6-13 #GratefulWeekends: Samsung has reportedly built a small 7nm production line that does not use U.S. equipment; OPPO is allegedly going to introduce SuperVOOC 3.0 with 80W rate; etc.

Samsung has reportedly cooperated with equipment manufacturers in Japan and Europe to build a small, 7nm production line that does not use U.S. equipment. Samsung hopes to actively attract multiple customers through this move. Samsung and Huawei are considering a deal under which Samsung would fabricate advanced chips for Huawei’s 5G equipment, and Huawei would in effect cede a substantial amount of its smartphone market share to Samsung. (Phone Arena, Asia Times, EE Times)

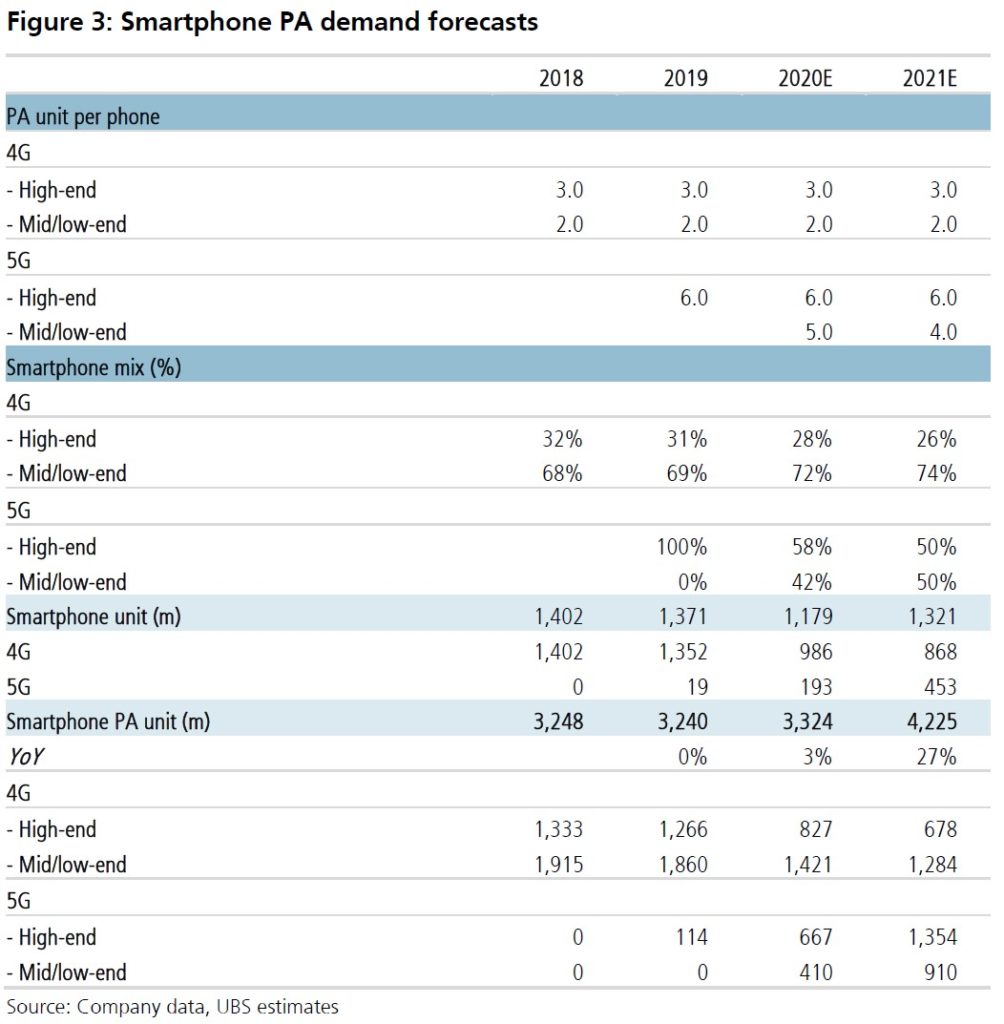

UBS forecasts global PA units to grow 3% / 27% in 2020 / 2021. UBS has a non-consensus view about Asia’s relatively faster 5G rollout, and they estimate Asia’s PA to grow 45% / 84% YoY in the same period. UBS expects Asia’s PA companies to grow market shares in China’s 5G smartphone segment from 25% in 2019 to 55% in 2021, with potentially more 5G design wins from 2H20. (UBS report)

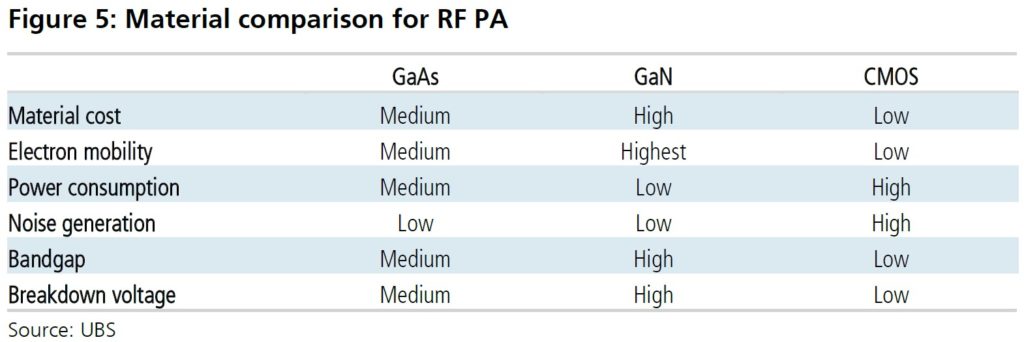

In terms of materials, smartphone PAs have been mostly dominated by circuits made with gallium arsenide (GaAs) in the 2G to 4G eras. Compared with CMOS, GaAs provides superior performance on signal transmission and is quieter. For 5G, UBS believes sub 6 could continue to be made with GaAs, whereas mmWave is migrating to CMOS processes. (UBS report)

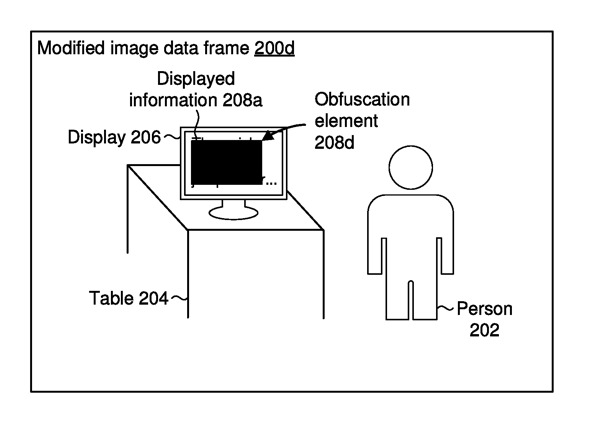

Apple is researching technology that would identify confidential or sensitive elements in a video frame, and automatically blur or replace them with a static image to protect privacy. Apple’s patent “Per Pixel Filter” is like a specific and dynamic version of the blurred or replaced backgrounds users can now have in Zoom or Skype. (Apple Insider, CN Beta, USPTO)

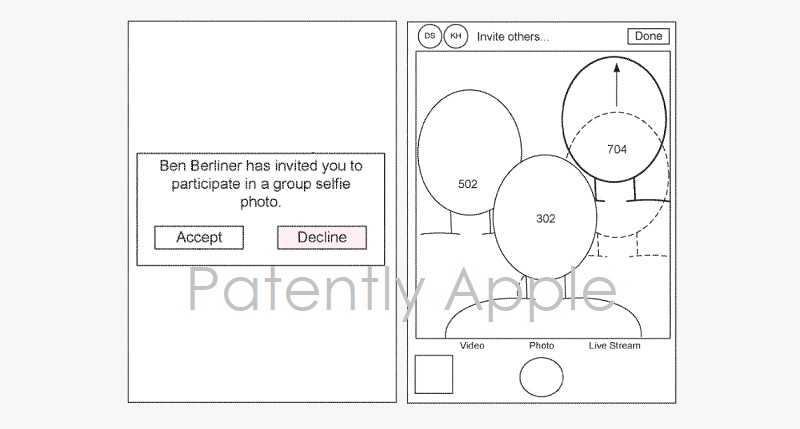

Apple has just been granted a patent for software that would generate “synthetic group selfies”, which could be a way to take group selfies for social media with social distancing. An Apple device user could invite others to take part in a group selfie, and the software would arrange them together in a single image. (The Verge, Patently Apple, USPTO, Sina)

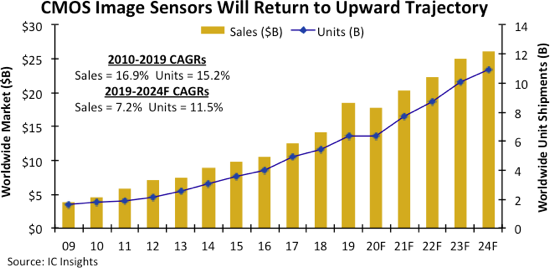

According to IC Insights, the fallout from the Covid-19 virus crisis in 2020 is expected to lower CMOS image sensor sales for the first time in 10 years, but new record-high revenues are seen in 2021. Driven by camera phones and the rapid spread of new embedded applications, CMOS image sensors were the fastest growing semiconductor product category in the last decade with sales quadrupling between 2010 and 2019 to reach USD18.4B in 2019. CMOS image sensor sales are forecast to drop to USD17.8B in 2020 after surging 30% in 2019. The sales would rebound 15% in 2021 to reach a new all-time high of USD20.4B. (Laoyaoba, IC Insights, press)

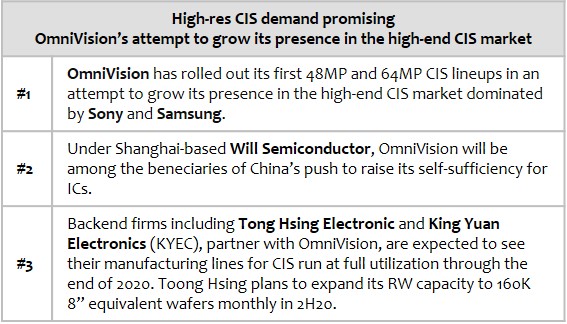

The market for high-resolution CMOS image sensors is set to boom starting later in 2020, thanks to a rise in the popularity of high-spec smartphones and other mobile devices, according to Digitimes. (Digitimes, press)

Xiaomi’s patent shows a phone featuring a true full display (i.e., no notch nor hole in display). The patent also shows two pop-outs on the top frame, which could possibly be used for 360º video recording. This phone could sport such an under-display camera. If so, the utility of the two pop-outs becomes unclear. (CN Beta, LetsGoDigital)

TCL has applied for a design patent for the hidden front camera under the screen. The phone described in the patent uses a full screen and rounded corners. Turn to the back of the phone, there is also a unique design near the rear camera module (six circles). (CN Beta, LetsGoDigital)

Imaging startup Light has confirmed that it is “no longer operating in the smartphone industry”. The comment suggests that future smartphones would not feature Light technology. Light announced two major partnerships in early 2019, teaming up with Xiaomi and Sony, respectively. (TechCrunch, Android Authority)

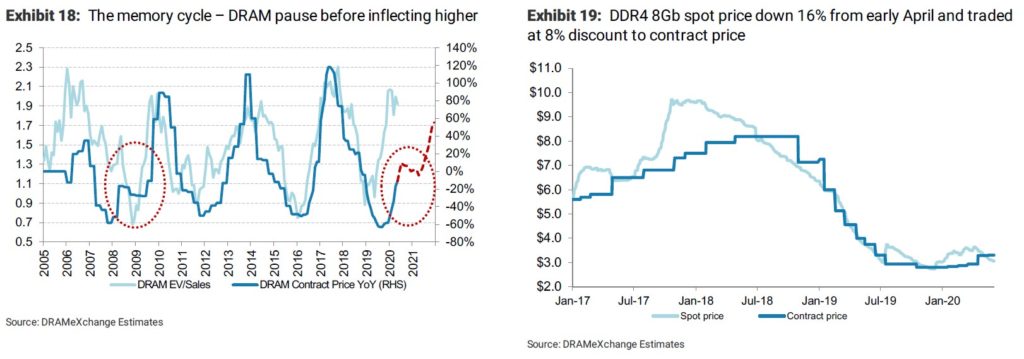

Mobile demand has improved following a bottom in Apr 2020, with tighter inventory because of reduced production allocation since beginning of the year – but not enough to affect 3Q20 price negotiations of DRAM. PC remains strong thanks to low channel inventory, and their 3Q20 forecast is for flat YoY PC ODM shipments. For DRAM blended ASP, Morgan Stanley believes that 3Q20 could come in around mid-single-digits lower to flat QoQ depending on final contracts through early Jun 2020. This keeps their estimates unchanged at -2% for 3Q20 and -3% for 4Q20. (Morgan Stanley report)

New game console launch (Sony PlayStation 5 in 2H20 with 800GB+ SSD) should boost demand, but 2H20 global smartphone model launches and content growth are key, considering that mobile NAND is more than 50% of the mix at Samsung and Hynix. Morgan Stanley forecasts 2018-2021 volume CAGR of nearly 20% for SSD, driven by the continued narrowing price gap between SSD and HDD. Notebook PC attach rates, having reached 66% in 2019, are likely to show a slower rate of increase from here, but SSD penetration is likely to continue in other applications. (Morgan Stanley report)

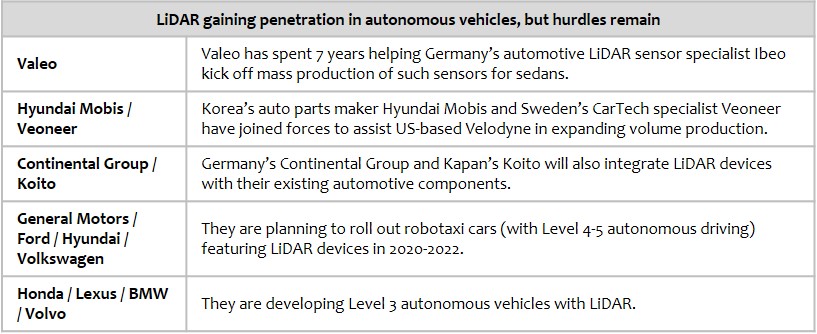

Many first-tier international automotive components makers have been keen on collaborating with LiDAR developers trying to increase economies of scale for LiDAR devices, but high unit prices and slow revisions of laws governing autonomous driving remain major obstacles, according to Digitimes Research. Japan has allowed Level 3 autonomous cars to run on roads in the country starting April 2020, and the US, China and European Union have not readied their relevant regulations in this regard. (Digitimes, press, Digitimes)

Microsoft has followed competitors Amazon and IBM in restricting how it provides facial recognition technology to third parties, in particular to law enforcement agencies. The company says that it does not currently provide the technology to police. (The Verge, Twitter, Laoyaoba)

OPPO is allegedly going to introduce SuperVOOC 3.0 with 80W rate in 2021. Currently, OPPO has SuperVOOC 2.0 at 65W available on a number of phones including Ace2, Find X2 and X2 Pro. The Realme X50 Pro implements the same technology under a different name – SuperDart Flash Charge. (GSM Arena, Weibo, Playful Droid, Sina)

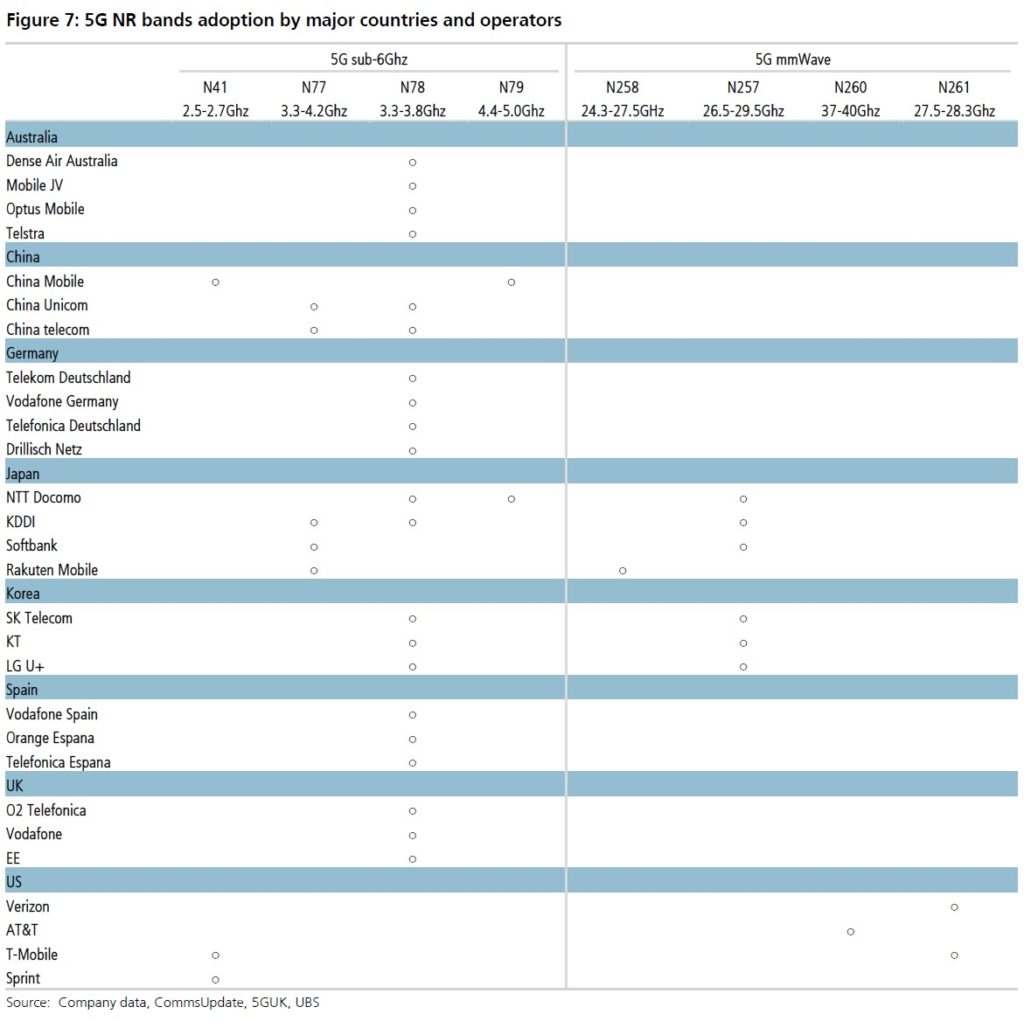

Similar with the 3G and 4G generations, a phone supporting all the global NR bands would require more PA than a regional phone. In China, China Mobile uses N41 and N79, whereas China Unicom and China Telecom are on N77 and N78. However, the current government requirement is that all 5G phones need to support all operators. This could change if the government were to allow operators to sell phones that only feature their own bands. (UBS report)

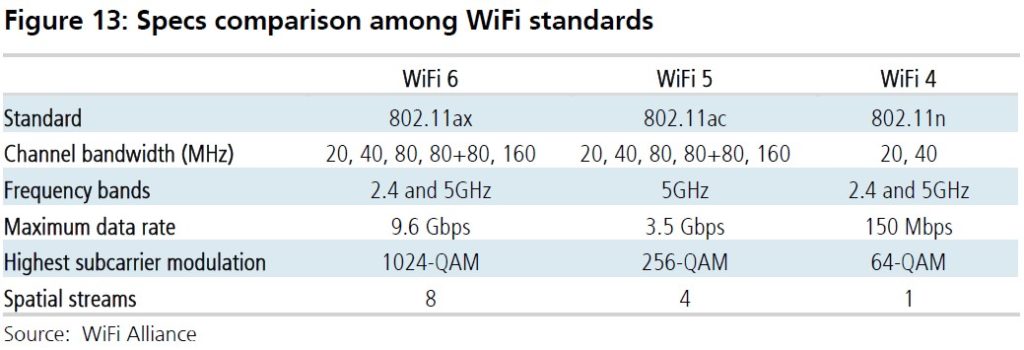

WiFi 6, also named 802.11ax, is a new WiFi standard finalized by WiFi Alliance in 2019. It is a successor of WiFi 5 (802.11ac), which has been around for more than 7 years. WiFi 6 is considered a more meaningful technology upgrade than previous standards, as it provides faster speed and coverage, some new features (OFDMA and enhanced multi-user MIMO) to improve the efficiency of the WiFi bandwidth and reduces the latency to mission-critical end devices. (UBS report)

Apple CEO Tim Cook has announced that Apple is launching a $100 million initiative to promote racial equality for people of color with a focus on “education, economic equality, and criminal justice reform”. The program, named Apple’s Racial Equity and Justice Initiative, will be led by Apple VP Lisa Jackson. (CN Beta, The Verge, WSJ, CNBC)

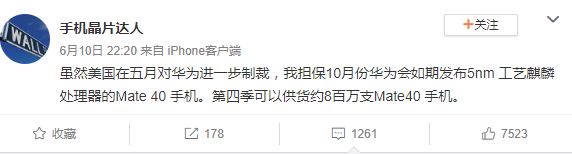

Huawei is reportedly looking to ship 8M Mate 40 phones in 4Q20 alone. Huawei is expected to introduce its Mate 40 lineup in 2020 fall. (GizChina, GSM Arena)

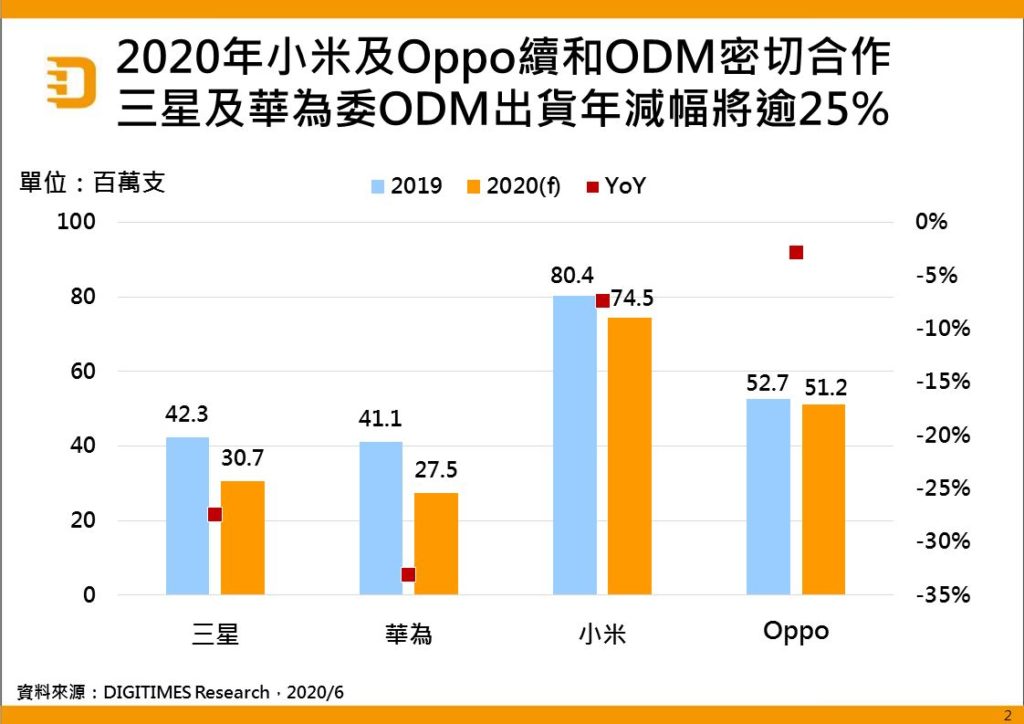

China’s top-3 handset ODMs – the Wingtech Group, Huaqin Telecom Technology and Longcheer – are expected to ship a total of 183M ODM models to the world’s four major brand vendors in 2020, decreasing 15.28% from the 216M shipped a year earlier, Digitimes Research estimates. The 4 handset brands – Samsung Electronics, Huawei, Xiaomi and OPPO – have been outsourcing most of their entry-level to mid-tier smartphone models priced below CNY2,000 (USD283) to the 3 ODMs. (Digitimes, press, Digitimes)

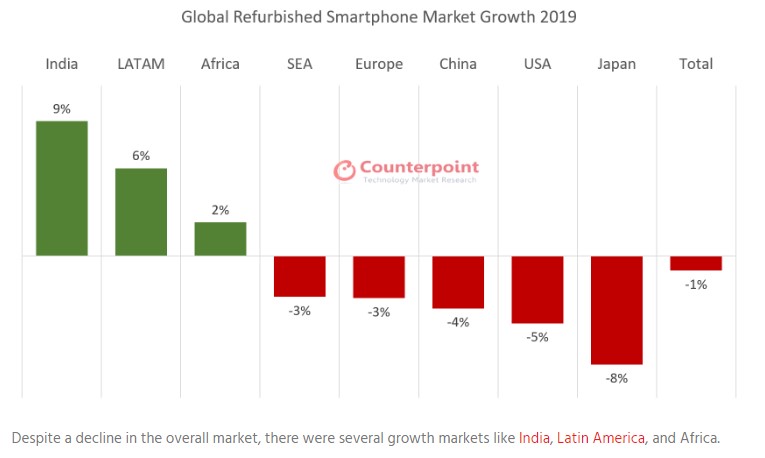

The smartphone market recorded a decrease in shipments in 2019, and this affected the refurbished segment as well. According to Counterpoint Research, manufacturers have sold 137M refurbished devices (9% of total sales), which is a 1% decrease on a yearly basis. Markets like Europe, China, and the United States saw a decrease, while India, the LATAM region and Africa saw an increase. (Counterpoint Research, GSM Arena)

Redmi 9 is launched in Spain – 6.53” 1080×2340 FHD+ IPS u-notch, MediaTek Helio G80, rear quad 13MP-8MP ultrawide-5MP macro-2MP depth + front 8MP, 3+32 / 4+64GB, Android 10.0, rear fingerprint scanner, 5020mAh 18W, EUR149 / EUR179. (GSM Arena, Mi.com)

ZTE Blade A3 Prime launches on Yahoo Mobile and Visible – 5.45” 1440×720 HD+ TFT, MediaTek Helio A22, rear 8MP + front 5MP, 2+32GB, Android 10.0, rear fingerprint scanner, 2660mAh, USD99. (GSM Arena, Gizmo China)

Xiaomi Mi Band 5 debuts with 1.1” AMOLED display, featuring accelerometer, heart rate monitor, barometer and gyroscope. It can recognize five of the main swimming styles automatically. The band itself can be submerged in up to 50m of water. It is priced at CNY189 (USD27) / CNY229 NFC-version (USD32). (GSM Arena, Mi.com, TechCrunch, IT Home, Sina)

In Jan 2020, Sonos sued Google alleging patent infringement related to smart speakers. In a countersuit, Google is alleging that it contributed “substantial Google engineering resources” to help Sonos in the past. (CN Beta, The Verge, 9to5Google, SlashGear)

BMW i Ventures, BMW’s hybrid venture firm, has announced it is investing in Prometheus Fuels. The Silicon Valley startup is working on technologies for pulling CO2 out of the atmosphere and processing it into carbon-neutral gasoline. The investment will help the company as it prepares for retail launch as early as late 2020. (CN Beta, New Atlas, BMW Group)

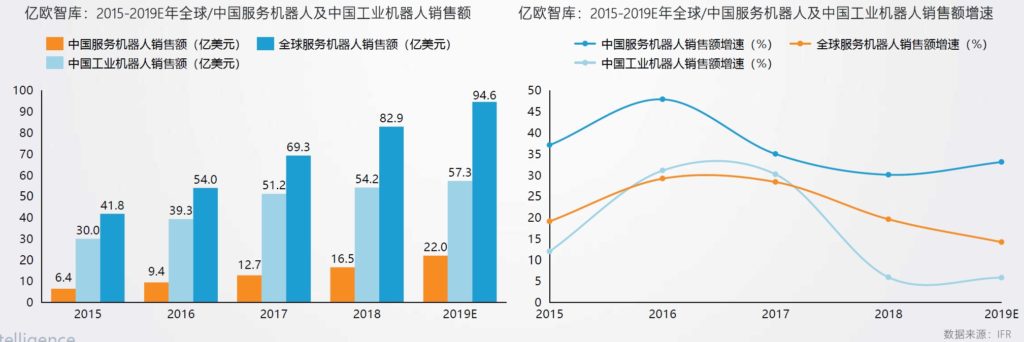

According to IFR statistics, China’s service robot market in 2019 is about USD2.2B, accounting for about 25% of the global market share. The Chinese Electronics Society predicts that this proportion is expected to reach 30% in the future. From 2015 to 2019, the growth rate of China’s service robot sales continued to be higher than the global service robot sales growth rate and China’s industrial robot sales growth rate, maintaining a good growth. (EO Intelligence report)

In 2019, Capital investment in the field of service robots was more cautious than in the previous 2 years, and capital began to focus more on the top tier companies. According to the review of some of the major financing events in 2019 by EO Intelligence, capital prefers companies with obvious core technology advantages (such as Zhuiyi Technology, Guiji Intelligence, etc.) or companies that have proven to be feasible and have clear application scenarios (such as Yunji Technology, Excelland Technology, etc.) (EO Intelligence report)

Two of Indonesia’s top fintech startups Dana and Ovo have agreed in principle to merge to create a stronger challenger to Gojek’s GoPay. Digital-payments company Ovo and digital-wallet provider Dana ironed out differences over valuations and structure as they aim to reduce cash burn. (CN Beta, Bloomberg, 36Kr, Bloomberg Quint)