8-15 #VIPBirthday: Huawei is to build its own semiconductors manufacturing line; Samsung reportedly will not apply 3D ToF (Time of Flight) modules for the Galaxy S21; Samsung has announced that its latest flagship phones will receive 3 years of OS updates; etc.

Huawei is reportedly working with several companies and required material manufacturers in the semiconductor industry supply chain to build its own semiconductors manufacturing line. Huawei will first begin with 45nm (nanometer) process technology that will be ready by the end of this year. Aside from 45nm, Huawei has also planned to build a 28nm manufacturing line. (CN Beta, CN Beta, WCCFTech, Huawei Central)

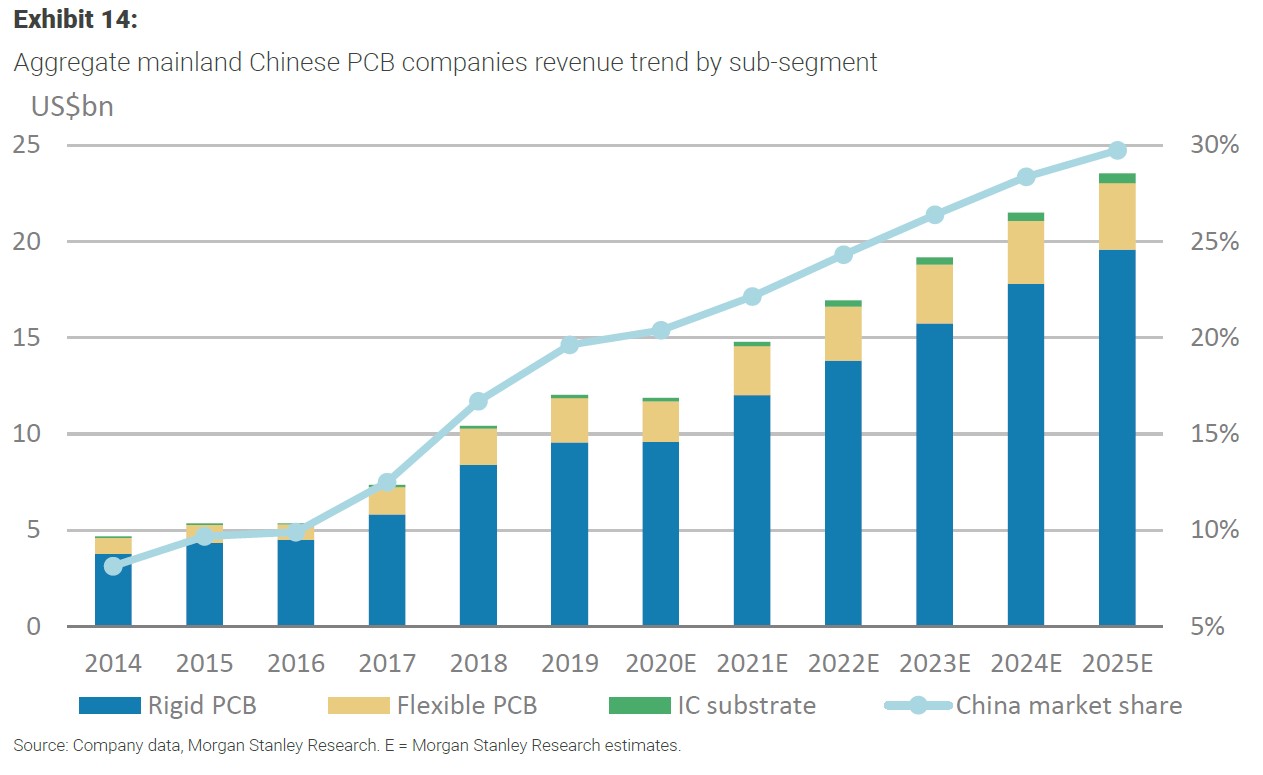

The China localization trend is playing out across all sub-segments within the PCB space, such as rigid PCBs, flexible PCBs, IC substrates, and even in the upstream key raw material, copper clad laminate (CCL). For PCBs (rigid PCB, flexible PCB, IC substrates), Morgan Stanley estimates the PCB production value of mainland Chinese PCB companies will reach ~USD23.5B by 2025, implying Chinese PCB companies in aggregate will reach 29.7% global PCB market share, up from 19.6% in 2019. (Morgan Stanley report)

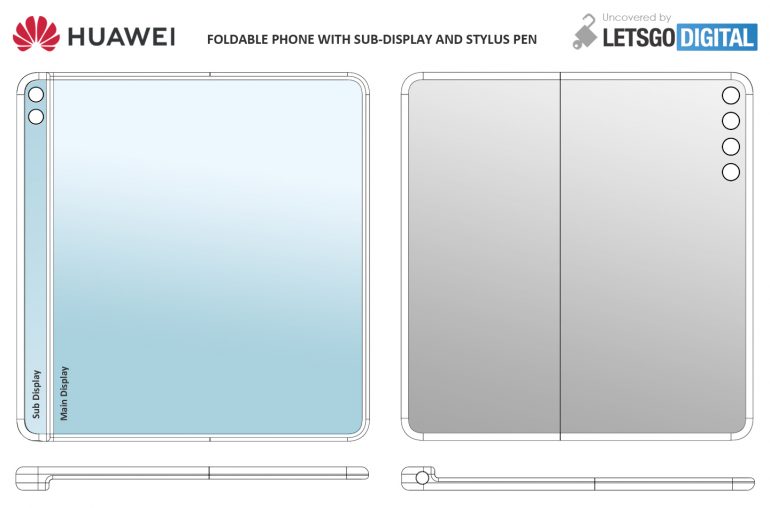

Huawei has filed a patent with China National Intellectual Property Administration (CNIPA) for a foldable smartphone, which features a stylus and has a sub display right next to the primary screen, which follows an inward folding design. This sub display is narrow and long, covering the entire length on the left side, and features two cut outs for a dual front facing camera system. (Gizmo China, LetsGoDigital)

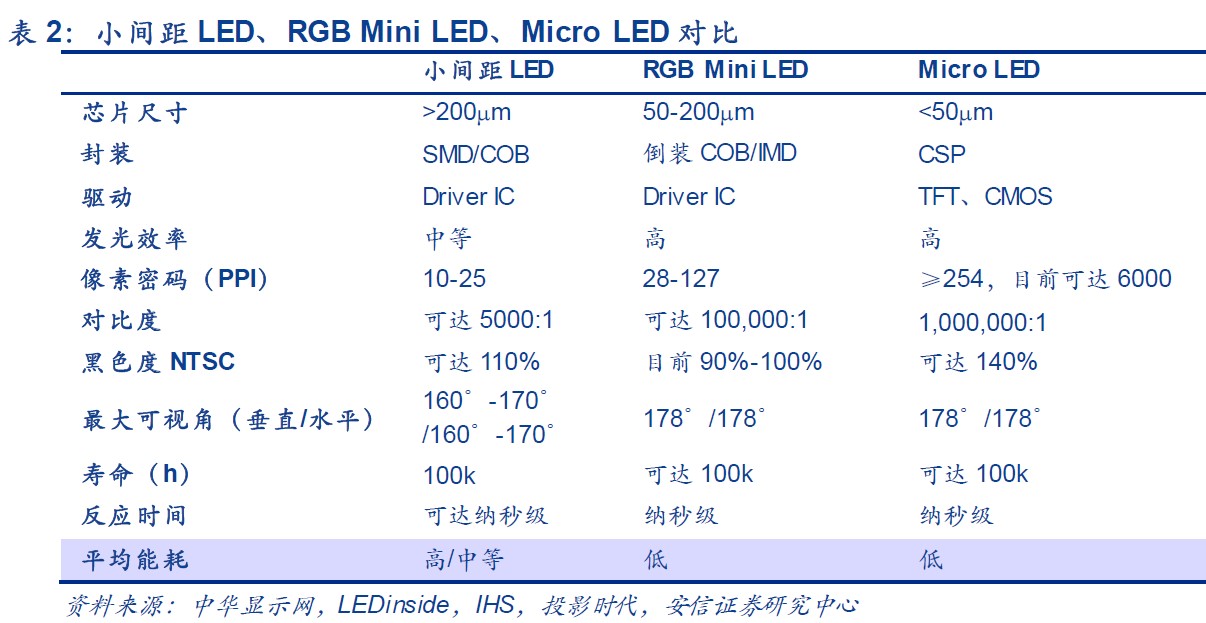

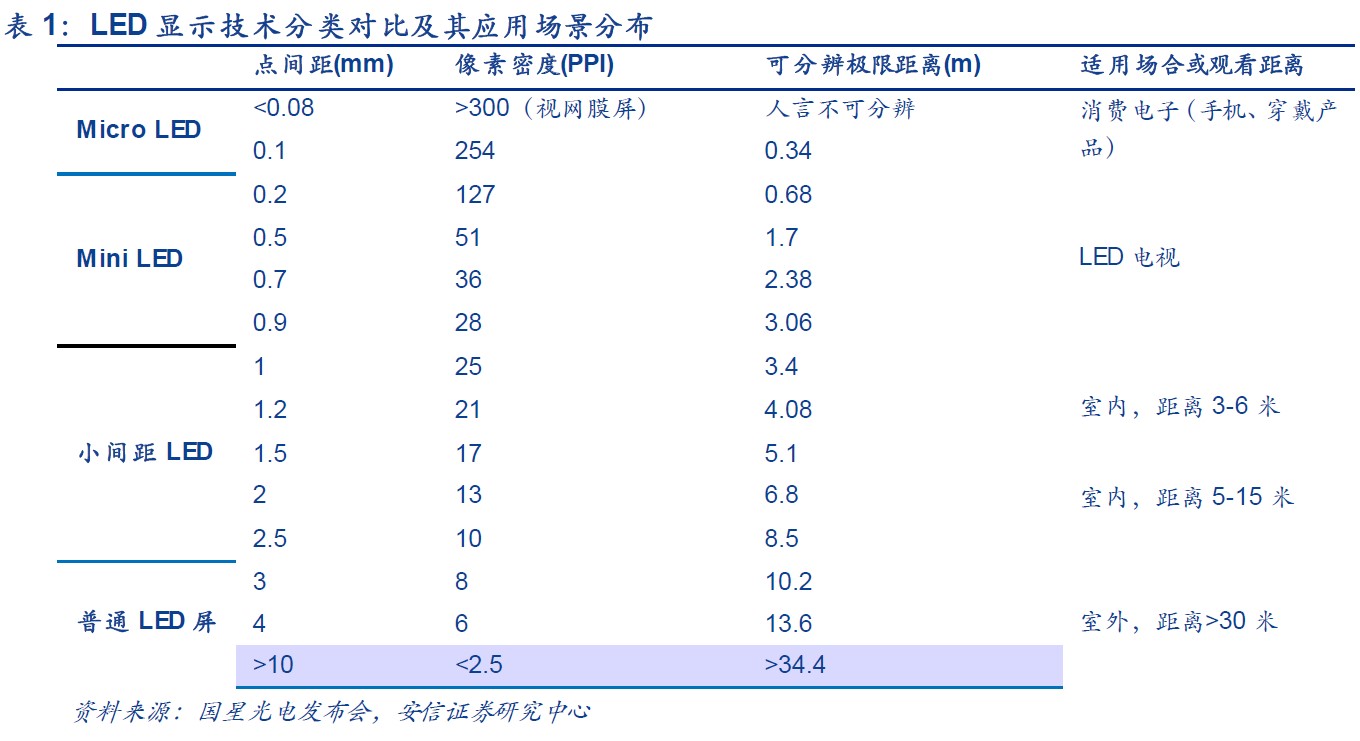

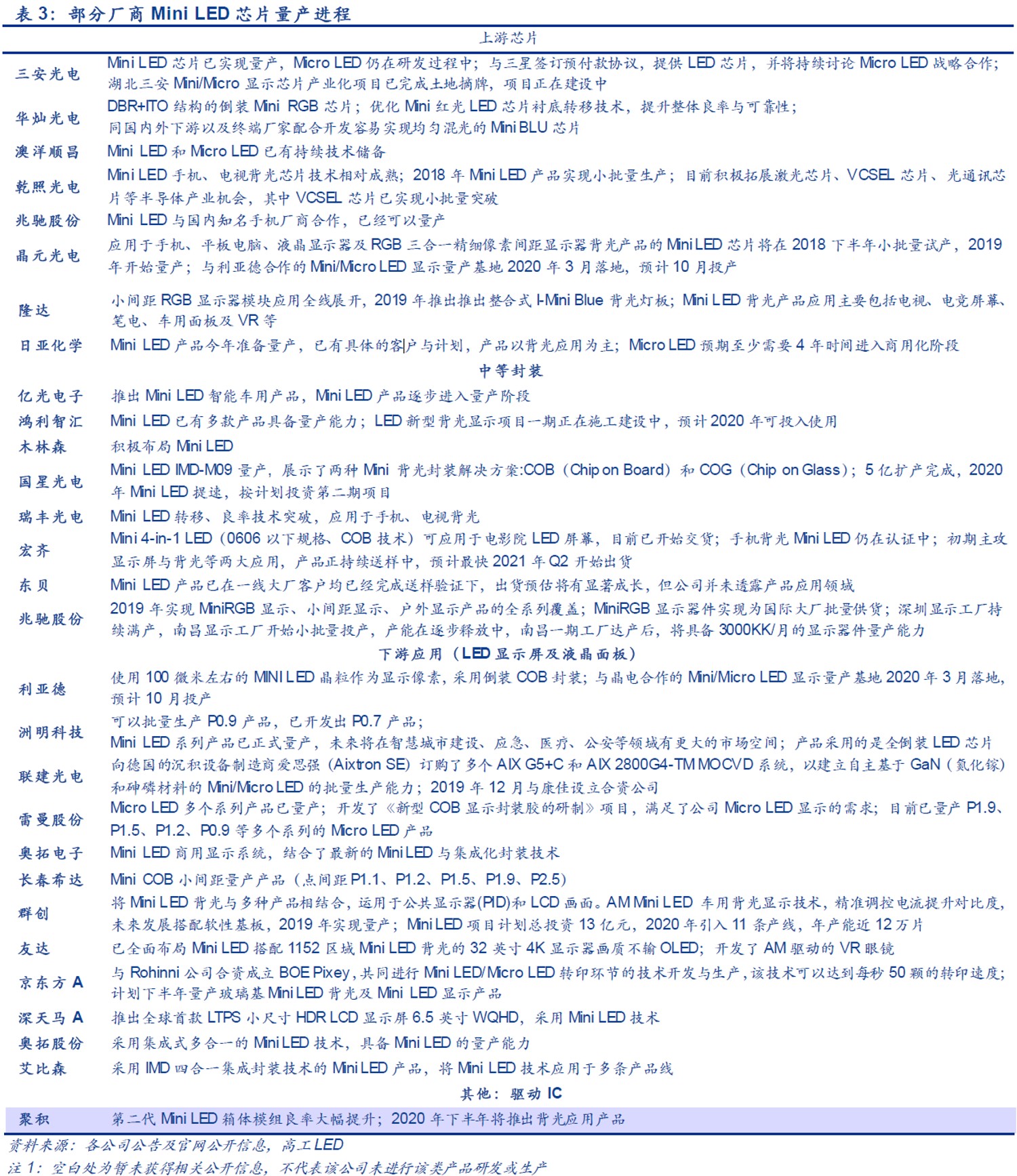

All aspects of Micro LED performance are in line with future display trends, but are limited by technical bottlenecks such as the miniaturization process and massive transfer, and it is expected that commercialization will still take a long time. Mini LED is a transitional innovative technology between small-pitch LED (chip size >200μm) and Micro LED (chip size around 1-10μm), which can be applied to backlight and display fields. In backlight applications, Mini LED backlight adopts direct area dimming principle to achieve higher contrast and uniformity at a smaller mixing distance, and achieve high dynamic range imaging (HDR); in display applications, RGB Mini LED can achieve higher pixel density, improved image granularity, and improved gray-scale display effect under low brightness, with flexible substrate to achieve high-curved display. (Essence Securities report)

Manufacturers such as Sanan Optoelectronics and HC Semitek have entered the stage of mass production of Mini LED chips; in terms of packaging, Mini LED display products from NationStar, Refond, Honglitronic, Shenzhen MTC LED products have begun small-batch production; on the downstream application side, P0.9 products from display manufacturers such as Leyard and Unilumin Technology have been shipped. (Essence Securities report)

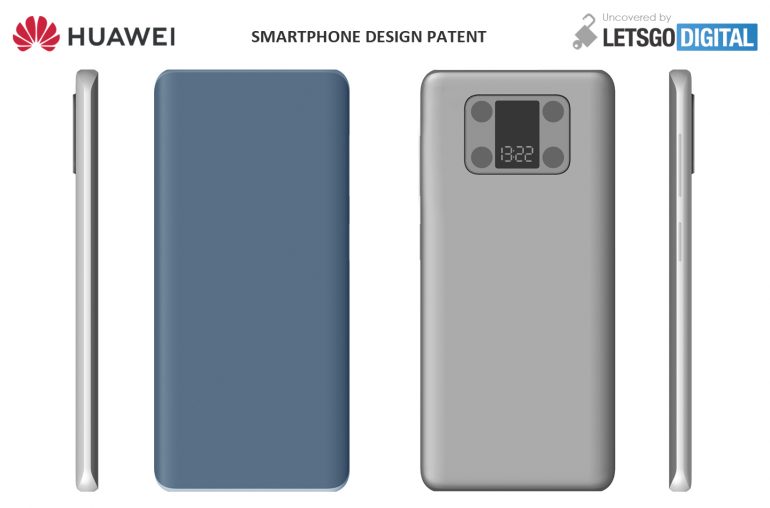

Huawei has filed a patent for a smartphone design that has a small display on the back, which can show the time, but it may have other uses as well. (CN Beta, LetsGoDigital, 91Mobiles)

Samsung reportedly will not apply 3D ToF (Time of Flight) modules for the Galaxy S21 launching in 2021. The feature is absent as well in the recently launched Galaxy Note20 series. Low usability was one of the reasons why Samsung decides to remove the feature as there is no so-called “killer contents” that uses ToF. (Gizmo China, The Elec)

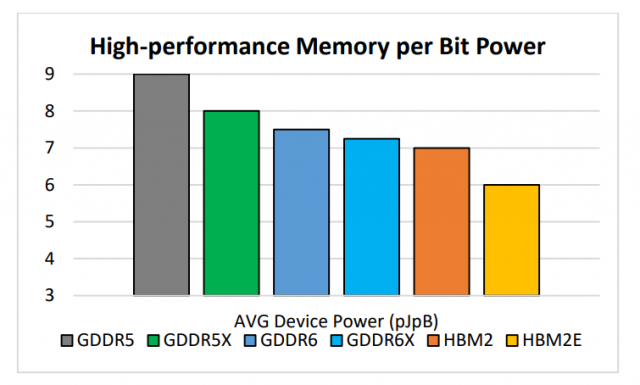

Micron has made a pair of announcements around next-generation memory technologies, HBMnext and GDDR6X. The latter will debut with the upcoming RTX 3090, which will offer 12GB of onboard RAM. As for the company’s HBMnext, it appears equivalent to SK Hynix’s HBM2E, where the “E” stands for “Evolutionary”. Micron expects to ship its version of HBM2E / HBMnext by the end of 2022, with solutions available in 4-Hi/8GB and 8-Hi/16GB densities. (My Drivers, Extreme Tech, Tom’s Hardware)

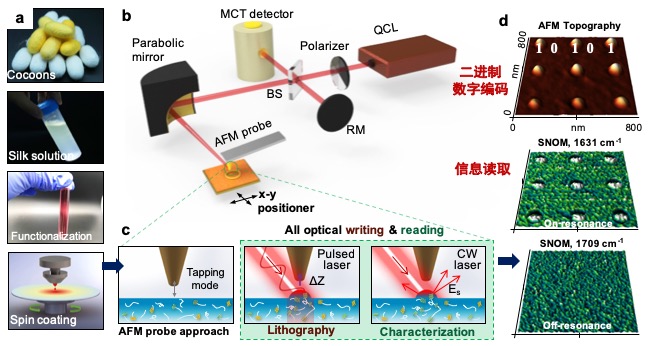

Chinese scientists have developed the world’s first hard drive memory using natural bioproteins, which can store digital and biological information at the same time. As an optical storage medium, the silk drive can store digital and biological information with a capacity of 64 GB per square inch and exhibits long-term stability under various harsh conditions. (CN Beta, Nature, Global Times)

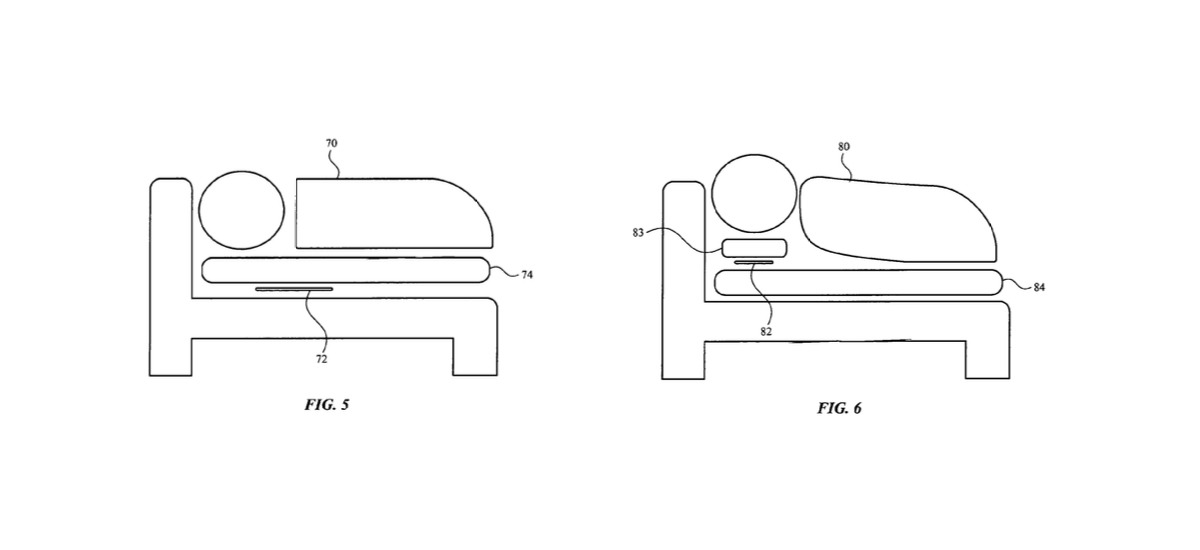

Apple is working on an integrated health sensor system that could monitor, analyze and help manage the state of a user’s chronic diseases. The patent application, titled “Monitoring System for Assessing Control of a Disease State”, offers a few ways that various health technology systems could be used to address the “large and costly” problem of managing chronic diseases. (Apple Insider, USPTO)

TF Securities analyst has reported that Apple’s 5.4″ and 6.1″ iPhone 12 phones, are facing some issues with the lenses of the ultra-wide camera. The coating of the elements produced by one of the suppliers for the non-Pro models was said to be susceptible to cracking. Genius Electronic Optical (GSEO) has since refuted the report, maintaining that its production is still running without issues and that demand from its clients remains normal. (GSM Arena, Digitimes, Mac Rumors, Sina)

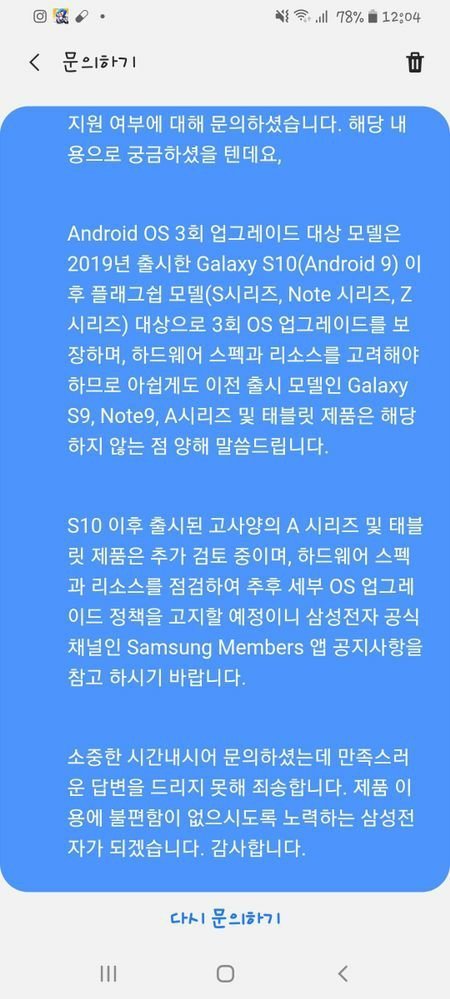

Samsung has announced that its latest flagship phones will receive 3 years of OS updates, along with monthly security patches. The company’s new update policy may also apply to select Galaxy A series phones. (Android Authority, TizenHelp, Android Central, ePrice)

realme C12 is announced in Indonesia – 6.517” 720×1560 HD+ v-notch, MediaTek Helio G35, rear tri 13MP-2MP mono-2MP macro + front 5MP, 3+32GB, Android 10.0, rear fingerprint scanner, 6000mAh 10W, IDR1.899M (USD128). (GSM Arena, NDTV)

Redmi has announced an affordable gaming laptop, Redmi G – 16.1” 1920×1080 FHD+ 144Hz, Intel Atom Core i7-10750H / i5-10300H / i5-10200H + Nvidia GeForce GTX 1650 Ti / 1650, 10MP front camera, DDR4 16GB, SSD 512GB, Windows 10 Family, 55Wh battery, CNY5,299-6,999 (USD762-1,007). (GSM Arena, Mi.com, Laoyaoba)

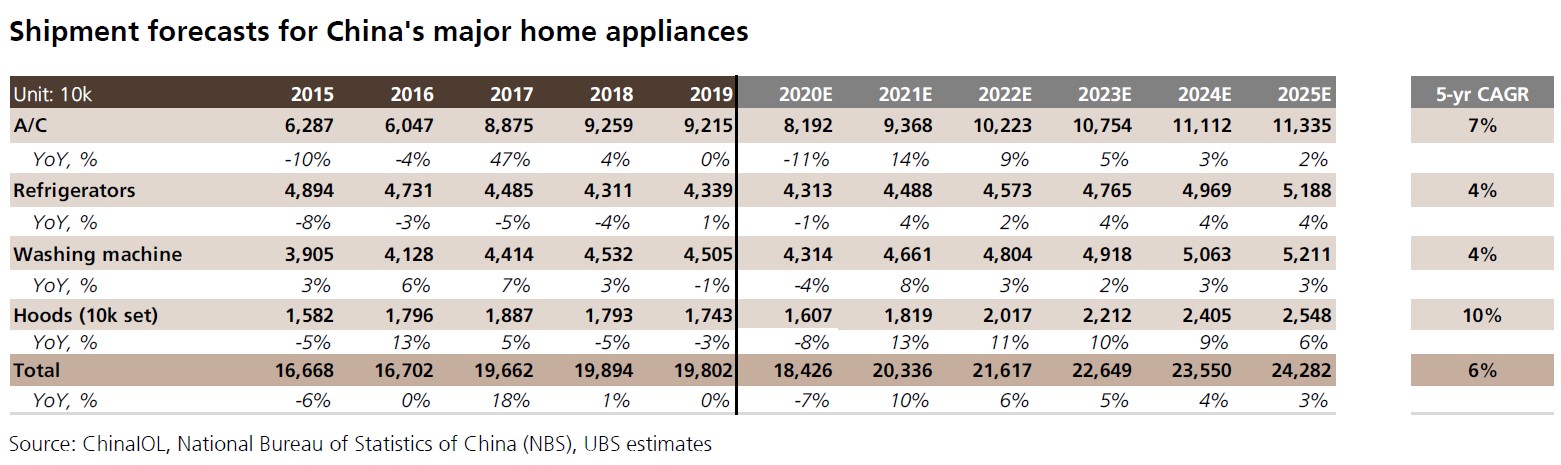

UBS projects a significant turnaround from a -3% volume CAGR in major home appliances demand in 2018-2020, rising to an 8% CAGR in 2020-2022. UBS expects this to be driven by pent-up demand during the COVID-19 outbreak, property completion growth, an end to ACs’ destocking cycle and accelerating replacement demand, as well as continuous penetration growth. (UBS report)

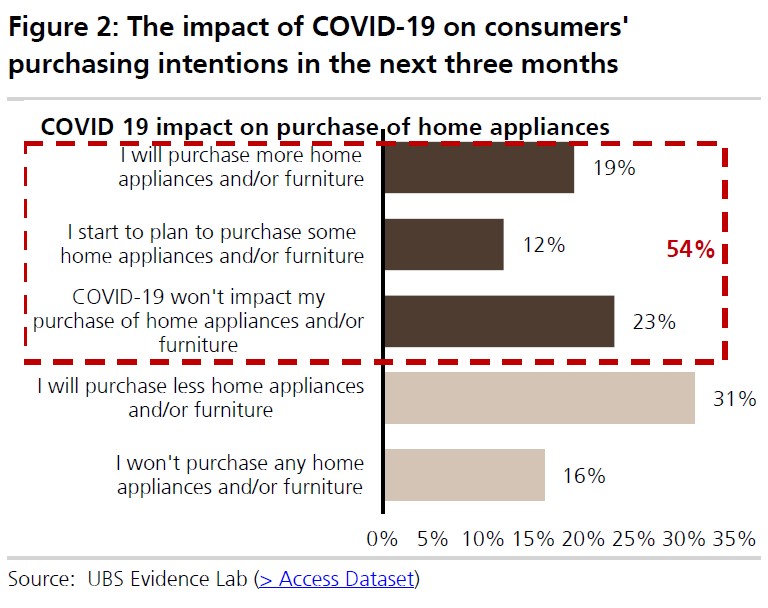

UBS Evidence Lab conducted an online survey of 3,011 consumers in China in Jun 2020 to gauge their intentions to purchase home appliances after COVID-19. The survey results suggest better-than-expected consumer purchasing intentions, as 54% of respondents revealed COVID-19 did not negatively affect their purchasing behaviors (no impact / purchase some / purchase more), while only 46% of consumers were less willing to buy appliances. (UBS report)

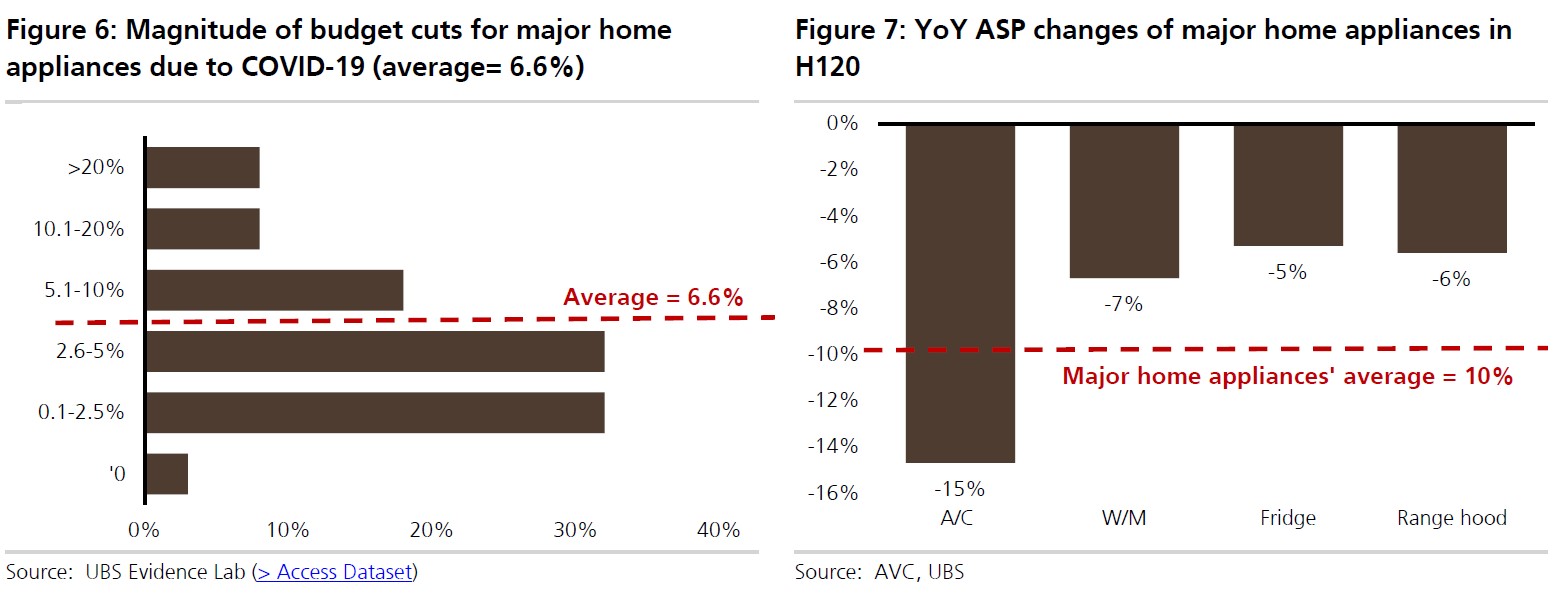

UBS Evidence Lab survey revealed COVID-19 caused consumers to lower their budgets for home appliances by 6.6% on average. The magnitude is less than the 10% price cuts they observed on the retail side, based on AVC’s data, suggesting room for a potential price recovery. By category, the ASPs of ACs / WM / fridges / range hoods declined 15% / 7% / 5% / 6% in 1H20. They believe the sharp ASP decline in ACs in 1H20 is also due to channel destocking by Gree, which accelerated its channel reforms and aimed to cut layers in its offline distribution networks. (UBS report)

Wang Jun, head of Huawei’s intelligent car solution business unit, introduced the latest achievements Huawei has gained for intelligent vehicle development, including 3 in-car operating systems and a cross-domain integrated software architecture dubbed Vehicle Stack. The 3 operating systems unveiled—HOS (Harmony OS), AOS and VOS—focus on automobile cockpit, intelligent driving and smart vehicle control, respectively. (CN Beta, IT Home, CN Beta, My Drivers, Huawei Central, Gasgoo)

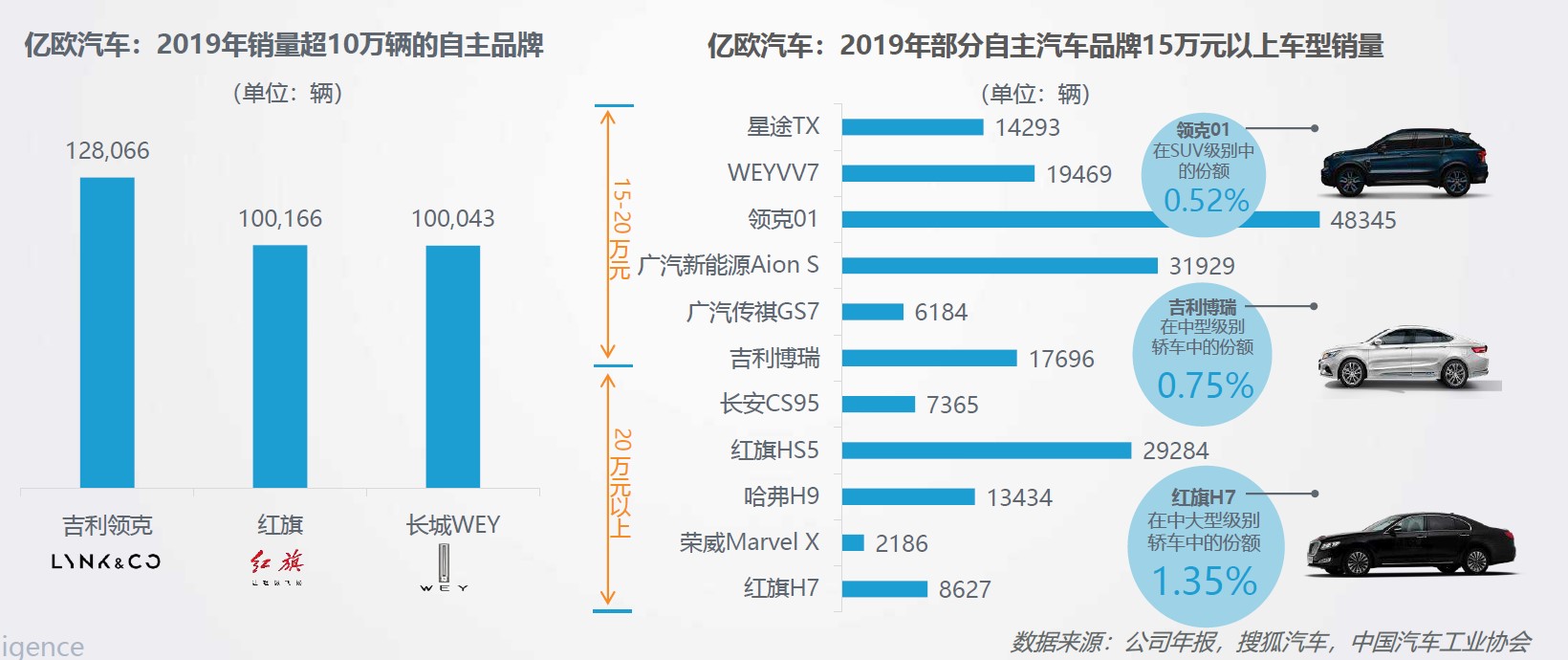

Starting with Chery’s first high-end positioning Qoros car in 2007, many Chinese auto brands have tried to upgrade their high-end products. From 2007 to 2014 is a period of “barbaric growth” for Chinese auto brands, but due to lack of product quality and brand premium capabilities, it fails to have a truly successful case of high-end Chinese car brands. In 2016, marked by the launch of Geely and Great Wall Motor (GWM) high-end brands, high-end technology ushered in new opportunities. The high-end new brands or new brand strategies of mainstream Chinese auto companies such as FAW, BAIC, SAIC, GAC, Geely, GWM, Changan, Chery have been released. (EO Intelligence report)

According to EO Intelligence, some high-end Chinese auto brands have made breakthroughs in the scale of production and sales. High-end brands with annual production and sales exceeding 100,000 vehicles include Geely Lynk & Co, FAW Hongqi, Great Wall WEY. Among the mid-to-high-end models of Chinese auto brands, Hongqi H7, Geely Borui, and Lynk & Co 01 occupy a relatively high market share in the segmented vehicle segment of the passenger car market. (EO Intelligence report)