11-3 #Stare: Huawei has plans to build a chip factory in Shanghai; Samsung is rumored to supply its Exynos to Xiaomi, OPPO and vivo in 2021; LGD will supply Apple with Mini LED screens; etc.

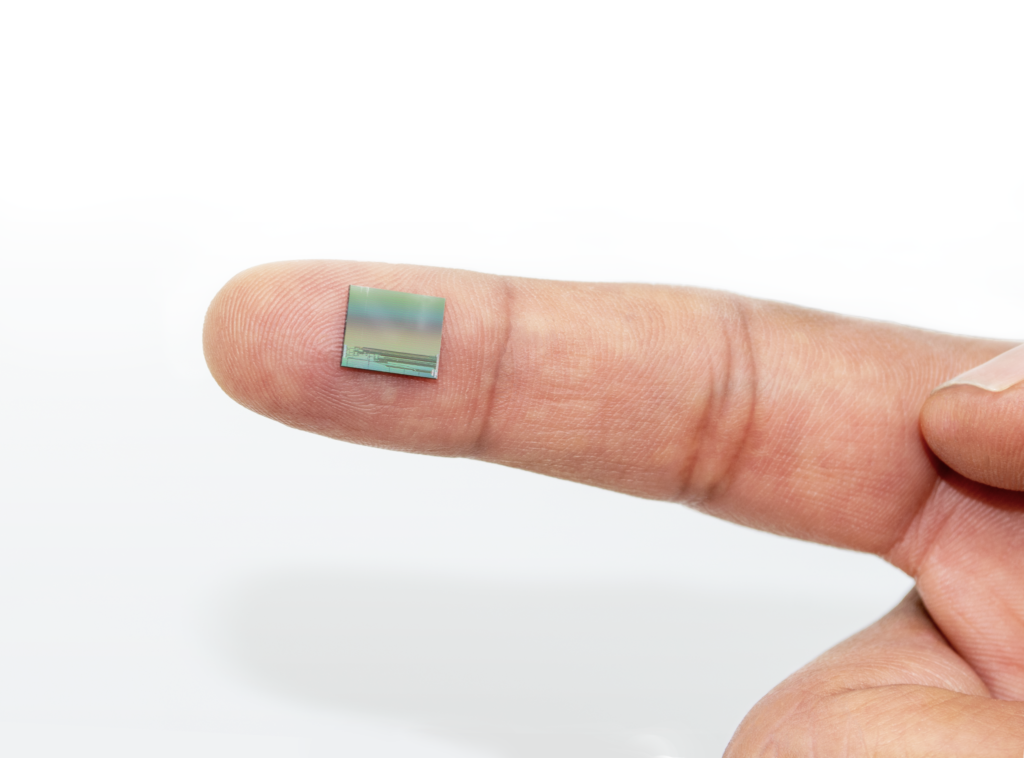

Huawei has plans to build a chip factory in Shanghai, which would be dedicated to manufacturing parts for its telecom hardware business. The factory will reportedly be run by Huawei’s partner, Shanghai IC R&D Center. The factory will initially be used to create legacy 45nm chips. The plan is to then move on to 28nm chips by 2021 and 20nm chips by 2022. (GizChina, Android Authority, Financial Times, Huawei, CN Beta)

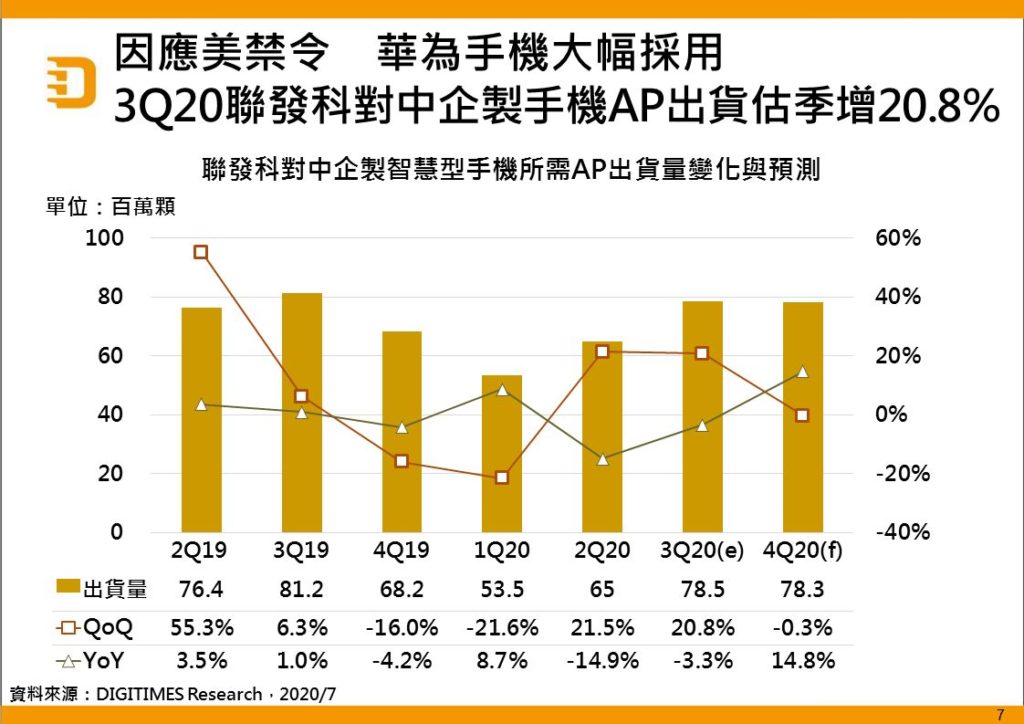

The supply of 4G SoCs and PA components for both 4G and 5G models are falling short of demand, but may ease by the end of 2020, according to Digitimes. The 4G SoC shortages mainly result from Huawei moving to thicken its IC inventory for lower-tier handsets by placing massive orders with chips vendors before tough US sanctions took effect in mid-Sept 2020. (Digitimes, press, Digitimes)

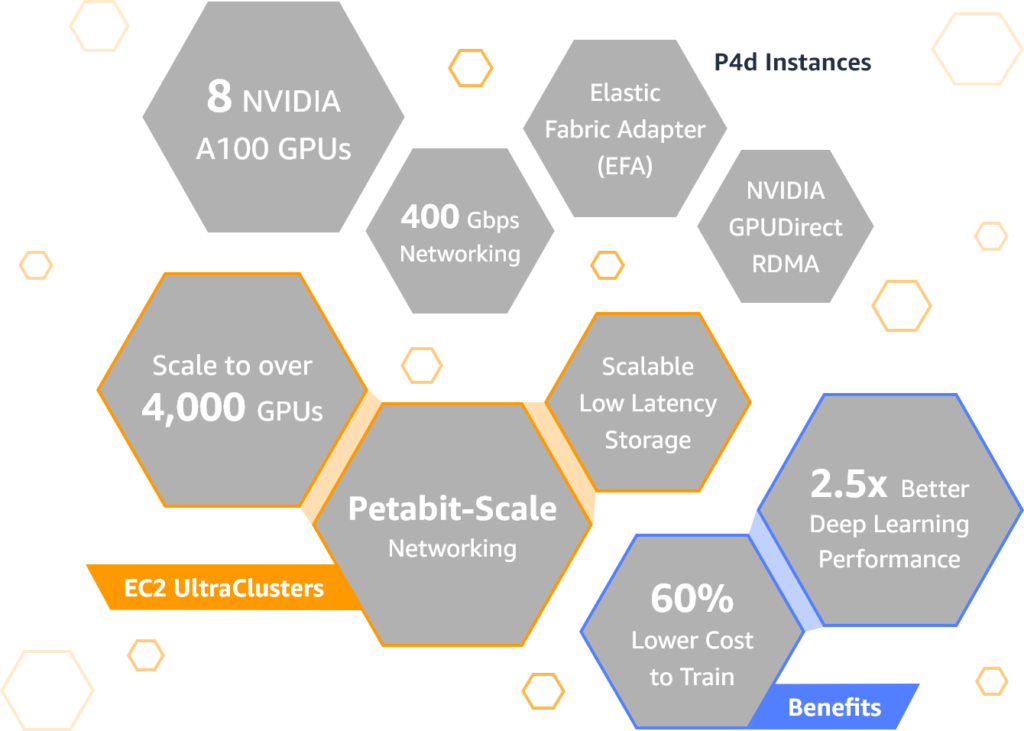

Amazon AWS has announced the launch of its newest GPU-equipped instances. Dubbed P4, these new instances are powered by Intel Cascade Lake processors and eight of NVIDIA’s A100 Tensor Core GPUs. These instances, AWS promises, offer up to 2.5x the deep learning performance of the previous generation — and training a comparable model should be about 60% cheaper with these new instances. (TechCrunch, Amazon)

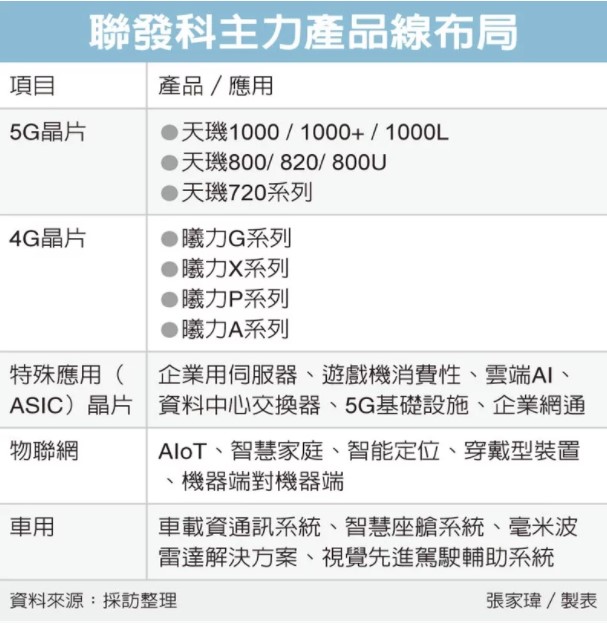

MediaTek reportedly has two new chips in the works, both based on a 5nm or 6nm process, namely MT6839 and MT6891. They will utilize the ARM Cortex-A78 architecture. It is possible they may be announced before end of 2020. (Android Central, Gizmo China)

MediaTek CEO Rick Tsai is optimistic of the 5G phones development driven by the major brands in the market. It is estimated that global 5G smartphone shipments would reach 200M units in 2020, and there will be at least double growth in 2021, which brings opportunities to MediaTek. He has emphasized that MediaTek’s plan to launch a complete product line remains unchanged, and will support 5G smartphones in different price ranges. The development of mmWave products is progressing smoothly. In the future, mmWave Modem and SoC will be launched. It is expected in early 2021 the company would start to send samples to customers, and will enter mass production in 2022. (UDN, Yahoo, TechNews)

Samsung System LSI Business Division is planning to supply its smartphone application processor (AP) Exynos to Xiaomi, OPPO and vivo in 2021. Samsung is reportedly planning to supply its APs for some budget smartphones of the Chinese makers in 1H21. The System LSI Business Division has started to reduce supply of the Exynos APs to the Wireless Business Division because of a low profit margin and sought to secure new customers, focusing on Chinese makers. (Gizmo China, Business Korea, My Drivers)

Semiconductor Industry Association (SIA) has announced worldwide sales of semiconductors totaled USD113.6B during 3Q20, an increase of 11% over the previous quarter and 5.8% more than 3Q19. Global sales for Sept 2020 were USD37.9B, an increase of 4.5% over Aug’s total and 5.8% more than sales from Sept 2019. (Digitimes, press, SIA)

Shipments of smartphone-use application processors (AP) to China, including those for handset exports, grew 13.4% sequentially but declined 9.5% on year to 192.6M units in 3Q20, Digitimes Research has found. The sequential growth comes as Huawei rushed to stock up APs from MediaTek prior to the US imposing fresh trade bans, and other Chinese brands were also ramping up smartphone shipments to India for inventory replenishments by channel operators there. (Digitimes, press, Digitimes)

According to a Digitimes, LG Display (LGD) will supply Apple with Mini LED screens. Apple will use it for its new generation iPad Pro products. In addition, Samsung Electronics plans to release Mini LED TVs in 2021, which brings business opportunities to Mini LED suppliers. Mini LED screens on tablets and TVs will become popular in 2021. However, their application in monitor screens will still maintain a negligible penetration rate (less than 1%). (GizChina, IT Home, Digitimes)

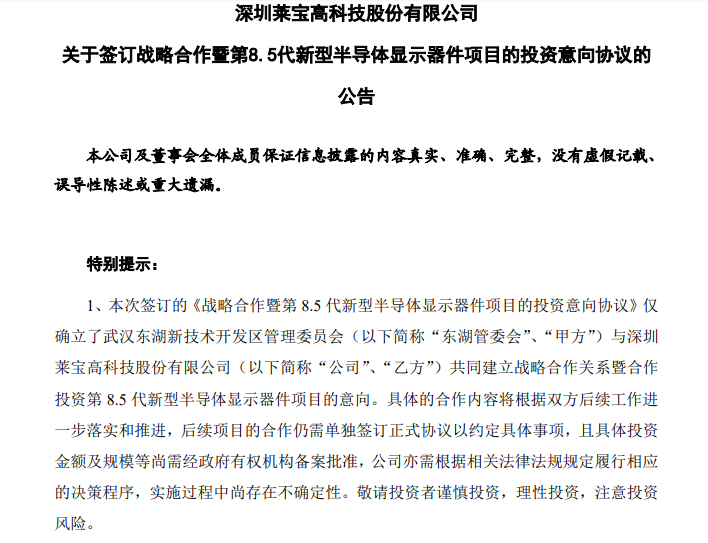

Shenzhen-based Laibao High-Tech has struck a deal with the local government in Wuhan, Hebei province to build an 8.5G LCD fab in its Donghu New Technology Development Zone. The planned CNY11.5B (USD1.719B) 8.5G line will have a capacity of 60,000 substrates per month utilizing IPS TFT and Oxide TFT technologies. (Digitimes, press, Digitimes, 51Touch, Sina)

Aeva, a Mountain View, California-based lidar company backed by Porsche SE, is merging with special purpose acquisition company InterPrivate Acquisition, with a post-deal market valuation of USD2.1B. The deal makes Aeva the third lidar technology developer to agree to go public in 2020 through a deal with a special purpose acquisition company (SPAC), following Velodyne Lidar and Luminar Technologies. (TechCrunch, Reuters)

The Volvo Group and Daimler Truck AG have now a signed binding agreement for a joint venture to develop, produce and commercialize fuel-cell systems for use in heavy-duty trucks as the primary focus, as well as other applications. The Volvo Group will acquire 50% of the partnership interests in Daimler Truck Fuel Cell GmbH & Co. KG for approximately EUR0.6B on a cash and debt-free basis. (Engadget, Volvo)

Sales of Samsung Galaxy Note20 series seem lower than expected. Samsung Mobile allegedly only produced around 70% of what it planned to produced for the month of Oct 2020. Samsung aimed to produce just short of 900K units of the Note20 series in Oct 2020 but only manufactured around 600K units. The company is planning to begin production of the Galaxy S21 series in Nov 2020. Samsung is preparing for initial batch of 2M units for 2021. (Android Authority, The Elec, CN Beta)

TikTok has signed a new licensing agreement with Sony Music Entertainment (SME) that will allow the short-form video app to continue to offer songs from Sony Music artists for use by creators on its platform. The agreement will also see the companies partnering on efforts to promote Sony artists. The expanded agreement will give TikTok’s creator community access to sound clips from Sony Music’s catalog of current hits, new releases, emerging favorites, iconic classics and deep cuts. (CN Beta, TechCrunch, TikTok, Rolling Stone)

Honor 10X Lite is launched in Saudi Arabia – 6.67” 1080×2400 FHD+ IPS LCD HiD, Kirin 710, rear quad 48MP-8MP ultrawide-2MP macro-2MP depth + front 8MP, 4+128GB, Android 10.0 (no Google Play Services), side fingerprint, 5000mAh 22.5W, SAR799 (USD213). (Gizmo China, GSM Arena, Honor)

Micromax IN Note 1 and IN 1b are unveiled in India: IN Note 1 – 6.67” 1080×2400 FHD+ IPS LCD HiD, MediaTek Helio G85, rear quad 48MP-5MP ultrawide-2MP macro-2MP depth + front 16MP, 4+64 / 4+128GB, Android 10.0, rear fingerprint scanner, 5000mAh 18W, reverse charging, INR10,999 (USD148) / INR12,999 (USD175). IN 1b – 6.67” 1080×2400 FHD+ IPS LCD v-notch, MediaTek Helio G85, rear quad 48MP-5MP ultrawide-2MP macro-2MP depth + front 16M, 2+32 / 4+64GB, Android 10.0, rear fingerprint scanner, 5000mAh, INR6,999 (USD94) / INR7,999 (USD108). (GSM Arena, Micromax, Micromax, Android Authority)

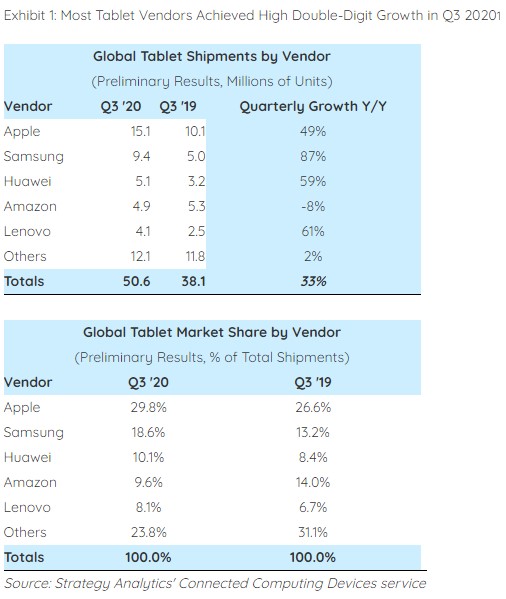

The worldwide tablet market delivered solid results in 3Q20 with 24.9% year-over-year growth and shipments totaling 47.6M units, according to IDC. Apple shipped 13.9M units in 3Q20 to lead the tablet market once again. Samsung regained the second position with shipments of 9.4M units and year-over-year growth of 89.2%. (GizChina, IDC)

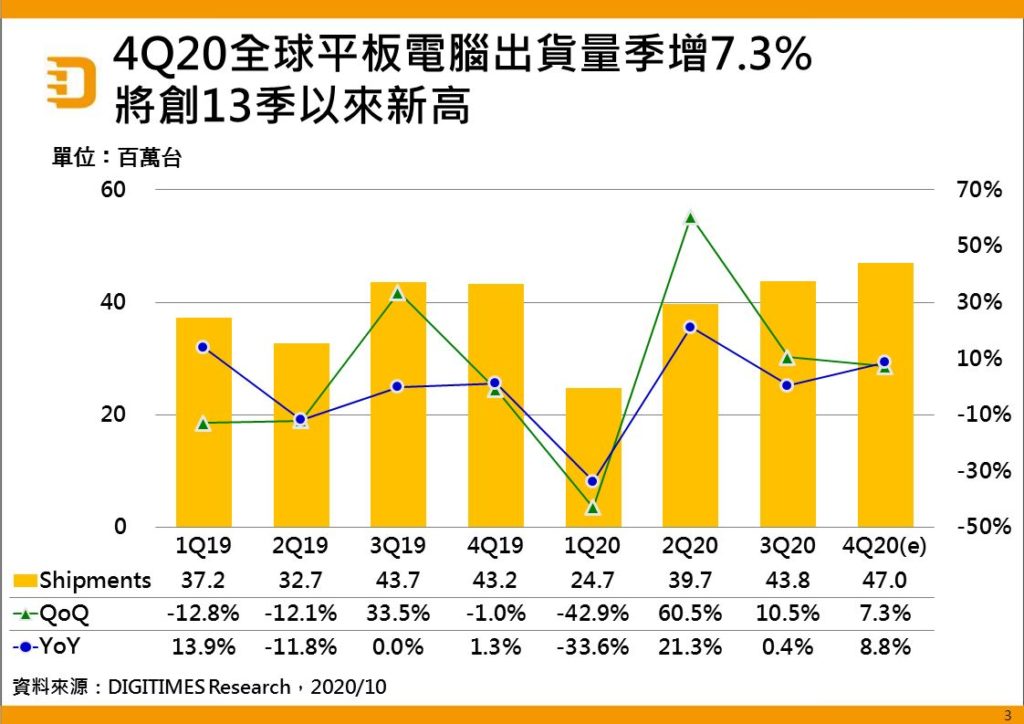

Global tablet shipments are expected to increase 7.3% sequentially to a 13-quarter high in 4Q20, with significant increases in orders from Southeast Asia, India and Latin America for education applications, according to Digitimes Research. Global tablet shipments in 3Q20 rose 10.5% sequentially and 0.4% on year to 43.83M units, with non-Apple vendors maintaining strong shipment momentum in the peak season with friendly pricing, thwarting shipments of white-box tablet models. (Digitimes, press, Digitimes)

A years-long strategy to transform tablets into low-cost productivity devices is finally paying off. This preparation by major vendors served critical needs in the back-to-school season, as consumers and educational institutions bought a record number of tablets to support the transition to e-learning environments, according to Strategy Analytics. Apple leads the market with 15M shipped, follows by Samsung with 9.4M units, and Huawei with 5.1M units. (Strategy Analytics, CN Beta)

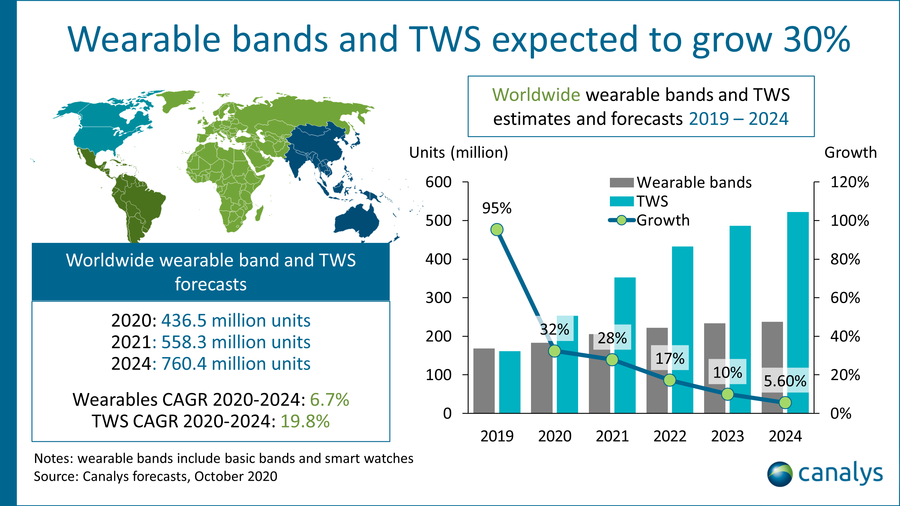

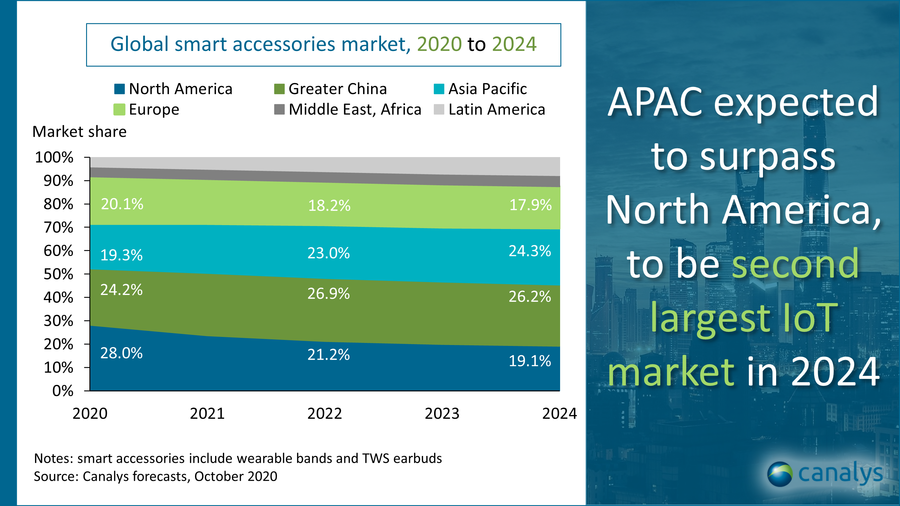

Canalys forecasts shipments of smartphone accessories, namely wearable bands and TWS devices, to exceed 200M units and 350M units respectively in 2021. As the COVID-19 pandemic deepened globally, consumers turned their attention to smart wearable and smart hearable accessories. Compared to smartphones, wearable bands and TWS earbud categories will be more resilient against the pandemic, with shipments projected to grow at a healthy rate of 32% in 2020. (GSM Arena, Canalys, CN Beta)

Huawei has launched the Huawei Sound smart speaker. Huawei has launched in-depth technical cooperation with French high-end audio brand Devialet, adopting a full set of Devialet acoustic speaker structure design and professionally tuned by Devialet. Huawei Music has also reached a cooperation with Hi-Res streaming music service provider Sony Select to simultaneously launch a high-resolution streaming music library on the Huawei Sound smart speaker series. (Gizmo China, GizChina, IT Home)

Walmart has ended its effort to use roving robots in store aisles to keep track of its inventory, reversing a yearslong push to automate the task with the hulking machines after finding during the coronavirus pandemic that humans can help get similar results. Walmart has ended its contract with robotics company Bossa Nova Robotics with which it joined over the past five years to gradually add six-foot-tall inventory-scanning machines to stores. (Digital Trends, WSJ)