1-10 #SecondHome : Sony has announced the world’s first cognitive intelligence televisions; QuantumScape has completed over 1,100 test cycles of its solid-state battery; General Motors (GM) has debuted a new logo; etc.

Sony has announced the world’s first cognitive intelligence televisions. The new BRAVIA XR televisions include MASTER Series Z9J 8K LED, MASTER Series A90J and A80J OLED, and X95J and X90J 4K LED. Powered by the Cognitive Processor XR, the brain of the new BRAVIA XR, the televisions use a completely new processing method designed to replicate the ways humans see and hear. (Laoyaoba, GSM Arena, Engadget, Sony)

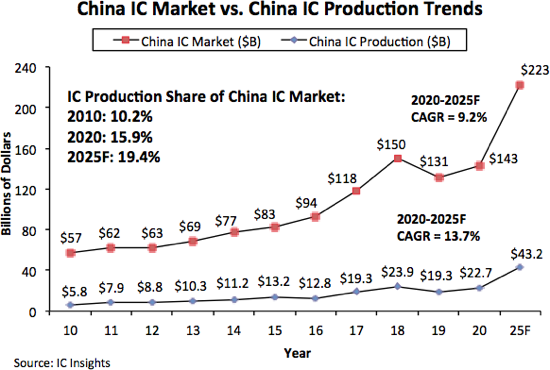

As IC Insights has oftentimes stated, although China has been the largest consuming country for ICs since 2005, it does not necessarily mean that large increases in IC production within China would immediately follow. IC production in China represented 15.9% of its USD143.4B IC market in 2020, up from 10.2% 10 years earlier in 2010. Moreover, IC Insights forecasts that this share will increase by 3.5ppt. from 2020 to 19.4% in 2025 (a 0.7ppt. per year gain on average). Of the USD22.7B worth of ICs manufactured in China in 2020, China-headquartered companies produced only USD8.3B (36.5%), accounting for only 5.9% of the country’s USD143.4B IC market. (IC Insights, GizChina)

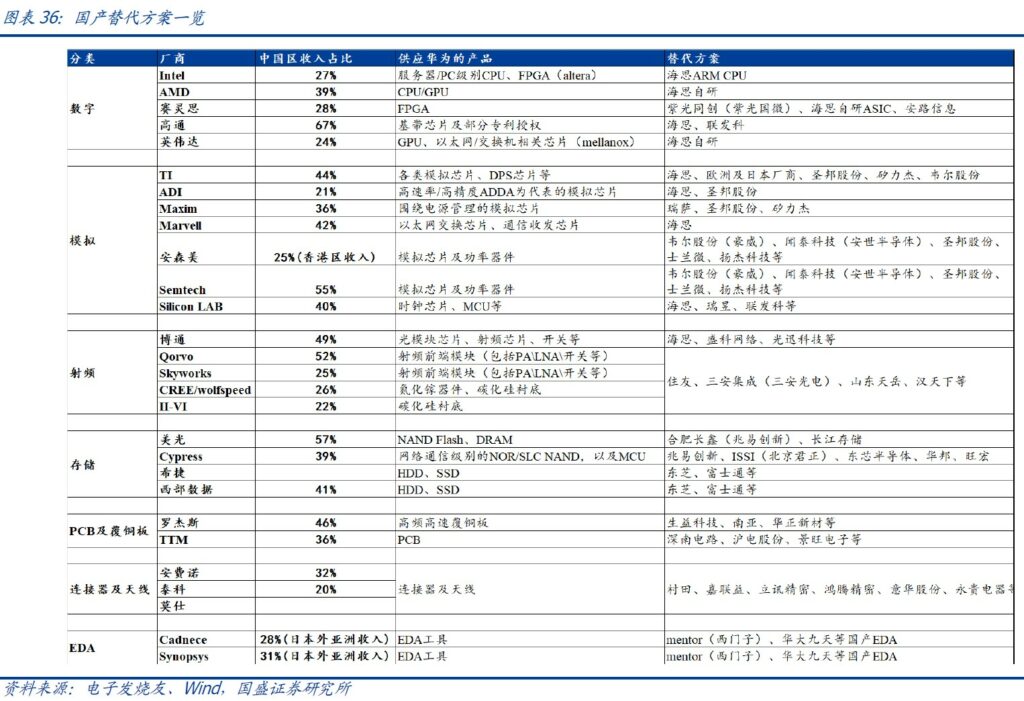

The historic opportunity for China’s domestic replacement has opened, and it would be officially realized in 2019-2020. It is expected to continue to accelerate in 2021. Entering 2021, Guosheng Securities expects that with the acceleration of localization and the upward trend of industry cycles, leading A-share semiconductor companies are expected to continue their high growth performance. (Guosheng Securities report)

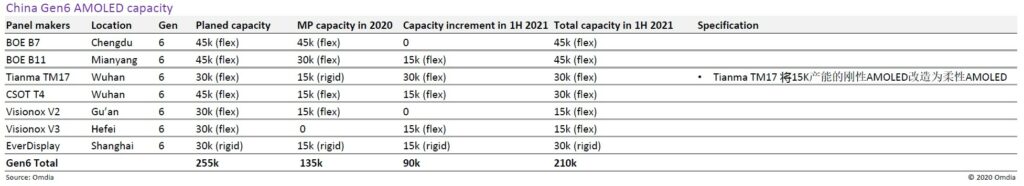

According to Omdia, in 1H21, China’s Gen-6 AMOLED production capacity will increase by 90K large subtrates per month. (Omdia report, Omdia report)

According Omdia, due to the impact of COVID-19, lower-priced in-cell TFT LCD displays grab shipment shares. However, on-cell AMOLED displays almost have no growth in 2020. (Omdia report, Omdia report)

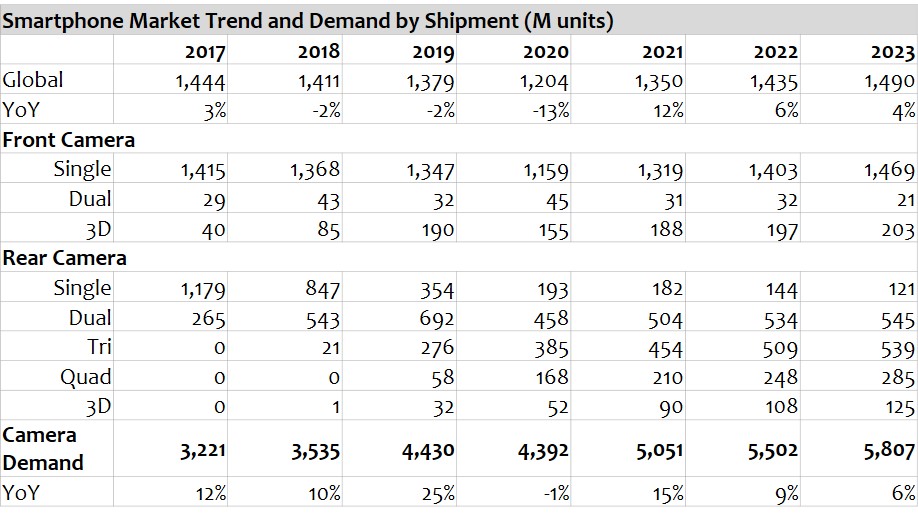

Based on Omdia’s forecast data, the global smartphone market will grow by 12% in 2021, and the demand for cameras will grow by 15% to 5B, but the overall growth will slow down from 2022. (Omdia report, Omdia report)

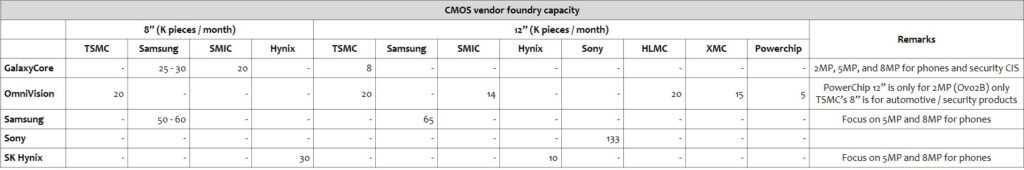

After Huawei ban, OPPO and Xiaomi quickly responded by increasing the layout of low and medium-end overseas products and stocking up on low and medium-end cameras in 4Q20, resulting in a tight suppy for 5MP and 8MP. Since Dec 2020, various suppliers began to adjust their price strategies. Samsung has increased the cost by 40% since Dec 2020, while other suppliers have generally increased by about 20%. Due to the shortage of 4G SoC, the demand of each company will decline. Part of the stock in 4Q20 will be sluggish. It is expected that part of the stock will be digested in 1Q21. (Omdia report, Omdia report)

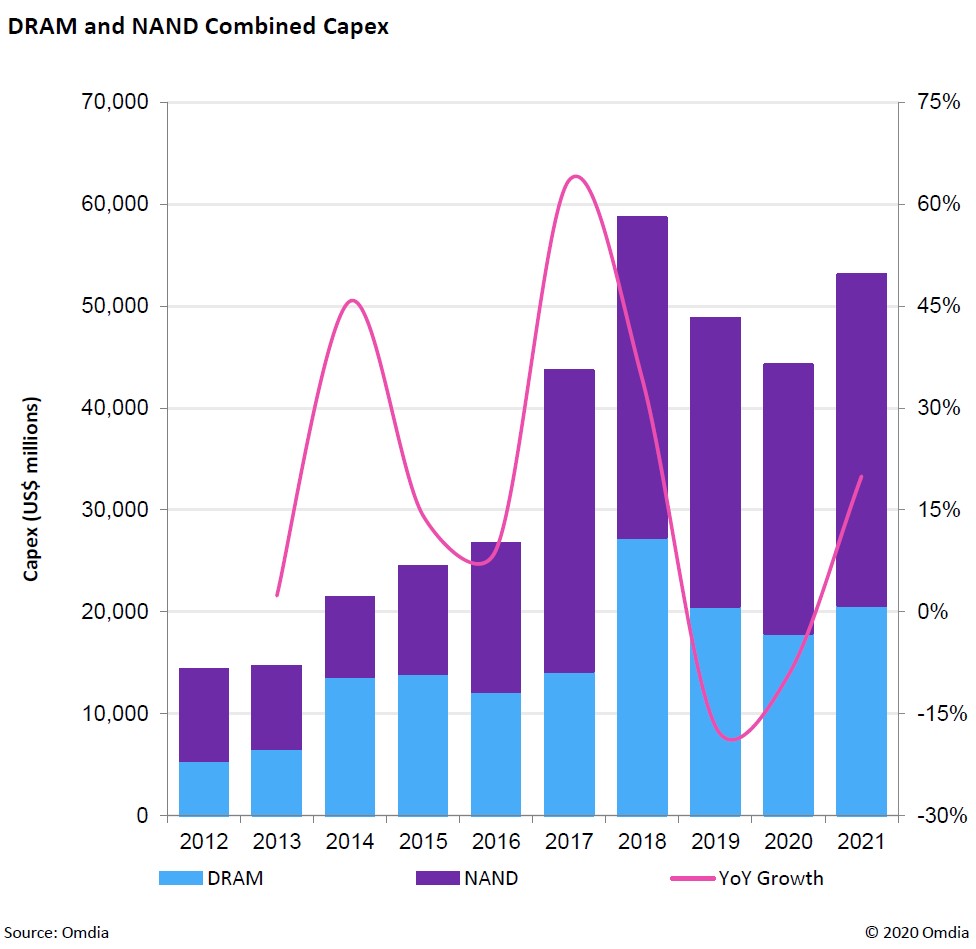

2020 memory capex is projected to fall once again due to the heavy losses that took place in 2019, as well as the effects of COVID-19 in 2020, but 2021 will be a return to capex growth. Capex has been revised upwards for 2021 as NAND capex is expected to increase as NAND competition increases. (Omdia report, Omdia report)

QuantumScape has completed over 1,100 test cycles of its solid-state battery, corresponding to real-life usage of 300,000 miles for a 300-mile battery pack and 500,000 miles for a 500-mile battery pack. The company claims that its battery has retained over 80% of its capacity, equating to a Coulombic Efficiency (CE) – a ratio of the total charge extracted from the battery to the total charge put into the battery over a full cycle – of over 99.991%. (CN Beta, WCCFTech)

Although in 2020, the impact of the Covid-19 on the China domestic mobile phone market has gradually eased, under the combined effect of multiple internal and external factors, the development of the Chinese market in 2021 will be full of more uncertainties. IDC predicts the future from the perspective of market supply and demand and technological development, aiming to help industry partners predict future opportunities and resist potential risks. (IDC, 199IT, Laoyaoba)

Sony has announced two new wireless home speakers – the SRS-RA5000 and SRS-RA3000. Both speakers are designed with providing a room-filling sound in an indoor setting and feature Sony’s proprietary 360 Reality Audio feature. Both speakers feature Bluetooth and Wi-Fi connectivity, and have Amazon Alexa and Google Assistant. RA5000 is priced at EUR599 and RA3000 is priced at EUR359. (GSM Arena, Sony, Engadget)

EV automaker Nio unveils its latest EV model, the ET7 sedan. The ET7 will start at CNY448,000 (USD69,000) if buyers opt for the standard 70kwH battery pack. However though if customers opt for the CNY980 (USD150) / month “battery services” subscription, the starting price drops to CNY378,000 (USD58,375). (Engadget, CN Beta, My Drivers)

General Motors (GM) has debuted a new logo meant to convey the automaker’s renewed commitment to the production and sale of electric vehicles. The company is also launching a new marketing campaign to underscore that commitment. (The Verge, Motor Trend, CNBC, Leiphone)

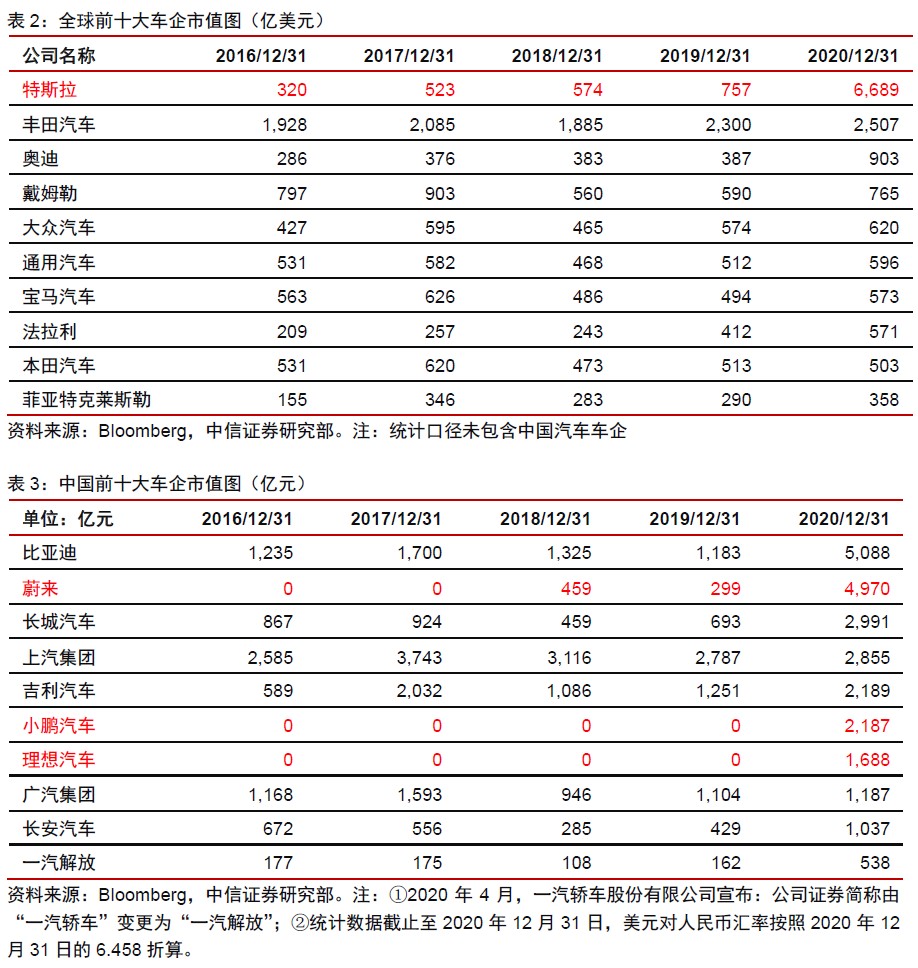

Tesla is the world’s largest auto company by market value, and Nio, Xpeng, and Li Xiang have entered the top 10 auto companies in China by market value. As of December 31, 2020, Nio, Xpeng and Li Xiang are the 2nd largest, 6th largest and 7th largest auto companies in China by market value, respectively. The combined market value of the 3 companies amounts to CNY884.5B (USD135.6B). (CITIC Securities report)

IEA data shows that in 2019, global sales of new energy vehicles reached 2.2M units, with a penetration rate of 2.4%. Moody’s predicts that the global penetration rate of new energy vehicles will further increase in 2020-2025, from 4.8% in 2020 to 13.7% in 2025. According to Marklines data, China’s new energy vehicle sales in 2019 were 1.206M, with a penetration rate of 4.68%; China’s new energy vehicle sales are expected to reach 1.3M in 2020, a year-on-year increase of 8%. (CITIC Securities report)

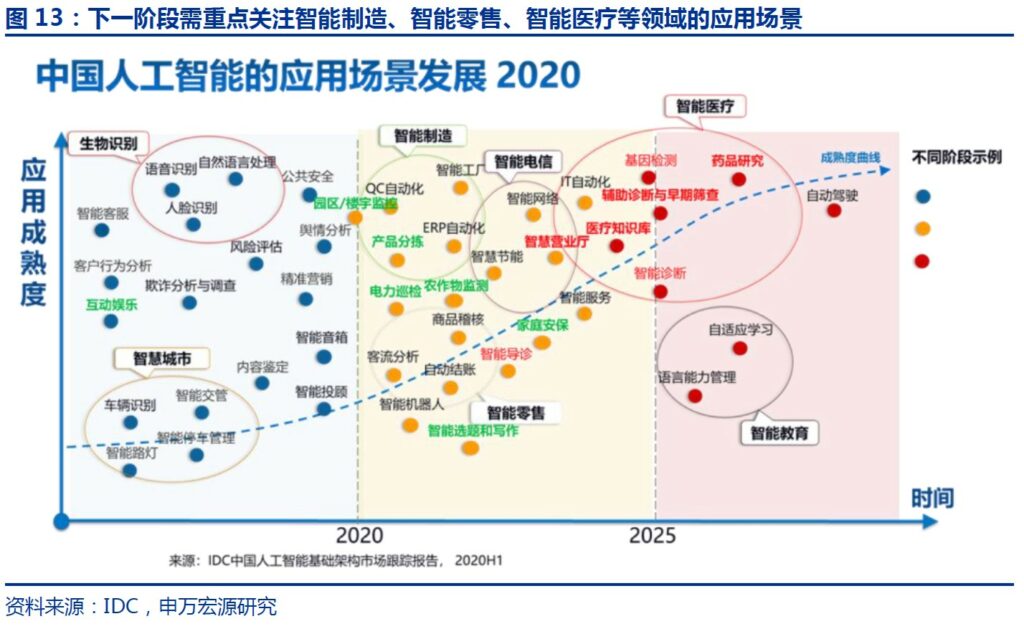

According to IDC, combined with the current industrial layout of the 4 key applications of machine vision, SWS Research has the following judgments on the commercialization of AI: 1) Biometrics, smart cities, smart finance and other fields have been widely used. Apparently, smart cities and smart finance Application maturity and market space still have great upside potential; 2) Smart retail and smart manufacturing are expected to focus on the next stage; 3) Smart healthcare and smart education have great long-term growth potential, but it will take a long time cultivation and accumulation, it is estimated that it will take about 5 years to usher in the application peak. (SWS Research report)

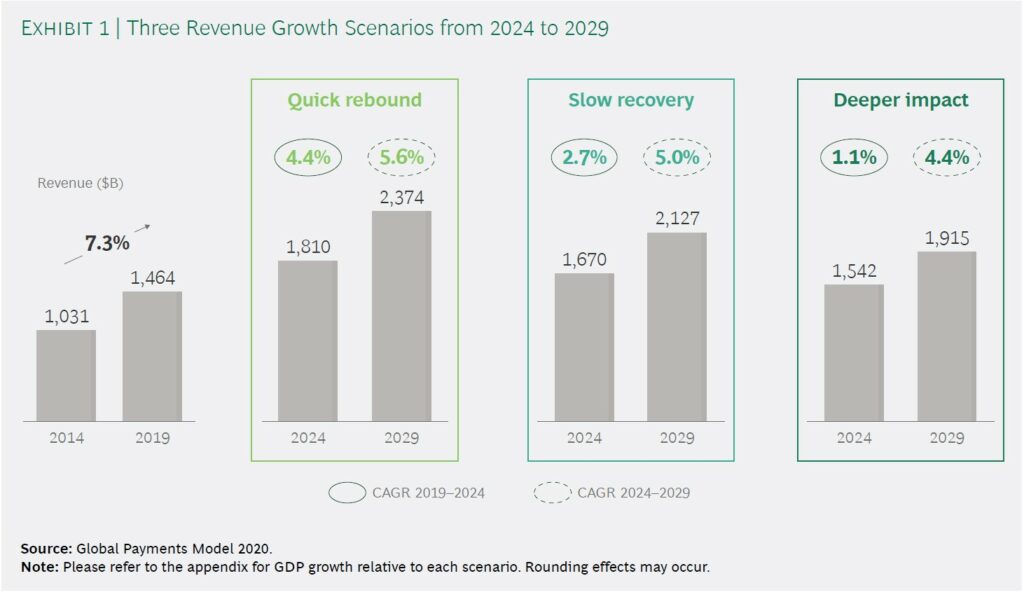

Given the uncertainty surrounding the still unfolding pandemic and questions about subsequent waves of infection, Boston Consulting Group’s payments forecast includes 3 revenue growth scenarios based on global GDP development. Under a quick-rebound scenario, their outlook suggests that the global payments revenue pool will expand from USD1.5T in 2019 to USD1.8T in 2024, a compound annual growth rate (CAGR) of 4.4%. (BCG x Swift report)

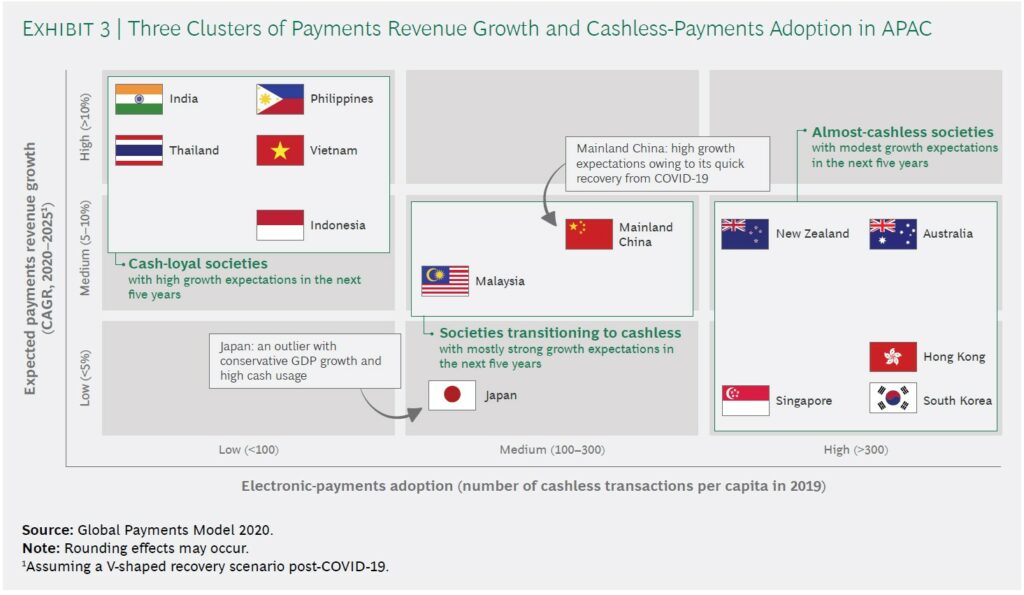

Given the region’s diversity, Boston Consulting Group sees markets falling into 3 broad clusters: (1) Almost-Cashless Societies; (2) Societies Transitioning to Cashless; and (3) Cash-Loyal Societies. (BCG x Swift report)

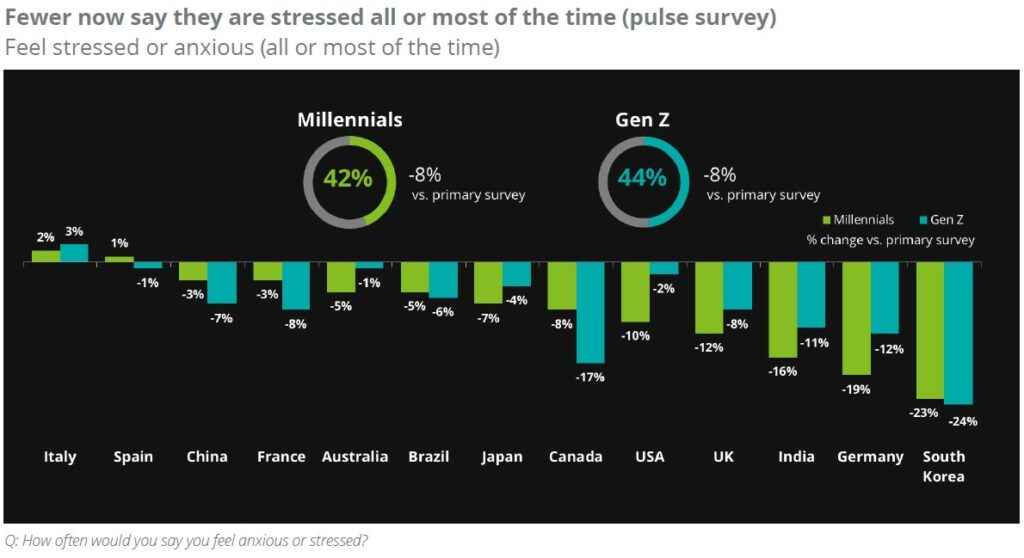

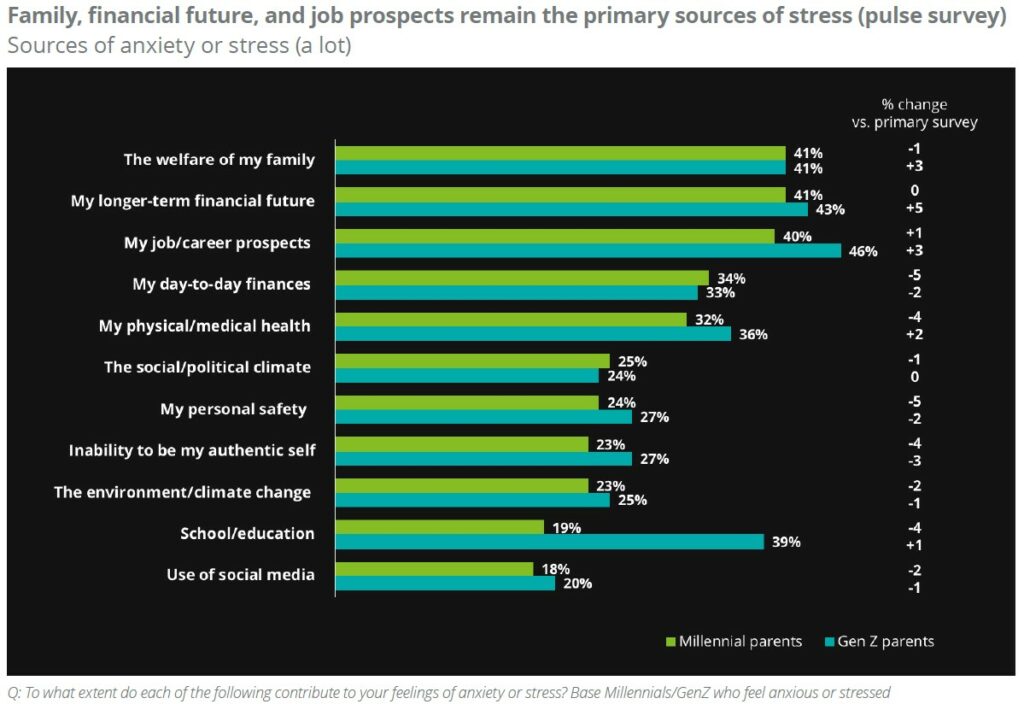

Based on Deloitte’s survey, Millennials and Gen Zs certainly had more concerns about their health, the welfare of their families, job prospects, and their long-tern financial futures after the onset of the outbreak of Covid-19. However the crisis also forced life to slow down. Many of those in white-collar jobs were now working from home, spending more time with immediate family and less commuting in traffic jams or on packed trains and subways. And though their jobs likely were affected in some way, most remained employed while also spending less. (Deloitte report)