12-2 #Cold: Qualcomm unveils Snapdragon 888 featuring Qualcomm’s 3rd generation Snapdragon X60 5G modem; Samsung Electronics may discontinue its premium Galaxy Note phone in 2021; etc.

Qualcomm unveils Snapdragon 888 featuring Qualcomm’s 3rd generation Snapdragon X60 5G modem. Qualcomm has completely re-engineered the Hexagon processor, which now delivers 26 TOPS. For comparison, the S865 is rated at 15 TOPS while Apple advertises 11 TOPS for the M1. The new processor will power the flagships of 2021 from a host of manufacturers including Xiaomi, Samsung, LG, and Sony. (Android Authority, Gizmo China, GSM Arena, EE Times)

Apple’s certain models like the iPhone 12 Pro are still in short supply. The primary reason for the lack of inventory is the shortage in some key ICs for the device. These components are crucial for the handset, which cannot be assembled due to supply constraints. (Gizmo China, UDN)

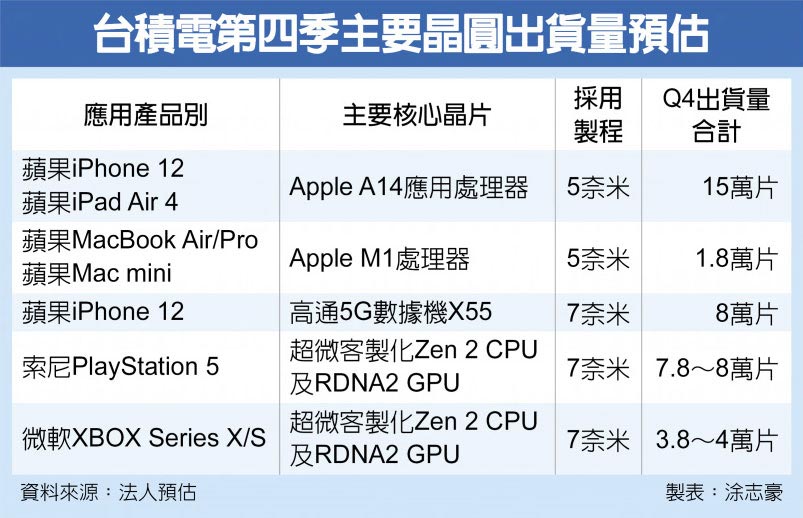

Thanks to major customers such as Apple, Qualcomm, and Advanced Micro Devices (AMD), the 7nm and 5nm advanced processes are fully loaded, and the production yield has been significantly improved. TSMC’s 4Q20 consolidated revenue to exceed the high expectations of performance and even continued to record highs. TSMC has stated that TSMC’s 4Q20 7nm and 5nm chips will be shipped at full capacity, and the obvious improvement in the yield rate will positively help chip prices and gross profit margins. (CN Beta, CSIA)

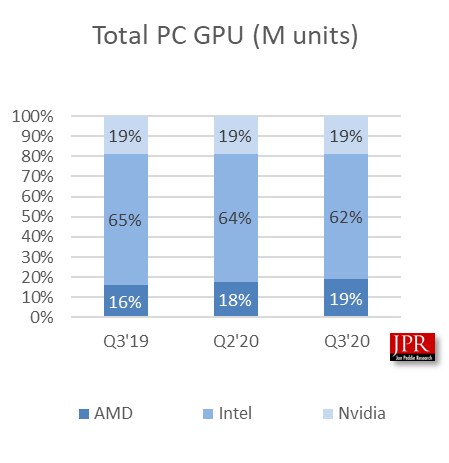

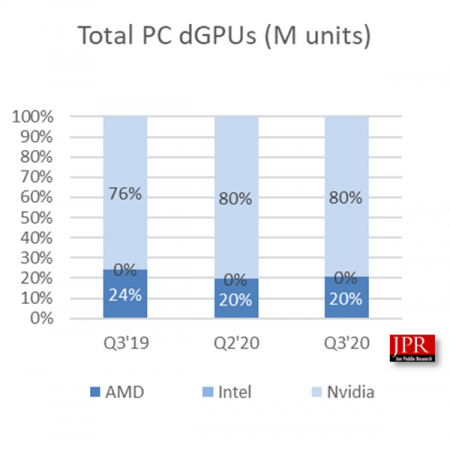

According to Jon Peddie Research, before 2020, the PC market was showing signs of improvement and settling into a new normal. The pandemic has distorted all models and predictions. AMD’s GPU market share in 3Q20 from last quarter increased by 1.3%, Intel’s decreased by 1.4%, and Nvidia’s market share increased by 0.09%. Overall GPU shipments increased by 10.3% from the last quarter. (Jon Peddie Research, Sina, CN Beta)

AWS has announced the launch of AWS Trainium, the company’s next-gen custom chip dedicated to training machine learning models. It can offer higher performance than any of its competitors in the cloud, with support for TensorFlow, PyTorch and MXNet. It will be available as EC2 instances and inside Amazon SageMaker, the company’s machine learning platform. (TechCrunch, Amazon)

Infineon Technologies has announced Singapore as its base for developing artificial intelligence applications for its global operations. The company will initially invest SGD27M (USD20.2M) to establish the AI hub over 3 years, said Chua Chee Seong, president and managing director of Asia-Pacific operations. Over 1,000 of the chipmaker’s staff will be taught AI skills, with an aim of launching 25 projects in the emerging technology by 2023. (Laoyaoba, Straits Times, Singapore Business, Asia Nikkei)

Huawei’s first domestic chip plant is located in the Optics Valley Center of Wuhan, with a total construction area of 208,900 square meters. The construction includes FAB plant, CUB power station, PMD software factory and other supporting facilities. The chip factory would help Huawei build a smart world with the Internet of Everything, and truly realize the complete industrial chain of chips from design to manufacturing, packaging and testing, and investment in the consumer market. (CN Beta, My Drivers)

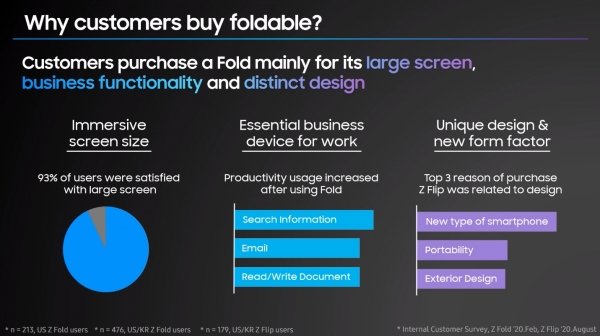

According to Lee Jong-min, the Executive Director of the planning team at Samsung’s mobile division, foldable phones will enable growth in the “saturated smartphone market”. He adds that foldable phones will become thinner and lighter in the future. The Folds will take over as Samsung’s premium phone line-up. (GSM Arena, The Elec, Twitter, Android Authority, Sam Mobile)

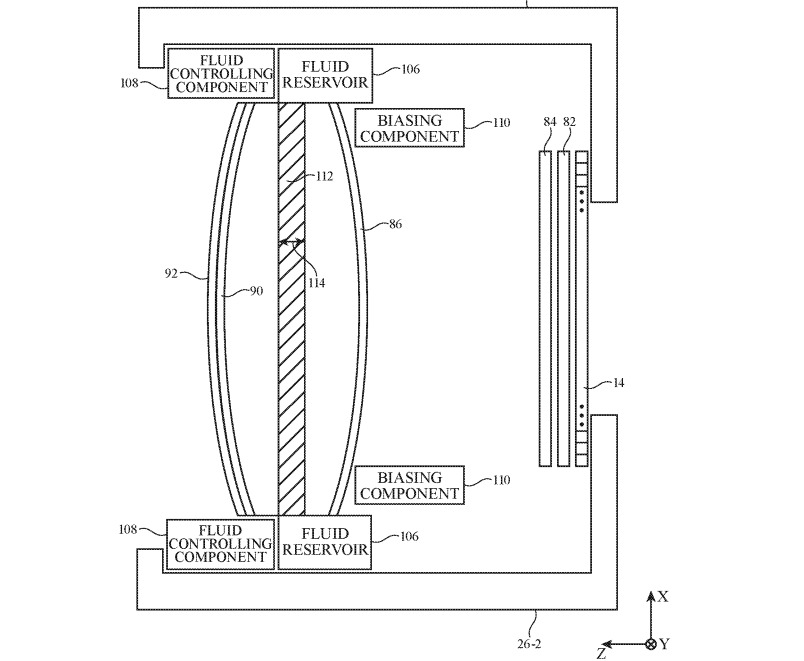

Apple’s patent titled “Electronic device with a tunable lens” suggests the problem of lens selection and switching could be mitigated by using a single lens system. One that takes advantage of fluid and pressure to adjust a more malleable lens quickly and with relatively little user effort. It is a series of lens components around a central fluid chamber that can be inflated and emptied by a connected pump and reservoir. (Apple Insider, USPTO, CN Beta)

Hongli Zhihui has held the official commissioning ceremony of the first phase of the Mini/Micro LED display project in the Guangzhou headquarters park. The project is carried out in 2 phases. The investment of the first phase is about CNY150M. The project plans to invest in 50 production lines. After reaching full capacity, it can produce 20,000 75” TV backlights per month, and the production capacity of P0.9mm RGB direct display products can reach 1,000 square meters per month. (Laoyaoba, LED Inside, Sohu)

AWS has launched a new hardware device, the AWS Panorama Appliance, which, alongside the AWS Panorama SDK, will transform existing on-premises cameras into computer vision-enabled super-powered surveillance devices. With AWS Panorama, tasks that have traditionally required human inspection to improve visibility into potential issues can be automated. (Amazon, TechCrunch)

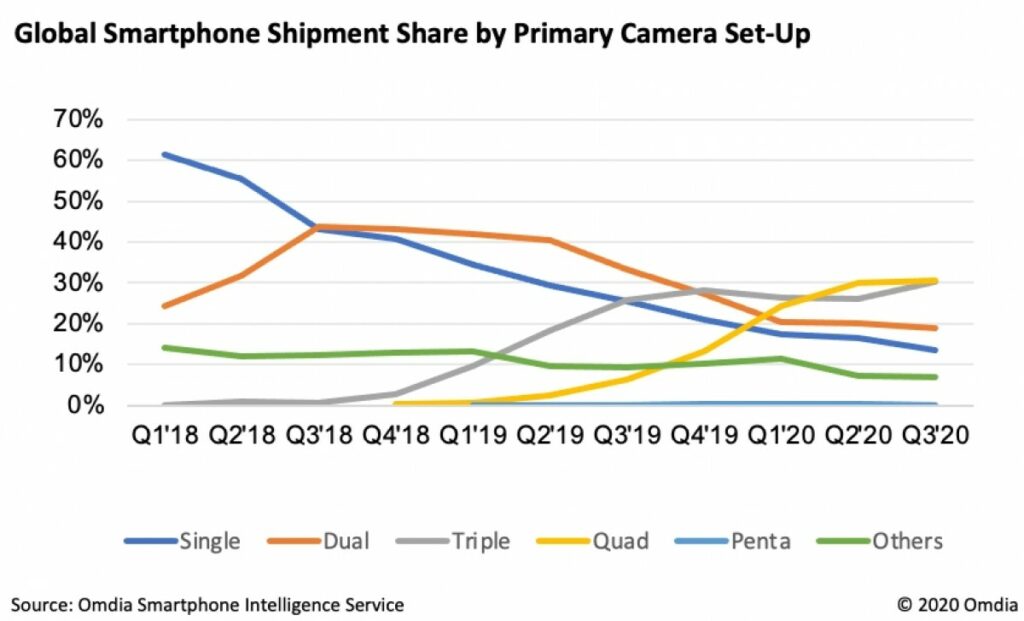

According to Omdia, quad-camera smartphones are most popular among consumers in 2020, surpassing the triple cameras solution — nearly 60% of all shipments were of smartphones with four cameras in 3Q20. Omdia has indicated that phones with multiple cameras are no longer considered premium – the feature has become a necessity even in mid-range to low-priced smartphones. (GSM Arena, Omdia)

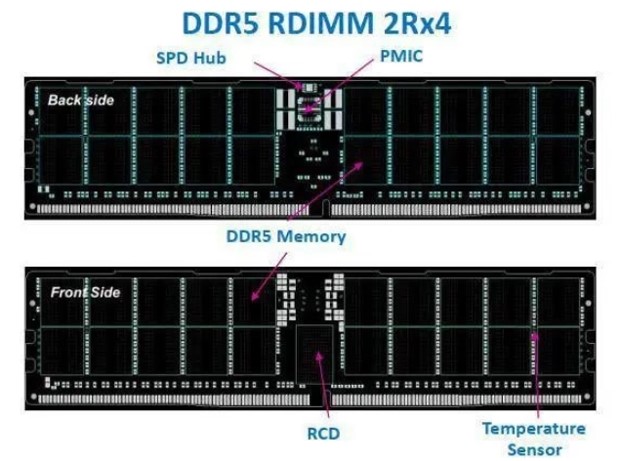

Powev Electronic Technology owns 2 memory brands—Gloway and Asgard. The company has announced that it is actively deploying the introduction of DDR5, and will be the first to mass produce DDR5 in Pingshan, Shenzhen in 2021. Currently Powev is actively communicating with chip manufacturers to introduce and develop a new generation of DDR5 memory technology. At the same time, it is preparing to configure a DDR5 production line. It is expected to launch a single 16GB DDR5 memory module in 2Q21. (CN Beta, My Drivers, Sina)

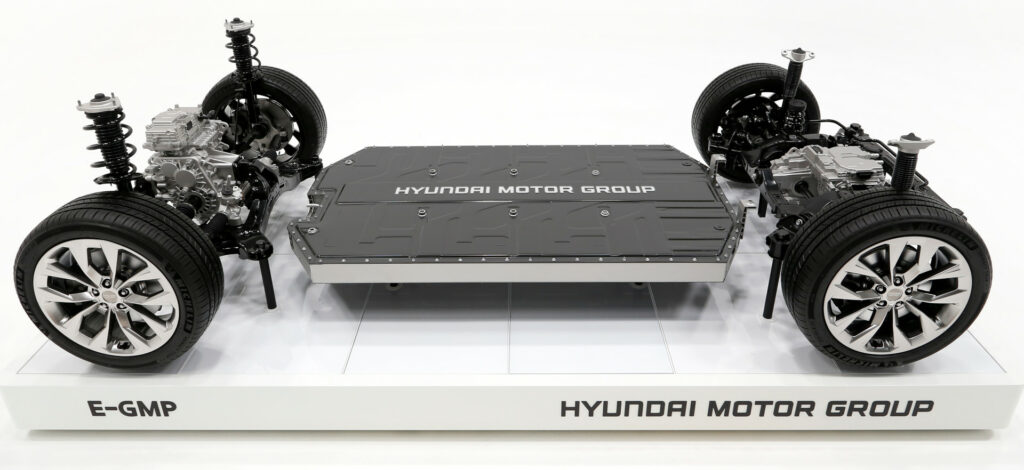

Hyundai Motor Group reveals E-GMP, its first dedicated BEV platform, for next-generation BEV line-up. BEVs based on E-GMP can provide range over 500km on a full charge (WLTP) and be charged up to 80% within 18 minutes through high-speed charging. High performance model based on E-GMP will accelerate from zero to 100kph in less than 3.5 seconds, with top speed of 260kph. Hyundai Motor Group plans to introduce 23 BEV models and sell 1M BEV units worldwide by 2025. (CN Beta, Motor1, Inside EVs, Hyundai)

Digital Secretary Oliver Dowden will say operators must stop installing any Huawei equipment in 5G networks from the end of Sept 2021 as the Telecommunications (Security) Bill has its second parliamentary reading. Bill comes alongside GBP250M (USD334M) strategy to diversify 5G telecoms market with plans for a world-class National Telecoms Lab and trials with Japanese vendor NEC. (CN Beta, Gov.UK, Market Watch, Telegraph)

Huawei has entered an agreement with Indonesia to develop talent in 5G technology and related fields. The company will assist in training 100,000 people to become proficient in digital technology, such as in the cloud and 5G sectors. Huawei will deploy its internal know-how in employee training, based on the memorandum of understanding. (Laoyaoba, Asia Nikkei)

Bosch set up the network together with Nokia. While Bosch defined use cases, Nokia provided 5G components. The two companies are jointly responsible for network planning, operation, and servicing. Bosch will gradually roll 5G out to our roughly 250 plants around the world. The locations where Bosch will be setting up 5G networks in the coming months include its research campus in Renningen, Germany. The company is also developing 5G-capable products and launching its first solutions for industrial use. (Laoyaoba, Bosch, Mobile Europe)

Reliance Jio has accelerated efforts to migrate its 4G feature phone users to smartphones and poach 2G users from rival telcos Vodafone Idea and Bharti Airtel. The 4G-only telco will soon roll out “Jio exclusive” smartphones through a partnership with vivo. Jio is currently also in talks with local players like Lava, Karbonn and other Chinese brands for similar partnerships. It is aiming to bring smartphones priced about INR8,000 or lower. (Gizmo China, Economic Times)

The president of ZTE Corporation Xu Ziyang has revealed that it will unify its 3 mobile brands in 2021. These 3 brands are ZTE, Nubia, and Red Devil / Red Magic. He has also announced that they plan to expand their offline retail presence by constructing up to 5000 retail stores across China. The company’s new “1+2+N” product strategy which will integrate phones, personal and family data, and a plethora of connected smart products that will also be linked to ZTE Cloud for a seamless 5G experience. (Sina, Gizmo China, Sohu)

As part of its long-running PRODUCT (RED) efforts, Apple reports that it has been supplying personal protective equipment to the Ministry of Health in Zambia. the company has announced that it has donated millions of units of personal protective equipment (PPE) to Zambia’s Ministry of Health. (CN Beta, Apple, Apple Insider)

Samsung has filed trademark “Samsung Smart Tag”, which will be employed in object tracking, interfacing with NFC, and RFID. The Smart Tag can also be used as an authentication device. (Gizmo China, Mac Rumors, Sam Mobile, LetsGoDigital)

Samsung Electronics may discontinue its premium Galaxy Note phone in 2021, a move that would reflect the sharp drop in demand for high-end smartphones due to the coronavirus pandemic. At present, Samsung does not have plans to develop a new version of the Galaxy Note for 2021. (CN Beta, Reuters, Android Authority)

ZTE Blade 20 Pro 5G is announced in China – 6.47″ 1080×2340 FHD+ AMOLED u-notch curved edge, Qualcomm Snapdragon 765G, rear quad 64MP-8MP ultrawide-2MP macro-2MP depth + front 20MP, 8+128GB, Android 10.0, fingerprint on display, 4000mAh 18W, CNY2,798 (USD425). (GSM Arena, ZTE, Gizmo China)

ZTE Axon 20 5G Extreme Edition is announced in China – 6.92” 1080×2460 FHD+ OLED 90Hz camera under display, Qualcomm Snapdragon 765G, rear quad 64MP-8MP ultrawide-2MP macro-2MP depth + front 32MP, 12+256GB, Android 10.0, fingerprint on display, 4220mAh 30W, CNY3,498 (USD532). (GSM Arena, ZTE, Gizmo China)

Samsung sold 11.8M smart TVs worldwide in 3Q20, the best ever quarter by Samsung or any other vendor, according to Strategy Analytics. Samsung’s 3Q20 performance means that there are now more than 155M Tizen OS smart TVs in use around the world, an increase of 23% in the past year. The global market for connected TV devices as a whole (including smart TVs, media streamers and games consoles) reached 81.3M units in 3Q20, an increase of 19% YoY, representing a strong recovery after two quarters of flat or declining sales during the peak of the COVID-19 pandemic. (Laoyaoba, Strategy Analytics)