5G Info Consolidation — Prelim

This is a tiny report consolidating the data available publicly in regards to 5G smartphones, with respect to shipment forecast, market leaders expectation, BOM and ASP predictions, etc.

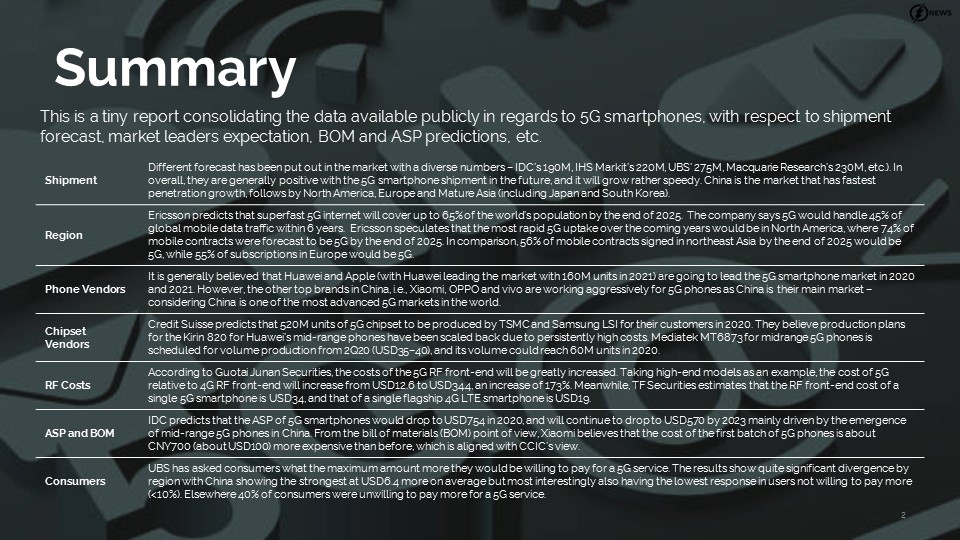

Different forecast has been put out in the market with a diverse numbers – IDC’s 190M, IHS Markit’s 220M, UBS’ 275M, Macquarie Research’s 230M, etc.). In overall, they are generally positive with the 5G smartphone shipment in the future, and it will grow rather speedy. China is the market that has fastest penetration growth, follows by North America, Europe and Mature Asia (including Japan and South Korea).

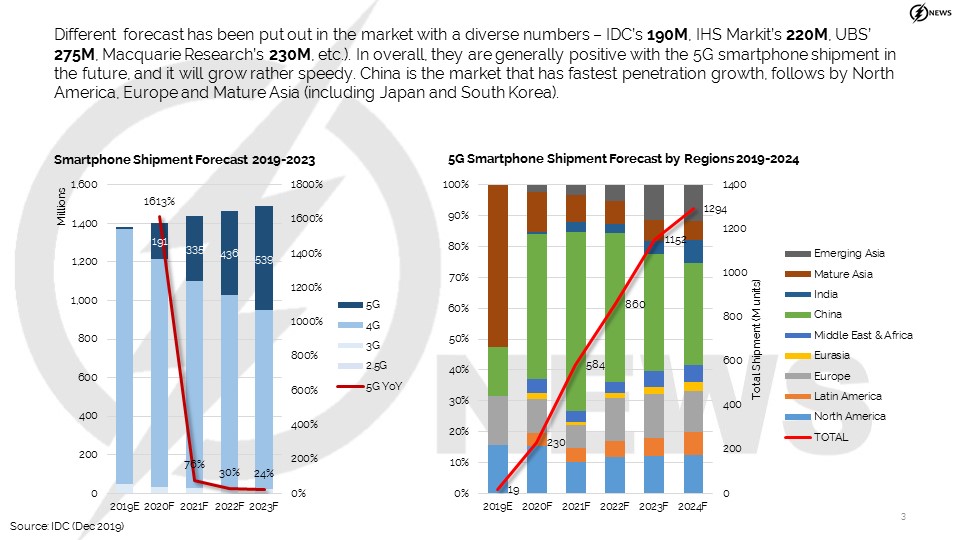

Ericsson predicts that superfast 5G internet will cover up to 65% of the world’s population by the end of 2025. The company says 5G would handle 45% of global mobile data traffic within 6 years. Ericsson speculates that the most rapid 5G uptake over the coming years would be in North America, where 74% of mobile contracts were forecast to be 5G by the end of 2025. In comparison, 56% of mobile contracts signed in northeast Asia by the end of 2025 would be 5G, while 55% of subscriptions in Europe would be 5G.

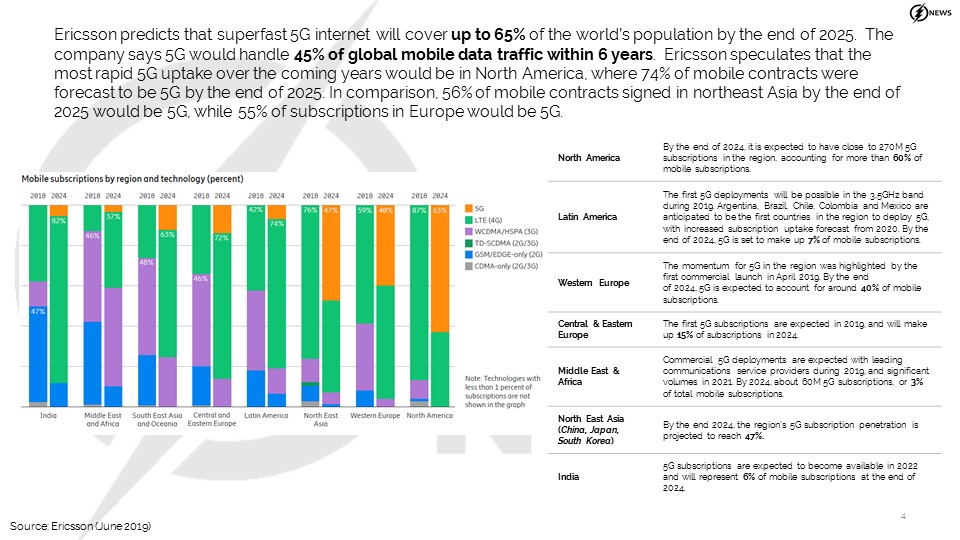

It is generally believed that Huawei and Apple (with Huawei leading the market with 160M units in 2021) are going to lead the 5G smartphone market in 2020 and 2021. However, the other top brands in China, i.e., Xiaomi, OPPO and vivo are working aggressively for 5G phones as China is their main market – considering China is one of the most advanced 5G markets in the world.

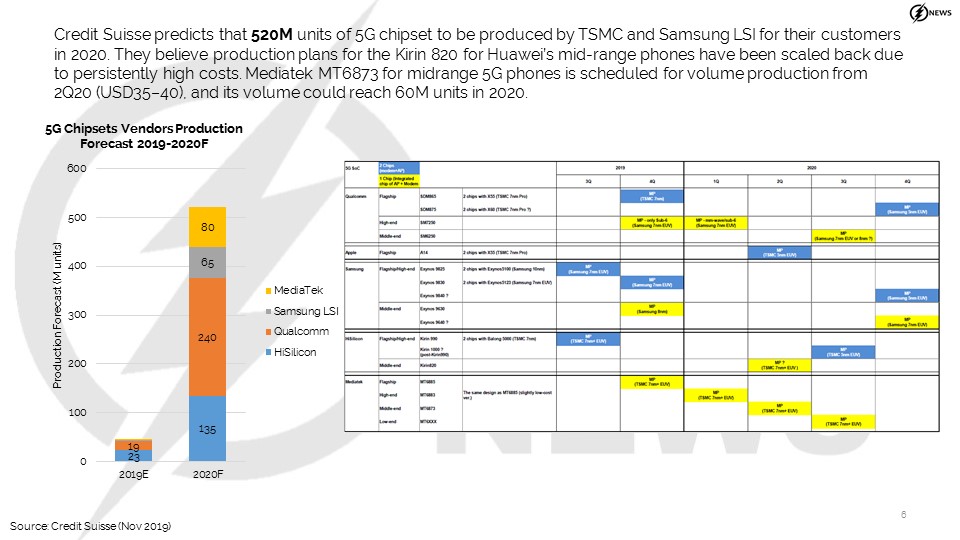

Credit Suisse predicts that 520M units of 5G chipset to be produced by TSMC and Samsung LSI for their customers in 2020. They believe production plans for the Kirin 820 for Huawei’s mid-range phones have been scaled back due to persistently high costs. Mediatek MT6873 for midrange 5G phones is scheduled for volume production from 2Q20 (USD35–40), and its volume could reach 60M units in 2020.

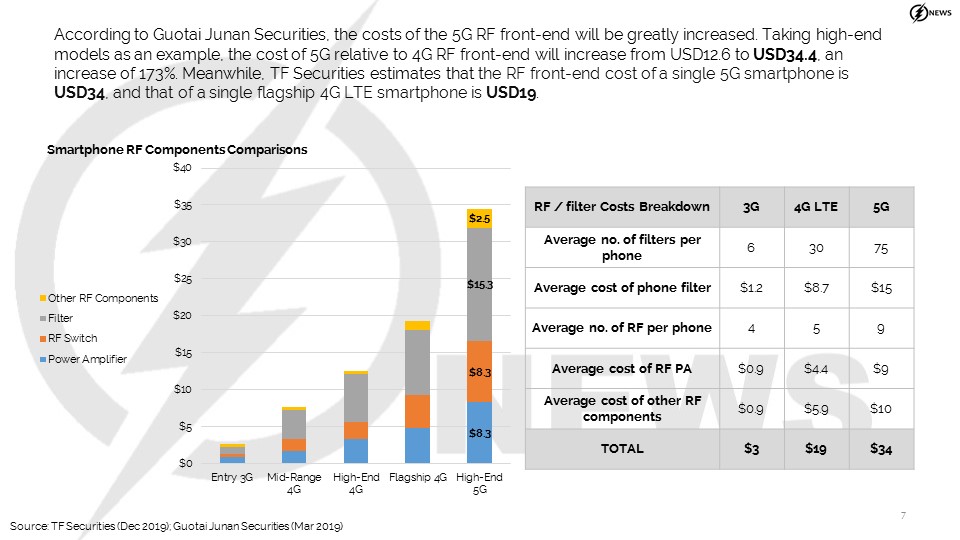

According to Guotai Junan Securities, the costs of the 5G RF front-end will be greatly increased. Taking high-end models as an example, the cost of 5G relative to 4G RF front-end will increase from USD12.6 to USD34.4, an increase of 173%. Meanwhile, TF Securities estimates that the RF front-end cost of a single 5G smartphone is USD34, and that of a single flagship 4G LTE smartphone is USD19.

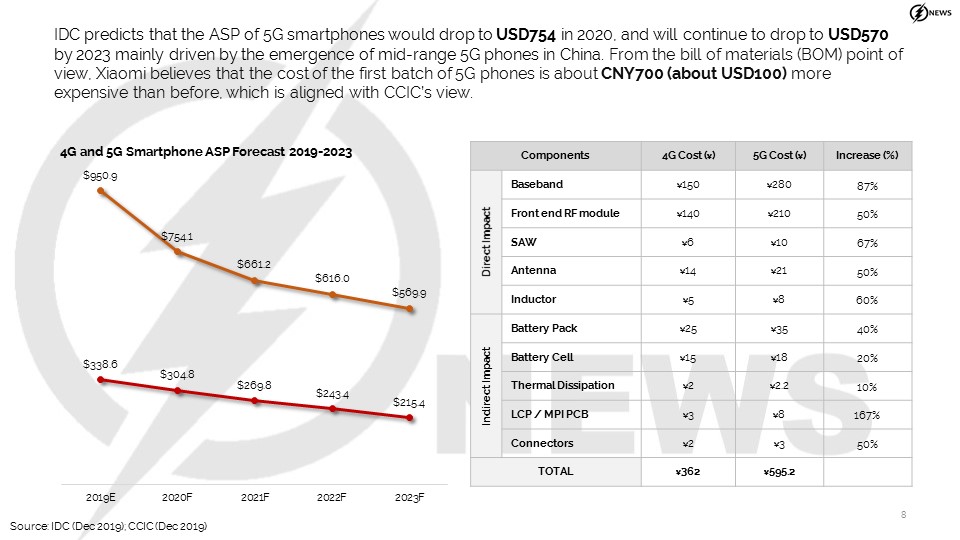

IDC predicts that the ASP of 5G smartphones would drop to USD754 in 2020, and will continue to drop to USD570 by 2023 mainly driven by the emergence of mid-range 5G phones in China. From the bill of materials (BOM) point of view, Xiaomi believes that the cost of the first batch of 5G phones is about CNY700 (about USD100) more expensive than before, which is aligned with CCIC’s view.

UBS has asked consumers what the maximum amount more they would be willing to pay for a 5G service. The results show quite significant divergence by region with China showing the strongest at USD6.4 more on average but most interestingly also having the lowest response in users not willing to pay more (<10%). Elsewhere 40% of consumers were unwilling to pay more for a 5G service.