5-1 #LaborDay: Huawei is working with STMicroelectronics to co-design mobile and automotive chips; CSOT reportedly plans to build its second Gen-6 flexible OLED line, dubbed t5; etc.

Chipsets

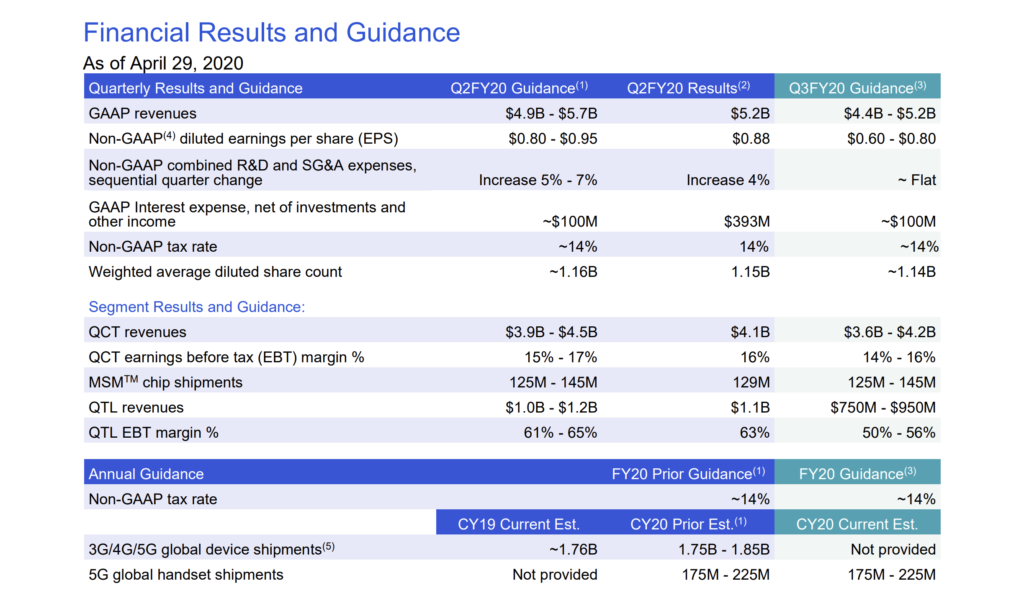

Qualcomm has revealed that the coronavirus pandemic reduced demand for phones in 2Q20 about 21% compared to its previous expectations and on a year-over-year basis, primary driven by China. Qualcomm still expects 175M~225M 5G phones to ship during 2020, which is unchanged from before. Qualcomm shipped 129M modem chips during 1Q20, and predicts to sell 125M~145M in 2Q20. (Apple Insider, Light Reading, 9to5Google, CNBC)

MediaTek has announced Helio G85, built with 12nm process, featuring 2x Cortex-A75 cores clocked at 2.0GHz and 6x Cortex-A55 cores clocked at 2.0Ghz plus. (Gizmo China, Pocket Now, GizChina, My Drivers)

Samsung Electronics has revealed that it will strengthen EUV (Extreme Ultra-violet) leadership in 2Q20 and begin mass production of 5nm products. The company has also said it will focus on the GAA 3nm process. (GizChina, My Drivers, Samsung, SamMobile, Business Korea)

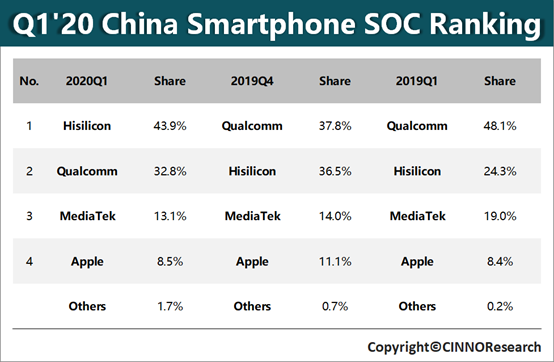

According to CINNO Research, 1Q20 is severely affected by COVID-19 and other factors, and smartphone shipments in mainland China declined significantly, resulting in a sharp decrease of 44.5% in smartphone shipments in the mainland China market compared to 1Q20. HiSilicon has become the only major brand in the Chinese market that did not decline year-on-year in 1Q20, with 22.21M units shipped, which is basically the same as the 22.17M units in 1Q20. It has also surpassed Qualcomm for the first time while gaining 43.9% market share, officially become the largest mobile phone processor brand in the Chinese market. (CINNO, Laoyaoba, SCMP, Gizmo China)

Huawei is working with French-Italian chipmaker, STMicroelectronics (STMicro) to co-design mobile and automotive chips. Huawei is doing a collaboration with STMicro to accelerate Huawei’s autonomous driving development. Partnership with STMicro will lead Huawei to develop top automotive semiconductors and sell its solutions to firms such as Tesla and BMW. (CN Beta, Huawei Central, Asia Nikkei, Asia Times)

MediaTek is still upbeat about 5G in 2020 and its forecast for global 5G smartphone shipments to reach 170M-200M units in the year remains unchanged, according to company CEO Rick Tsai. (UDN, Sina, Digitimes)

Touch Display

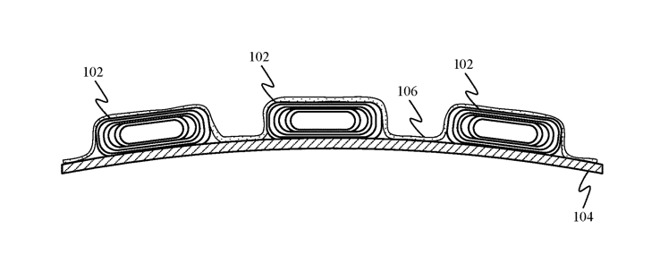

Apple’s patent “Cosmetic integration of displays” proposes it would be possible to change how displays appear within a vehicle. Apple suggests the use of a covering layer for a display that hides it from view as part of the general design of the vehicle. The cover could include a number of elements, such as force and touch sensors for accepting input, and electronic shutters. (Apple Insider, USPTO, CN Beta)

China Star Optoelectronics Technology (CSOT) reportedly plans to build its second Gen-6 flexible OLED line, dubbed t5, at its panel production base in Wuhan, where its first 6G OLED line (Fab t4) is located along with a 6G LTPS line (Fab t3). (Digitimes, East Money, 51Touch)

TCL CSOT’s Gen-11 ultra-high-definition new display device production line project (t7 project) has successfully completed the first CVD, PVD and exposure machine moved in. The investment of t7 project is CNY42.68B. It is officially signed on 22 May 2018, and construction began on 14 Nov 2018. It mainly includes the following 3 features: mainly focusing on super-large size; with mass production of 4K / 8K and other ultra-high-definition products Ability; conform to the trend of the times, can produce OLED TV products. (Laoyaoba, EE World)

Camera

OmniVision has announced OV64B 1/2” camera sensor. The company claims is the world’s first 0.7-micron 64MP image sensor which can be used in high-end ultra-thin smartphones. It is built on OmniVision’s PureCel Plus stacked die technology. (Gizmo China, Omnivision, CN Beta)

Memory

A weak DRAM market put a lid on growth in the total memory market in 2015 and 2016. However, the robust DRAM and NAND flash market growth in 2017 and 2018 lifted the total memory market 64% and 26%, respectively. After those two outstanding growth years, the memory market reversed course in 2019 as DRAM and NAND flash sales dragged the overall memory market 32% lower to USD110.4B. Before the global pandemic took hold in 1Q20, IC Insights is forecasting a strong 14% increase in the total memory market in 2020. The total memory market in 2020 is now expected to be flat with 2019. (IC Insights, press, Laoyaoba)

Hefei-based ChangXin Memory Technologies (CXMT) has started mass production of 10nm-level (10nm~19nm) DDR4 memory chip (8Gb). The productio capacity of CXMT’s 19nm wafer chip will increase from 20K per month to 40K per month by the end of 2Q20. Additionally, CXMT’s 17nm process chip is advancing as scheduled, and mass production will be completed before the end of 2020. (CN Beta, Sina)

Biometrics

Huami, the wearable device maker behind the Amazfit wearables, is working on a face mask that does not interfere with face unlock on smartphones. Huami’s “Project Aeri” goal is to allow users to reveal their facial expressions and emotions while breathing safe air. Huami has created two concept designs, X and Y, that feature a clear anti-fog cover, a translucent frame, a replaceable filter pad, a ventilation fan, and a built-in UV light, among other components. (Gizmo China, XDA-Developers, CN Beta)

Battery

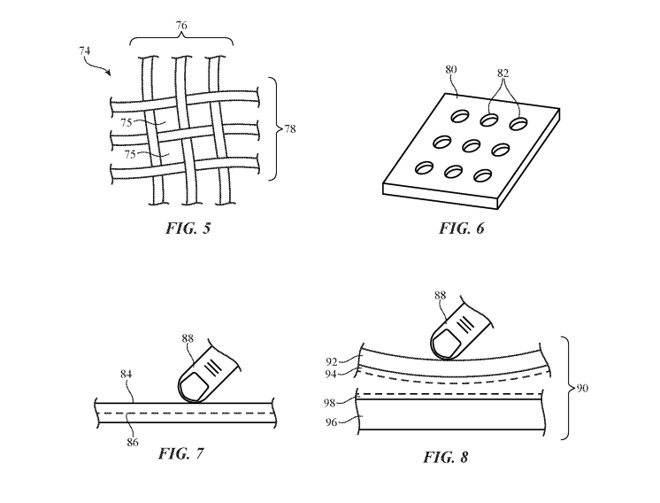

Apple’s patent “flexible battery structure” details many different ways of making batteries flexible enough to be used with foldable displays in an iPhone or iPad, or to save space inside regular devices. Apple’s several proposals all center on working with both battery cells and the connections between them. (Apple Insider, CN Beta)

Cockrell School of Engineering at The University of Texas at Austin has found a way to stabilize one of the most challenging parts of lithium-sulfur batteries, bringing the technology closer to becoming commercially viable. They show that creating an artificial layer containing tellurium, inside the battery in-situ, on top of lithium metal, can make it last 4 times longer. (CN Beta, UT News, Joule)

South Korea’s SK Innovation, a supplier for Volkswagen and Ford Motors, will spend USD727M to build its second electric vehicle (EV) battery plant in the United States. Construction of the plant with annual capacity of 11.7GWh of batteries will begin in July in the southern state of Georgia with production aimed for 2023. (Laoyaoba, Electrek, Reuters)

Connectivity

InterDigital, a developer of digital mobile and video technology, has said that it has entered a worldwide patent licensing agreement with China’s Huawei Technologies, and that the companies have settled all litigation against each other. In a regulatory filing, InterDigital said the licensing agreement runs through 2023, and covers royalties from the sale of some of Huawei’s 3G, 4G and 5G wireless telecommunications products. (CN Beta, SCMP, Reuters)

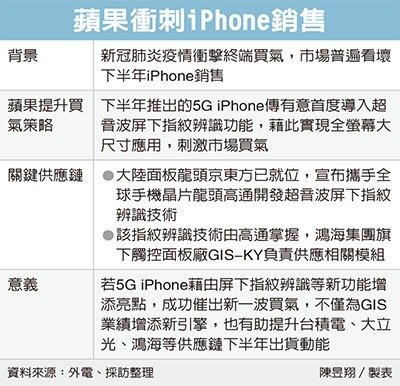

Phone

Samsung is limiting its component orders by half. The company is now making about 10M smartphones a month. That is a decrease over the 25M smartphones that the company is previously building. The order cuts after Samsung’s entire smartphone portfolio. (ET News, GizChina, ESM China)

Huawei is allegedly planning to re-release its 2019 mid-range phone with Google services. The phone in question is the Huawei P Smart 2019, which will be named the P Smart 2020 this time around. (Android Headlines, Twitter)

India’s smartphone shipments grew a modest 4% YoY to reach a little over 31M units in 1Q20, according to Counterpoint Research. Xiaomi leads the India smartphone market with a 6% YoY growth in 1Q20 to reach its highest ever market share since 1Q18. Apple grew a strong 78% YoY driven by strong shipments of iPhone 11 and multiple discounts on platforms like Flipkart and Amazon. In the ultra-premium segment (>INR45000, ~USD600) it was the leading brand with a market share of 55%. (Counterpoint Research, Apple Insider)

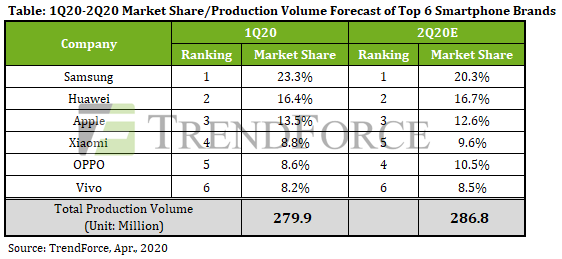

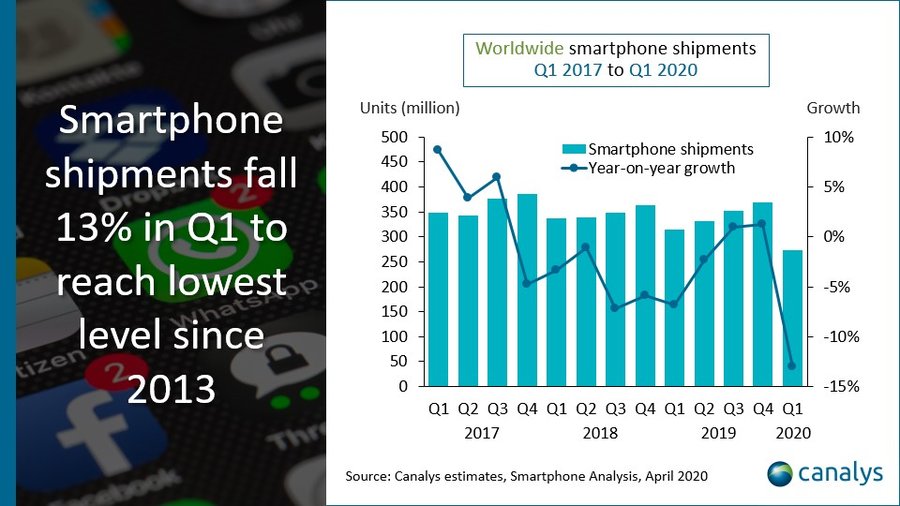

According to TrendForce, the global spread of COVID-19 in 2020 has brought about the greatest magnitude of declines in the smartphone market in recent years. Global smartphone production for 1Q20 fell by 10% YoY to around 280M units, the lowest in five years, due to pandemic-induced disruptions across the supply chain, such as delayed work resumption and labor/material shortages, which caused low factory capacity utilization rates. Global production for 2Q20 is now estimated to register another YoY drop of 16.5% to 287M units, the largest decline on record for a given quarter. TrendForce forecasts total yearly production volume of 1.24B units, an 11.3% decrease YoY. (Apple Insider, TrendForce, TrendForce, press)

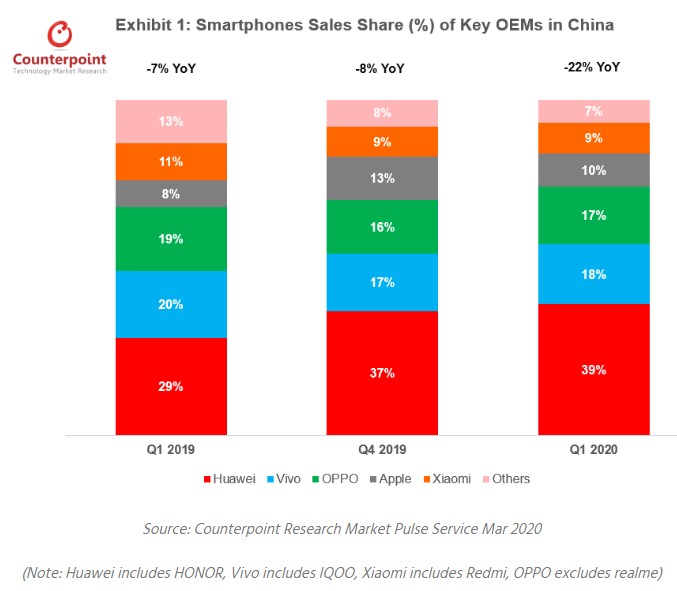

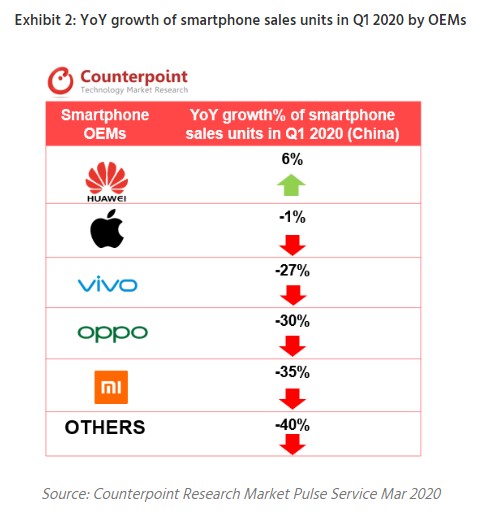

Smartphone sales in China fell by 22% YoY and 24% QoQ in 1Q20 due to the impact of COVID-19 Pandemic, according to Counterpoint Research. The market share of the leading OEM, Huawei, rose to near 40% during the COVID-19 crisis. Huawei is the only smartphone player that achieved positive YoY growth even amid the COVID-19 pandemic. (GizChina, Counterpoint Research)

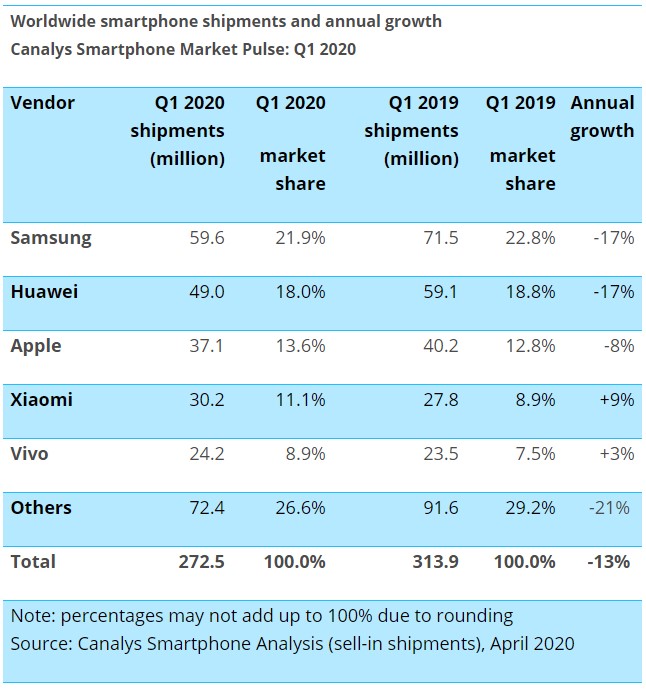

According to Canalys, the coronavirus pandemic wreaked havoc on the smartphone market in 1Q20, with shipments falling 13% to 272M units. Samsung has returned to the top of the market, but its shipments fell 17% to 60M. Huawei has shipped 49M, as its mix continues to shift toward China and away from overseas markets due to its US Entity List status. (The Verge, Canalys, press)

Worldwide smartphone shipments have decreased 11.7% year over year in 1Q20, according to IDC. In total, 275.8M smartphones are shipped during 1Q20. Although 1Q20 usually experiences a sequential decline in shipments, with the average sequential decline over the last 3 years hovering -15%~-20%, this is the largest annual decline ever. (IDC, press, CN Beta)

Gree Electric chairwoman Dong Mingzhu has said once: Gree phones would be the first in the world and can sell 50M units. It is not a problem to sell 100M units in the future. Recently, she has indicatd that the company is still making mobile phones. She has said that others think Gree has failed to make a mobile phone because there is no volume, but she will not give up making mobile phones, which can bring many technical extensions. (My Drivers, CN Beta)

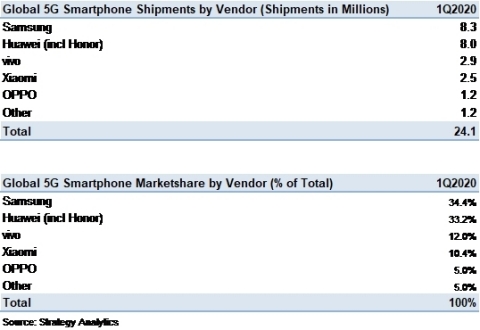

According to Strategy Analytics, global 5G smartphone shipments has surged 24.1M units in 1Q20. Demand from China is higher than expected. Samsung leads the 5G smartphone market in 1Q20 by shipping 8.3M 5G smartphones globally. (CN Beta, VentureBeat, Strategy Analytics, press)

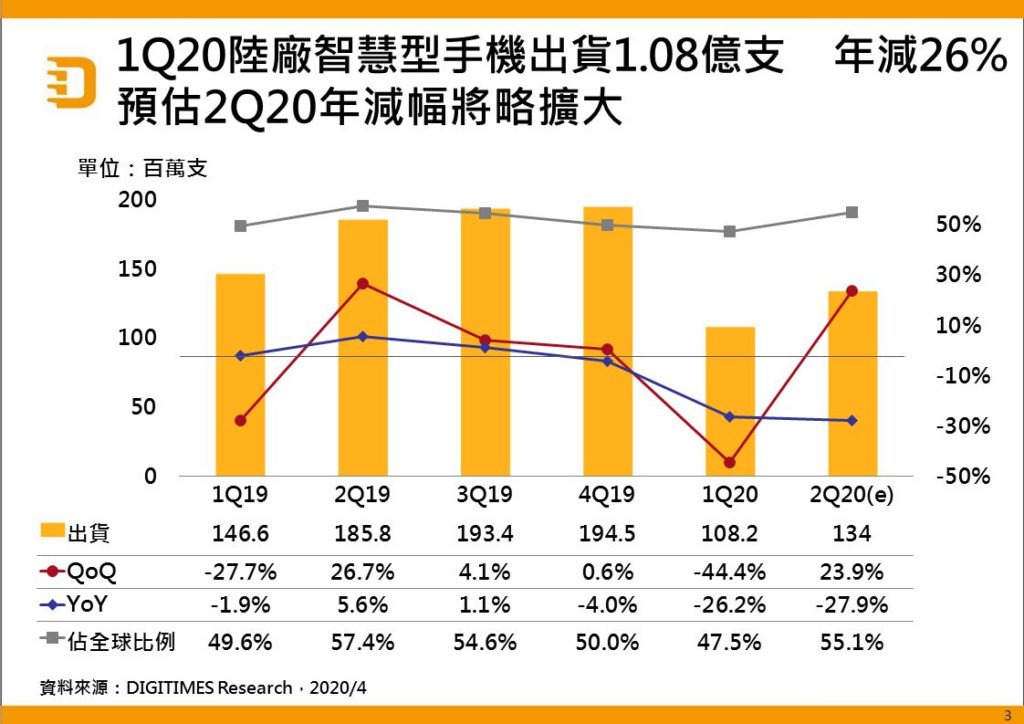

Shipments of smartphones by China’s handset makers totaled 108M units in 1Q20, declining 26.2% from a year earlier, Digitimes Research has found. Looking forward to 2Q20, as the epidemic continues to impact worldwide, affecting the supply and demand, the annual decrease is expected to expand. (Digitimes, Digitimes)

Honor 9S, 9A and 9C are unveiled in Russia: 9S – 5.44” 720×1440 HD+, MediaTek Helio P22, rear 8MP + front 5MP, 2+32GB, Android 10.0 (HMS), no fingerprint, 3020mAh, RUB6,990 (USD95). 9A – 6.3” 720×1600 HD+ u-notch, MediaTek Helio P22, rear tri 13MP-5MP ultrawide-2MP depth + front 8MP, 3+64GB, Android 10.0 (HMS), rear fingerprint, 5000mAh, RUB10,990 (USD150). 9C – 6.39” 720×1560 HD+ HiD, HiSilicon Kirin 710A, rear tri 48MP-8MP ultrawide-2MP depth +front 8MP, 3+64GB, Android 10.0 (HMS), rear fingerprint, 4000mAh, RUB12,990 (USD175). (GSM Arena, Gizmo China)

PC Tablet

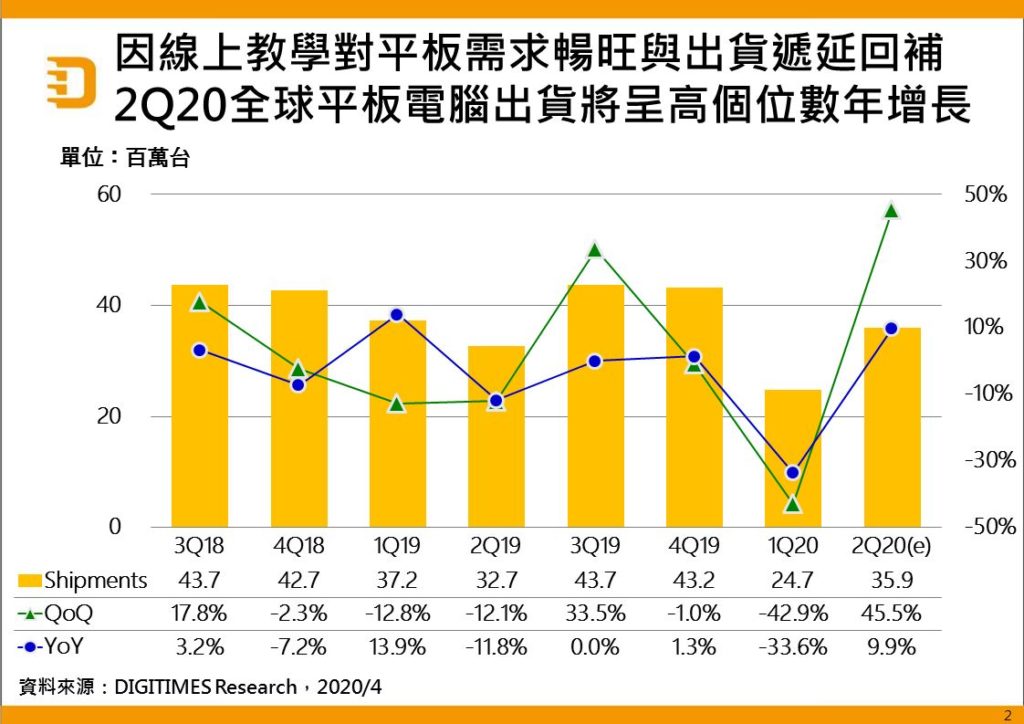

Global tablet shipments are forecast to climb 45.5% sequentially and 9.9% on year in 2Q20 thanks to a recovery in the related supply chain’s capacity in China and educational tablet orders deferred from 1Q20, according to Digitimes Research. Shipments in 1Q20 slipped 33.6% on year to reach around 24.7M units due to the coronavirus outbreak, which crippled the supply chain’s upstream production in China. (Digitimes, press, Digitimes)

Wearables

Apple’s wearables — AirPods, Apple Watch, Beats, Apple TV, and HomePod — has grown to the size of a Fortune 140 company. During 1Q20 results Apple called out wearables as a Fortune 150 company. During 2Q20, wearables earned USD6.3B, up from USD5.1B during the year ago quarter. (Apple Insider, Apple)

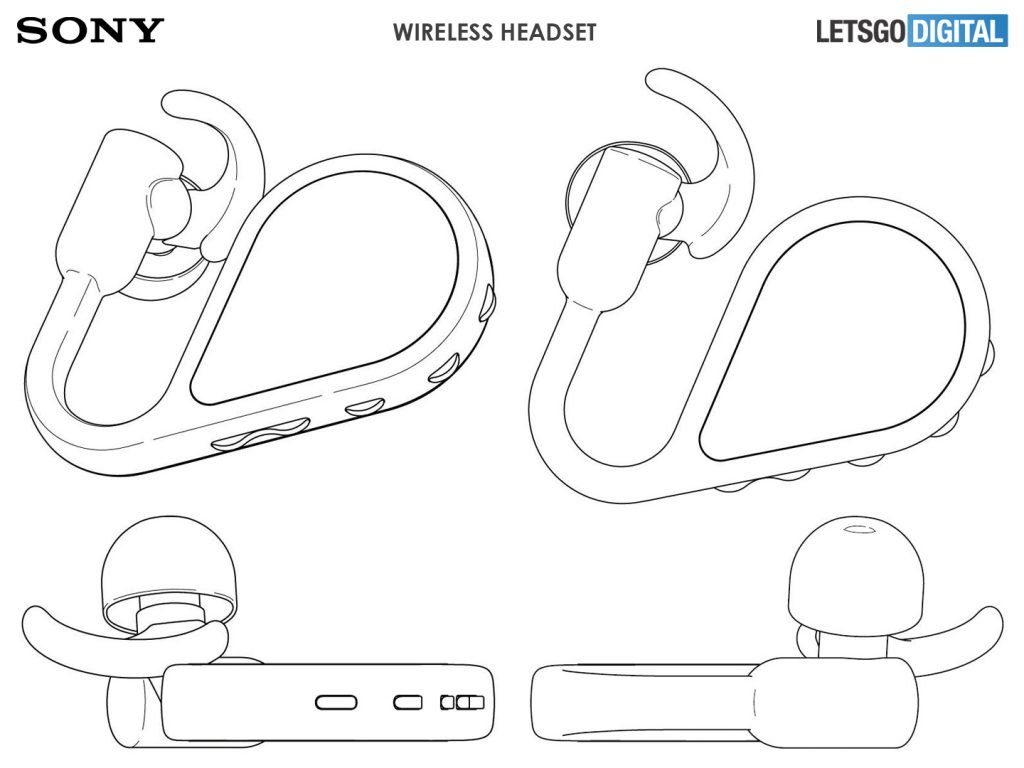

Sony has filed for design patents with the Japanese patent agency JPO for new wireless earphones. The patent has revealed that the earphones can be used under a helmet. This is achieved by having the earpiece stay inside the helmet while the region with the controls can be positioned outside of it. (Gizmo China, LetsGoDigital, Sina, CN Beta)

Robotics

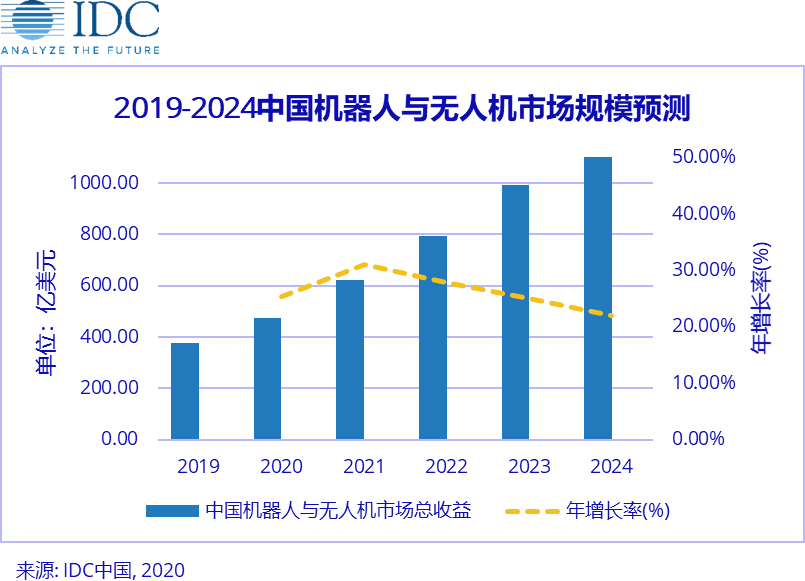

IDC predicts that overall global robotics and drone market expenditures will be slightly reduced under the influence of the COVID-19 epidemic in 2020, reaching USD124.57B, an increase of 13.4% compared with 2019. IDC believes that based on 2019, the global market will achieve a CAGR of 20.1% during the forecast period of 2020-2024, and the market size in 2024 will reach USD274.62B. China is the world’s largest market for robotics (including drones), which is expected to account for 38% of the global market by 2020, with a total expenditure of USD47.38B, and will account for 44% of the global market by 2024, with a scale of USD121.12B. (Laoyaoba, IDC)

Automotive

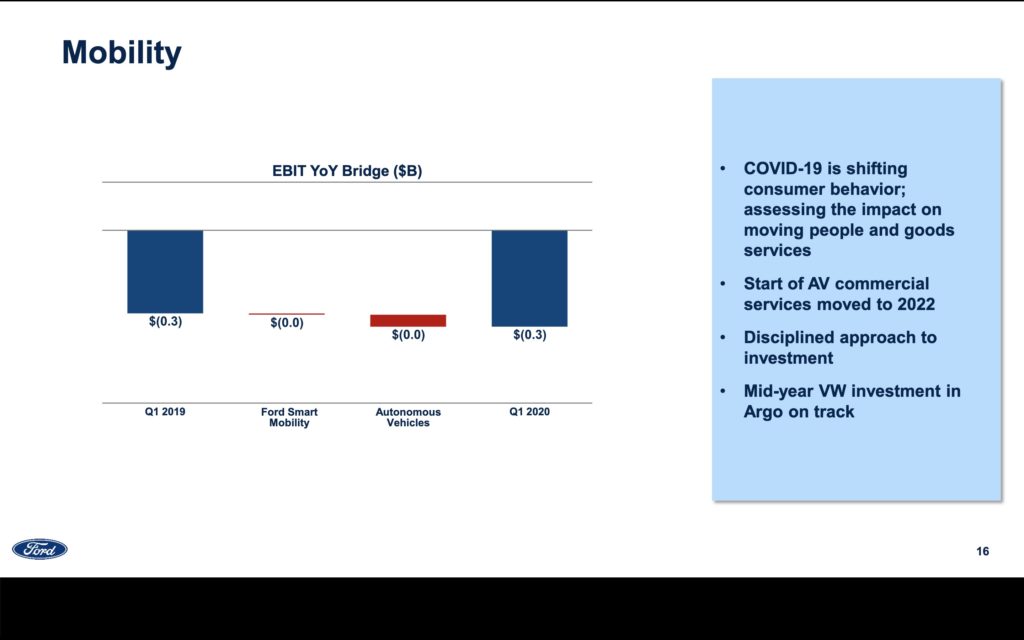

Ford has revealed that the company will delay until 2022 plans to launch an autonomous vehicle service, as the COVID-19 pandemic has prompted the company to rethink its go-to-market strategy. (TechCrunch, Forbes, Ford, The Verge, CN Beta)

Ford and its luxury brand Lincoln have canceled an all-electric SUV that was going to be powered by technology provided by EV startup Rivian. Lincoln says it is still working closely with Rivian, including an “alternative vehicle” that will also be based on Rivian’s electric vehicle skateboard platform. (Auto News, iFeng, The Verge)

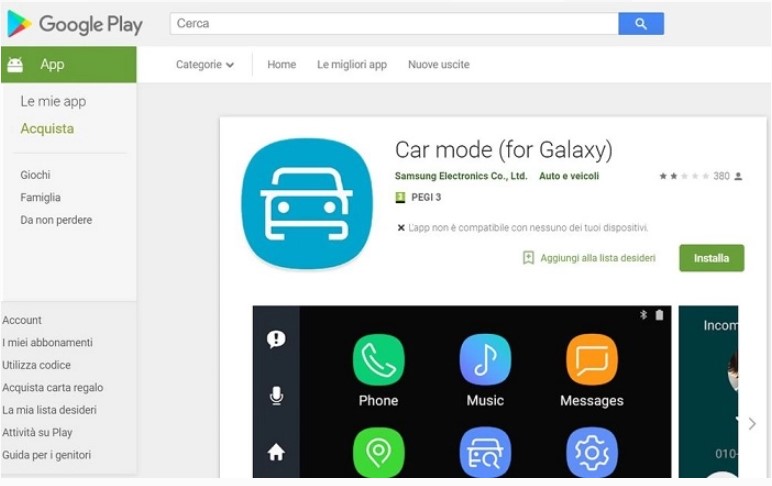

Samsung has decided to end support for three in-car services at the same time. The company will allegedly no longer support MirrorLink, Care Mode and Find My Car. Samsung’s devices have had MirrorLink support since 2014. MirrorLink is a widely used standard for car and smartphone connectivity. (CN Beta, Sam Mobile)

According to regulatory filing, Lyft plans to lay off 982 employees, or 17% of the ride-hailing firm’s workforce, due to economic challenges caused by the coronavirus pandemic. Lyft estimates to incur about USD28M~36M of restructuring charges, primarily related to the layoffs. (CN Beta, TechCrunch, Reuters)