9-6 #BackToCinema: Huawei’s Kirin 9000 inventory is allegedly 10M pieces; TCL CSOT plans to invest CNY46B to build a printing and rollable display R&D and production base in Huangpu District, Guangzhou in 2021; etc.

Huawei has reportedly decided to delay the launch of its 5nm Kirin mobile processors and are urging TSMC to deliver the orders as soon as possible. (Gizmo China, Sohu)

Huang Haifeng, a senior independent analyst in the communications industry, has revealed that Huawei’s Kirin 9000 inventory is about 10M pieces, and about 10M Huawei smartphone could use this chip, which may last about half a year. However, when the stocks are used up, Huawei’s mobile phone business, especially the high-end mobile phone business, will soon encounter huge challenges. (CN Beta, UDN, MyZaker)

China is reportedly planning a sweeping set of new government policies to develop its domestic semiconductor industry and counter Trump administration restrictions, conferring the same kind of priority on the effort it accorded to building its atomic capability. Beijing is preparing broad support for so-called third-generation semiconductors for the 5 years through 2025. President Xi Jinping has pledged an estimated USD1.4T through 2025 for technologies ranging from wireless networks to artificial intelligence. (Bloomberg, press, Gizmo China)

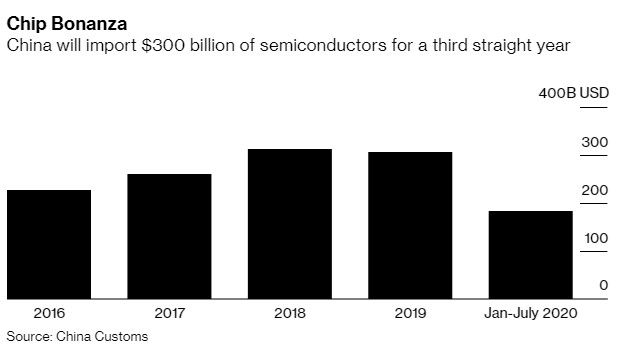

Driven by government support, vast market and increasing R&D spending, China, Japan, South Korea and Taiwan together have become the “Big 4” semiconductor players in Asia Pacific, holding four of the top six spots by overall semiconductor revenue and each have several global semiconductor giants. Asia Pacific is also the world’s biggest market for semiconductors, accounting for 60% of global semiconductor sales, within which China alone accounts for over 30%. (Deloitte report, Deloitte report)

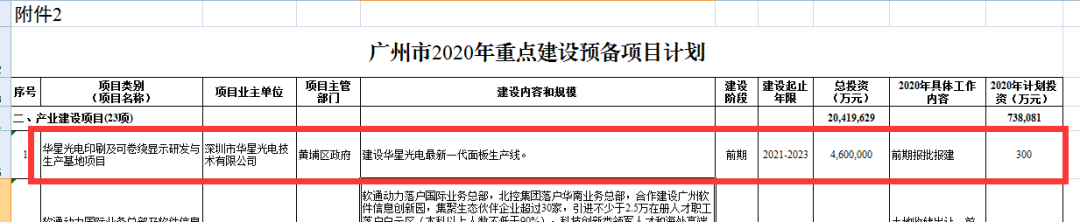

TCL CSOT plans to invest CNY46B to build a printing and rollable display R&D and production base in Huangpu District, Guangzhou in 2021. TCL Technology Chairman Li Dongsheng has confirmed that the Gen-8.5 printed OLED production line in Guangzhou will start construction in 2021. Inkjet printing technology is considered to be an effective way to solve the high cost of OLED production cost. (Laoyaoba, China FPD)

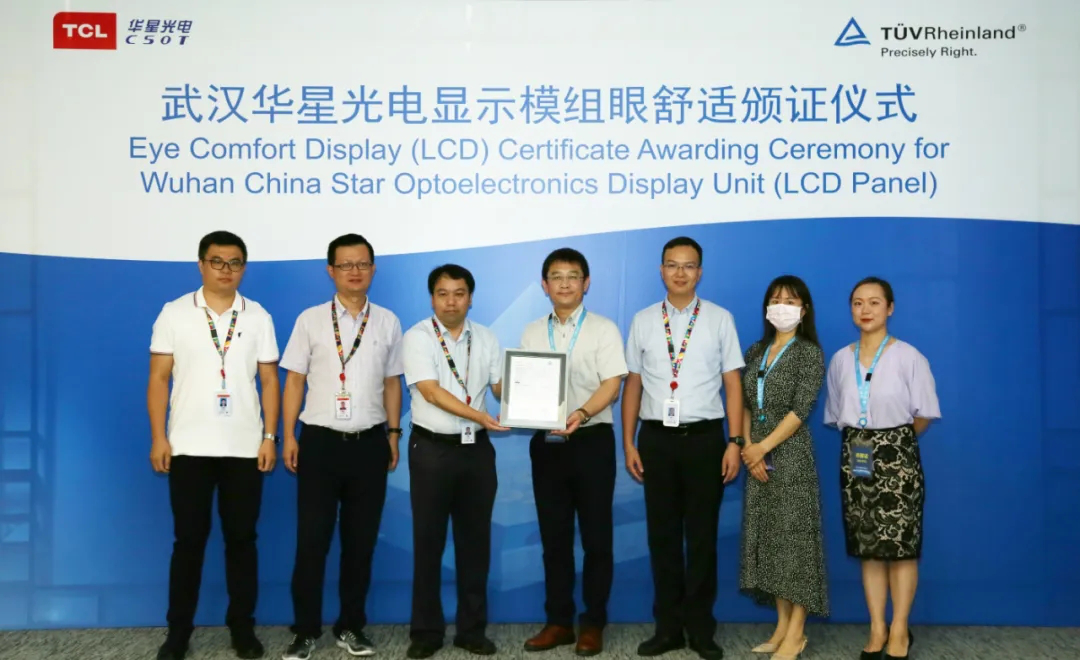

TCL CSOT has obtained the world’s first Eye Comfort Display (LCD) certification issued by the international independent third-party testing, inspection and certification organization TÜV Rheinland. (Laoyaoba, ZOL)

Visionox has revealed that it has a total of 5 production lines, 3 panel production lines, and 2 module production lines. Visionox’s smartphone products have entered the supply chain of many first-tier brand customers at home and abroad, such as Xiaomi, LG, ZTE, Nubia, and Transsion. (Laoyaoba, Sohu)

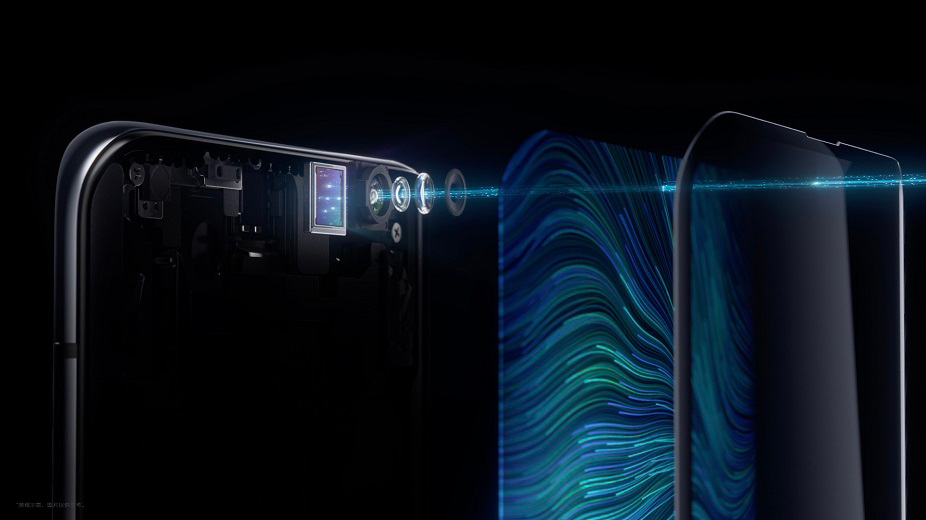

O-Film has revealed that the company has technical capability of camera under display. The company will cooperate with major smartphone vendors. For detailed supply status, the market needs to refer to the official product information. (Laoyaoba, Sina)

ZTE Axon 20 5G features an under-display camera setup, with lens modules supplied by Taiwan-based Largan Precision and Chinese firms O-Film Tech and Sunny Optical Technology. Xiaomi’s in-house-developed under-display camera technology will also enter volume production in 2021. (Digitimes, press)

Facebook Reality Labs Research is working on novel technologies to enable both audio presence and perceptual superpowers, letting users hear better in noisy environments with their future AR glasses. There are two separate technologies, which Facebook is calling Audio Presence and Enhanced Hearing. (Engadget, CN Beta, The Verge, CNET, Facebook, Oculus)

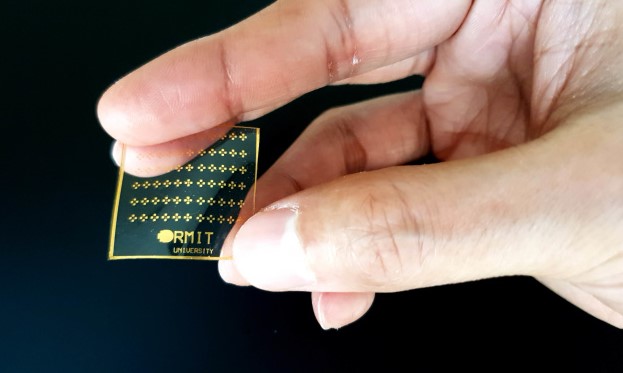

RMIT University researchers have developed an artificial skin that reacts to pain much like humans do. It would provide “near-instant” feedback if pressure and temperatures hit levels that would make someone yelp. The wearable prototype is made of stretchable, extremely thin electronics (oxides and biocompatible silicone) with pressure sensing, temperature-reactive coatings and brain-like memory cells. (Engadget, SciTech Daily, RMIT)

University of Southern California has developed new imaging contrast agents using common dyes such as tattoo ink and food dyes. When these dyes are attached to nanoparticles, they can illuminate cancers, allowing medical professionals to better differentiate between cancer cells and normal adjacent cells. These “optical inks” can be attached to cancer-targeting nanoparticles to improve cancer detection and localization. (CN Beta, Eureka Alert, USC Viterbi, Slash Gear)

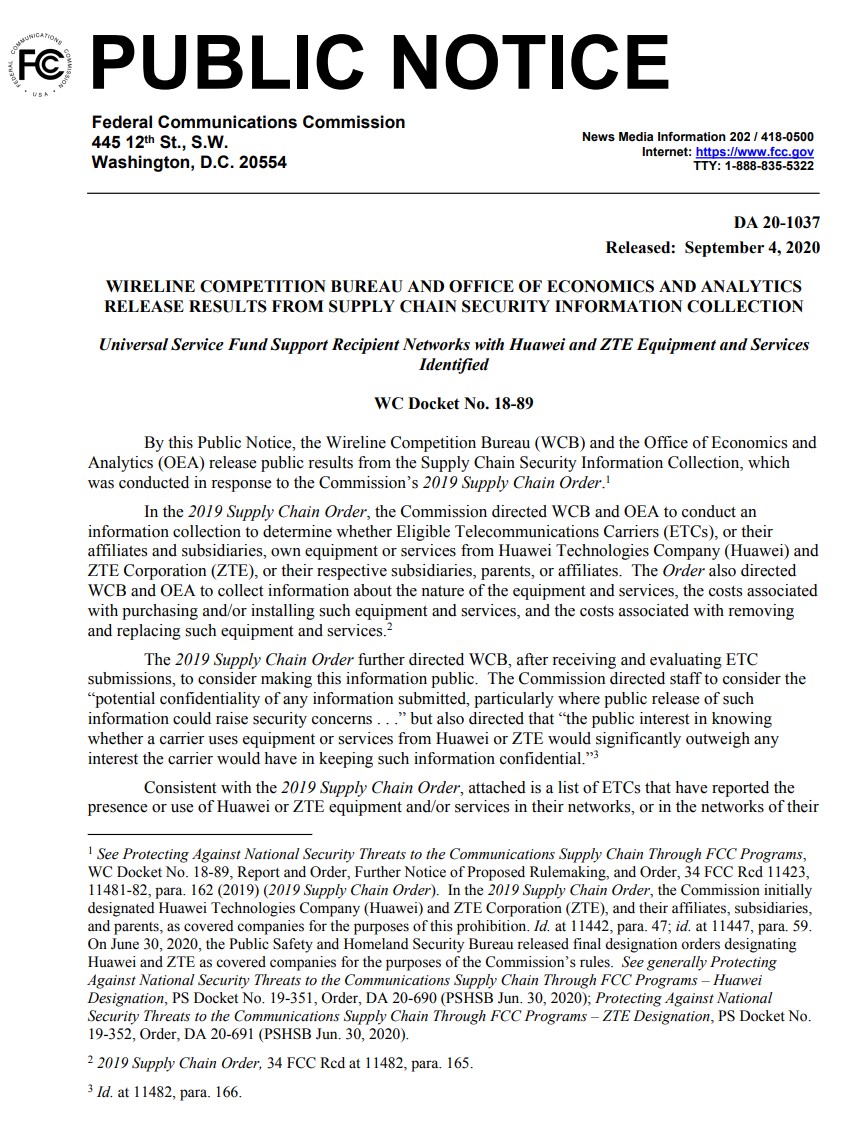

Removing Chinese equipment including Huawei and ZTE will cost small carriers as much as USD1.8B, according to a new report from the Federal Communications Commission. The report estimates that as much as USD1.6B of the cost would be eligible for federal reimbursement — but Congress has yet to appropriate the necessary funds. (The Verge, FCC)

Xiaomi Founder and CEO, Lei Jun has shown its Xiaomi Lab, a place where 1,800 smartphones are undergoing continuous testing. Xiaomi Lab prepares and tests 200 smartphones for continuous 1 month long test before the model is made available for the market. (Gizmo China, Sohu, My Drivers)

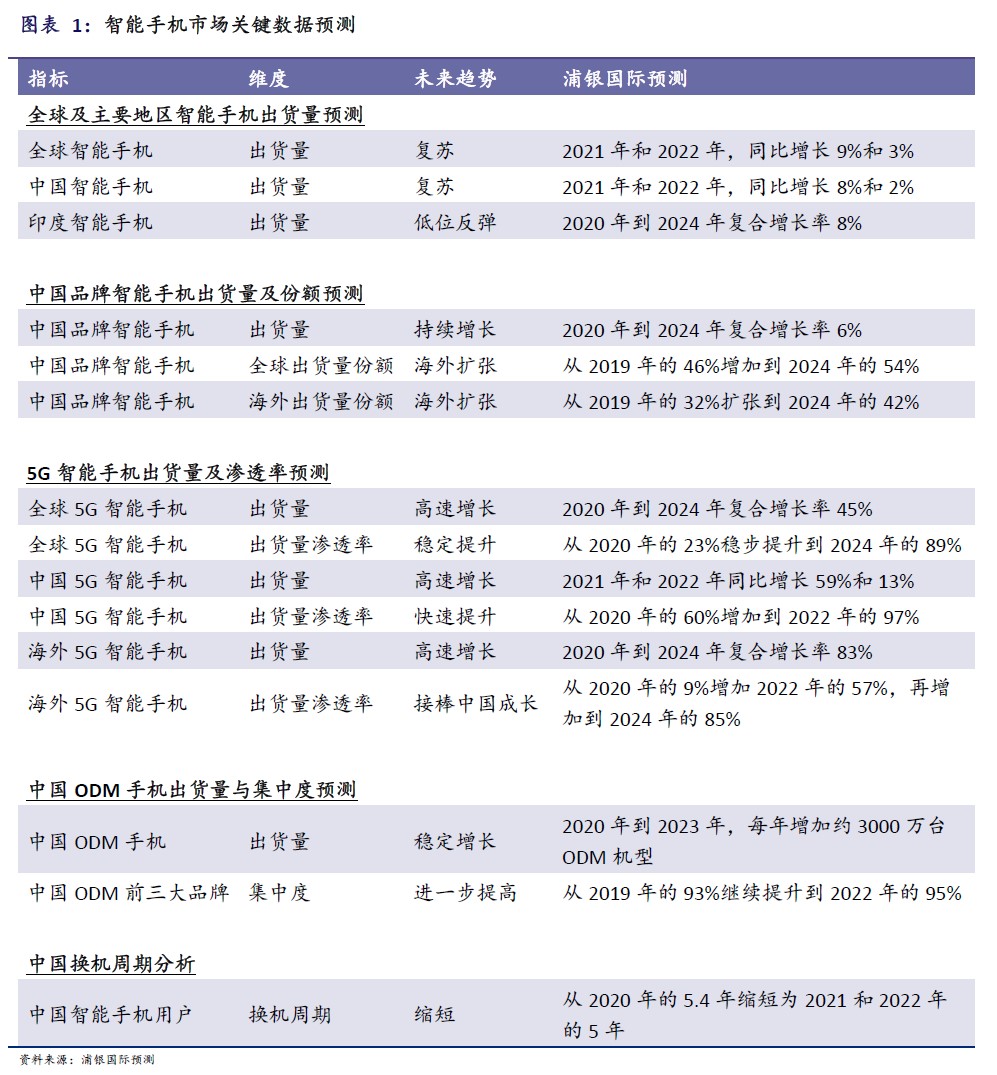

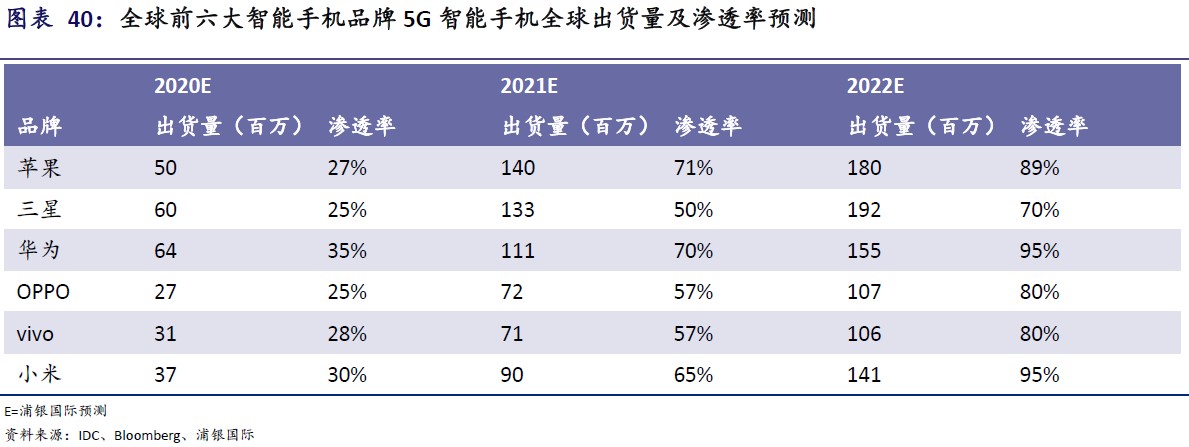

According to SPDB International’s analysis, global demand for smartphones is being affected by the global pandemic. The recurrence of the global pandemic will lead to a decline in demand for smartphones, slow recovery, and a decline in production capacity caused by supply chain shutdowns. The intensified Sino-US trade conflict will bring difficulties for some brands to go overseas, which will lead to a decline in the demand for smartphones. (SPDB International report)

In terms of global shipments, SPDB International predicts that Chinese brands will ship 159M 5G smartphones in 2020, and 346M and 509M in 2021 and 2022, an increase of 118% and 47% YoY. SPDB International predicts that Apple’s new phones may be delayed in 2020. Therefore, Apple’s 5G mobile phone shipments in 2020 will be about 50M units, but Apple will grow 140M units and 180M units in 2021 and 2022, making it a global 5G smartphones own 22% and 20% of shipments. (SPDB International report)

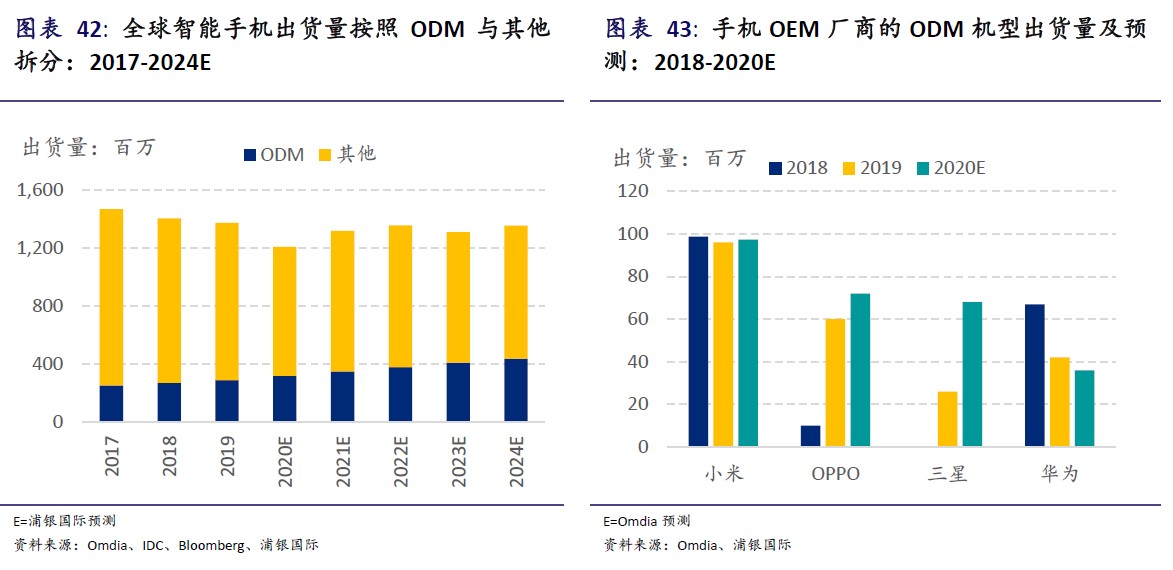

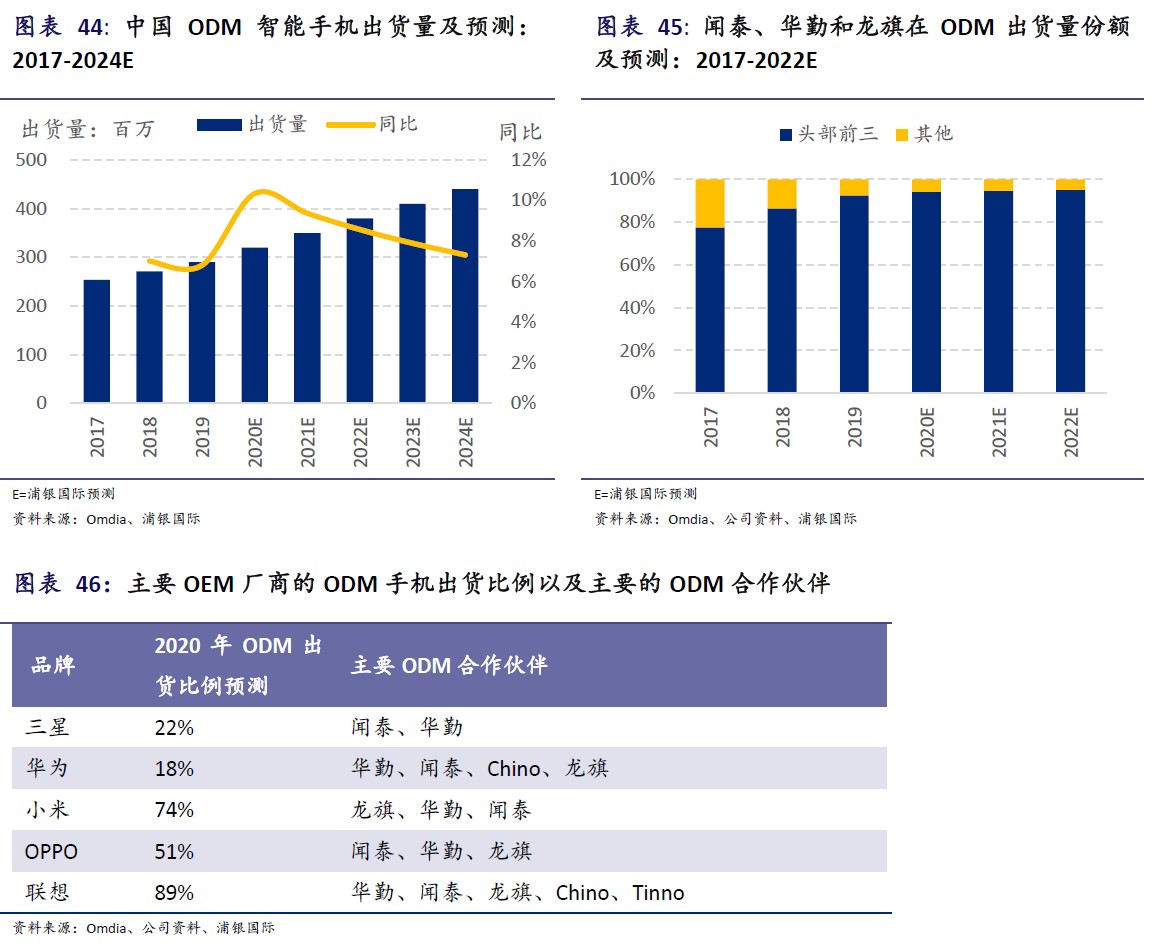

SPDB International predicts that ODM mobile phone shipments will be 320M, 350M and 380M in 2020-2022. The overall growth rate is still higher than the overall performance of the Chinese smartphone market. The growth momentum mainly comes from: 1) the natural growth of smartphone shipments of Chinese brands, and 2) the increase in the ODM ratio of Samsung, OPPO and some international second-tier brands. In 2H20, ODM manufacturers will start shipping 5G smartphones to help OEMs accelerate the layout of 5G models. (SPDB International report)

SPDB International predicts that in 2020, 2021 and 2022, the shares of the three ODM giants WingTech, Huaqin and Longcheer will further increase to 94.2%, 94.7% and 95.1%. The increase comes from the increase in the proportion of OPPO and Samsung ODM and the natural growth of other 4 major Chinese brands. (SPDB International report)

Honor unveils Honor Watch GS Pro and ES with multi-day battery life: GS Pro – 1.39” 454×454 AMOLED, it supports over 100 workout modes, SpO2 monitor, sleep tracking, stress monitor, 24/7 heart rate monitoring, and so on. Priced at EUR249.90. ES – 1.64” 456×280 display, it includes include fitness features like 95 workout modes, 44 animated exercise guides, 12 animated full workout courses, an SpO2 monitor, sleep tracking, and a stress monitor. Priced at EUR99. (Neowin, Gizmo China, Phone Arena)

Nreal has secured USD40M from a group of high-profile investors in a Series B round that could potentially bring more adoption to its portable augmented headsets. (TechCrunch, 36Kr, Sohu)

Wearable devices such as AR glasses integrated with communication functionality currently available on smartphones are likely to become a growth driver for communication hardware products in the coming years, according to Steve Huang, CTO of Pegatron. Pegatron has completed the development of its second-generation AR glasses optimized by mature technologies developed in house. (Digitimes, press)

Yandex — the publicly traded Russian tech giant that has started as a search engine but has expanded into a number of other, related areas — has announced that it is spinning out its self-driving car unit from MLU BV — a ride-hailing and food delivery joint venture it operates in partnership with Uber. As part of the spin-out, Yandex is investing USD150M into the business. (TechCrunch, Yandex, Sina)

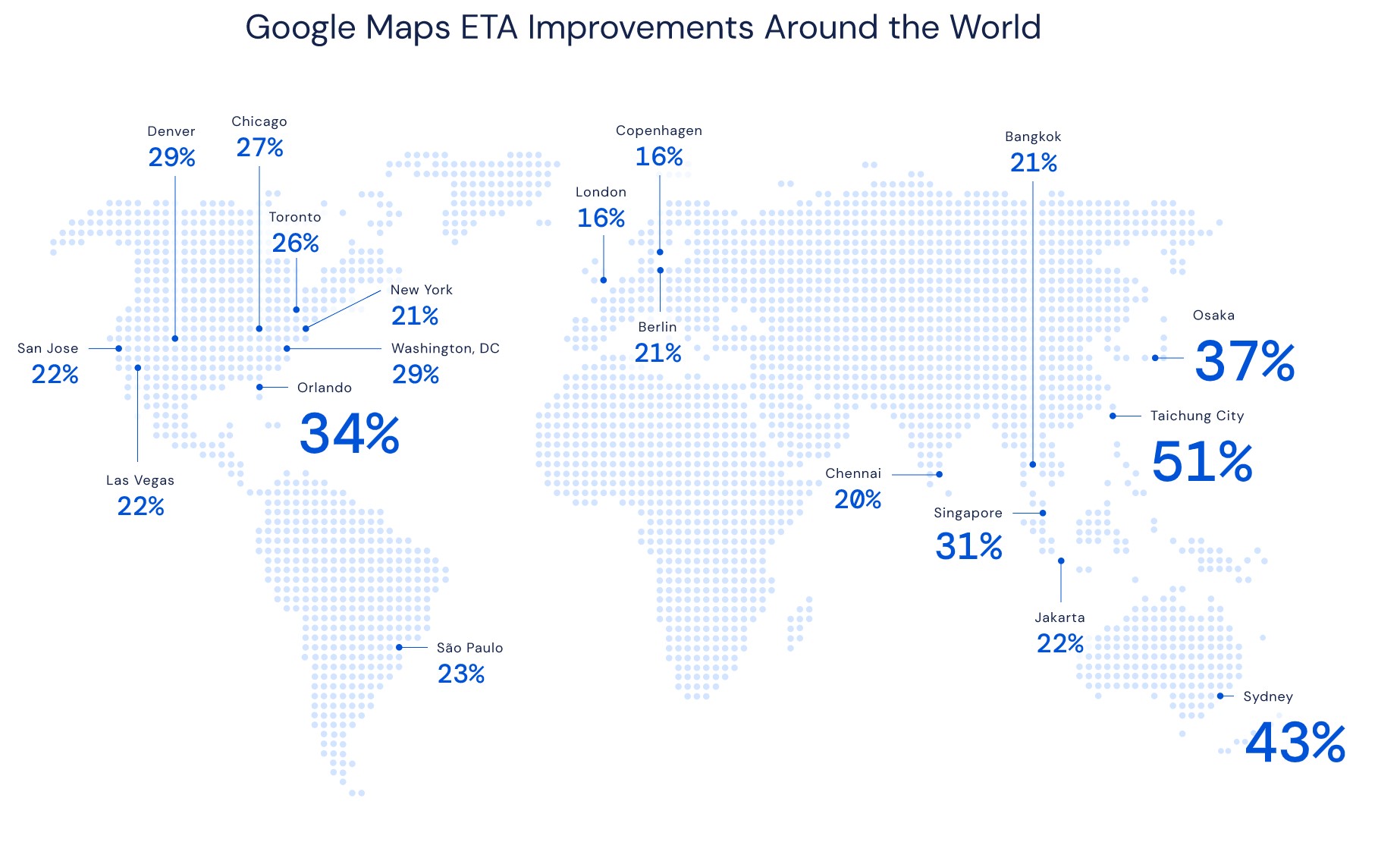

It has been nearly 13 years since Google Maps started providing traffic data to help people navigate their way around, alongside providing detail about whether the traffic along the route is heavy or light, the estimated travel time, and the estimated time of arrival (ETAs). In a bid to further enhance those traffic prediction capabilities, Google and Alphabet’s AI research lab DeepMind have improved real-time ETAs by up to 50% in places such as Sydney, Tokyo, Berlin, Jakarta, Sao Paulo, and Washington DC by using a machine learning technique known as graph neural networks. (CN Beta, The Verge, DeepMind AI, ZDNet, Google)