6-28 #ShortBreak: Samsung Display is updating its A3 flexible OLED production line; Xiaomi will reportedly launch the world’s first 100W super fast charge; etc.

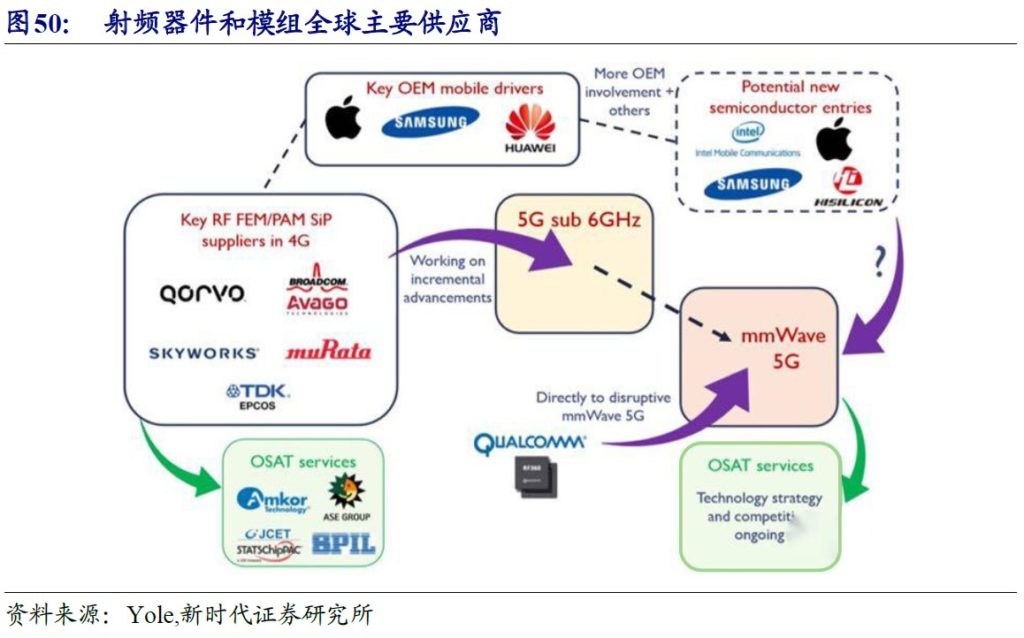

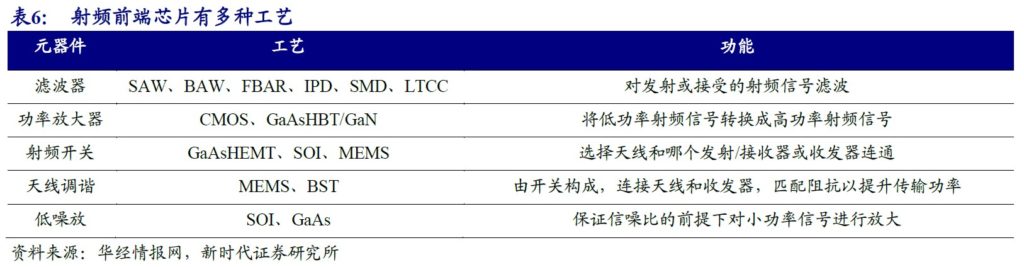

Due to 5G, a large number of frequency bands are integrated into a phone, which directly brings a sharp increase in the amount of radio frequency (RF) chips. For example, in the 2G era, the number of frequency bands is 4, and the total cost is USD0.8; in the 3G era, the number of phone frequency bands has risen to 6, and the total cost is USD3.25. In the 4G era, the number of frequency bands in a phone with ~CNY1000 price has reached 8-20, and flagship phone has about 17-30 frequency bands, which require 20-40 filters, 10 switches, and a total cost USD16-20. For 5G phones, the number of bands will reach 50, requiring 80 filters and 15 switches, the total cost reaches USD25-40. (New Times Securities report)

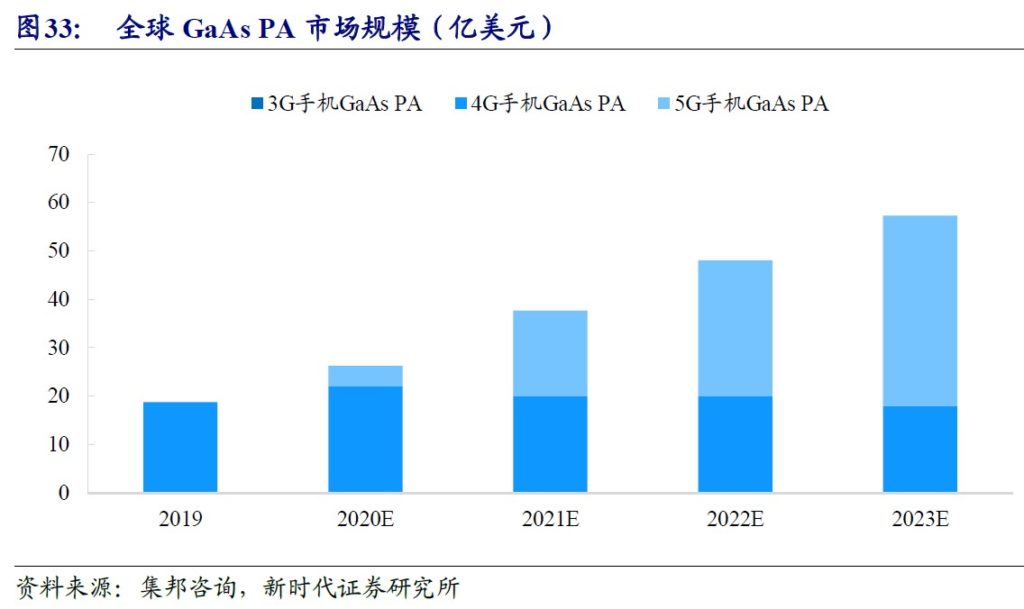

According to TrendForce, with the gradual increase of 5G smartphone penetration rate, it will drive the growth of the China mobile phone GaAs PA market from USD1.876B in 2019 to USD5.727B in 2023, with a compound annual growth rate of 19.17%. (New Times Securities report)

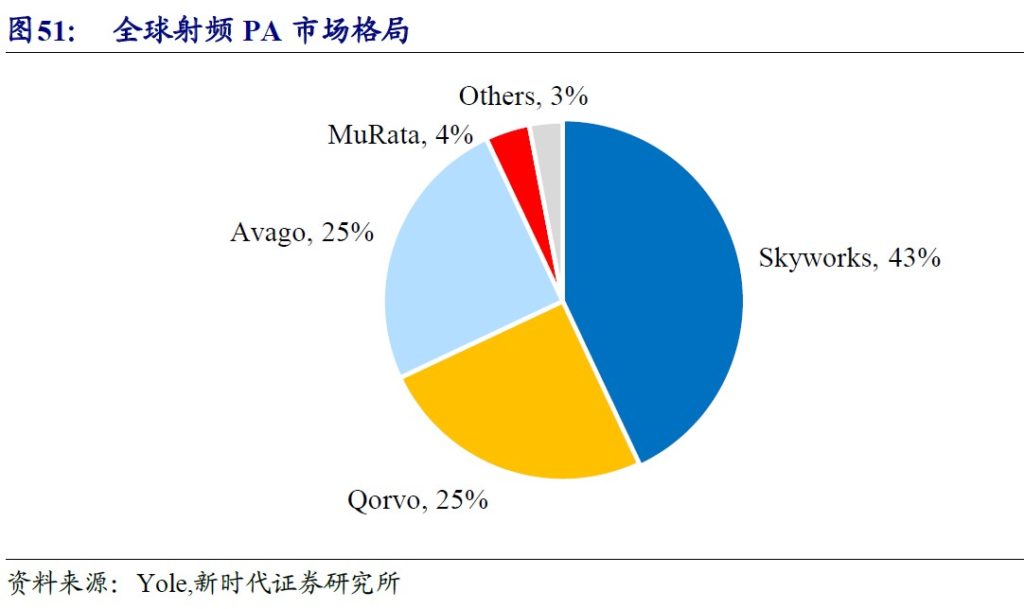

The RF PA market is mainly monopolized by 4 companies, Skyworks, Qorvo, Avago, and Murata. In 2017, the 4 companies accounted for 97% of the market. The top 3 companies of American manufacturers occupy 93% of the shares, and have a huge influence in the world. (New Times Securities report)

RF technology and materials are very critical components. Benefiting from the upgrade of communication networks, a new generation of semiconductor materials is booming. From 3G to 4G, GaAs is widely used, from 4G to 5G, and GaN has become a popular application material. (New Times Securities report)

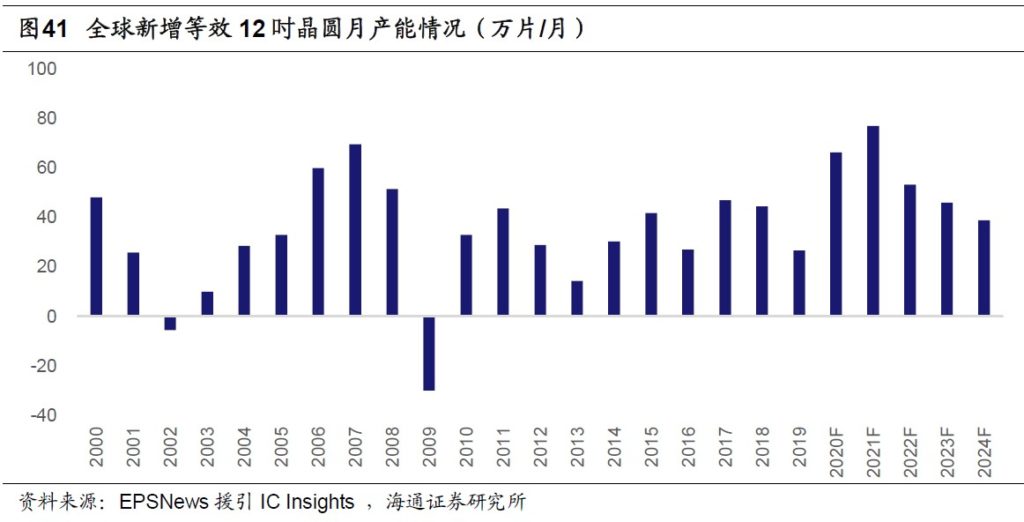

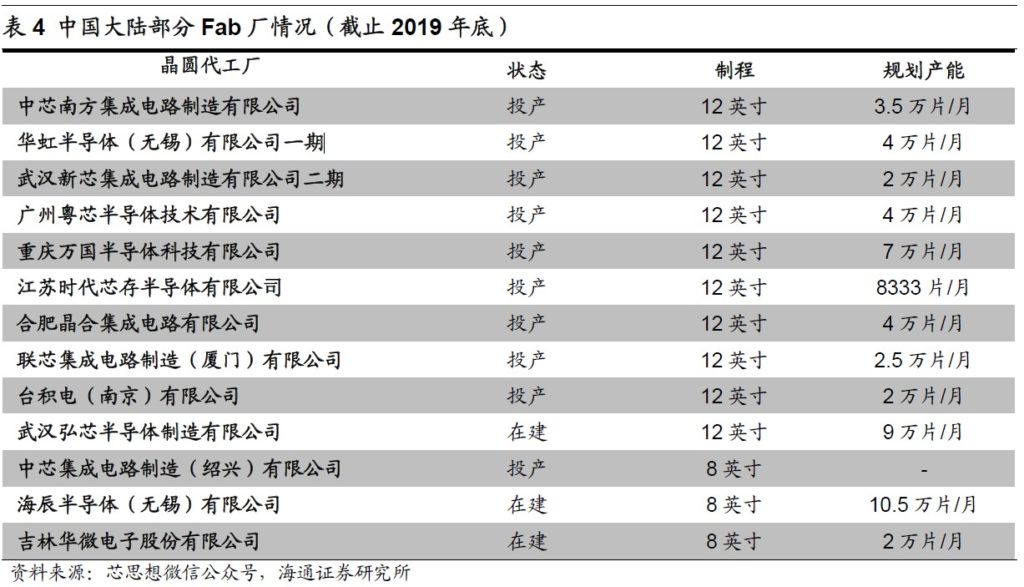

According to SEMI, it is estimated that by 2020, the installed capacity of Mainland China fabs will reach 1.77878M equivalent 12” wafers per month, which is a compound annual growth rate of 12%, as compared with 10.222M equivalent 12” wafers in 2015. IC Insights predicts that in 2020, 2021, and 2022, global wafer production capacity will add 663,300 wafers/month, 770,400 wafers/month, and 533,300 wafers/month, equivalent to 12” wafers. (Haitong Securities report)

According to SEMI-News, as of the end of 2019, in Mainland China, there are 12 wafer fabs in production stage, 12 in ramping stage, 15 under construction, and 7 under planning. (Haitong Securities report)

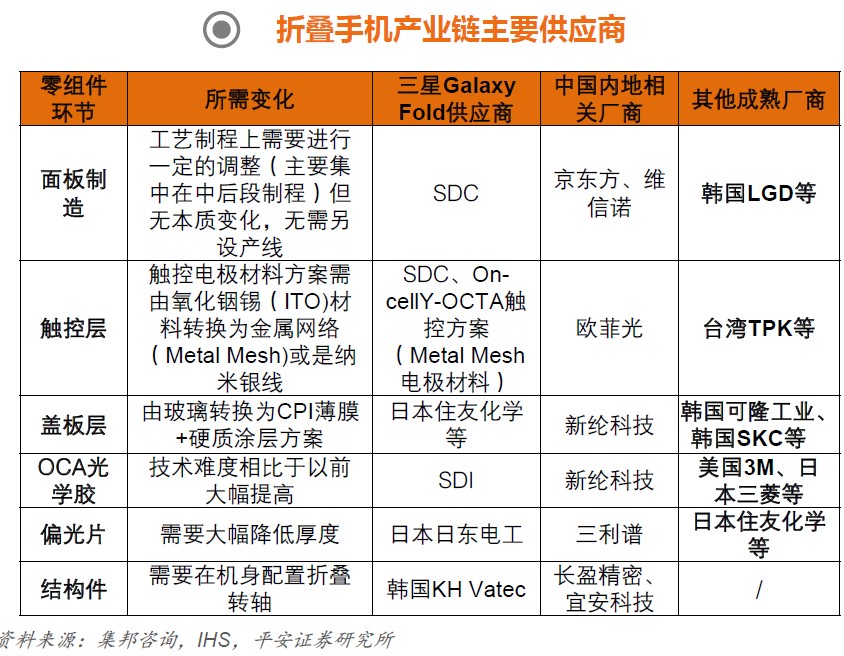

For the upstream supply chain of foldable display, only AMOLED can realize the folding functionality for the time being. In the initial stage, the supply of the foldable display will be relatively scarce, and the price of the foldable phone will be quite expensive. According to OLEDIndustry data, Samsung Display’s 7.3” AMOLED foldable display cost is about USD218. However, with the continuous improvement of technology and the increasing yield, the production cost of foldable display is expected to decrease, and more foldable products are expected to be launched. (Ping-An Securities report)

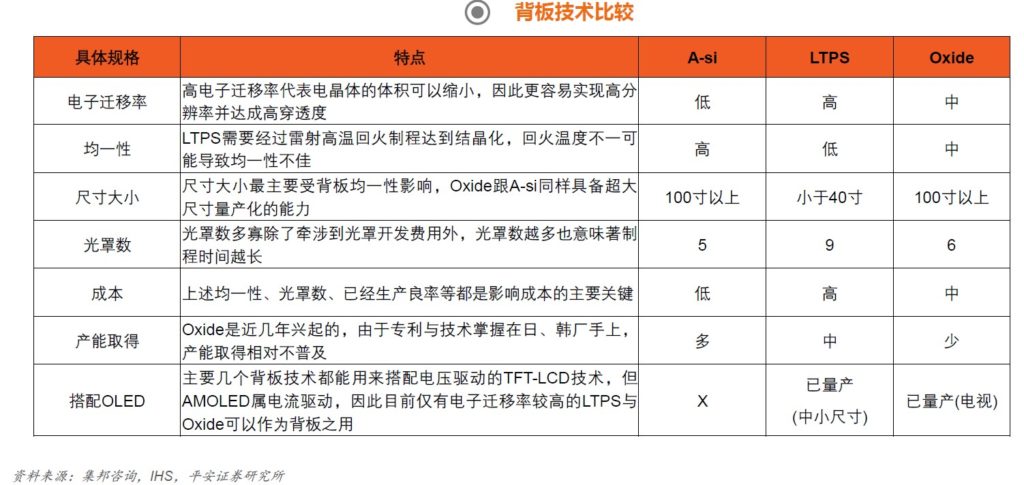

The semiconductor materials of the channel layer in the TFT backplane are mainly amorphous silicon (a-Si), low temperature polysilicon (LTPS), oxide (Oxide), etc. LTPS has the advantages of high resolution, fast response, high brightness, high aperture ratio, etc. LTPS has strong performance and high reliability, but it can only be in the middle and low ages, plus the order of LTPS silicon crystals is more ordered than a-Si, making the electronic mobility more than 100 times higher, and the peripheral drive circuit can be fabricated on the glass substrate at the same time, to achieve the goal of system integration, save space and drive IC cost. (Ping-An Securities report)

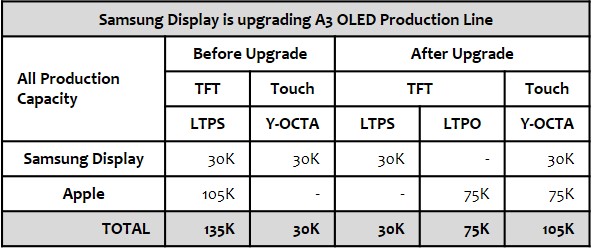

Samsung Display is updating its A3 flexible OLED production line, to support 2 new technologies. The TFT process is being updated, for some of the capacity, to Apple’s LTPO technology. According to UBI, Samsung will dedicate 75K monthly substrates to produce smartphone LTPO displays. (My Drivers, Sina, OLED-Info)

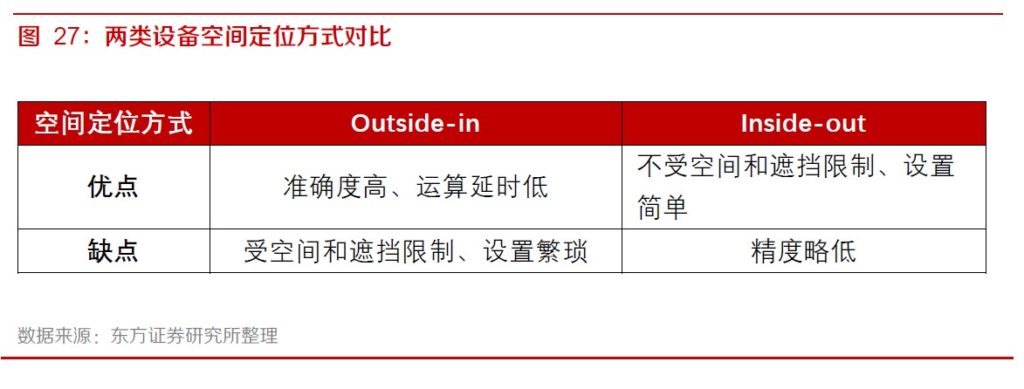

There are currently two types of VR/AR headsets spatial positioning: Outside-in and Inside-out. Outside-in motion tracking from outside to inside, using external tracking equipment, such as camera or Lighthouse, and mark the headset to track the movement of the headset. Inside-out is a tracking system from the inside out, relying on the depth camera for three-dimensional space input, combined with real-time positioning and map construction algorithm SLAM (Simultaneous Localization and Mapping) to achieve tracking of the target. Inside-out technology is not limited by space and simple to set up, and is expected to become the technology trend of future VR/AR equipment. (Orient Securities report)

By monitoring human heart rate and electrocardiogram, combined with models and intelligent algorithms, smartwatches can serve as reminders and warnings for sports health, heart health management, mental stress, etc. In addition, smartwatches are also widely equipped with sleep quality detection and sedentary reminders, female physiological cycle recording and other functions. In the future, smartwatches are expected to support a wider range of health functions, such as blood pressure, blood sugar and other functions. (Orient Securities report)

Xiaomi will reportedly launch the world’s first 100W super fast charge. 100W super fast charge can fully charge 4000mAh battery in only 17 minutes. (My Drivers, CNMO, IT Home)

Top global players such as Foxconn and Wistron, manufacturers of Apple iPhones, Flex, Samsung, OPPO and vivo are likely to apply for a production-linked incentive scheme (PLI) worth INR41,000 crore as part of India’s massive push to wean away companies from China and emerge as the world’s hub for electronics production. Flex India runs three factories in India, which manufacture smartphones for Xiaomi, Motorola and Lenovo. (Laoyaoba, India Times, Financial Express)

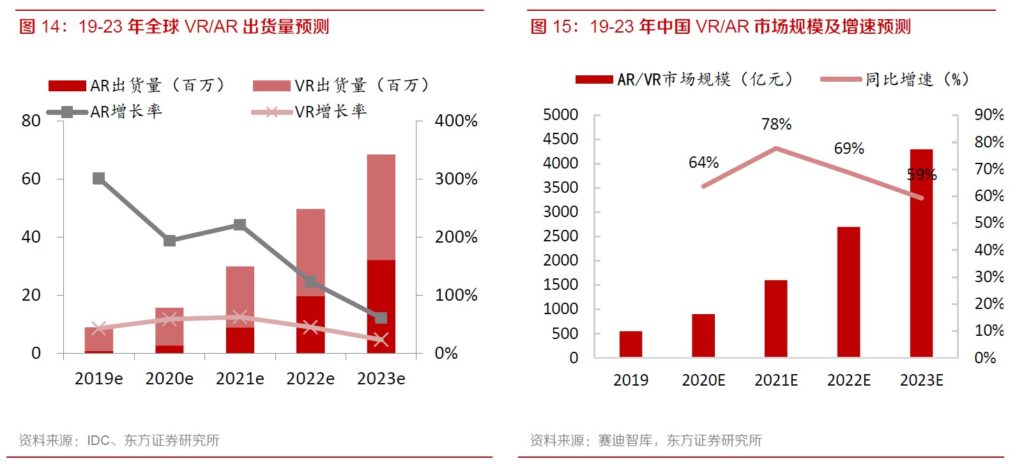

According to IDC’s forecast, in 2019, VR and AR heatset sales will be 8.04M and 890K units, respectively, and it is expected to grow to 36.2M and 32.18M units by 2023, with a compound annual growth rate (CAGR) of 46% and 145%, respectively. According to the prediction of CCID, the growth of China’s VR/AR market will remain above 60% in the next 4 years. By 2023, the domestic VR/AR market will reach CNY430B. (Orient Securities report)

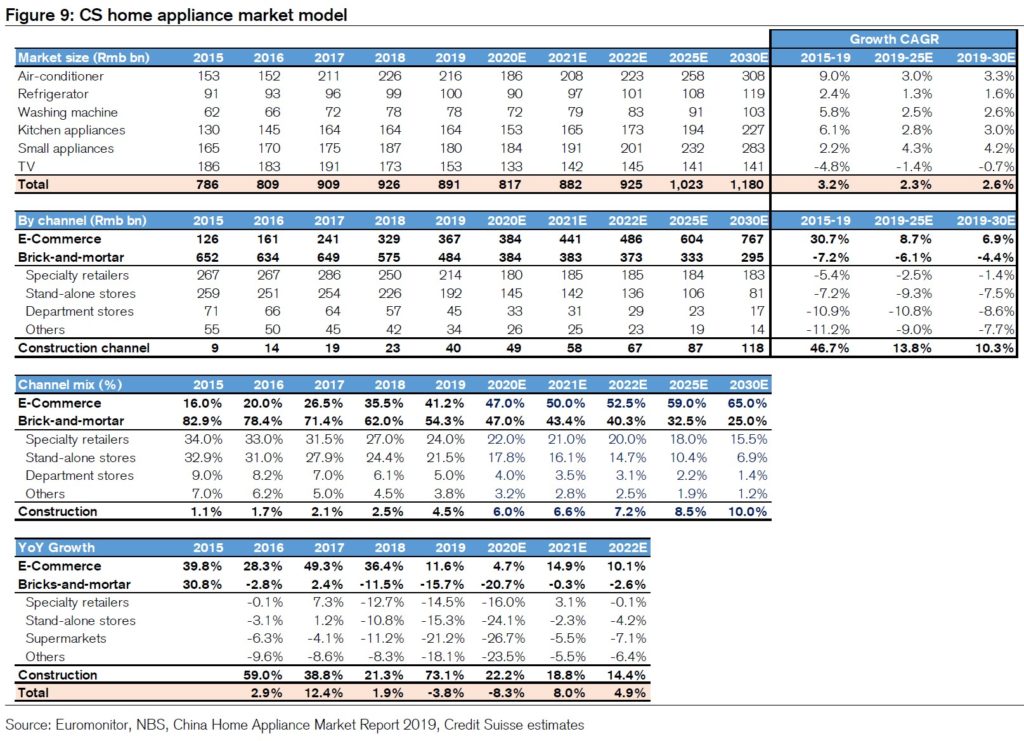

Credit Suisse expects the total China home appliances market to reach CNY1,180B by 2030, with a 2.6% CAGR over 2019-2030 (vs 3.2% over 2015-2019). By segment, small appliances / air-conditioners / kitchen appliances should see the fastest CAGR during the period at 4.2% / 3.3% / 3.0%, driven by rising penetration in lower tier markets and production innovation. (Credit Suisse report)

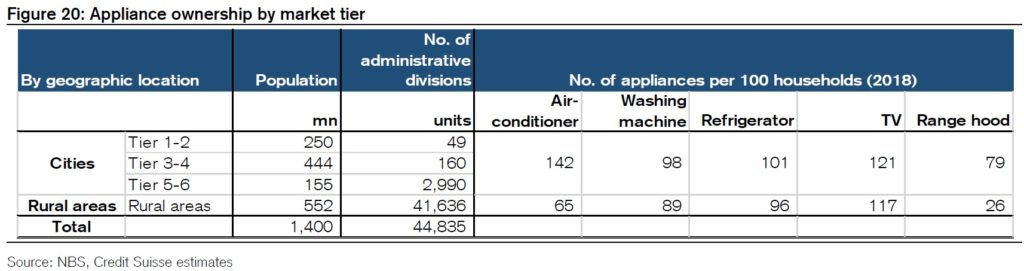

Though washing machines, refrigerators, and TVs are well owned by households nationwide, Credit Suisse sees potential residing in air-conditioners / range hoods, ownership for which in rural areas is only 46% / 33% of urban areas. With 40% of the total population living in rural areas, ample purchasing power awaits to be released. (Credit Suisse report)

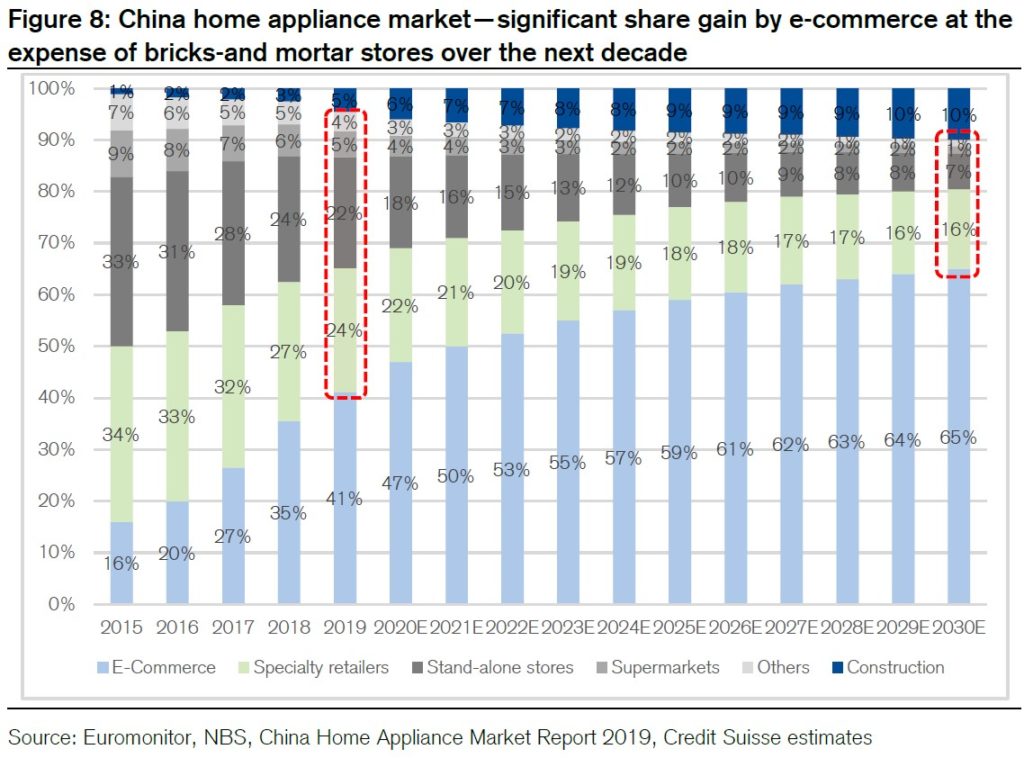

Credit Suisse has developed a market model to understand how the structure of home appliances retailing will change in the next decade. Based on Credit Suisse estimation, e-commerce / construction channel would be the biggest winners with their share of total sales rising to 65% / 10% in 2030 from 41% / 4.5% in 2019 in China, while standalone stores would be the biggest losers with share dropping from 22% in 2019 to 7% in 2030. (Credit Suisse report)

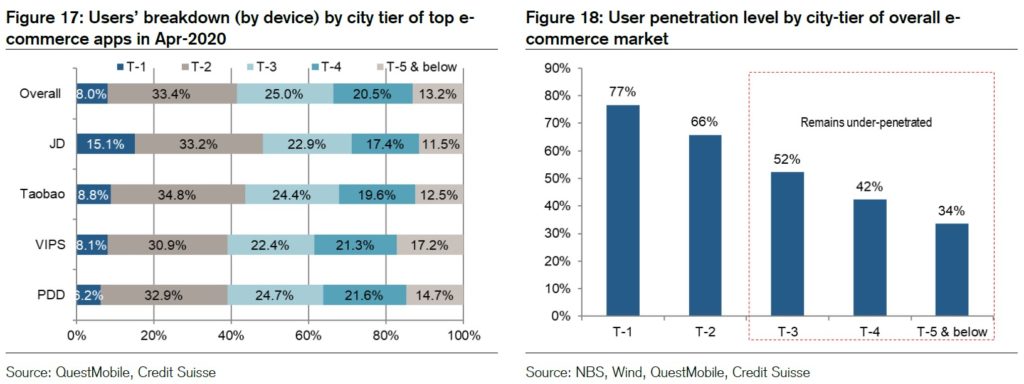

Tier 1 and 2 cities, where consumers tend to be more tech-savvy and receptive to new things, have been the focus of most online platforms for many years. Meanwhile, the heavy investment and higher return on investment on infrastructure and logistics network also justify the development in high-tier cities. With the online penetration rate steadily climbing up to 60-80% for those cities, the new engine of growth needs to be fueled by the vast 800M users from less developed areas. The success of PDD tells the best tale. (Credit Suisse report)

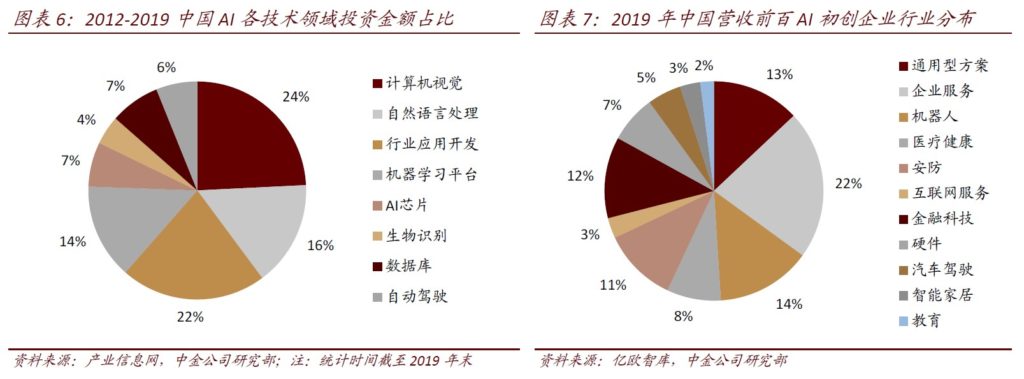

Funds are mainly invested in the development of computer vision (CV) and natural language processing (NLP) technologies and application scenarios including enterprise services, robotics, finance and security industries. From the perspective of the amount of investment and financing, the field of CV is the easiest to land, the fastest to realize, and the most capital absorbing. The investment accounted for 24.2%; AI industry applications and NLP accounted for 21.6% and 16.2%, respectively. There are less funds invested in areas such as AI chips and autonomous driving. (CICC report)

According to Yiou statistics, 22 of the top 100 AI start-ups focused on providing AI products and services to various corporate customers, the largest number, in line with the characteristics of 2B market fragmentation. There are 14 companies engaged in robotic design and manufacturing, 13 companies provide a common AI platform, and more than 10 companies deploy AI applications in the field of financial technology and AI + security. (CICC report)