6-21 #HappyFathersDay: Some consolidate of some reports and some numbers…

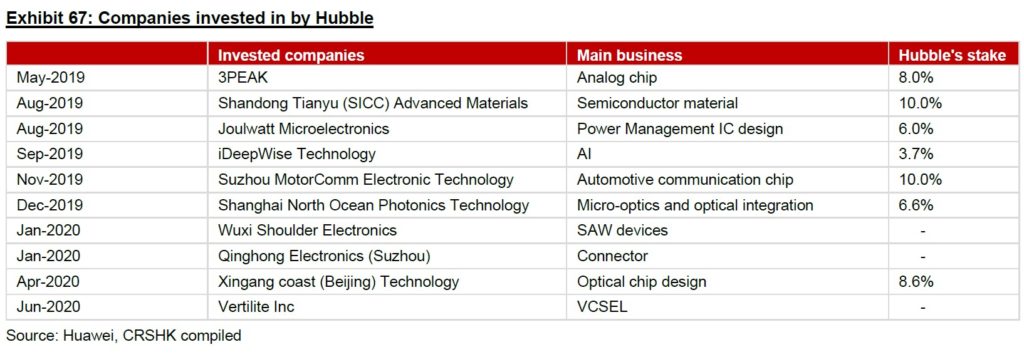

In response to the US restrictions imposed starting from 15 May 2019, Huawei has stepped-up efforts to secure its business sustainability: 1) established the subsidiary Hubble Technology Investment to support the domestic semiconductor industry; 2) shifted investment focus of its Corporate Development Department to domestic players; 3) extended the inventory cycle for key components and key chips; and 4) promoted domestic substitution and reduced the proportion of US-produced products through adopting self-developed components from its subsidiary HiSilicon and components supplied by domestic or other foreign suppliers, such as EU, Japanese and Korean suppliers. (China Renaissance report)

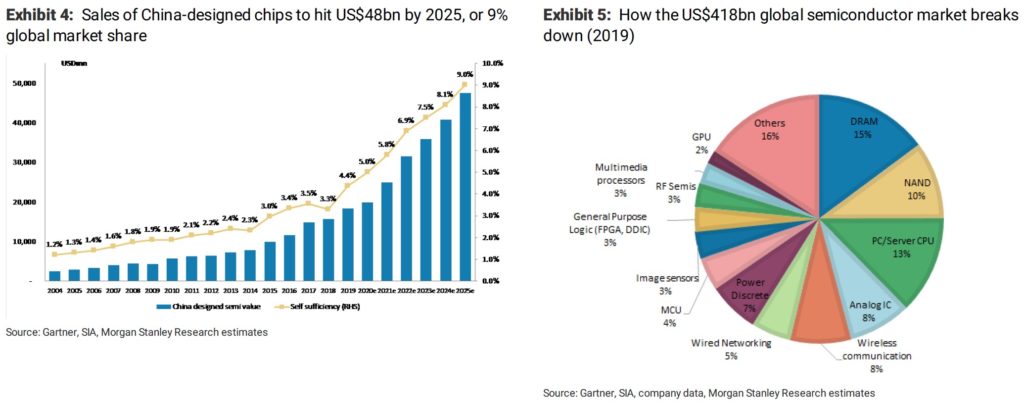

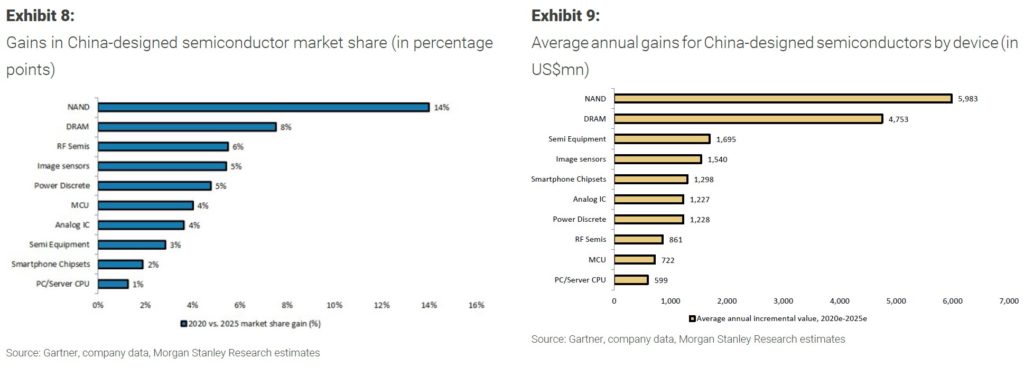

Morgan Stanley forecasts that sales of China-designed chips will rise from USD18B in 2019 to USD48B in 2025, a CAGR of 17%, as more local designs and products compete with global vendors. They forecast that, by 2025, China will reach 9% global semi market share, up from 4-5% today. China will also be able to meet 40% of its system companies’ needs by then, per their estimates. (Morgan Stanley report)

Morgan Stanley has classified global semis into 6 categories – compute logic, communication logic, memory, specialties, MCU / sensors, and manufacturing / design tools. They show the current global leaders in these sub-segments and key competitors from China (both incumbents and new entrants). (Morgan Stanley report)

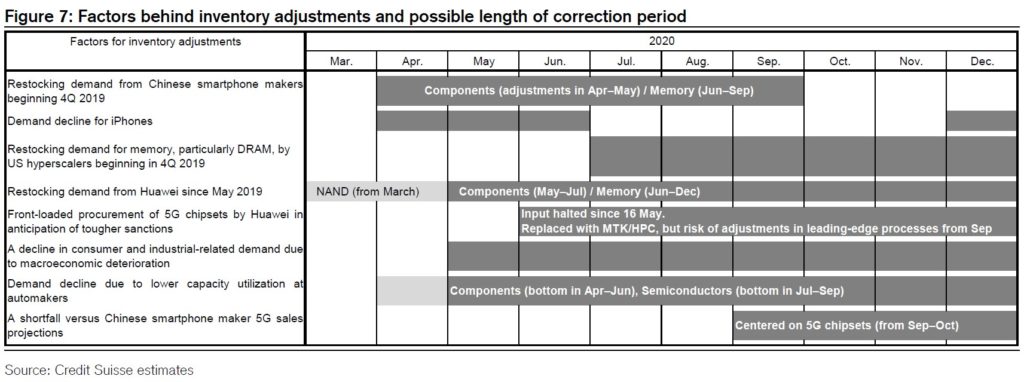

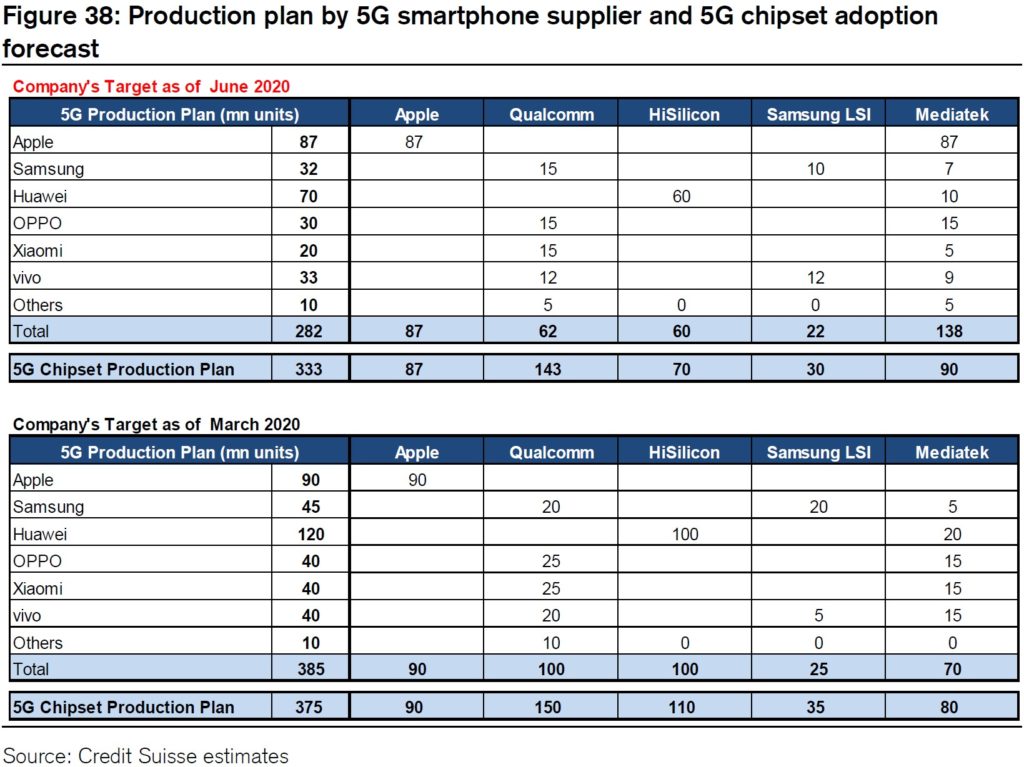

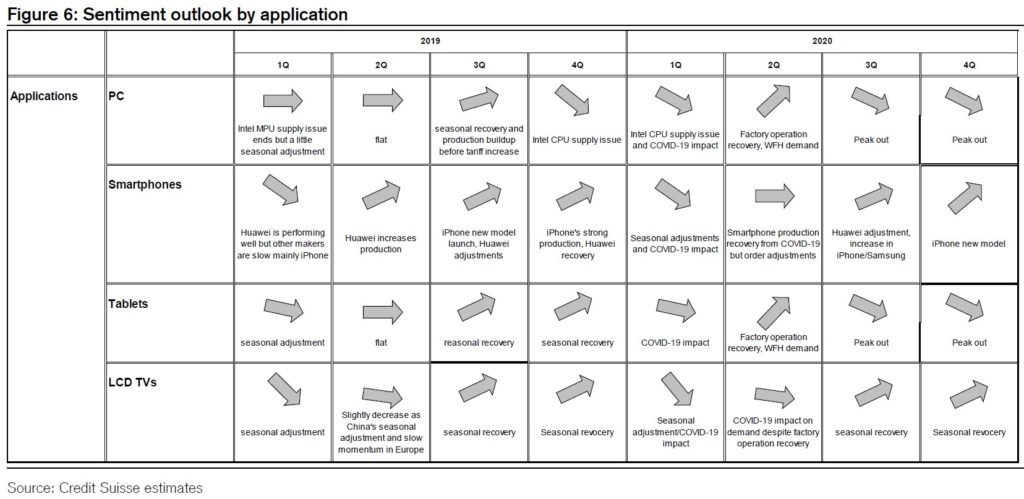

Credit Suisse expects inventory adjustments across the technology industry to result in (1) a pullback in restocking demand from Chinese smartphone makers that started in 4Q19, (2) a pullback in restocking demand for memory (particularly server DRAM) from hyperscalers, (3) a pullback in Huawei’s restocking demand since May 2019, (4) inventory adjustments at Huawei due to the company bringing forward 5G chipset procurements in anticipation of stricter sanctions, (5) a decline in consumer and industrial-related demand due to macroeconomic deterioration, (6) weaker demand due to a decline in utilization rates at automobile manufacturing plans, and (7) a shortfall versus Chinese smartphone makers’ 5G sales projections. (Credit Suisse report)

Credit Suisse understands that HiSilicon itself has more than 4 months of inventory, and is also preparing 5M–25M units for its Kirin 1000 (5nm process). From this, they surmise that Huawei has secured 5G chipsets volumes for flagship and high-end models through spring 2021. MediaTek, on the other hand, which is starting inventory adjustments after its previous restocking, is apparently asking TSMC to increase capacity by several tens of millions of units in order to increase the use of MediaTek product in smartphones by Huawei (which currently plans to procure 90M units). This suggests sufficient inventory for Huawei smartphones. (Credit Suisse report)

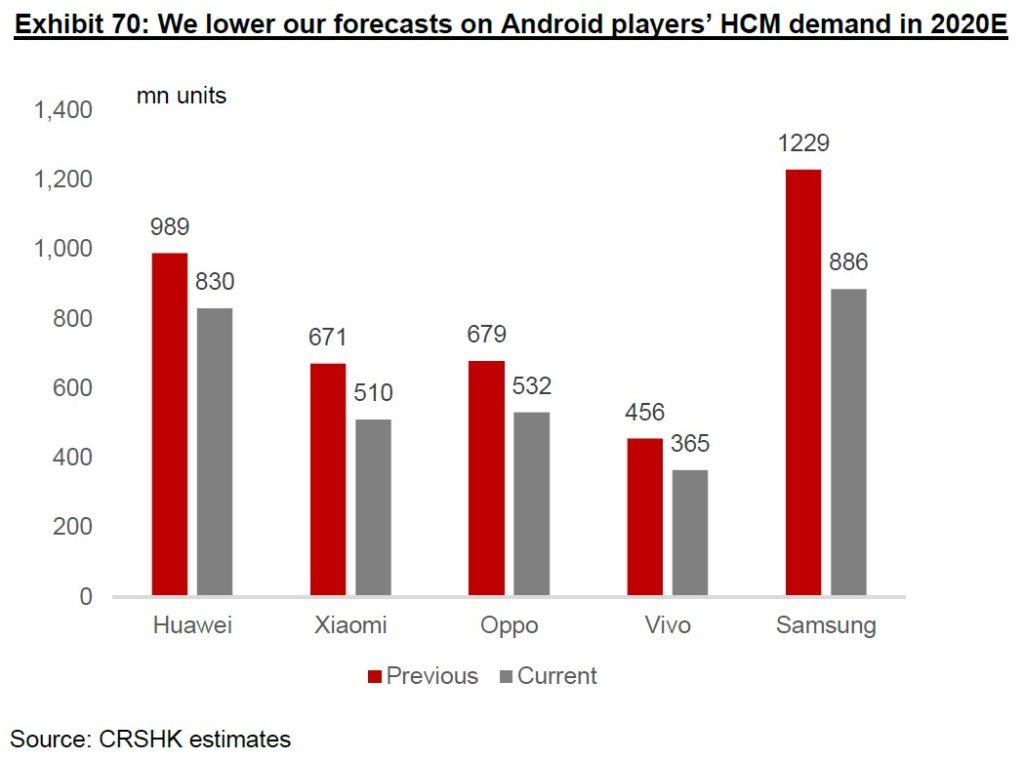

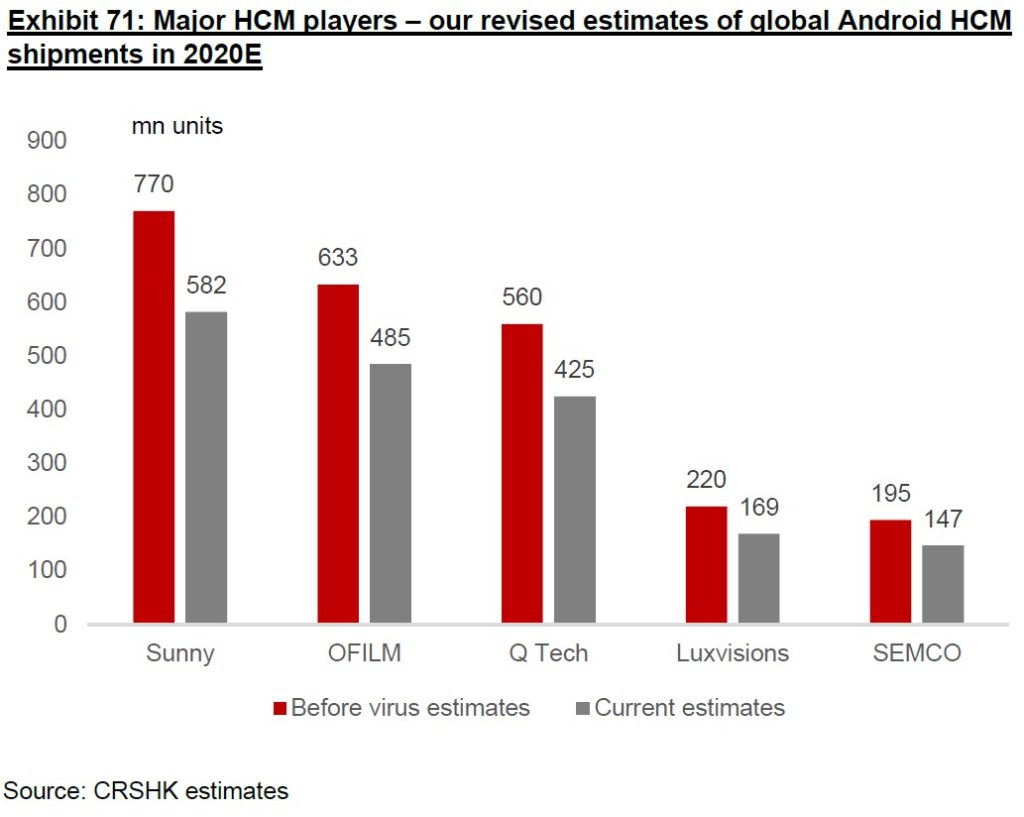

China Renaissance estimates global Android smartphone camera module shipments will reach 3.1B units in 2020. They now expect Huawei to reduce its camera module demand by 16%, compared with its previous planned demand in 2020, Xiaomi to reduce by 24%, OPPO to reduce by 21.6%, vivo to reduce by 20%, and Samsung to reduce by nearly 30%. (China Renaissance report)

China Renaissance expects Huawei / Xiaomi to potentially shift their orders to Sunny and O-Film, and OPPO / vivo to potentially shift orders to QTech. Samsung may shift orders to affiliate SEMCO, at the expense, potentially, of Chinese camera module makers like Sunny and QTech. (China Renaissance report)

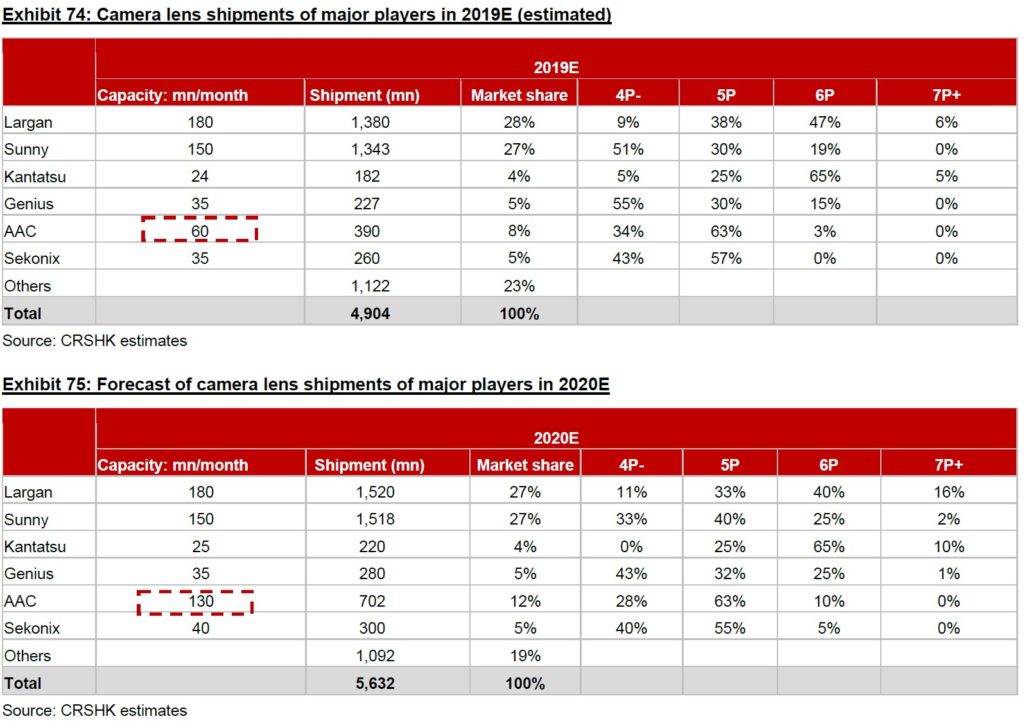

According to channel checks of China Renaissance, Largan has entered into Samsung’s supply chain, which is likely adding pressure on Sunny. Sunny’s capacity is also likely to stay at the current level (150M/month), and expect the company to increase its 6P proportion in total product shipment to 30% in 2020, from 23% in 2019. Sunny’s lens shipments to Samsung to be cut by around 20-30%, due to Sunny’s expected market share loss to Largan and AAC in 2020. (China Renaissance report)

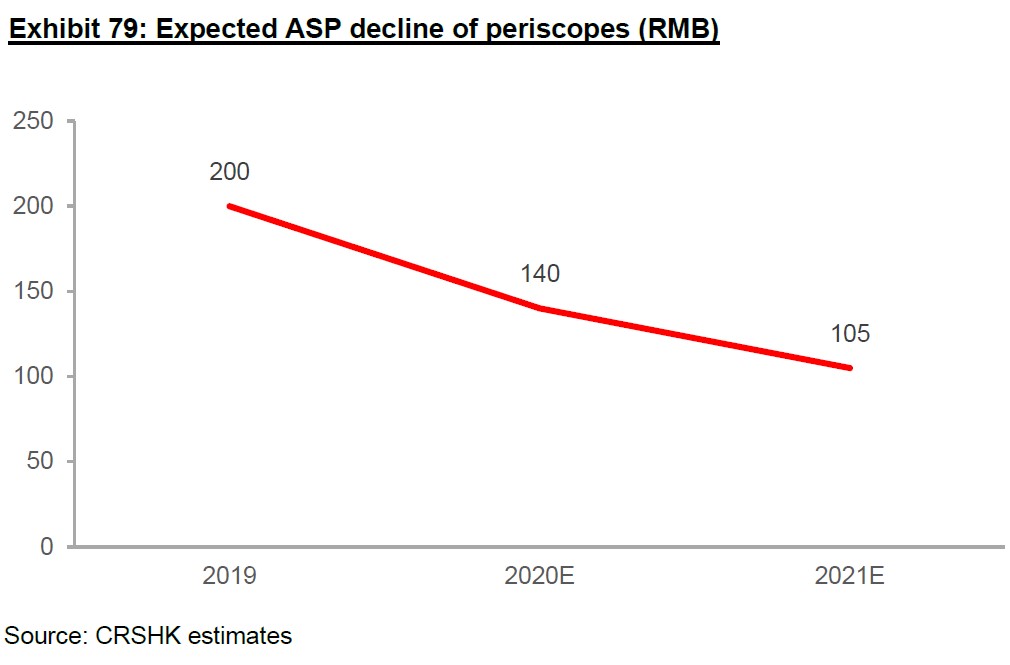

China Renaissance estimates the shipment volume of periscopes will reach 87M units in 2020, with 30M units shipped to Huawei, 30M units shipped to Samsung. They expect shipments to further increase, to 200M units in 2021, with majority shipped to low- to mid-end smartphones. They also estimate a price decline for periscopes to below CNY140 in 2020 on maturing technology. (China Renaissance report)

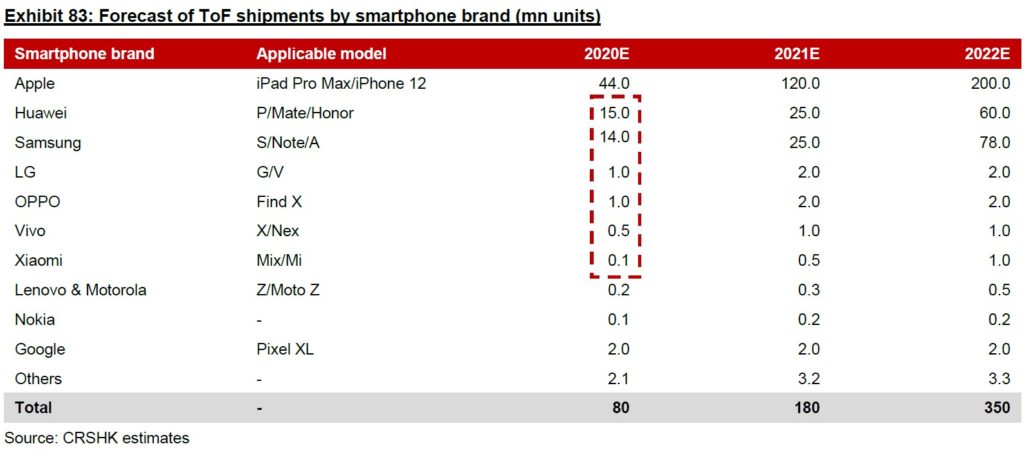

China Renaissance estimates ToF shipments will reach 180M units in 2021, with relatively slower growth compared with 2022, as: 1) Apple and suppliers of sensors and drivers have strong exclusive agreements; and 2) Android players are still waiting to see further applications of ToF. With maturing technologies and more ToF applications going forward, they expect ToF shipments to further increase to 350M units in 2022. (China Renaissance report)

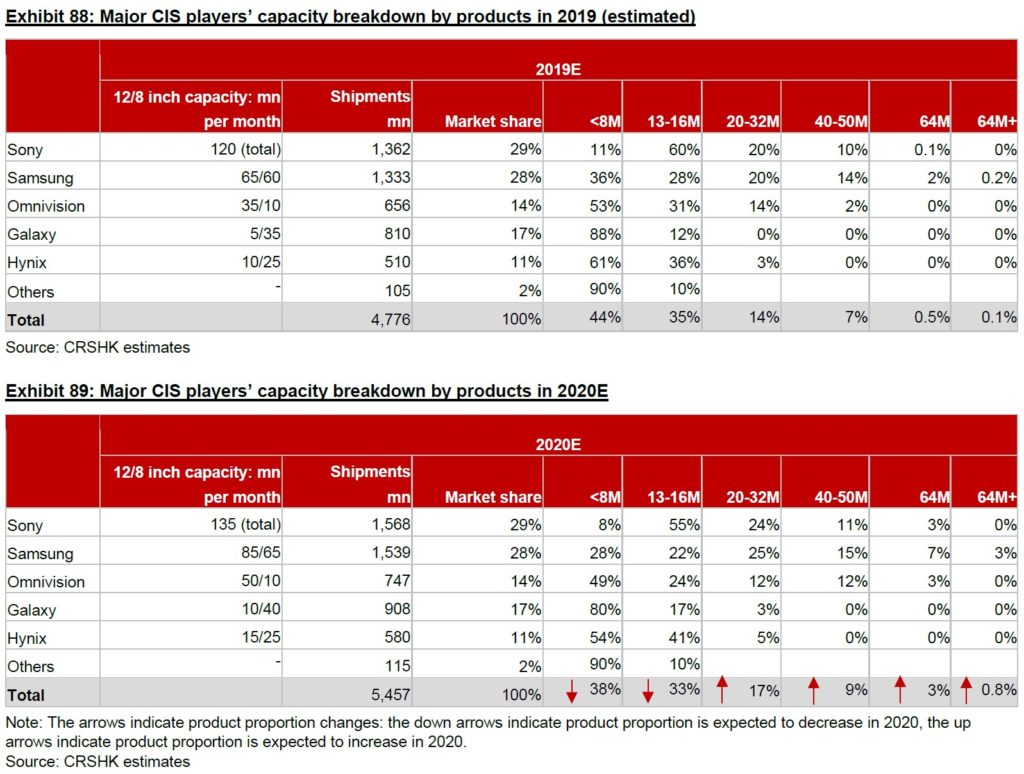

Currently, the industry focus is still on 48MP and 64MP CMOS chips. China Renaissance estimates the total demand for 48MP CMOS chips in China will reach 200-250M units in 2020, as some 64MP demand to be replaced by 48MP, due to the smartphone configuration downgrade trend amid the COVID-19 outbreak. Meanwhile, they expect relatively low-end 64MP chips to occur in 2H20, with ASP at around USD5. (China Renaissance report)

Samsung’s CIS production volume slightly fell (50K/wpm for 300mm wafer input, 50-55K/wpm in 1Q20). The company plans to increase output to 60–70K by end-2020 (by converting Line 11 and all of its former DRAM production lines). Samsung is planning to manufacture CIS in Xian. SK Hynix has already expanded its 300mm CIS production line to 20K wafers/month. (Credit Suisse report)

Global semi revenues were around USD418B in 2019, with Chinese designs accounting for USD18B, implying 4-5% market share. Memory (DRAM / NAND) accounts for 25% of global semi value and should be the main segment in China’s next stage of semi growth. Morgan Stanley expects the most disruption in NAND Flash, with a 14ppt gain, followed by DRAM and RF semis. (Morgan Stanley report)

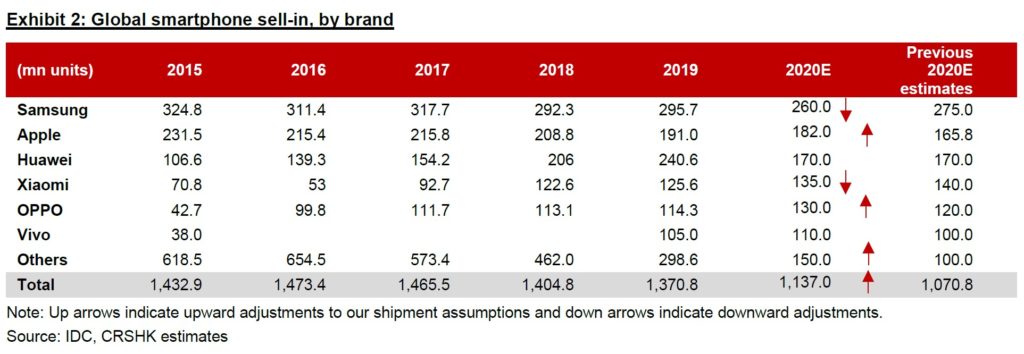

Given the global smartphone market is undergoing a gradual recovery, China Renaissance revises up slightly global smartphone sell-in forecasts for 2020 to 1.14B units from 1.07B units. However, they believe overall market demand remains weak and they expect smartphone players to experience higher inventory levels. By region, China’s smartphone market is gradually recovering, although not all of the pent-up demand Jan-Feb 2020 is likely to be deferred to later months. (China Renaissance report)

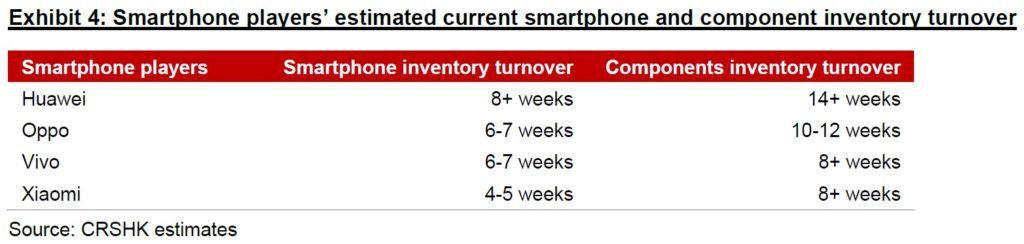

China Renaissance believes the current inventory of both smartphones and components has reached a high level. Their latest supply chain checks suggest Huawei’s current smartphone inventory turnover stands at more than 8 weeks, while they estimate it is 6-7 weeks for OPPO (3 weeks for 4G smartphones) and vivo, and 4-5 weeks for Xiaomi. In particular, they notice the smartphone inventory of Xiaomi has been rising since early 2020, while they believe inventory at Huawei, OPPO and vivo has recently returned to the high levels of early 2020 after a short period of inventory digestion. (China Renaissance report)

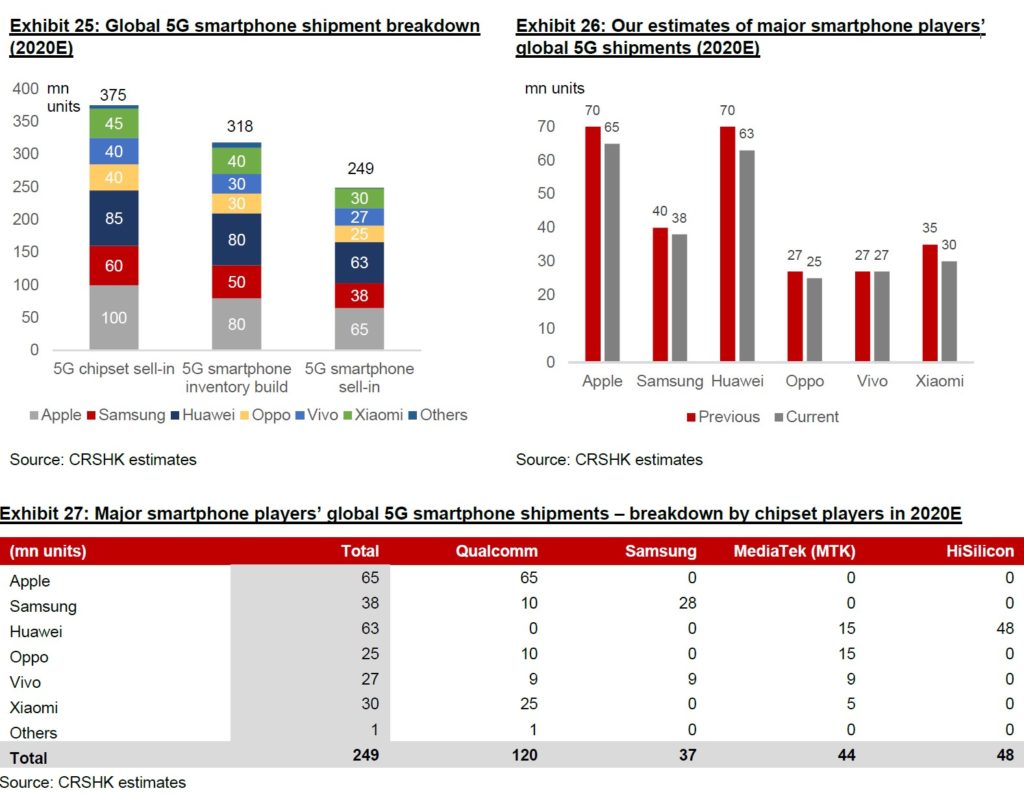

In terms of global 5G smartphone sell-in, China Renaissance revises down 2020 estimates to 249M units from 274M units previously. By smartphone player, they expect the 2020 5G smartphone shipments to be 63M units for Huawei, around 65M units for Apple, 38M units for Samsung, 25M units for OPPO, 27M units for vivo, 30M units for Xiaomi, based on their estimates of their global market share. (China Renaissance report)

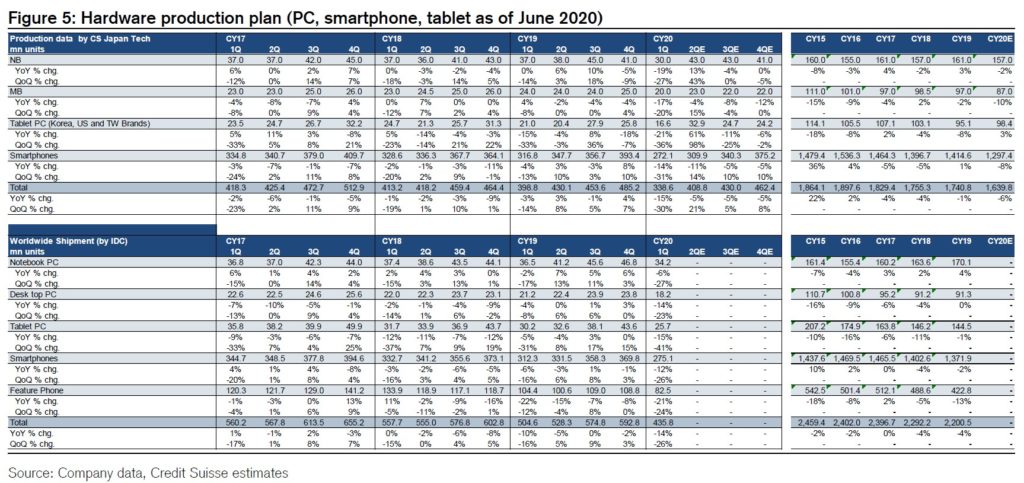

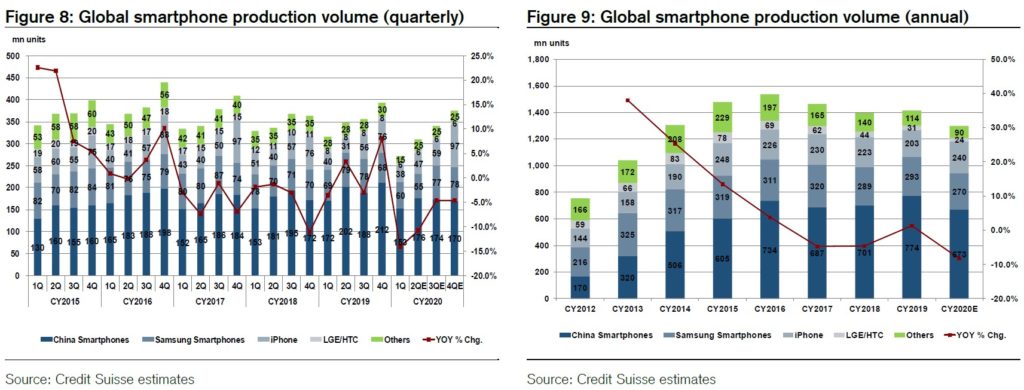

Credit Suisse estimates global smartphone production totaled 1,396M units (−5% YoY) in 2018 and 1,415M (+1%) in 2019. As of the latest survey, the outlook is for 1,297M units (−8% YoY) in 2020, down from 1,359M units (−4%) in the previous survey (Mar 2020). However, Credit Suisse sees downside risk to this production forecast, considering record-setting levels of Apple iPhone production and Samsung’s plans to increase smartphone production after sanctions were tightened on Huawei. (Credit Suisse report)

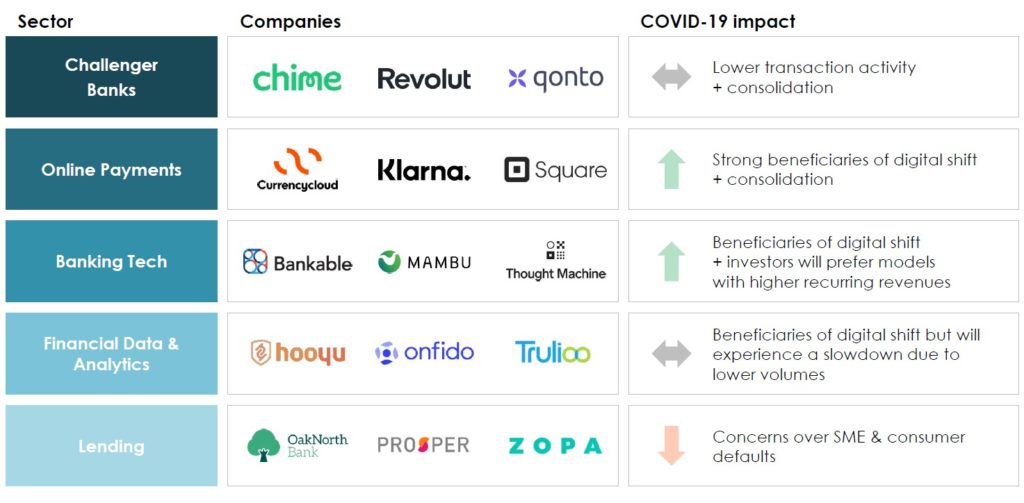

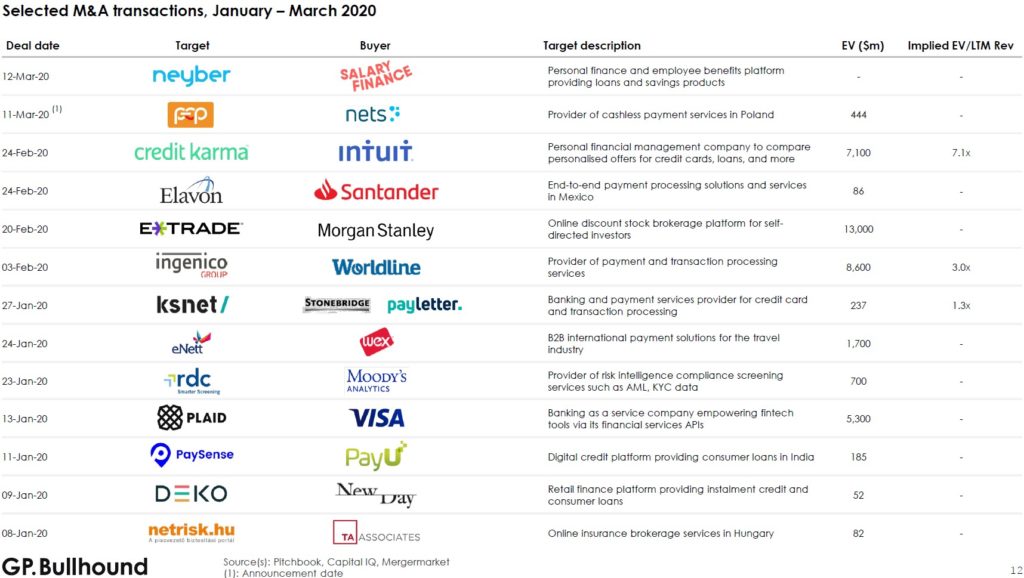

On a macro level, GP Bullhound sees the COVID-19 pandemic bring to a head the importance of a digital economy and expect the digital shift to intensify the fight between different stakeholders vying for market share in the digital wallets of individuals and companies alike. This fight amongst incumbent and challenger payment solutions will most likely lead to consolidation in the space – which was already happening pre-COVID-19. (GP Bullhound report)

1Q20 saw a continued effort by strategic to consolidate the payments market with Plaid / Visa and Ingenico / Worldline being two of the largest deals. GP Bullhound also believes the Credit Karma / Intuit transaction may point to more deals to come in the consumer data space. (GP Bullhound report)

The value of the GP Bullhound’s fintech index dropped by USD24B over 1Q20 as a result of the difficult trading environment caused by the COVID-19 pandemic. (GP Bullhound report)

how can i show morgan ,etc report?

Great stuff – thank you!

The link to the China Renaissance report appears to be broken – do you have an alternative one?