10-17 #VIP: Micromax is planning a comeback with a new “in” series of smartphones; LG Chem has indicated that the company is in talks with a “couple” of automakers to create joint ventures to produce automotive batteries; etc.

According to SEMI, global silicon wafer shipments are set to increase 2.4% year-over-year in 2020, with growth continuing in 2021 and shipments reaching a record high in 2022. (SEMI, PR Newswire, Laoyaoba)

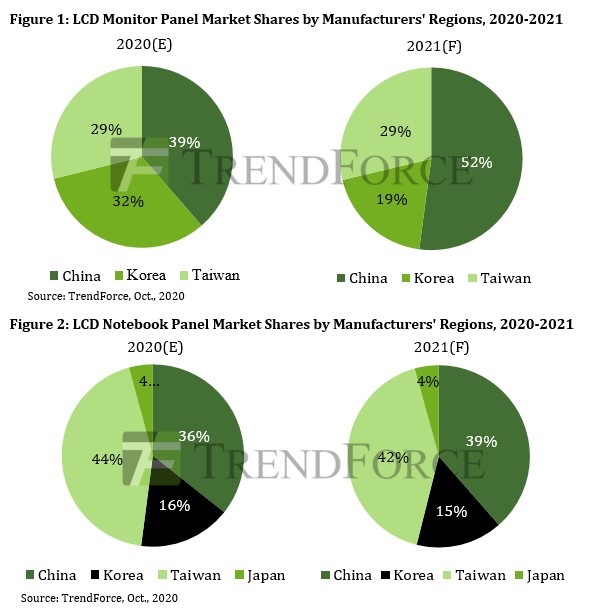

Chinese manufacturers are expected to raise their market share from 39% in 2020 to 52% in 2021 year in the monitor panel market, and 36% to 39% in the notebook panel market, according to TrendForce. As such, these manufacturers are expected to maintain their plans of transitioning some production capacities from TV panel manufacturing to IT panel manufacturing in spite of the TV panel shortage in 2H20 caused by various factors such as the closedown of SDC’s LCD panel manufacturing operations, the rise of the stay-at-home economy, and the stimulus policies instituted by governments worldwide. (Laoyaoba, TrendForce, TrendForce)

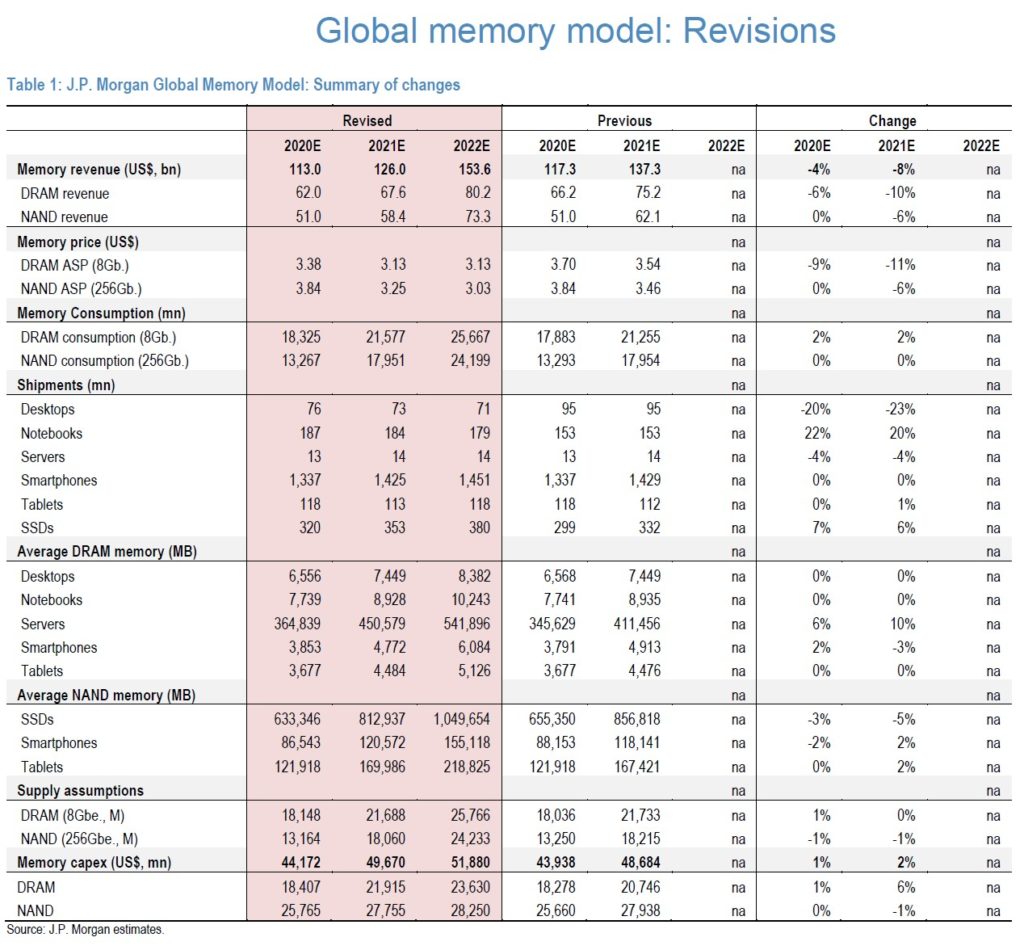

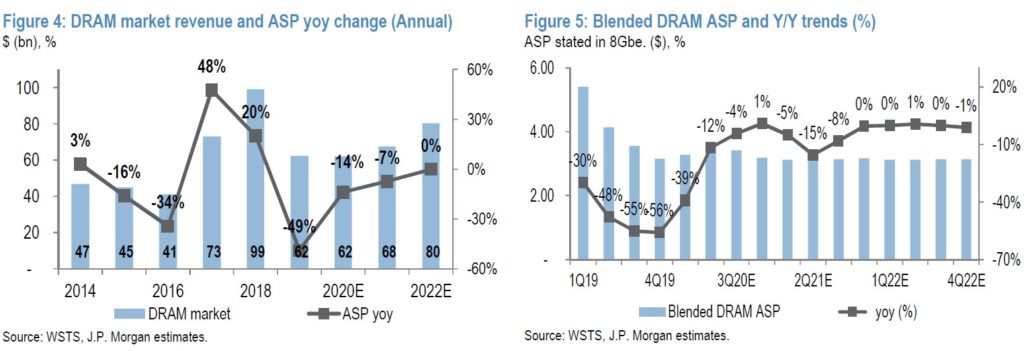

With changes in major assumptions, JP Morgan now forecast the DRAM market will be flattish in 2020, and grow ~10% in 2021, while the NAND market will grow by 27% in 2020 followed by 13~19% growth in 2021. They also introduce 2022 outlook which shows decent growth for both DRAM (19%) and NAND (25%), implying a historical high memory market of USD154B. In terms of quarterly momentum, DRAM / NAND will bottom-out in 2Q21 along with seasonal upticks in demand and ASP declines slowing. (JP Morgan report)

JP Morgan models 7% QoQ DRAM price correction in both 3Q20 / 4Q20 with server / PC DRAM showing the highest magnitude of declines following strong inventory build-ups in 1H20, while mobile and specialty DRAM price is relatively resilient on account of strong seasonality, flagship launches and HoH recovery in demand. With structural growth in SSD adoption along with disciplined supply, JP Morgan forecast 4% YoY growth for NAND price in 2020. Moving into 2021, expect 15% YoY NAND price correction on high-base and new wafer adds from Korea / Japan manufacturers. (JP Morgan report)

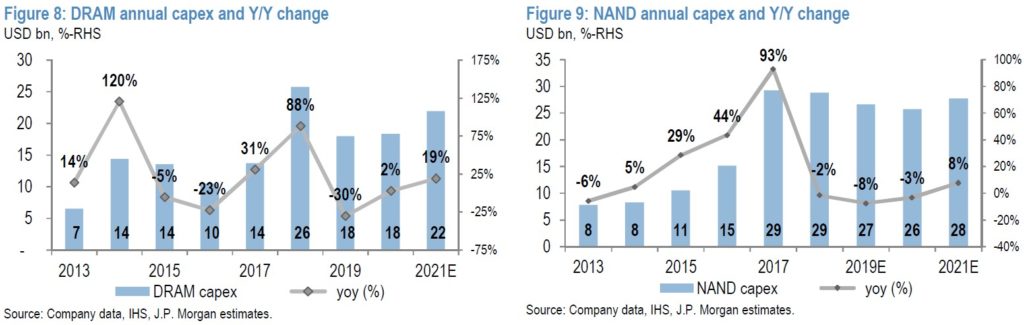

Based on updated capex estimates for 2020 / 2021, JP Morgan sees the updated capex for DRAM at ~USD18B / 22B and for NAND at ~USD26B / 28B. DRAM capex has remained subdued / flattish in 2020 after a major 30% decline in 2019 but they expect high-teen% Y/Y growth in 2021. NAND capex also likely grows by 8% Y/Y in 2021 after 3 years of consecutive decline in 2018-2020. (JP Morgan report)

LG Chem’s CEO Hak Cheol Shin has indicated that the company is in talks with a “couple” of automakers to create joint ventures to produce automotive batteries. He has further elaborated that LG Chem is already moving ahead with battery joint ventures with General Motor (GM) and Geely and hopes to expand to other car makers. (CN Beta, Auto News, Yahoo, Reuters)

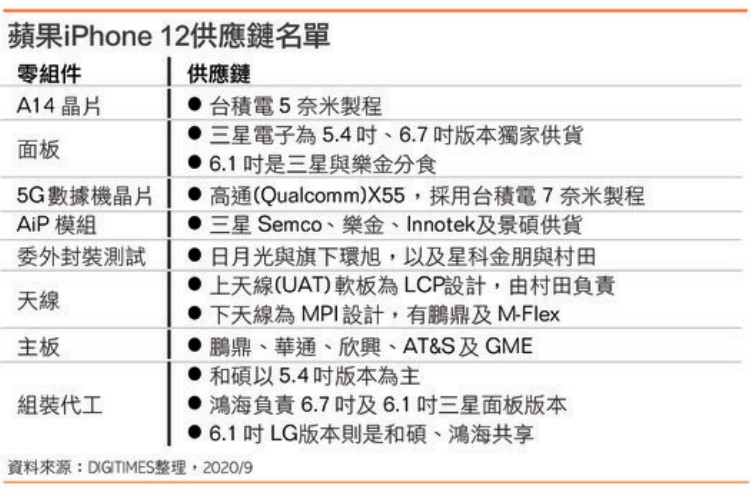

Apple is expected to accelerate the adoption of LCP (liquid crystal polymer)-based flexible PCBs for the antenna modules to be used by its future iPhone lineup supporting 5G mmWave technology, according to Digitimes. Apple will use more LCP antenna modules instead of current mainstream of MPI (modified polyimide)-based models as the former ones perform better than the latter for high-speed data transmission. (Digitimes, Digitimes, press)

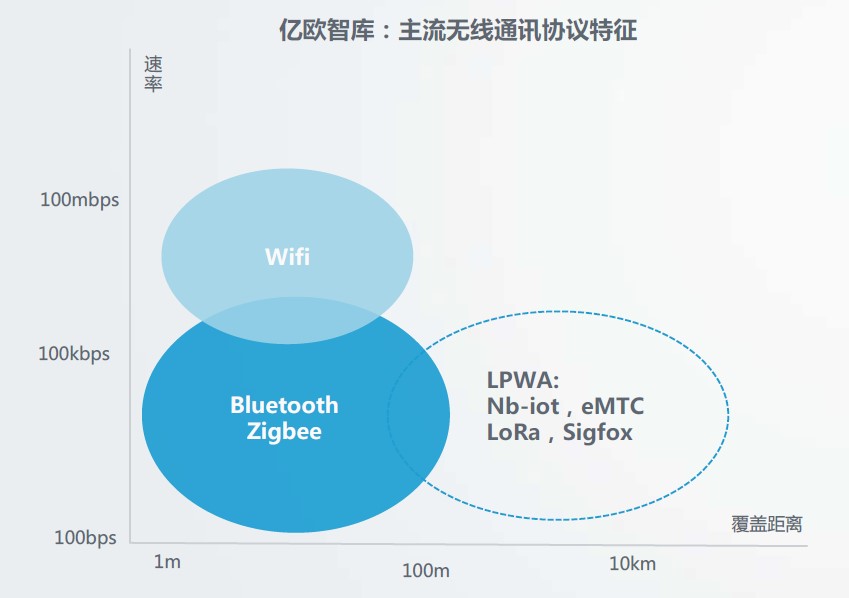

Wireless communication technology is applied in a variety of scenarios in smart homes; among the wireless communication technologies currently on the market, Wifi, Bluetooth, and Zigbee are the most widely used in this industry. According to its advantages and disadvantages, it is also suitable for different smart home products. (EO Intelligence report)

Micromax co-founder Rahul Sharma has announced the company is planning a comeback with a new “in” series of smartphones. He says that Micromax was one of India’s leading smartphone brands before the arrival of Chinese brands that launched its range of smartphones at a much lower price. (GSM Arena, Hindustan Times, Mobile Indian)

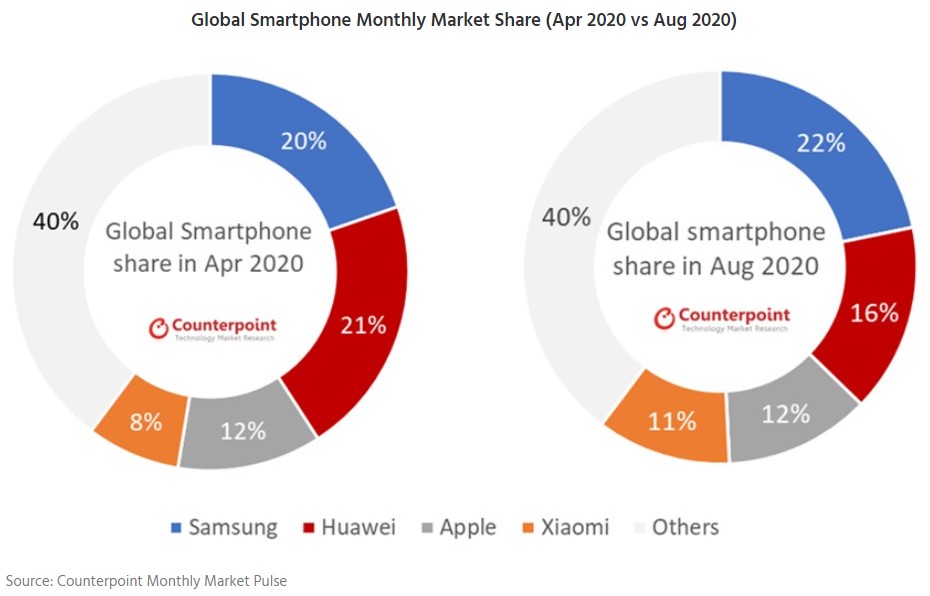

Samsung took the top spot in the global smartphone market in Aug 2020, accounting for 22% of the market share according to Counterpoint Point. In Apr 2020, Samsung lost the top spot to Huawei due to sharp declines in its major markets of India and Europe. But in Jul / Aug 2020, Samsung rebounded as India recovered from a nationwide lockdown. Samsung has now reached its highest market share in India since 2018 by adopting an aggressive online channel strategy to benefit from opportunities arising due to anti-China sentiments in the country. (GSM Arena, Counterpoint Research, GizChina)

According to Strategy Analytics, Samsung has captured an impressive 88% market share of all 5G smartphones shipped in Western Europe during 1H20. Apple iPhone 12, Xiaomi and other Chinese smartphone brands will challenge Samsung’s 5G dominance in 2H20. A record 4M 5G smartphones were shipped in Western Europe during 1H20. The 5G category accounted for 7% of all smartphones shipped in Western Europe in 1H20, jumping from less than 1% of total during 1H19. (Strategy Analytics, Laoyaoba)

Huawei nova 7 SE 5G is announced in China – 6.5” 1080×2400 FHD+ IPS HiD, MediaTek Dimensity 800U, rear quad 64MP-8MP ultrawide-2MP macro-2MP depth + front 16MP, 8+128GB, Android 10.0, side fingerprint scanner, 4000mAh 40W, CNY2,299 (USD340). (GSM Arena, Huawei, Gizmo China)

Infinix Note 8 and Note 8i are launched in India: Note 8 – 6.95” 720×1640 HD+ IPS 2xHiD, MediaTek Helio G80, rear quad 64MP-2MP macro-2MP depth-2MP AI lens + front dual 16MP-2MP depth, 6+128GB, Android 10.0, side fingerprint, 5200mAh 18W, expected INR14,700 (USD200). Note 8i – 6.78” 720×1640 HD+ IPS HiD, MediaTek Helio G80, rear quad 48MP-2MP macro-2MP depth-2MP AI lens + front 8MP, 6+128GB, Android 10.0, side fingerprint, 5200mAh 18W, price not yet announced. (GSM Arena, Gizmo China, India Today)

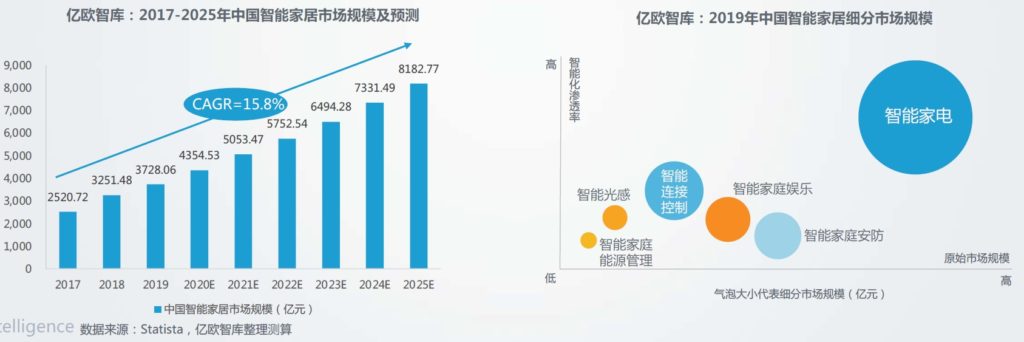

The market scale calculation of EO Intelligence covers smart home hardware equipment costs, related service costs (design, installation, maintenance) and network service costs, which specifically cover 6 market segments. China’s smart home has a market size of CNY100B, and it is increasing year by year, with rapid growth. Based on the data of Statista, EO Intelligence has compiled and calculated that the market size in 2020 is about CNY435.4B, and it is expected to exceed CNY800B in 2025. (EO Intelligence report)