10-8 #GreatInventions: Qualcomm reportedly will team up with Asustek Computer to develop and launch its own-brand gaming smartphones; LG’s first rollable display phone will allegedly use BOE panels; etc.

Qualcomm reportedly will team up with Asustek Computer to develop and launch its own-brand gaming smartphones at the end of 2020 at the earliest, which will be powered by Qualcomm Snapdragon 875, according to Digitimes. (GSM Arena, Digitimes, Sina, CN Beta)

Qualcomm has reportedly chosen Samsung over TSMC to manufacture its upcoming Snapdragon 750G chipset, which will succeed the 730G and will also supposedly be made using the 8nm process to keep the cost down. Qualcomm is expected to announce the high-end Snapdragon 875 and it is built on a 5nm silicon manufactured by TSMC. (Gizmo China, Korean Investors)

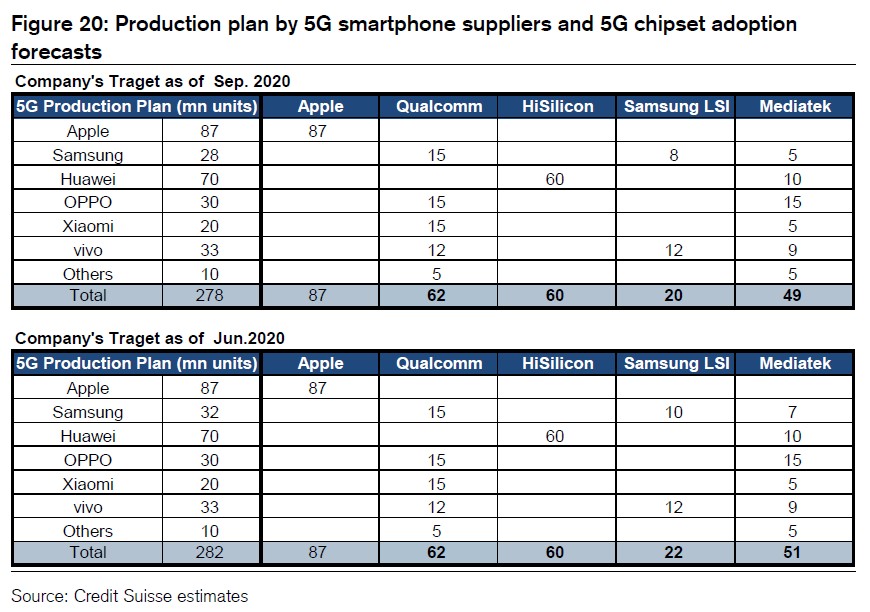

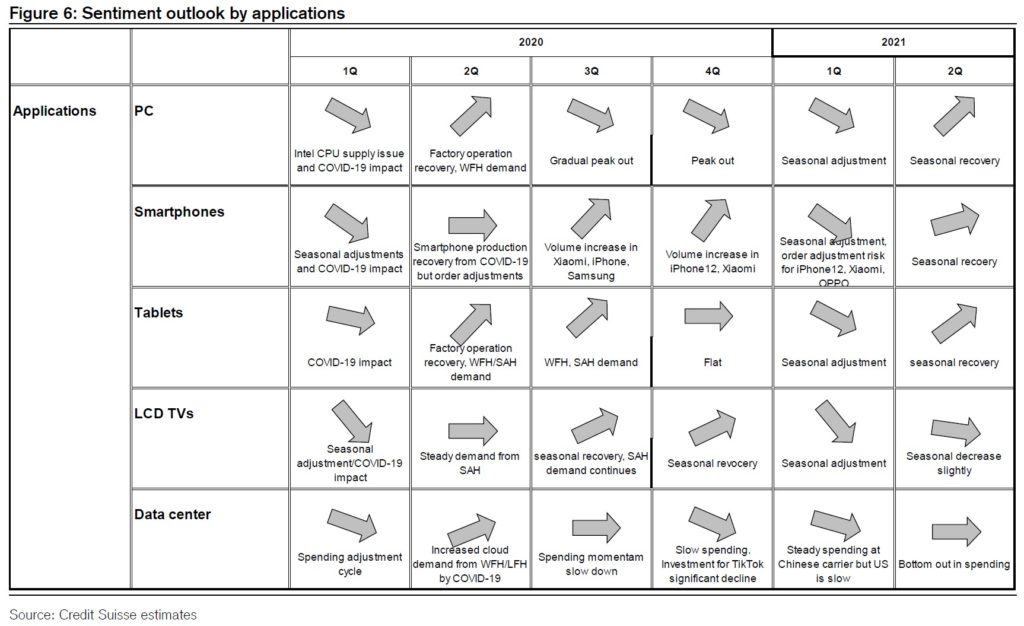

In APs for 5G smartphones, a notable development in 2020 is that Samsung LSI has sharply lowered its production plan for the Exynos. Samsung Mobile is increasing its use of Qualcomm and MediaTek chips, and Samsung LSI’s share is projected to fall to 45% in 2020 from over 70% through 2019. Samsung Electronics and Chinese smartphone manufacturers plan to increase their smartphone market share in 2021, so expect Qualcomm and Mediatek to continue benefiting in 2021. (Credit Suisse report)

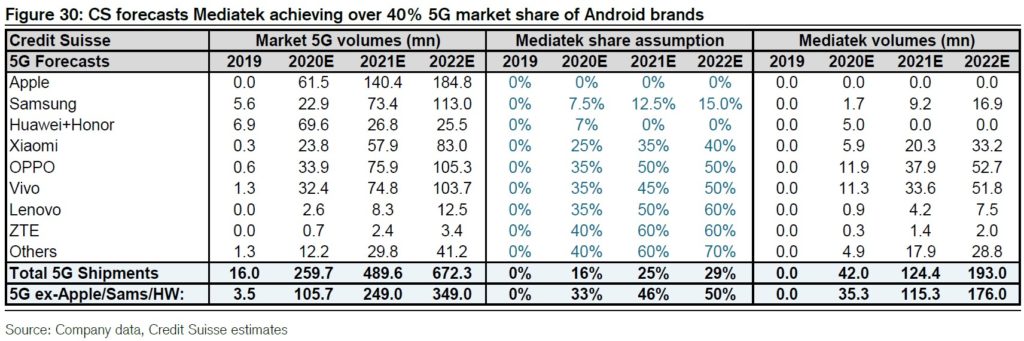

MediaTek has seen design wins across all brands including flagship design wins across OPPO, vivo, Xiaomi and LG and expects to ramp up more Samsung and LG both as they shift low-mid-tier models to ODMs. Credit Suisse believes Mediatek’s strong demand pull could bring its ending inventory exiting 3Q20 toward 70 days, alleviating concerns it has excess inventory built up for Huawei. The company maintains target for over 40% market share on 4G and 5G at other brands, supporting their view it can still have more upside than pre-initial Huawei ban as that OEM used to keep 85% of its allocation in-house. (Credit Suisse report)

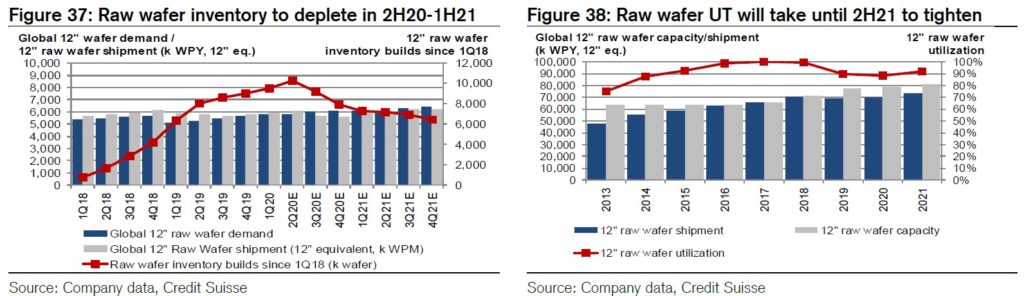

Raw wafer outlook more stable but excess inventory and overcapacity delay the long-term agreement (LTA) and pricing recovery. Globalwafers and Siltronic have both noted the 12” demand stays healthy in 2H20 mainly driven by the strong demand from the advanced logic foundries. For the smaller diameter raw wafer demand, the 8” is mixed as foundry is strong from 5G/WFH content though IDM demand from auto/industrial has not fully come back while 6” with lower technology barrier is in structural oversupply due to the China capacity ramp in the past few years. (Credit Suisse report)

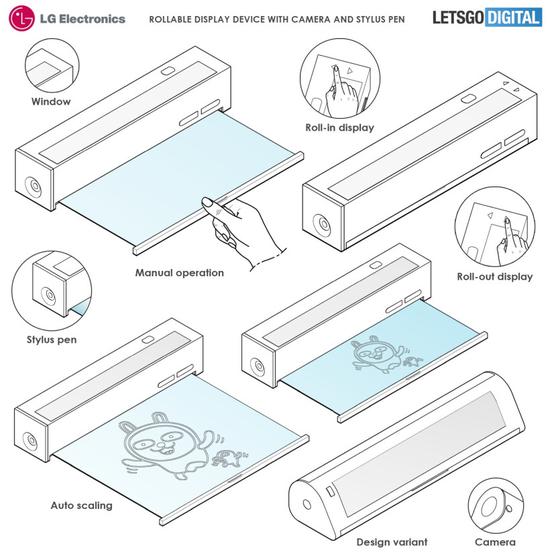

LG’s first rollable display phone will allegedly use BOE panels. The device will launch in 1H21. Its screen can be rolled up and will be 8” in size when unfolded. (Laoyaoba, Sina, GizChina, Digitimes)

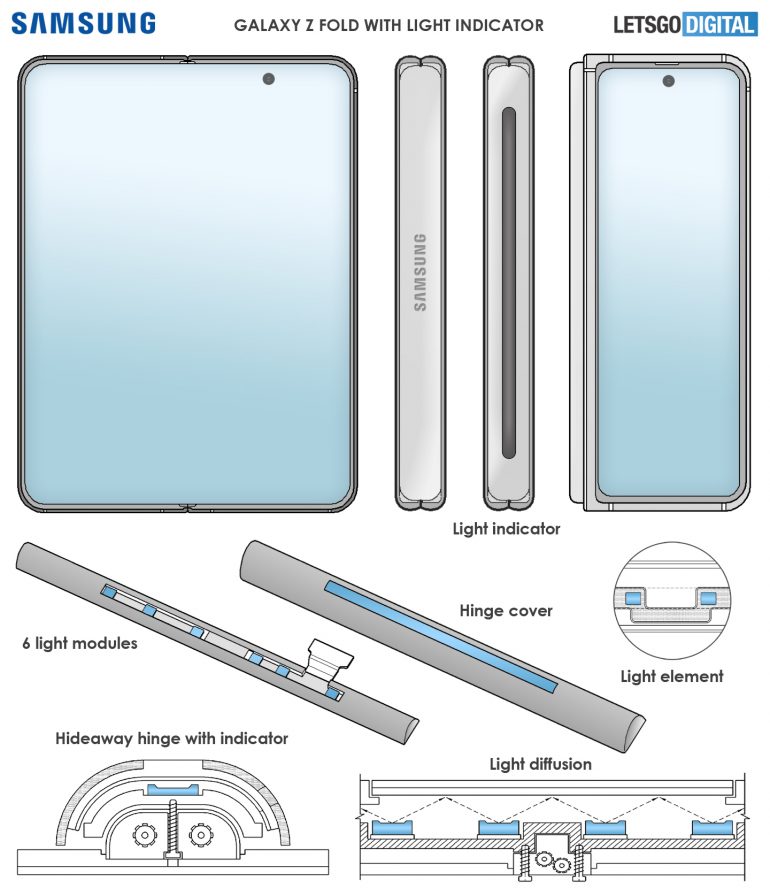

Samsung has filed a utility patent regarding LED indicators in foldable smartphones. The patented device will come with a 6 LED module hidden inside its hinge. These red, blue, green and white lights will be covered by a translucent layer to diffuse their rays. (Android Authority, Gizmo China, LetsGoDigital)

DongJin Koh, president of Samsung mobile communication business has revealed that the company is working on a rollable smartphone. However, that is not coming in 2020 or 2021. He has also added that the company is developing a multifold display, and that it will launch before a rollable one. (Android Headlines, Twitter)

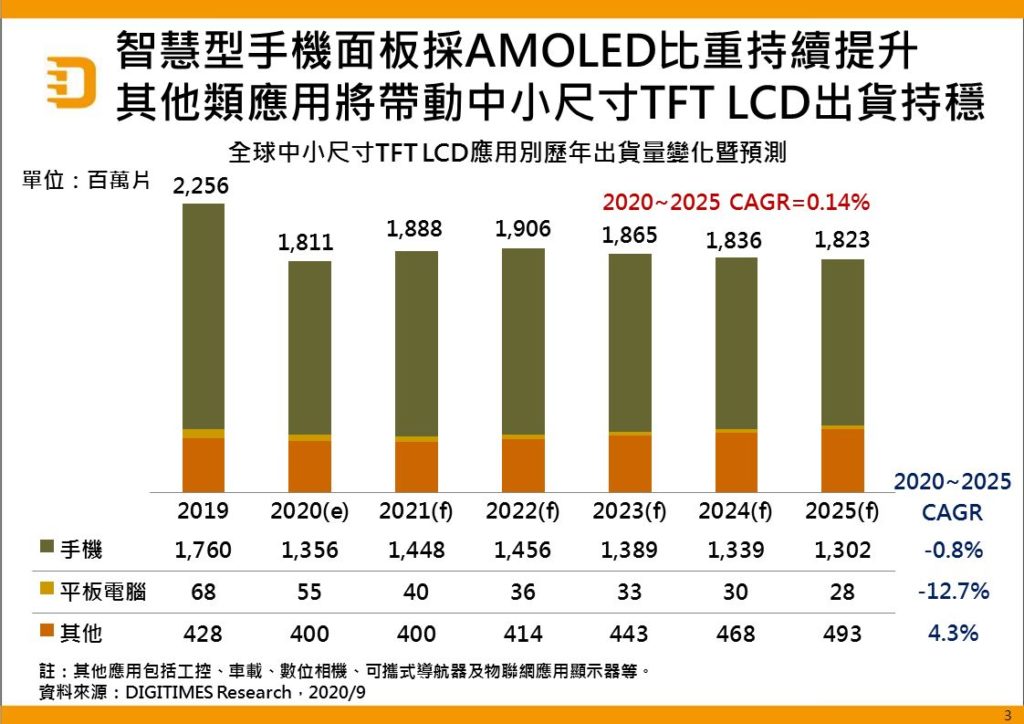

Global shipments of small- to medium-size TFT LCD panels will be steady in a five-year forecast period to reach 1.82B units in 2025, after seeing an on-year fall of 19.7% to 1.81B units in 2020 amid the coronavirus pandemic, according to Digitimes Research. Demand for handset panels, currently the largest application segment for small- to medium-size LCD displays, is expected to stage a rebound in 2021. (Digitimes, press, Digitimes, Gizmo China)

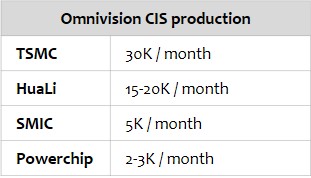

Credit Suisse expects Samsung’s CIS recovery trend to continue in 4Q20. Demand is brisk for not only 300mm wafers, but also 200mm wafers due to multiple cameras being featured in smartphones. TSMC is maintaining production volumes of logic for CIS. The 40nm process is tight, so CIS makers have responded by building up inventories in order to secure their own production capacity. If SMIC is added to the entity blacklist, the impact could extend to CIS at Omnivision and CIS logic at Sony, for example. (Credit Suisse report)

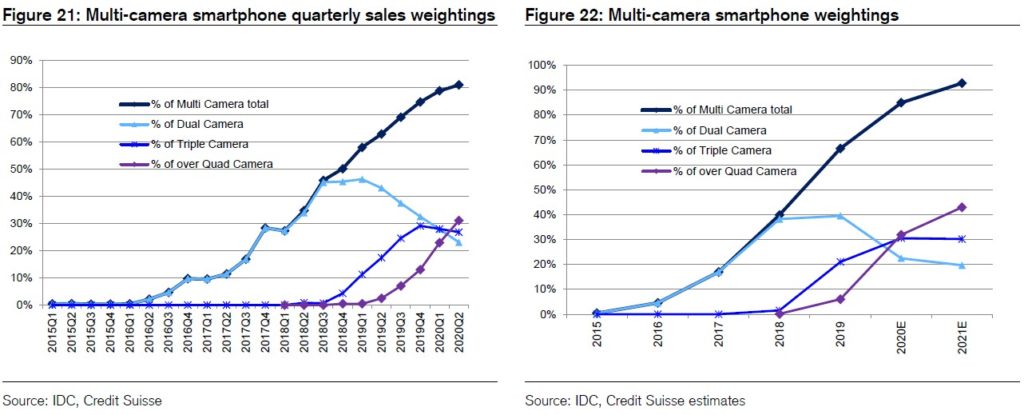

According to Credit Suisse, 2Q20 has seen continued increase in the proportion of smartphone models featuring cameras of 24MP or more, with a particular rise in use of cameras at 48MP and 64MP or higher, especially in 5G smartphones. Among 5G handsets, 77% feature a main camera that is at least 48MP, and expect the increase in resolution of smartphone cameras as a whole to continue in concert with rise in the volume of 5G handsets. (Credit Suisse report)

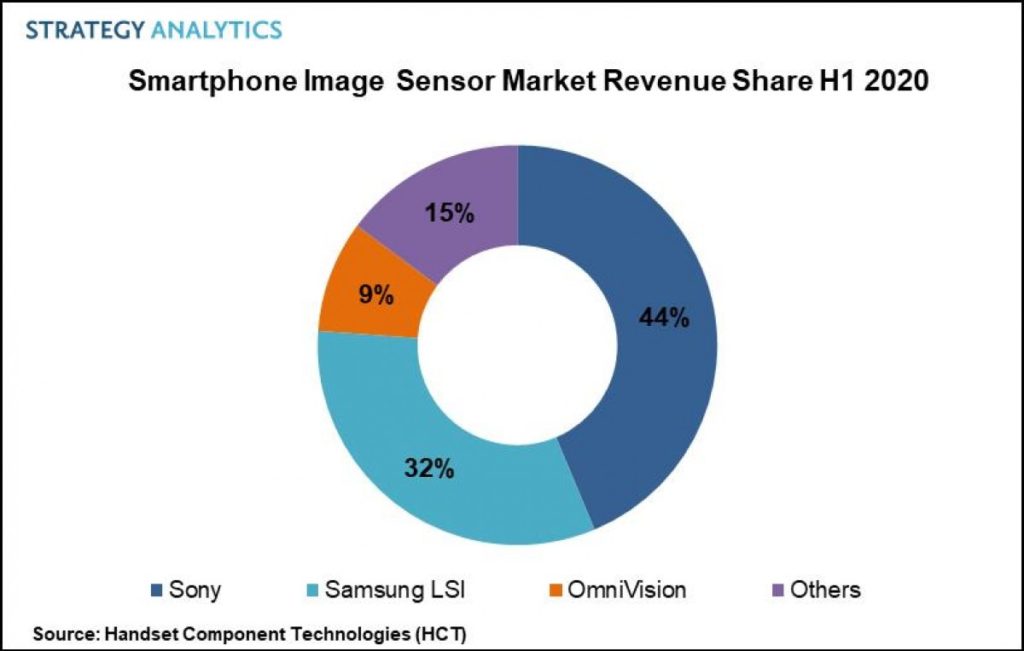

According to Strategy Analytics, the global smartphone Image sensor market reached a total revenue of USD6.3B in 1H20. Sony captured the first position in the smartphone image sensor market with 44% revenue share followed by Samsung LSI and OmniVision in 1H20. The top-3 vendors captured almost 85% revenue share in the global smartphone image sensor market in 1H20. (Strategy Analytics, GSM Arena, My Drivers)

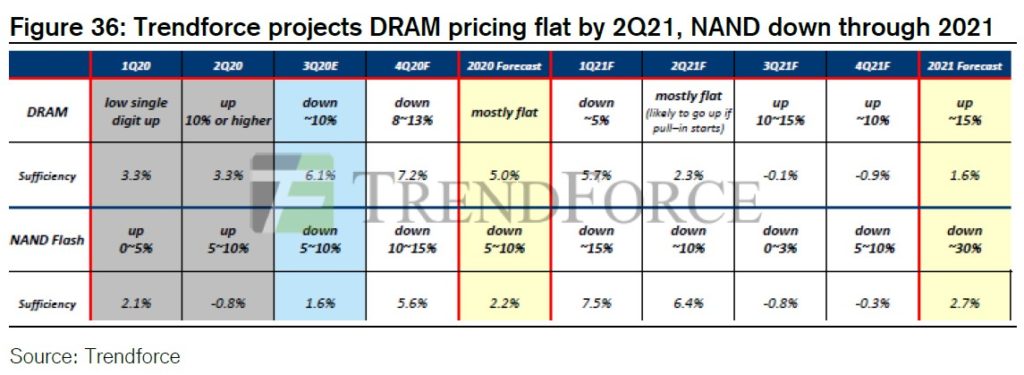

For 2021, the DRAM makers are keeping disciplined on supply but hopeful on-going server growth and rebounding mobile units along with 5G upgrades could support a return to tightness. Trendforce also expects the DRAM market to move oversupply in 2H20 into tightness in 2021 based on +14% / +18% supply growth vs +15% / +22% demand growth in 2020 / 2021, potentially setting up for price hikes from 2Q21. The NAND flash is also oversupply in 2H20. The supply chain expects the major driver for low 30% NAND bit growth in 2021 (vs mid 30% YoY growth in 2020) to be mainly driven by the growing content in mobile and enterprise and new game console launches to at least keep close to balance in the peak season. (Credit Suisse report)

Micron, which is behind Samsung and SK Hynix, has yet to introduce EUV process to its products and it is looking to respond to demands as much as it can with its current lithography technologies. Samsung and SK Hynix are looking to differentiate themselves with their own EUV DRAM technologies and possibly causing a change to the oligopolistic structure of the market that did not look to be changed. (Laoyaoba, ET News)

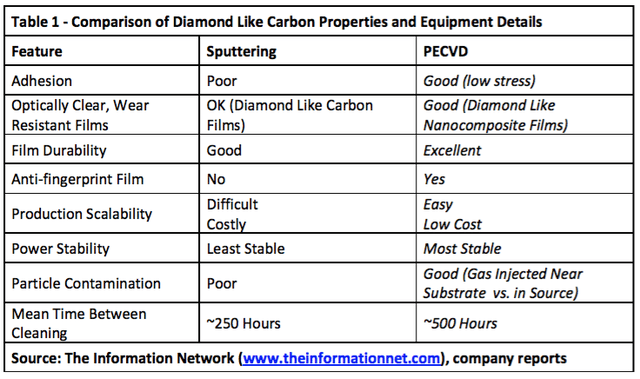

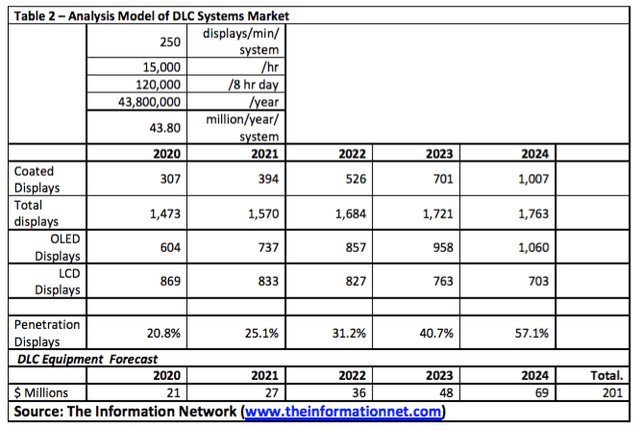

Apple is evaluating methods to strengthen further its display Corning Gorilla Glass by coating them with diamonds. Intevac and privately held Denton Vacuum supply equipment to smartphone manufacturers to deposit diamond thin films. Denton’s PECVD system can coat one Gen 6 panel per minute, achieving 57% smartphone penetration on an equipment spend of USD200M. (Phone Arena, Seeking Alpha)

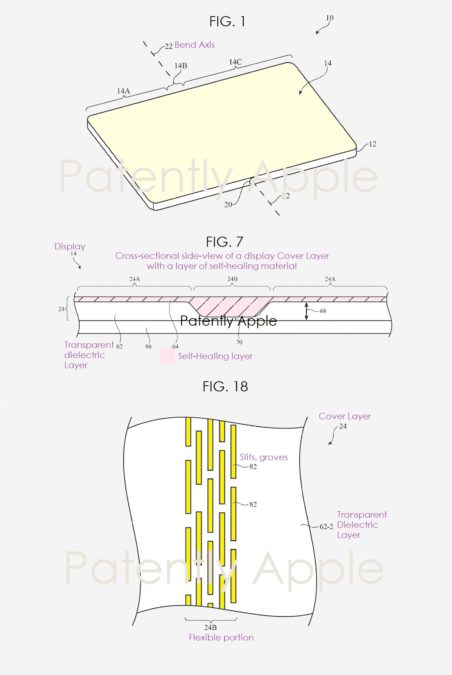

Apple has filed a patent that details a self-healing material — seemingly based on elastomer — that could allow foldable phones’ displays to automatically fill in those inevitable scratches and surface damage. The self-healing coating could be applied to the foldable’s internal folding display or on the phone’s outer areas. The healing process may also be sped up using heat, light, or electric current. (Vanguard Tech, TechXplore, Patently Apple, USPTO, Sina)

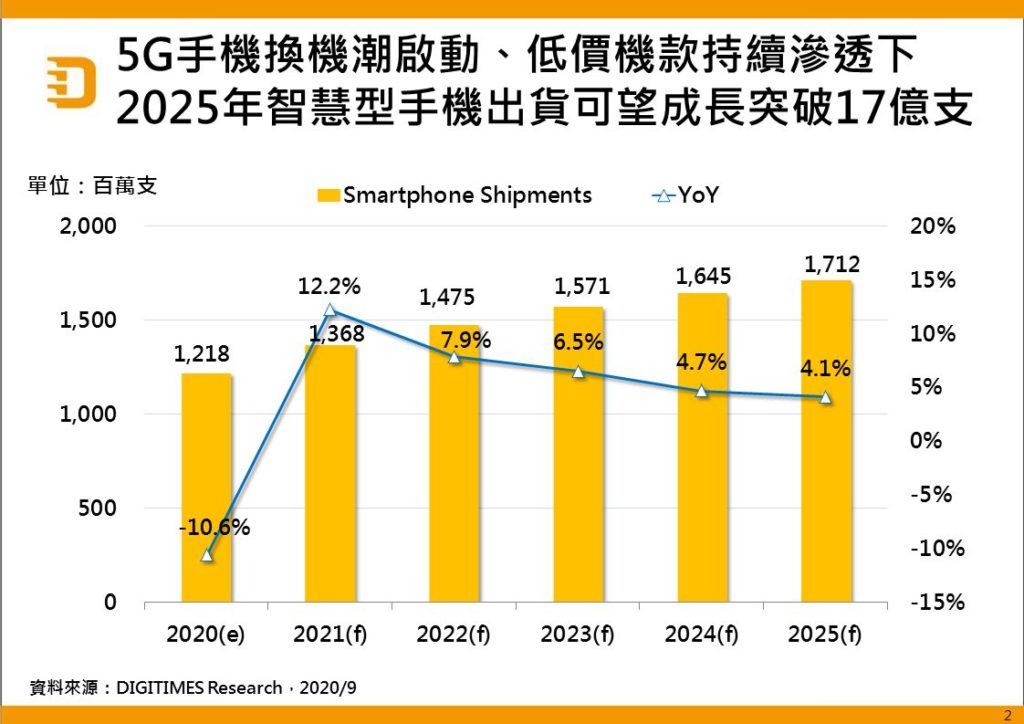

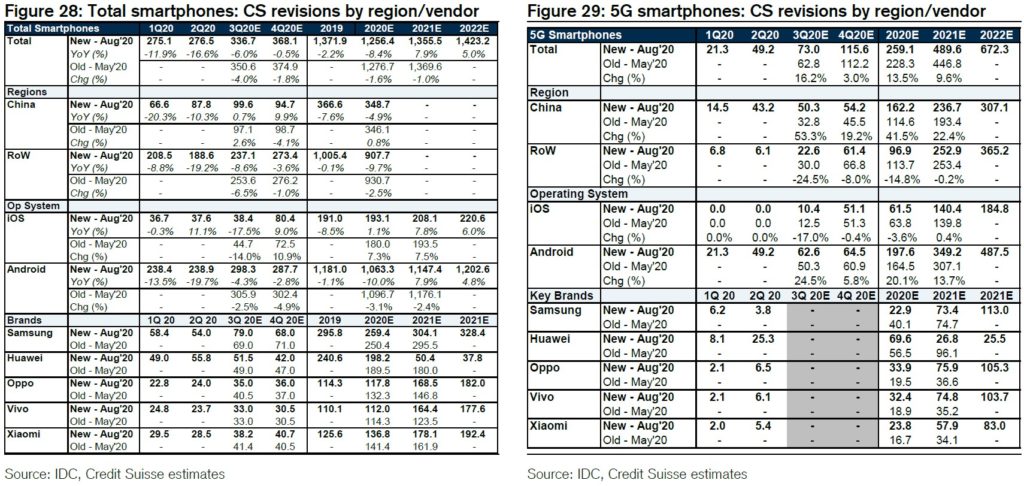

Following 3 consecutive years of declines in 2018-2020, global smartphone shipments are expected to grow by a double-digit rate or 150M units in 2021, bolstered by renewed efforts to build infrastructure and accelerate commercial operations for 5G in Japan, Western Europe and the US, according to Digitimes Research. Looking into the next 5 years, replacement demand for 5G phones will gather momentum thanks to the growing number of commercial 5G networks and expanding coverage. The availability entry-level 5G or 4G devices in emerging markets will also drive global smartphone shipments, which are expected to reach over 1.5B units in 2023 and 1.7B units in 2025, respectively. (Digitimes, press, Gizmo China)

Samsung may phase out the Galaxy Note series in 2021 shortly after its release and move some of its features to the Galaxy S Series, such as the S Pen stylus, which will reportedly be included in the Galaxy S21 Ultra to be launched in 2021. (Laoyaoba, Korea Herald, Android Headlines)

According to TF Securities analyst Ming-Chi Kuo, after a comprehensive scenario analysis of Huawei’s potential countermeasures against the US ban, one of the most likely scenarios is that Huawei sells the Honor mobile phone business. He has noted that if Honor is independent from Huawei, the procurement of parts will not be restricted by the US ban on Huawei. This would help Honor mobile phone business and suppliers grow. (Gizmo China, Laoyaoba)

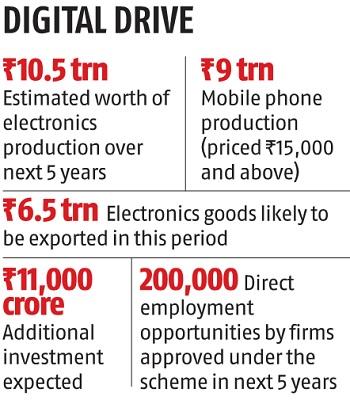

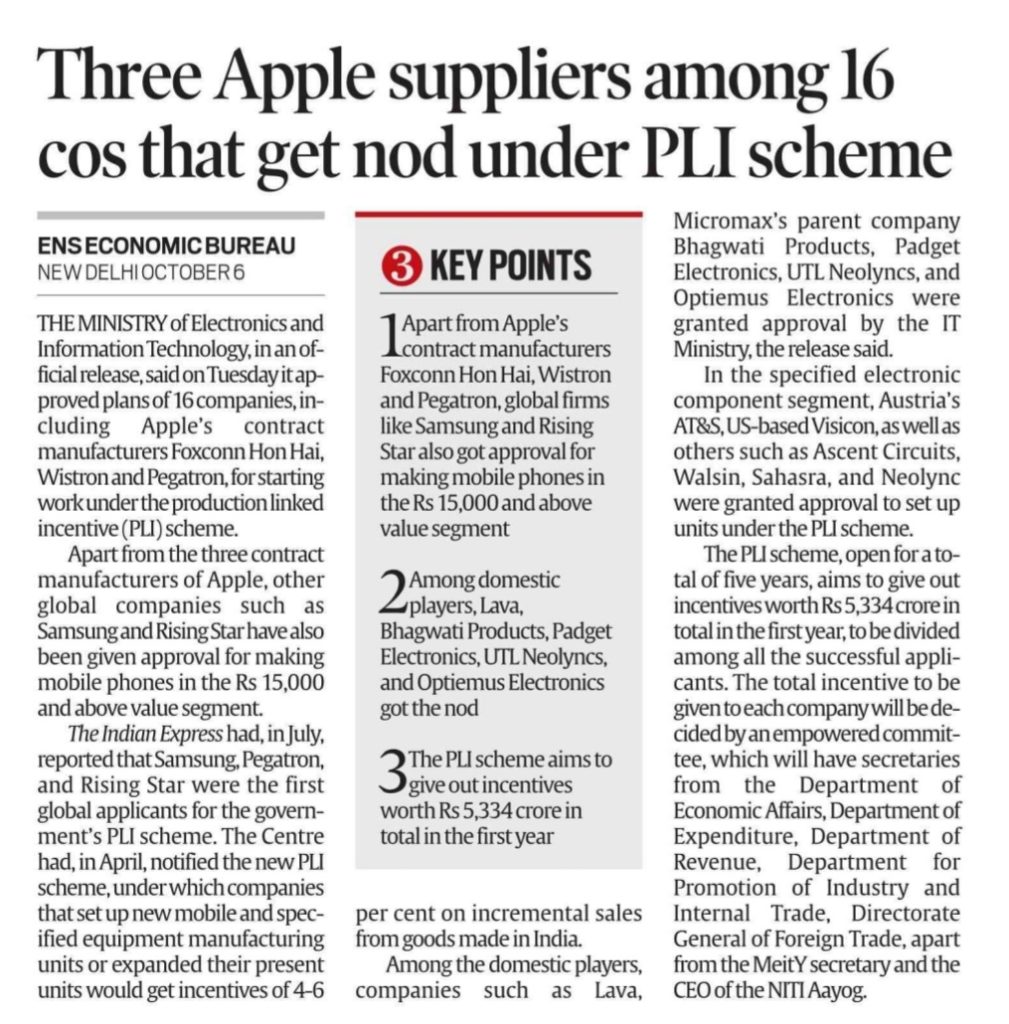

The Indian government’s push to domestic mobile phone manufacturers in form of incentives under product-linked incentives (PLI) scheme has set a challenge for them to become globally competitive. The government has approved applications of 16 electronics companies including 10 mobile phone manufacturers for reward under the PLI scheme for total disbursement of INR40,000 crore, expected to attract investment of INR11,000 crore in next 5 years. Indian mobile phone makers who have been approved are Lava, Bhagwati (Micromax), Padget Electronics, UTL Neolyncs and Optiemus Electronics who have proposed production output of INR1.25 lakh crore over the next 5 years. (India Times, CN Beta)

Indian manufacturing incentives proposed earlier in 2020 have now been confirmed. In return for manufacturing premium smartphones in India, manufacturers will qualify for incentives worth 4-6% of the cost of each device. The Production Linked Incentive (PLI) scheme applies only to smartphones selling for INR15,000 (USD205) or more. The government has announced that Samsung and Apple’s partners Foxconn, Wistron, and Pegatron have won a 5-year approval to gain benefits from this scheme. (9to5Mac, TNW, Techspot, Laoyaoba)

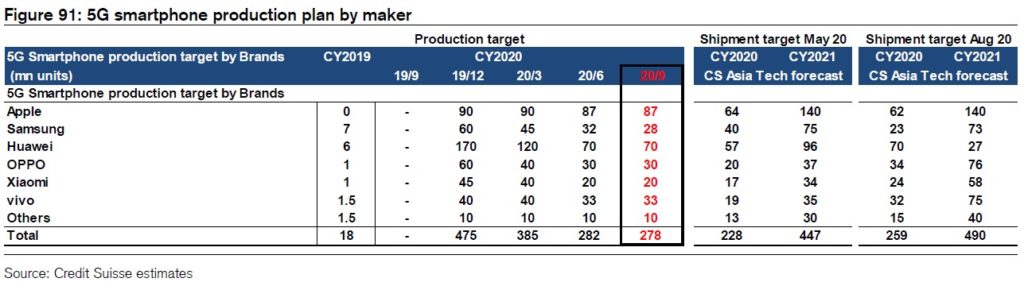

According to Credit Suisse, the 2020 smartphone production forecast was 1.359B units (-4% YoY) in Mar 2020 and 1.297B units (-8%) at the time of the previous survey (Jun 2020). As of the current survey (Sept 2020), it is 1.299B units (-8%). After sanctions on Huawei were tightened in Aug 2020, OPPO and Xiaomi have informed device makers that they will increase production in 2021. OPPO plans to produce 270M units, including the realme and OnePlus (vs. 160M units in 2020) and Xiaomi plans to produce 240M units (170M units in 2020). Samsung and Apple are also ramping up production. (Credit Suisse report)

At the time of the Sept 2019 survey, Credit Suisse has forecast that 5G smartphone production in 2020 is likely to reach 250-300M units. As of Nov 2019 survey, 5G smartphone production plans has risen well above actual demand to reach 470-480M units. However, in their Mar 2020 survey, the production plans, though still excessive, has declined to just under 400M units and in their previous survey (Jun 2020), production plans have declined back down to around 280M units. From the latest survey, Credit Suisse notes plans for 5G smartphone production volume of 278M units in 2020. (Credit Suisse report)

Credit Suisse has revised smartphone estimates are consistent with that trend with Huawei units declining from 198M in 2020 to 50M / 38M in 2021 / 2022. Other vendors are gaining YoY in 2021, with Apple growing by 15M units, Samsung by 45M, OPPO by 50M, vivo by 52M and Xiaomi by 41M units, providing growth opportunities to all other the vendors. (Credit Suisse report)

realme 7i is announced in India – 6.517” 720×1600 HD+ 90Hz IPS HiD, Qualcomm Snapdragon 662, rear quad 64MP-8MP ultrawide-2MP macro-2MP depth + front 16MP, 4+64 / 4+128GB, Android 10.0, rear fingerprint scanner, 5000mAh 18W, INR11,999 (USD165) / INR12,999 (USD175). (GSM Arena, GizChina)

realme Buds Air Pro with Active Noise Cancellation (ANC) is announced in India. It is powered by realme S1 high-performance noise cancellation chip. They pack in 10mm bass boost drivers, a dual-mic design for noise cancellation, instant auto-connect, Google fast pair support, and IPX4 water resistance. They are priced at INR4,999 (USD70). (GSM Arena, XDA-Developers, IT Home)

Redmi Earbuds 2C is announced in India. The buds offer touch control, 12 hour music playback and features 12 hour music playback as well as IPX4 sweat and splash resistance. It is priced at INR1,499 (USD20). (GSM Arena, Gizmo China)

Virtual reality (VR) startup Virtuix is building a VR treadmill for home. The Omni One is an elaborate full-body controller that lets you physically run, jump, and crouch in place. Following an earlier business- and arcade-focused device, it is supposed to ship in mid-2021 for USD1,995, and Virtuix is announcing the product with a crowdfunding investment campaign. (CN Beta, The Verge, VR Focus)

Einride, the Swedish autonomous trucking startup, has has raised an additional USD10M in venture capital funding. The company has also unveiled a new vehicle type that the company hopes to have on the road delivering freight starting in 2021. The vehicles, dubbed Autonomous Electric Transport (AET), came in 4 different variations. (The Verge, VentureBeat, TechCrunch)

Volkswagen owned truck manufacturer Scania is covering a trailer with 1,507 square feet of solar cells to power one of its hybrid semi-tractors. The goal is to see how much fuel could be saved and whether it could be connected to the grid when not in use. Scania and its partner Ernst Express figure that the panels could generate about 14,000kWh over the course of a year. (Engadget, Autoblog)

French fintech startup Lydia is going to work with financial API startup Tink for its open banking features in its app. Lydia started as a peer-to-peer payment app and now has 4M users in Europe. (TechCrunch, French Web, Fintech Ranking, Lifesly)

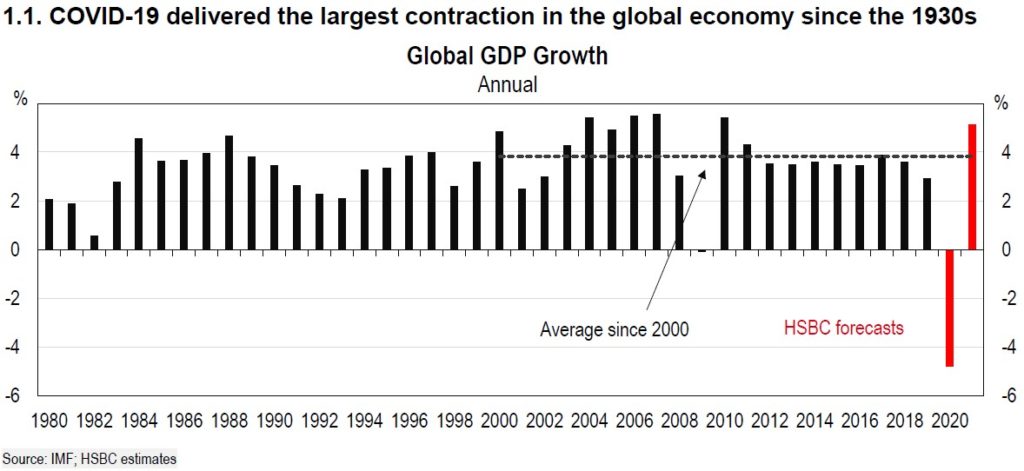

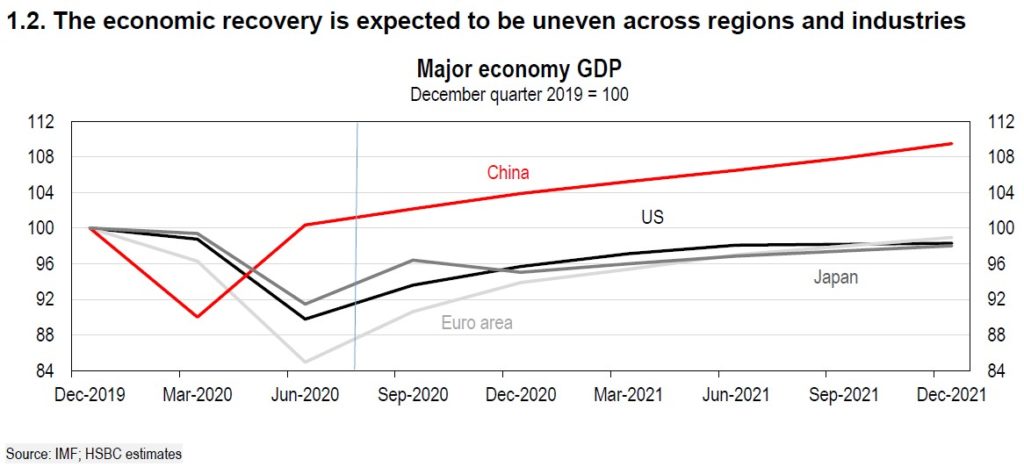

The COVID-19 pandemic has delivered the largest global economic contraction since the 1930s in 1H20. The shock began in China, which registered a significant 10% contraction on 1Q20 GDP. However, the rebound in activity in China has also been strong, with GDP rising by 11.5% in 2Q20, returning to above its pre-COVID-19 level. Timely indicators suggest that positive growth momentum has continued in China in 3Q20, although, like elsewhere, the recovery is uneven across sectors. (HSBC report)

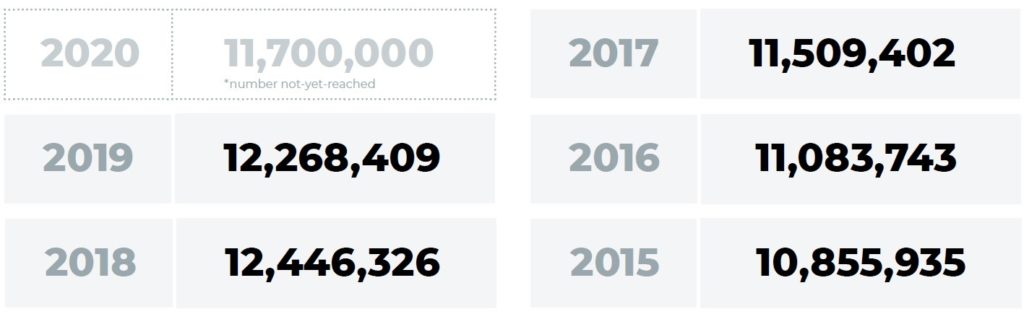

According to Jungle Scout, total imports for the U.S. rose 13.2% between 2015 and 2019. And overall imports for the U.S. have averaged nearly 12M per year since 2015. If imports were equal for 2H20 (1Jul -31 Dec 2020), annual U.S. imports would reach 11.3M by the end of 2020, showing a significant YoY decrease of 7.5% from 2019. However, imports during 2H20 are typically about 6% higher than imports in 1H20. At this rate, the U.S. could reach 11.7M imports by the end of 2020 — a lesser, but still significant year-over-year drop in imports of 4.8%. (Jungle Scout report)