9-14 #MuscleStrain: NVIDIA will acquire ARM from SoftBank in a transaction valued at USD40B; Qualcomm will allegedly launch a price war challenging MediaTek; Visionox is investing in the construction of a Gen-6 full-flex AMOLED module production line in Guangzhou; etc.

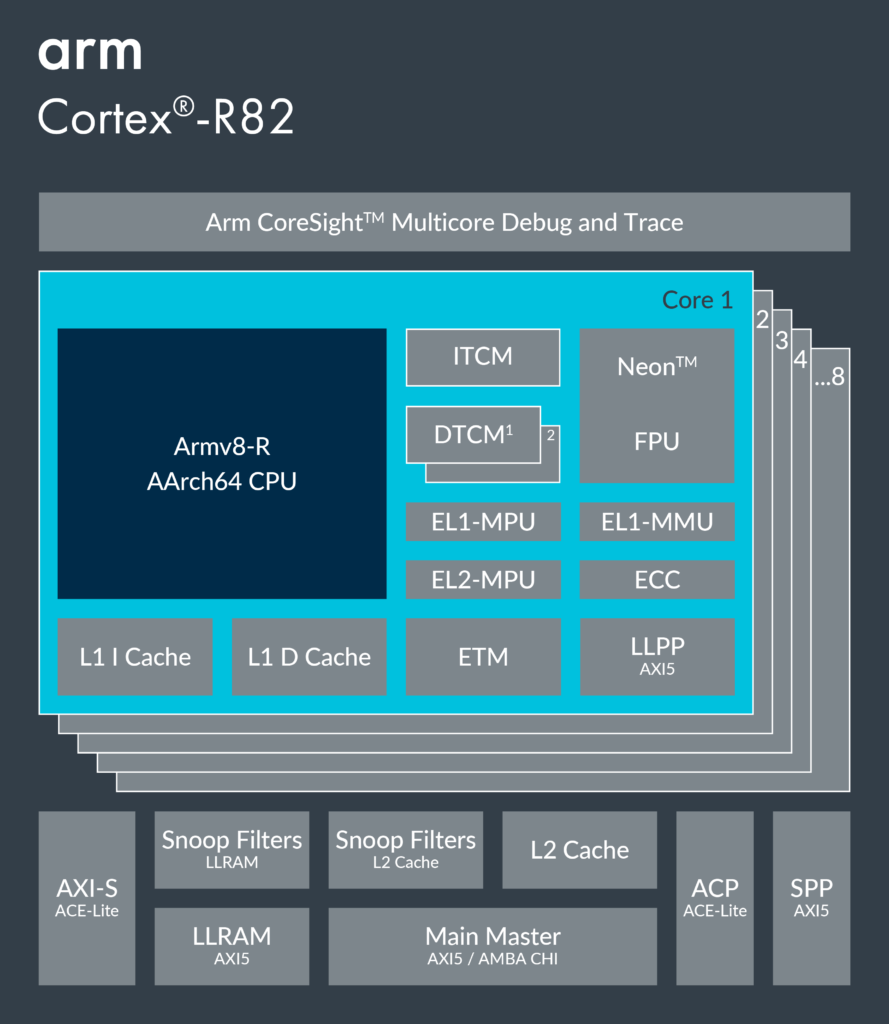

ARM has announced its first 64-bit Cortex-R82 core that can run both real-time and high-level operating systems. The new Cortex-R82 features double the performance of its predecessor and is aimed primarily at ultra-high-end SSDs that need up to 1TB of DRAM, all-flash arrays as well as emerging in-storage processing applications. (CN Beta, ARM, Ars Technica, Tom’s Hardware)

NVIDIA and SoftBank have announced a definitive agreement under which NVIDIA will acquire ARM from SoftBank in a transaction valued at USD40B. The deal is expected to close sometime in 18 months, or around early 2022. (Nvidia, Android Authority, CN Beta)

Manufacturers are leaving China amid intensifying trade disputes between Beijing and Washington, but China will continue to dominate manufacturing operations in the next 2-3 years, especially for Taiwanese manufacturers, according to Digitimes. As China’s manufacturing advantages decline, many supply chain players are seriously mulling moving their production out of the country, with Vietnam, India and Indonesia as popular destinations for relocation. Yet there is still uncertainty concerning the development of two supply chains – the so-called “G2” structure – serving China and the US separately. (Digitimes, press, Digitimes)

TSMC, the world’s largest chip foundry, has widened the gap with Samsung Electronics. TSMC has stated that its sales in Aug 2020 hit USD4.19B. This figure is a 15.8% increase over the same period in 2019 and an increase of 16% over Jul 2020. In Jul 2020, its sales fell 12.3% from Jun 2020. TrendForce predicts that in 3Q20, TSMC and Samsung will account for 53.9% and 17.4% of the global foundry market. This means that the gap increases from 51.5% and 18.8% in 2Q20. The widening gap in sales between the two companies is why some experts believe that US sanctions on Huawei will not seriously affect TSMC. (GizChina, Business Korea, CN Beta)

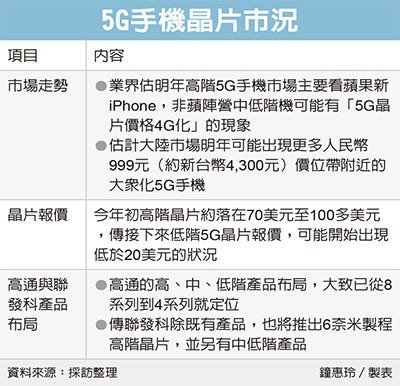

Qualcomm will allegedly launch a price war in order to reduce the interference of Huawei’s ban and expand its market share. The low-end chips will drop by as much as 30% or even be cut, and the low-end version will fall below USD20. MediaTek has a chance to reach 40M sets of 5G mobile phone chip shipments in 2020. If Qualcomm initiates a price war, it will face great pressure. (CN Beta, UDN, UDN)

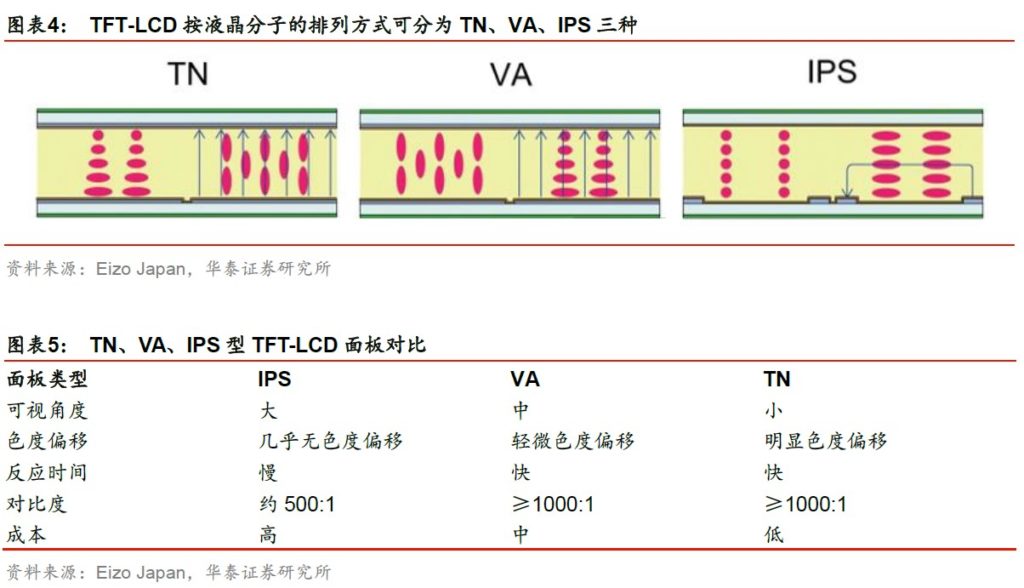

According to the difference in the arrangement of liquid crystal molecules in the liquid crystal layer, TFT-LCD can be divided into 3 types: TN, VA, and IPS. Twisted Nematic (TN) has the advantages of low cost and fast response speed, but the disadvantage is that the color reproduction is not accurate enough and the viewing angle is small; the Vertical Alignment (VA) has the advantage of high contrast, and the disadvantage is that the response is compared with TN. Slightly slower and higher cost compared with TN; lateral electric field effect display technology IPS (In-Plane-Switching) has the advantages of good viewing angle, low power consumption, suitable for touch screens, but the disadvantages are slow response speed and high cost. (Huatai Securities report)

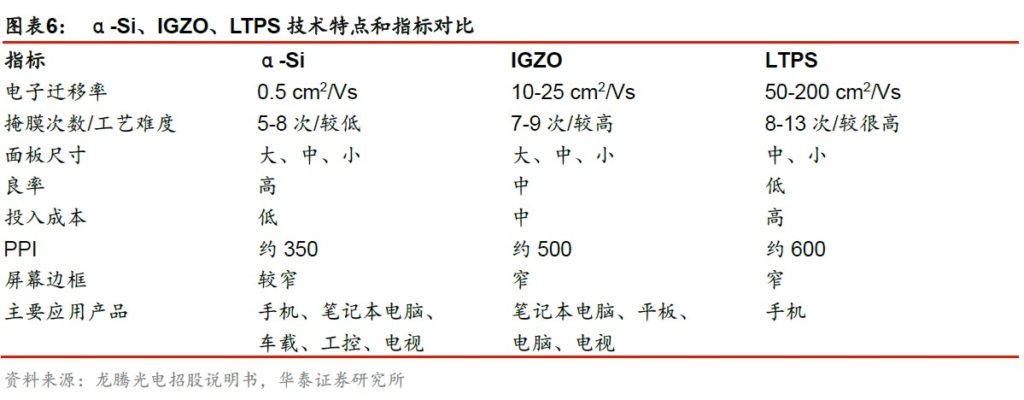

According to the different channel layer semiconductor substrate materials used by TFT, TFT-LCD can be divided into α-Si, IGZO and LTPS. Amorphous silicon (α-Si) technology is mature and stable, with low cost. It can achieve higher yields on all size products and achieve mainstream display performance. It is the mainstream technology for most major product markets such as TVs, monitors, notebook computers, and automotive displays. (Huatai Securities report)

According to the size of the glass substrate, the TFT-LCD production line can be divided into different generations. The higher the generation number of the LCD production line, the larger the glass substrate size, the larger the corresponding production area, and the higher the technical level. Each generation of LCD panel production line has its corresponding optimal panel cutting size and number of sheets. The production line suitable for cutting large-size TV panels of the 6th generation and above is usually called the high-generation line. (Huatai Securities report)

Visionox is investing in the construction of a Gen-6 full-flex AMOLED module production line in Guangzhou. Currently the main plant has been capped. The process equipment will be moved in in Nov 2020 and will be put into production at the end of 2020. This production line focuses on small and medium-sized fully flexible AMOLED modules, covering emerging applications such as curved surfaces, folding, wearables and vehicles. Visionox plans to increase the proportion of localization of OLED module equipment to over 80% in the next 2 years. (Laoyaoba, Sohu)

Xiaomi is allegedly developing a 27” transparent OLED monitor for 2021, based on panels supplied by Samsung Display. Xiaomi has announced 55” 120Hz WOLED transparent OLED TV, with LG Display WOLED TV panel. (CN Beta, OLED-Info, Gizmo China, My Drivers, Display Channel)

French OLED microdisplay maker MicroOLED has announced that it has raised EUR8M by EU-based Cipio Partners and Ventech. MicroOLED has recently launched a new compact optical module called ActiveLook, and the company reports it is being adopted by eyewear companies such as Julbo, UVEX and others. (OLED-Info, DisplayDaily, Zhihu)

In 2018 Merck opened an OLED technology center in Shanghai, that includes laboratories to enable device fabrication and characterization for local Chinese-based OLED customers. Merck is allegedly investing USD25.9M to expand the OLED laboratories and build an OLED material plant in the area. The new plant will start production by the end of 2022. (OLED-Info, Yicai Global, ZOL)

Shenzhen Tianma has said that the first phase of Wuhan Tianma’s Gen-6 AMOLED production line has entered mass production and shipping to customers including Xiaomi, Lenovo, Asus, Transsion, HTC, LG, etc. The yield rate can meet customer requirements, and it is currently undergoing rigid conversion. , It is expected that all flexible production capacity will be released by the end of 2020. The second phase of the Wuhan Tianma project is for flexible display production. The key equipment has been moved in and mass production will begin in 2020. The combined production capacity of the first and second phase is expected to be 37,500 flexible AMOLED display per month. (Laoyaoba, Sohu, Sina)

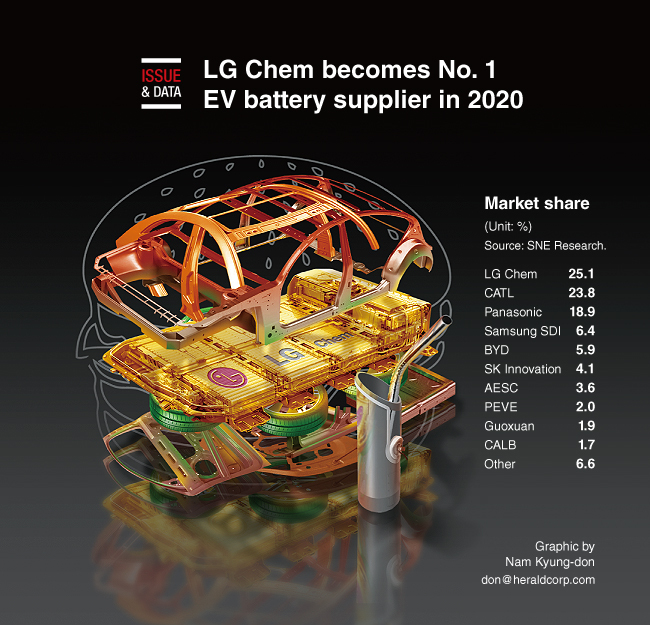

According to SNE Research, during the challenging first 7 months of 2020, the global EV battery market amounted to 53.3GWh, which is 16.8% less than a year ago. LG Chem is also the top player with an estimated 13.4GWh of capacity deployed (up 97.4%) and the highest market share of 25.1%. Chinese CATL is #2 because of a 25.5% decrease YoY to 12.7GWh, and Panasonic (once the lone market leader) decreased even more, by 30.9% to 10.1GWh. (My Drivers, YNA, Inside EVs, Korea Herald)

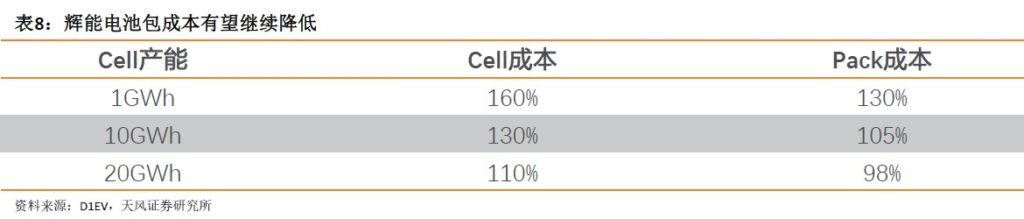

There is no process such as liquid injection in the processing of solid-state batteries, and the battery production line investment is also lower than that of traditional liquid lithium batteries. According to the 10-year depreciation calculation, the depreciation of solid-state batteries per kilowatt-hour is USD0.1 less than that of traditional lithium batteries. According to Huineng, when the capacity of solid-state batteries exceeds 20GWh according to current technology, the cost of solid-state batteries in PACK will be lower than that of traditional batteries. (TF Securities report)

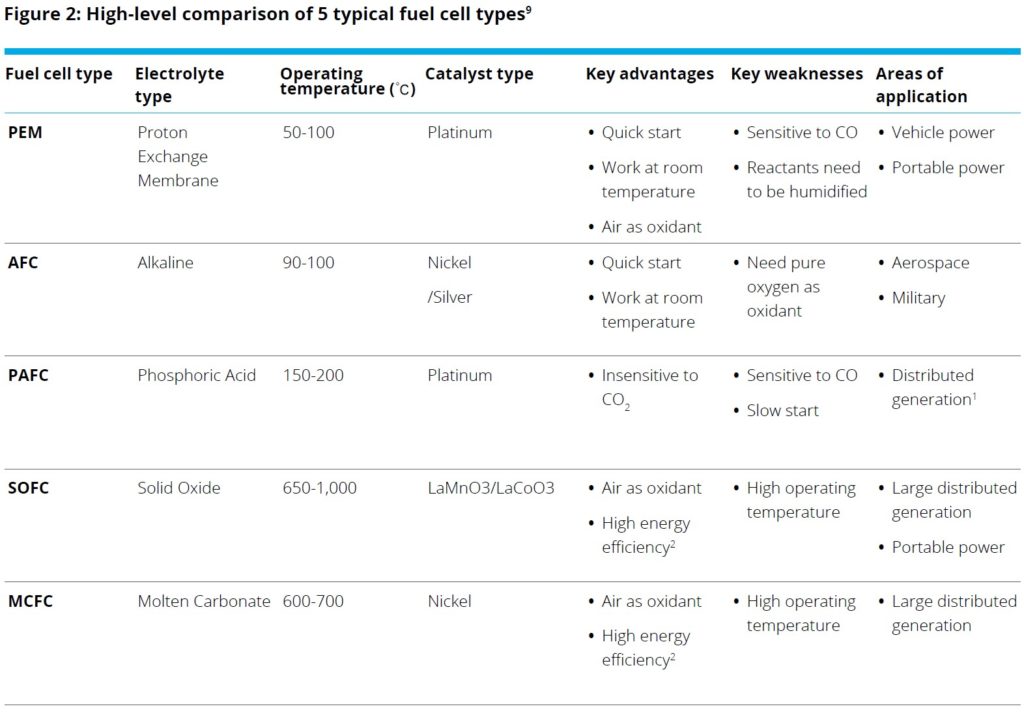

Fuel cells are typically categorized by the type of electrolyte used. Typical types of fuel cells electrolytes include Proton Exchange Membrane (PEM), Alkaline fuel cell (AFC), Phosphoric Acid Fuel cell (PAFC), Solid Oxide Fuel Cells (SOFC) and Molten Carbonate Fuel cell (MCFC). Of these, PEM is the most commercialized type today, due to its low operating temperature (50-100°C), short start time and ease of use of its oxidant (atmospheric air). (Deloitte report, Deloitte report)

Emerging markets have always been behind developed countries in adopting the latest generation mobile networks, with a few exceptions. While it would be safe to assume that emerging markets would also lag in 5G adoption, ABI Research finds that emerging countries will have faster than expected 5G subscriber adoption. The CAGR of 5G subscriptions in emerging markets is estimated to be 26% between 2020 to 2030, an impressive rate considering the global CAGR of 5G subscriptions is only a slightly higher 28% in the same period. (ABI Research, Digitimes, press)

DivX has filed patent infringement complaints in the District of Delaware against LG Electronics, Samsung Electronics, and LG’s semiconductor manufacturer, Realtek Semiconductor, alleging that the defendants infringed the patents-in-suit through video processing devices, smart televisions, and related parts in order to stream videos using this patented technology. (Laoyaoba, Sohu, Law Street)

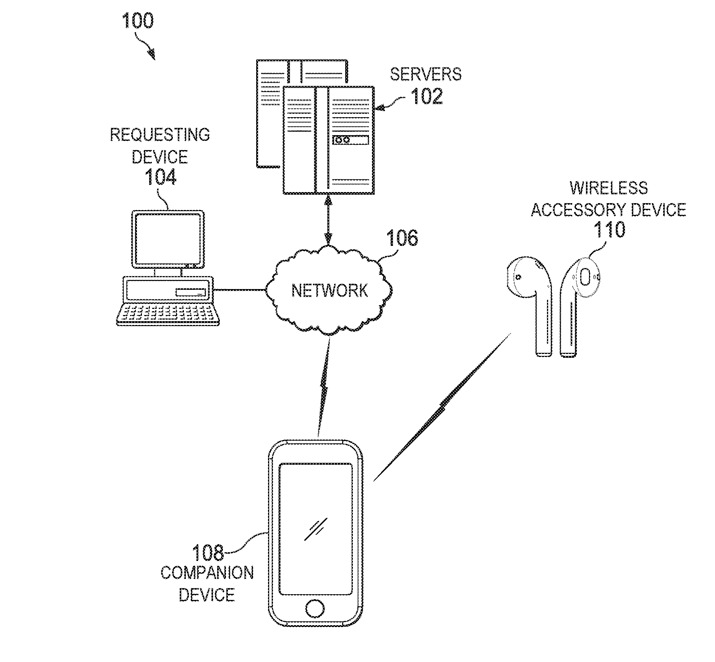

Apple’s patent titled “locating wireless device” describes how devices can use sound outside the range of human hearing. The sound is played at a specified frequency that utilizes a frequency response of the loudspeaker. The sound is received through two or more microphones of the electronic device (configured for beamforming). Beamforming is when a signal is no longer broadcast in all directions, but rather directed at a particular device. Or during a search, in different directions until the device is located. (Apple Insider, USPTO)

TomTom has announced that its Go Navigation app is available on all major app platforms, including Huawei’s App Gallery. It offers up-to-date 2D and 3D maps as well as many of the staples of better navigation apps. These include real-time traffic, speed camera alerts, lane guidance, and data-saving offline maps. Huawei is reported to have struck a deal with TomTom to use its mapping data for an in-house app. (GSM Arena, Android Authority, Pocket Now, JRJ, TomTom)

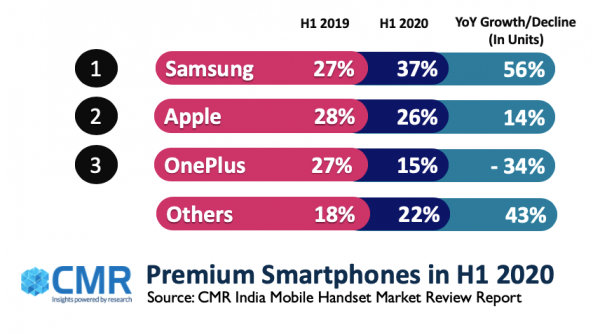

According to CMR, India’s smartphone shipments in the premium segment (>INR25,000) grew 18% YoY in 1H20, despite the critical challenges facing the India smartphone market. These challenges arose primarily owing to the COVID-19 pandemic-linked national lockdowns, and consequent supply and demand issues. Samsung led the premium smartphone segment with 37% market share, followed by Apple with 26% share, and OnePlus at a distant third with 15% share. (CN Beta, CMR)

IKEA has announced that it is teaming up with ASUS’ Republic of Gamers (ROG) division to create “affordable gaming furniture accessories” with a line of around 30 products. The gaming range will be developed by the IKEA Product Development Center in Shanghai. (Engadget, IKEA, Pocket-Lint, GNN)

Google CEO Sundar Pichai has announced that the company will shift solely to renewable power by 2030. To that end, Google says it will be helping to bring 5GW of new carbon-free energy sources online by 2030 across regions where it has physical resources that need access to clean power. (TechCrunch, Google, Neowin, Reuters)

Tecno Spark Power 2 Air is launched in India – 7” 720×1640 HD+ v-notch, MediaTek Helio A22, rear quad 13MP-2MP macro-2MP depth-AI lens + front 8MP, 3+32GB, Android 10.0, rear fingerprint scanner, 6000mAh, INR8,499 (USD116). (Gizmo China, GSM Arena)

Zipline is partnering with Walmart for a new drone delivery operation in the US. The program is for on-demand deliveries of health and wellness products and will begin in a trial early 2021 near Walmart’s headquarters in Bentonville, Arkansas. Zipline’s launch and release system allows for on-demand delivery in less than an hour, and operating from a Walmart store, can service a 50-mile radius. (The Verge, TechCrunch, Walmart, Sina, CN Beta)

French startup called Storelift believes it can create a new convenience store concept that leans on many of the same AI and computer vision tools used in Amazon Go stores to reinvent the shopping and checkout experience. Storelift has announced that it has launched its first two stores under the name “Boxy”. The Boxy stores are repurposed shipping containers that can be plopped down in various urban neighborhoods that lack good shopping options. (VentureBeat, SlashDot, Sohu)

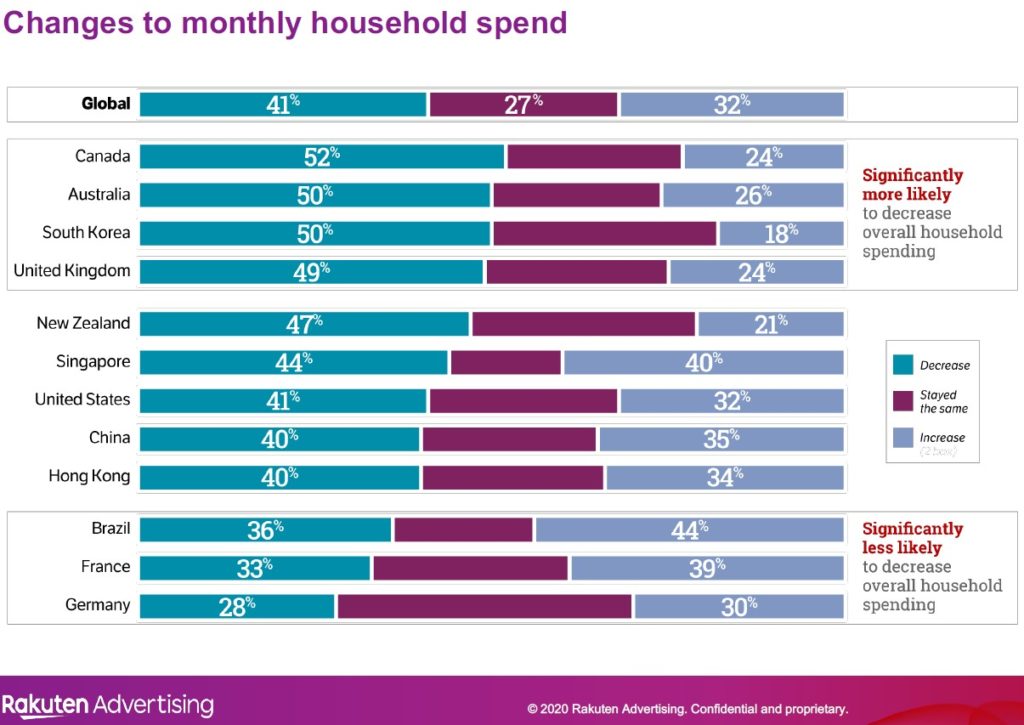

Since the coronavirus outbreak, consumers have shifted their overall monthly household spend as they adapt to lockdown situations. Taking a closer look at vertical changes, it is unsurprising that travel sales have experienced the most significant reduction (80%). This is followed by declines in the jewelry (59%) and apparel and footwear (55%) verticals. Globally, groceries and prepared meals experienced the strongest growth (54%) during COVID-19, followed by digital entertainment (45%). (Rakuten report)

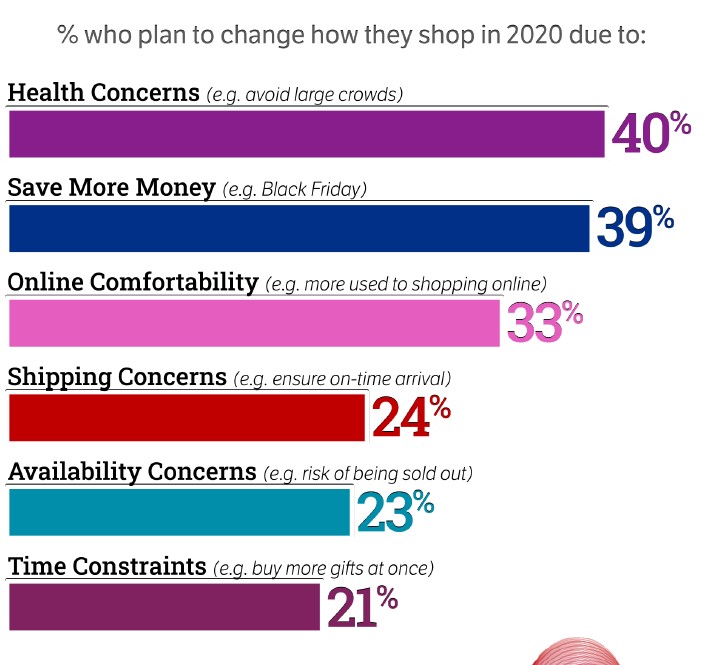

Although the amount people spend may not change, in 2020 there are new considerations for brands to be aware of as they may affect how people purchase. 40% of shoppers have expressed concerns over health and the desire to avoid large crowds. It is likely this will continue to drive consumers online to purchase. Globally, consumers have said they will increase spend during Nov (22%) and Dec (40%) 2020. Looking forward to 2021, 54% of global consumers have said there will be no change to their spend for key shopping dates, such as Chinese New Year and Valentine’s Day, in 1H21. (Rakuten report)