11-21 #SoBeIt: BOE has allegedly yet again failed to clinch a supply order from Apple for OLED panels; Apple will pay USD113M to settle probe on battery issues with old iPhones;

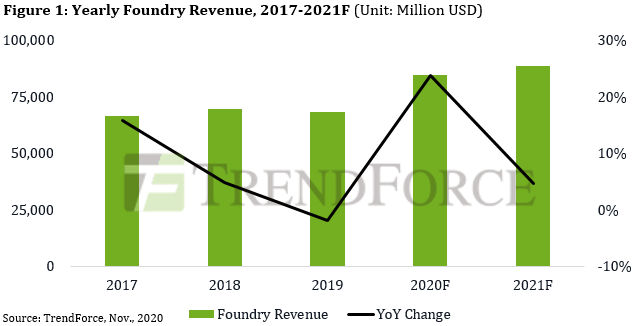

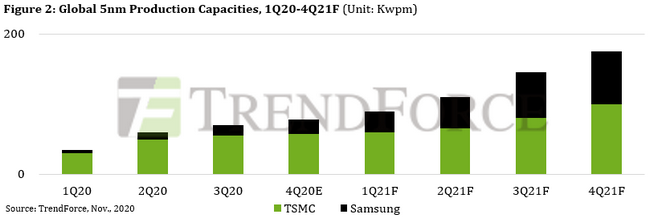

TrendForce expects global foundry revenue is projected to undergo a 23.8% increase YoY in 2020, the highest percentage in 10 years. Based on the status of various foundries’ client orders, TrendForce expects the current tight supply of wafer capacity to persist at least until 1H21. With regards to advanced processes below and including the 10nm node, both TSMC’s and Samsung’s wafer capacities are currently close to fully loaded. As well, since 4/3nm processes are expected to arrive on the market in 2021 and 2022, respectively, ASML’s EUV machines have now become a scarce commodity highly sought after by various foundries. (TrendForce, TrendForce, Mac Rumors)

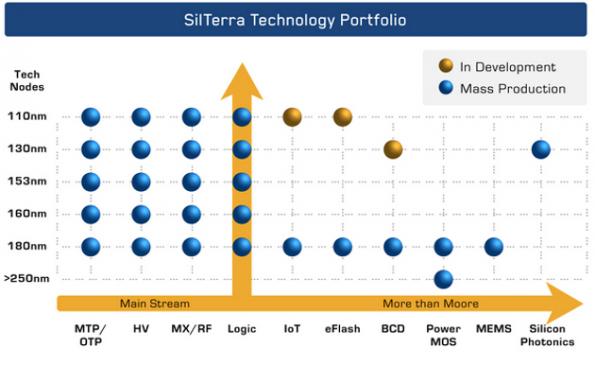

Hon Hai’s chairman Liu Yangwei has confirmed that he participated in the bid for the equity of Silterra, an 8” wafer fab in Malaysia, and is expected to make a decision by the end of 2020. He has indicated that the 8” wafer fab has become popular. The world’s ICs are not only high-end ICs made by TSMC, but there are actually many small ICs. At first glance, but it cannot move without it, so Hon Hai has deployed it very early. In fact, the Malaysian fabs and IC design houses are all moving towards the group’s “3 + 3” strategy. (UDN, Chain News, Apple Daily, EE News Analog)

SMIC first started volume production of chips using its 14nm FinFET fabrication process in 4Q19. The company CEO Liang Mengsong has revealed that the yield rate has reached mass production level. Since then, the company has been hard at work developing its next generation major node, which it is calling N+1. The technology has certain features that are comparable to competing 7nm process technologies, but SMIC wants to make it clear that N+1 is not a 7nm technology. (CN Beta, My Drivers, SMIC)

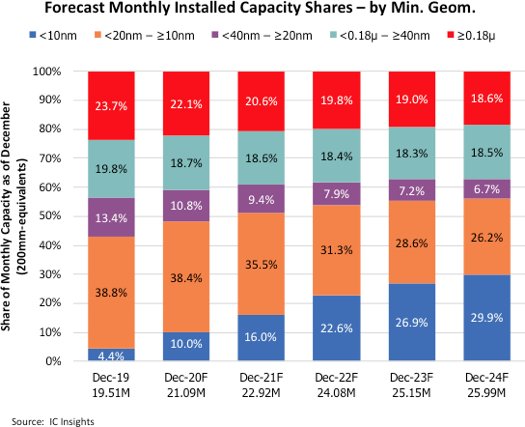

According to IC Insights, IC capacity for leading-edge (<10nm) processes is expected to grow and become the largest portion of monthly installed capacity across the industry beginning in 2024. At the end of 2020, <10nm capacity is expected to account for 10% of the IC industry’s total wafer capacity, and then is forecast to rise above 20% for the first time in 2022, and increase to 30% of worldwide capacity in 2024. (IC Insights, press, Laoyaoba)

To mass produce 3nm chips in 2022 as scheduled, Samsung is rumored to start a new EUV dedicated system LSI plant investment plan in its semiconductor subsidiary in Austin, Texas. This investment is as high as USD10B, and the monthly production capacity is about 70,000 pieces. Samsung Electronics is allegedly planning to establish EUV production systems in Hwaseong, Pyeongtaek, South Korea, and Austin, Texas, as a production base for chips below 7nm. (CNYES, Laoyaoba, China Times)

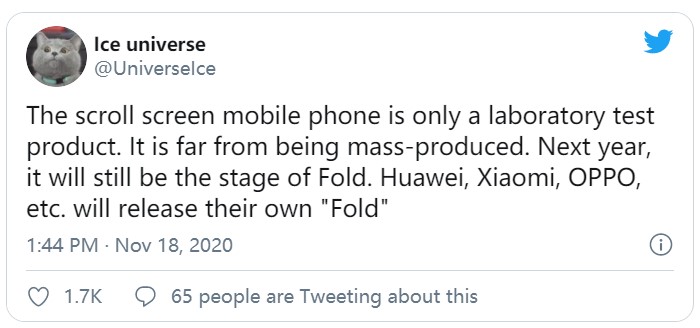

Samsung’s Vice Chairman Lee Jae-yong was apparently seen with a rollable prototype recently. Samsung may beat competitors launching a rollable handset in 1H21. (Phone Arena, Naver)

BOE has allegedly yet again failed to clinch a supply order from Apple for OLED panels. The company will now have to try again in 1H21, which means 2021 iPhone series will likely use panels made by Samsung Display and LG Display again. BOE’s B7 line at Chengdu, Sichuan province has failed Apple’s review for OLED supply. (Gizmo China, The Elec)

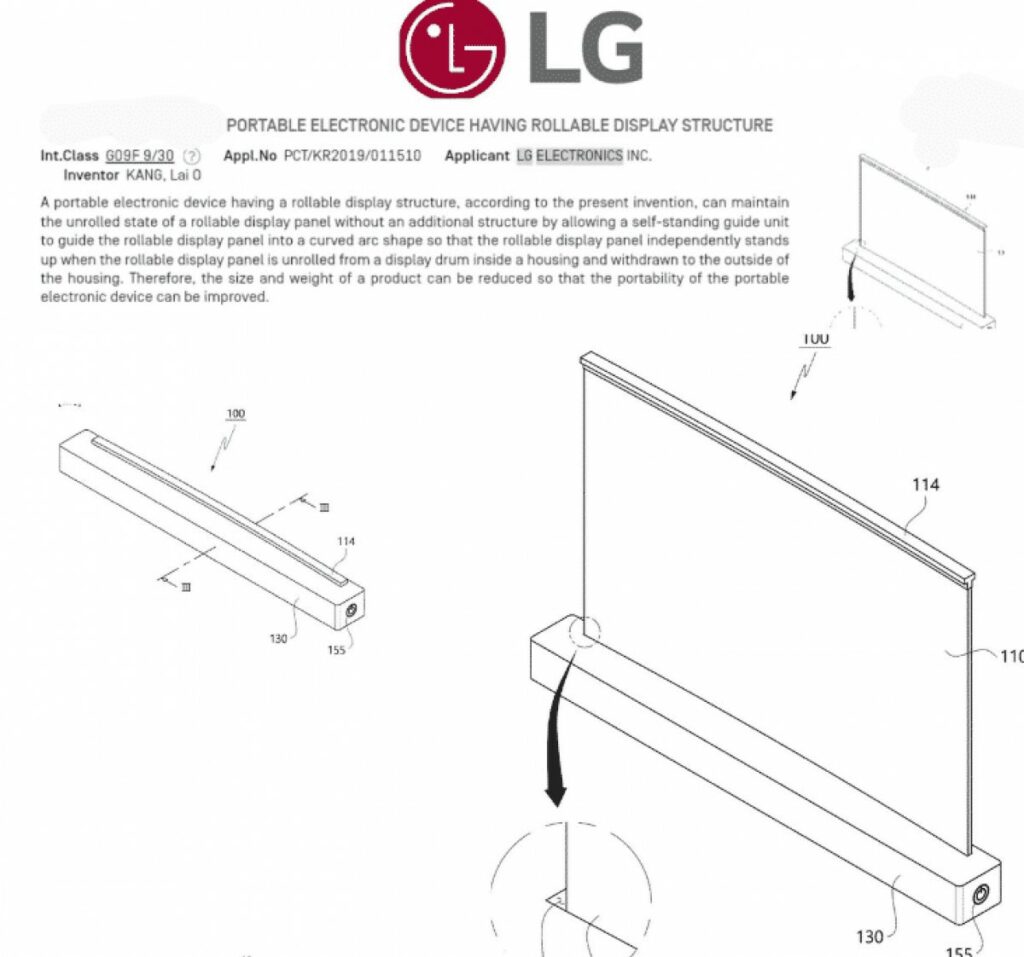

LG has patented a laptop with a rollable display. The laptop can be used anywhere between 13.3” to 17” just by rolling it. The laptop when unrolled resembles a soundbar. The patent mentions that the rollable display panel can independently stand up when the rollable display panel is unrolled from a display drum. (GSM Arena, Root MyGalaxy, GizChina)

OPPO X 2021 is a unique concept device with a rollable display. Its 6.7” panel can stretch up to 7.4” when needed. BOE vice president Yuan Feng has revealed that the rollable display is manufactured by BOE. In order to create seamless transition and “zero crease” panel, BOE provided the know-how to OPPO for zonal frame stacking so the rolling and stretching look as natural as possible. (GSM Arena, IT Home, Sparrow News)

Samsung Electronics has registered a trademark in Australia for ‘Samsung Quantum Mini LED’. The application is categorized as Class 9, with the following description: televisions; television display apparatus. It can be deduced from the name ‘quantum’ that this is a QLED variant. QLED is Samsung’s name for its LCD display panels with quantum-dot technology. (CN Beta, Sina, LetsGoDigital, World Today News)

Samsung is allegedly planning to use an under-screen camera (UDC) for the first time on the Galaxy Z Fold3, which is to be launched in 2H21. Samsung Display has developed a display that supports UDC. The gap between the pixels becomes wider to allow light to pass through. Even so, because the light is refracted by the OLED display layer, it needs a special algorithm to correct the image. The camera module is from Samsung LSI. (Gizmo China, ET News, GizChina, CN Beta)

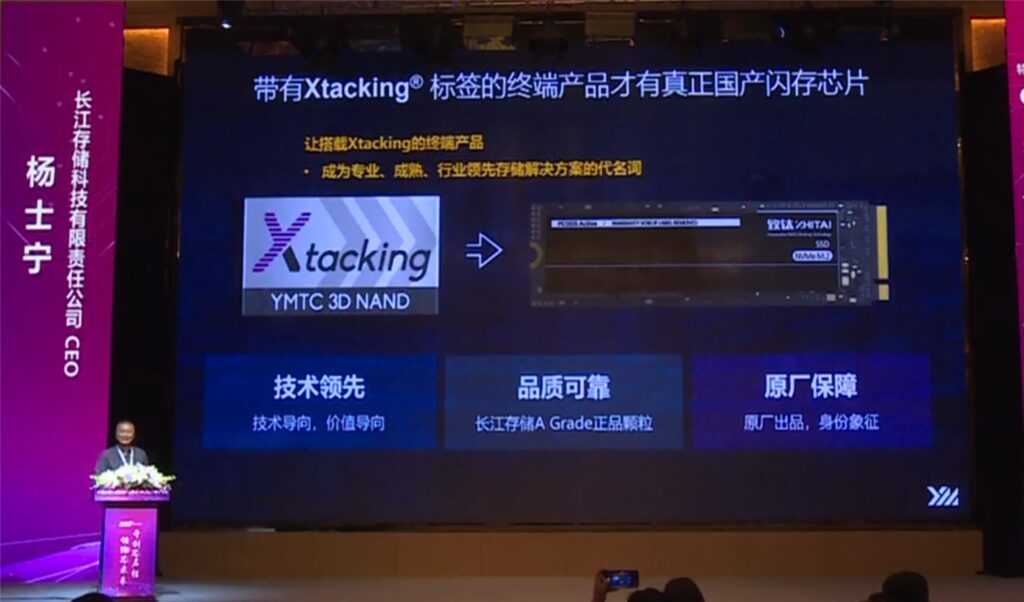

Yangtze Memory Technologies (YMTC) CEO Simon Yang has indicated that compared with major international storage companies, the company has achieved a leap from 32-layer to 64-layer to 128-layer in just 3 years. He has also confirmed that their 64-layer flash memory has been adopted by Huawei Mate40. (CN Beta, Sohu, IT Home, iPhone Wired)

Velodyne has announced its latest sensor, the Velarray H800 with a target price of just USD500. It is the first of Velodyne’s line of solid-state lidar sensors. It utilizes Velodyne’s proprietary micro-lidar array architecture (MLA) with multiple laser emitters. The H800 has a horizontal field of view of 120º and 16º vertical. The angular resolution which is critical to being able to detect objects at longer distances is dynamically variable from 0.1º to 0.25º. (CN Beta, Forbes)

Lidar startup Luminar has announced a partnership with Intel’s Mobileye to collaborate on self-driving car development. As part of the agreement, Luminar says it will work with Mobileye to use the former’s lidar for its robo-taxi pilot and first-generation driverless fleet in regions around the world, including Tel Aviv, Dubai, Paris, and Daegu City. (TechCrunch, Forbes, VentureBeat, Luminar, Reuters)

Apple will pay USD113M to settle probe on battery issues with old iPhones. The settlement is with 34 states that have sued the tech giant, led by Arizona, Arkansas and Indiana, for concealing its practices of throttling the performance of older iPhone models with degraded batteries from their owners. (Neowin, Washington Post)

Google is rolling out end-to-end encryption for RCS in Android Messages beta. For Android users outside China and Russia who use Android Messages, one-on-one chats will eventually be end-to-end encrypted by default, meaning neither carriers nor Google will be able to read the content of those messages. (The Verge, Google Messages, Engadget)

Fan Dian, chairman of Xiaomi’s AIoT strategy committee and general manager of the IoT platform department, has announced that Xiaomi will develop a new IoT operating system Vela. The Xiaomi IoTsystem can open up fragmented IoT applications, support cost-effective MCU devices, and natively support the Xiaomi Mixiang function. Watches, bracelets, speakers, smart home appliances, camera ISPs, sensors and other hardware will be interconnected in the future and integrated into a complete operating system. (My Drivers, OfWeek, Xiaomi, CN Beta)

Xiaomi has announced it sold more than 140M units of its Redmi Note series smartphones globally, with the Note 8 phones being the second best-selling in 1H20, according to Omdia. (GSM Arena, Seek Device, Weibo)

According to Statista, since the iPhone’s release in 2007, Apple’s system support cycle for the iPhone can be up to 6 years, including iPhone 5s, iPhone 6s/6s Plus, and iPhone SE; Models up to 5 years old, such as iPhone 4s, iPhone 5, iPhone 6/6 Plus, iPhone 7/7 Plus. Android phones generally only provide a system support period of 2 or 3 years. (My Drivers, 199IT, iPhone Wired)

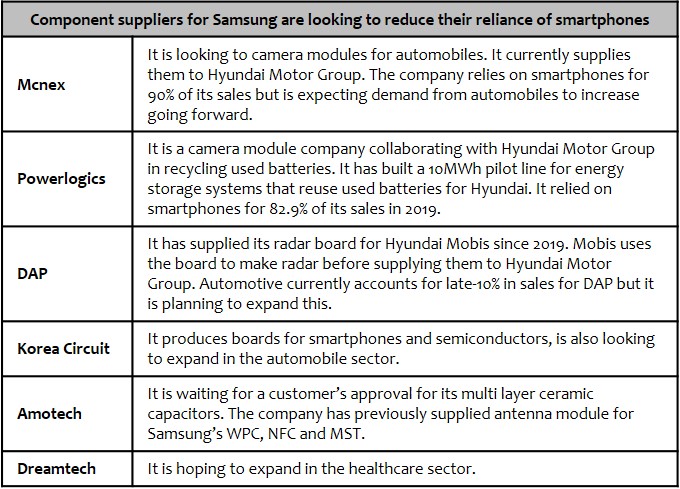

Component suppliers for Samsung Electronics are looking to reduce their reliance of smartphones. The smartphone market has matured while competition between the suppliers are intensifying, forcing them to look for new revenue stream elsewhere. (Gizmo China, The Elec)

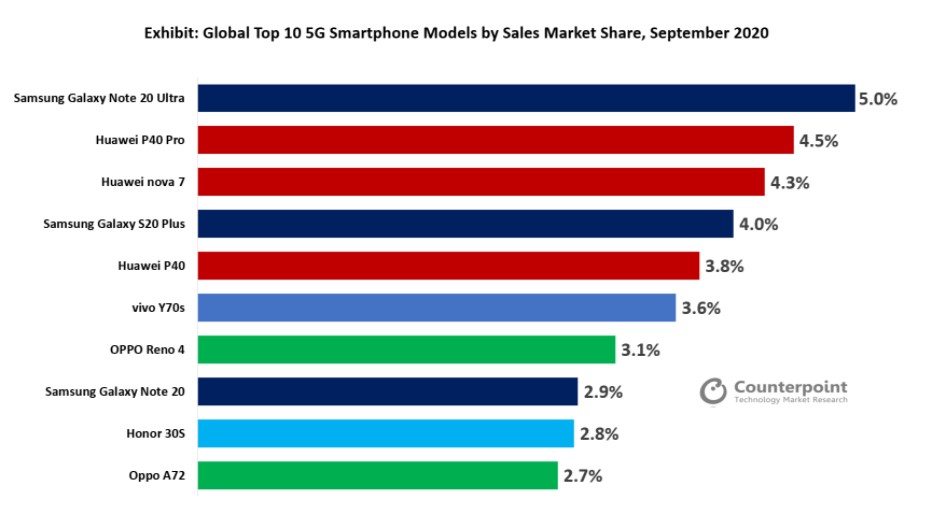

According to Counterpoint Research, Samsung Galaxy Note 20 Ultra 5G was the bestselling model globally in Sept 2020, capturing 5% share among all 5G models. Samsung Galaxy Note 20 Ultra beat Huawei P40 Pro 5G, which was the bestselling 5G model in Aug 2020. Out of the top 10 models, 7 are from Chinese OEMs, considering over 60% of the global 5G market is situated in China. (Counterpoint Research, GizChina)

Gionee M12 is unveiled in Nigeria – 6.55” 720×1600 HD+ HiD, MediaTek Helio A22 / P22, rear 48MP-5MP ultrawide-2MP macro-2MP depth + front 16MP, 4+64 / 6+128GB, Android 10.0, rear fingerprint scanner, NGN75,000 (USD196) / NGN85,000 (USD223). (GSM Arena, Gionee, Gizmo China)

realme 7 5G is announced in UK – 6.5” 1080×2400 FHD+ 120Hz HiD, MediaTek Dimensity 800U 5G, rear quad 48MP-8MP ultrawide-2MP macro-2MP depth + front 16MP, 6+128GB, Android 10.0, side fingerprint scanner, 5000mAh 30W, GBP279 (USD303). (GSM Arena, Gizmo China)

vivo S7e 5G is launched in China – 6.44” 1080×2400 FHD+ AMOLED u-notch, MediaTek Dimensity 720 5G, rear tri 64MP-8MP ultrawide-2MP depth + front 32MP, 8+128GB, Android 10.0, fingerprint on display, 4100mAh 33W, CNY2398 (USD365). (Gizmo China, vivo, IT Home)

According to IDC, in 3Q20, China’s tablet market shipped approximately 6.9M units, a year-on-year increase of 21.7%. The increase in demand brought about by the Covid-19 and the large-scale purchase of census items have enabled the Chinese tablet market to record the highest year-on-year growth rate in a single quarter since 2014. Among them, the shipment of Slate Tablet (traditional straight tablet) is about 3.34M units, a year-on-year decrease of 11.6%; Detachable Tablet (supporting official keyboard tablets) shipped approximately 3.57M units, a year-on-year increase of 87.9%. (CN Beta, IDC)

Amazon has announced an upgraded model of its Echo Frames smart glasses, adding better sound quality, longer battery life, and new colors. Furthermore, the new Echo Frames are now available for anyone to buy, as the company transitions the Alexa-equipped glasses from a “Day One Edition” invitation-only device to a full-fledged product. (The Verge, Amazon)

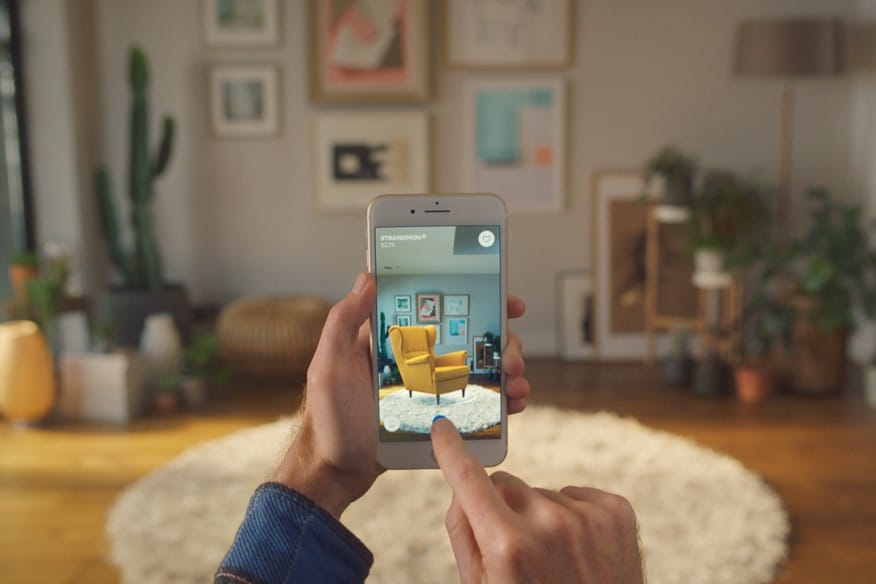

Mike Rockwell, Apple’s head of augmented and virtual reality, talks about AR’s future, saying that “AR has an enormous potential” provided its implementation is successful. Allessandra McGinnis, its senior product manager for AR has revealed that the company will be working together with the blind and partially sighted communities to improve specifically on the people-detection side. Layering AR with real-world locations and popping up experiences automatically, while making creative tools and developing assistive tech based on AR’s capabilities, could, in the long run, become the biggest killer apps. (CN Beta, Sina, CNET, iPhone Hacks)

IBM has acquired Instana, a German-American software firm that specializes in developing application performance management software. The acquisition represents IBM’s continued investment in hybrid cloud, big data, and AI capabilities. (VentureBeat, IBM, TechCrunch)

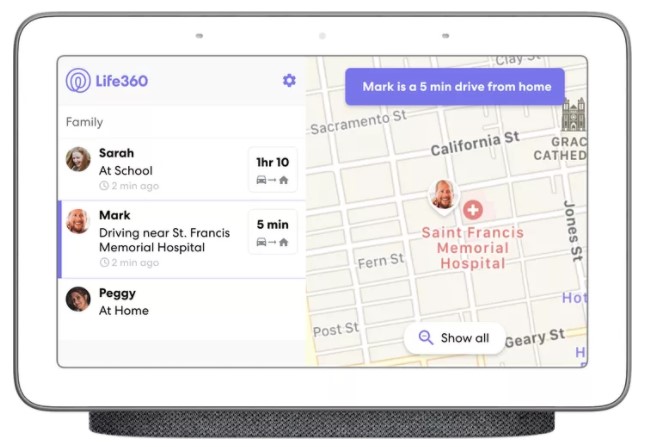

Google has announced new family-oriented updates for Assistant and Fi. The first of the new features is Family Notes. Users will be able to add a sticky note (reminders or to-dos) to the main screen for everyone to see. Another interesting feature that has been added to Google Assistant is the ability to ask where family members are. (CN Beta, Android Police, XDA-Developers, Gizmo China, The Verge)

Google has announced a major relaunch of Google Pay—which formerly was a relatively simple tap-to-pay app but will now be a complete financial service. After about 5 years in the market, Google Pay now has about 150M users in 30 countries. Google is also partnering with 11 banks to launch a new kind of bank account in 2021. Called Plex, these mobile-first bank accounts will have no monthly fees, overdraft charges or minimum balances. (Engadget, Google, The Verge, TechCrunch, Ars Technica, Engadget, Business Wire)

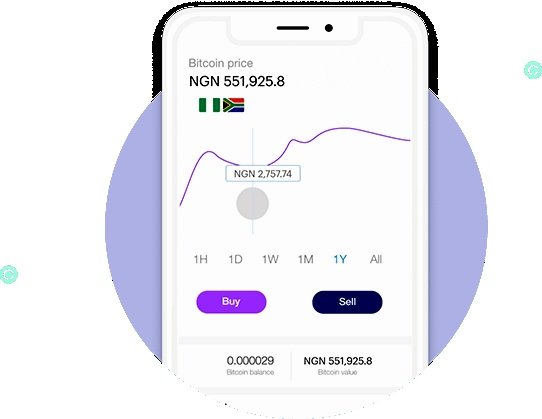

African cross-border fintech startup Chipper Cash has raised a USD30M Series B funding round led by Ribbit Capital with participation of Bezos Expeditions. The company offers mobile-based, no fee, P2P payment services in seven countries: Ghana, Uganda, Nigeria, Tanzania, Rwanda, South Africa and Kenya. (TechCrunch, Tech Cabal)

PayPal is expanding its fundraising efforts with the launch of the Generosity Network. Unlike the PayPal Giving Fund, which helps people support charities through online donations, the new Generosity Network lets people raise money for themselves, other individuals in need, or organizations like a small business or a charity. (CN Beta, PayPal, TechCrunch, CNET)