8-3 #ActualWeekend: TCL CSOT has shown off a new 10.8” and 32” screens with a refresh rate as high as 240Hz; TCL Electronics plans to acquire TCL Communication as part of its AI x IoT strategy; etc.

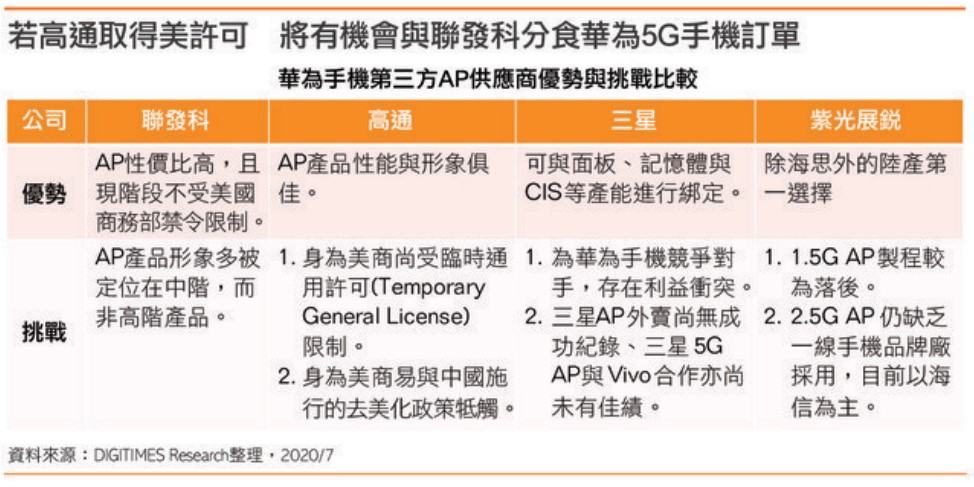

Huawei is increasing the proportion of mobile application processors (APs) from third-party suppliers for its smartphones, reducing use of Kirin chips from its subsidiary HiSilicon Technologies, as a contigency against the US trade ban, according to Digitimes Research. Multiple sourcing for mobile APs is a necessity for Huawei to maintain its product competitiveness, stable supply and profitability, and the Chinese vendors is likely to add 1-2 vendors to its supplier list for smartphone APs. (Digitimes, press, Digitimes)

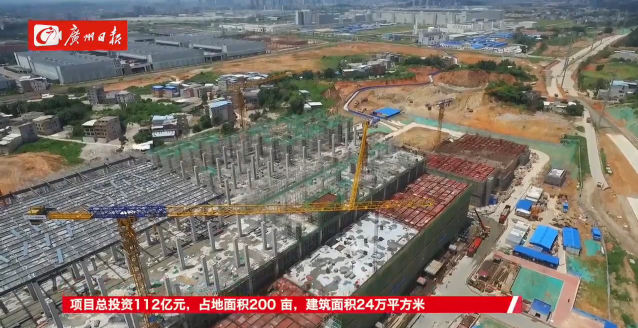

The main plant of Guangzhou’s first flexible AMOLED production line will begin in Sept 2020 and will be officially put into production at the end of 2020. On 6 Sept 2019, a state-owned enterprise in Zengcheng District, Guangzhou City and Visionox jointly funded the establishment of Guangzhou Guoxian Technology Co., Ltd. to build the first flexible AMOLED module production line in Guangzhou. Visionox flexible AMOLED module production line project has a total investment of CNY11.2B. It is mainly engaged in the production, research and development and sales of small and medium-sized full-flex AMOLED modules. The products cover emerging applications such as curved surfaces, half-folds, wearables and vehicles. The planned annual production capacity is about 50M modules. (Laoyaoba, EXP Review, East Money)

TCL CSOT has shown off a new 10.8” and 32” screens with a refresh rate as high as 240Hz. The 10.8” LCD display has a punch hole at the top left corner and a resolution of 2560×1600. (CN Beta, IT Home, TechWeb, Gizmo China)

The high price of lidar still limits the cost of sensors. DJI enters the segment and releases lidar with a price of as low as USD1,000, which may produce a catfish effect to accelerate the industry’s cost reduction. Mobileye predicts that by 2022, the total cost of all hardware packages will fall to USD10,000 to USD15,000, and the system cost may fall below USD5,000 by 2025. CITIC Securities makes the following forecast. (CITIC Securities report)

SK Innovation will collaborate with Nobel laureate and professor John B Goodenough of the University of Texas at Austin to develop next generation batteries. They research solid-state electrolyte together to realize lithium metal batteries. The goal is to increase the energy density of batteries to increase travel distance of electric vehicles (EV) per charge. It will also increase battery stability. (Laoyaoba, The Elec)

US-based InterDigital has filed two patent infringement complaints against Xiaomi before the Delhi High Court. One complaint involves infringement of five of InterDigital’s cellular 3G and 4G Indian patents, while another alleges infringement of three of its video codec technology (H.265/HEVC) patents in the country. (Laoyaoba, Business Line, India Times)

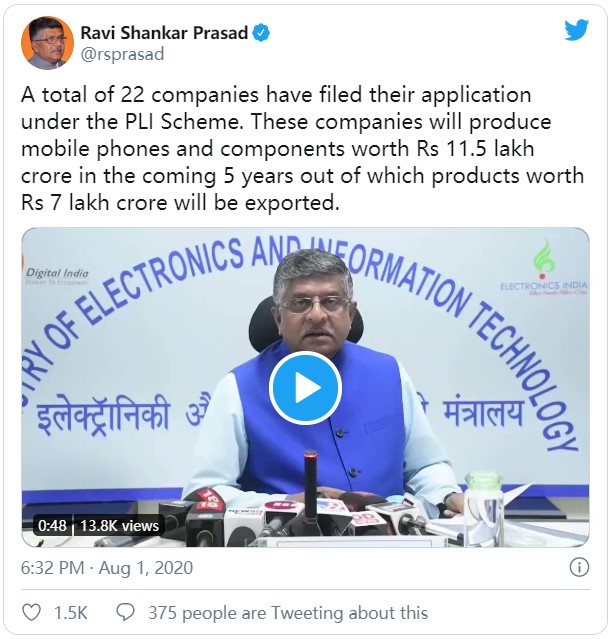

Three key Apple key suppliers Foxconn Hon Hai, Wistron and Pegatron along with Samsung and homegrown phone maker Lava and Dixon are among the 22 applicants for the government of India’s mega electronics manufacturing investment scheme called the Production Linked Incentive (PLI). According to the union minister for electronics and IT, Ravi Shankar Prasad, investment proposals are expected to total up to INR1,150,000 crore of total production in the next 5 years with employment potential of 3 lakh direct employment and 9 lakh indirect employment. (India Times, GSM Arena)

TCL TVs are made by TCL Electronics while TCL phones are manufactured by TCL Communications. TCL Electronics plans to acquire the latter as part of its AI x IoT strategy. The acquisition (actually more of a merger) will result in TCL Electronic’s addition of new arms including TCL smartphones, tablets, wearables, and connectivity in addition to its TV business. (Business Wire, Gizmo China, PR Newswire, Sina)

LG has revealed that the company’s mobile communications division (smartphones) is working hard to increase the profitability of its business and become more competitive in the current market. LG may release 5G smartphones worth USD100-200 in markets such as the US or China. (Android Headlines, Yahoo Finance, GizChina)

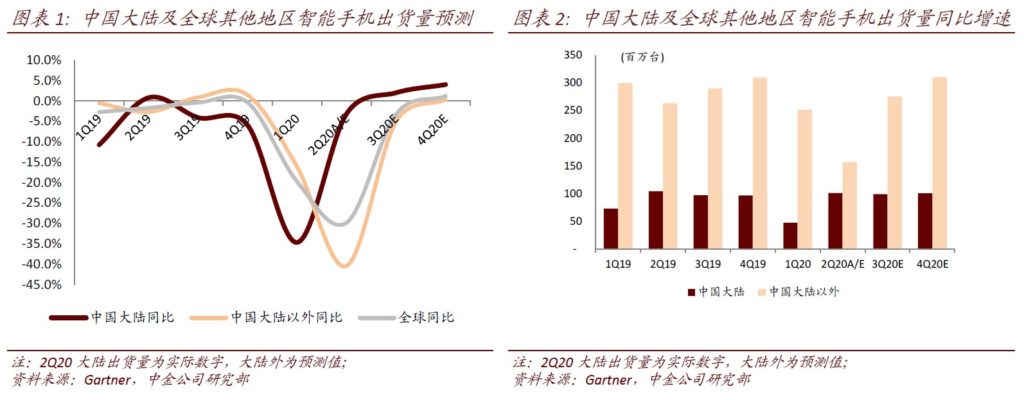

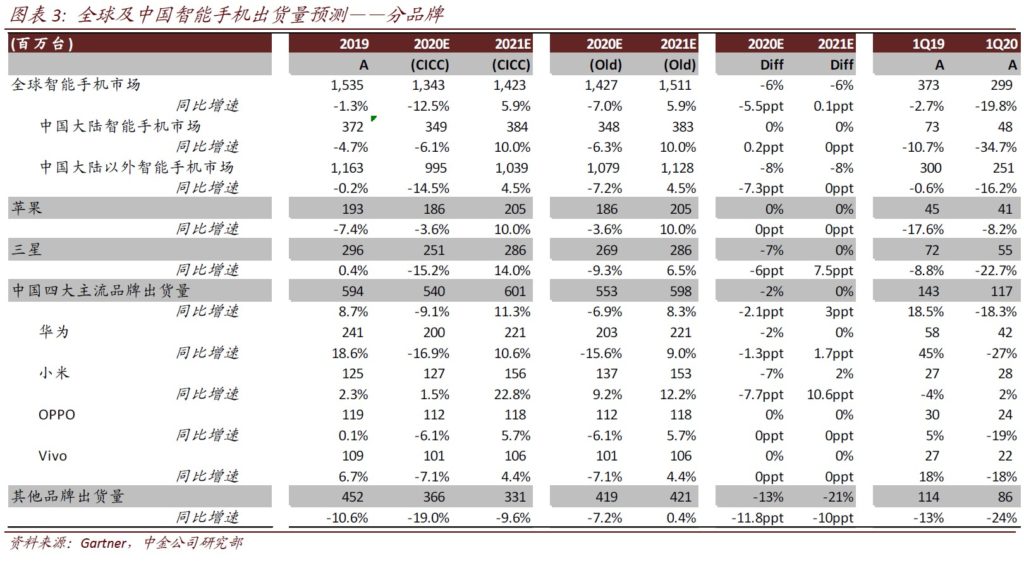

CICC has estimated earlier that under the influence of the epidemic, global smartphone shipments in 2020 will fall by 7.0% year-on-year to 1.427B units. Taking into account the different recovery of the epidemic situation in various regions of the world, they made independent shipment growth assumptions for different regions, and concluded that global smartphone shipments in 2020 will fall 12.5% year-on-year to 1.343B units. (CICC report)

CICC has adjusted the shipment volume of smartphone vendors: Apple: Maintain the 2020 global shipment forecast of 186M units, down 4% YoY. Samsung: Decrease 2020 global shipments to 251M units, down 15% YoY. Huawei: Decrease 2020 global shipments 200M units, a YoY decrease of 16.9%. Xiaomi: Decrease 2020 global shipments to 127m units, a YoY increase of 1%. OPPO: Maintain global shipments of 112M units in 2020, down 6% YoY. vivo: Maintain global shipments of 101M units in 2020, down 7% YoY. (CICC report)

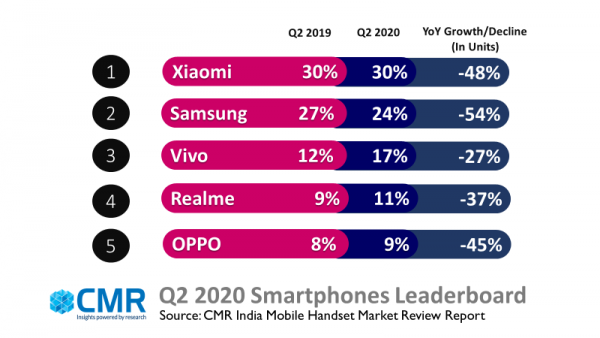

According to CMR, total smartphone shipments in India in 2Q20 declined by 41% QoQ, and 48% YoY, owing to the nationwide lockdown, disruptions in supply chain and curtailed domestic production. However, the smartphone market is showing some encouraging signs of revival, that sets it on a potential course for market recovery in 2H20. Xiaomi (30%), Samsung (24%) and vivo (17%) have rounded off the top three spots in the smartphone leader board for 2Q20. CMR’s current estimates point to a better performance for the India smartphone market in 2H20, with market anticipated to recover by >40%, in comparison to 1H20. (Laoyaoba, CMR, Zeebiz)

In a major relocation from China as part of global business’ effort for derisking of manufacturing bases by diversifying supply chains, a contract manufacturer for Apple is shifting 6 production lines looking forward to exporting around USD5B worth of iPhones from India apart from catering to the domestic market. (Laoyaoba, India TV News, India Times)

The development of the industry above the level of L3 semi-autonomous driving requires the reorganization and integration of supplier relationships in the entire automotive industry. Form a combination of “car companies + suppliers + chip giants + taxi software + logistics companies”. The figure below is drawn based on the statistics of Granite Bay Capital. (CITIC Securities report)