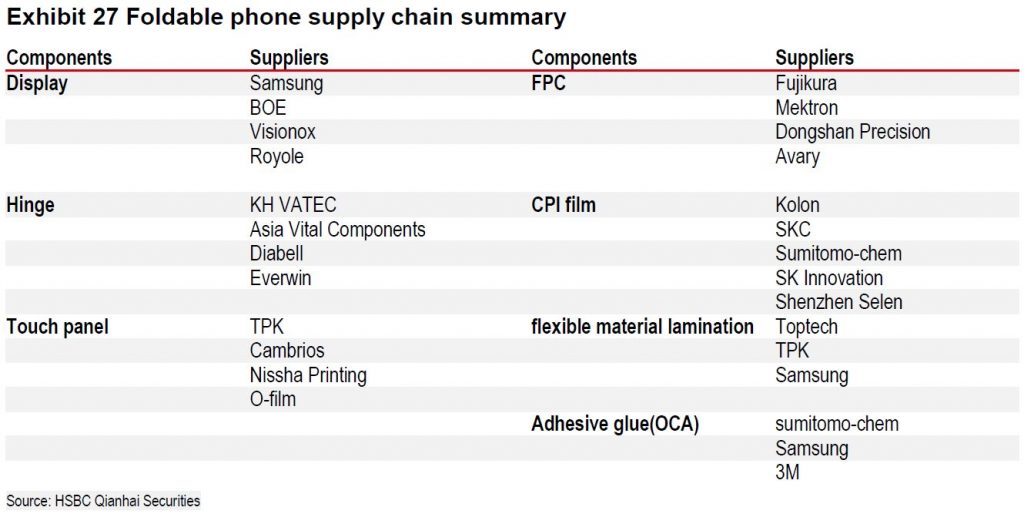

HSBC has consolidated the foldaphone phone supply chain, with display mainly contributed by Samsung Display, BOE, Visionox and Royale. (HSBC report)

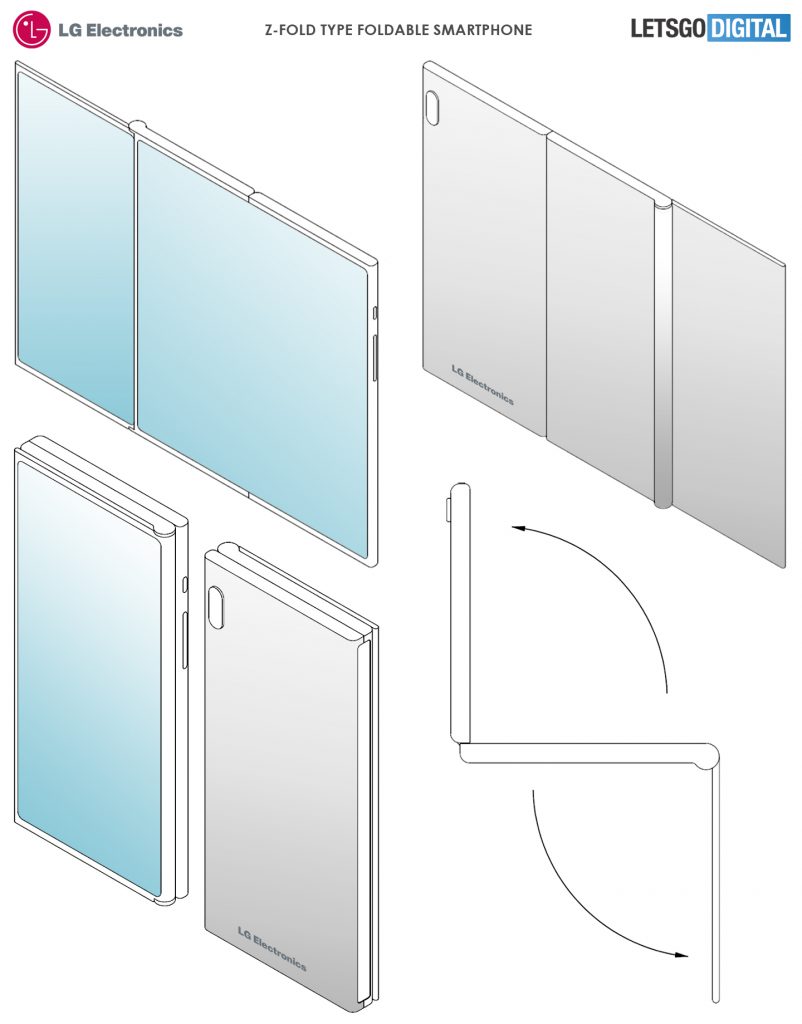

LG’s patent “Z-fold type foldable smartphone” combines a foldable display, bending inward with a separate second display, also mounted on a hinge in a rather clever way. The two outer segments appear to fold in on the middle one, positioning the separate display on the front of the folded-in device. (CN Beta, GSM Arena, LetsGoDigital)

Camera

Xiaomi has filed for a patent of a smartphone that includes what looks like a periscope zoom lens with WIPO. The patent shows a handset with an all-screen design and a pop-up selfie camera. (GizChina, 91Mobiles, My Drivers)

Apple’s next iPad Pro could come with a triple-camera array, while the regular 10.2” iPad might come with a dual-camera system. (Neowin, Phone Arena, Maco Takara, The Verge, Sina, IT Home)

Memory

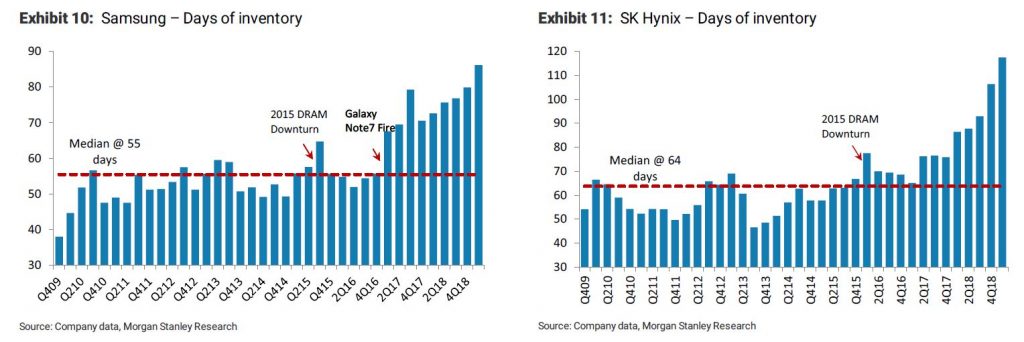

According to Morgan Stanley’s analysis: For DRAM, there is too much inventory on Samsung Electronics and SK Hynix balance sheets, which weighs on prices through Jul 2019; but they believe that capital spending in aggregate will decline 20% or more in 2019, as DRAM cash flows are declining sharply. For NAND, they think inventories are even higher, and while spending has declined by 75% at SK Hynix, they think that all vendors will consider cutting production to cope with excess supply. (Morgan Stanley report)

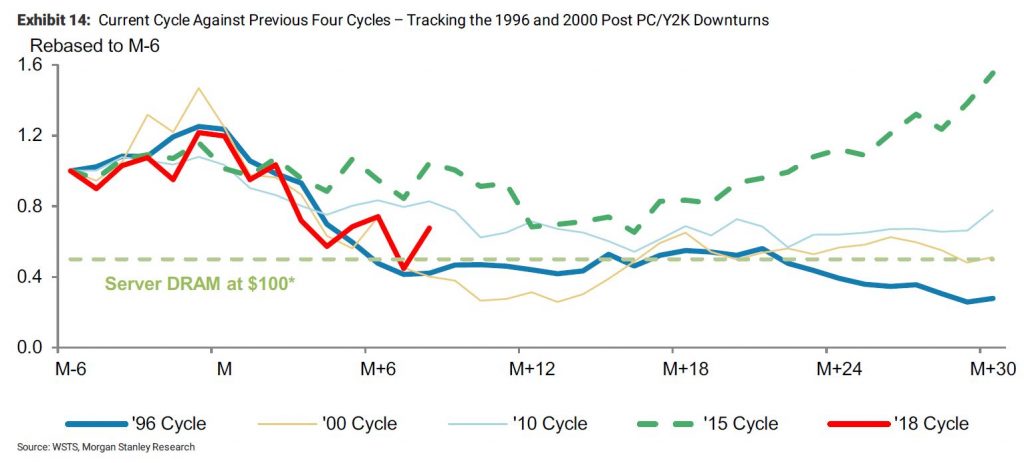

Morgan Stanley emphasizes that memory cycles have often been independent of tech seasonality and global downturns (e.g., 2004, 2015). What drives most memory cycles is supply, and the memory sales cycle is often independent of economic cycles – in the current cycle, supply has become the key driver, due to political tensions. Previous downturns were driven less by changes in demand and more by problems bringing in supply as quickly as people were expecting. Nevertheless global growth is an important driver for markets, and their economics team forecasts further slowing through 4Q19. (Morgan Stanley report)

Sensory

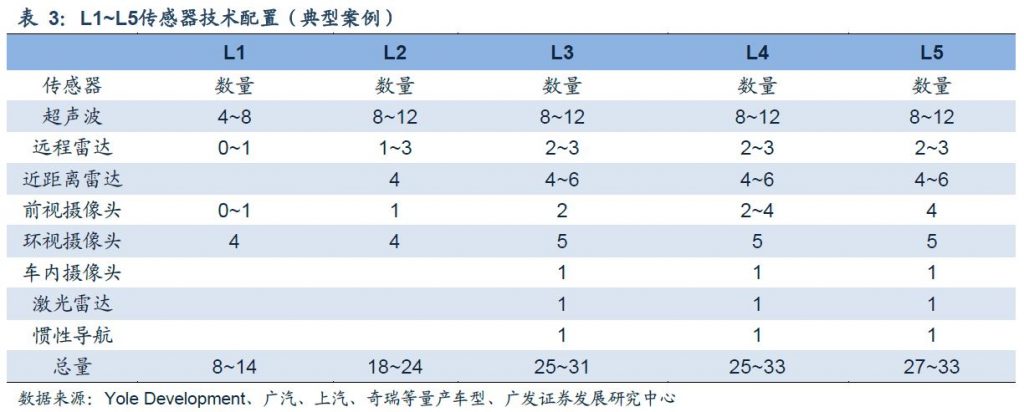

GF Securities consolidate: For different level of self-driving, there are different level of sensors configurations. Currently in China the mass-produced cars with level L1 (Cherry, Dong Feng, etc.) is equipped with 8 ultrasonic sensors, 1 front-view camera and 4 surround-view cameras. The mass produced cars with L2, such as GAC Aion S, SAIC Motor MarvelX, Changan CS75, etc., are equipped with 12 ultrasonic sensors, 1 forward-looking camera, 4 surround-view cameras and 3 millimeter-wave radars. (GF Securities report)

According to GF Securities, from the promotion plan of most leading automakers, the L3 class will land in 2020~2022, and the L4 class will land after 2020. Mercedes-Benz, Audi and other adopt relatively stable progressive development from L0 to L5; Ford, Volvo and other strategies are more radical, skipping L3 and launching L4. (GF Securities report)

Biometrics

Huawei’s engineering machine has demoed an LCD under display fingerprint scanner. Currently LCD panel has a wide market in the less than CNY2,000 price segment. It is speculated that Huawei will launch a phone feature LCD under display fingerprint scanner for its low-end models. The high-end flagships should still feature OLED display. (My Drivers, CN Beta, IT Home)

Material

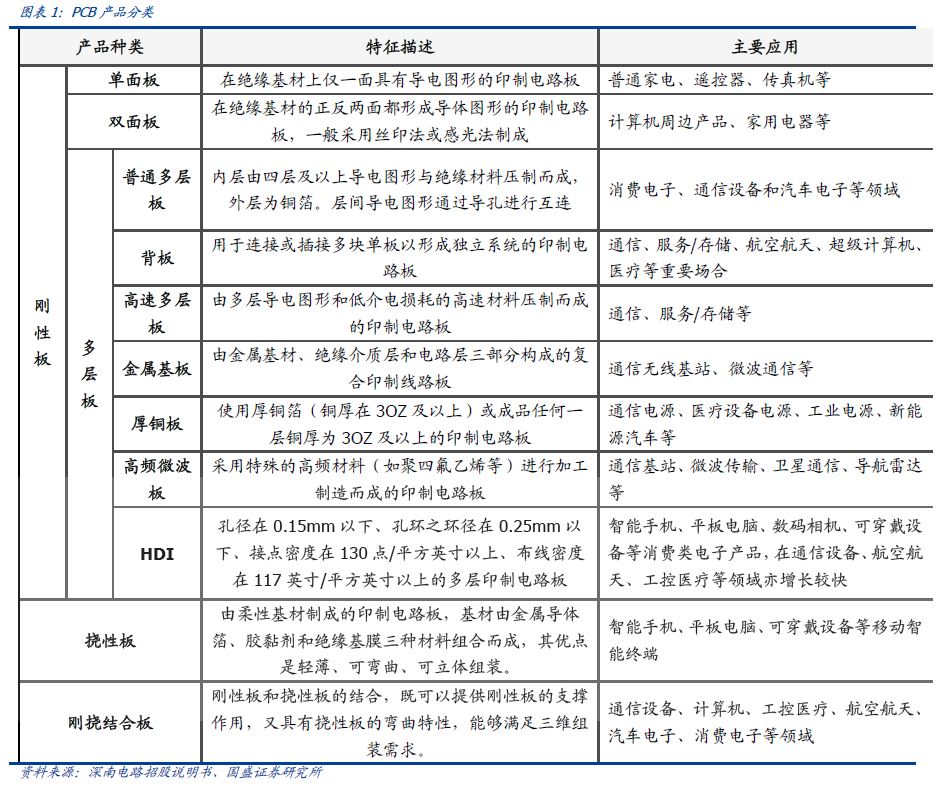

According to Guosheng Securities, PCBs can be divided into rigid boards (RPCB), flexible boards (FPC) and rigid-flex boards according to their hardness. They can be divided into single-panel, double-panel and multi-layer boards according to the number of layers. Due to the large number of downstream applications, the requirements for PCB boards are not the same. In the 5G era, the demand for high-frequency high-speed PCBs and other boards for 5G base stations is gradually increasing. (Guosheng Securities report)

According to Prismark, global PCB production value reached USD63.5B in 2018, up 8.0% year-on-year. China’s PCB output value reached USD33.4B, up 12.45% year-on-year. Although the growth rate of the PCB industry in the future is full, it still maintains a growing trend. Among them, the PCB growth rate in mainland China still maintains a good momentum on a global scale. (Guosheng Securities report)

Phone

Samsung Electronics and the United Nations Development Programme (UNDP) have announced a new partnership in support of the Sustainable Development Goals (SDGs), also known as the Global Goals. The Global Goals address some of the biggest challenges faced around the world, including those related to inequality, climate and environmental degradation, and education. (Neowin, Samsung, CN Beta)

Brazil’s Sao Paulo Governor João Doria has announced that Huawei plans to build an USD800M plant in Sao Paulo state over the next 3 years. The company is gearing up to build the plant to attend to Brazil’s first 5G spectrum auction, which is scheduled for March 2020. (CN Beta, Reuters, MSN)

OPPO has announced the completion of the first phase of its manufacturing facility in Greater Noida with which the company expects to double its manufacturing by 2020 from the current 4M smartphones a month. With the increased production and future export plans, they aim to achieve their dream of making India a global export hub for smartphone phones. (CN Beta, Business Line, BGR, India Times, NDTV)

Augmented / Virtual Reality

Google is making its new augmented reality (AR) walking directions, known now as Google Maps Live View, available to a much wider range of Android phones and Apple iPhone. (The Verge, VentureBeat, 93913)

Xiaomi has allegedly laid off the entire Mi VR / Go development team, consisting of a dozen employees who would otherwise have been responsible for maintaining and evolving the platform. Xiaomi has officially claimed that the production and sales of Mi VR are continuing for the time being. (VentureBeat, The Ghost Howls, Sohu)

Snapchat parent company Snap is looking to raise USD1B in convertible debt. The company plans to invest in more media content, augmented reality (AR) features, and may also buy other companies. (CNBC, VentureBeat, Business Insider)

Home

Huawei unveils Honor Vision smart TV, powered by Hongjun 818 (developed by HiSilicon), featuring 55” 3840×2160 4K full display with 94% screen ratio, full metal frame design, only 6,9mm thin, pop-up AI camera, and priced at CNY3799 or CNY4799. (CN Beta, My Drivers, Engadget CN, XDA Developers, TechRadar)

Automotive

Audi is releasing an electric scooter that combines the handlebar function of a scooter with the rider positioning of a skateboard. Audi says it will offer the e-tron Scooter for sale in late 2020 for around EUR2,000. (The Verge, Business Insider, Metro, Sina, Tencent)

Payment

Paytm, India’s biggest mobile payments firm, as 10M customers in Japan. Paytm entered Japan Oct 2018 after forming a joint venture with SoftBank and Yahoo Japan called PayPay. According to Paytm CEO Vijay Shekhar Sharma, PayPay is now supported by 1M merchant partners and local stores in Japan. (TechCrunch, Twitter)

J.D. Power found that awareness is already remarkably high for the Apple Card and many credit card customers are likely to apply when it becomes available – 38% of U.S. adults are already aware of it. Among those who are aware of the card, 35% say that they are somewhat or very likely to apply for the card. Those numbers are even higher among younger credit card customers. Among 18-29 year-olds, 52% are aware of the Apple Card. (Apple Insider, PED3.0, 9to5Mac)