1-24 #Weekends : Samsung Electronics has clinched its first order from Intel to manufacture Intel-designed chips; Samsung Display has filed a second patent lawsuit against JOLED in the US; Honor has reportedly picked KAIFA and BYD Electronic as its OEMs; etc.

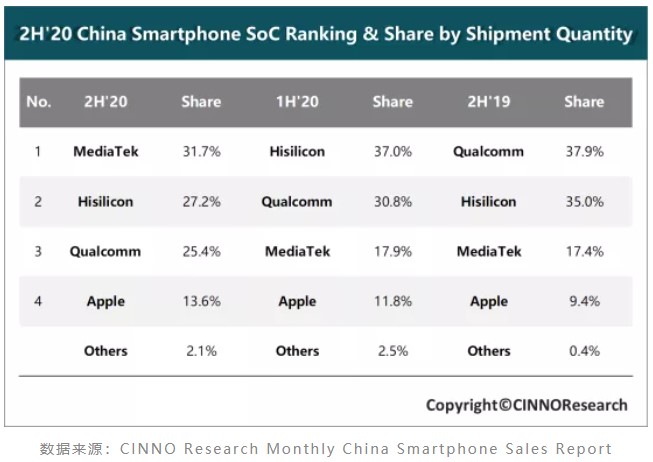

According to CINNO Research, smartphone processor shipments in the Chinese market would be 307M in 2020, a YoY decline of 20.8% compared to 2019. Qualcomm’s shipments in China’s smartphone market shrank as much as 48.1% YoY. HiSilicon’s shipments in 2H20 suffered a setback due to US sanctions, shrinking by 17.5% year-on-year, while MediaTek and Apple took advantage of the trend. In 2H20, MediaTek’s market share has shown explosive growth, rising to 31.7%, becoming the largest smartphone processor manufacturer in China’s domestic market for the first time. (CINNO, GizChina, IT Home)

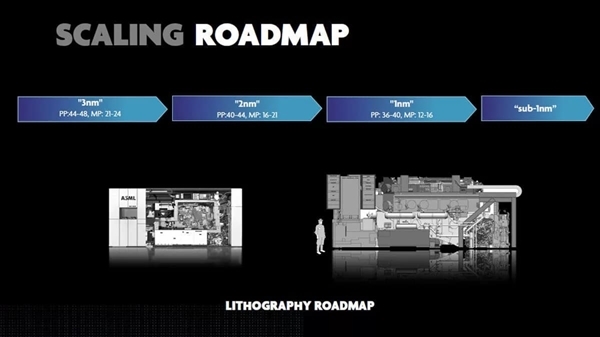

ASML has declared a next-generation high NA of the EUV lithography confidential to 2025-2026 to between Year Large-scale application means that it will be delayed. ASML ’s EUV lithography device is currently mainly NEX: 3400B/C series, NA numerical aperture is 0.33, and the next generation EUV lithography device is NEX: 5000 series, which can increase NA to 0.55, which means that the resolution of the lithography device is improved. of 70%. (CN Beta, Globe Newswire, Barron’s, Tip3X)

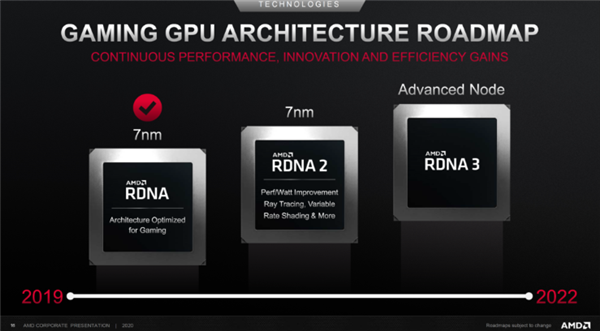

AMD’s next-generation graphics card should replace the RDNA2 in 2020 with the RDNA3 architecture, code-named Navi 3X. The flagship Navi 31 of the big core may use the MCM multi-chip architecture, twice the scale. The Navi 31 may adopt MCM multi-chip package design, consisting of 2 groups of chips, each with 80 groups of CU units, so that together is 160 groups of CU units, double the size and theoretically double the performance. (My Drivers, VideoCardZ, Aroged, Tech Powerup)

Samsung Electronics has clinched its first order from Intel to manufacture Intel-designed chips. Intel has recently outsourced production of its southbridge chipsets, which are installed on the computer motherboard and control all of the computer’s input and output functions. If the deal goes through, starting the second half of 2021, Samsung will manufacture 15,000 graphic chips for Intel at the Austin plant, which utilizes 14nm processing technology. TSMC is planning to manufacture Intel GPUs using a 4nm process. (CN Beta, Reuters, Korea Economy Daily, Korea Times)

The average selling price (ASP) of Qualcomm Snapdragon 8 series processors is around USD100, which is more than USD30 higher than ASP in the 4G era; while Qualcomm’s Snapdragon 7-series processors are less than USD45, but Cinda Securities expects the price of new products in 2021 would have an increase of USD10-20. In terms of radio frequency (RF) chips: the cost of the flagship Sub-6 solution has increased by about USD15 compared to the 4G solution. Even the low-end models that do not pursue full-band coverage have an increase of about USD5 compared to 4G. (Cinda Securities report)

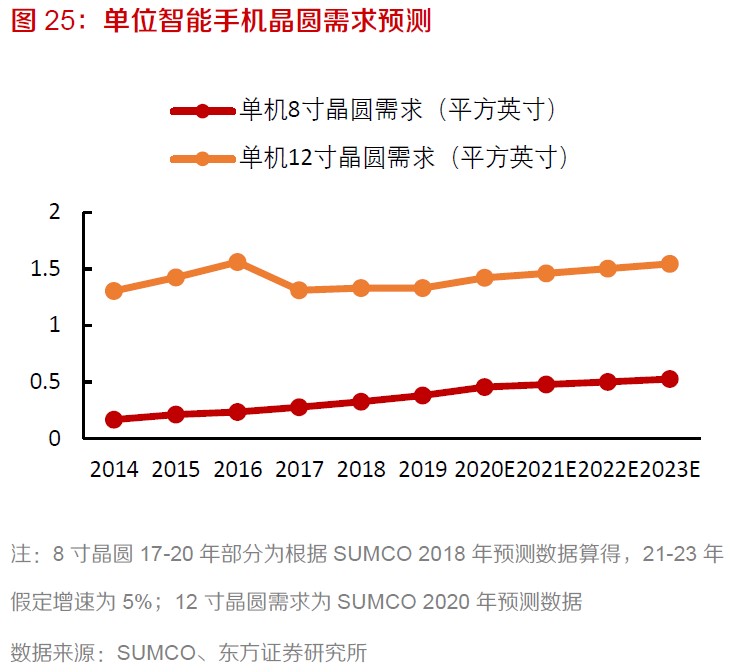

Due to the increase in PMIC, RFIC, and CIS usage of 5G phones, the demand for single 8” wafers will increase. In 2020, the demand for single 8” wafers for smartphones will be 0.45 square inches (calculated from SUMCO 2018 forecast data). Orient Securities assumes 2020-2023 the annual unit phone wafer demand growth rate is 5%, and the unit phone 8” wafer demand will reach 0.53 square inches in 2023. (Orient Securities report)

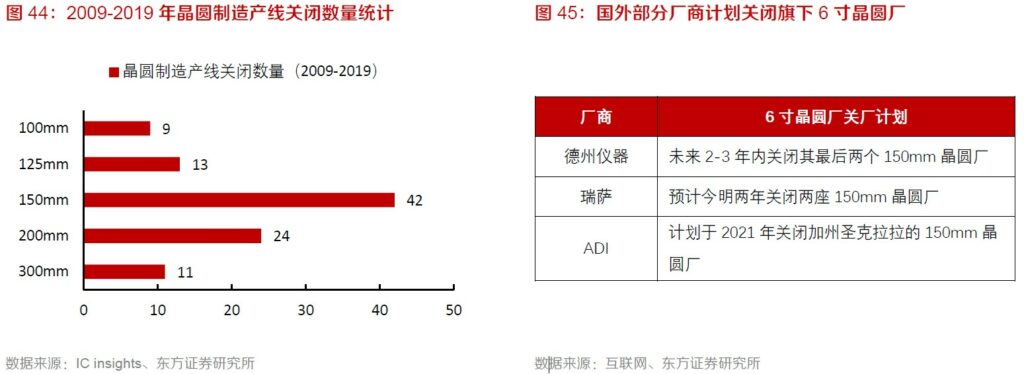

According to IC Insights, there are 64 fabs of 6” and below closed in 2009-2019. At the same time, manufacturers such as Texas Instruments, Renesas, ADI and others are currently planning close their 6” fabs in the coming 1-3 years. The shutdown of the 6” wafer production line will shift demand to 8” wafers, increasing the overall demand. On the other hand, driven by the Internet of Things and new energy vehicles, the demand for MEMS, sensors, and power discrete devices has increased, and the increase in product shipments has made the migration of wafer size from 6” to 8” deem more economical and more efficient. (Orient Securities report)

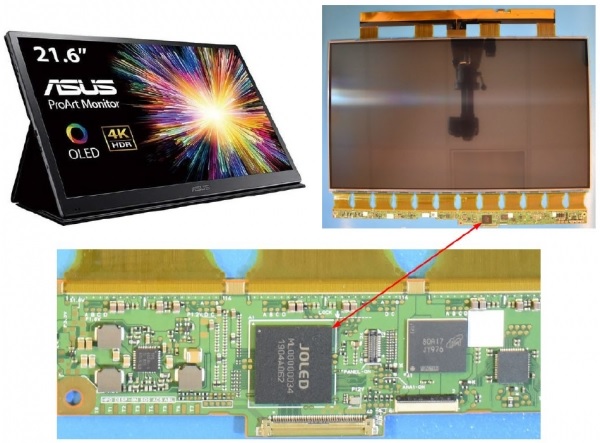

Samsung Display has filed a second patent lawsuit against JOLED in the US, claiming the latter violated its patents. Intellectual Keystone Technology (IKT), a US subsidiary of Samsung Display, filed the suit to the US District Court for the Western District of Texas, against JOLED and ASUS. (Laoyaoba, Gizmo China, The Elec)

Lumentum has agreed to acquire Coherent in a cash-and-stock deal valued at USD5.7B. Lumentum and Coherent are both focused on optical components—lasers—for a variety of different applications. (Laoyaoba, Coherent, Barron’s, Market Watch)

With the development of the camera technology, the periscope lens has become a high-power zoom solution for smartphones. The principle of the periscope lens is to place the telephoto lens that originally required a long channel vertically and horizontally, and then use a special optical prism to let the image light refracted to the image sensor of the telephoto lens. Thereby without increasing the thickness of the phone, the focal length of the camera can be greatly increased to make up for the lack of internal zoom and achieve a higher optical zoom. (Cinda Securities report)

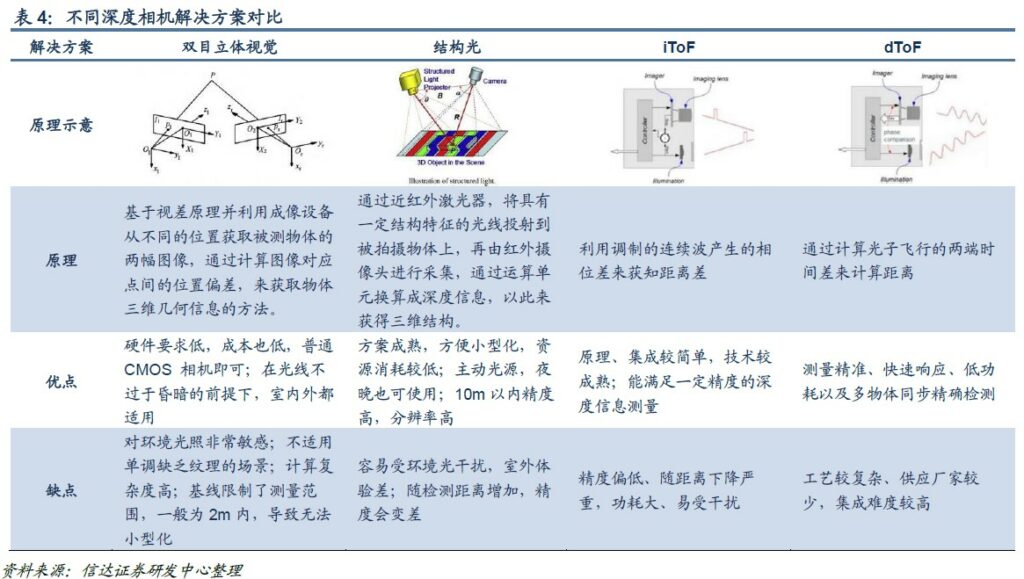

Current depth cameras can be divided into 3 types according to their working principles: time of flight (ToF), binocular stereo vision, and structured light. ToF can be divided into indirect time of flight (iToF) and direct measurement time of flight (dToF). (Cinda Securities report)

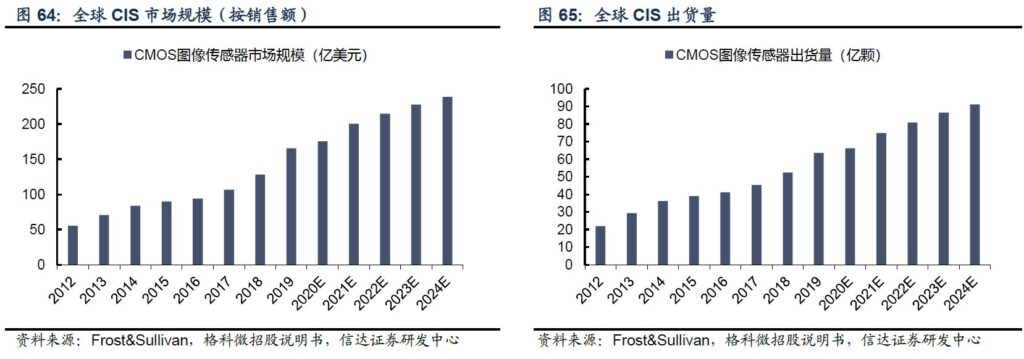

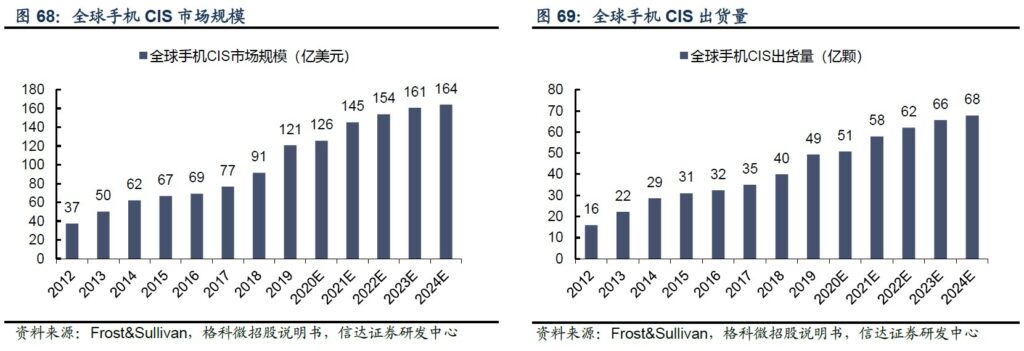

The mobile phone CIS market reached USD12.1B in 2019. Despite the impact of the epidemic in 2020, smartphone sales are flat, but the CIS market is still growing, with an estimated revenue of USD12.6B and shipments of 5.1B units. As the impact of the epidemic subsides, the phone market is back on track. Innovative applications such as multi-camera, high-resolution, periscope and depth cameras have become popular, and smartphone CIS growth has picked up. According to Frost & Sullivan’s estimates, the size of the phone CIS market in 2024 will reach USD16.4B, and shipments will grow to 6.8B units. (Cinda Securities report)

SK Hynix has begun to install EUV lithography machines at its M16 factory in Icheon, South Korea to mass produce 10nm 1a DRAM. The installation time of EUV lithography machine takes 3-6 months, so SK Hynix can mass produce the first products in 1H21 as soon as possible. (Laoyaoba, Korea Elec, Digitimes)

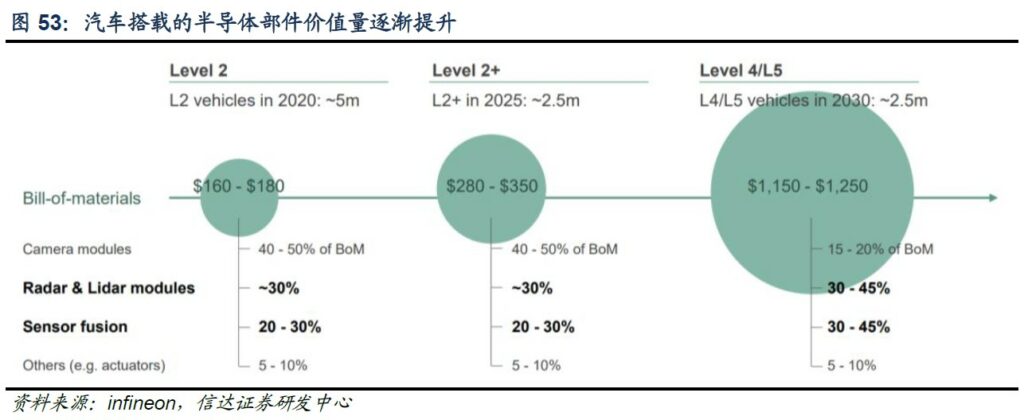

The increase in the level of autonomous driving will significantly drive the expansion of the on-board sensor market. According to Infineon’s data, the cost of L2 level single-vehicle sensors is between USD160-180, L2+ has nearly doubled the cost to USD280-350, and L4 -L5 level is as high as USD 1,150-1,250. With the increasing popularity of autonomous driving functions and the gradual leap from L0 to L2, the requirements for environmental perception are also increasing. There will be opportunities for car-mounted sensors to increase in volume and costs. (Cinda Securities report)

According to NXP, L1/2 level autonomous driving only requires 1 camera module, 1-3 ultrasonic radars and lidars, and 0-1 fusion sensors. The cost of the new semiconductors is USD100-350. For L3 level the cost of new semiconductors is about USD600, and to L4/5 level autonomous vehicles will introduce 7-13 ultrasonic radars and lidars, 6-8 camera modules, and V2X modules and multi-sensor fusion, thus the cost of the new semiconductor is more than USD1,000. (Orient Securities report)

Honor has reportedly picked KAIFA and BYD Electronic as its OEMs, the latter of which will produce more than 50M units of handsets. As early as many years ago, BYD Electronic started cooperation with Huawei to produce mobile phones for its OEM. (Laoyaoba, AA Stock, Sohu)

The U.S. International Trade Commission (ITC) has launched an investigation of a patent-infringement complaint Amphenol seeking to block imports of rival high-speed electrical connectors. Amphenol claims China-based Luxshare Precision “has engaged in unauthorized activities aimed at replicating Amphenol’s technology and diverting Amphenol’s customers away from Amphenol and to Luxshare instead”. (CN Beta, Laoyaoba, Reuters, ITC)

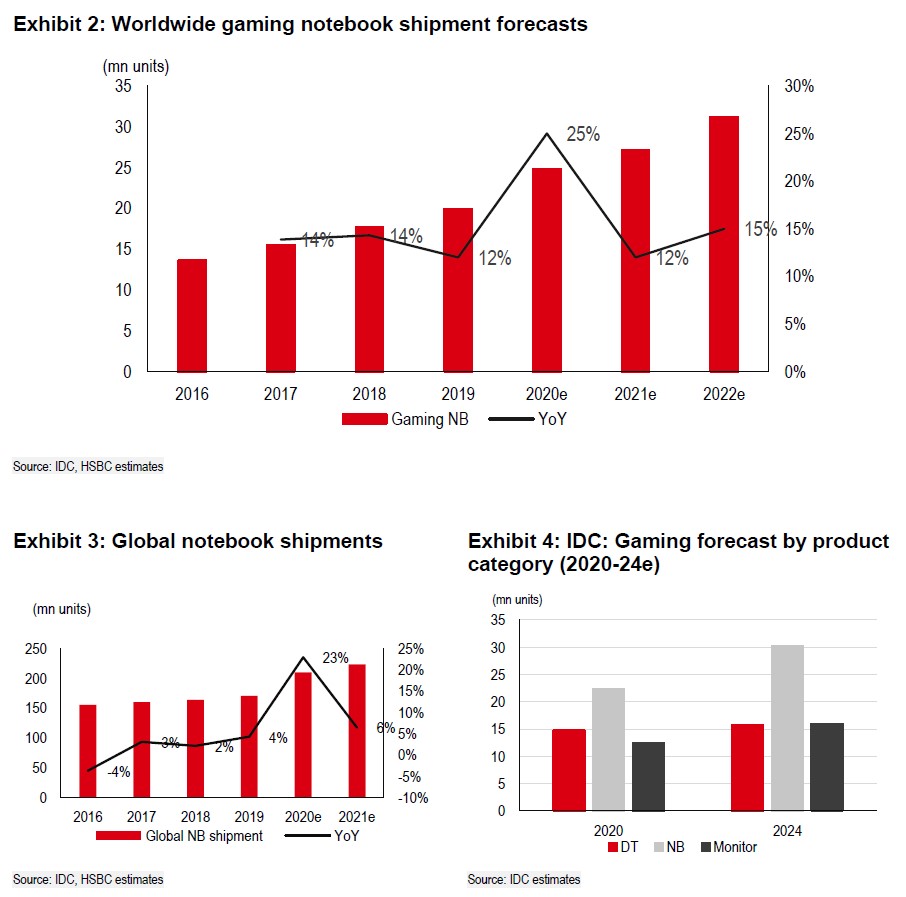

HSBC believes 2021 is likely to repeat the strong graphics card replacement cycle seen in 2016 when Nvidia released its GTX 10 series. They also forecast worldwide gaming notebook shipments to increase by a CAGR of 13% in 2021-2022, supported by the long-term growth in the gamer population, which leads to increasing hardware upgrade demand. Their 2021 gaming notebook shipment growth forecast of 12% is above their global notebook shipment growth forecast of 6% in 2021 and higher than IDC’s 2020-2024 gaming notebook shipment CAGR of 8%. (HSBC report)

Credit Suisse’s checks have indicated leading PC brands have set ambitious build plan targets in 2021 for an aggregated notebook (NB) units of 250-280M, on top of a higher 2020 base for shipments of ~210M, supported by the continued strength from various at-home activities for business continuity, eLearning and entertainment amid COVID-19, the continuing shift from desktop/AIO PC to NB, and potentially double booking. However, they believe the aggressive build plan for NB would be capped by component shortages, and expect total NB volumes to only grow 2-3% YoY, reaching ~220M in 2021, consistent their view for leading NB ODMs’ shipment growth. (Credit Suisse report)

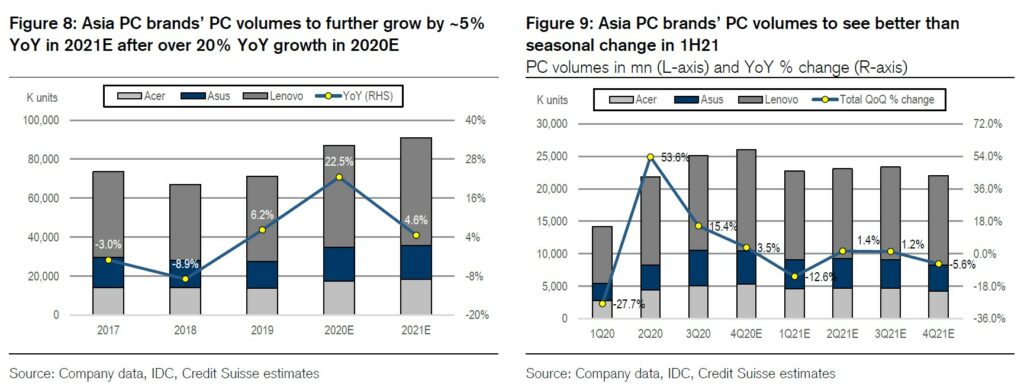

Credit Suisse has revised up PC shipment forecasts for Asia PC brands, including Acer, Asus and Lenovo by 5.5%, as they expect their total PC volumes to reach 91.1M in 2021, before some normalization in 2022 by -1.4% to 89.9M, supported by strength in NB and offset by continued softness in DT. They also expect their total PC units to trend ahead of seasonality in 1H21, although 1Q21 would still decline 13% QoQ, vs seasonality of a 15-20% QoQ decline, followed by a better 2Q21 pull-in on unfulfilled demand push-out. (Credit Suisse report)

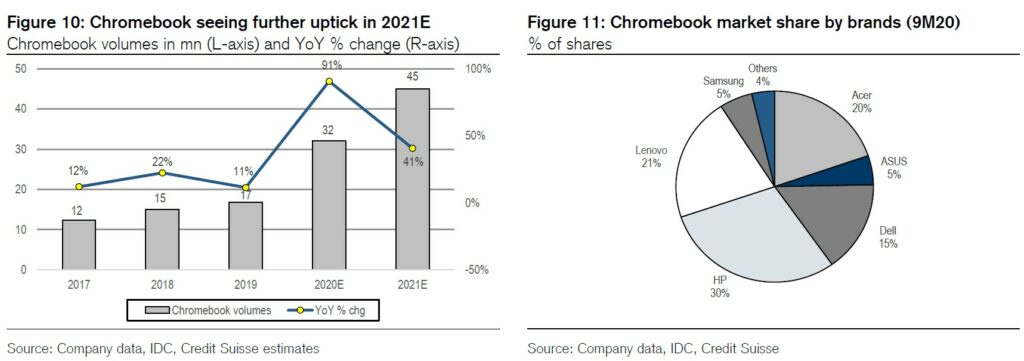

For 2021, Credit Suisse’s checks with leading brands, ODM, and component makers suggest the overall Chromebook build plan could exceed 60M units, up from 31-33M units in 2020 on growing educational TAM, continued learning-from-home demand and shipment push-off from 4Q20 due to component shortages. Nevertheless, they believe that a more realistic and achievable shipment target could be at 45-50M units, judging from the component constraints, while the potential resource optimization by allocating some critical components for Wintel NB could further drag down the volume to 40-45M units in 2021. (Credit Suisse report)

Huawei has announced 3 new health studies, including hypertension management, smart body temperature health, and coronary heart disease screening. Huawei is also developing the continuous body management technology based on smart wear and is conducting joint research on smart body temperature to achieve abnormal body temperature detection. (Laoyaoba, CN Beta, Huawei Central)

Pinterest is expanding its virtual makeup try-on capabilities with the launch of a new augmented reality (AR) feature that allows online shoppers to virtually try on new eyeshadow. Initially, Pinterest is allowing try-on with 4,000 shades from brands like Lancome, YSL, Urban Decay and NYX Cosmetics. (TechCrunch, Pinterest)

The industry’s first augmented reality (AR) technology standard drafted by SenseTime in collaboration with China Electronics Standardization Institute, Zhejiang University, OPPO, Xiaomi, Baidu, iQiyi and many other companies and research institutions are officially approved and released. (Laoyaoba, Sohu, 163)

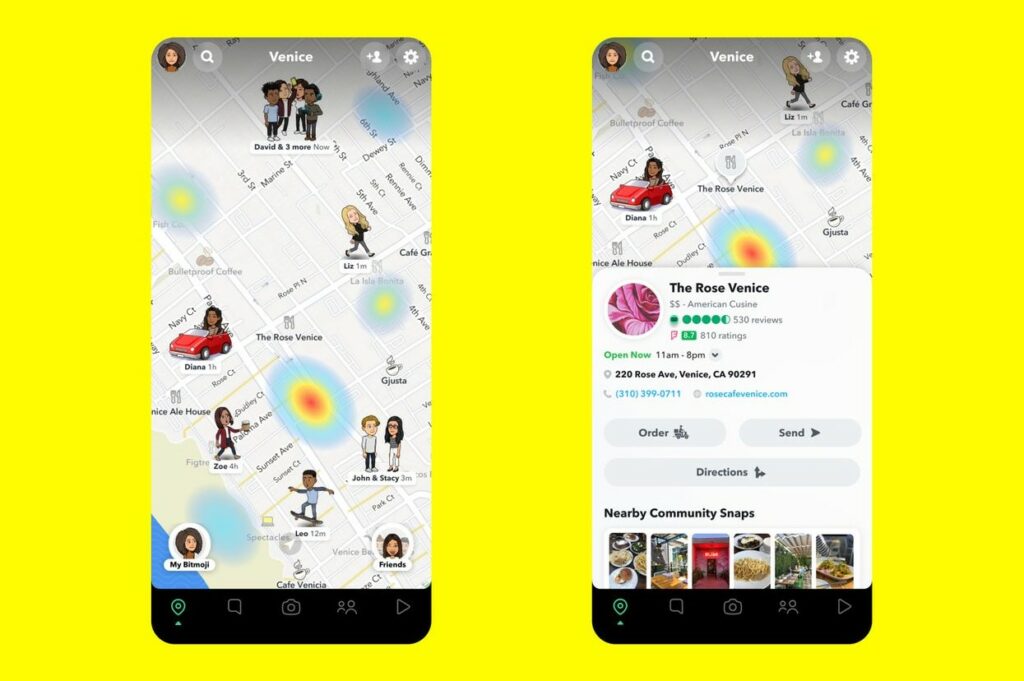

Snap is expanding in promising new directions. Snap has launched 15 different products and functionalities using augmented reality (AR) for businesses in just the first 9 months of 2020. Deutsche Bank analyst Lloyd Walmsley believes that in the next few years, the potential revenue of a single AR lens and AR filter advertising can reach USD4B, more than double the company’s total revenue in 2019. Snap’s Snap Map launched in 2017 also brought a lot of revenue. Jefferies analyst Brent Thill has said that Snap Map may be Snap’s most undervalued asset at the moment, and is expected to increase the company’s annual advertising revenue by USD1.5B by 2023. (CN Beta, Sohu, WSJ)

Tesla plans its India entry in 2021, it has taken a tax-friendly jurisdiction route. he company, which is setting up its research and development center in Bengaluru, is in touch with a few states, including Gujarat, to start India operations. (CN Beta, Reuters, Economic Times, India Times)

Huizhou, Guangdong held a signing event for the Alibaba Longmen Cloud Computing Center project, with a total investment of CNY13.2B. This is the 7th large-scale data center project in Huizhou since Apr 2020. (Laoyaoba, Huizhou.cn)