3-8 Happy International Women’s Day: K Hynix has developed four new CMOS image sensors under its new brand “Black Pearl”; Microsoft has demonstrated its ability to generate 3D-shaped images based on unstructured 2D images; etc.

Touch Display

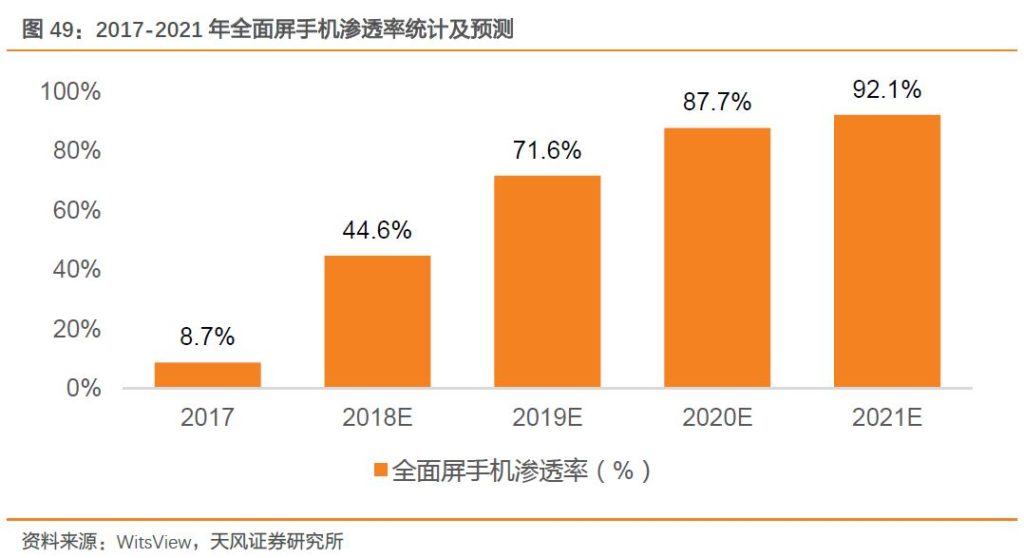

According to Witsview data, the full-display penetration rate jumped to 44.6% in 2018, and will continue to climb rapidly to 71.6% in 2019; it is expected that the penetration rate of full-display mobile phones will reach 92.1% by 2021, becoming the standard configuration for smartphone display. (TF Securities report)

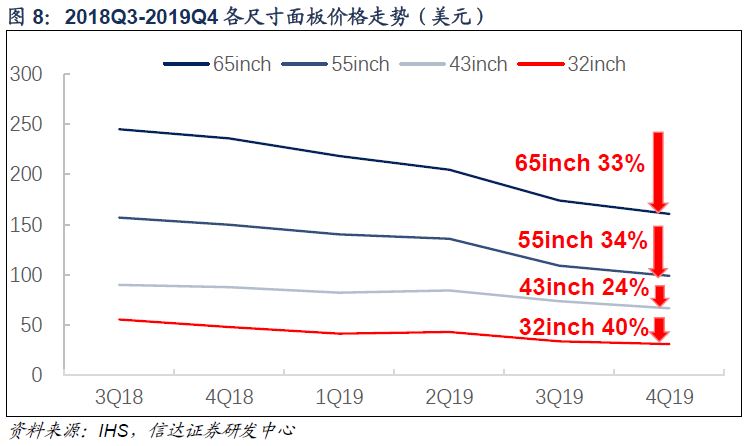

According to WitsView, the current mainstream panel sizes include 32”, 43”, 55” and 65”. Among them, the price of 32” in Dec 2019 decreased by 44.64% compared with Sept 2018; 43” decreased by 25.27%; 55” decreased by 35.67%; 65” decreased by 33.88%. It can be seen that the price of 32” panels has fallen the most in the past 1 year, while the price of 43” panels has fallen relatively little. (Cinda Securities report)

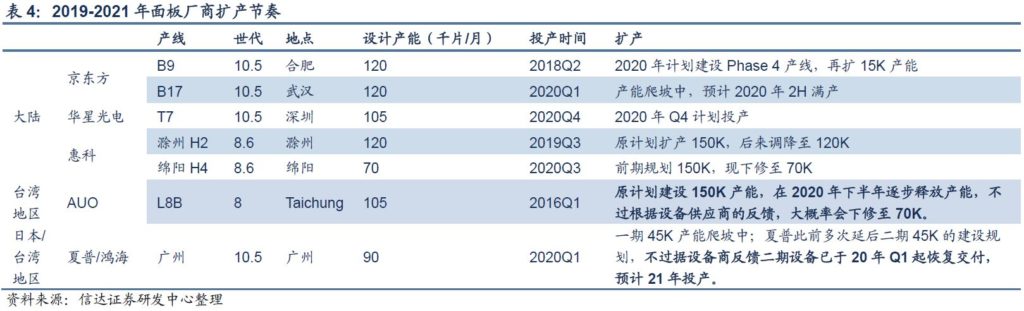

In addition to reducing the production rate, non-leading panel manufacturers have slowed down the pace of expansion, while Korean manufacturers with poor net profit have reopened their capacity exit plans. Cinda Securities based on industry chain surveys consolidating the production capacity withdrawal / reduction plans for Japanese, Korean, and Taiwanese manufacturers in 2019-2021. For comparison, companies with expansion plans in 2019-2021 are mainly located in BOE, CSOT, HKC, Sharp and AUO. (Cinda Securities report)

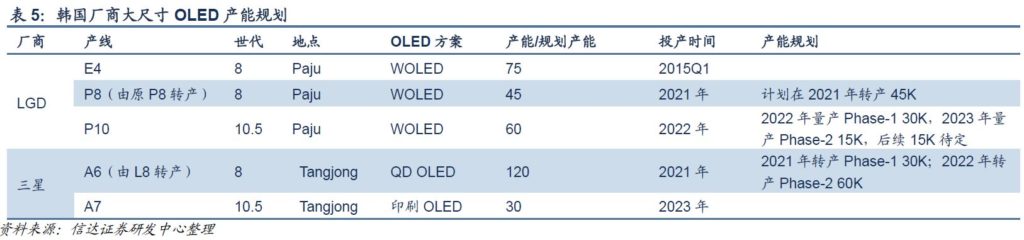

Cinda Securities consolidates the capacity construction plans for large-size OLEDs at the Korean plant. In 2021-2023, the Korean factory’s OLED production capacity expansion will be only 15.470Mm2 per month. From 2021 to 2023, the Korean factory’s large-scale OLED production capacity expansion is only equivalent to 10.81% of mid-2019 global production capacity. (Cinda Securities report)

TF Securities analyst Ming-chi Kuo has indicated that Apple is developing 6 Mini-LED products, which will be released in 2020 and 2021. He has said that Apple is developing a 12.9” iPad Pro, a 27” iMac Pro, a 14.1” MacBook Pro, a 16” MacBook Pro, a 10.2” iPad, and a 7.9” iPad Mini. Epistar leads Apple’s adoption of Mini-LED. (TF Securities, My Drivers, CN Beta)

Camera

SK Hynix has developed four new CMOS image sensors under its new brand “Black Pearl”. The chipmaker has begun supplying three of them to smartphone manufacturers and will begin mass production of the fourth in Mar 2020. (Laoyaoba, Korea Times)

Microsoft has demonstrated its ability to generate 3D-shaped images based on unstructured 2D images. They detail a framework in that uses “scaleable” training technology for the first time in this field. The researchers note that when training with 2D images, the framework can always produce 3D shapes better than existing models. (CN Beta, VentureBeat, Small Tech News)

Memory

Specifically for the semiconductor industry, UBS is currently forecasting semiconductor capex in China of USD8.6B in 2020, up 41% from 2019. However, majority of the uptick is in NAND flash and SMIC, where YMTC is expected to expand its capacity significantly and SMIC is expanding its leading edge. Taking out YMTC and SMIC, China capex is still increasing, but UBS would expect some downside due to lower demand. (UBS report)

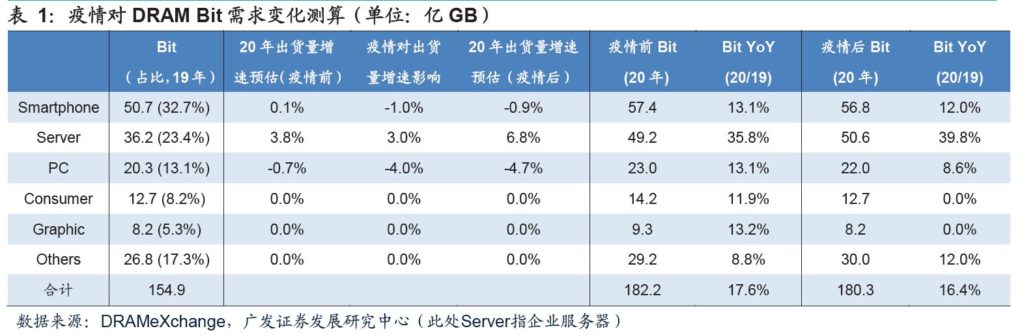

In order to quantify the current changes in DRAM bit demand, GF Securities makes the following assumptions on the 3 major sensitive variables for smartphones, enterprise servers, and PCs with a combined bit demand of 69%: 1) Smartphones: volume growth rate in 2020 is revised down from 0.1% to -0.9%; 2) PC: PC shipment growth rate is revised from -0.7% to -4.7% in 2020; 3) Server: Server shipment growth rate in 2020 is upgraded from 3.8% to 6.8%. Based on the above assumptions, the global DRAM bit demand growth rate will narrow from 17.6% before the epidemic to 16.4%, but this number is still significantly higher than the 12.2% supply growth rate (assuming the epidemic will not cause significant disturbance to the supply side). (GF Securities report)

Considering the high uncertainty of the development of the global epidemic situation, GF Securities conducts a sensitivity analysis on the reduction in smartphones and the gap in DRAM bit demand: Even if the reduction in smartphones is 3%, the gap between DRAM bit supply and demand remains 3.3%, the supply and demand relationship of industrial DRAM bits has not changed. (GF Securities report)

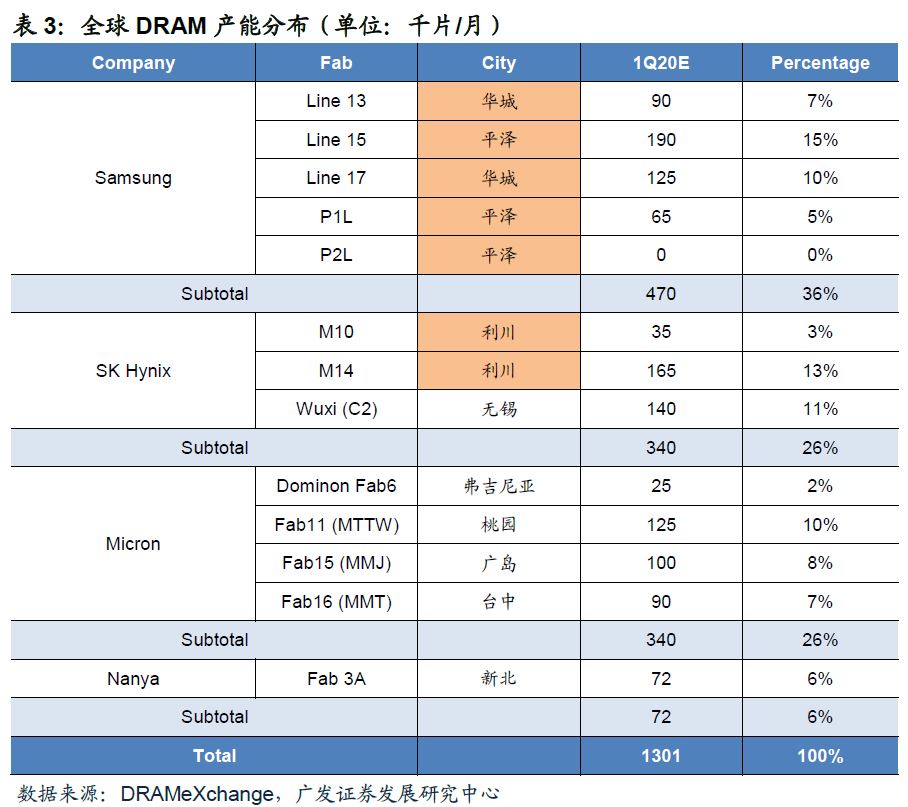

From the perspective of the supply side, more than half (51%) of Samsung and SK Hynix’s production capacity are in South Korea, due to the high degree of semiconductor front-end automation, their production and manufacturing will not stop due to the epidemic, and the back-end modules are in South Korea is relatively few, so the manufacturing process is less affected by the epidemic situation. However, due to: 1) the inventory pull-in drive of the server continues; 2) the epidemic has affected the logistics sector to a certain extent, and the delivery period has been extended; 3) the DRAM inventory has fallen to a lower level, DRAM prices (of server and smartphone) have continued to rise in recent days. (GF Securities report)

Sensory

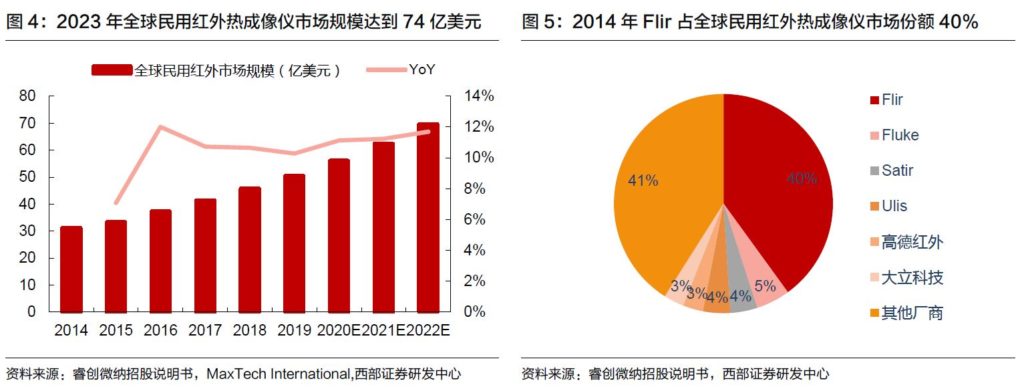

The global consumer infrared market has maintained steady growth at a low growth rate, with overseas manufacturers occupying a major market share. According to MaxTech International’s forecast, the global consumer infrared thermal imager market size may reach USD7.4B (CAGR 10%) in 2023. From the perspective of competitive share, the US-based Flir accounts for 40% of the consumer infrared thermal imager market, and domestic manufacturers Guide Infrared and Dali Technology each has 3% of the market. (Western Securities report)

Biometrics

General Interface Solutions (GIS) is expected to ramp up shipments through at least 2Q20 as it starts fulfilling orders for ultrasonic in-display fingerprint sensor modules for Samsung’s new handsets, according to Digitimes. To fulfill the orders, GIS has invested in building more automated production lines at its plant in Chengdu, China, boosting the plant’s monthly capacity to 5M units from 2M-3M. (Digitimes, press, Digitimes)

Material

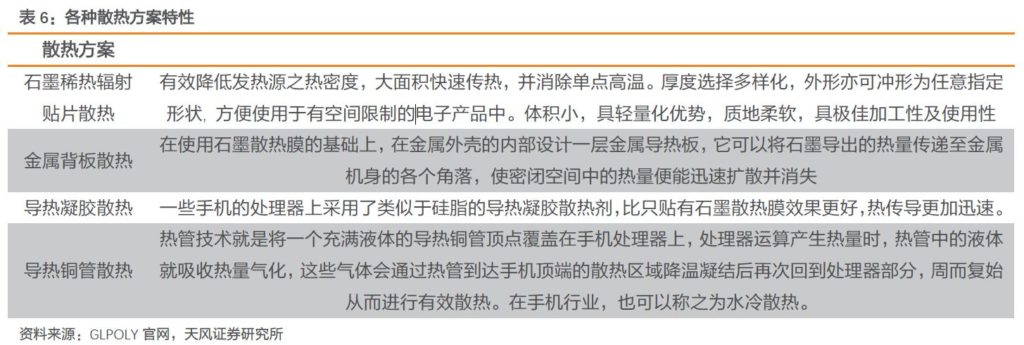

With the pursuit of thin, small, and miniaturized designs for smartphones, the space inside the phones has become smaller. However, due to the improvement of mobile phone hardware configuration, the upgrade of CPU multi-core high performance, and the increase of communication speed, the demand for heat dissipation has also increased, which has driven the demand for materials with high heat dissipation performance. Current heat dissipation technology used in smartphones mainly includes graphene heat radiation patch heat dissipation, metal backplane heat dissipation, heat conduction gel heat dissipation, and heat conduction copper pipe heat dissipation. (TF Securities report)

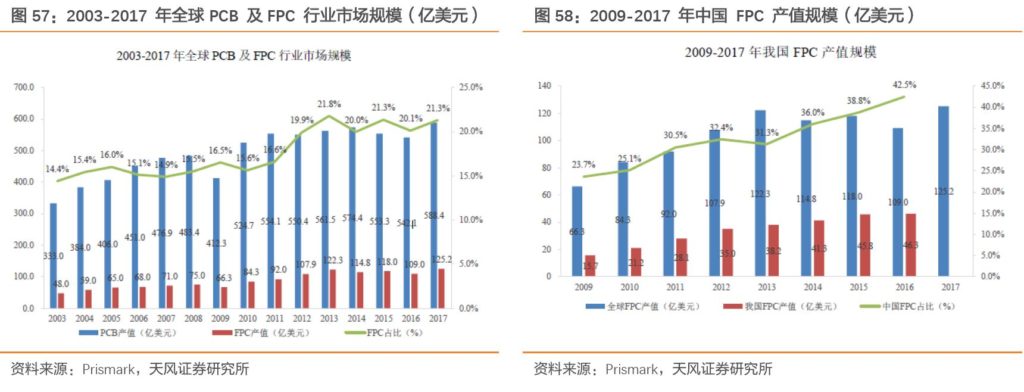

In recent years, China has gradually become the main source of FPC, and the proportion of FPC output value in China has increased continuously. According to data from Prismark, the output value of China’s FPC industry reached USD4.63B in 2016, and the output value of FPC (including foreign-funded enterprises) in China accounted for the global proportion. From 23.7% in 2009 to 42.5% in 2016, the global FPC industry output value reached USD12.52B in 2017. (TF Securities report)

Phone

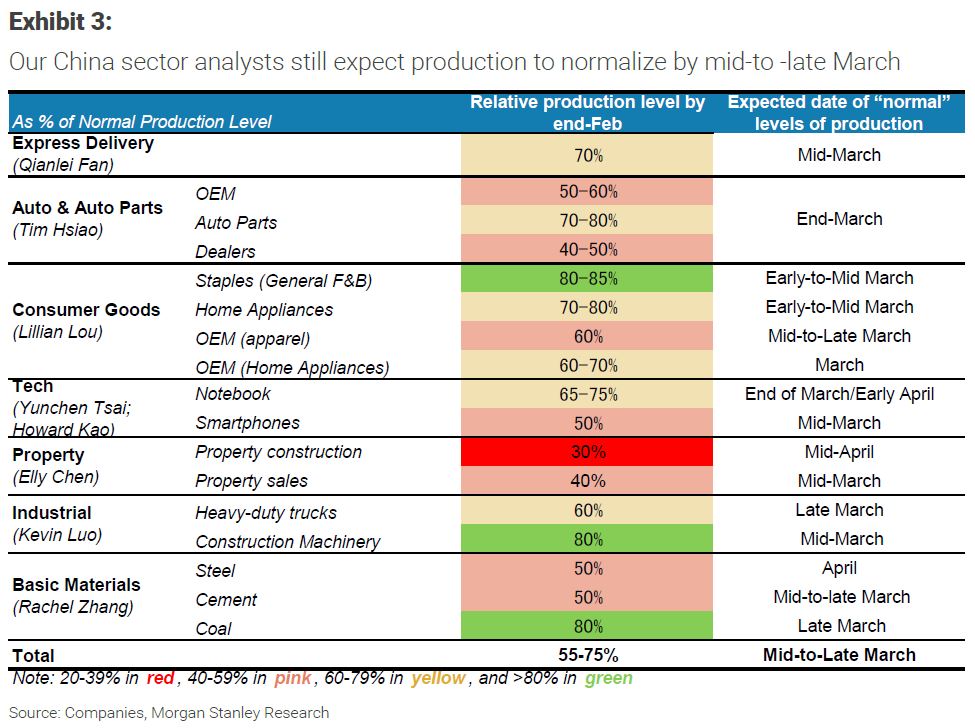

Production activity in China since the Lunar New Year holiday has been recovering at a gradual pace, according to Morgan Stanley, is only at 55%-75% of normal levels as of the end of Feb 2020. However Morgan Stanley is projecting that production will get back to normal levels during Mar 2020, except in the case of steel (normalization expected in Apr 2020) and notebook PCs (normalization between end-Mar / early Apr 2020). (Morgan Stanley report)

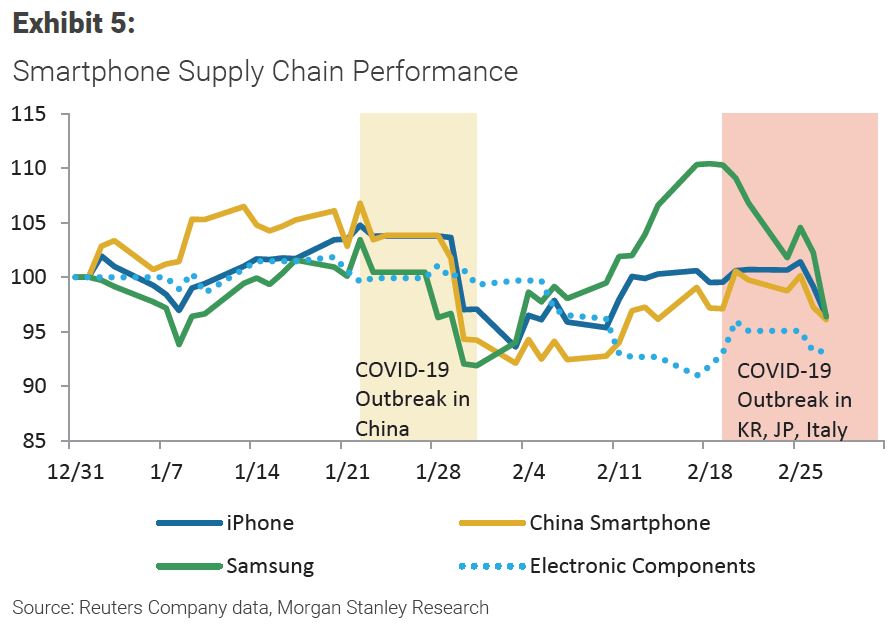

Morgan Stanley shows share price movements for companies making up the supply chain for Apple iPhone, Chinese smartphones, and Samsung smartphones in end-Dec 2019 – end-Feb 2020. iPhones and Chinese smartphones are produced almost entirely in China, but production of Samsung smartphones is more dispersed, and includes bases in S. Korea and Vietnam, for example, which for a time appeared to be little impacted by the coronavirus, but due to the implications for the China supply chain the share price performance through end-Feb is no different. (Morgan Stanley report)

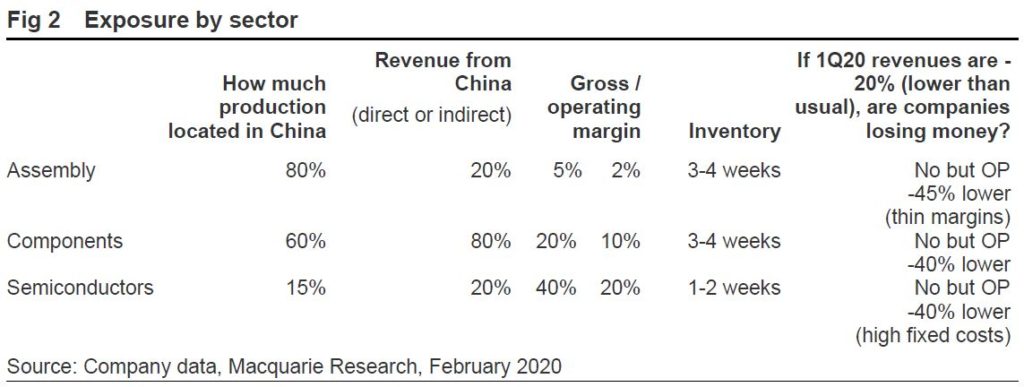

According to Macquarie Research, China is the manufacturing hub for two-thirds of the global supply chain. China is 25% of global end-demand. About 75% of technology hardware is assembled in China (phone, computer, server, data center equipment, telecom equipment, etc). About 50% of components are made in China (lowest exposure is semiconductors 15%). About 25% of technology products are consumed by China’s domestic market, consumers and enterprises. (Macquarie Research report)

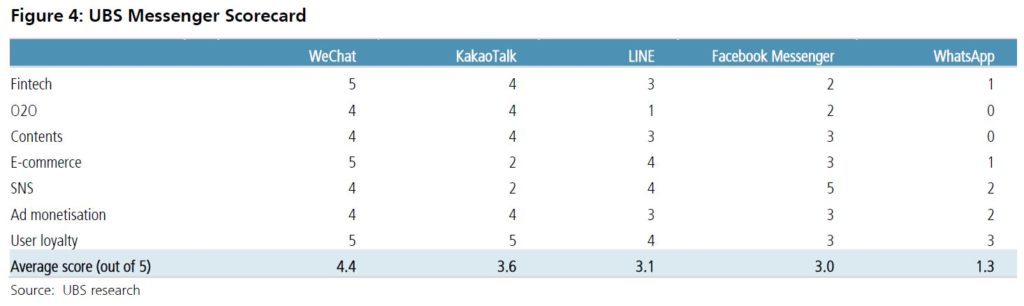

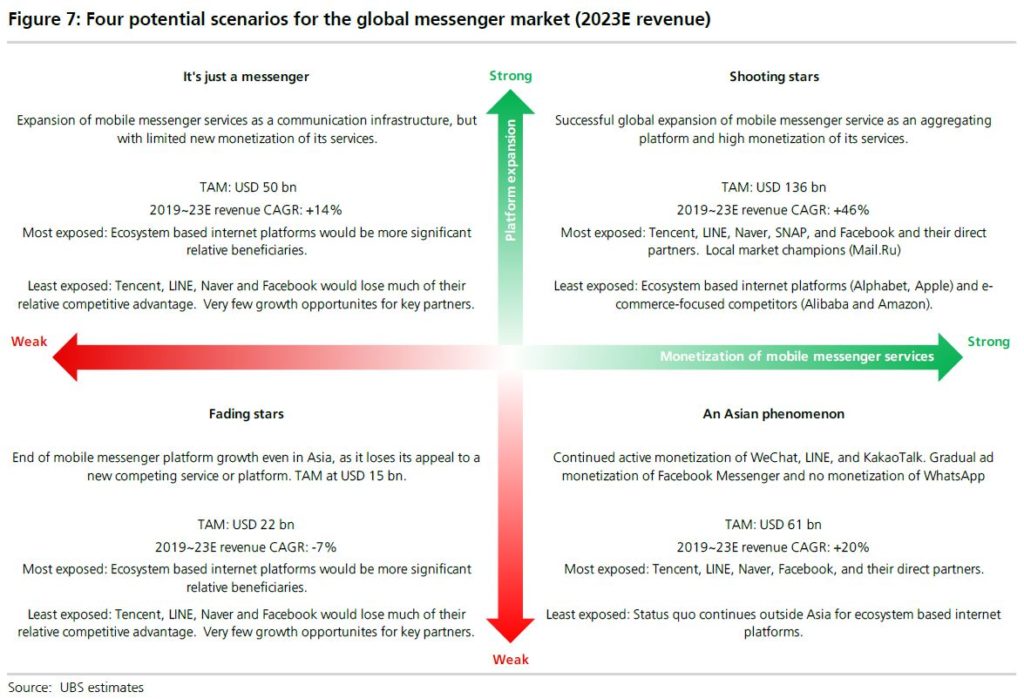

UBS’ case studies and messenger scorecard put WeChat at the forefront of platform expansion and monetization, anchoring Tencent’s ‘super app‘’ strategy. LINE and Kakao have followed a similar strategy and have room to expand further (especially in Southeast Asia). Outside Asia, the platform expansion of major players has been driven via a portal / search ecosystem, not a single super app, and they have been slower to monetize the similarly dominant positions of key messenger apps, so far. (UBS report)

UBS sees two long-term drivers of the market opportunity from messenger services: 1) Degree of platform expansion as an aggregator of different internet services (i.e., whether mobile messengers are used outside its core messaging functions); 2) Degree of monetization by the mobile messengers measured by the revenue generated by mobile messenger per its MAU. (UBS report)

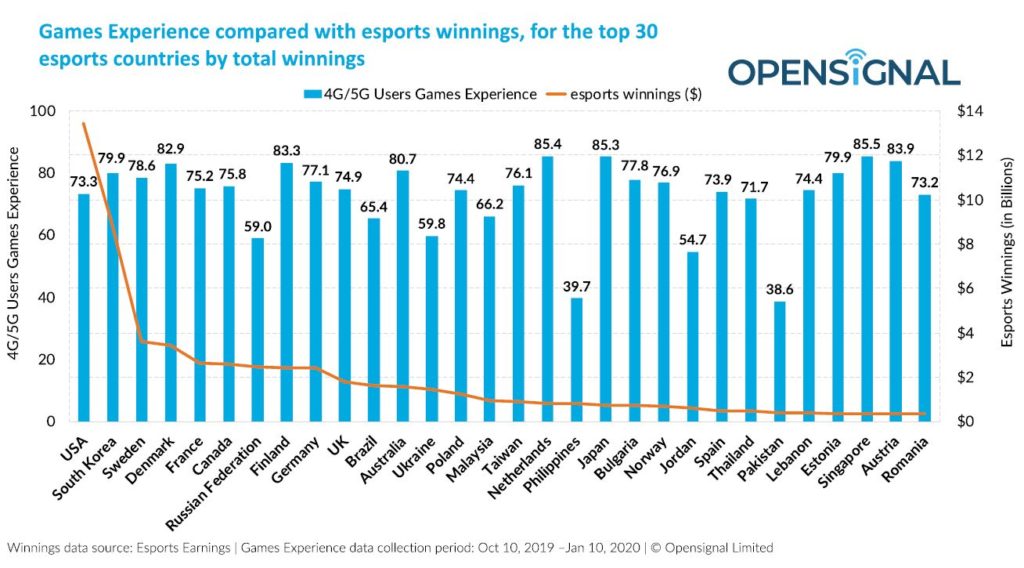

According to OpenSignal, among the top 30 countries by esports winnings, players in Philippines, Pakistan, Russia and the Ukraine have a mobile Games Experience where most users will find the service provided by the mobile network unacceptable. While in both Brazil and Malaysia, most users will find the experience only average. (OpenSignal report)

Artificial Intelligence

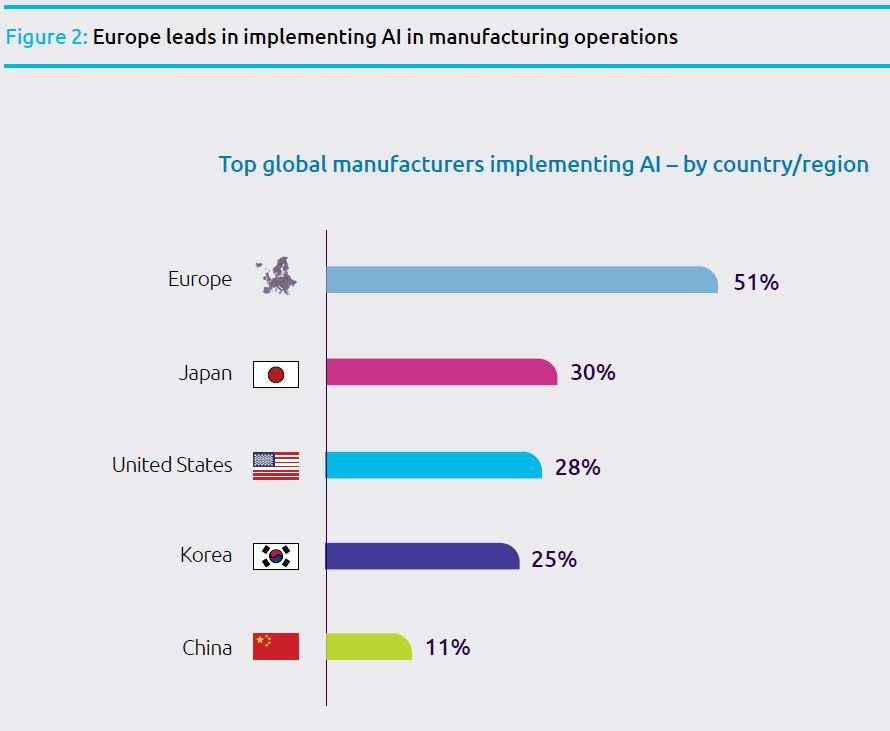

According to Capgemini Research, more than half of the European cohort are implementing AI solutions, with Japan and the US following in second and third. In Europe, Germany leads the way, with 69% of its manufacturers implementing at least one AI use case in manufacturing. Germany is followed by France (47%) and UK (33%). (Capgemini Research report)

Banjo is bringing pervasive AI surveillance to law enforcement throughout Utah, USA. Banjo has signed a 5-year USD20.7M contract with Utah. The agreement gives the company real-time access to state traffic cameras, CCTV and public safety cameras, 911 emergency systems, location data for state-owned vehicles and more. In exchange, Banjo promises to alert law enforcement to “anomalies”. (Engadget, Vice)