6-14 #PrayforGood: UMC has been ordered to pay a fine of NTD100M (USD3.36M) to Micron in Taiwan; Samsung has sold its smartphones at USD292 on average in 1Q20; etc.

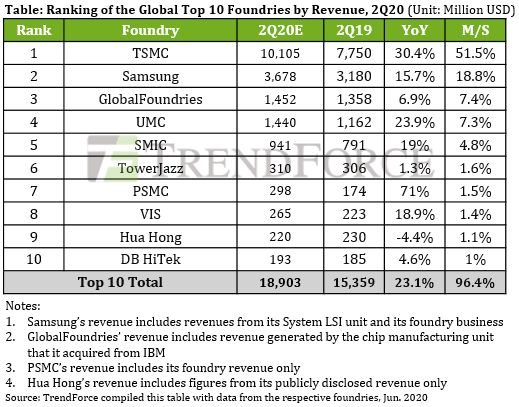

According to TrendForce, the combined revenues of the top 10 foundries increased by more than 20% YoY in 2Q20. This growth took place as there was not a massive reduction in wafer start orders in 1Q20, while foundry clients expanded their orders in 2Q20 due to both increased production of existing devices and new applications generated by the COVID-19 pandemic. The comparatively low base period in 2Q19 also contributed to the YoY increase in foundry revenue in 2Q20. (Laoyaoba, TrendForce, TrendForce, press)

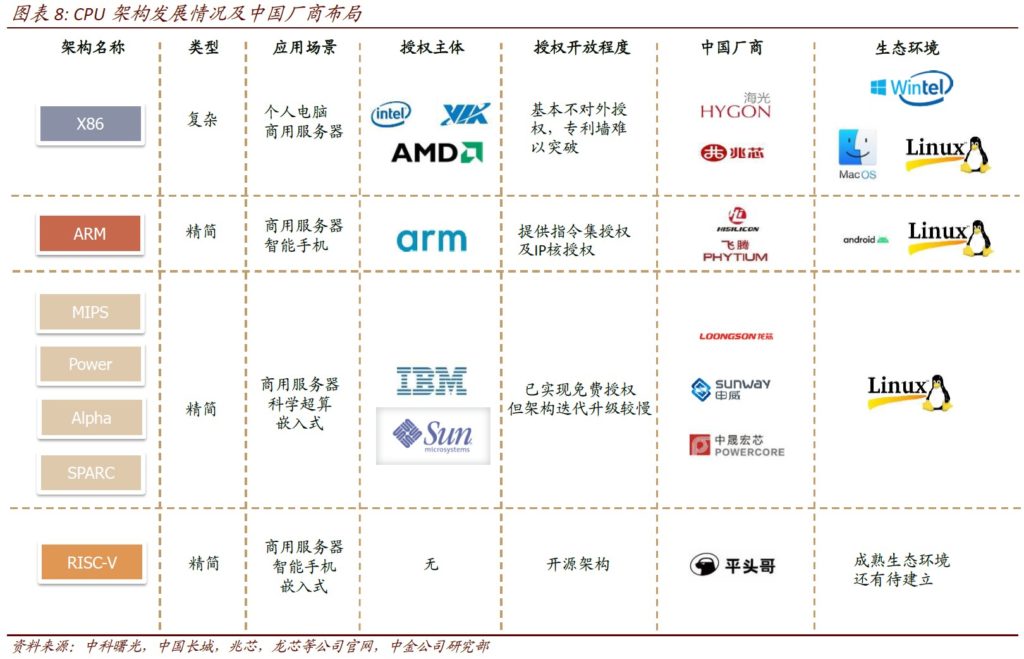

The instruction set architecture is the upstream of the CPU design, and the authorization barriers and ecological environment of different instruction set architectures vary greatly. Generally speaking, the better the ecological environment, the higher the patent and licensing barriers, and the relatively open instruction set lacks complete ecological equipment. The current mainstream architecture in the market can be divided into 4 categories: x86 architecture with complex instruction set, ARM architecture with reduced instruction set, newly introduced RISC-V architecture, and other RISC MIPS / Power / Alpha / SPARC and other architectures. (CICC report)

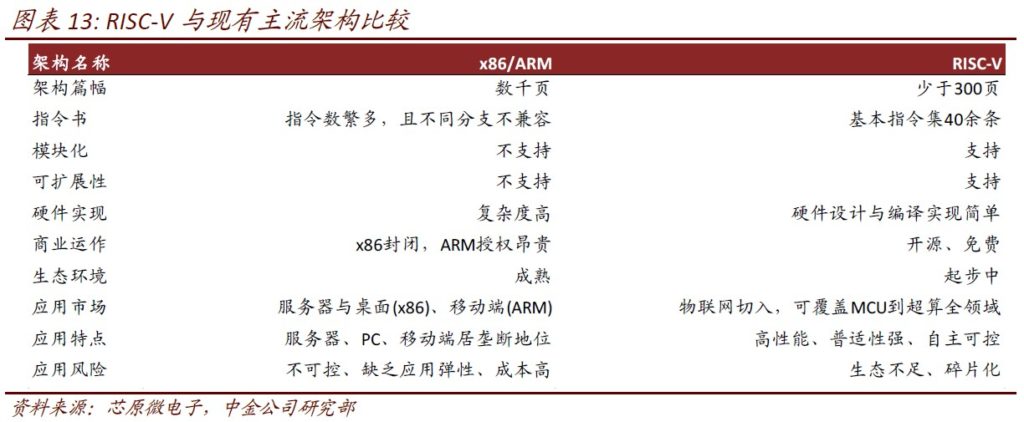

RISC-V is a new open source reduced instruction set architecture that appeared in 2010. There is no historical burden on the architecture design, and the concepts and methods adopted are more advanced. Compared with the mainstream architecture x86/ARM, the RISC-V architecture has less space, fewer basic instruction sets, supports modularity and scalability, is open source and free, and meets the needs of differentiation and customization. However, the RISC-V architecture appeared late, and the adaptation software and tools were insufficiently deposited, and the ecological environment still needs to be built. Among the domestic chip manufacturers, Ali’s PingTouGe Semiconductor has launched data center and embedded IoT chip products based on the RISC-V architecture. (CICC report)

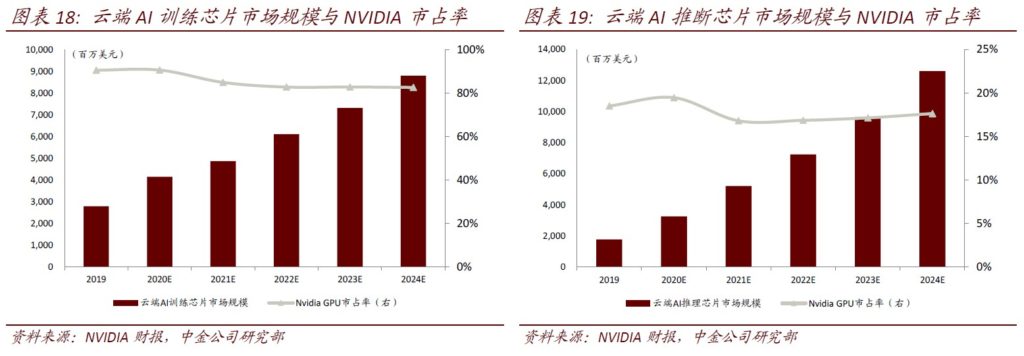

The cloud AI chip market is expected to grow 4.7 times in the next 5 years, reaching a scale of USD21.4B in 2024. At present, several listed companies have participated in the AI chip market, and the market penetration of chips is also increasing. Based on this, CICC estimates that the cloud AI chip market will reach USD4.6B in 2019 and will maintain an annual growth rate of 36% in the next 5 years. (CICC report)

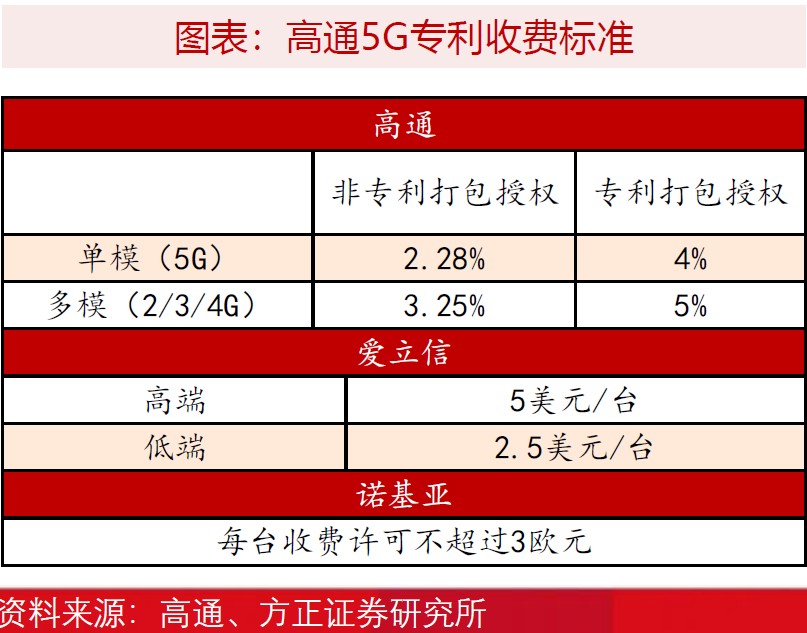

Compared with 3G / 4G patent fees, Qualcomm has eased a lot on 5G patent fees. Qualcomm will split the patent pool according to the agreement reached in 2015 with the National Development and Reform Commission, which is mainly divided into standard essential patents and non-standard essential patents. They will not be bundled together and sold, reducing the patent costs of some manufacturers. When using mobile network core patents alone, the wholesale price of mobile phones is the standard, and the wholesale price is 65% of the retail price. For single-mode 5G phones, the benchmark is 2.275%, and for multi-mode 5G mobile phones, the benchmark is 3.25%. At the same time, the use of mobile network standard core patents and non-core patents must pay 4% and 5% of the benchmark as patent fees. The mobile phone wholesale price is capped at USD400, with a maximum of USD20 for each mobile phone. (Founder Securities report)

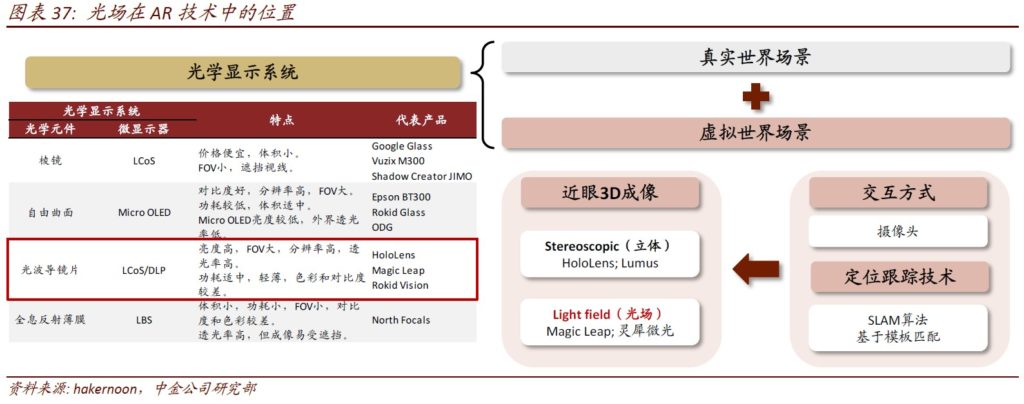

The path from freeform / Birdbath (BB) to the optical waveguide is clear, and the production cost determines the AR optical solution. In Mar 2020, Nreal built a research and development and production center in Wuxi to conduct R&D and mass production of BB modules. As the BB technology is relatively mature and the production cost is low, the product can be accepted by C-end users. Additonally, the Micro OLED light source has low power consumption characteristics, which can ensure the heat dissipation and endurance requirements of AR devices. (CICC report)

There are 2 options for AR to achieve near-eye 3D imaging, namely stereoscopic and light field. After the virtual image is formed, it will be coupled into the optical element (optical waveguide, etc.) through the light source device (LCOS or DLP), and finally after refraction and reflection, it will be coupled to the user’s eyes and combined with the real scene to complete the AR display. CICC believes that the light field can effectively solve the VAC vertigo, optimize the AR experience, combined with the characteristics of light waveguides and thin, large FOV, etc., is expected to become the mainstream AR display solution in the future. (CICC report)

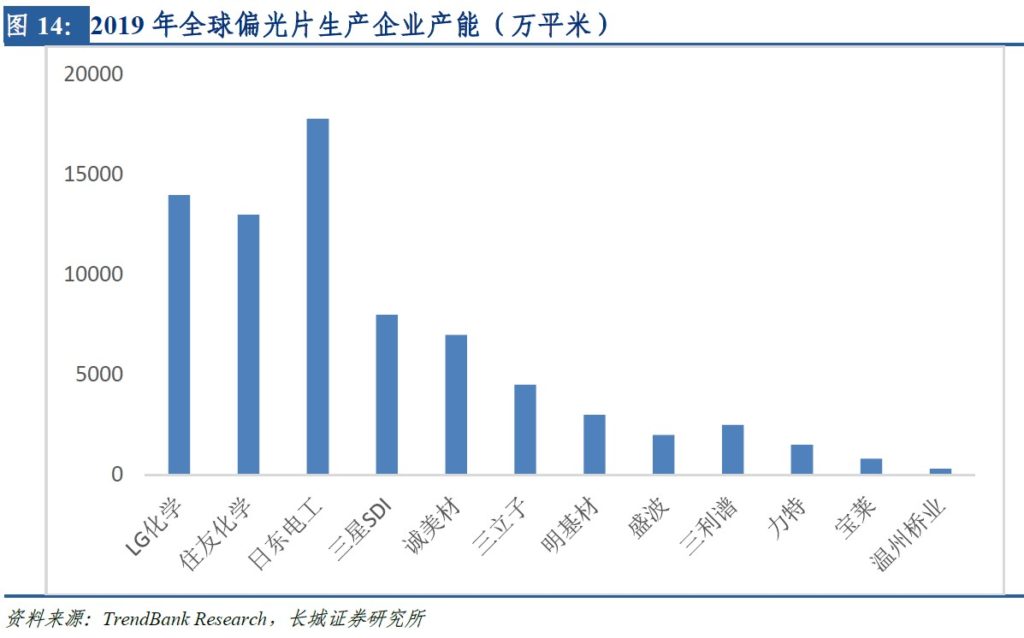

Due to fierce global panel competition, Panasonic and Samsung has begun to gradually reduce production since 2019. In Jan 2020, LG Display (LGD) announced that it will close its LCD panel factory in South Korea by the end of 2020. Affected by the epidemic and insufficient demand, Samsung has accelerated the withdrawal of production capacity at the end of Mar 2020 and decided to stop production of all LCD panels in South Korea and China by the end of 2020. According to Omdia, Samsung Display’s LCD panel market share in the global market is 10.9% in 2019. As of the end of 2019, LGD’s LCD panels accounted for 15.6% of large-size panel production capacity, i.e., P7 and P8 corresponded to 11% of global large-size panel production capacity. The withdrawal of the production capacity of the two giants will greatly reduce the supply of LCD panels. (Orient Securities report)

According to the DSCC forecast, the investment scale of LCD equipment will drop rapidly from 50% of panel equipment in 2020 to 25% in 2021. Currently, the new LCD production capacity mainly comes from the high-generation production capacity of mainland manufacturers. Affected by industry factors, the expansion of mainland manufacturers has also slowed down to a certain extent: 1) BOE’s Wuhan B17 production line is put into operation in 1Q20. Previously affected by the epidemic, the progress of capacity ramping is slightly delayed. 2) The designed production capacity of HKC’s plant is 150K, which is put into production in 3Q20. The first phase reached 90K. It is originally planned to expand to 120K in 2020. However, the tracking equipment manufacturers have not found relevant orders for Chuzhou plant, and the possibility of accelerated expansion in the short term is smaller; HKC’s Mianyang plant has a designed capacity of 150K and will be put into production in 3Q20, but the current equipment orders are relatively limited. (Orient Securities report)

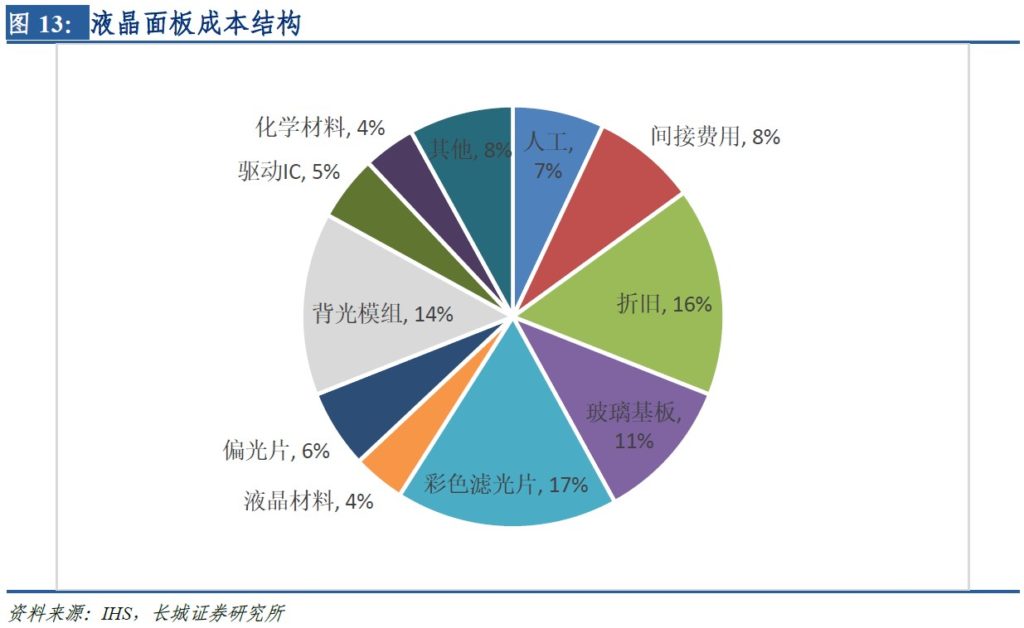

According to the Great Wall Securities, from the perspective of the cost structure of liquid crystal panels (LCD), the total cost of raw materials including glass substrates and color filters account for more than 50%, depreciation expenses are about 16%, and labor costs account for 7%. (Great Wall Securities report)

In the field of liquid crystal materials, the core manufacturing technology patents are still controlled by German and Japanese manufacturers. High-end liquid crystal materials are mainly controlled by the 3 major manufacturers of German MERCK, Japanese JNC, and DIC. Together, they hold more than 85% of global mixed crystal materials market. Domestic liquid crystal materials started late, mainly including Slichem Display Material, etc. (Great Wall Securities report)

Powev Electronic Technology has announced that as the first DDR4 memory module with China-manufactured core, Gloway PRO DDR4 series is currently in mass production in Pingshan, Shenzhen, which is manufactured by Powev. (CN Beta, My Drivers, IT Home)

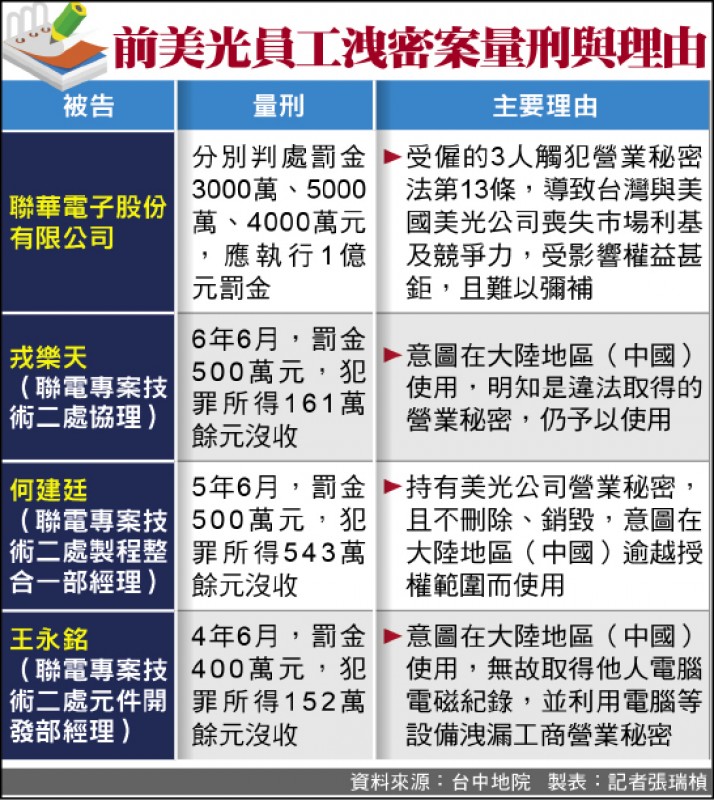

United Microelectronics Corp (UMC), Taiwan’s second largest pure wafer foundry operator, has been ordered to pay a fine of NTD100M (USD3.36M) by a district court in Taichung City which found the company and 3 of its employees guilty in a trade secret theft case brought by U.S.-based memory chipmaker Micron Technology. (CN Beta, My Drivers, TechNews, UDN, LTN, Focus Taiwan)

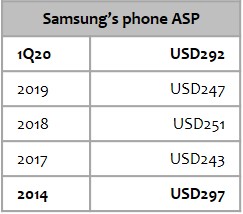

Samsung has sold its smartphones at USD292 on average in 1Q20, up 8.5% from a year earlier. The 1Q20 ASP also marks a 20.7% rise on quarter, according to Strategic Analytics. Samsung’s 1Q20 ASP marks the highest since the 2Q14 when the comparable figure was USD297. (CN Beta, Korea Herald, Jiemian, YNA)

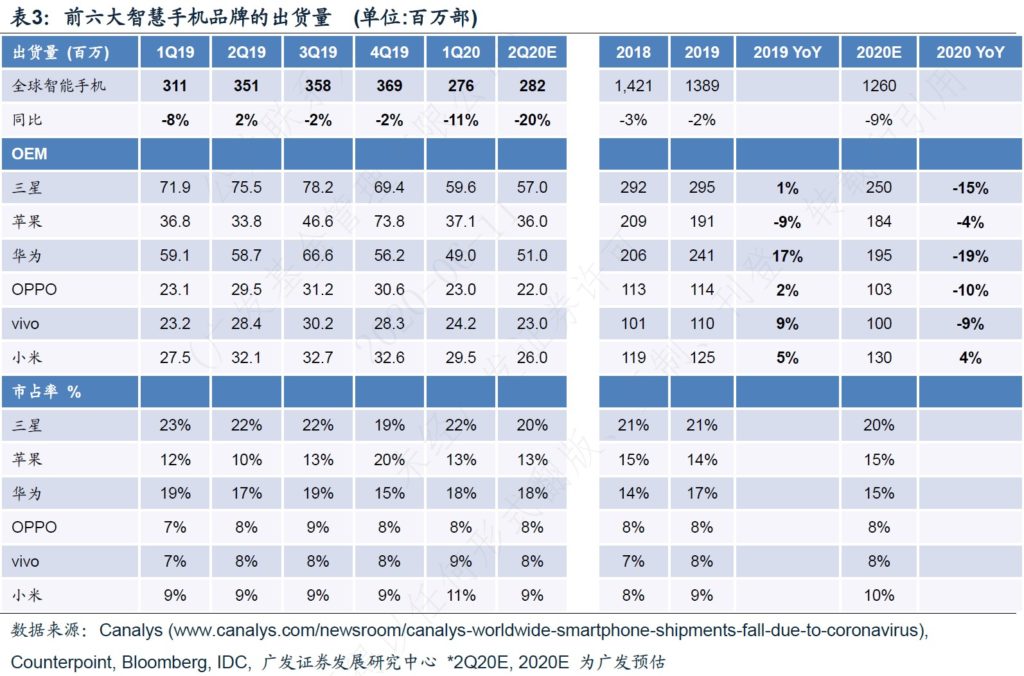

GF Securities maintains a forecast of the overall smartphone market and the shipments of major brands. The overall industry forecast for 2020 is a 9% YoY decline, which is similar to TSMC’s view (single digit decline), but it is lower than market optimistic expectations (down 10- 15%). GF Securities believes that the downward trend of shipments has slowed down, even though the demand in mainland China is weak May-Jun 2020, the industry continues to bottom, the main driving force is the decline in the retail price of 5G phones, and the restart of overseas offline stores. (GF Securities report)

vivo V19 Neo is announced in Philippines – 6.44” FHD+ Super AMOLED HiD, Qualcomm Snapdragon 675, rear quad 48MP-8MP ultrawide-2MP macro-2MP depth + front 32MP, 8+128GB, Android 10.0, under display fingerprint, 4500mAh 18W, PHP17,999 (USD360). (vivo, GSM Arena, Walastech)

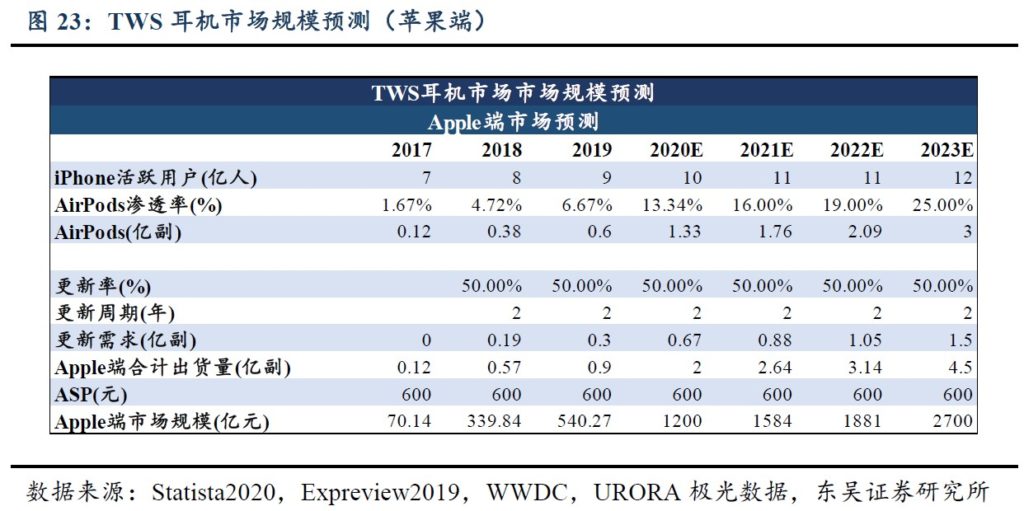

According to Apple AirPods shipments, the growth rate and volume of AirPods shipments are on par with the iPhone. Currently, AirPods penetration rate is less than 10% for iPhone users. Soochow Securities believes that there is still much room for improvement in the future. Non-Apple TWS earphones are also catching up quickly. Recently, non-Apple TWS earphones on the market have gradually overcome technical difficulties and captured the low-end TWS market, but the current penetration rate is less than 50% of AirPods. Therefore, Soochow Securities believes that there is still a lot of room for TWS market demand. The results show that by 2023 global TWS headset shipments will break the 1B mark, and the overall market will exceed CNY350B. (Soochow Securities report)

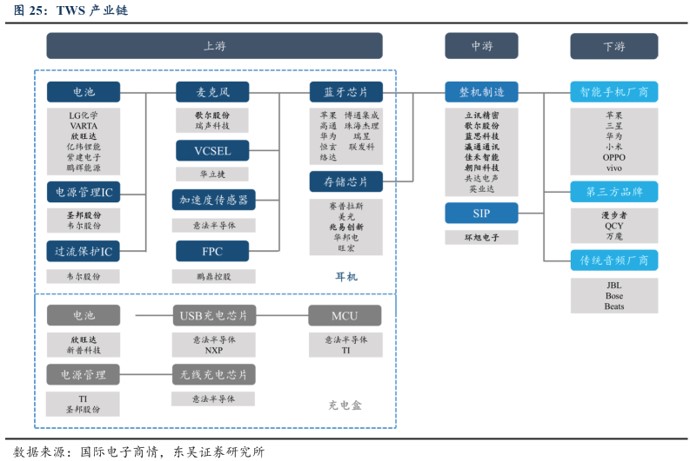

The TWS industry chain mainly includes upstream component suppliers, midstream machine manufacturers and downstream terminal brand manufacturers. Among them, the upstream components mainly include batteries, power management ICs, microphones, FPC, Bluetooth chips and memory chips; the whole machine manufacturers are mainly OEM/ODM manufacturers with the ability to process acoustic precision components; downstream terminal brand manufacturers mainly include smartphone manufacturers, traditional audio manufacturers and third-party brand manufacturers, etc. (Soochow Securities report)

Soochow Securities divides TWS’s ODM / OEM manufacturers into two categories, one is the traditional electro-acoustic product ODM / OEM factory, and the other is a precision manufacturing platform company that follows the major customers and expands horizontally into the TWS assembly field. (Soochow Securities report)

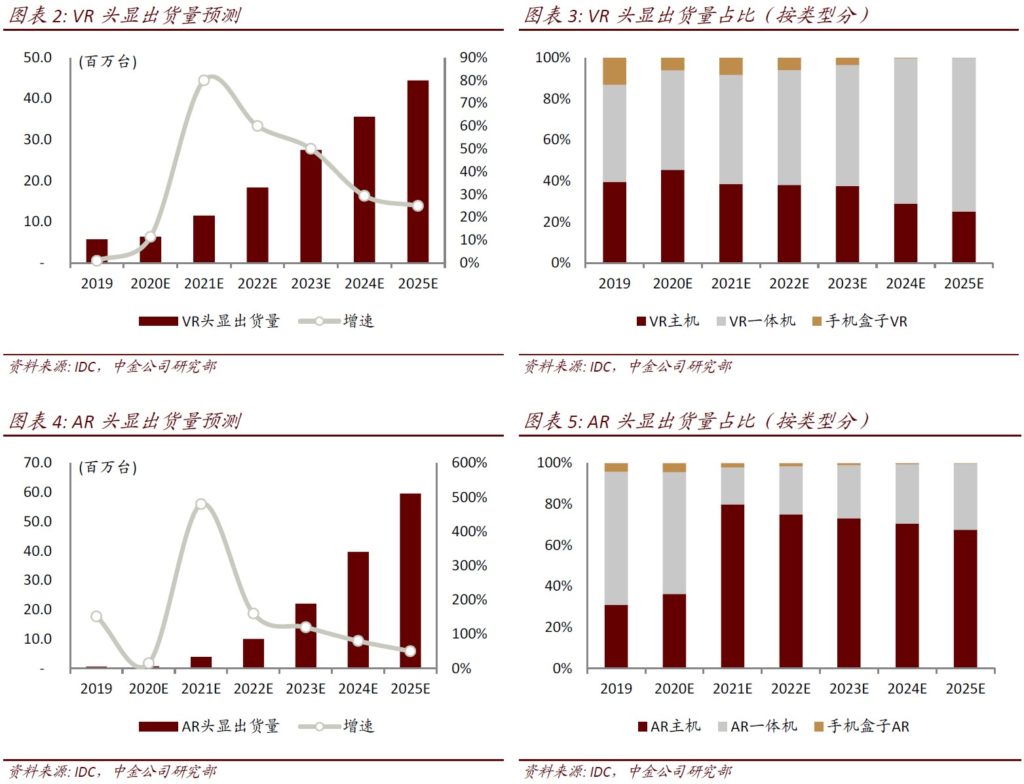

CICC predicts that virtual reality (VR) shipments will be 637M / 11.147M units in 2020 / 2021, up 11% / 80% YoY. CICC predicts that VR headset shipments will reach 44.51M units by 2025, with a 2020-2025 CAGR of 48%. CICC forecasts that shipments of augmented reality (AR) headsets for 2020 / 2021 will be 690K / 3.86M units, up 15% / 480% YoY. Shipment of AR headsets is expected to reach 59.68M units in 2025, and 2020-2025 CAGR will reach 146%. (CICC report)