1-31 #ItNeverEnds : LG is collaborating with Qualcomm for the development of a 5G connected car platform; Samsung Display is planning to build a new production line for notebook OLED at its A4 factory in Asan; SK Hynix is moving chip facilities to China to meet rising customer demands and lower costs as well; etc.

Samsung’s last major in 2016 is acquiring audio and automotive giant HARMAN International Industries for USD8B. Samsung has announced its plan to become the world’s largest semiconductor firm by 2030 by investing USD115B. It is also considering building a USD10B chip facility in Austin, Texas in the US to fabricate 3nm chips. Samsung has said its capital expenditures in 2020 reached a total of KRW38.5T, up 43% from a year ago, which includes a KRW32.9T investment in semiconductors and KRW3.9T in spending on displays. (Android Headlines, Sam Mobile, Korea Herald)

Samsung Electronics has said a global semiconductor shortage that has hit global carmakers could also disrupt orders for the memory chips used in smartphones, as manufacturers rushed to respond to the crisis. This squeeze on foundries, and any subsequent slowdown in mobile device orders, could affect demand for its DRAM and NAND memory chips, which enable smartphones and tablets to perform multiple tasks at once. (CN Beta, Financial Times)

LG Electronics is collaborating with Qualcomm Technologies for the development of a 5G connected car platform. In 2019, the two agreed to strengthen the ecosystem of LG’s in-vehicle infotainment system called webOS Auto. (Gizmo China, Pulse News, Business Korea, CN Beta)

AMD could shift some of its GPU / APU production to Samsung. AMD wants to ramp up production, but TSMC is unable to keep up due to prior commitments. AMD could likely be one of the first companies to utilize Samsung’s upcoming 3nm facilities. (My Drivers, Notebook Check, Clien)

Samsung Display has revealed that it will develop new display form factors such as rollable and slidable to cement in leadership in 2021. Samsung Display will adopt technologies such as variable refresh rate and low-power to react against competitors entering the OLED market. Samsung Display initially aimed to end LCD production in 2020 but it is continuing to do manufacture them from requests of Samsung Electronics and other customers. (Android Authority, The Elec)

Samsung Display is planning to build a new production line for notebook OLED at its A4 factory in Asan. The line will have a production capacity of 30,000 substrates per month and will produce mid-sized OLED panels in the 18”-20” range aimed at notebooks. Orders for the equipment to be placed at the new production line will go out in the summer and placed inside within 2021 at the earliest and early 2022 at the earliest. It has previously modified its A2 and A3 production lines to use some of them to produce notebook OLED panels. (Laoyaoba, The Elec, OLED-Info)

An unexplained explosion occurred at AGC Fine Techno Korea in Gumi, North Gyeongsang Province, South Korea, causing 4 injuries. AGC Korea is a company established in Gumi Industrial Park by AGC, a subsidiary of Japan’s Asahi Glass, with an investment of USD500M in 2004. It mainly produces TFT-LCD glass substrates. (Laoyaoba, Teller Report, YC News)

Corning has disclosed it is expanding production at its 10.5G LCD glass substrate plants in China to meet stgrong demand for IT and TV applications. Corning said demand for large-size TVs remains robust, with 75” TV sales growing more than 60% in 2020. Corning said 10.5G glass offers the best efficiency in producing large-size TV applications, and its 10.5G lines in Wuhan and Guangzhou in China are expanding production to meet clients’ needed. (Digitimes, press)

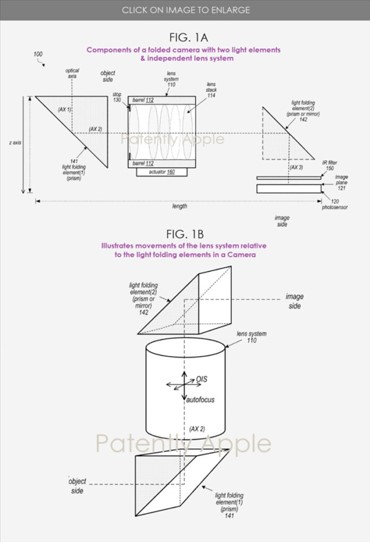

Apple has filed a patent titled “Periscopic Camera Module” that features two light folding elements and a lens system located between these two elements. Furthermore, the lens system itself may be independent from the light folding elements and it may also include an aperture stop and lens element with a refractive power mounted in a lens barrel. (Gizmo China, Patently Apple)

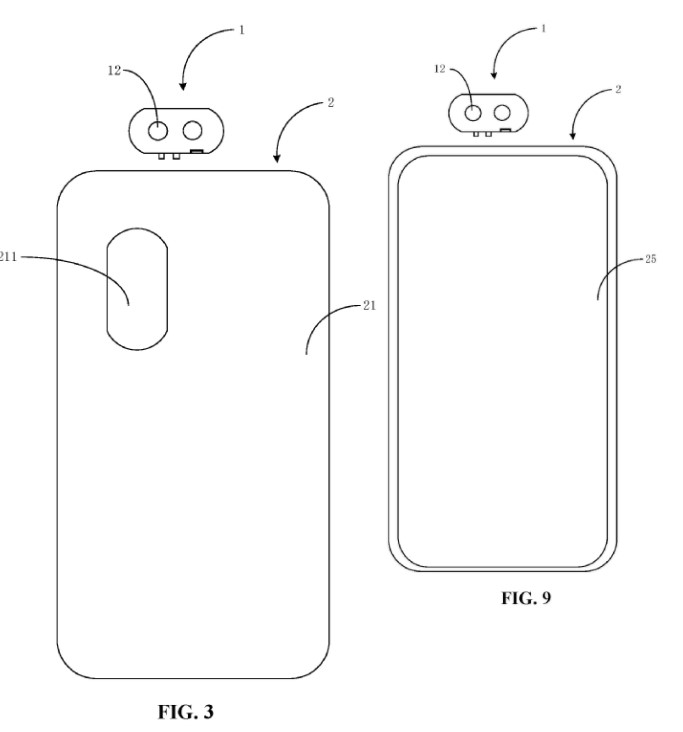

Xiaomi has filed a patent that features a phone with a detachable rear camera. The patent shows the rear camera module with multiple lenses that can be removed from and assembled on the top to use it as a front camera. It uses magnetic suspension for attaching. (Phone Arena, My Drivers, 91Mobiles)

Goodix has announced that it plans to invest CNY1B in the construction of the western R&D and ecological headquarters project in Chengdu High-tech Zone, and carry out R&D business in the field of CMOS image sensing, audio software solutions, and Bluetooth low energy. (Laoyaoba, Sohu, C114)

SK Hynix is moving chip facilities to China to meet rising customer demands and lower costs as well. Its foundry chips that are based on its 8” wafers are facing strong demand, as its supply of chips using 12” wafers is limited due to the higher requirement of investment to build newer facilities. Hynix forecast that its performance will be even better in 2021 because demand for memory chips for 5G smartphones is expected to double now that Apple has joined Samsung and Huawei Technologies in producing 5G handsets. (Asia Nikkei, Gizmo China)

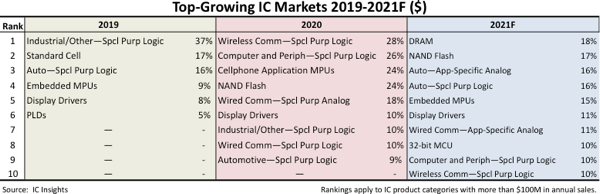

According to IC Insights, DRAM and NAND flash are expected to be the two fastest-growing product segments in 2021 with 18% and 17% sales growth, respectively. Laying claim as the fastest growing IC product segment is familiar territory for the DRAM market. DRAM was also ranked as the fastest-growing IC segment in 2013, 2014, 2017, and 2018. On the other hand, due to its extreme cyclicality, DRAM has also been among the poorest performing categories. Collapsing prices resulted in the DRAM market falling -37% in 2019, which ranked it last among the 33 IC product categories that year. (Laoyaoba, IC Insights)

Xiaomi is reportedly working on 2new phones supporting 67W wireless charging—codenamed “star” and “mars”. (GSM Arena, XDA-Developers, Weibo, Veriety Info)

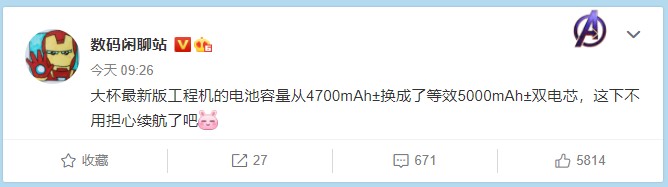

Xiaomi Mi 11 Pro would allegedly feature ⩾5000mAh dual-cell battery. Additionally it would support 200W fast charging as well as 67W fast wireless charging. (IT Home, Sohu, GizChina)

Xiaomi has announced its remote charging technology — the Mi Air Charge. It is based on space positioning and energy transmissions. The technology in its current iteration will allow for 5W remote charging for one device within a radius of “several meters”. (Android Authority, Mi.com, Neowin, My Drivers)

Lenovo China’s General Manager Chen Jin has showcased Motorola’s over-the-air charging solution. It can charge multiple phones remotely. It can charge a phone placed up to 1m away. (Android Authority, GizChina, My Drivers)

SK Innovation has announced that it plans to invest KRW1.26T to build a third factory at its Hungary battery production plant. The company completed the first factory, which has a production capacity of 7.5GWh, in 2020. The second factory, which has a production capacity 9GWh, is currently being built. The third factory will have a capacity of 10GWh. (Laoyaoba, The Elec, Bloomberg, Nikkei)

Honor Device CEO George hao has indicated that the company has a new mission for 2021: compete with its former owner and Apple in the market as an equal. He has revealed that the company is in talks with Google and expects to resume its partnership with the company. (SCMP, GizChina, GizChina, GSM Arena)

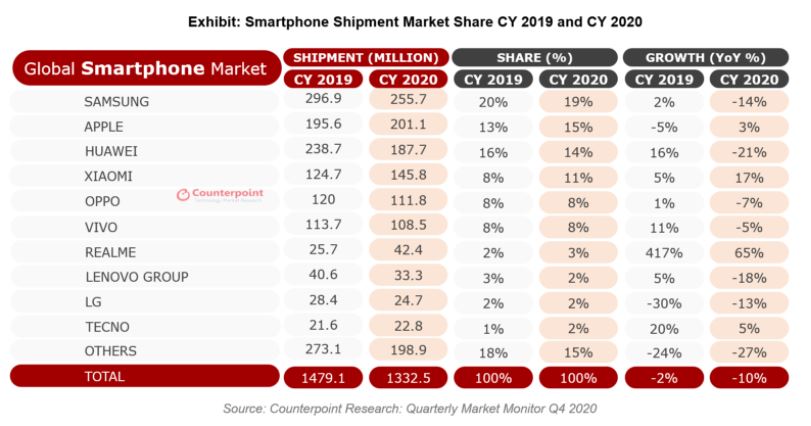

The global smartphone market continued to recover in 4Q20, rebounding 8% QoQ to 395.9M units. Apple’s 8% YoY and 96% QoQ growth helped it lead the market in 4Q20. Samsung slipped to the second spot with 62.5M units in 4Q20, However, it led the overall market in 2020. For the first time, OPPO and vivo surpassed Huawei to capture the fourth and fifth spots, respectively, Huawei slipped to the sixth spot. realme emerged as the fastest growing brand in 2020 with 65% YoY growth. (Counterpoint Research, GizChina)

OPPO’s super flagship store in Huashi Plaza, Huaihai Middle Road, Huangpu District, Shanghai has been closed. All signs have been removed, and the interior is under construction. OPPO will reportedly focus on online in 2021, and offline stores will shrink to a certain extent. (CN Beta, JRJ, Sina)

Xiaomi is suing the U.S. Defense and Treasury departments, challenging a blacklisting that blocks American investors from buying the Chinese smartphone giant’s securities. BlackRock, the Vanguard Group and State Street are among the top American institutional investors in Xiaomi that would be forced to divest holdings in the company by Nov 2021. (Gizmo China, GSM Arena, China Times, Bloomberg, RFI)

realme has launched realme 7i is Europe as Narzo 20 – 6.517” 720×1600 HD+ v-notch IPS, MediaTek Helio G85, rear tri 48MP-8MP ultrawide-2MP macro + front 8MP, 4+64GB, Android 10.0, rear fingerprint, 6000mAh 18W, reverse charging, EUR159. (realme, GizChina, GSM Arena)

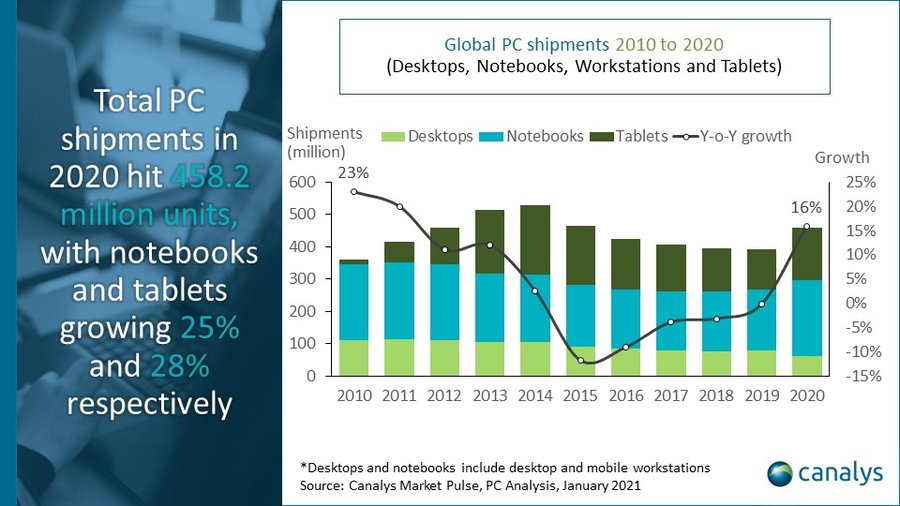

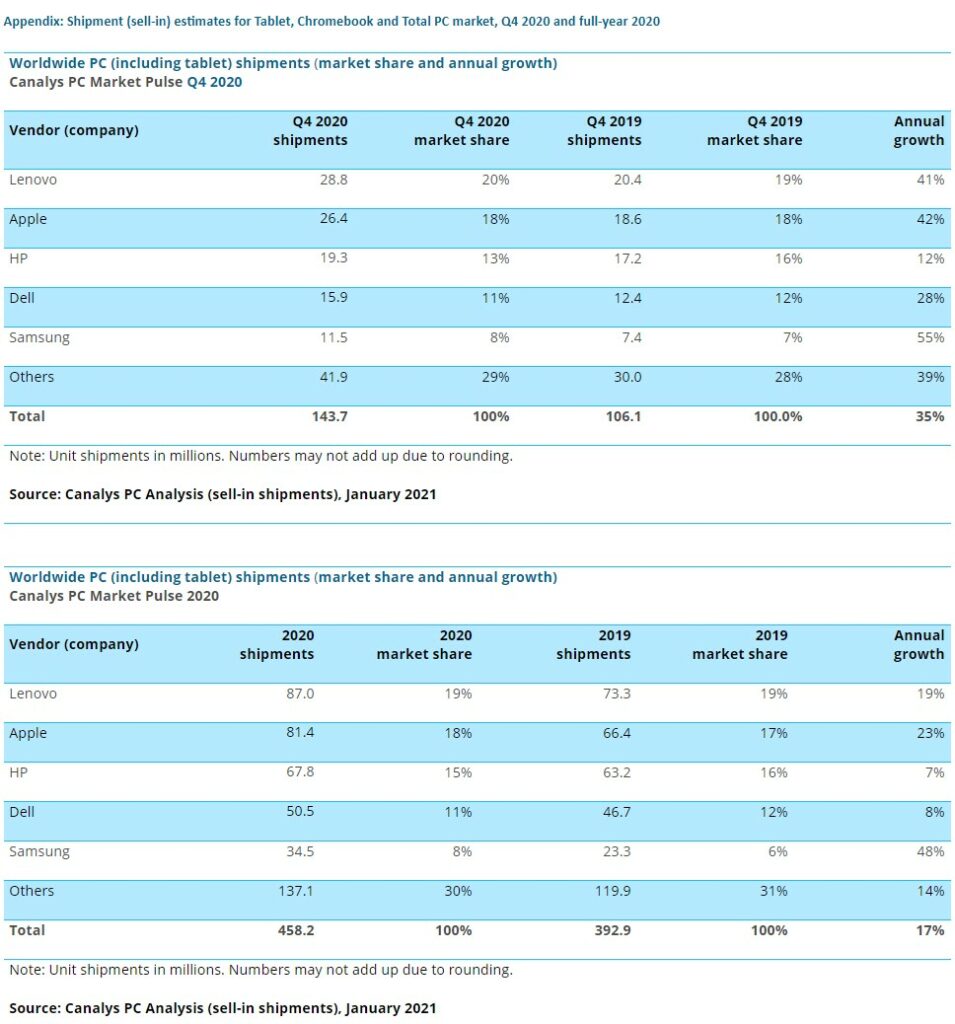

The Global PC market (including tablets) ended 2020 on a high, posting a third consecutive quarter of annual growth as shipments hit 143.7M units in 4Q20, up 35% year-on-year. As a result, total shipments for 2020 grew 17% to reach 458.2M units, the highest volume since 2015. Lenovo led the market in 4Q20 and for the full year, with shipments of 28.8M and 87.0M units, respectively. (GSM Arena, Canalys, CN Beta)

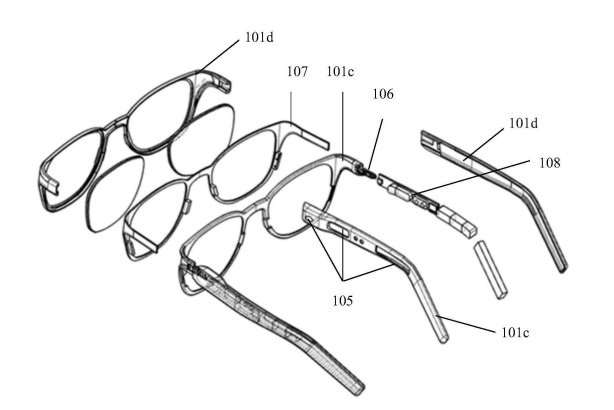

Xiaomi has filed a patent for “a smart glasses and glasses case”. The patented smart glasses and glasses case can integrate detection and treatment. The patent also suggests that the product emits some therapeutic signals which include phototherapy signals (ultraviolet signals, visible light signals, infrared signals, and laser signals) and sound wave signals, that can be used to treat brain diseases, mental diseases (for example, depression or anxiety), or eye fatigue. (Gizmo China, GizChina, Sohu, IT Home)

General Motors (GM) plans to exclusively offer electric vehicles by 2035, ending production of its cars, trucks and SUVs with diesel- and gasoline-powered engines. The company’s “aspirations” are part of a larger plan for the Detroit automaker to be carbon neutral by 2040 in its global products and operations. (CN Beta, Engadget, CNBC)

Electric vehicle maker Faraday Future (FF) has agreed to go public through a merger with blank-check firm Property Solutions Acquisition Corp in a deal valuing the combined entity at USD3.4B. (Gizmo China, Sina, 163, Reuters, Reuters, NBD)

Faraday Future (FF) and Zhejiang Geely have jointly signed a framework cooperation agreement. The two sides will cooperate in technology and engineering support, and will explore the possibility of using OEM production services provided by the joint venture between Foxconn and Geely. FF has said that in the next 5 years, its plan will include FF 91, FF 81 and FF 71. FF 81 is expected to be launched in mass production in 2023, and FF 71 is expected to be launched in mass production at the end of 2024. Currently, FF 91 has opened reservations. (My Drivers, Yahoo, Reuters, Business Wire)

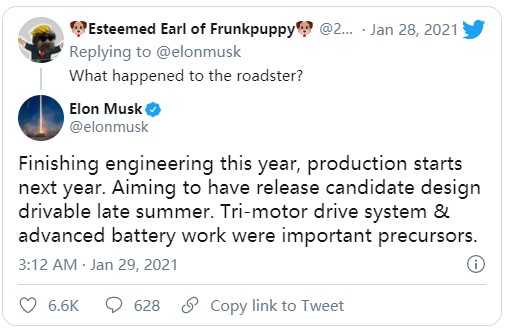

Tesla CEO Elon Musk has indicated that the company’s Roadster tri-motor drive system and advanced battery work” are to blame for the delay. He says that Tesla hopes to finish engineering in 2021, and to have a “release candidate design drivable in late summer”. (CN Beta, The Verge, CNET)

SpaceX could be valued at a minimum of USD60B as it finalizes a funding round expected to close in Feb 2021. It is possible that SpaceX’s valuation could reach as much as USD92B, up from a USD46B valuation in a funding round in Aug 2021. (CN Beta, US News, Business Insider)

San Jose-based robotics company Fetch has unveiled its latest robot this morning. The PalletTransport1500 is an autonomous bot designed specifically to replace forklift uses in warehouses. The device joins a number of different robotic forklift solutions from various companies, including Toyota. (CN Beta, Fetch, TechCrunch, Yahoo)

The Indian government is planning to introduce a law for debate in Lok Sabha that could see private cryptocurrencies like bitcoin be banned from use inside the country. The law also calls for the creation of a national digital currency issued by the Reserve Bank of India (RBI). The bill is titled ‘The Cryptocurrency and Regulation of Official Digital Currency Bill, 2021’. (Neowin, Indian Parliament, Reuters, Wall Street CN, CN Beta)