8-22 #MeetingEverywhere: TSMC has manufactured their 1B good die on their 7nm technology; LG Display has launched transparent OLED screens in subway train windows; Apple has recently hit a USD2T market capitalization milestone; etc.

Huawei has enough semiconductor chips used in telecom base stations in its inventory to last years. Huawei has reportedly already secured enough volume of semiconductors for its business-to-business operations since 2019. These chips for base stations have a longer production cycle compared to those used in smartphones. (Gizmo China, The Elec)

IBM has unveiled a new milestone on its quantum computing road map, achieving the company’s highest Quantum Volume to date. Combining a series of new software and hardware techniques to improve overall performance, IBM has upgraded one of its newest 27-qubit client-deployed systems to achieve a Quantum Volume 64. The company has made a total of 28 quantum computers available over the last four years through IBM Quantum Experience. (CN Beta, IBM)

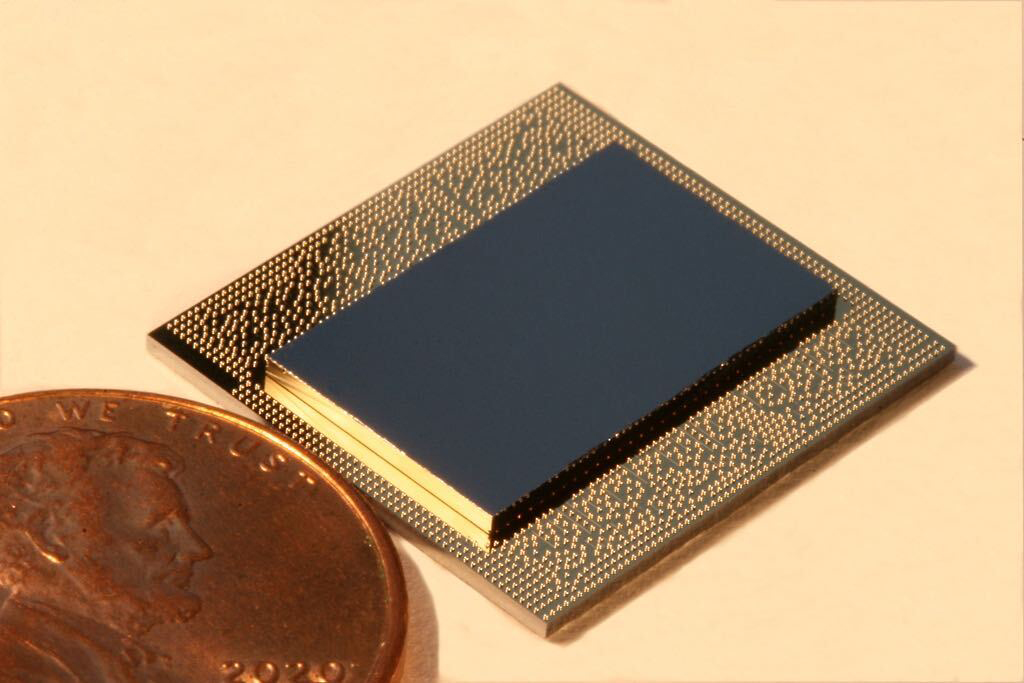

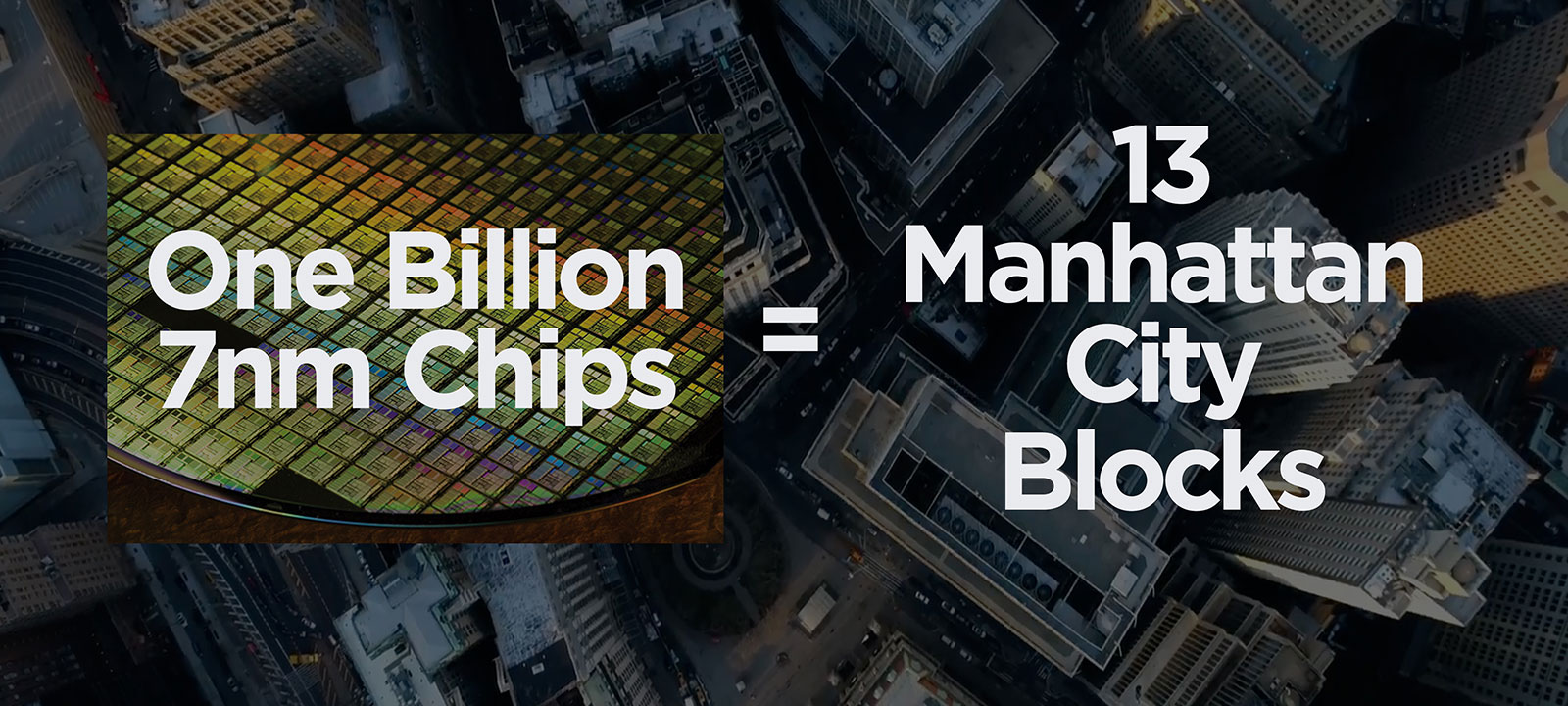

TSMC marked an amazing milestone in Jul 2020, they have manufactured their 1B good die on their 7nm technology. TSMC has begun production of 7nm chips back from Apr 2018. Since then, the firm has “manufactured 7nm chips for well over 100 products from dozens of customers”. The customers include AMD, Apple, Qualcomm, and even Huawei up until Sept 2020. (TSMC, Gizmo China, NBD)

TSMC 6nm process is now in mass production. TSMC’s 6nm process uses extreme ultraviolet lithography. Theoretically, the density of the chip will increase by nearly 20%. (Gizmo China, IT Home, CN Beta)

According to TF Securities analyst Ming-Chi Kuo, adoption of Sub-6GHz 5G technology will increase Apple’s costs by USD75–85, while millimeter wave technology will incur a USD125–135 cost for Apple. the battery board is one area where Kuo believes suppliers will see the biggest cost trimming with Apple reportedly moving to a simpler and smaller design with fewer layers. The hybrid hard and soft battery board for the iPhone 12 will reportedly be 40–50% cheaper than the equivalent part in the iPhone 11 series, although this component is likely a small contributor to Apple’s overall costs. (GSM Arena, TF Securities, Mac Rumors, Sina)

ARM and the U.S. Defense Advanced Research Projects Agency (DARPA) have announced a 3-year partnership agreement to “enable the research community that supports DARPA’s programs to quickly and easily take advantage of ARM’s leading IP, tools and support, accelerating innovation in a variety of fields”. (CN Beta, ARM, Inside HPC)

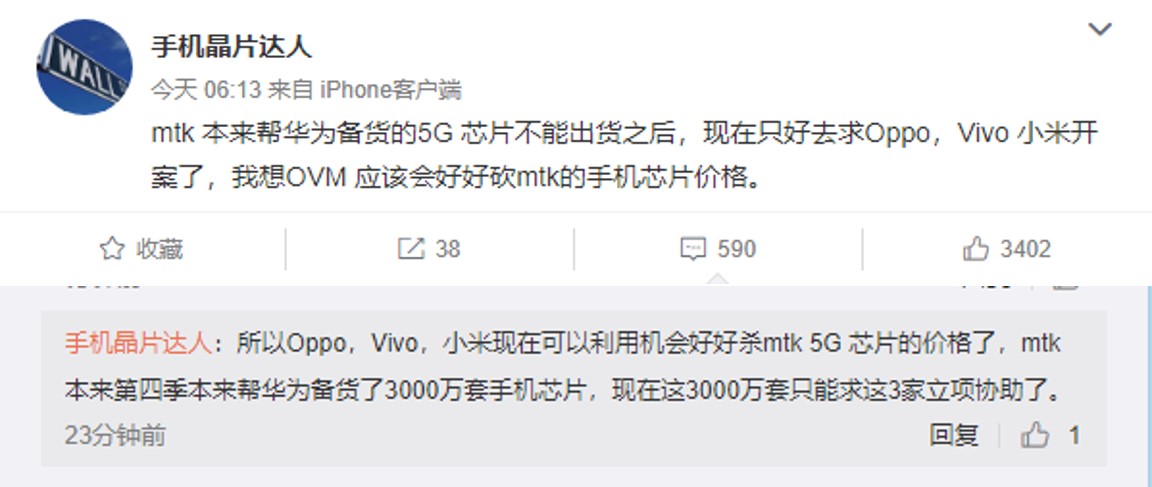

The U.S. Department of Commerce’s Bureau of Industry and Security (BIS) has further escalated restrictions on Huawei and its non-U.S. affiliates on its “Entity List” to use U.S. technology and software to produce products at home and abroad. Huawei will be prohibited from purchasing “parts”, “components”, or “equipment” that are developed or manufactured based on U.S. software or technology, unless a U.S. license is obtained. MediaTek might have helped Huawei stocked 5G chips cannot ship, and now have to resort to OPPO, vivo, Xiaomi’ open case. MediaTek originally in 4Q20 would have helped Huawei stocked 30M sets of mobile phone chips. (CN Beta, GizChina, Sparrow News, ZOL, My Drivers)

According to Nomura Securities’ analysis, with the gradual escalation of the China-US trade war, China’s domestic semiconductor companies have been affected in many ways. The main risks are as follows: 1) Materials: At this stage, China’s semiconductor wafer capacity targets are optimistic and may not be realized entirely. It will take time for 12” wafers to catch up; 2) Equipment: A large number of semiconductor companies are concerned about the escalation of trade war and make a lot of equipment expenditures in advance; 3) Design: Product degradation is gradually becoming a reality, and industry competition may gradually intensify; 4) Manufacturing: SMIC’s orders may drop sharply, affecting the overall supply chain. Huawei HiSilicon provides SMIC with about 20% of its operating income and is a major customer of SMIC’s high-end chips. The ban on Huawei bringing the impact on SMIC, which may take 1-2 years to recover; 5) Packaging and testing: The inventory of domestic semiconductor manufacturers is high, and the growth of packaging and testing plants is slowing down. (Nomura report)

LG Display (LGD) has launched transparent OLED screens in subway train windows. The technology is currently available on subway trains in Beijing and Shenzhen. The 55”, see-through displays show real-time info about subway schedules, locations and transfers on train windows. They also provide info on flights, weather and the news. (Android Authority, CN Beta, Engadget)

Demand has been weakened by the coronavirus pandemic and the US trade sanctions against Chinese smartphone vendor Huawei, who is a globally top-three vendor of high-end smartphones. Huawei’s global shipments for flagship smartphones are expected to drop in 2020. Quotes for 6P (six plastic lens pieces) 48MP autofocus lens modules for high-end smartphone are estimated to drop from about USD10.5 in 2Q20 to USD9.5 in 3Q20, according to Sigmaintell Consulting. (Digitimes, press)

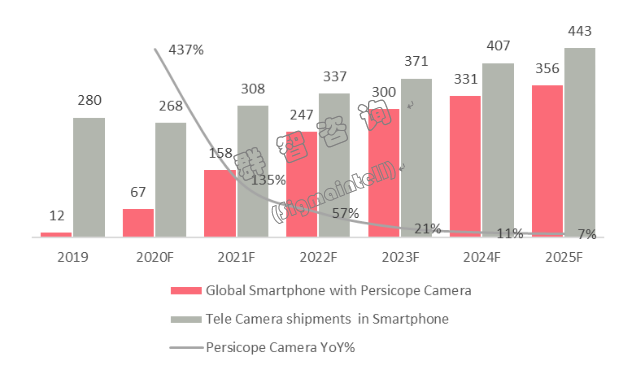

Sigmaintell predicts that by the end of 2020, the lowest price of a 5x optical zoom periscope camera module will fall below USD15. The minimum price of a periscope camera module with 10x optical zoom will drop below USD40. Sigmaintell predicts that in 2020, the shipment of periscope camera modules will reach 67M units, and telephoto cameras will reach 270M units. (Sigmaintell, Sigmaintell)

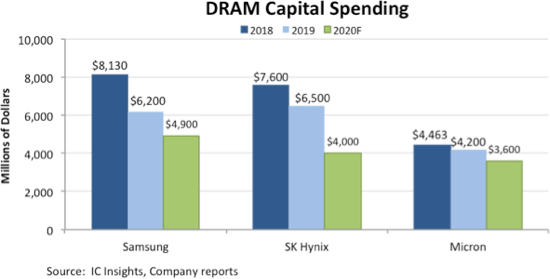

Three major DRAM suppliers – Samsung, SK Hynix and Micron Technology – are expected to make further cuts in their DRAM capital spending in 2020 as most new facilities and upgrades to current fabs are in place to handle near-term demand, IC Insights indicated. Samsung’s DRAM capital expenditure budget will decline 21% to USD4.9B in 2020, while SK Hynix will trim its DRAM capex budget 38% to USD4B. Micron is expected to cut its DRAM capex by 16% in 2020 to USD3.6B. (IC Insights, press, Digitimes)

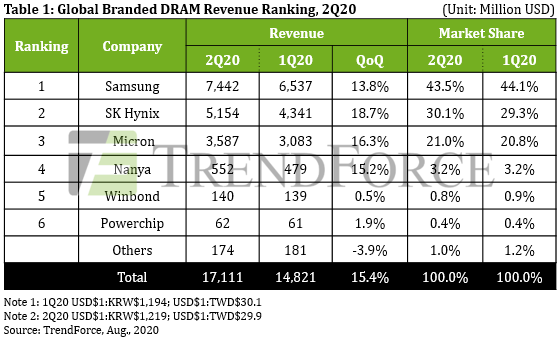

Revenue of the global DRAM memory market increased 15.4% sequentially to USD17.1B in 2Q20, driven by growth in both bit shipments and ASPs, according to TrendForce. OEMs maintained or even stepped up procurement of components because they feared disruptions in the supply chain. The market revenue saw a slight drop sequentially in the prior 1Q20, when bit shipments were affected adversely by coronavirus lockdowns and the epidemic’s impact on logistics services. DRAM bit shipments for the second quarter were higher-than-expected, when ASPs rose about 10% on quarter. (TrendForce, TrendForce, press, Digitimes)

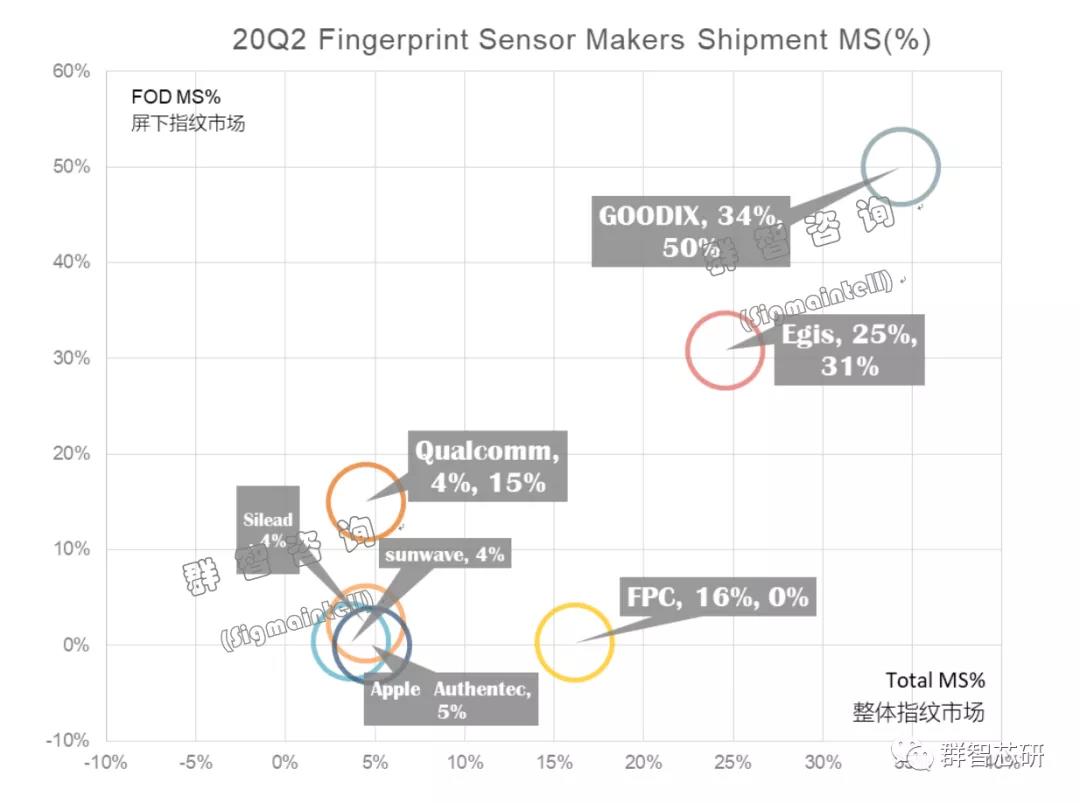

According to Sigmaintell, global shipments of fingerprint chips in 2Q20 will be around 230M, a YoY decrease of about 8%. At the same time, they predict that the shipment of under display fingerprint sensors in 1H20 screen will be about 112M, an increase of about 14% YoY. In 2Q20, the shipment of under display fingerprint chips is approximately 69.4M, an increase of 8.3% YoY; among them, the shipment of optical fingerprint chips is 59M, an increase of 8.6% YoY; the shipment of ultrasonic fingerprint chips is 10.4M, an increase of approximately 6.1% YoY. (Sigmaintell, Sigmaintell)

Apple has recently hit a USD2T market capitalization milestone, and Loup Ventures’ Gene Munster has said the company has a “clear path” to USD3T. Apple’s current and future golden geese (wellness, AR, autonomous systems) are becoming more central to our lives in this new world. Amazon and Microsoft boast market capitalizations of about USD1.5T each. Google’s is just north of USD1T. (Apple Insider, Apple Insider, Loup Ventures, NBC News, Benzinga)

The Bureau of Indian Standards (BIS) has in recent weeks delayed approvals for mobile phone components and televisions, jeopardizing the plans of firms such as Xiaomi as well as OPPO. Chinese firms like Xiaomi are facing delays getting approvals from India’s quality control agency for their goods. (Economic Times, Zoom News, CN Beta)

LG K31 is official – 5.7” 720×1520 HD+ u-notch, MediaTek Helio P22, rear dual 13MP-5MP ultrawide + front 5MP, 2+32GB, Android 10.0, rear fingerprint scanner, 3000mAh, USD150. (GSM Arena, GizChina)

Apple has acquired Isreal-based startup Camerai (formerly known as Tipit) in early 2019 for ‘tens of millions’. The startup’s tech makes software developers’ experience much easier when working on implementing AR and related features. (Apple Insider, Calcalist, TechCrunch, 9to5Mac)

Zoom has announced that its “Zoom for Home” video conferencing platform is coming to Amazon’s Echo Show line, Google’s smart displays plus Facebook’s Portal devices. (Liliputing, CN Beta, Engadget)

Baidu has launched the full operation of its Robotaxi service “Apollo Go” in Cangzhou, Hebei province, which allows local commuters to enjoy a free self-driving taxi ride through a simple click on Baidu Maps, a desktop and mobile web mapping service application provided by Baidu. The “Apollo Go” is jointly operated by Baidu’s Apollo autonomous driving platform and its eco-partner Yuntu, a Cangzhou-based intelligent driving solution provider. (CN Beta, PR Newswire, Gasgoo)

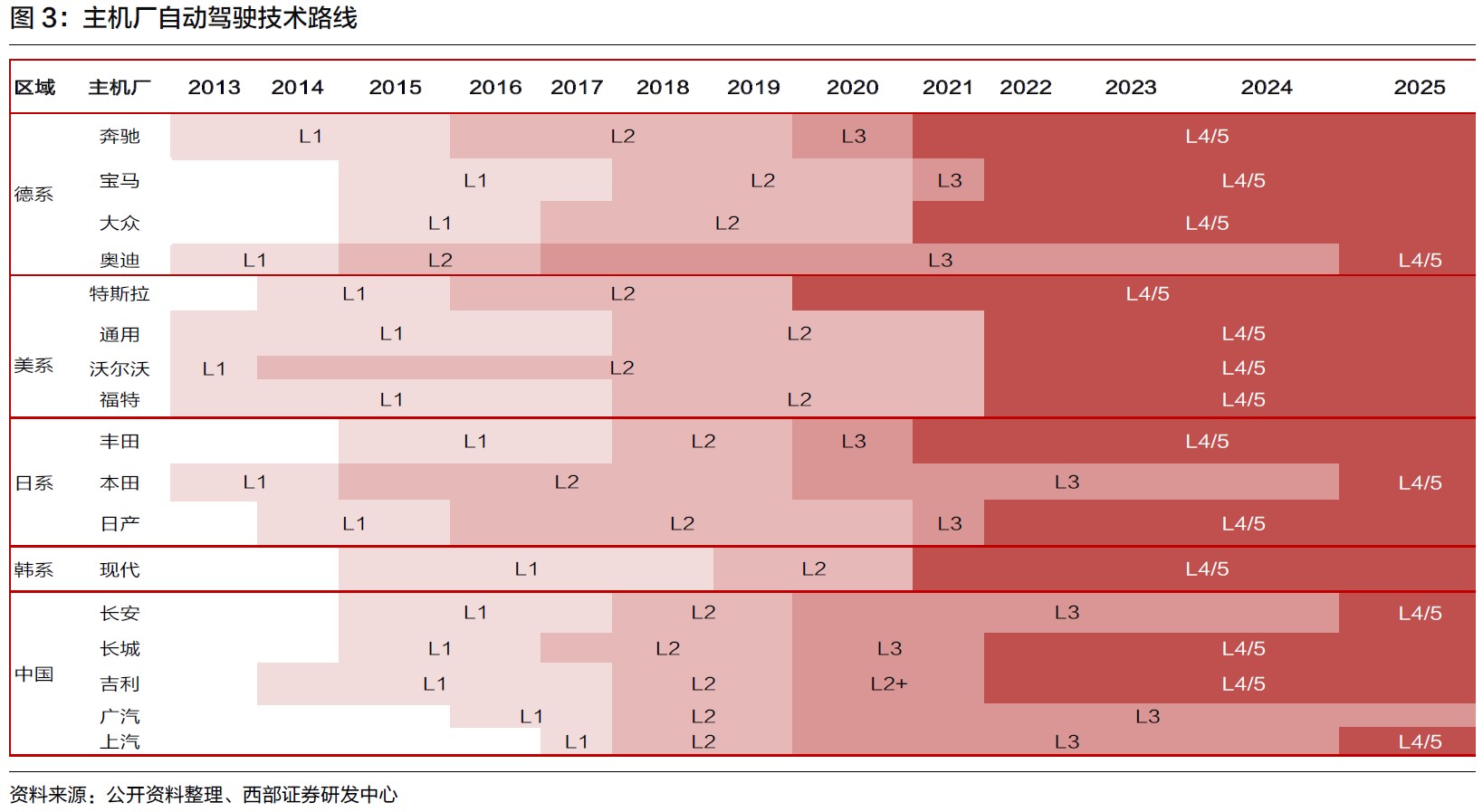

Google took the lead in launching the autonomous driving project in 2009. Currently, the autonomous driving field has covered many players such as automakers, Tier 1, technology giants, autonomous driving companies, and travel companies. According to the plans of car companies, 2020-2021 will be the year of concentrated mass production of L3 level models, and some car vendors such as Tesla, General Motor, Volvo, etc. choose to skip L3 and upgrade to L4 autonomous driving. Autonomous driving is divided into 3 parts: perception and positioning, planning and decision-making, and execution control. At present, Tier 1 at home and abroad has many layouts at the perception and decision-making levels. The execution control of autonomous driving is monopolized by Bosch, Continental and other foreign Tier 1. (Western Securities report)

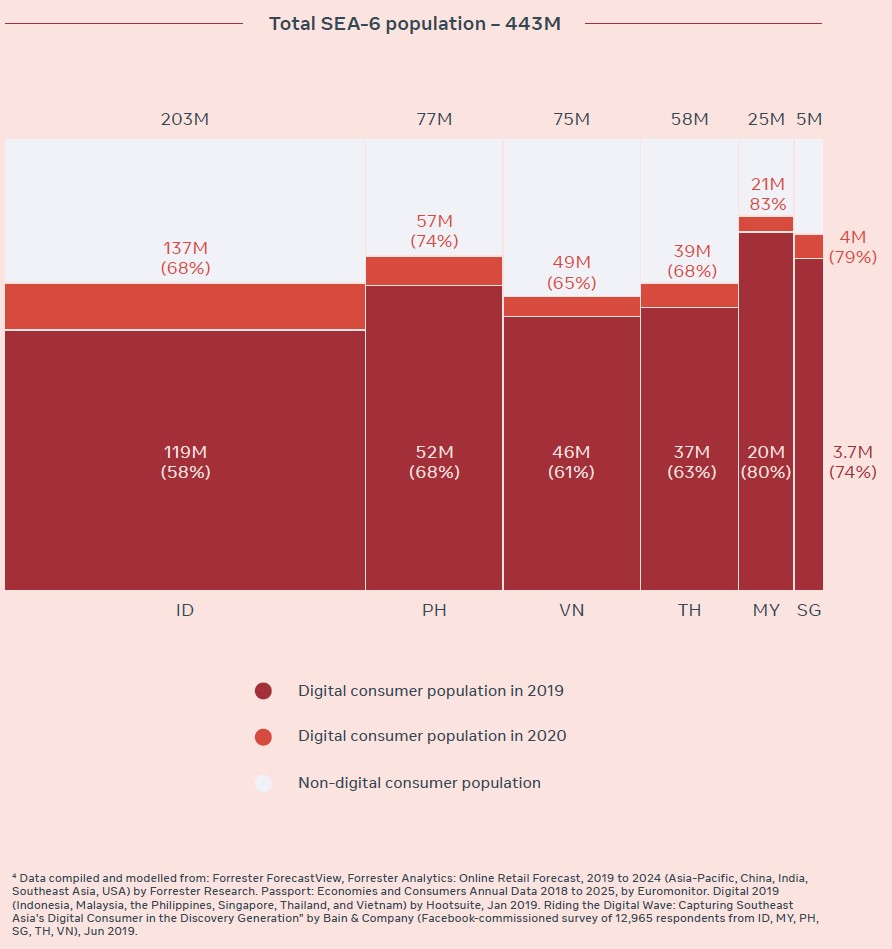

According to a survey done by Facebook and Bain & Company, among all the Southeast Asian countries, Indonesia’s digital consumer population growth outpaces its counterparts. Where growth in neighboring countries averaged 5%~9%, Indonesia’s digital consumer population rose 15% in 2020. Indonesia now has 137M digital consumers, which represents 68% of its estimated total population who are 15 years old and above. (Bain & Company report)

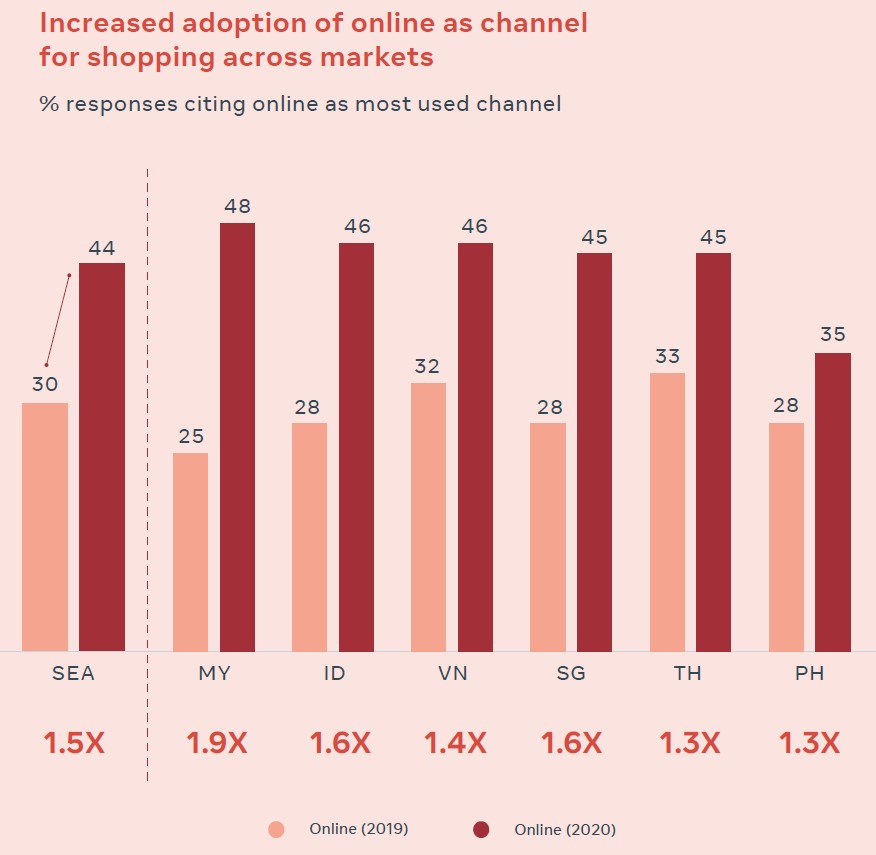

According to a survey done by Facebook and Bain & Company, across Southeast Asia, preference to buy from online channels has seen a leap. There are 41% of consumers switched to purchase mostly online in 2019. (Bain & Company report)