12-15: Samsung has clarified that “1M sales of Galaxy Fold”; ZTE’s goal is clear and to become a 5G pioneer and lead innovation; etc.

Chipsets

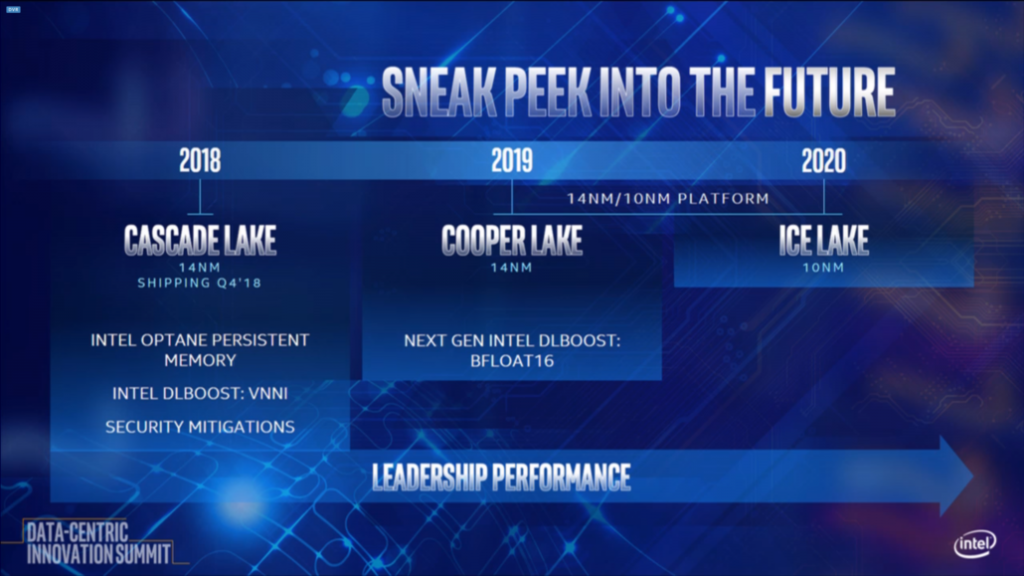

Intel has revealed that it will not be skipping 10nm to go directly to 7nm. Intel has claimed that it remains on track for delivery of the Whitley platform starting with production of Cooper Lake in 1H20 followed by Ice Lake production in 2H20. They are also on track to follow Whitley with the delivery of Sapphire Rapids in 2021. (Laoyaoba, WCCFTech)

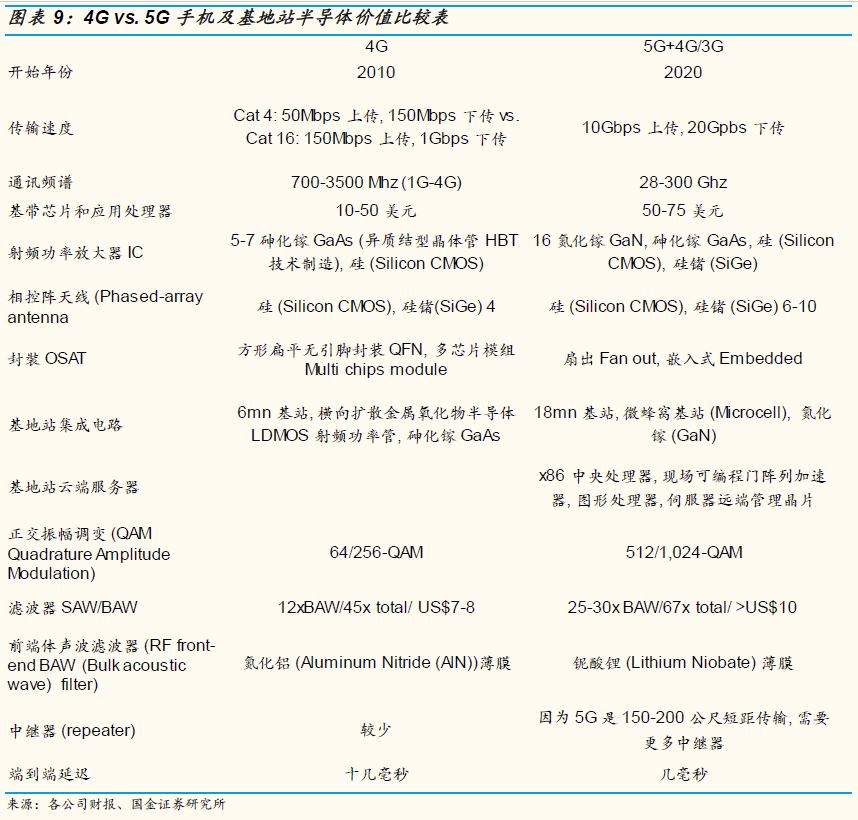

The yearly growth of the phone semiconductor market in 2020/2021 will greatly exceed the yearly growth in phone shipments, mainly because the semiconductor value used for each 5G phone is more than double of 4G phone. According to Sinolink Securities and Qualcomm, 5G mobile phones will grow from 5-10M units in 2019 to 180-220M units in 2020 and 400M units in 2021. The semiconductor value of each 4G smartphone (AP + baseband) will increase from USD20-40 to USD50-80 for a 5G smartphone, which drives the year-on-year growth of the global smartphone semiconductor market. (Sinolink Securities report)

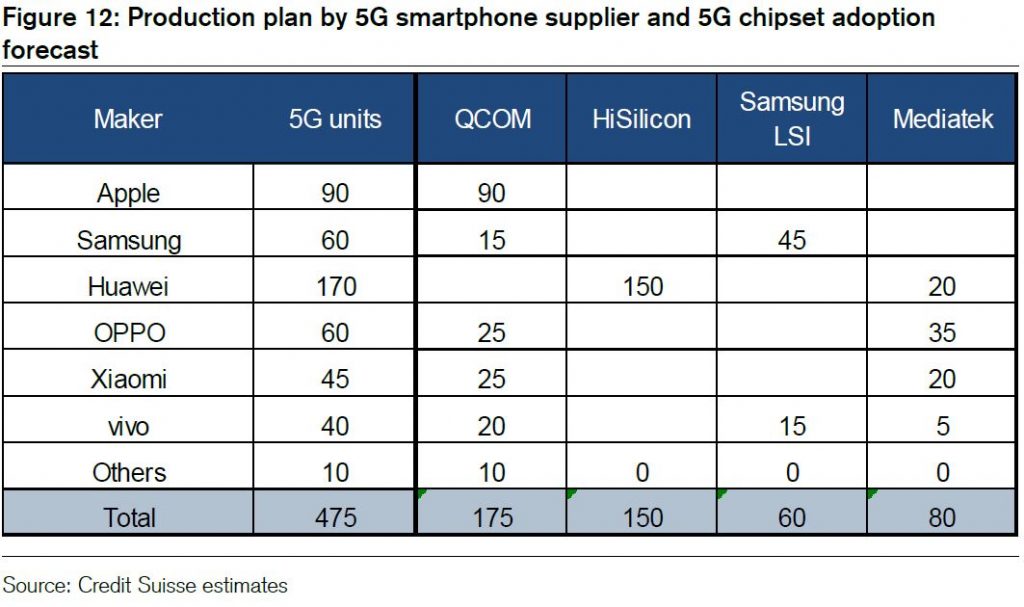

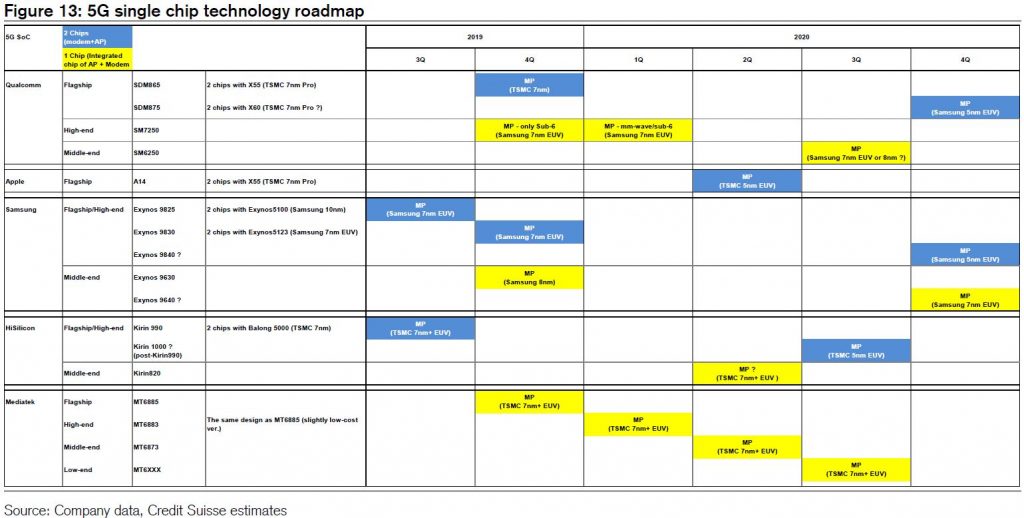

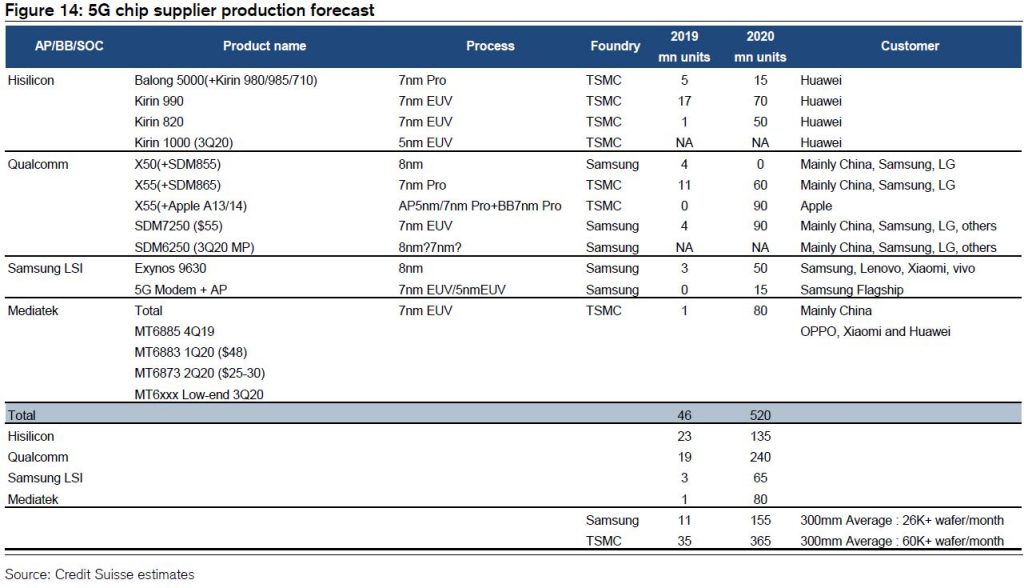

Credit Suisse reported in Sept 2019 that TSMC and Samsung LSI planned to produce a combined 515M 5G chipsets in 2020 (current plans total 520M chipsets), and global smartphone production was subsequently revised up to 470–480M units as of end-Nov 2019 after Chinese manufacturers raised their targets in Sept and again in Oct 2019. Credit Suisse expects 80–85% of chipset production to contribute to 2020 smartphone production. (Credit Suisse report)

According to Credit Suisse, specifically, production plans for the HiSilicon Kirin 820 for midrange Huawei phones (volume production from 2Q20) have been scaled back due to persistently high costs. It will be replaced with a downgraded version of the Kirin 990 (for flagship/high-end phones) and with Mediatek MT6873. Both of these are produced using TSMC’s 7nm+ (EUV) process, so there should be no particular mismatch between semiconductor capex and materials demand. (Credit Suisse report)

Touch Display

In regards to the report of 1M units Galaxy Fold sold, Samsung has clarified that “may have confused the figure with the company’s initial sales target for 2019, emphasizing that sales of the tech firm’s first foldable handset have not reached 1M units”. (GizChina, GSM Arena)

Camera

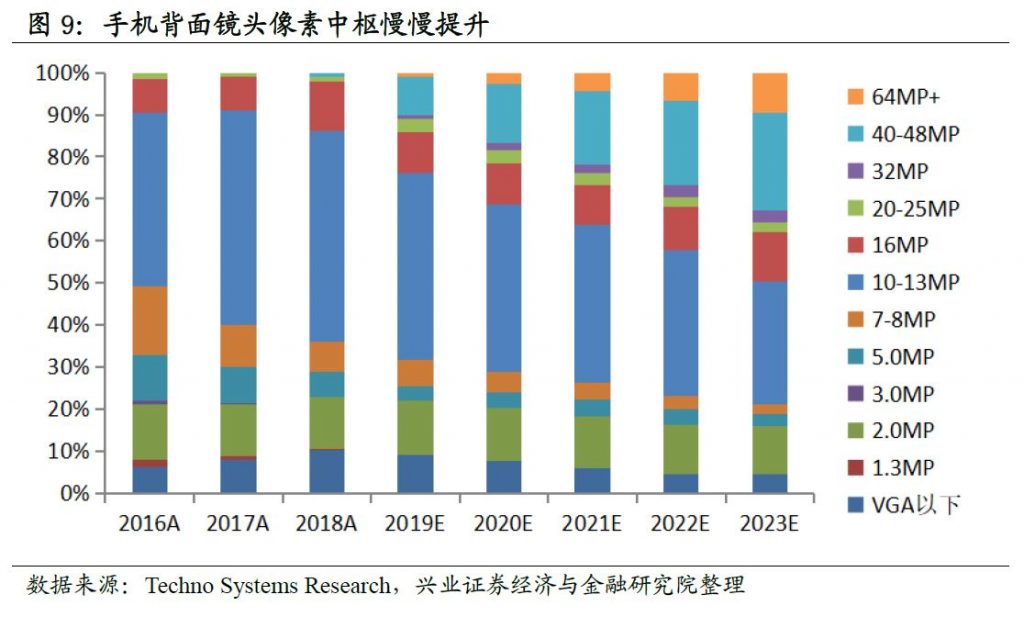

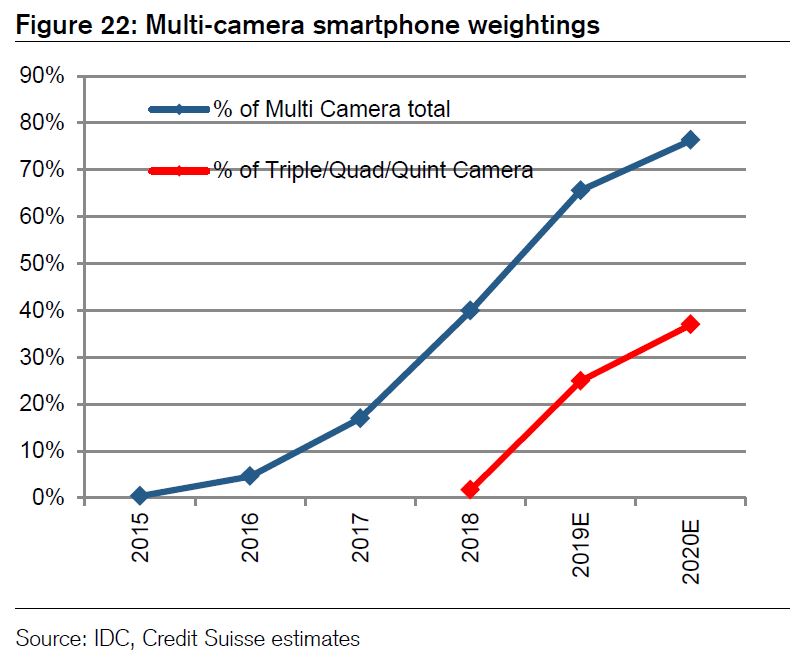

High pixels means high definition. For a time, high pixels were a big selling point for phone vendors. Many manufacturers have embarked on the road of “increasing the number of pixels and reducing the unit pixel area”. According to Industrial Securities, the penetration rate of phones with more than 10MP rear camera in 2016 has exceeded 50%, and it is estimated that by 2023, that will account for nearly 80%. It is estimated that in the next few years, among the high-end phones, 40-48MP mobile phones will be most favored by vendors, and penetration rate is expected to raise to 20% in 2020. (Industrial Securities report)

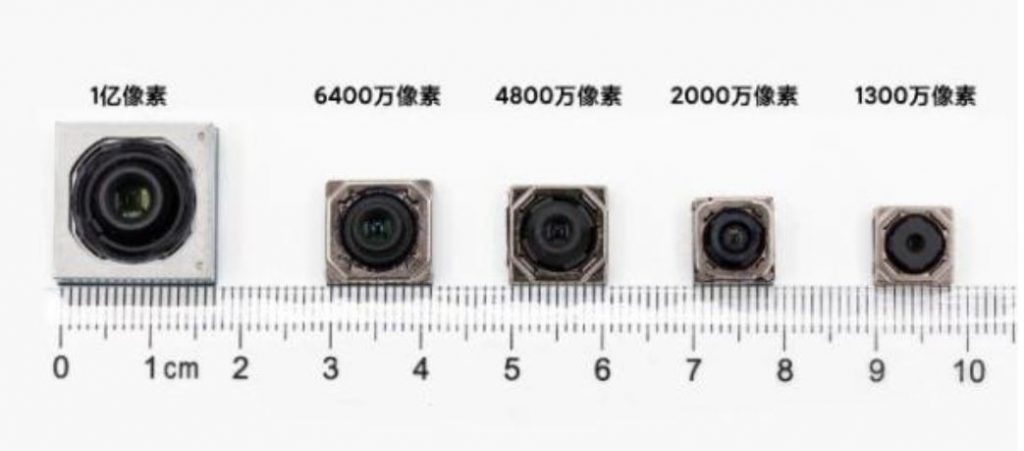

Xiaomi CC9 PRO features five rear cameras, which are the main camera + portrait + super telephoto + ultra wide angle + macro. The main camera has 109MP. Sensor, which not only challenges the internal structural space of the phone, but also puts forward higher requirements on the lens and the motor. This mass-produced multi-megapixel phone officially puts the phone lens into the “billion era”. (Industrial Securities report)

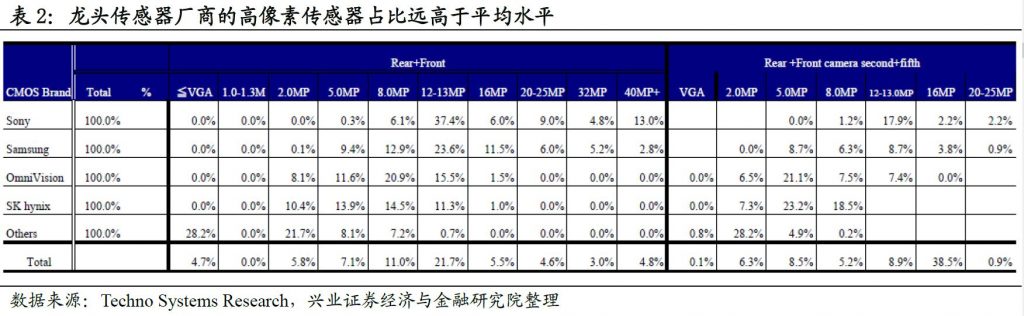

According to the prediction of Techno Systems Research, the penetration rate of the main camera sensor of the front and rear 2H19 cameras is 12-13MP, accounting for 21.7% of the sensor ratio. Sensor supplier leader Sony ’s high-pixel sensors account for much higher than average levels, which indicates that “higher pixels” are still the common choice of leading mobile phone vendors with increasing concentration in the downstream, and high-pixel mobile phones will continue to become Megatrends in mobile phone upgrades. (Industrial Securities report)

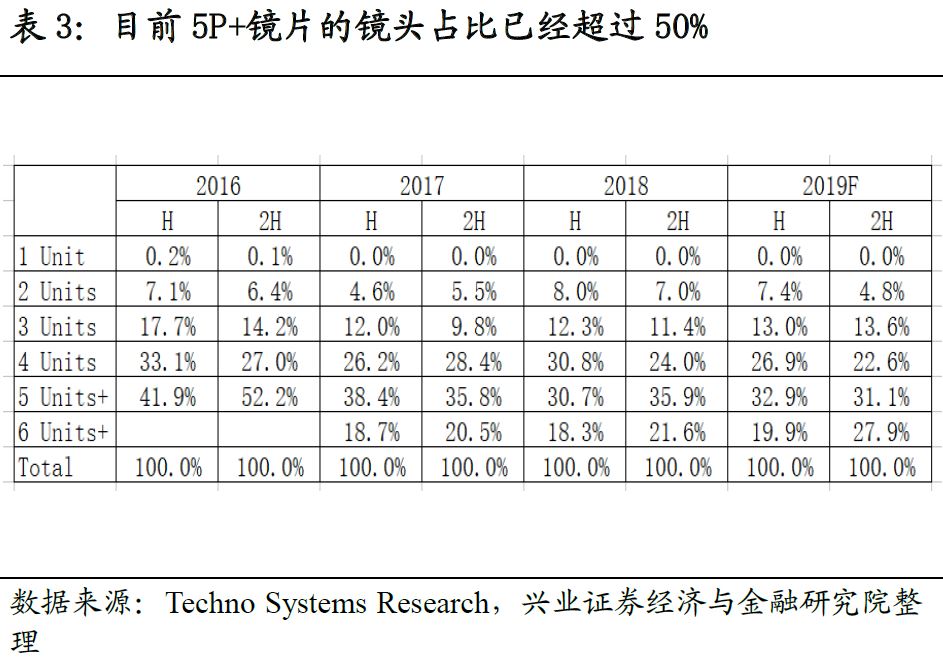

Currently, most mobile phone lenses on the market are composed of 4-5 lenses, and some high-end smartphones have already adopted 6 or more lens configurations. With the advent of periscope lens technology, the number of lenses is no longer limited by the thickness of the phone. It is expected that the average center of lens numbers will continue to move up in the future. The penetration rate of 6P + lenses in 2H19 is expected to exceed 28%. (Industrial Securities report)

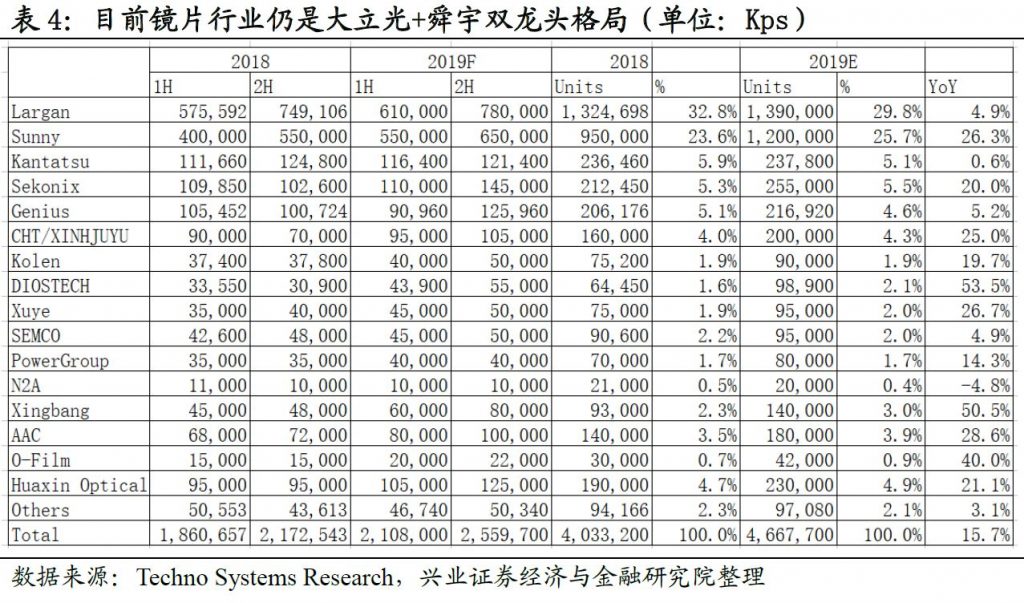

The lens industry is still a duopoly of Largan Precision and Sunny Optical, with a market share of 55%. Leader Largan has a 5% growth in 2019, which is lower than the industry‘s average growth of 15%, and its market share has also declined. While Sunny continues to develop new customers, intensive cultivation, and continuous high R&D investment, its share may gradually challenge Largan. (Industrial Securities report)

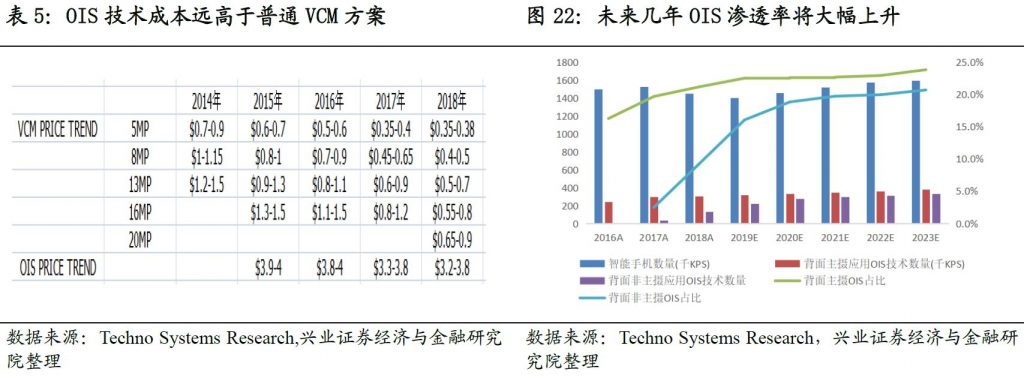

According to Techno Systems Research, the penetration rate of the rear main camera OIS market in 2018 is about 20%, while the three major brands of Apple, Samsung and Huawei accounted for 95% of the total OIS. Other phone vendors have not yet followed up due to cost considerations. It is reported that some series of Xiaomi in 2020 will use dual OIS configuration. Considering that the back of the three major brands of non-main camera lenses and other Android brands have low penetration of the main camera OIS, it is expected that by 2023, the OIS of non-main camera lenses will also be aligned with the main camera lens, and the penetration rate of OIS will increase rapidly. (Industrial Securities report)

According to Credit Suisse, Samsung Electronics is winding down production of low-pixel-count CISs (16MP and below) and preferentially allocating logic manufacturing capacity to 24MP/48MP and above CISs. Omnivision is benefiting from this in particular and has raised prices by around 15% in 4Q19. This is causing CIS market conditions to improve rapidly. (Credit Suisse report)

Memory

According to UBS tracking of DRAM, by end 2019 the DRAM inventory levels unlikely to have normalized; by 2H20 the supply will have modest re-acceleration; in 2020 mobile DRAM demand bit growth will reach 21%; server DRAM demand is driven by Ice Lake CPU in 2H20; and by 2021 China DRAM industry build up (less than 1% industry supply). (UBS report)

Based on UBS’ NAND tracking, NAND inventory levels are largely normalize by 4Q19; Net wafers will start growing again in 2020 driving supply growth; price elasticity starting to kick in driving the NAND flash demand; Samsung’s NAND flash strategy is to accelerate capacity ramp in 2020; and also in 2020 YMTC will enter the NAND flash market in 2020. (UBS report)

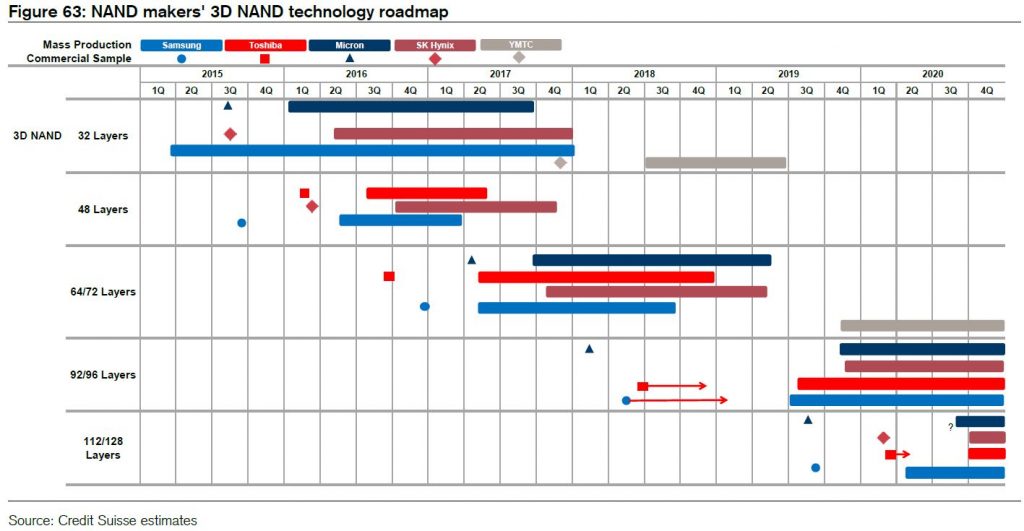

With regard to 3D NAND multilayer investment, 9-x layer products have already reached the mass-production stage but makers other than Samsung Electronics are experiencing issues with production yield and chip performance, and are not yet ready to expand production capacity to volume production level. Samsung Electronics has apparently achieved stable mass-production with a yield of over 90%, and Credit Suisse estimates this makes it substantially more cost competitive than its competitors. (Credit Suisse report)

Sensory

The semiconductor value of each SAE Level 5 self-driving vehicle may be more than 10 times of a gasoline vehicle in 2019. The most basic Power MOSFET estimated by Sinolink Securities will require more than 10 times more. Cameras, CIS , Radar sensor, MLCC, power management chip requires 5 times more, 2 times for the sensor, not to mention a large number of RF power amplifiers, wired communications, AI, and a variety of power chips, which will drive the global car in the next 20 years with a 5-10% CAGR in the semiconductor market, the semiconductors value per vehicle will be less than 3% in 2019, even if the global gasoline / electric vehicle shipments in the next 20 years will increase by <5%. (Sinolink Securities report)

Connectivity

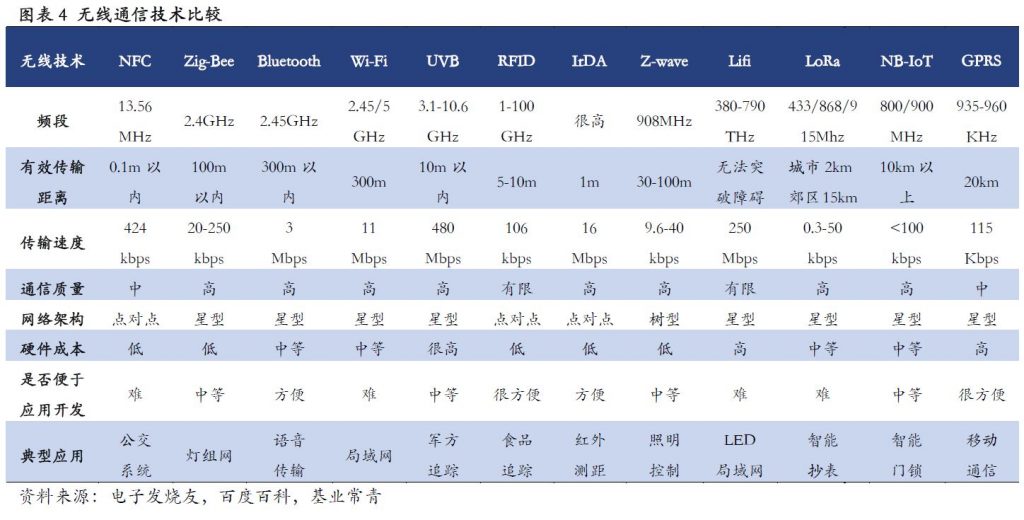

Wireless communication technology is mainly divided into wide area network and local area network, the difference is in transmission distance and communication protocol. LAN wireless communication technologies include NFC, IrDA, WIFI, Bluetooth, ZigBee, Z-Wave, UWB, RFID, LiFi, etc., and transmission is generally 0-300m; WAN wireless communication technologies include GPRS, LoRa, NB-IoT, etc. Distance is in kilometers. Bluetooth is one of the most important local area network (short-range) wireless communication methods. (Jiyechangqing report)

Phone

ZTE’s SVP and president of ZTE’s smartphone business unit Xu Feng has indicated that ZTE’s goal is clear and to become a 5G pioneer and lead innovation. With 5G, the company is going back to the mainstream of the market. ZTE plans to release over 10 5G devices in 2020. These will have a starting price of CNY3,000 (USD430), for high-end flagships. Meanwhile low to mid-range phones will go for CNY2,000 (USD280) or less. (GizChina, My Drivers)

Loup Ventures partner Gene Munster thinks the first year of Apple’s 5G for the iPhone will be a “disappointment for investors”. The switch to 5G is still a “massive opportunity for Apple”, Muster has indicated, but carrier rollouts of 5G will be the bottleneck in the process. (CNBC, My Drivers, 9to5Mac, Seeking Alpha)

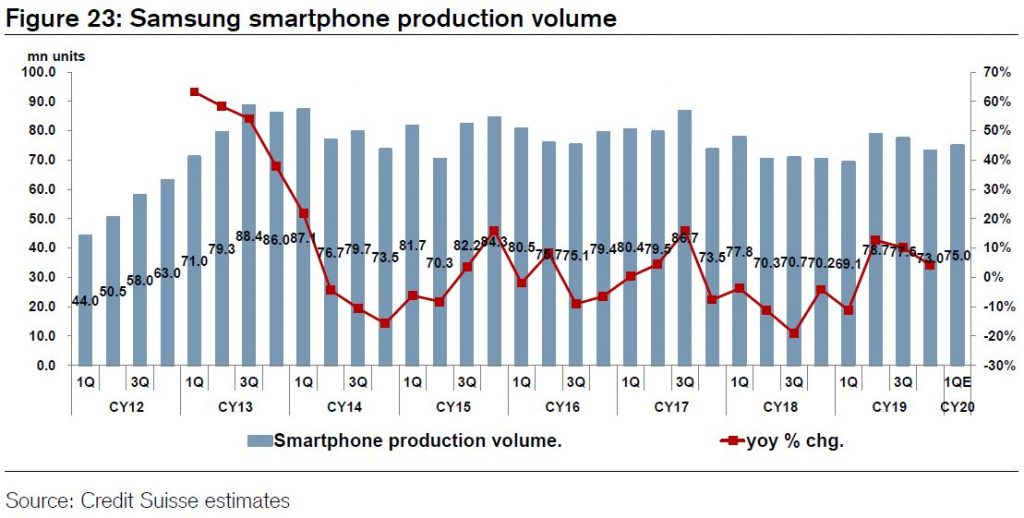

Credit Suisse understands that Samsung is expecting production to remain flat at 300M units in 2020, on the assumption that US blacklisting of Huawei restricting its access to Google Mobile Service will continue. Wingtech’s production is in full swing, starting with 2019 A10 and A20 series phones. Credit Suisse understands that outsourced production will be about 20M-25M units in 2019. It appears that the company plans for ODM production volume of about 60M units in 2020, but the ODMs are hoping for up to about 100M and are making inquiries to device manufacturers based on the hoped-for volume. (Credit Suisse report)

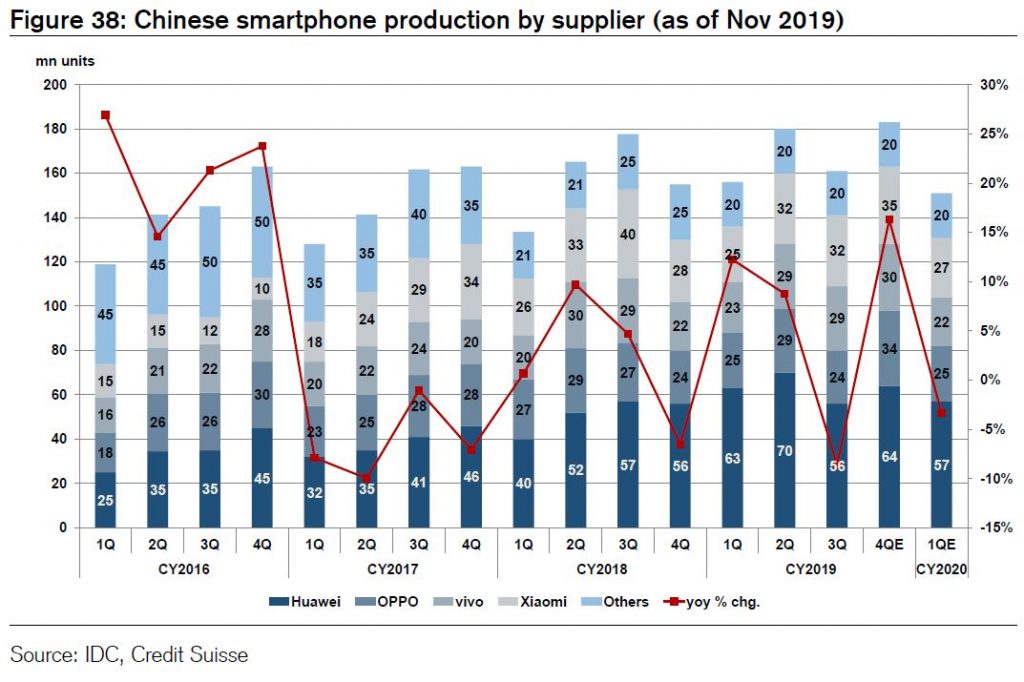

According to Credit Suisse, Huawei has restored its production plan to 250M units, and Xiaomi is targeting output of about 125M units and OPPO and vivo each around 110M units. Huawei appears to be increasing its share of the Chinese market, while OPPO and vivo are covering sluggish Chinese sales with sales in the ASEAN market and Xiaomi is compensating for stagnant Chinese and Indian sales with higher sales in Europe. (Credit Suisse report)

Wearables

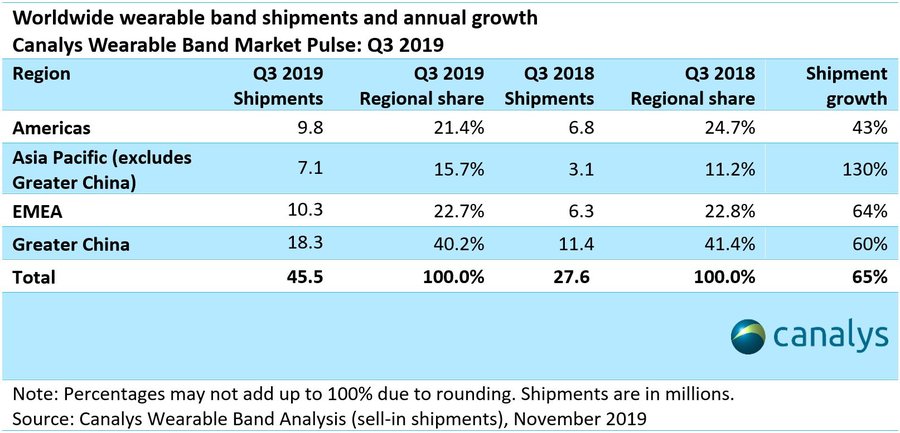

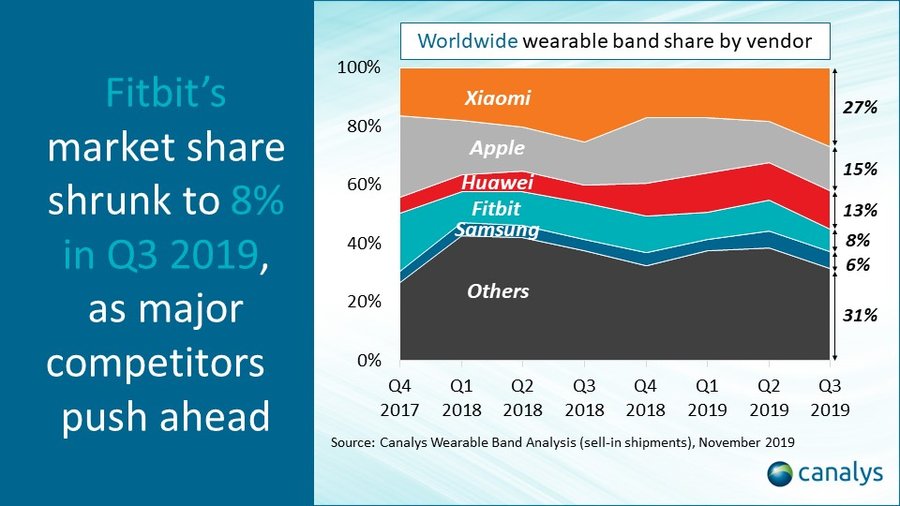

According to Canalys, the worldwide wearable band market has demonstrated clear signs of vigor in Q3 3Q19, growing 65% to a record 45.5M units, with strong momentum in Asia Pacific and Greater China. Greater China remains the largest region, contributing 40% of worldwide shipments and grew 60% year-on-year. On a global level, Xiaomi remained in top position shipping 12.2M wearable bands, growing 74% year-on-year. (Canalys, press, GizChina)

Automotive

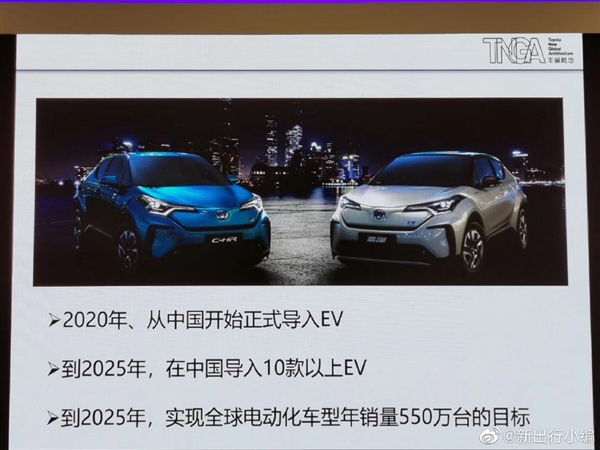

Toyota plans to launch pure electric vehicles (EVs) in the Chinese market in 2020, and this number will reach more than 10 models by 2025. Toyota also aims by 2025, the global sales of EVs to reach 5.5M units. (CN Beta, China Daily)

Volkswagen AG will help develop a fleet of self-driving electric shuttles for use in Qatar’s capital Doha in 2022. Volkswagen and the Qatar Investment Authority have signed an agreement for the self-driving Level 4 electric vehicles. (TechCrunch, Bloomberg)

Pingback:VGA to Stay in Smartphones – Machine.Vision

Pingback:VGA to Stay in Smartphones | Tech Mirror