8-10 #RespectPls: Qualcomm is reportedly lobbying the U.S. government to revoke restrictions on sale of components to Huawei; Huawei will reportedly begin using two processor solutions from Mate 40 at the earliest; etc.

Qualcomm is reportedly lobbying the U.S. government to revoke restrictions on sale of components to Huawei Technologies, after the Chinese company is blacklisted by the United States. With these restrictions, the U.S. has handed Qualcomm’s foreign competitors a market worth as much as USD8B annually. (Phone Arena, WSJ, Reuters)

Huawei will reportedly begin using two processor solutions from Mate 40 at the earliest, among which MediaTek and Samsung may be candidates. It is said that Huawei has increased its procurement of MediaTek chips in the market starting in May 2020, and even “stocked up” with a price increase of USD10 per chip. Moreover, Huawei recently ordered 120M chips from MediaTek, and 6 of the mobile phones released in 2020 use MediaTek chips. (Yicai, CN Beta)

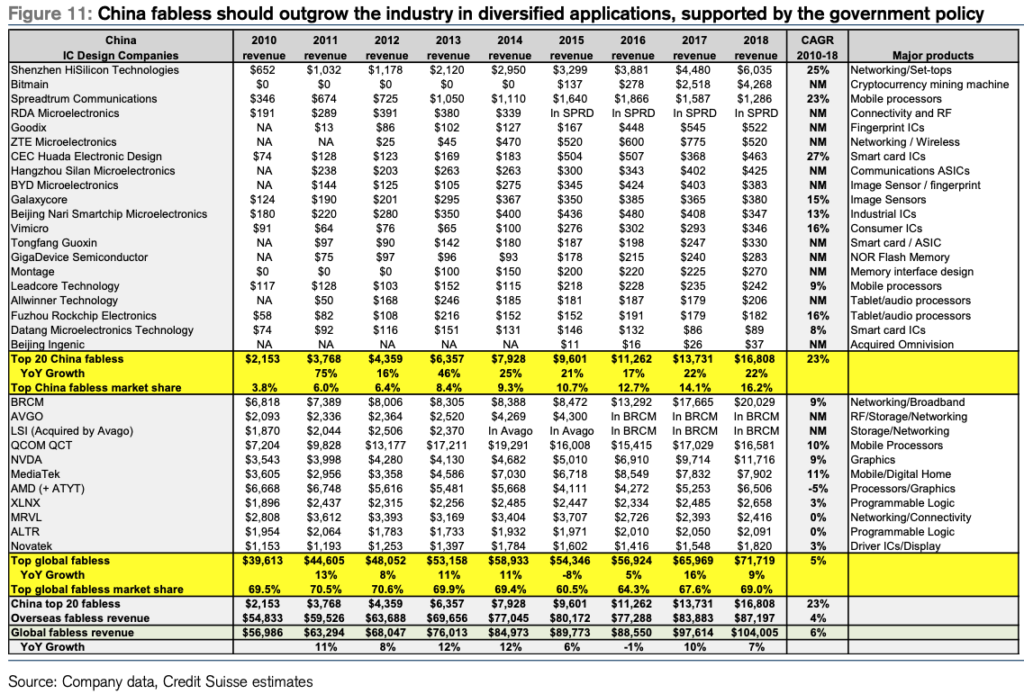

According to Credit Suisse, for China, the semiconductor IC design has also been growing at a 20-25% CAGR in the past decade, driven by the government’s initiative to support local semiconductor ecosystem and HiSilicon’s success in smartphone chipset supplying to its parent company, Huawei, and its share gains in networking equipment market in 4G and the upcoming 5G. Outside fabless, Credit Suisse expects the start-ups and system companies to develop more customised ICs for their own use in cloud computing (e.g., cloud training and inference) and supply the core processors to customers adopting their cloud solutions. (Credit Suisse report)

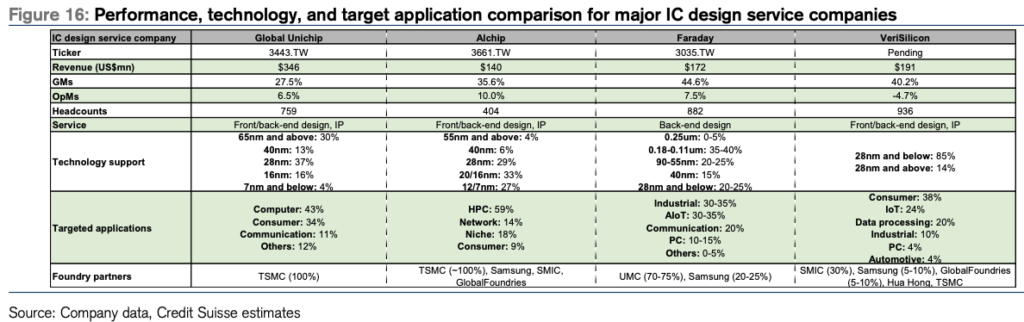

The design service capability and capacity, IP portfolio, success rate, supply chain relationship, target applications and technology/IP support are the important factors when customers choose their service provider. Credit Suisse compares the competiveness for the major companies, including Global Unichip, Alchip, and Faraday in Taiwan and VeriSilicon in Mainland China. (Credit Suisse report)

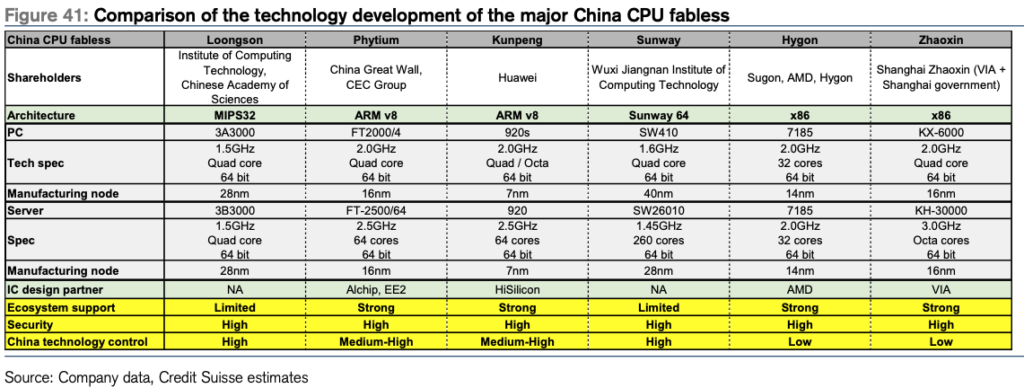

Following the development in the past decade, the ecosystem developed by China local CPU fabless has been more comprehensive, with major players including Loongson, Phytium, Kunpeng, Sunway, Zhaoxin and Hygon. Credit Suisse introduces the development of these companies and compare the chipsets. (Credit Suisse report)

Xiaomi CEO Lei Jun has revealed that they have encountered some major difficulties developing Surge, despite that, they have not ceased the development of new processors. (Leiphone, Gizmo China)

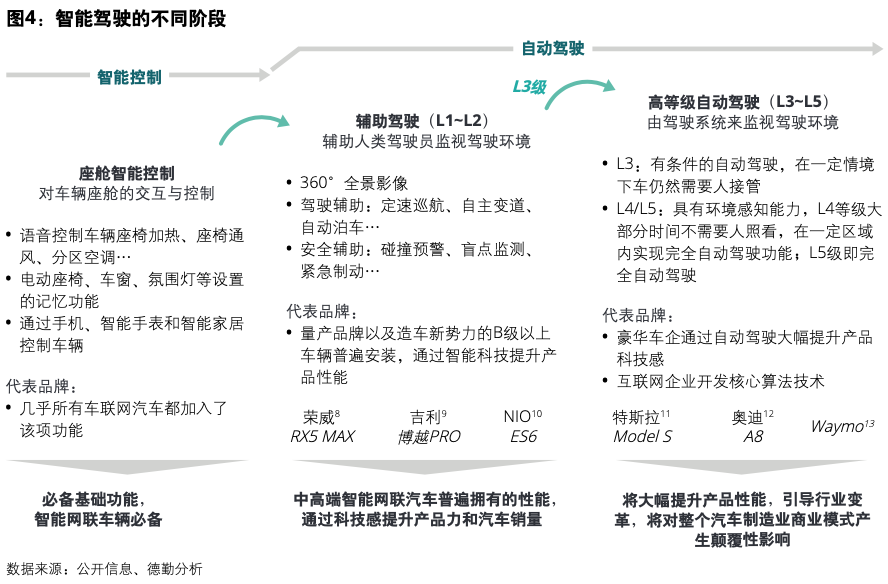

Smart driving includes two stages: smart control and automatic driving. Among them, the cockpit smart control function is a necessary function of the smart connected car. The driving assistance function has become a common feature of mid-to-high-end vehicles on the market, and this function should be added to B-class cars and above. As for the high-level autonomous driving of L3 and above, although the number of car companies with L3 is limited, it has huge commercial potential and will have a disruptive impact on the industry structure and business model. High-end electric vehicle brands and leading foreign traditional manufacturers have targeted Key breakthroughs in L4/L5 autonomous driving technology. (Deloitte, report)

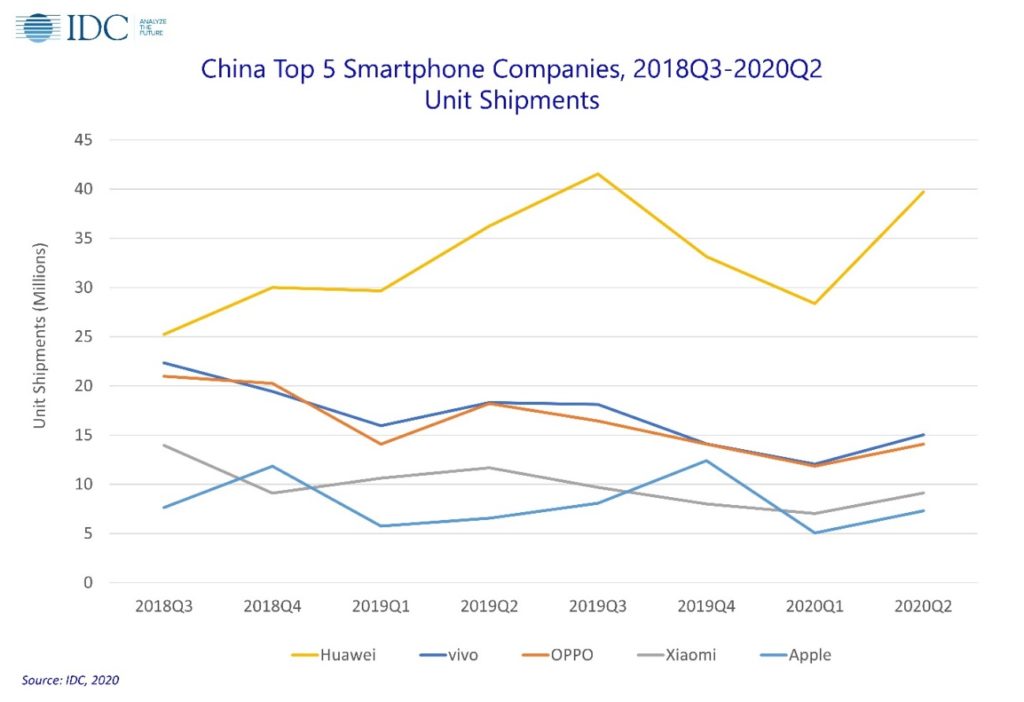

According to IDC, 87.8M smartphones were shipped in China during 2Q20, down 10.3% year-on-year. Evidently, consumer sentiment was a challenge but this was still a narrower figure compared to the 20.3% decline in 1Q20 – resulting to a 14.9% contraction from the same period last year in 1H20. In China, more than 43M 5G smartphones were shipped in 2Q20, with the weighted average selling price falling below USD500. (GizChina, IDC)

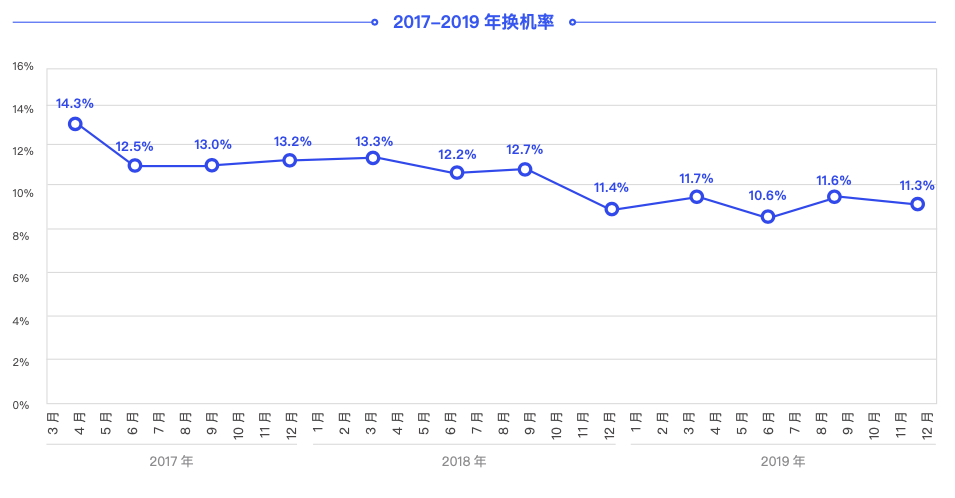

According to Tencent’s analysis, looking at the replacement market, the replacement rate will generally fluctuate with the development of breakthrough technologies, such as 3G, 4G, imaging quality, major updates of iOS and Android systems, and so on. However, as software and hardware technologies mature, the development speed decreases, and the difference in experience between product generations shrinks. At the same time, consumers’ mentality is becoming more mature and rational, and the replacement time will inevitably be lengthened. The data shows that the overall exchange rate of the Chinese market has shown a downward trend, and the market has become saturated. The exchange rate has dropped from 14.3% at the beginning of 2017 to 11.3% at the end of 2019. (Tencent report)

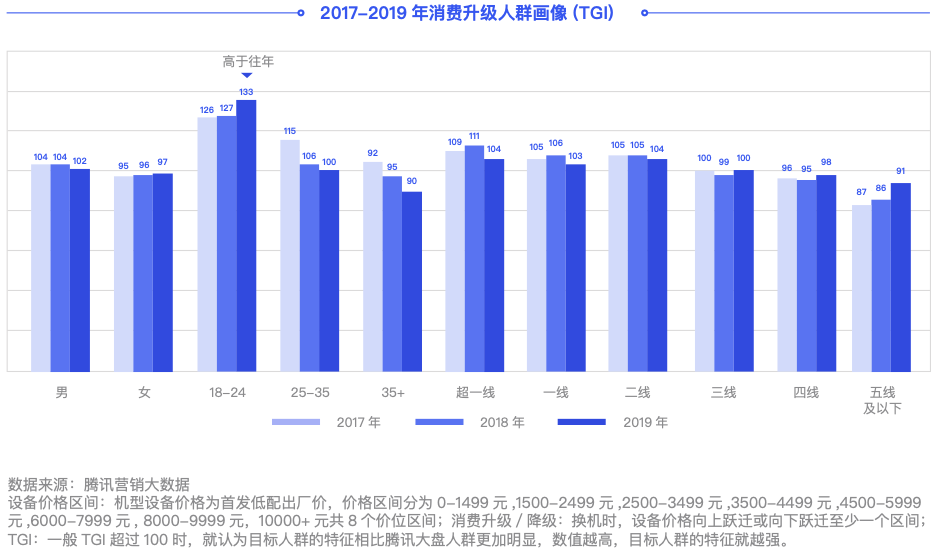

As the new purchasers have basically disappeared, replacement users have become the absolute focus of all brands. Looking back at 2019, consumption upgrades are still the main theme among all the people who replaced phones. The number of users who upgraded consumption throughout the year reached 197M, which is very consistent with the finding that mid-to-high-end phones dominate the mainstream. Further analysis of the replacement group, Tencent analysis found that young people and low-tier cities are the main force in consumption upgrades. The tendency of people aged 18-24 and third-tier and below to upgrade and replace their phones is higher than in previous years. (Tencent report)

vivo Y1s is announced in Cambodia – 6.217” 1520×720 HD+ v-notch, MediaTek Helio P35, rear 13MP + front 5MP, 2+32GB, Android 10.0, 4030mAh 10W, USD109. (Sina, vivo, Gizmo China)

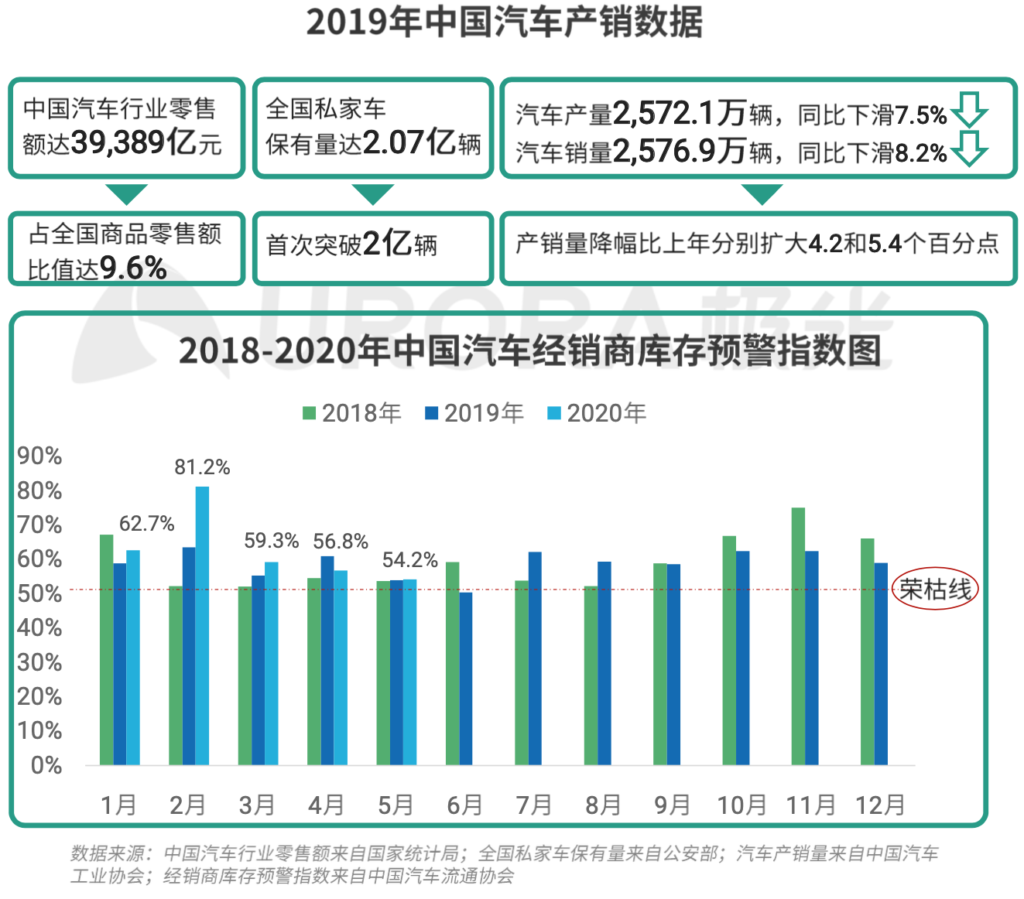

In 2019, the retail sales of China’s auto industry reached nearly CNY4T, and the number of private cars nationwide exceeded 200M for the first time, showing the auto industry’s status as a pillar industry in China’s economy and the growing consumer demand in the auto market; on the other hand, In 2019, China’s auto production and sales declined, and the decline was further expanded compared with the previous year; affected by the decline in the auto market, the dealer inventory warning index was higher than 50% for 2 consecutive years. (Urora report)

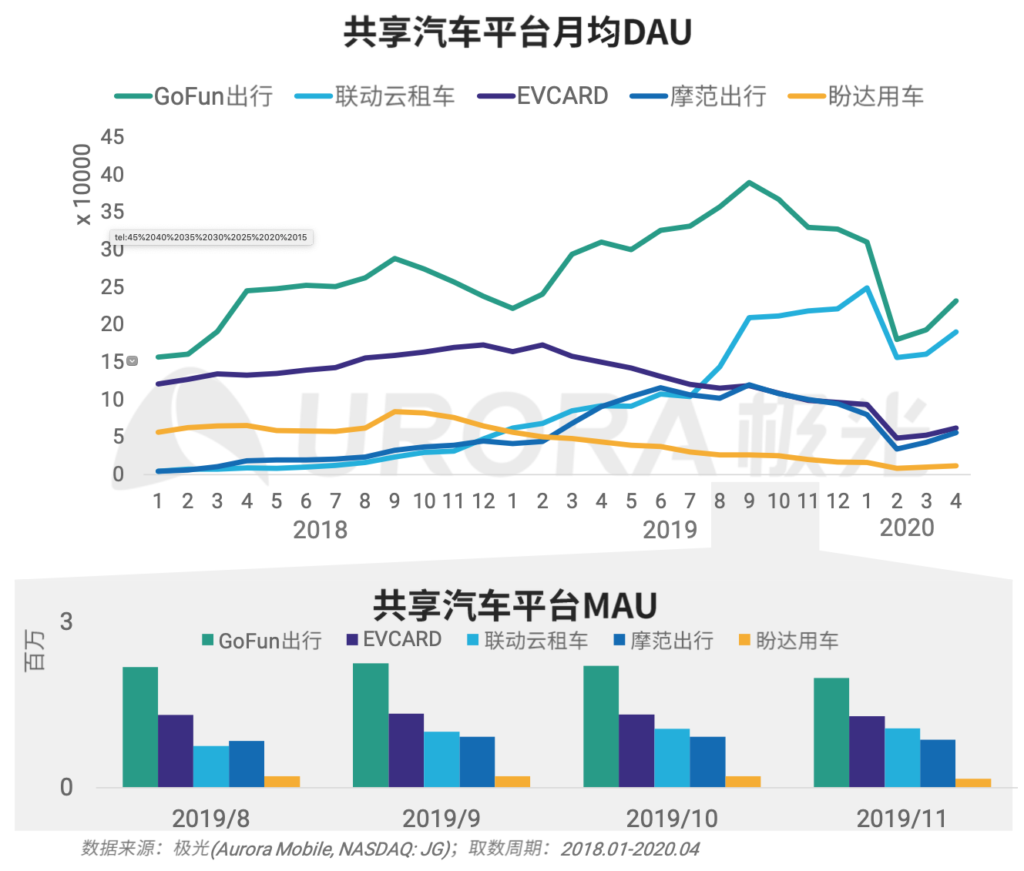

In the car-sharing lead platform, GoFun’s average monthly DAU continued to lead from 2018 to Apr 2020, and reached the highest value in Sept 2019, close to 400,000; Lian Dong Yun Rental Car took the 2nd place; EVCARD ranked at number 3. Compared with the high monthly average DAU range from Aug to Nov 2019, GoFun travel MAU also maintained its lead, with a maximum value of nearly 2.5M; EVCARD maintained the second position in the MAU ranking, and the Lian Dong Yun ranked third. (Urora report)

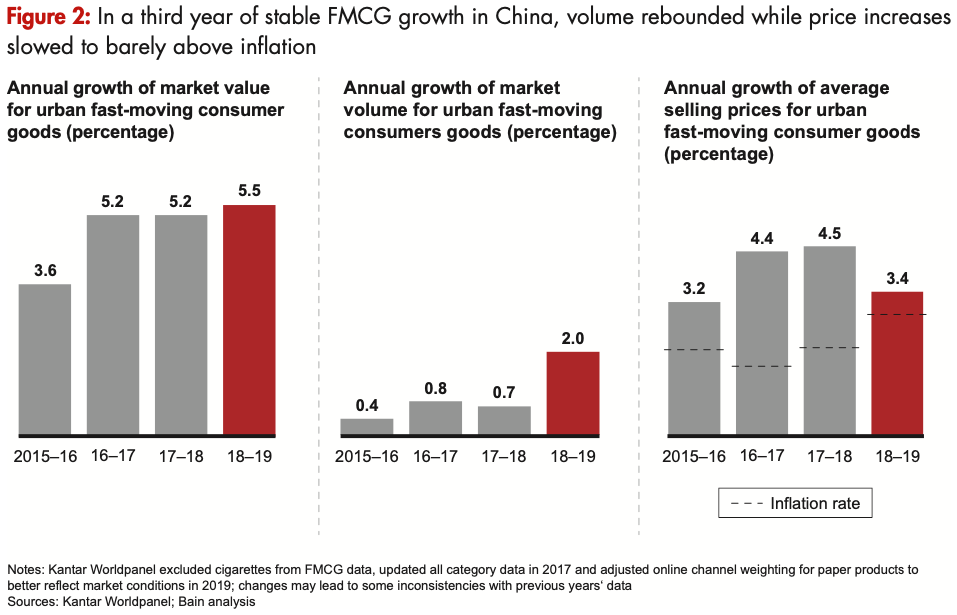

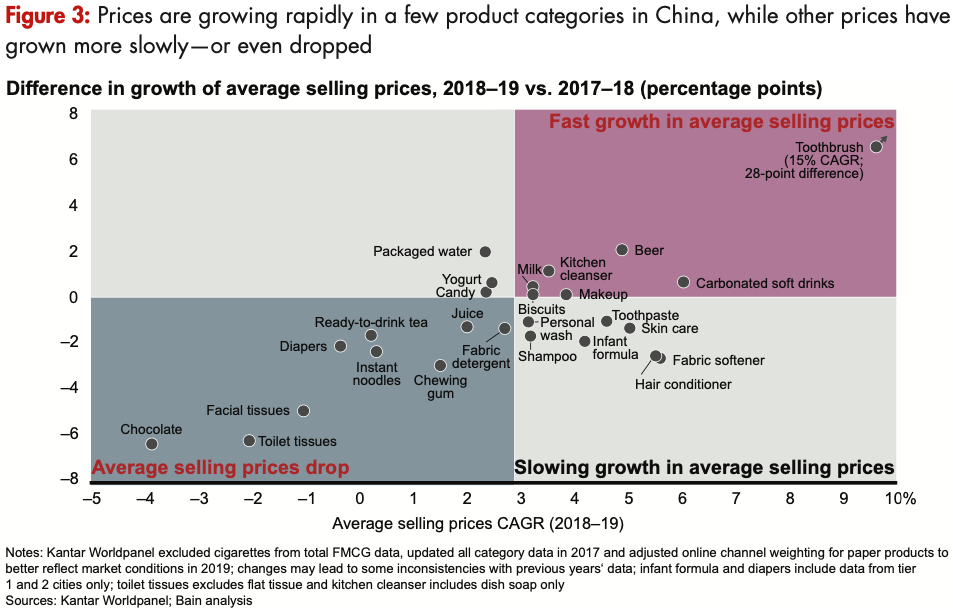

According to Bain & Company, the two-speed dynamic is evident in volume and prices. Overall FMCG volume grew 2.0%, a sizable leap from 0.7% in 2018. However, ASP growth dropped to 3.4% from 4.5%, barely above the rate of inflation. This signals that FMCG companies could not depend on premiumization as much as in previous years. Indeed, only a handful of product categories are enjoying fast price growth, while most are experiencing slower price growth—or even price drops. (Bain & Company report)

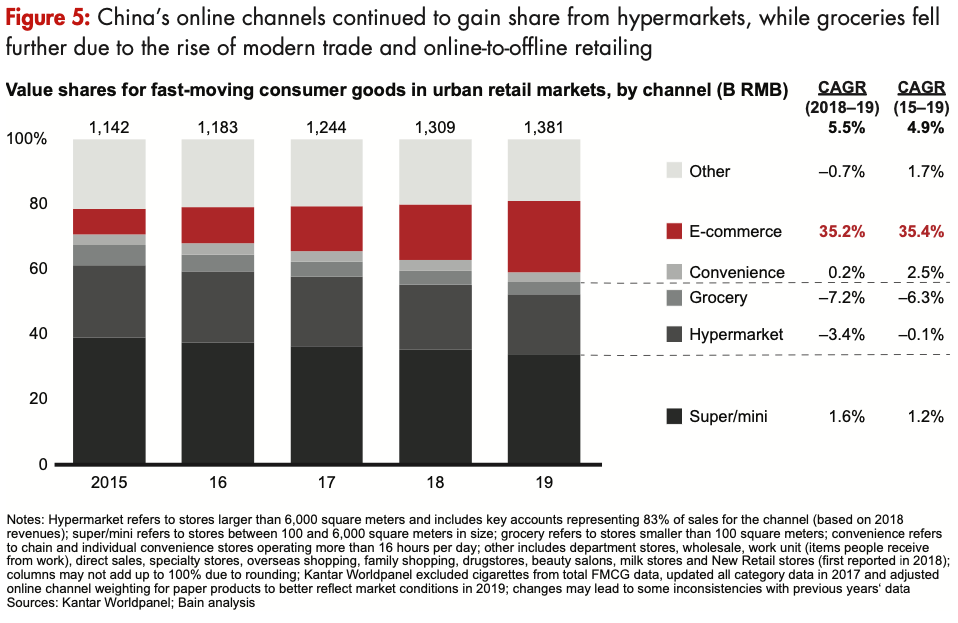

According to Bain & Company, e-commerce grew by 35.2% in 2019, gaining share from hypermarkets, which declined by 3.4%, while grocery further declined by 7.2% due to the rise of modern trade and O2O retailing. The pursuit of convenience is evident in the widespread adoption of O2O, which now represents 4.3% of total FMCG value share and is playing an increasing role in sustaining offline channels. This is the promise of New Retail, with physical stores partnering with online retailers to form ecosystems that blur the lines between online and offline. (Bain & Company report)

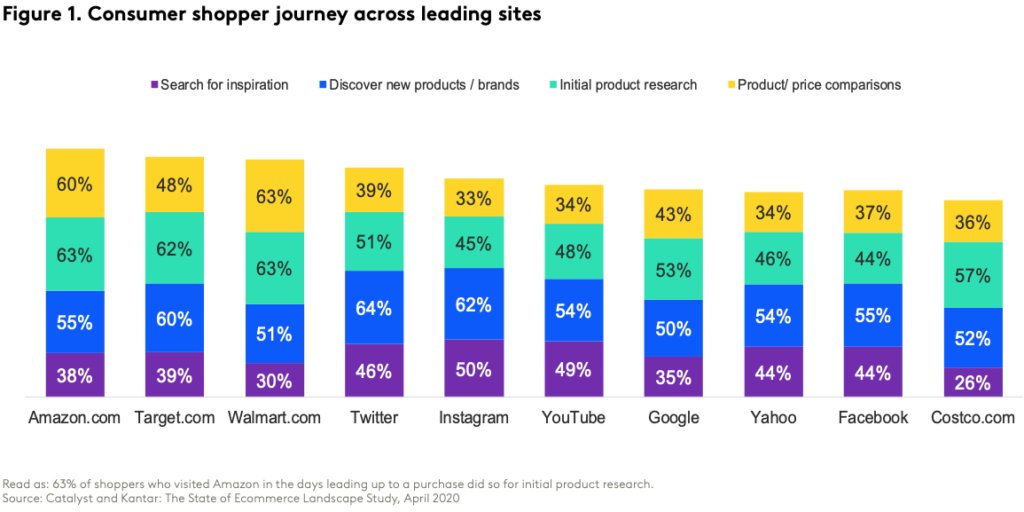

Today’s shopper journey is broader than ever. Not only do consumers shop a range of retailer sites, they also shop using traditional search engines and social media platforms. Furthermore, they use these platforms for a variety of activities during their cross- channel shopping journey. Among those who visited these specific sites, 50% searched for inspiration on Instagram, 50% discovered new products or brands on Google, 63% did their initial product research on Amazon, and 63% compared products or prices on Walmart.com. (Kantar report)

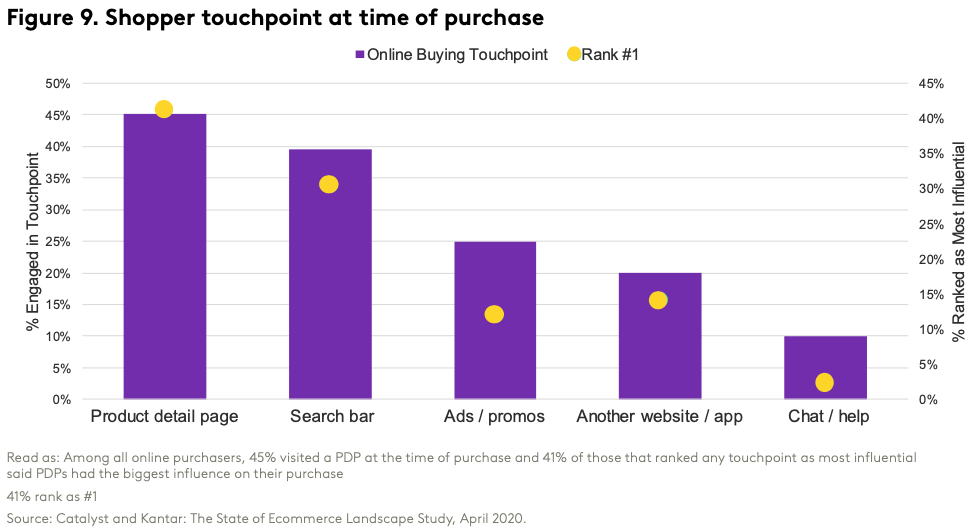

Across many of Kantar’s interviews, it was clear that marketers valued the product detail page (PDP) for its important role in driving conversion. Their study has revealed that, among all online purchasers, nearly half (45%) have indicated that they visited a PDP at the time of purchase, and 41% of those that ranked any touchpoint as #1 said PDPs had the biggest influence on their purchase. (Kantar report)

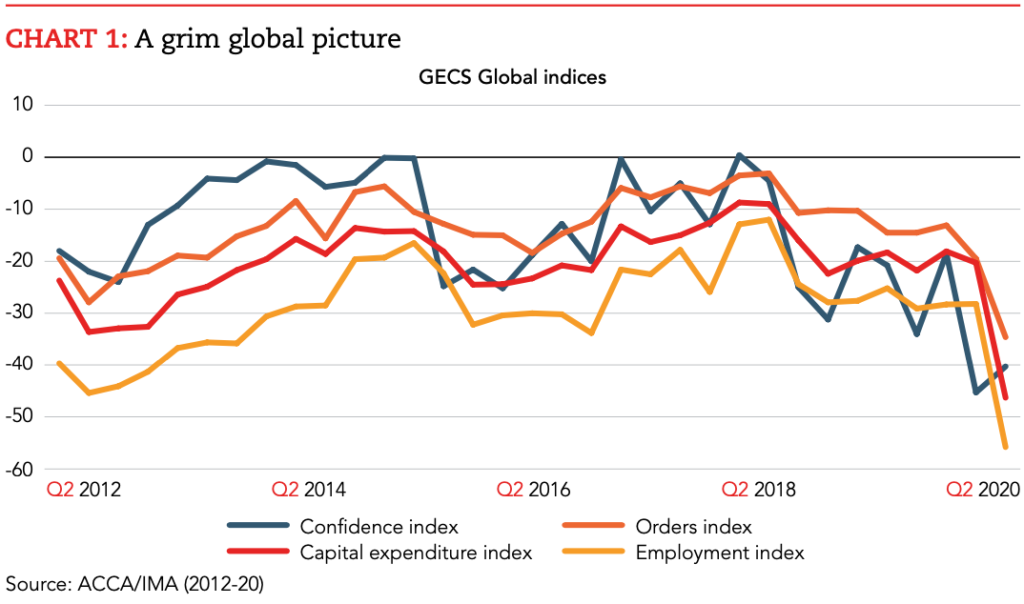

The 2Q20 Global Economic Conditions survey (GECS) reflects the scale of the global recession now under way. Globally orders and employment indices have plummeted to record lows in the latest survey, consistent with the view that this is the most severe recession in decades. By contrast, global confidence recovered slightly from the record low reached in the 1Q20 survey. This provides some optimism that recovery is in prospect in 2H20, notwithstanding the collapse in activity through the 1H20. (ACAA report)