6-27 #DreamsHoliday: Huawei officially announced that its first phase plan at the Cambridge campus in the United Kingdom has been approved; Microsoft has announced a strategic change in its retail operations, including closing Microsoft Store physical locations; etc.

MediaTek’s 5G chip shipments will increase QoQ to the end of 2020, and the shipments in will still reach the original expectations. MediaTek has reportedly reserved more chip production capacity to support the business development of 2H20. MediaTek’s new reservation is mainly TSMC’s production capacity, but also includes back-end production capacity such as packaging and testing. MediaTek’s supply of 5G SoCs to Huawei will increase to 42M units. In addition to normal growth, Huawei’s orders will bring MediaTek an additional 5.4% profit. (Laoyaoba, TechWeb, OfWeek)

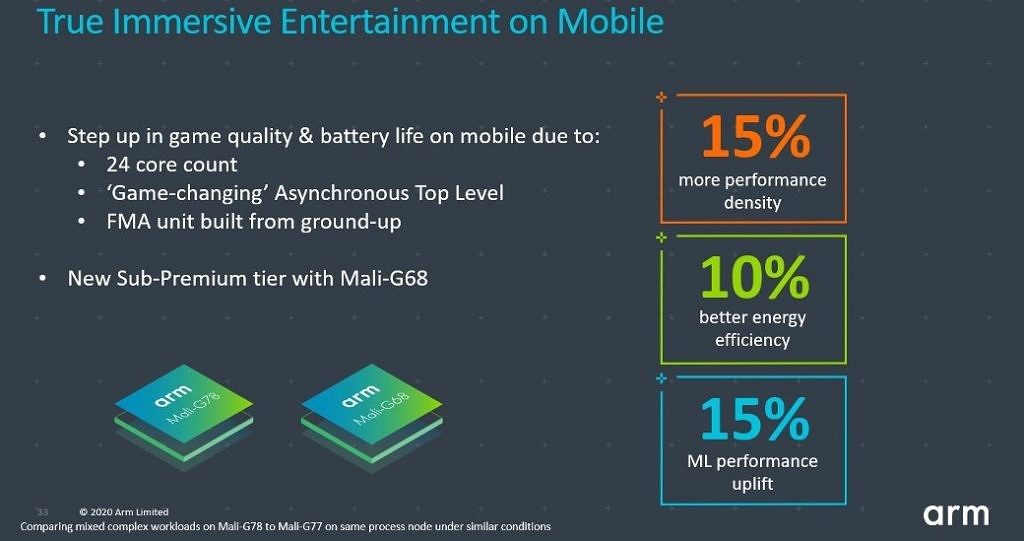

With the launch of Snapdragon 865 and Snapdragon 765 / 765G SoCs, Qualcomm has announced support for updateable GPU drivers via app store. ARM also announces similar support for its Mali GPUs. ARM has also announced support for Android GPU Inspector for its upcoming GPUs, which is an open-source profiling tool that helps game developers to optimize graphic performance. (Gizmo China, ARM, XDA-Developers, CN Beta)

GlobalFoundries CEO Tom Caulfield has revealed that the company could install new equipment to take advantage of 30%~40% of floor space that is unused at its Malta, New York factory, which would boost output within 12~14 months. In a second phase, it may build an adjacent plant that could be producing chips by 2024. The plan could be significantly sped up if U.S. lawmakers pass a USD22.8B package to bolster domestic chip manufacturing. (Laoyaoba, NY Times, US News)

Yuekai Securities Securities believes that the popularization of chips supporting the blue technology 5.X will help solve the delay, stability, power consumption and other issues of true wireless stereo (TWS) headsets, and significantly improve the performance of TWS headsets. Yuekai Securities has counted the mainstream TWS earphones with good sales volume on the market, and the main control chips used by it support the blue 5.X standard. (Yuekai Securities report)

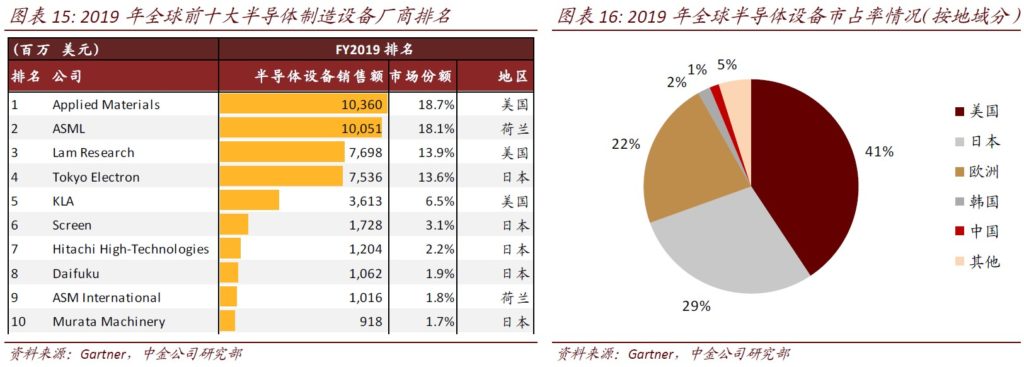

According to Gartner, the global market for semiconductor manufacturing equipment reach USD59.8B in 2019. Depending on the wafer manufacturing process, semiconductor equipment can be subdivided into lithography, etching, deposition, cleaning, CMP, heat treatment, process control and other equipment The competitive landscape in the segment of equipment segment is different, but overall, American equipment manufacturers occupy a leading position, and in 2019, US equipment market share in the global market reached 40.7%. (CICC report)

Currently China’s domestic semiconductor equipment has made breakthroughs in the main links of semiconductor manufacturing. It has some import substitution strengths in etching, cleaning, degumming, heat treatment/oxidation diffusion, etc., but it is still in the depth of the product line and the coverage of advanced processes There is a large gap with international manufacturers. At the same time, American companies are in the market leading position in key processes such as etching, deposition, ion implantation, process control, CMP, and the market share of some subdivided equipment in advanced processes is close to 100%. CICC believes that it is still difficult to achieve complete import substitution of semiconductor equipment in the short term. (CICC report)

Samsung is introducing ISOCELL GN1, which is a 50MP sensor with 1.2μm pixels. As Samsung’s first image sensor to feature both Tetracell and Dual Pixel technologies. The former uses 4:1 pixel binning to create sharper photos with less noise. The latter provides ultra-fast autofocus as good as the AF capabilities that could be found on DSLR cameras. (Phone Arena, Samsung)

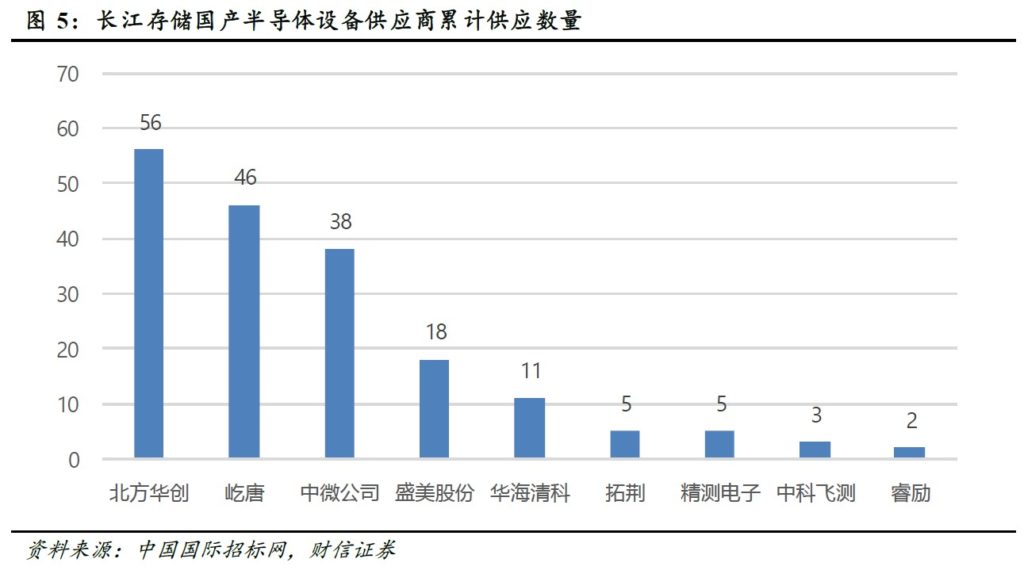

The production lines of Yangtze Memory Technology Corp (YMTC) and Hefei Changxin Memory Technology Corp (CXMT) are in the process of capacity ramp-up. As of 1Q20, their capacity utilization rate is around 20%, and there is still a large capacity space. According to the estimation of the share of Chinese-made equipment in the process of its equipment bidding and procurement, the capacity expansion of YMTC and CXMT will effectively drive the domestic semiconductor equipment manufacturers to release their performance, focusing on the core domestic semiconductor equipment suppliers such as AMEC, NAURA, etc. (Chasing Securities report)

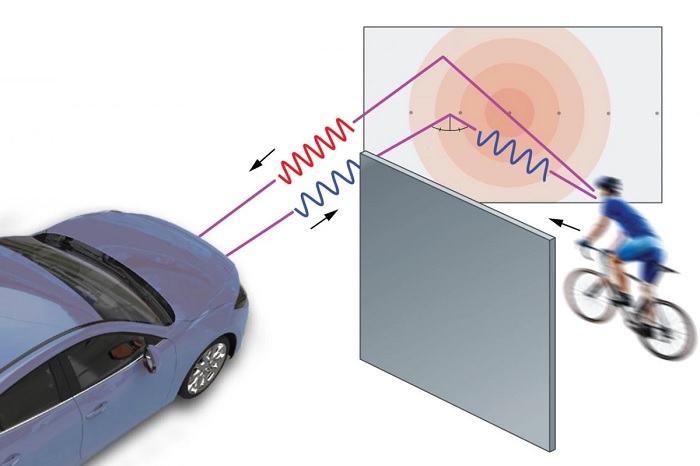

Using radar commonly deployed to track speeders and fastballs, Princeton University has developed an automated system that will allow cars to peer around corners and spot oncoming traffic and pedestrians. The system, easily integrated into today’s vehicles, uses Doppler radar to bounce radio waves off surfaces such as buildings and parked automobiles. The radar signal hits the surface at an angle, so its reflection rebounds off like a cue ball hitting the wall of a pool table. The signal goes on to strike objects hidden around the corner. Some of the radar signal bounces back to detectors mounted on the car, allowing the system to see objects around the corner and tell whether they are moving or stationary. (CN Beta, Princeton University)

Singtel Mobile Singapore has picked Ericsson as their provider of 5G network while a joint venture consortium between StarHub Mobile and M1 Limited has selected Nokia to build the network and supply the core and mmWave networks. The companies have said they are also exploring other network parts with China’s Huawei and ZTE. (GizChina, CNBC, Nikkei, Mothership, Reuters)

Ford and Vodafone Business lead consortium to develop the potential of 5G in manufacturing. Electric vehicle (EV) manufacturing processes to be enhanced by 5G connectivity. New mobile private network (MPN) to provide faster and more accurate control and analysis of EV manufacturing. As per Ford and Vodafone, the project, which would be the first of its kind in Britain, is part of a GBP65M (USD80.87M) investment by the UK government, out of which GBP2M is committed specifically for Vodafone. (Neowin, Vodafone)

Huawei officially announced that its first phase plan at the Cambridge campus in the United Kingdom has been approved. The plan is mainly for optoelectronics research, development, and manufacturing. The Huawei Cambridge Campus is located in the hinterland of the “Silicon Marsh” in Cambridge, England, where high-tech companies gather. (GizChina, IT Home)

The US Department of Defense has published a list of 20 companies it claims are closely tied to the Chinese military. In the technology sector, the companies on the list include state-owned enterprises China Electronics Technology Group, China Mobile, and China Telecommunications Corp, and nominally private businesses Hikvision, Huawei, Inspur, Panda Electronics Group, and Sugon. (Laoyaoba, DCD News, Business Insider, CNET)

Apple, Cisco, Dell, Ford Motor and Foxconn products are allegedly among the goods from U.S. companies being caught up in India’s border tensions with China, as Indian ports hold up imports from China. However, new reports claim that foreign companies such as Apple that import finished goods or inputs from China to India could be spared the recently imposed 100% physical check of shipments from that country. (Phone Arena, Economic Times, Reuters)

mophie and InvisibleShield, ZAGG Brands companies, have announced the mophie UV Sanitizer and InvisibleShield UV Sanitizer, designed to kill 99.99% of the most common surface bacteria found on mobile devices and other frequently touched items by utilizing ultraviolet (UV) light. The mophie UV Sanitizer features a Qi-enabled wireless charging lid so users can simultaneously charge their mobile device while sanitizing other personal items such as keys, credit cards, earbuds, and more. (CN Beta, Engadget, Globe Newswire)

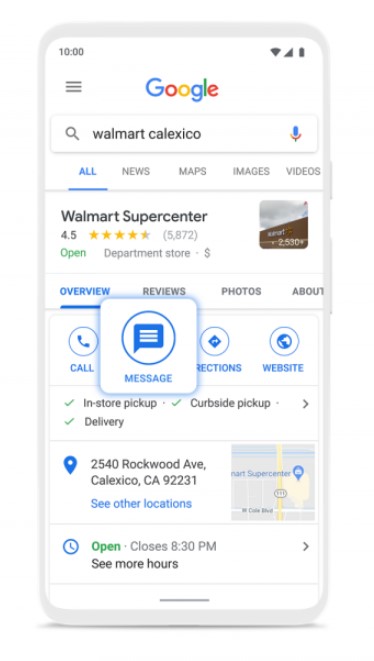

Google has announced to expand Business Messages in Maps and Search to support all kinds of businesses connect directly with their customers. Business Messages will also be available on mobile websites so that a business can add the ability for customers to quickly Message right from their website and offer the same smart automated replies, paired with live agent connection. (CN Beta, Business Insider)

realme X3 is announced in India – 6.6” 1080×2400 FHD+ 2xHiD IPS LCD, Qualcomm Snapdragon 855+, rear quad 64MP-12MP telephoto 2x optical zoom-8MP ultrawide-2MP macro + front dual 16MP-8MP ultrawide, 6+128 / 8+128GB, Android 10.0, side fingerprint scanner, 4200mAh 30W, INR24,999 (USD330) / INR25,999 (USD343). (GSM Arena, Android Authority)

Microsoft has announced a strategic change in its retail operations, including closing Microsoft Store physical locations. The company’s retail team members will continue to serve customers from Microsoft corporate facilities and remotely providing sales, training, and support. (VentureBeat, PR Newswire, Sina)

LG has announced 2 TWS earbuds namely HBS-FN4 and HBS-FN6. The latter features an industry-first self-cleaning charging case that uses LG’s UVnano to kill bacteria as the earbuds recharge. The UVnano works by emitting UV light onto the silicone tip and inner mesh. LG claims this is kills 99.9% of E. coli and S. aureus 2. (Neowin, GSM Arena, LG)

NASA’s Jet Propulsion Lab (JPL) has developed PULSE, which is a 3D-printed wearable device that pulses, or vibrates, when a person’s hand is nearing their face. The haptic feedback from a vibration motor simulates a nudge, reminding the wearer to avoid touching these entryways in order to reduce potential infection. (CN Beta, Engadget, NASA)

ITTBank consolidates ODM/OEM of 25 true wireless stereo (TWS) headphones. (ITTBank)

North is reportedly in the “final stages” of an acquisition from Alphabet. Google’s parent company is said to be paying USD180M for the Canadian company. First known as Thalmic Labs, the Canadian startup’s first claim to fame was the Myo armband that promised Jedi-like powers by letting user control phones and computers using gestures. (CN Beta, 9to5Google, The Globe and Mail, SlashGear)

Google’s parent company Alphabet is reportedly planning to acquire Canadian smart glasses company North for USD180M. North produces a line of smart glasses called Focals. In Dec 2019, the company stopped selling Focals and starting teasing Focals 2.0; the next-generation smart glasses would be the “most significant product introduction to date in the category” according to North. The “lighter and sleeker” Focals 2.0 are said to feature 10 times the display while the technology is miniaturized by 40%. (Phone Arena, The Globe and Mail, 9to5Google)

Waymo and the Volvo Cars Group have agreed to develop a self-driving electric vehicle designed for ride hailing use, as part of a new global partnership. Waymo will focus on the artificial intelligence and certain hardware, including cameras, lidar and radar, for the automated “driver”. Volvo will design and manufacture the vehicles. Waymo will work with Volvo’s global brands, including Polestar and Lynk & Co. (CN Beta, The Verge, Reuters)

Amazon has reportedly agreed to pay more than USD1B to buy Zoox, an early developer of autonomous vehicles. The deal would give Amazon control of a nearly 1,000-person startup that has designed a prototype vehicle to ferry passengers in urban areas. (The Verge, The Information, Financial Times, Engadget, Amazon)